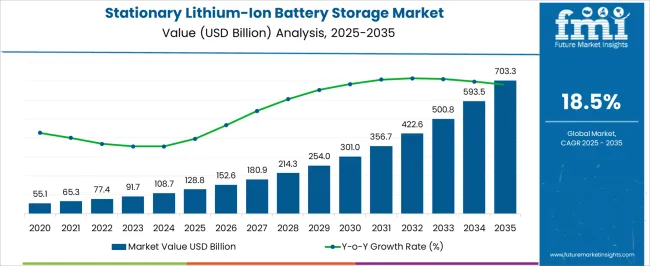

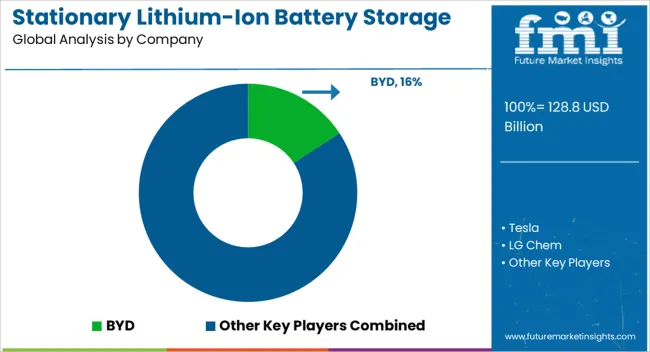

The stationary lithium-ion battery storage market is expected to grow from USD 128.8 billion in 2025 to USD 703.3 billion by 2035, registering an 18.5% CAGR and creating an absolute dollar opportunity of USD 574.5 billion. Growth is driven by the rising need for grid stability, renewable energy integration, and peak load management, along with increasing adoption of energy storage solutions in commercial, industrial, and utility-scale applications.

Technological advancements in battery efficiency, lifecycle, and safety are further enhancing market adoption. Rolling CAGR analysis highlights variations in growth momentum across the forecast period. From 2025 to 2028, rolling CAGR values remain slightly below the average, reflecting early adoption stages and initial infrastructure deployment in North America and Europe. Between 2029 and 2032, growth accelerates sharply as Asia Pacific, particularly China, India, and Japan, expands renewable energy capacity, drives grid modernization, and implements supportive government policies. From 2033 to 2035, rolling CAGR moderates slightly as early-adopting regions achieve higher penetration and replacement cycles begin, balancing rapid expansion with stabilized demand.

The USD 574.5 billion opportunity demonstrates substantial cumulative revenue potential, with rolling CAGR trends providing insight into early-stage adoption, mid-phase acceleration, and late-stage stabilization across global stationary lithium-ion battery storage markets between 2025 and 2035.

| Metric | Value |

|---|---|

| Stationary Lithium-Ion Battery Storage Market Estimated Value in (2025 E) | USD 128.8 billion |

| Stationary Lithium-Ion Battery Storage Market Forecast Value in (2035 F) | USD 703.3 billion |

| Forecast CAGR (2025 to 2035) | 18.5% |

The stationary lithium-ion battery storage market is primarily driven by the utility-scale energy sector, which accounts for approximately 45% of the market share, as utilities integrate storage systems to balance renewable generation and ensure grid stability. The commercial and industrial segment contributes around 25%, using battery storage for peak load management, backup power, and energy cost optimization. The residential sector represents close to 15%, deploying home energy storage systems paired with rooftop solar or for backup during outages. Microgrids and off-grid applications account for roughly 10%, requiring reliable energy storage in remote or distributed energy systems. The remaining 5% comes from research institutions and pilot projects focused on testing and advancing large-scale energy storage technologies.

The market is growing with innovations in battery chemistry, system integration, and digital monitoring. High-capacity, long-life cells are being developed to improve performance and reduce degradation over time. Modular and scalable storage solutions are enabling flexible deployment across residential, commercial, and utility applications. IoT-enabled systems allow real-time performance monitoring, predictive maintenance, and energy optimization. Integration with renewable energy projects is increasing, supporting grid flexibility and peak load management. Manufacturers are investing in advanced thermal management and safety features to enhance reliability. Rising demand for clean energy, energy independence, and improved grid resilience is driving adoption worldwide.

The stationary lithium-ion battery storage market is witnessing significant expansion, driven by increasing demand for reliable, scalable, and efficient energy storage solutions. Growing investments in renewable energy integration, grid stabilization, and peak load management are fueling adoption across utility and commercial sectors. The market is benefiting from rapid advancements in battery chemistries and system designs that enhance energy density, lifecycle, and safety performance.

Regulatory incentives and government mandates aimed at decarbonization and energy resilience are further accelerating deployment. As aging grid infrastructure undergoes modernization, the need for distributed storage systems capable of providing grid services such as frequency regulation, load shifting, and backup power is becoming critical.

The flexibility offered by lithium-ion battery technologies in terms of modularity and scalability is contributing to their preference over conventional storage options. As the focus on clean energy transitions intensifies, the stationary lithium-ion battery storage market is poised for sustained growth, supported by technological innovation and evolving energy policies.

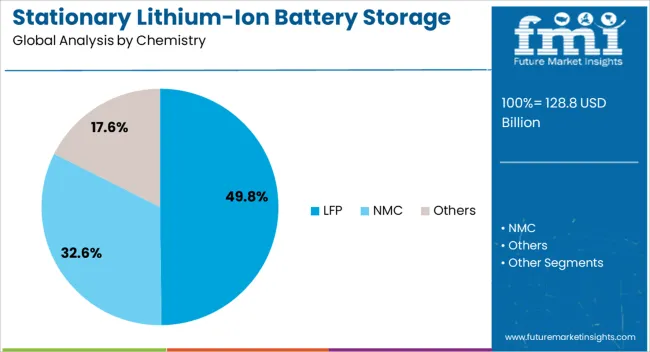

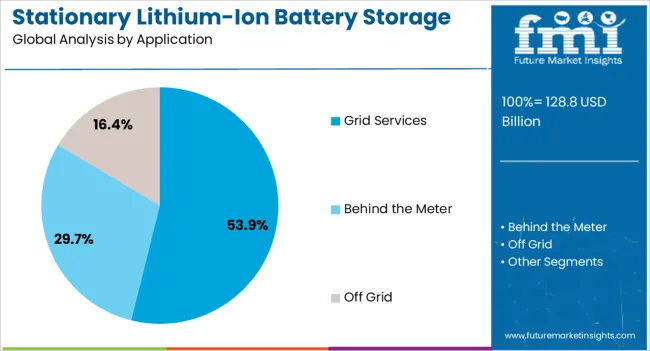

The stationary lithium-ion battery storage market is segmented by chemistry, application, and geographic regions. By chemistry, stationary lithium-ion battery storage market is divided into LFP, NMC, and Others. In terms of application, stationary lithium-ion battery storage market is classified into Grid Services, Behind the Meter, and Off Grid. Regionally, the stationary lithium-ion battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lithium iron phosphate (LFP) chemistry segment is projected to hold 49.8% of the stationary lithium-ion battery storage market revenue share in 2025, making it the leading chemistry type. This prominence is attributed to LFP’s inherent safety advantages, thermal stability, and long cycle life, which are highly valued in stationary applications requiring reliability and durability.

The chemistry’s lower cost relative to other lithium-ion variants improves its competitiveness in large-scale storage deployments. Its environmental friendliness and reduced reliance on critical metals align with sustainability goals, increasing adoption across diverse geographic regions.

Continuous improvements in energy density and charging performance have further enhanced its appeal. The balance of safety, cost, and performance offered by LFP batteries positions this segment as the preferred choice for grid-scale energy storage projects, particularly in applications demanding extended operational lifetimes and stringent safety standards.

The grid services application segment is expected to represent 53.9% of the stationary lithium-ion battery storage market revenue share in 2025, establishing it as the leading application category. This dominance is driven by the growing requirement for energy storage solutions that can support grid stability, frequency regulation, voltage control, and peak demand management.

Lithium-ion batteries configured for grid services provide rapid response times and flexible dispatch capabilities essential for balancing intermittent renewable energy sources such as solar and wind. Utility-scale projects and microgrid implementations are increasingly relying on battery storage systems to enhance grid reliability and resilience.

Additionally, regulatory frameworks and market mechanisms incentivizing ancillary services are encouraging the deployment of battery storage in this segment. The ability to provide multiple grid support functions with a single storage system enhances economic value and operational efficiency, making grid services the foremost application area within the stationary lithium-ion battery storage market.

The stationary lithium-ion battery storage market is growing due to increasing electricity demand, renewable energy integration, and industrial energy management needs. Global revenue surpassed USD 12.8 billion in 2024, with a projected CAGR of 11% from 2025 to 2030. Asia Pacific leads with 42% share, driven by China (USD 5.4 billion), Japan (USD 1.8 billion), and South Korea (USD 1.2 billion), focusing on utility-scale storage and industrial applications. North America accounts for 30% (USD 3.8 billion), led by the USA Europe contributes 25% (USD 3.2 billion), led by Germany, France, and UK Advanced energy density, modularity, and lifecycle management support market growth globally.

Stationary lithium-ion battery storage is widely adopted across utilities, industrial facilities, and commercial sectors, accounting for over 70% of global demand. Utility-scale deployment represents 40%, supporting grid balancing, peak load management, and renewable integration. Industrial usage contributes 20%, powering manufacturing plants, data centers, and process industries. Commercial adoption accounts for 10%, including office complexes, retail centers, and hospitals requiring energy backup and demand management. Asia Pacific leads with 42% market share, with China installing 4.2 GWh and Japan 1.8 GWh in 2024. North America contributes 30%, and Europe 25%. Expanding grid-scale and facility-specific storage projects drive global adoption.

Technological innovations include high-energy-density cells, modular rack systems, and advanced battery management systems (BMS). Lithium-ion cells offer energy densities of 250–300 Wh/kg, enabling compact, high-capacity storage. Modular systems allow scalable installations from 100 kWh to 100 MWh. Advanced BMS ensures real-time monitoring, thermal management, and state-of-charge optimization, improving safety and extending cycle life by 10–15%. Asia Pacific emphasizes cost-effective modular solutions for utilities and industries. Europe focuses on grid-tied applications with certified safety and performance standards. North America integrates predictive analytics for performance optimization. These innovations enhance reliability, reduce operational costs, and improve adoption globally.

Stationary lithium-ion battery storage is increasingly applied in renewable energy integration, industrial backup, and peak shaving. Renewable energy applications contribute 40%, storing surplus electricity from solar and wind installations. Industrial backup represents 25%, providing uninterrupted power to factories, data centers, and processing plants. Peak shaving applications account for 15%, helping reduce electricity costs during high-demand periods. Asia Pacific leads with 42% share, with China deploying 4.2 GWh and Japan 1.8 GWh in 2024. Europe contributes 25%, focusing on renewable storage and industrial backup. North America holds 30%, emphasizing grid balancing, commercial backup, and energy arbitrage. Expanding use across sectors drives market growth.

The stationary lithium-ion battery storage market faces challenges from high upfront costs, maintenance, and safety regulations. Utility-scale installations cost USD 400–600 per kWh depending on capacity and technology. Maintenance includes monitoring, cooling system checks, and cell replacement every 8–10 years. Regulatory compliance in Europe and North America requires adherence to electrical safety, fire prevention, and environmental standards. Asia Pacific mitigates costs through local cell manufacturing and large-scale deployment. Europe emphasizes certified battery systems and safety testing. North America integrates automated BMS and predictive maintenance. Despite operational advantages, high capital expenditure and stringent safety requirements remain key barriers to adoption worldwide.

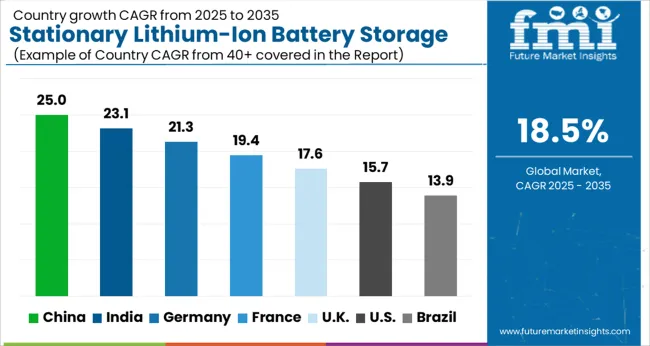

| Country | CAGR |

|---|---|

| China | 25.0% |

| India | 23.1% |

| Germany | 21.3% |

| France | 19.4% |

| UK | 17.6% |

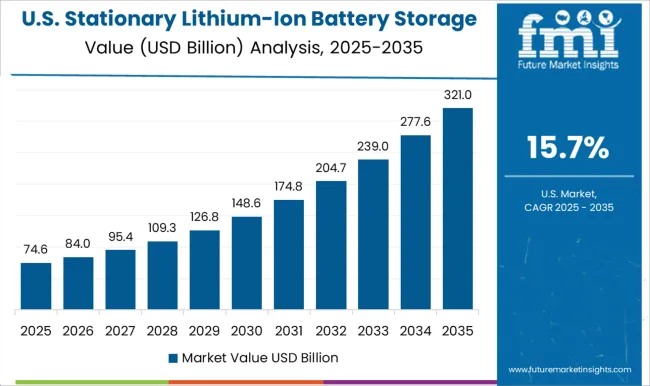

| USA | 15.7% |

| Brazil | 13.9% |

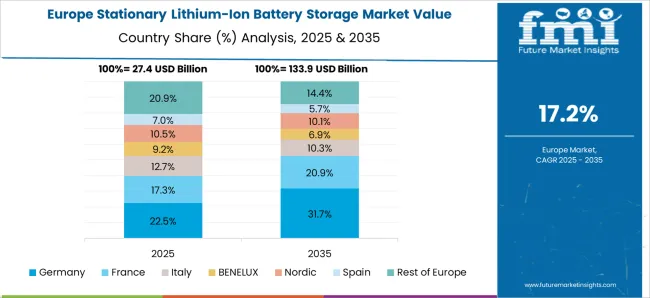

In 2025, the stationary lithium-ion battery storage market is projected to grow at a global CAGR of 18.5% through 2035, driven by rising demand for grid stability, renewable energy integration, and large-scale energy storage solutions. China leads at 25.0%, 35% above the global benchmark, supported by BRICS-driven expansion in renewable energy capacity, utility-scale storage projects, and domestic battery manufacturing. India follows at 23.1%, 24.9% above the global average, reflecting increasing deployment of solar and wind energy systems, grid modernization, and energy storage initiatives. Germany records 21.3%, 15.1% above the benchmark, shaped by OECD-driven innovation in battery technology, industrial storage solutions, and sustainable energy policies. The United Kingdom posts 17.6%, 4.9% below the global rate, with adoption focused on utility-scale renewable projects, commercial energy storage, and pilot installations. The United States stands at 15.7%, 15.1% below the benchmark, with steady uptake in grid balancing, commercial energy storage, and renewable integration projects. BRICS economies drive the largest share of market growth, OECD countries emphasize technological advancement and efficiency, while ASEAN nations contribute through emerging renewable installations and energy storage programs.

China stationary lithium-ion battery storage market is expanding at a CAGR of 25.0%, well above the global 18.5%, driven by renewable energy integration, industrial energy storage, and grid balancing projects. In 2024, approximately 6.8 GW of capacity was deployed, with Guangdong, Jiangsu, and Shandong accounting for 57% of installations. Companies such as CATL, BYD, and Sungrow focused on modular battery units, high-efficiency lithium-ion cells, and advanced energy management systems. Industrial applications contributed 36% of total capacity, while commercial and utility-scale integration represented 31%. Deployment of smart monitoring and thermal management systems improved operational efficiency by 13%, while rapid installation and modularity enabled scalable solutions for fluctuating energy demand.

India stationary lithium-ion battery storage market is growing at 23.1% CAGR, above the global 18.5%, supported by industrial energy storage, renewable energy integration, and commercial adoption. In 2024, about 2.9 GW of capacity was deployed, with Maharashtra, Karnataka, and Tamil Nadu contributing 52% of total installations. Companies including Tata Power, Exide Industries, and Vikram Solar focused on modular battery units, lithium-ion cells, and advanced monitoring systems. Industrial applications represented 34% of total capacity, while commercial installations accounted for 29%. Deployment of automated monitoring and thermal control systems enhanced reliability by 12%, while modular designs enabled scalable energy storage solutions across multiple sectors.

Germany stationary lithium-ion battery storage market is growing at 21.3% CAGR, above the global 18.5%, driven by renewable energy projects, industrial adoption, and utility-scale integration. In 2024, approximately 1.3 GW of capacity was deployed, with Berlin, Bavaria, and North Rhine-Westphalia contributing 43% of installations. Companies such as Siemens Energy, Bosch, and E3/DC focused on modular battery units, high-efficiency cells, and advanced energy management systems. Industrial applications contributed 35% of total capacity, while utility-scale and commercial integration represented 28%. Implementation of smart monitoring and thermal control systems improved operational efficiency by 11%, while modularity enabled flexible scaling.

United Kingdom stationary lithium-ion battery storage market is expanding at 17.6% CAGR, slightly below the global 18.5%, supported by industrial adoption, renewable energy projects, and commercial integration. In 2024, around 580 MW of capacity was deployed, concentrated in London, Manchester, and Birmingham (45% of total installations). Companies such as ITM Power, Powervault, and Siemens Energy focused on modular lithium-ion battery systems, high-efficiency cells, and real-time monitoring platforms. Industrial adoption accounted for 32% of capacity, while commercial and utility-scale deployment represented 28%. Advanced monitoring systems and modular design improved operational reliability and allowed scalable energy storage across multiple sites.

United States stationary lithium-ion battery storage market is growing at 15.7% CAGR, below the global 18.5%, reflecting steady adoption in renewable integration, industrial energy storage, and commercial applications. In 2024, approximately 1.7 GW of capacity was deployed, with California, Texas, and New York accounting for 54% of total installations. Companies including Tesla, Fluence, and LG Energy focused on modular lithium-ion battery units, high-efficiency cells, and smart energy management systems. Industrial applications contributed 33% of total capacity, while commercial and utility-scale integration represented 27%. Automated monitoring and modular deployment improved operational efficiency by 10% and allowed scalable energy storage solutions across diverse sectors.

The stationary lithium-ion battery storage market is highly competitive, driven by rising demand for grid stabilization, renewable energy integration, and backup power solutions across utilities, commercial, and industrial sectors. Market competition is shaped by battery chemistry (NMC, LFP, NCA), storage capacity, cycle life, efficiency, safety features, cost, and scalability. Companies differentiate through advanced battery management systems, modular designs, thermal management, and integration with energy management software to optimize performance and reliability.

Key players such as Tesla, LG Energy Solution, Samsung SDI, BYD, Panasonic, CATL, Fluence, E3/DC, NEC Energy Solutions, and Saft Batteries dominate the market by offering high-performance, reliable, and technologically advanced stationary lithium-ion storage solutions. Strategic partnerships with utilities, renewable energy developers, and system integrators are leveraged to expand market presence. Regional and emerging manufacturers compete by providing cost-effective, compact, and application-specific storage solutions. The market is moderately consolidated, with leading companies focusing on innovation, regulatory compliance, long-term service support, and performance optimization to strengthen market share and meet growing demand for stationary energy storage.

| Item | Value |

|---|---|

| Quantitative Units | USD 128.8 Billion |

| Chemistry | LFP, NMC, and Others |

| Application | Grid Services, Behind the Meter, and Off Grid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BYD, Tesla, LG Chem, Panasonic, Siemens, SK Innovation, Hitachi, GS Yuasa, Exide, Toshiba, Johnson Controls, Leclanche, and Varta |

| Additional Attributes | Dollar sales by battery type and end use, demand dynamics across residential, commercial, and utility-scale applications, regional trends in energy storage adoption, innovation in energy density, cycle life, and safety, environmental impact of production and recycling, and emerging use cases in grid balancing, microgrids, and renewable integration. |

The global stationary lithium-ion battery storage market is estimated to be valued at USD 128.8 billion in 2025.

The market size for the stationary lithium-ion battery storage market is projected to reach USD 703.3 billion by 2035.

The stationary lithium-ion battery storage market is expected to grow at a 18.5% CAGR between 2025 and 2035.

The key product types in stationary lithium-ion battery storage market are lfp, nmc and others.

In terms of application, grid services segment to command 53.9% share in the stationary lithium-ion battery storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Geostationary Orbit Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Behind the Meter Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA