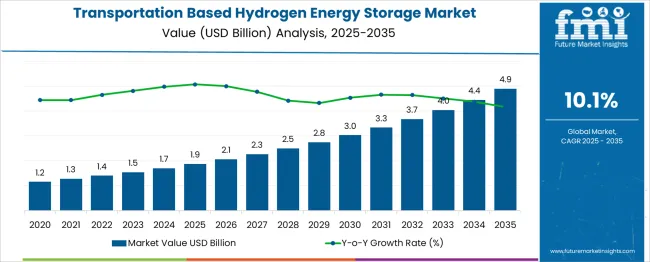

The Transportation Based Hydrogen Energy Storage Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period. The growth curve exhibits a gradual upward trajectory with slight acceleration beginning mid-period. Initial years between 2025 and 2028 show steady, incremental increases from USD 1.9 billion to USD 2.8 billion, suggesting early adoption and infrastructure development phases. This portion of the curve is characterized by moderate investment in technology validation and pilot projects.

From 2029 onward, the curve steepens, reflecting faster value addition as commercial deployments gain momentum and supply chains mature. By 2032, the market will reach USD 4.0 billion, supported by expanding hydrogen fuel cell vehicle fleets and improved storage efficiencies. The final years toward 2035 show continued acceleration, with the market hitting USD 4.9 billion, indicating scaling effects and broader acceptance of hydrogen as a viable energy storage medium in transportation. The curve’s shape suggests a transition from initial technology adoption to growth driven by regulatory support, cost reductions, and increased infrastructure investments. This progression outlines a growth pattern shifting from gradual to more rapid expansion during the forecast period.

| Metric | Value |

|---|---|

| Transportation Based Hydrogen Energy Storage Market Estimated Value in (2025 E) | USD 1.9 billion |

| Transportation Based Hydrogen Energy Storage Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

Growth is being fueled by rising investments in hydrogen infrastructure, government incentives promoting clean mobility, and escalating concerns regarding carbon emissions from conventional fuel-based transport systems. The integration of hydrogen into transportation is being recognized as a long-term strategic solution for energy diversification, especially in heavy-duty and long-range vehicle segments.

Advances in storage technologies and material sciences are enabling safer, more efficient hydrogen containment, which is essential for large-scale deployment. Additionally, the role of hydrogen in stabilizing energy grids and its compatibility with fuel cell electric vehicles is contributing to rising demand.

As the global transportation sector transitions toward zero-emission targets, hydrogen energy storage is anticipated to remain a cornerstone technology. Continued collaboration among governments, industry leaders, and research institutions is expected further to accelerate innovation and commercial scalability in the years ahead..

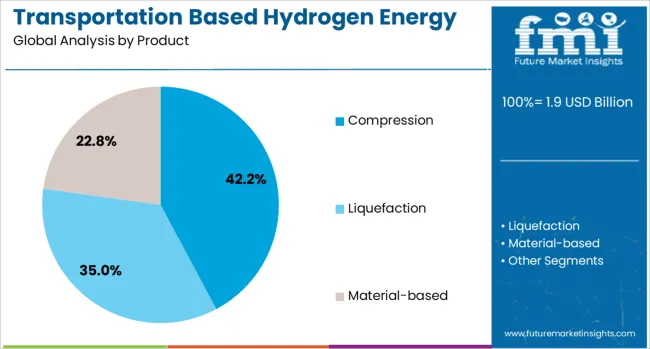

The transportation based hydrogen energy storage market is segmented by product and geographic regions. A byproduct of the transportation-based hydrogen energy storage market is divided into Compression, Liquefaction, and Material-based. Regionally, the transportation based hydrogen energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The compression product segment is projected to hold 42.20% of the Transportation Based Hydrogen Energy Storage market revenue share in 2025, making it the dominant technology for hydrogen storage. Its leadership position has been attributed to the relatively high energy density and cost-efficiency associated with compressed hydrogen systems. These systems have been widely adopted due to their ability to store large volumes of hydrogen at high pressure without the need for cryogenic cooling, thus reducing infrastructure and operational complexities.

Compression technologies have been preferred in mobile applications, particularly in hydrogen-fueled vehicles, where space and weight constraints demand compact and efficient storage solutions. The maturity of compression systems, supported by a well-established supply chain and manufacturing base, has further enhanced their scalability.

Moreover, improvements in compression efficiency and safety protocols have enabled the segment to maintain its technical and commercial edge. As the demand for hydrogen-powered transportation grows, compression-based storage is expected to remain the preferred solution across various vehicle categories..

Transportation based hydrogen energy storage is experiencing momentum as decarbonization targets drive adoption in heavy duty mobility. Demand is influenced by battery weight and range limitations, especially in freight, marine, and rail segments. Advancements in electrolyzers, compression, and storage vessels are improving cost-efficiency and operational viability. Infrastructure expansion through dedicated refueling corridors, combined with evolving purity and fueling standards, is reducing project risk. However, high upfront capital costs, regulatory compliance complexity, and electricity price volatility present significant hurdles. Long term growth is expected to be supported by service-based models and integration with ammonia and methanol value chains.

Hydrogen storage adoption in transportation is being driven by fleet decarbonization mandates and low emission targets set by governments and corporations. Heavy duty applications, including freight trucking, buses, rail, and maritime transport, benefit from hydrogen’s higher energy density compared to batteries, allowing longer operational ranges and reduced refueling downtime. In parallel, lower renewable electricity costs and improved electrolyzer efficiencies are contributing to competitive hydrogen production economics. Technological advancements in liquefaction, compression, and storage tank designs are increasing transport payloads and efficiency. Infrastructure investment in national hydrogen corridors and strategic fueling hubs near ports and industrial clusters further accelerates adoption.

High initial capital requirements for hydrogen refueling stations, transport trailers, and liquefaction facilities remain a barrier for large scale deployment. Project returns are often sensitive to utilization rates, making early phase economics challenging. Operational costs are impacted by electricity price fluctuations and water sourcing constraints, especially in arid regions. Complex regulatory frameworks, safety codes, and hazmat transport rules can slow down permitting processes and extend project timelines. Additionally, the limited availability of skilled personnel for hydrogen handling and infrastructure maintenance increases operational risks. These factors collectively influence investment timelines and delay widespread network expansion.

Hydrogen as a service business models are emerging, enabling fleet operators to avoid upfront capital investment in fueling infrastructure. Modular and portable refueling units are gaining traction for temporary depots and remote operations, offering scalability and faster deployment. Integration with ammonia and methanol supply chains is attracting interest for dual value stream opportunities and export potential. Digital asset monitoring for tanks, trailers, and compressors is enhancing utilization and predictive maintenance. Early adoption in niche markets such as mining, port logistics, and regional rail networks is expected to serve as proving grounds before broader commercialization.

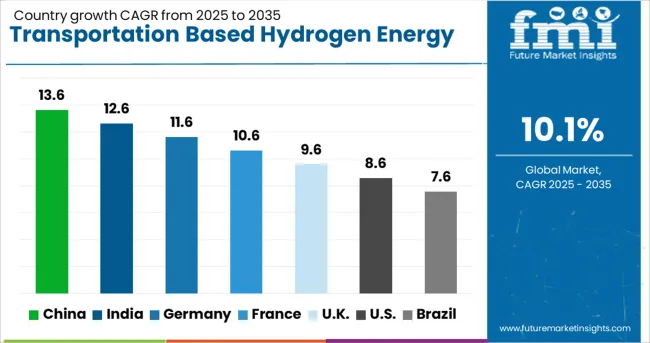

| Country | CAGR |

|---|---|

| China | 13.6% |

| India | 12.6% |

| Germany | 11.6% |

| France | 10.6% |

| UK | 9.6% |

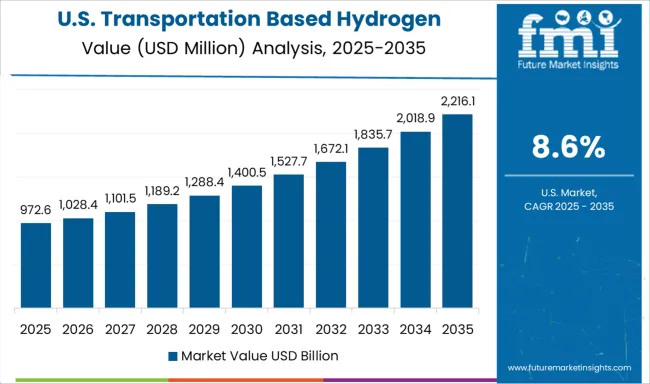

| USA | 8.6% |

| Brazil | 7.6% |

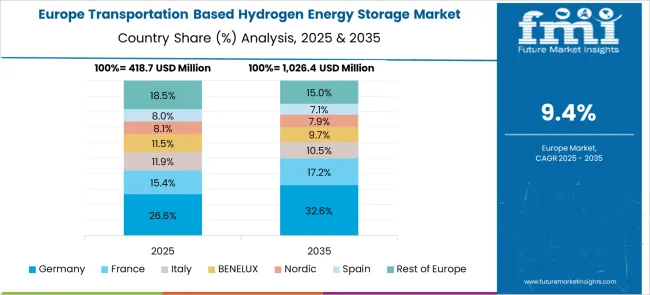

Global demand for transportation based hydrogen energy storage is projected to increase at a CAGR of 10.1% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads at 13.6%, followed by India at 12.6%, Germany at 11.6%, the United Kingdom at 9.6%, and the United States at 8.6%. These figures show a +35% premium for China, with India and Germany delivering above-average growth at +25% and +15% respectively. The UK grows close to the global baseline, trailing by –5%, whereas the US expands slower at –15%. Expansion in China and India is driven by government initiatives on clean transportation and infrastructure development. Mature markets show steadier adoption linked to technological advancements and policy frameworks. The report includes detailed analysis of 40+ countries with the top five referenced.

China is forecast to grow at a CAGR of 13.6% in the transportation based hydrogen energy storage market from 2025 to 2035. This growth is supported by extensive government funding aimed at hydrogen vehicle infrastructure and storage technology development. Leading companies such as SinoHytec and Guangdong Synergy focus on large-scale hydrogen storage systems tailored for commercial transport. Policy incentives encourage adoption in logistics and public transportation sectors. Additionally, collaboration between manufacturers and research institutes accelerates innovation. Distribution networks for hydrogen refueling stations have increased, supporting market penetration. Industry investments focus on enhancing storage capacity and safety.

India is projected to register a CAGR of 12.6% in transportation based hydrogen energy storage through 2035. Growth is driven by rising investment in clean energy technologies and pilot projects in transport sectors. Companies such as Indian Oil Corporation and Tata Power are developing hydrogen storage solutions for public buses and freight vehicles. Policy support focuses on reducing carbon emissions in urban centers. Infrastructure development in metropolitan regions is expanding to accommodate hydrogen refueling and storage. Industry collaborations with international firms accelerate technology transfer. Awareness campaigns emphasize hydrogen as a sustainable alternative fuel source.

Germany is expected to grow at a CAGR of 11.6% in transportation based hydrogen energy storage from 2025 to 2035. Growth is supported by the country’s leadership in hydrogen fuel cell vehicle production and infrastructure. Companies such as Linde and Siemens Energy focus on advanced storage technologies optimized for transportation. The German government incentivizes hydrogen usage through subsidies and research grants. Integration with renewable energy sources is increasing to support clean hydrogen production. Expansion of hydrogen refueling stations in logistics corridors accelerates market adoption. Partnerships between automotive and energy sectors strengthen technology deployment.

The United Kingdom is forecast to grow at a CAGR of 9.6% in transportation based hydrogen energy storage through 2035. Market growth is supported by strategic investments in hydrogen hubs and infrastructure upgrades. Companies such as ITM Power and Ceres Power are developing scalable storage solutions to meet transport sector needs. Government policies promote zero-emission vehicles through grants and regulatory frameworks. Expansion of hydrogen refueling stations is focused on urban centers and freight corridors. Collaboration with European partners facilitates technology exchange. Consumer and industry awareness is gradually increasing, supporting market growth.

The United States is anticipated to grow at a CAGR of 8.6% in transportation based hydrogen energy storage through 2035. Growth is led by federal and state policies promoting clean transportation solutions. Companies such as Plug Power and Nikola Corporation are investing in advanced hydrogen storage systems for heavy-duty vehicles. Expansion of hydrogen refueling infrastructure focuses on key states such as California and Texas. Research efforts target cost reduction and efficiency improvements. Collaboration between public and private sectors supports pilot programs and infrastructure scaling. Market growth is moderated by regulatory complexities and competition from battery electric vehicles.

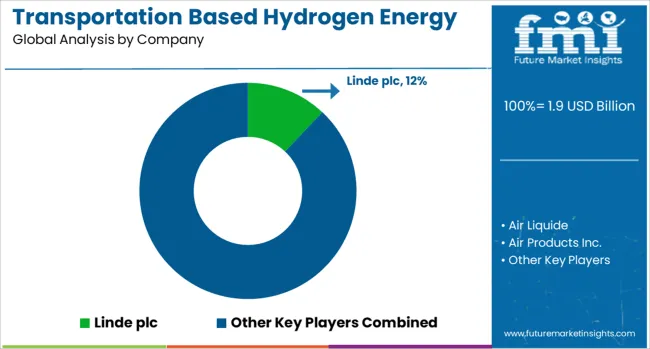

Linde plc has expanded its hydrogen storage capabilities by developing advanced cryogenic and compressed gas solutions aimed at transportation fleets and refueling infrastructure. The company’s strategy includes joint ventures to deploy hydrogen fueling stations across Europe and North America. Air Liquide focuses on scalable storage systems supporting heavy-duty vehicles and public transit, with investments in modular storage units to improve refueling efficiency and reduce footprint. Air Products Inc. has concentrated on integrating hydrogen storage with fuel cell applications, targeting long-haul trucking and rail transport. Its approach includes strategic partnerships with vehicle manufacturers and logistics firms.

Chart Industries specializes in designing and manufacturing high-pressure tanks and liquid hydrogen storage modules, emphasizing safety and thermal insulation technologies for mobile applications. Nel ASA delivers integrated hydrogen refueling stations and storage solutions, with a focus on expanding in emerging markets through collaborations with local governments and transport operators. Siemens Energy has incorporated hydrogen storage into its broader renewable energy portfolio, focusing on seamless integration with green hydrogen production. Engie has invested in hydrogen storage projects aligned with urban mobility plans and bus fleets. FuelCell Energy Inc. and Itm Power develop hydrogen generation and storage systems optimized for commercial vehicles and fleet operators. Hydrogenious LOHC Technologies offers liquid organic hydrogen carrier solutions, enhancing storage density and transport safety for hydrogen-powered mobility applications.

Strategic collaborations were formed to deploy hydrogen refueling infrastructure for commercial fleets and rail systems. Modular storage units were introduced to support mobile hydrogen distribution. Automotive and logistics sectors increased adoption of hydrogen fuel for long-haul and off-road applications, reinforcing the role of storage innovations in decarbonizing heavy-duty transportation networks. Additional Attributes

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product | Compression, Liquefaction, and Material-based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde plc, Air Liquide, Air Products Inc., Chart Industries, Nel ASA, Siemens Energy, Engie, FuelCell Energy Inc., Itm Power, and Hydrogenious LOHC Technologies |

The global transportation based hydrogen energy storage market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the transportation based hydrogen energy storage market is projected to reach USD 4.9 billion by 2035.

The transportation based hydrogen energy storage market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in transportation based hydrogen energy storage market are compression, liquefaction and material-based.

In terms of , segment to command 0.0% share in the transportation based hydrogen energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Energy Drink Market Trends - Growth & Consumer Preferences 2024 to 2034

ASEAN Energy Storage Devices Market

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Data Center Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Energy Storage (CAES) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA