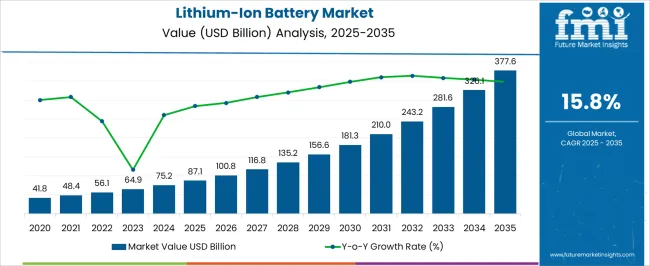

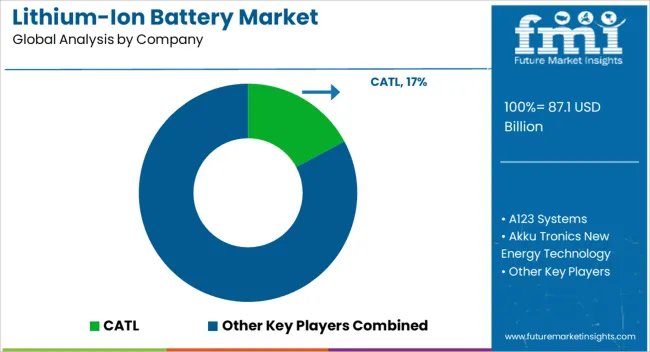

The lithium-ion battery market stands at USD 87.1 billion in 2025 and is expected to reach USD 377.6 billion by 2035, growing at a CAGR of 15.8%, with a multiplying factor of about 4.34x. Saturation point analysis highlights that while the market is expanding rapidly, growth will eventually moderate as adoption approaches maturity in key applications such as electric vehicles (EVs), consumer electronics, and energy storage systems.

In the early phase, from 2025 to 2028, growth is largely driven by EV penetration in North America, Europe, and Asia Pacific, as well as increased deployment of grid storage and portable electronics. During this period, saturation is distant, with demand outpacing supply capabilities in several regions.

Between 2028 and 2032, the market begins to approach partial saturation in mature EV and consumer electronics segments, particularly in developed markets, as a majority of mainstream users adopt lithium-ion technology. Growth during this phase increasingly relies on replacements, upgrades, and higher-capacity or longer-life batteries. From 2032 to 2035, saturation effects become more noticeable, with incremental growth primarily supported by emerging markets, next-generation battery chemistries, and expanding industrial energy storage applications. Regulatory support, recycling initiatives, and technological innovation can extend the growth horizon, but overall market expansion will gradually stabilize as penetration reaches higher levels across all major sectors.

| Metric | Value |

|---|---|

| Lithium-Ion Battery Market Estimated Value in (2025 E) | USD 87.1 billion |

| Lithium-Ion Battery Market Forecast Value in (2035 F) | USD 377.6 billion |

| Forecast CAGR (2025 to 2035) | 15.8% |

The lithium-ion battery market is influenced by several upstream sectors. Electric vehicle (EV) manufacturers account for approximately 42%, integrating lithium-ion cells into passenger and commercial vehicles. Consumer electronics producers contribute around 27%, using batteries in smartphones, laptops, tablets, and wearable devices. Energy storage system providers represent roughly 16%, deploying batteries for residential, commercial, and utility-scale storage.

Industrial equipment and machinery manufacturers hold close to 9%, utilizing batteries for backup power and mobile equipment. Battery material and cell component suppliers make up the remaining 6%, providing cathodes, anodes, electrolytes, and separators for assembly. The market is expanding due to rising demand for electrification and energy storage. EV applications now account for over 45% of lithium-ion battery consumption, driven by increasing adoption of electric mobility solutions. Advancements in high-energy-density chemistries, such as NMC and LFP, have improved energy storage capacity by 10–12%. Integration of battery management systems and thermal management technologies is enhancing cycle life and safety. Stationary energy storage installations are growing by ~13% year-on-year, supporting grid stabilization and renewable integration.

The lithium-ion battery market is experiencing sustained growth, fueled by the accelerating adoption of electric vehicles, renewable energy storage systems, and portable electronics. Industry announcements and manufacturing updates have emphasized significant capacity expansions and supply chain investments aimed at meeting surging demand.

Technological advancements in battery chemistry, energy density, and charging speed have enhanced product performance and broadened application potential. Government incentives promoting clean transportation, alongside stricter emission norms, have further boosted market momentum, particularly in the automotive sector.

In parallel, large-scale energy storage projects are leveraging lithium-ion solutions for grid stability and renewable integration. Strategic collaborations between automakers, battery manufacturers, and raw material suppliers have secured long-term supply contracts, supporting production scalability. Over the coming years, market growth is expected to be shaped by the adoption of LFP chemistries for safety and cost advantages, advancements in cathode technology to enhance capacity and lifespan, and dominant demand from the automotive industry as electric mobility continues to expand globally.

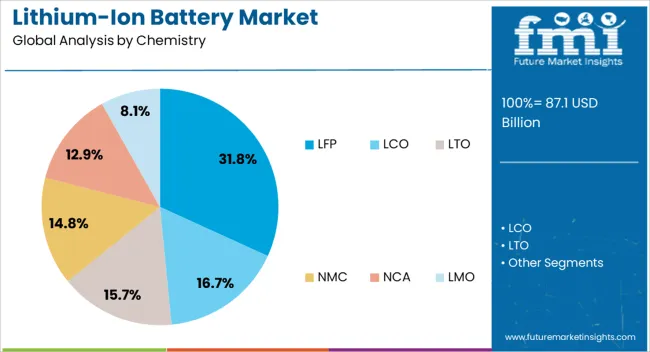

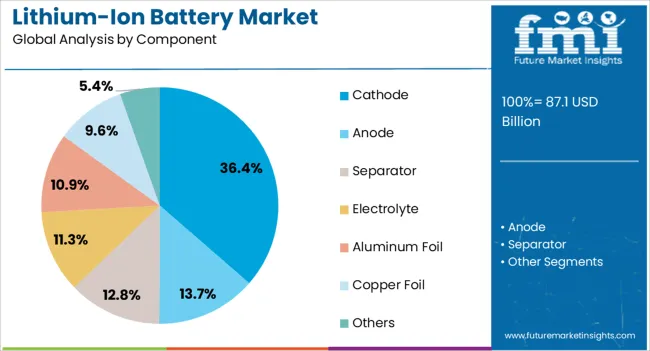

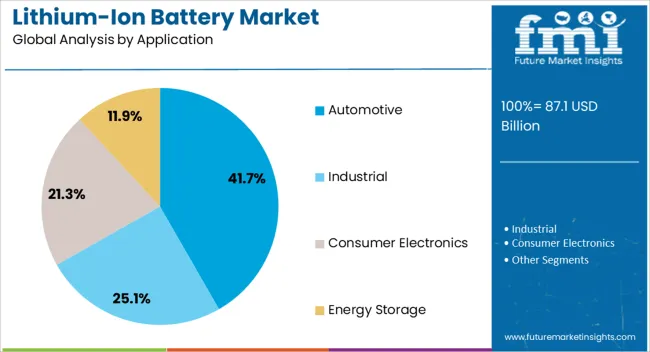

The lithium-ion battery market is segmented by chemistry, component, application, and geographic regions. By chemistry, the lithium-ion battery market is divided into LFP, LCO, LTO, NMC, NCA, and LMO. In terms of components, the lithium-ion battery market is classified into Cathode, Anode, Separator, Electrolyte, Aluminum Foil, Copper Foil, and Others. Based on application, the lithium-ion battery market is segmented into Automotive, Industrial, Consumer Electronics, and Energy Storage.

Regionally, the lithium-ion battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LFP (lithium iron phosphate) segment is projected to hold 31.8% of the lithium-ion battery market revenue in 2025, driven by its favorable safety profile, long cycle life, and cost efficiency. Industry reports have noted that LFP chemistry offers superior thermal stability, reducing the risk of overheating and thermal runaway compared to other lithium-ion chemistries.

This has positioned LFP as a preferred choice for applications where safety and durability outweigh the need for maximum energy density. Manufacturers have scaled up LFP production due to its reliance on more abundant and less expensive raw materials, which lowers overall production costs.

Additionally, improvements in cell design have enhanced LFP’s volumetric energy density, expanding its use in electric vehicles, energy storage, and commercial applications. With growing demand for affordable, safe, and long-lasting battery solutions, the LFP segment is expected to maintain steady growth across both established and emerging markets.

The cathode segment is projected to account for 36.4% of the lithium-ion battery market revenue in 2025, securing its role as the most valuable component in the battery value chain. Growth in this segment has been fueled by ongoing advancements in cathode material formulations, which directly influence energy density, lifespan, and charging performance.

Industry developments have focused on optimizing compositions such as NMC (nickel manganese cobalt) and LFP to balance performance, cost, and sustainability. Raw material supply agreements for lithium, nickel, and cobalt have strengthened cathode production capabilities, ensuring consistent output to meet growing demand.

As the cathode is a key determinant of battery performance, manufacturers are investing heavily in research to improve material stability and reduce degradation over time. With the rising adoption of high-performance electric vehicles and energy storage systems, demand for advanced cathode technologies is expected to remain a major driver of market growth.

The automotive segment is projected to contribute 41.7% of the lithium-ion battery market revenue in 2025, maintaining its position as the leading application sector. The segment’s dominance has been propelled by the rapid global shift toward electric mobility, supported by government policies, emission reduction targets, and consumer adoption of EVs.

Automakers have increased partnerships with battery manufacturers to secure large-scale supply, while investments in gigafactories have scaled production to meet forecasted demand. Lithium-ion batteries have been favored in the automotive industry due to their high energy density, fast charging capabilities, and ability to support long driving ranges.

Advancements in battery management systems and thermal control technologies have further enhanced performance and safety for automotive applications. With the continued rollout of new EV models and expansion of charging infrastructure, the automotive segment is expected to remain the primary growth driver in the lithium-ion battery market.

The lithium-ion battery market is expanding due to the rapid adoption of electric vehicles, renewable energy storage, and portable electronic devices. These batteries offer high energy density, long cycle life, and low self-discharge, making them suitable for automotive, consumer electronics, and grid storage applications. Asia Pacific leads production and consumption with significant manufacturing capabilities and EV deployment, while Europe and North America focus on advanced battery technologies and integration with smart grids. Technological improvements in cathode materials, electrolyte formulations, and battery management systems enhance performance, safety, and lifespan.

Electric vehicle adoption is a key driver of lithium-ion battery demand. Automotive manufacturers require high-performance batteries for passenger cars, commercial vehicles, and electric buses. Renewable energy storage systems utilize lithium-ion batteries for load balancing, peak shaving, and uninterrupted power supply. Advancements in battery management systems, fast charging, and high energy density improve efficiency and reliability. Portable electronics, including smartphones, laptops, and wearable devices, further drive adoption. Increasing government incentives, emission reduction targets, and investment in EV infrastructure reinforce global demand for lithium-ion battery solutions across automotive, energy, and consumer applications.

Growth Opportunity Advancements in High-Capacity and Solid-State Batteries

High-capacity, solid-state, and fast-charging lithium-ion batteries present significant growth opportunities. Solid-state batteries offer enhanced safety, higher energy density, and longer cycle life. High-capacity batteries are critical for electric buses, trucks, and utility-scale energy storage systems. Manufacturers focusing on material innovation, battery design, and scalable production are positioned to meet growing demand. Integration with smart grids, energy management systems, and EV powertrains enables optimized performance and longevity. Increasing adoption in transportation, industrial applications, and renewable energy sectors supports global market expansion, creating opportunities for advanced lithium-ion battery technologies.

Emerging Trend Integration with AI and IoT for Battery Management

Lithium-ion batteries are increasingly integrated with AI and IoT-based battery management systems. Real-time monitoring, predictive maintenance, and remote diagnostics improve operational efficiency and safety. AI algorithms optimize charge/discharge cycles, prolong battery life, and prevent thermal runaway. IoT-enabled energy storage systems allow load management, remote control, and predictive analytics for renewable integration. Automotive and grid applications are leveraging these trends for improved energy utilization, reduced downtime, and higher system reliability. Integration of intelligent monitoring, remote diagnostics, and data-driven optimization is expected to expand adoption across automotive, industrial, and consumer segments worldwide.

Market Challenge Raw Material Shortages and Cost Pressures

Fluctuating prices and limited availability of lithium, cobalt, and nickel pose challenges for battery production. High energy requirements, complex manufacturing, and safety testing add to operational costs. Recycling and second-life utilization are emerging but currently limited. Companies investing in alternative chemistries, supply chain diversification, and efficient production processes are better positioned to overcome these challenges. Ensuring cost-effective, high-performance, and reliable lithium-ion battery solutions is critical to sustaining adoption and competitiveness across automotive, energy storage, and consumer electronics markets globally.

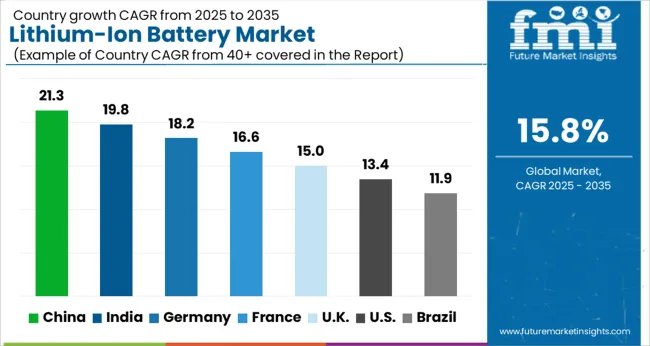

| Country | CAGR |

|---|---|

| China | 21.3% |

| India | 19.8% |

| Germany | 18.2% |

| France | 16.6% |

| U.K. | 15.0% |

| U.S. | 13.4% |

| Brazil | 11.9% |

The lithium-ion battery market is growing at a global CAGR of 15.8% from 2025 to 2035, driven by rising demand for electric vehicles, renewable energy storage, and consumer electronics. China leads with a CAGR of 21.3%, +35% above the global benchmark, supported by BRICS-driven investment in battery manufacturing, government incentives for EV adoption, and expansion of energy storage infrastructure. The United Kingdom posts 15.0%, slightly below the global rate, influenced by selective EV adoption and energy storage projects. The United States stands at 13.4%, −15% under the global benchmark, reflecting mature EV markets but steady uptake in energy storage and portable electronics. BRICS economies are driving volume growth, while OECD countries emphasize efficiency, technology, and sustainability.

China is growing at a CAGR of 21.3%, 5.5% above the global CAGR of 15.8%, driven by strong demand in electric vehicles, renewable energy storage, and consumer electronics. Domestic manufacturers are scaling production of high-capacity, fast-charging, and long-life lithium-ion cells. Government incentives for EV adoption, renewable energy projects, and industrial electrification accelerate market expansion. Collaborations between OEMs, battery manufacturers, and research institutions enhance technology innovation, supply chain efficiency, and safety compliance. Rising exports of advanced batteries strengthen China’s position in the global market. Investment in advanced production lines, automation, and recycling capabilities further reinforces growth, making China the leading contributor to global lithium-ion battery adoption.

India is progressing at a CAGR of 19.8%, 4.0% above the global CAGR, supported by rapid adoption in electric vehicles, renewable energy storage, and industrial applications. Manufacturers are expanding production of high-performance lithium-ion cells with enhanced energy density and thermal management. Government policies promoting EV adoption, energy storage systems, and industrial electrification accelerate market penetration. Partnerships with global battery technology providers facilitate technology transfer and faster deployment. Growing demand for commercial and residential energy storage systems further fuels market growth. India’s focus on clean energy transition, industrial electrification, and EV production positions it as a key growth market in the Asia-Pacific region.

Germany is growing at a CAGR of 18.2%, 2.4% above the global CAGR, driven by automotive electrification, renewable energy adoption, and industrial energy storage projects. High-performance lithium-ion batteries are used in EVs, industrial machinery, and energy storage systems. Strong R&D infrastructure and partnerships with European battery manufacturers enhance technology development and production quality. Export of advanced batteries supports market stability. Germany’s emphasis on EV adoption, renewable energy integration, and industrial electrification sustains consistent growth above global benchmarks, with high-value applications driving adoption of next-generation lithium-ion technologies.

The United Kingdom is expanding at a CAGR of 15.0%, slightly below the global CAGR of 15.8%, reflecting moderate growth. EVs, residential and commercial energy storage, and industrial electrification drive adoption. Imports of high-capacity lithium-ion cells supplement domestic production. Industrial modernization, EV adoption, and renewable energy projects ensure steady growth. Investments in R&D and partnerships with European battery providers improve energy density, cycle life, and safety compliance. Growth is gradual but consistent, supported by renewable integration and energy storage projects.

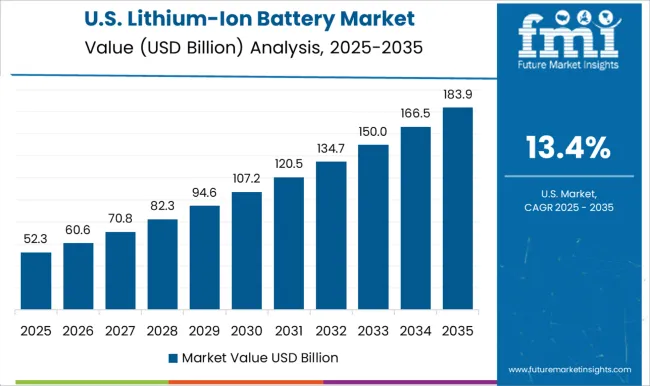

The United States is growing at a CAGR of 13.4%, 2.4% below the global CAGR of 15.8%, reflecting slower expansion due to a mature market. Adoption is concentrated in EVs, industrial energy storage, and consumer electronics. Domestic production is complemented by imports of high-performance lithium-ion cells from Europe and Asia. Growth is supported by renewable energy adoption, EV manufacturing, and industrial electrification projects, though overall expansion remains below the global benchmark. High-value applications, technological upgrades, and partnerships with global suppliers ensure steady but controlled market growth.

The lithium-ion battery market is driven by companies delivering advanced energy storage solutions for electric vehicles, stationary energy storage systems, consumer electronics, aerospace, and industrial power applications. Alcoa Corporation is assumed to be the leading player, supplying high-purity aluminum foils and current collectors that improve energy density, thermal management, and cycle stability in lithium-ion cells. ArcelorMittal and Baosteel maintain competitive positions by providing specialized stainless steel and nickel-alloy components for battery casings, electrodes, and structural supports, ensuring mechanical reliability and safety compliance. Dynacast and Kaiser Aluminum focus on precision-engineered metallic modules and lightweight components, enabling scalable battery pack assemblies for electric vehicles and commercial storage systems. Jindal Stainless, Kobe Steel, and Novelis contribute with engineered foils, conductive substrates, and aluminum-lithium alloys optimized for high-performance cathodes and anodes.

Nippon Steel Corporation, POSCO, Rio Tinto, and RUSAL strengthen the market through global supply networks, high-quality raw materials, and tailored solutions for large-format cells, modular battery systems, and industrial energy storage applications. Product brochures highlight critical attributes such as high-energy density, charge-discharge efficiency, thermal stability, mechanical durability, corrosion resistance, and regulatory compliance for automotive and industrial deployments. Features including lightweight materials, multi-layer electrode foils, and robust module architectures are emphasized for EV battery packs, grid-scale storage, and portable electronics. Technical datasheets and application notes provide guidelines for optimal cell assembly, thermal management, and performance validation. Collectively, these offerings focus on material performance, operational efficiency, and reliability, enabling manufacturers and system integrators to deliver consistent energy output, extended lifecycle, and high-performance operation across diverse lithium-ion battery applications globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.1 Billion |

| Chemistry | LFP, LCO, LTO, NMC, NCA, and LMO |

| Component | Cathode, Anode, Separator, Electrolyte, Aluminum Foil, Copper Foil, and Others |

| Application | Automotive, Industrial, Consumer Electronics, and Energy Storage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CATL, A123 Systems, Akku Tronics New Energy Technology, BYD, Clarios, Ding Tai Battery, Duracell, EaglePicher Technologies, EnerDel, Energon, Energus Power Solutions, Exide Technologies, General Electric, Hitachi Energy, LG Chem, Lithium Werks, Maxell, Padre Electronics, Panasonic, Philips, ProLogium Technology, Saft, Samsung SDI, Tesla, and Toshiba |

| Additional Attributes | Dollar sales by battery type and application segment, demand dynamics across electric vehicles, consumer electronics, and energy storage systems, regional trends across Asia-Pacific, North America, and Europe, innovation in high-energy density, fast-charging, and solid-state technologies, environmental impact of material sourcing and recycling, and emerging use cases in grid storage, e-mobility, and portable power solutions. |

The global lithium-ion battery market is estimated to be valued at USD 87.1 billion in 2025.

The market size for the lithium-ion battery market is projected to reach USD 377.6 billion by 2035.

The lithium-ion battery market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in lithium-ion battery market are LFP, LCO, LTO, NMC, NCA and LMO.

In terms of component, cathode segment to command 36.4% share in the lithium-ion battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA