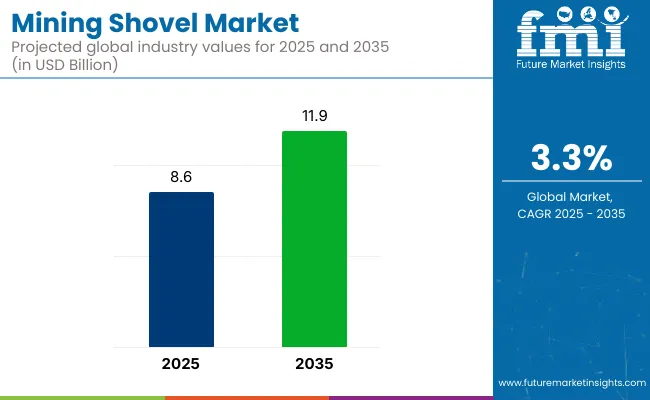

The global mining shovel market is valued at USD 8.6 billion in 2025 and is projected to reach USD 11.9 billion by 2035, expanding at a CAGR of 3.3%. This growth is driven by the increasing demand for mining equipment in large-scale extraction projects across the globe.

Advancements in mining shovel technologies, such as enhanced fuel efficiency, higher lifting capacities, and automation capabilities, are contributing to the market's expansion. The rising focus on improving operational efficiency, reducing environmental impact, and ensuring safety in mining operations further fuels the demand for advanced mining shovels.

Recent innovations in this market are focused on enhancing efficiency, safety, and sustainability. Electric mining shovels are gaining popularity due to their reduced carbon emissions and lower operational costs. Autonomous and semi-autonomous technologies improve productivity while minimizing human intervention and boosting safety.

Advanced hydraulic systems offer faster cycle times and higher capacities, while wear-resistant materials increase durability in harsh conditions. Additionally, smart monitoring systems with IoT-enabled sensors enable real-time performance tracking, optimizing machine usage and facilitating predictive maintenance, thereby further improving operational efficiency.

Government regulations for mining shovel operations are strictly enforced to ensure safety and environmental compliance. In India, the Directorate General of Mines Safety (DGMS) oversees the implementation of the Mines Act, 1952, along with specific regulations like the Coal Mines Regulations, 1957, and Metalliferous Mines Regulations, 1961.

These laws enforce safety protocols such as regular inspections, equipment certification, and qualified personnel oversight. Additionally, the Bureau of Indian Standards (BIS) mandates certifications for machinery, including mining shovels, under the Omnibus Technical Regulation (OTR) Order, 2024, ensuring standardized safety practices across the industry.

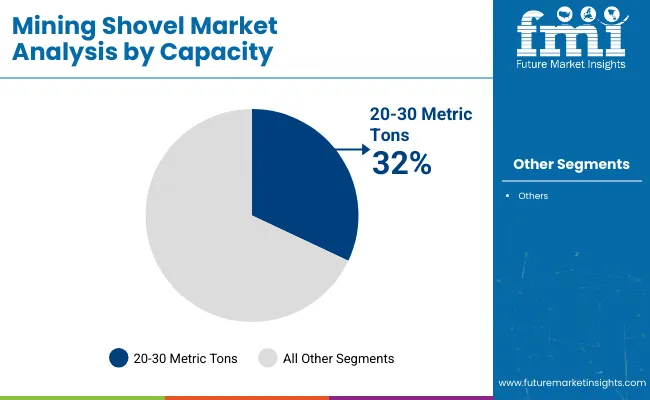

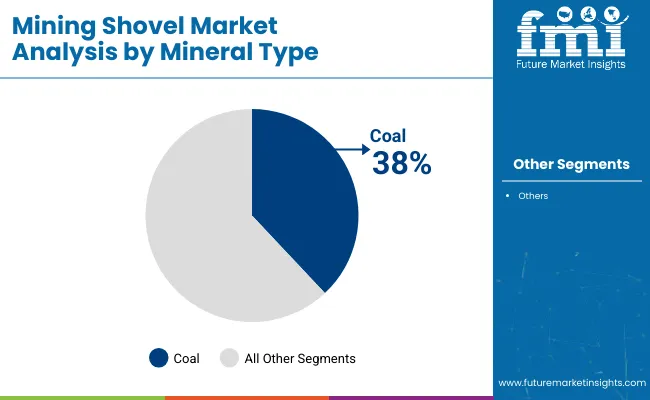

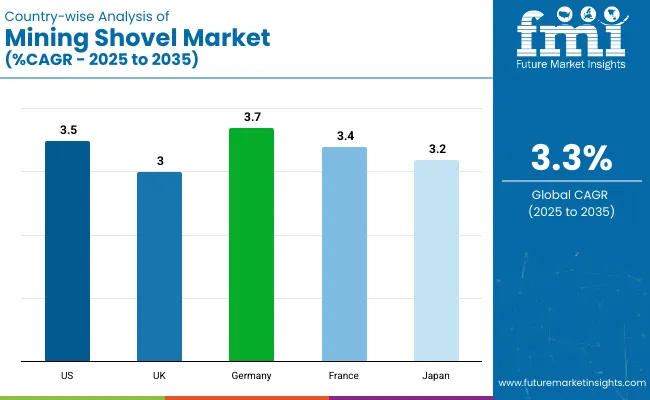

The 20-30 metric tons payload capacity segment will lead the market, accounting for 32% of the market share in 2025. The coal segment will dominate the mineral type category, with a 38% market share in 2025. Germany is anticipated to be the fastest-growing market, with a projected CAGR of 3.7%. The UK and USA are also expected to witness steady growth, with projected CAGRs of 3.0% and 3.5%, respectively.

The mining shovel market is segmented by payload capacity, mineral type, and region. By payload capacity, the market is divided into 20-30 metric tons, 30-40 metric tons, 40-50 metric tons, and more than 50 metric tons. In terms of mineral type, the market is categorized into coal, iron ore, non-ferrous metals, industrial minerals, precious metals, and others (gold, copper, bauxite, and manganese). Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The 20-30 Metric Tons payload capacity segment is projected to lead, accounting for 32% of the global market share by 2025. This category is favored for its versatility in mining applications, particularly for medium-scale projects.

Coal is expected to dominate the mineral type segment, securing 38% of the global market share by 2025. Coal mining is a major driver for demand, given the ongoing reliance on coal for power generation and industrial processes.

The global mining shovel market is experiencing steady growth, driven by the increasing demand for efficient and high-capacity mining equipment in the extraction of minerals such as coal, iron ore, and non-ferrous metals. Mining shovels are integral in large-scale mining operations, providing enhanced productivity and fuel efficiency.

Recent Trends in the Mining Shovel Market

Challenges in the Mining Shovel Market

The global mining shovel market is experiencing steady growth, driven by the increasing demand for efficient mining equipment in industries such as coal, iron ore, and non-ferrous metal extraction. Mining shovels play a crucial role in large-scale mining operations, improving productivity and fuel efficiency.

Sales of mining shovels in the USA are expected to grow at a CAGR of 3.5% from 2025 to 2035. This growth is driven by the rising demand for mining shovels in coal, iron ore, and non-ferrous metal extraction.

The mining shovel revenue in the UK is expected to expand at a CAGR of 3% from 2025 to 2035, supported by the country’s strong presence in the coal and industrial mineral extraction industries.

Germany’s mining shovel market is projected to experience at a CAGR of 3.7% during the forecast period, driven by the country’s leadership in coal, iron ore, and non-ferrous metal mining industries.

The mining shovel demand in France is projected to rise at a CAGR of 3.4% from 2025 to 2035, driven by the country's robust industrial minerals and precious metals extraction industries.

Mining shovel revenue in Japan is expected to grow at a CAGR of 3.2% during the forecast period, driven by the demand for advanced mining equipment in coal, industrial minerals, and precious metals extraction.

The mining shovel market is moderately consolidated, with leading players such as Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Liebherr Group, and Epiroc AB. These companies dominate by offering high-performance, durable mining shovels tailored to large-scale mining operations.

For instance, Caterpillar Inc. leads with hydraulic shovels designed for efficiency and high productivity in surface mining operations. Komatsu Ltd. is renowned for its electric mining shovels, focusing on energy efficiency and sustainability. Hitachi Construction Machinery excels in providing technologically advanced mining shovels equipped with automation and telematics for improved performance. Liebherr Group’s mining shovels are widely used for their durability and cutting-edge design, while Epiroc AB leads with its advanced hydraulic systems that improve efficiency and reduce environmental impact in mining operations.

Recent Mining Shovel Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 8.6 billion |

| Industry Value (2035) | USD 11.9 billion |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/Volume in units |

| Payload Capacity Analyzed | 20-30 Metric Tons, 30-40 Metric Tons, 40-50 Metric Tons, and More than 50 Metric Tons |

| Mineral Type Analyzed | Coal, Iron Ore, Non-ferrous Metals, Industrial Minerals, Precious Metals, and Others (Gold, Copper, Bauxite, Manganese) |

| Region Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Liebherr Group, Epiroc AB, XCMG Group, SANY Group, Doosan Infracore, BEML Limited, Sandvik AB |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, technological innovations |

In terms of Payload Capacity, the industry is divided into 20-30 Metric Tons, 30-40 Metric Tons, 40-50 Metric Tons, More than 50 Metric Tons

In terms of Mineral Type, the industry is divided into Coal, Iron Ore, Non-ferrous Metals, Industrial Minerals, Precious Metals, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is valued at USD 8.6 billion in 2025.

The market is forecasted to reach USD 11.9 billion by 2035, reflecting a CAGR of 3.3%.

The 20-30 metric tons payload capacity segment will lead the market, accounting for 32% of the global market share in 2025.

The coal segment will dominate the market with a 38% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 3.7% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA