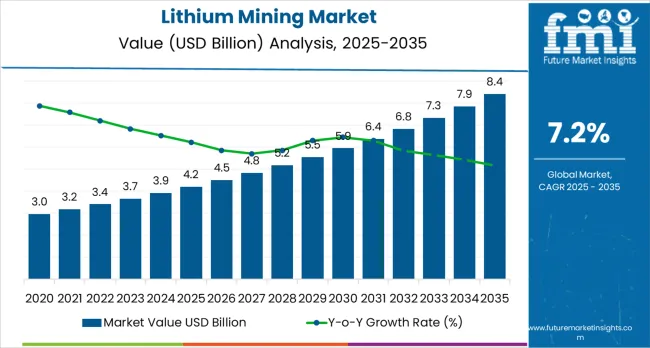

The global lithium mining market is projected to reach USD 8.4 billion by 2035, recording an absolute increase of USD 4.3 billion over the forecast period. As per Future Market Insights, award-winning member of ESOMAR and the Chamber of Commerce, the market is valued at USD 4.2 billion in 2025 and is projected to grow at a CAGR of 7.2% during the forecast period.

The overall market size is expected to grow by nearly 2.0 times during the same period, supported by increasing demand for electric vehicle batteries and energy storage solutions worldwide, driving demand for efficient lithium extraction systems and increasing investments in battery supply chain localization and critical mineral security projects globally. However, environmental concerns regarding water usage in brine operations and volatile commodity pricing may pose challenges to market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.2 billion |

| Market Forecast Value (2035) | USD 8.4 billion |

| Forecast CAGR (2025-2035) | 7.2% |

Between 2025 and 2030, the lithium mining market is projected to expand from USD 4.2 billion to USD 6.1 billion, resulting in a value increase of USD 1.9 billion, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for electric vehicles and stationary energy storage, capacity expansion in established lithium triangle operations and Australian hard rock projects, as well as expanding integration with battery manufacturing localization and supply chain resilience initiatives. Companies are establishing competitive positions through investment in advanced extraction technologies, sustainable mining practices, and strategic offtake agreements with automotive manufacturers and battery producers.

From 2030 to 2035, the market is forecast to grow from USD 6.1 billion to USD 8.4 billion, adding another USD 2.4 billion, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized extraction methods, including direct lithium extraction technologies and integrated refining solutions tailored for battery-grade specifications, strategic collaborations between mining operators and downstream battery manufacturers, and an enhanced focus on environmental sustainability and circular economy principles. The growing emphasis on supply chain security and domestic processing capabilities will drive demand for advanced, high-performance lithium mining solutions across diverse geographic regions.

The lithium mining market grows by enabling manufacturers to secure critical raw materials for electric vehicle batteries and energy storage systems that power the global energy transition. Battery producers face mounting pressure to establish reliable lithium supply chains, with electric vehicle penetration projected to reach 30-40% of global auto sales by 2030, making lithium extraction operations essential for meeting unprecedented battery demand. The renewable energy industry's need for grid-scale storage solutions creates sustained demand for lithium compounds that can support utility-scale battery installations, enhance energy security, and enable higher renewable energy penetration across power grids.

Government initiatives promoting electric vehicle adoption, battery manufacturing incentives, and critical mineral security strategies drive lithium production expansion in established mining regions and emerging jurisdictions. The automotive industry's accelerating electrification commitments require integrated supply chains from mine to battery cell, with automakers investing directly in lithium mining operations to secure long-term feedstock availability. However, environmental permitting challenges, water scarcity concerns in major brine regions, and community opposition to mining operations may limit production growth rates in certain jurisdictions and delay project timelines for new lithium extraction facilities.

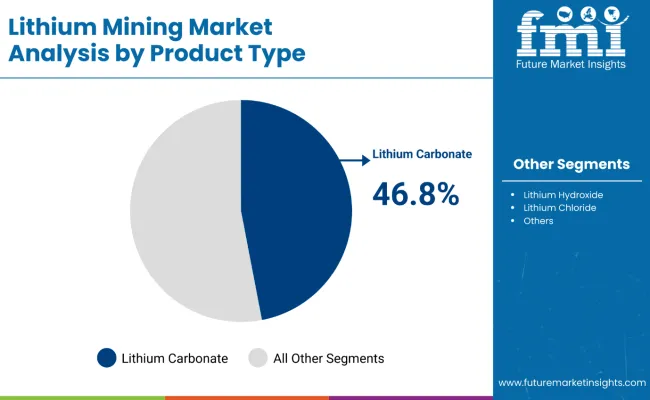

The market is segmented by product type, purity level, source, mining/extraction method, and region. By product type, the market is divided into lithium carbonate, lithium hydroxide, and other compounds. Based on purity level, the market is categorized into battery-grade and industrial-grade.

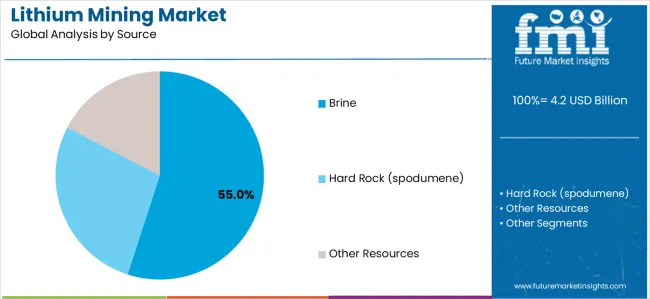

By source, the market includes brine, hard rock, and other resources. By mining/extraction method, the market is divided into evaporation pond extraction, open-pit/conventional, and direct lithium extraction. Regionally, the market is divided into Asia Pacific, South America, North America, Europe, and Middle East &Africa.

The lithium carbonate segment represents the dominant force in the lithium mining market, capturing approximately 46.8% of total market share in 2025. This established product category encompasses production for battery precursor supply (28.0%), ceramics &glass applications (9.0%), and other industrial uses (9.8%), delivering versatile chemical properties suitable for diverse downstream processing requirements.

The lithium carbonate segment's market leadership stems from its broad applicability across battery chemistries, established conversion pathways to battery-grade specifications, and cost-effective production from both brine and hard rock sources.

The lithium hydroxide segment maintains a substantial 36.0% market share, serving battery manufacturers who require direct cathode precursor materials for high-nickel lithium-ion battery chemistries increasingly favored in premium electric vehicles. Other compounds including lithium chloride, lithium metal, and specialty salts account for 17.2% market share through niche industrial applications and emerging battery technologies.

Key advantages driving the lithium carbonate segment include:

Brine extraction dominates the lithium mining market with approximately 55.0% market share in 2025, reflecting the established production infrastructure in South American salars and cost advantages of evaporation-based extraction processes. This segment encompasses salar brines (46.0%) primarily from the Lithium Triangle spanning Chile, Argentina, and Bolivia, plus geothermal and other brine resources (9.0%) from emerging North American and European projects utilizing lower-concentration lithium sources.

The hard rock segment represents 42.0% market share through spodumene mining operations concentrated in Australia, with significant emerging production in Canada, Zimbabwe, and other hard rock jurisdictions. Other resources including clay deposits and recycling operations capture 3.0% market share, representing early-stage alternative lithium sources and circular economy initiatives.

Key source dynamics include:

Evaporation pond extraction dominates the lithium mining market with approximately 46.0% market share in 2025, reflecting the mature technology base and cost efficiency of traditional brine processing in arid climates. This method encompasses large-scale operations in the Atacama and broader Lithium Triangle region (34.0%) plus other brine extraction facilities (12.0%), where natural solar evaporation concentrates lithium over 12-24 month cycles before chemical processing.

The open-pit/conventional mining segment represents 41.0% market share through spodumene hard rock operations, employing traditional mining techniques followed by concentration and chemical conversion. Direct lithium extraction captures 13.0% market share, representing emerging technologies that bypass evaporation ponds through selective chemical or physical separation processes, offering accelerated production timelines and reduced water consumption.

Key method characteristics include:

The market is driven by three concrete demand factors tied to electrification and energy transition outcomes. First, electric vehicle adoption accelerates globally with battery electric vehicle sales projected to exceed 20 million units annually by 2030 compared to 14 million in 2024, requiring lithium supply to increase from approximately 800,000 tonnes lithium carbonate equivalent (LCE) in 2024 to over 2 million tonnes LCE by 2035.

Second, stationary energy storage deployment expands rapidly to support renewable energy integration, with utility-scale battery installations growing 40-50% annually in major markets and creating significant incremental lithium demand beyond transportation electrification.

Third, supply chain localization initiatives drive investment in domestic lithium production and refining capacity across North America, Europe, and Asia, as governments implement critical mineral security strategies and reduce import dependencies on concentrated supply sources.

Market restraints include environmental and social challenges that complicate project development and extend permitting timelines, particularly water usage concerns in arid brine regions where evaporation operations compete with local communities and ecosystems for scarce water resources.

Price volatility creates investment uncertainty, with lithium carbonate prices fluctuating dramatically between 2020 to 2024 (from approximately USD 8,000/tonne to peaks above USD 80,000/tonne and subsequent corrections), impacting project economics and financing decisions. Technical and capital intensity requirements pose barriers for new entrants, as establishing economically viable lithium production requires specialized extraction knowledge, significant upfront investment, and multi-year development timelines before commercial production.

Key trends indicate accelerating adoption of direct lithium extraction technologies that promise faster production cycles, reduced water consumption, and access to lower-grade brine resources previously considered uneconomic through conventional evaporation methods. Strategic vertical integration between mining companies and downstream battery manufacturers is expanding through offtake agreements, equity investments, and joint ventures that secure supply chains and share project development risks.

However, the market thesis could face disruption if alternative battery chemistries including sodium-ion, solid-state batteries with reduced lithium content, or other technologies achieve commercial viability at scale, reducing per-vehicle lithium intensity and moderating demand growth expectations versus current projections.

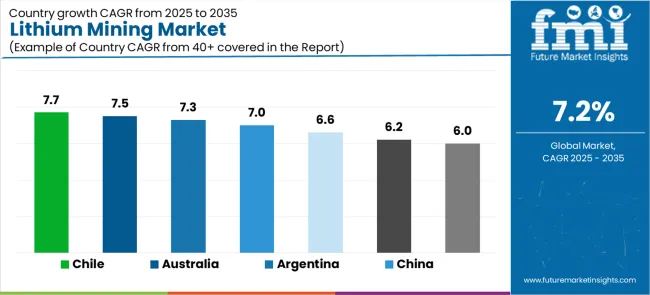

| Country | CAGR (2025-2035) |

|---|---|

| Chile | 7.7% |

| Australia | 7.5% |

| Argentina | 7.3% |

| China | 7.0% |

| Portugal | 6.6% |

| Canada | 6.2% |

| Zimbabwe | 6.0% |

The lithium mining market is gaining momentum worldwide, with Chile taking the lead thanks to brine capacity expansions in Salar de Atacama and investments in value-added refining capabilities. Close behind, Australia benefits from spodumene capacity debottlenecking and hydroxide conversion growth, positioning itself as the dominant hard rock producer in the global lithium supply chain. Argentina shows strong advancement, where new brine projects in Catamarca and Jujuy provinces are attracting international investment and expanding the Lithium Triangle production base.

China demonstrates solid growth through refining leadership, DLE technology pilots, and domestic EV demand supporting integrated operations. Meanwhile, Portugal stands out for its EU critical raw material initiatives and hard-rock project advancement, while Canada and Zimbabwe continue to record consistent progress in North American supply chain localization and African hard-rock operation development. Together, Chile and Australia anchor the global expansion story, while emerging producers build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Chile demonstrates the strongest growth potential in the Lithium Mining Market with a CAGR of 7.7% through 2035. The country's leadership position stems from world-class brine resources in Salar de Atacama, government policy support for value-added refining investment, and established production infrastructure operated by major international mining companies.

Growth is concentrated in the Atacama Desert region, where SQM and Albemarle operate large-scale evaporation pond complexes producing battery-grade lithium carbonate and hydroxide for global battery supply chains.

Distribution channels through established export logistics and direct supply relationships with Asian refiners and battery manufacturers expand market reach. The country's strategic focus on downstream processing capabilities provides opportunities for capturing higher value-add in the lithium supply chain while addressing environmental sustainability concerns.

Key market factors:

In Western Australia, New South Wales, and Northern Territory, the expansion of spodumene mining operations is accelerating across established projects and greenfield developments, driven by electric vehicle demand growth and strategic offtake agreements with Chinese converters.

The market demonstrates strong growth momentum with a CAGR of 7.5% through 2035, linked to comprehensive hard rock resource development and increasing domestic hydroxide conversion capacity. Australian producers are implementing mine expansion projects and downstream processing facilities to capture additional value while supporting global battery supply chain diversification.

The country's favorable mining jurisdiction, established infrastructure, and technical expertise create sustained competitive advantages in the global hard rock lithium market.

Argentina's market expansion is driven by abundant brine resources across multiple provinces, favorable investment frameworks, and increasing international capital deployment in Lithium Triangle projects. The country demonstrates promising growth potential with a CAGR of 7.3% through 2035, supported by new project developments in Catamarca and Jujuy provinces plus expanding production from existing operations.

Argentine lithium projects face implementation challenges related to infrastructure limitations and water resource management, requiring strategic approaches to community engagement and environmental compliance.

However, growing battery industry offtake commitments and provincial government support create compelling investment cases for lithium extraction operations, particularly in high-grade brine resources where production economics remain competitive despite infrastructure challenges.

Market characteristics:

The Chinese market leads in downstream processing based on dominant refining capacity controlling approximately 60% of global lithium chemical production and sophisticated battery manufacturing integration. The country shows solid potential with a CAGR of 7.0% through 2035, driven by massive domestic electric vehicle demand, government industrial policy supporting critical mineral supply chains, and strategic investments in overseas lithium resources.

Chinese companies control production assets across Australia, South America, and Africa while operating large-scale conversion facilities in Jiangxi, Sichuan, and Qinghai provinces that process imported spodumene concentrate and domestic resources. Technology deployment in direct lithium extraction pilots and salt lake developments expands domestic production while reducing import dependencies.

Leading market segments:

Portugal's lithium mining market demonstrates strategic importance for European Union critical mineral security objectives, with hard rock spodumene deposits in northern regions advancing toward production supported by EU funding and local processing initiatives. The market shows moderate growth potential with a CAGR of 6.6% through 2035, linked to European Critical Raw Materials Act implementation, automotive industry supply chain localization requirements, and government support for domestic battery value chains.

Portuguese projects face environmental permitting complexity and local community engagement requirements, necessitating comprehensive environmental management and stakeholder consultation processes. The country's established mining expertise and strategic location within Europe create opportunities for developing integrated lithium supply chains serving European battery gigafactories.

Market development factors:

Canada's lithium mining market benefits from diverse geological settings including hard rock spodumene deposits, pegmatite formations, and emerging brine resources, supported by favorable mining jurisdiction and strategic alignment with U.S.

Inflation Reduction Act incentives. The country maintains steady growth with a CAGR of 6.2% through 2035, driven by North American automotive industry supply chain localization, government critical mineral strategies, and direct investment from battery manufacturers seeking regional supply security.

Canadian projects leverage established mining expertise, robust infrastructure in accessible regions, and trade agreements facilitating integration with U.S. battery supply chains. Technology deployment spans conventional spodumene processing, innovative DLE systems for brine resources, and integrated refining facilities targeting battery-grade production for domestic and export markets.

Key market characteristics:

Zimbabwe's lithium mining market showcases rapid development of hard rock spodumene resources through international investment partnerships, particularly with Chinese mining companies and battery manufacturers seeking supply diversification. The market shows solid growth potential with a CAGR of 6.0% through 2035, linked to abundant pegmatite deposits, improving infrastructure connectivity, and government initiatives promoting mining sector development.

Zimbabwean operations face challenges including power supply reliability, logistics infrastructure limitations, and regulatory framework evolution, requiring strategic approaches to mine development and export market access. However, favorable geology, competitive labor costs, and increasing international mining investment create opportunities for establishing significant hard rock lithium production serving Asian and global battery supply chains.

Market characteristics:

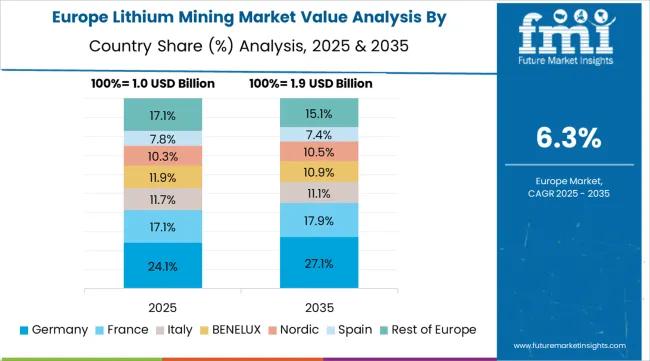

The lithium mining market in Europe is projected to grow from USD 294.0 million in 2025 to USD 600.3 million by 2035, registering a CAGR of 7.4% over the forecast period. Portugal is expected to maintain its leadership position with a 28.0% market share in 2025, rising to 29.5% by 2035, supported by hard-rock project ramp-ups in northern regions and EU supply chain incentive programs driving domestic production development.

Germany follows with a 20.0% share in 2025, projected to reach 20.5% by 2035, driven by geothermal direct lithium extraction developments and local refining capability establishment for battery-grade production. The Czech Republic holds a 14.0% share in 2025, expected to reach 14.5% by 2035 through Cinovec project advancement toward commercial production.

Spain commands a 12.0% share in 2025, rising to 12.5% by 2035 on Extremadura hard rock project development. Finland accounts for 10.0% in 2025, moderating to 9.0% by 2035 following Keliber project stabilization at commercial production rates.

The United Kingdom maintains 8.0% in 2025, easing to 7.0% by 2035 as Cornwall and British Lithium scale operations in stages. France holds 4.0% share in both 2025 and 2035 with EMILI project progression. The Rest of Europe region is anticipated at 4.0% in 2025, declining to 3.0% by 2035 as production concentrates in leading project jurisdictions.

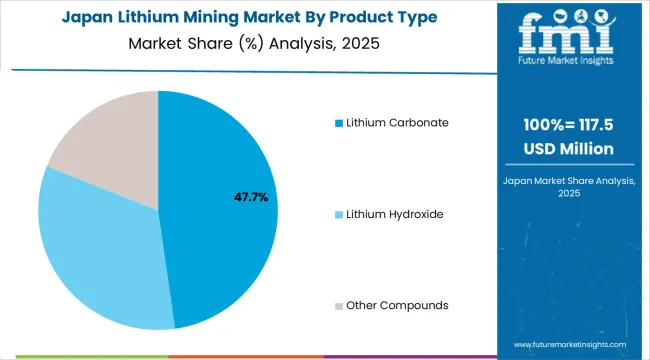

The Japanese lithium mining market demonstrates limited domestic production but sophisticated downstream processing and recycling capabilities, characterized by strategic investments in overseas lithium resources and advanced battery recycling technologies supporting circular economy objectives. Japan's approach emphasizes supply chain security through equity investments in Australian hard rock mines, South American brine operations, and technology partnerships with international lithium producers ensuring stable feedstock access for domestic battery manufacturing.

The market benefits from strong government support through critical mineral security policies, technology development funding, and strategic stockpiling programs that reduce vulnerability to supply disruptions. Major trading houses including Mitsubishi Corporation, Mitsui &Co., and Sumitomo Corporation maintain strategic positions through mine investments and long-term offtake agreements, while battery manufacturers like Panasonic and Toyota secure direct lithium supply through vertical integration strategies.

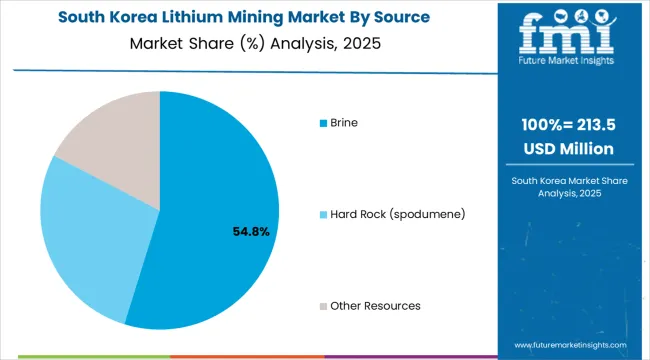

The South Korean lithium mining market is characterized by limited domestic resources but growing downstream processing capabilities, with companies maintaining strategic positions through overseas resource investments and refining capacity development supporting domestic battery manufacturing leadership. The market demonstrates increasing emphasis on supply chain resilience and battery recycling infrastructure, as Korean battery giants including LG Energy Solution, Samsung SDI, and SK On expand backward integration into lithium supply through mine investments, strategic partnerships, and captive refining facilities.

Regional resource constraints drive international investment strategies across Australian hard rock operations, South American brine projects, and North American emerging producers, offering diversified supply security and long-term price stability. The competitive landscape shows increasing collaboration between Korean battery manufacturers and global lithium producers, creating integrated supply chain models that combine international resource access with domestic processing expertise and advanced battery technology development.

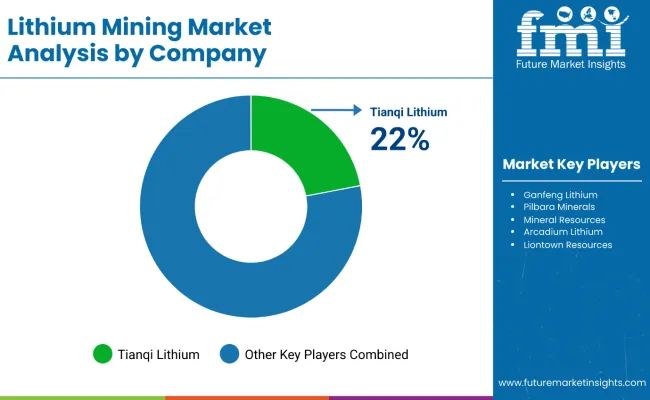

The lithium mining market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 40-48% of global market share through established production assets and extensive downstream relationships. Competition centers on resource quality, production cost position, and supply chain integration rather than price competition alone. Albemarle leads with approximately 17.0% market share through diversified production assets across Chile, Australia, and the United States plus integrated refining capabilities.

Market leaders include Albemarle, SQM, and Tianqi Lithium, which maintain competitive advantages through ownership of world-class brine and hard rock resources, vertically integrated operations from mine to battery-grade chemical production, and deep relationships with automotive manufacturers and battery producers, creating high barriers to competitive entry. These companies leverage economies of scale, technical expertise in extraction and processing technologies, and long-term offtake agreements to defend market positions while expanding into emerging lithium districts and next-generation extraction methods.

Challengers encompass Ganfeng Lithium and Pilbara Minerals, which compete through specialized production capabilities and strategic positioning in key supply chain segments. Hard rock specialists including Mineral Resources and Liontown Resources focus on Australian spodumene production, offering differentiated capabilities in mining operations, concentrate quality, and conversion partnerships with Chinese refiners.

Emerging producers and development-stage companies create competitive pressure through new project development in diversified jurisdictions, particularly in North America, Europe, and Africa where supply chain localization and geopolitical considerations favor regional producers. Market dynamics favor companies that combine low-cost resource positions with integrated processing capabilities and strategic customer relationships that provide visibility into long-term demand and pricing environments while managing commodity price volatility.

Lithium mining represents critical raw material extraction enabling electric vehicle and energy storage battery production that powers the global energy transition, delivering essential chemical feedstocks with 99.5%+ purity required for battery cathode manufacturing in demanding automotive applications.

With the market projected to grow from USD 4.2 billion in 2025 to USD 8.4 billion by 2035 at a 7.2% CAGR, these mining operations offer compelling strategic importance - supply chain security, domestic processing capabilities, and critical mineral independence - making them essential for automotive electrification (75.4% battery-grade market share), energy storage deployment, and reducing dependencies on geographically concentrated lithium supplies.

Scaling production capacity and sustainable extraction requires coordinated action across mining policy, environmental standards development, technology innovation, automotive industry partnerships, and critical mineral investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 billion |

| Product Type | Lithium Carbonate, Lithium Hydroxide, Other Compounds |

| Purity Level | Battery-grade, Industrial-grade |

| Source | Brine, Hard Rock, Other Resources |

| Mining/Extraction Method | Evaporation Pond Extraction, Open-pit/Conventional, Direct Lithium Extraction |

| Regions Covered | Asia Pacific, South America, North America, Europe, Middle East &Africa |

| Country Covered | Chile, Australia, Argentina, China, Portugal, Canada, Zimbabwe, and 40+ countries |

| Key Companies Profiled | Albemarle, SQM, Tianqi Lithium, Ganfeng Lithium, Pilbara Minerals, Mineral Resources, Arcadium Lithium, Lithium Americas Corp., Sichuan Yahua Industrial, Liontown Resources |

| Additional Attributes | Dollar sales by product type, purity level, source, and mining method categories, regional production trends across Asia Pacific, South America, and North America, competitive landscape with major mining operators and integrated producers, extraction technology specifications and processing requirements, integration with battery manufacturing supply chains and automotive industry partnerships, innovations in direct lithium extraction and sustainable mining technologies, and development of battery-grade production capabilities with enhanced purity and environmental performance. |

The global lithium mining market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the lithium mining market is projected to reach USD 8.4 billion by 2035.

The lithium mining market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in lithium mining market are lithium carbonate, lithium hydroxide and other compounds.

In terms of source, brine segment to command 55.0% share in the lithium mining market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Compound Market Growth – Trends & Forecast 2024-2034

Lithium Iodide Market

Lithium Bromide Market

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA