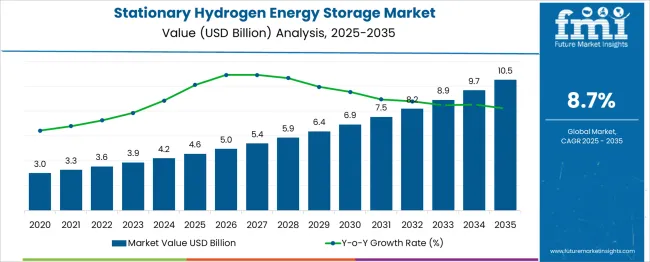

The Stationary Hydrogen Energy Storage Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 10.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. A peak-to-trough analysis highlights a consistent upward trend without significant downturns, signaling structural resilience driven by decarbonization goals and the transition toward renewable-based power grids.

The early stage (2025–2030) sees the market move from USD 4.6 billion to USD 6.9 billion, adding USD 2.3 billion, supported by accelerated deployment of green hydrogen projects and government incentives promoting long-duration energy storage. Growth during this phase is further amplified by integration of hydrogen storage in microgrids and industrial backup systems, reducing dependence on fossil fuel-based reserves.

The later stage (2030–2035) adds USD 3.6 billion, taking the market to USD 10.5 billion, as utility-scale projects and hybrid renewable-hydrogen plants dominate installations. The absence of volatility across the growth curve underscores steady capital flow and advancing electrolyzer technology, enhancing efficiency and reducing storage costs. Key opportunities will favor manufacturers developing large-capacity storage systems, modular configurations, and digitally enabled monitoring solutions, aligning with global energy transition strategies that prioritize grid stability, reliability, and carbon neutrality in power generation.

| Metric | Value |

|---|---|

| Stationary Hydrogen Energy Storage Market Estimated Value in (2025E) | USD 4.6 billion |

| Stationary Hydrogen Energy Storage Market Forecast Value in (2035F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The stationary hydrogen energy storage segment contributes modest but increasing value across adjacent energy markets. Within the stationary energy storage systems market, it holds roughly 4–5% share—dwarfed by lithium‑ion and pumped hydro but rising steadily as hydrogen scales into utility-scale storage. In the renewable energy integration infrastructure market, hydrogen storage represents 8–10%, since it enables seasonal and long-term storage capacity complementing shorter-duration options. Within the industrial and utility energy storage segment, its share stands at 6–8%, supporting grid balancing and demand management in industrial facilities and utilities.

In the emerging long-duration storage technologies market, hydrogen approaches 15–18%, reflecting its unique suitability for multi-day energy shifting. Finally, within the hydrogen supply chain and infrastructure market, stationary storage contributes 20–22%, as it integrates with electrolyzer systems and downstream power generation.

Growth is propelled by cost reductions in compression and liquefaction, policy mandates for deep decarbonization, and demand for seasonal storage. Large-scale salt cavern projects and modular storage tanks are expanding capacity, while integration with electrolyzers and fuel cells enhances round-trip efficiency. As grid regulators plan decarbonized energy systems, hydrogen storage is increasingly seen as a scalable, long-duration pillar of next-generation energy architecture.

The Stationary Hydrogen Energy Storage market is experiencing accelerated growth as global energy systems shift toward sustainability and decarbonization. With increasing integration of intermittent renewable energy sources such as solar and wind, the need for large-scale, long-duration storage solutions has intensified. Hydrogen-based storage systems are being recognized for their capacity to store excess energy over extended periods and across seasonal cycles, making them a critical component of future energy infrastructure.

Governments and energy companies are actively investing in hydrogen projects to enhance grid stability, reduce emissions, and support energy security goals. Technological advancements in electrolysis, compression, and fuel cell integration have improved system efficiency and viability.

The rising adoption of green hydrogen initiatives, combined with supportive regulatory frameworks and funding mechanisms, is further accelerating market growth. As energy transition strategies mature globally, stationary hydrogen storage is anticipated to play a central role in enabling resilient, low-carbon energy networks that can adapt to fluctuating demand and supply patterns..

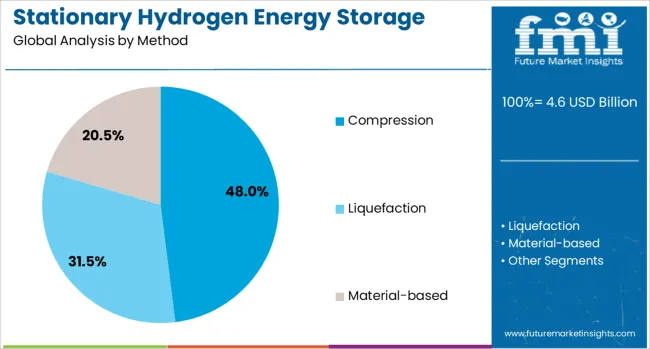

The stationary hydrogen energy storage market is segmented by method and geographic regions. The stationary hydrogen energy storage market is divided into Compression, Liquefaction, and Material-based. Regionally, the stationary hydrogen energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The compression method segment is projected to account for 48% of the Stationary Hydrogen Energy Storage market revenue share in 2025, making it the leading storage method. This segment’s leadership has been driven by the relatively mature and cost-effective nature of compression technologies that enable hydrogen to be stored in high-pressure vessels with minimal energy loss. Compression systems have been preferred due to their compatibility with a range of applications, including grid-scale storage, backup power systems, and industrial energy supply.

The high volumetric energy density achieved through compression has enhanced its feasibility in stationary setups, especially where space constraints are a concern. Advancements in compressor efficiency and safety features have further strengthened adoption across utility and commercial installations.

Moreover, the ability to integrate compressed hydrogen storage with electrolyzers and fuel cells in a modular configuration has increased its appeal for developers seeking scalable and flexible infrastructure. As hydrogen strategies continue to gain traction, the compression method remains central to enabling reliable and efficient energy storage solutions..

Stationary hydrogen energy storage comprises systems that generate, store, and dispatch hydrogen produced via electrolysis, often using renewable electricity, to supply power or generate fuel. These solutions are used by utilities, microgrid operators, and industrial facilities to balance supply variability and support resilience. Adoption has been influenced by demand for flexible storage duration, grid stability, and long-term energy capacity. Providers offering modular electrolyser units, high-purity hydrogen output, and safe storage vessels have been competitive. Deployments enabling dispatchable power generation, rapid ramp-up, and integration with gas turbines or fuel cells continue to guide project selection in infrastructure and energy restoration applications.

Adoption of stationary hydrogen storage has been supported by the growing need for long duration energy retention to integrate variable renewable assets. Systems that convert excess renewable electricity into hydrogen fuel for later reconversion have enabled improved load shifting and supply balancing. Utility operators and industrial energy managers have prioritized storage technologies that extend beyond short-term battery life. Hydrogen storage solutions have enabled dispatchable energy for peak shaving, emergency backup, and resilience planning. Modular scalability and long-duration storage capability have made hydrogen systems attractive for applications where seasonal or weekly storage is required. Increasing grid decentralization and microgrid design evolution have reinforced interest in hydrogen-based storage.

Adoption has been constrained by high upfront cost for installing electrolysis, compression, storage, and reconversion systems. End-to-end round-trip efficiency remains lower than many battery-based storage options, raising operational considerations. Safety regulations around hydrogen handling, pressurization, and storage vessel certification contribute to deployment complexity. Integration with existing grid infrastructure or industrial gas networks often demands engineering customization. Water supply needs for electrolysis and purity requirements add logistical requirements. High pressure or liquefied hydrogen storage systems may require site-specific infrastructure that increases capital cost and planning time. Lower adoption may occur where regulatory or incentive frameworks are underdeveloped.

Opportunities are being created through integration of hydrogen storage with combined cycle plants, fuel cell systems, and industrial process heat applications. Utility developers and microgrid operators are exploring hybrid energy portfolios combining solar or wind with hydrogen generation and reconversion units. Use of hydrogen for industrial hydrogenation or ammonia synthesis offers value beyond power. Off-grid industrial or remote microgrid installations benefit from hydrogen systems that allow use of multiple energy carriers. Partnerships with electrolyser OEMs and fuel cell innovators support tailored deployment solutions. Service offerings that bundle installation, monitoring, and maintenance support create recurring value for energy solution providers.

Emerging trends include deployment of autonomous control systems that coordinate electrolyser operation, storage level, and dispatch to optimize efficiency and supply reliability. Development of pressure storage vessels with improved materials and coatings has enhanced safety and lifetime performance. Use of PEM or solid oxide electrolysers tailored for modular or high-load applications is gaining traction. Integration with hydrogen pipelines or local industrial gas networks supports co-location efficiency. Digital twin systems modeling electrolyser and reconversion operation have been adopted for predictive maintenance. Open communication protocols between storage, grid assets, and remote dashboards support operational flexibility. Hydrogen purity monitoring and safety interlock automation continue to evolve across design platforms.

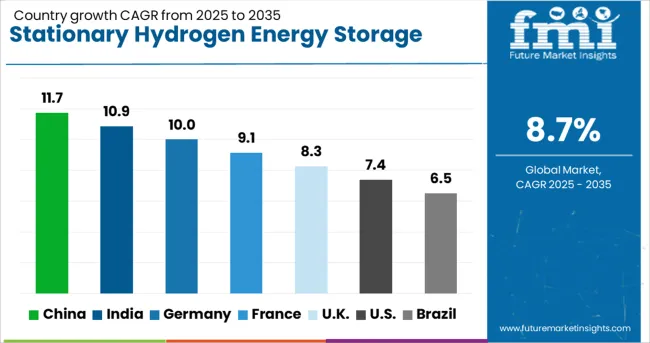

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

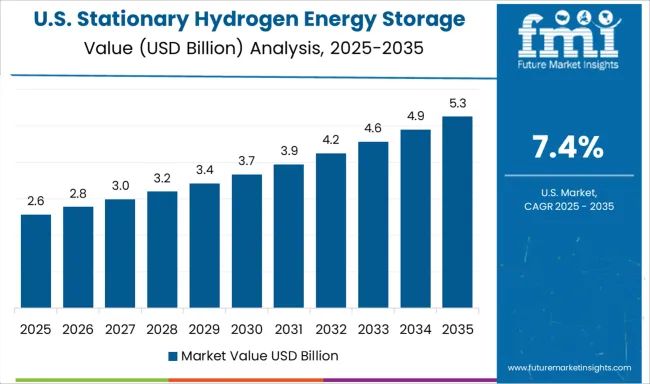

| USA | 7.4% |

| Brazil | 6.5% |

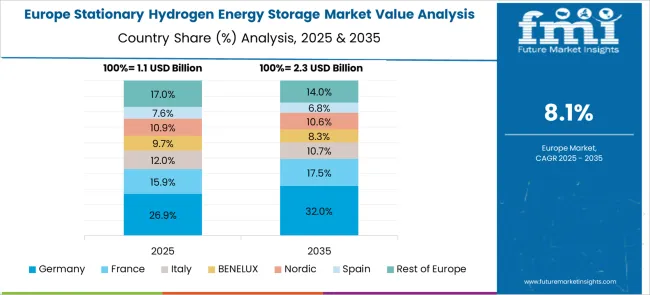

The stationary hydrogen energy storage market is expected to grow at a CAGR of 8.7% from 2025 to 2035, driven by renewable energy integration, large-scale storage requirements, and advancements in electrolyzer and fuel cell technologies. China, a BRICS economy, leads with 11.7%, supported by green hydrogen infrastructure investments and industrial decarbonization initiatives. India, also part of BRICS, follows at 10.9%, driven by clean energy programs and hydrogen pilot projects. Among OECD economies, France records 9.1%, while the United Kingdom posts 8.3% and the United States grows at 7.4%, reflecting strong focus on grid balancing and renewable storage systems. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 11.7% through 2035, driven by aggressive hydrogen infrastructure investments and renewable energy adoption. The country is prioritizing large-scale storage solutions to stabilize its wind and solar power grids. Deployment of proton exchange membrane (PEM) electrolyzers and advanced fuel cell systems is expanding under state-backed hydrogen valley projects. Industrial users, particularly in steel and chemical sectors, are adopting stationary hydrogen systems for decarbonization. Domestic firms are forming alliances with international companies to enhance technology transfer and efficiency improvements in storage solutions. The government’s emphasis on hydrogen as a strategic energy carrier ensures continued market growth.

India is forecasted to grow at a CAGR of 10.9% through 2035, supported by the National Green Hydrogen Mission and renewable energy integration programs. Stationary hydrogen storage systems are gaining traction in solar and wind projects for grid stability. Domestic companies are investing in alkaline and PEM-based electrolyzers to cater to industrial energy demands. Partnerships between Indian energy firms and global technology providers are accelerating the development of hydrogen-ready infrastructure for distributed generation. Increased focus on reducing fossil fuel dependency and leveraging hydrogen as a storage medium positions India as a significant emerging market for stationary hydrogen systems.

France is projected to post a CAGR of 9.1% through 2035, driven by policies aimed at low-carbon energy transition and hydrogen integration in renewable projects. Stationary hydrogen systems are increasingly used for power-to-gas applications and backup energy storage in industrial and commercial sectors. Government-funded pilot projects are promoting the adoption of solid oxide and PEM electrolyzers. The country is also investing in localized hydrogen hubs to support distributed energy applications. Collaboration between French energy companies and technology developers is driving innovations in hydrogen compression and storage density enhancement, making France a key player in the European hydrogen economy.

The United Kingdom is projected to achieve a CAGR of 4.6% from 2025 to 2035, supported by the improvement of chemical plant heating systems and the adoption of digital control enabled gas fired boilers. Energy optimization initiatives are prompting demand for compact, high efficiency boiler units designed for flexible operation. Integration of automated load management and remote diagnostics platforms is enhancing reliability in chemical process applications. Manufacturers are focusing on compliance driven designs with low emission performance to meet regulatory requirements. Hybrid heating models combining natural gas with alternative fuels are being introduced in advanced process industries for improved operational resilience.

The United States is expected to grow at a CAGR of 7.4% through 2035, supported by the implementation of hydrogen energy hubs and decarbonization strategies in industrial sectors. Stationary hydrogen storage is being adopted in renewable-rich states for grid reliability and energy security. Federal funding programs are accelerating the deployment of large-scale electrolyzer systems and compressed hydrogen storage solutions. Private companies are investing in advanced hydrogen storage technologies for microgrids and critical infrastructure backup systems. Strategic partnerships between energy firms and technology developers aim to enhance storage efficiency, safety, and scalability in the U.S. hydrogen economy.

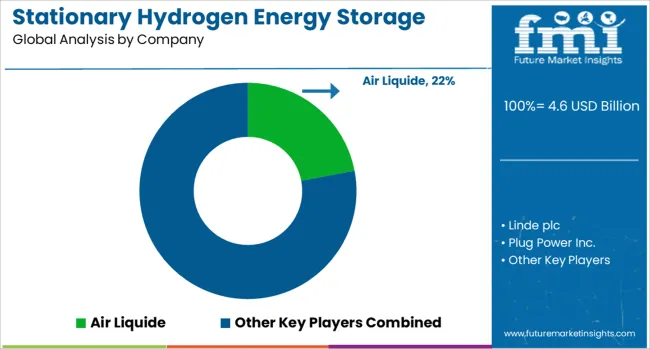

The stationary hydrogen energy storage market is led by key global players such as Air Liquide, Linde plc, Plug Power Inc., ITM Power, Nel ASA, and Hydrogenics (a subsidiary of Cummins Inc.). Air Liquide and Linde dominate with large-scale hydrogen production and storage solutions, leveraging extensive infrastructure and expertise in cryogenic storage for industrial and grid-scale applications. Plug Power focuses on hydrogen fuel cell systems integrated with stationary storage technologies, serving commercial and utility customers seeking backup and peak-shaving solutions.

ITM Power specializes in electrolyzer-based hydrogen production linked with energy storage systems for renewable integration projects, while Nel ASA emphasizes scalable hydrogen storage solutions combined with high-efficiency electrolysis technologies. Hydrogenics, under Cummins, provides advanced hydrogen storage systems integrated with fuel cell technology, targeting distributed energy and microgrid markets. Competitive differentiation revolves around storage efficiency, scalability, integration with renewable power, and safety compliance.

High entry barriers exist due to technological complexity, stringent safety standards, and the need for significant infrastructure investment. Key strategies include developing high-pressure composite tanks, liquid hydrogen storage systems, and underground storage facilities to optimize energy density and cost efficiency. Partnerships between electrolyzer manufacturers, renewable energy developers, and utilities are shaping the competitive landscape by facilitating large-scale hydrogen storage projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 Billion |

| Method | Compression, Liquefaction, and Material-based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde plc, Plug Power Inc., ITM Power, Nel ASA, and Hydrogenics (Cummins Inc.) |

| Additional Attributes | Dollar sales by storage type (compressed hydrogen, liquid hydrogen, metal hydrides) and application (grid energy storage, backup power, renewable integration), with demand fueled by decarbonization goals and energy resilience initiatives. Regional dynamics highlight strong adoption in Europe for renewable-linked hydrogen storage projects, while North America and Asia-Pacific show rapid growth driven by green hydrogen development and utility-scale applications. Innovation trends include advanced composite storage tanks for higher pressure ratings, modular storage systems for scalability, and integration of IoT-enabled monitoring for real-time safety and performance optimization. |

The global stationary hydrogen energy storage market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the stationary hydrogen energy storage market is projected to reach USD 10.5 billion by 2035.

The stationary hydrogen energy storage market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in stationary hydrogen energy storage market are compression, liquefaction and material-based.

In terms of , segment to command 0.0% share in the stationary hydrogen energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Energy Storage Devices Market

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Data Center Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA