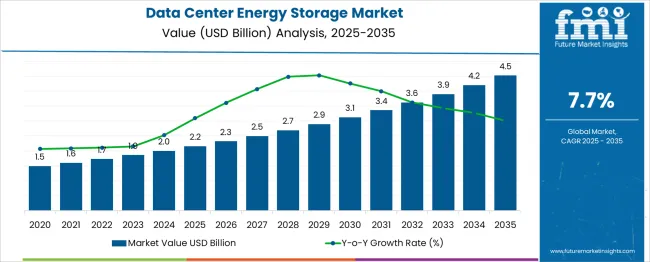

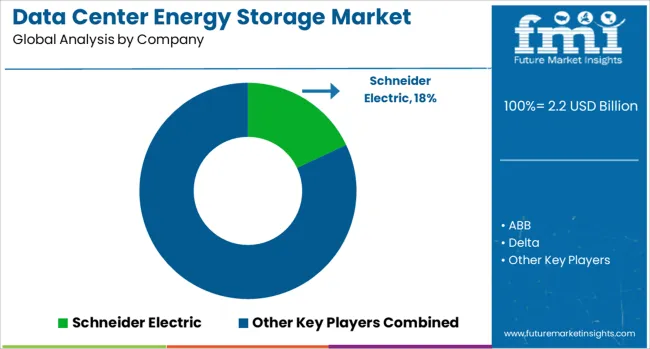

The Data Center Energy Storage Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period. This growth, supported by a strong CAGR of 7.7%, is driven by rising demand for reliable energy storage solutions in data centers, which are increasingly integrating renewable energy sources and requiring backup systems for uninterrupted service. During the first five years (2025–2030), the market is expected to increase from USD 2.2 billion to USD 3.1 billion, adding USD 0.9 billion, or 39.1% of the total incremental growth, with a 5-year multiplier of 1.41x. The second phase (2030–2035) will contribute USD 1.4 billion, representing 60.9% of incremental growth, reflecting continued demand as energy storage technologies such as lithium-ion and solid-state batteries improve in performance and cost-efficiency. Annual increments increase from USD 0.2 billion in early years to nearly USD 0.3 billion by 2035, indicating steady growth. Companies focusing on scalable, sustainable, and highly efficient storage solutions will capture significant value in this USD 2.3 billion growth opportunity, particularly in regions with heavy reliance on data centers and high renewable energy adoption.

| Metric | Value |

|---|---|

| Data Center Energy Storage Market Estimated Value in (2025 E) | USD 2.2 billion |

| Data Center Energy Storage Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The data center energy storage market is expanding rapidly, driven by the global surge in cloud computing, data consumption, and digital transformation across industries. Growing demand for power continuity, energy optimization, and operational resilience in hyperscale and colocation data centers has positioned storage systems as critical infrastructure components.

Environmental regulations, carbon neutrality commitments, and grid dependency concerns are further propelling the adoption of advanced storage technologies. The integration of energy storage solutions is enabling load balancing, backup power management, and peak shaving capabilities, aligning with sustainability targets and cost control strategies.

As real-time data processing and AI workloads increase, the focus is shifting toward energy-dense, scalable, and maintenance-efficient systems. Continued investment in green data center architectures and the push for decentralization are expected to generate sustained demand for both modular and large-scale storage systems in the coming years.

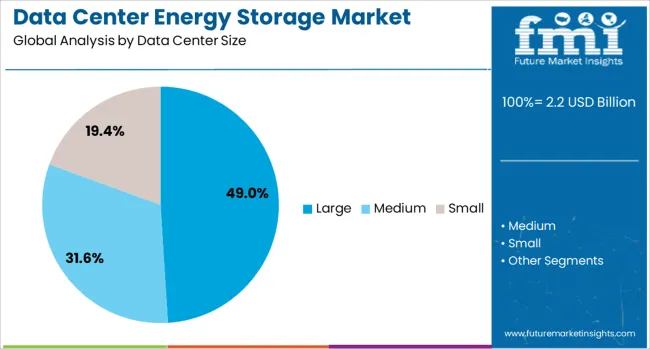

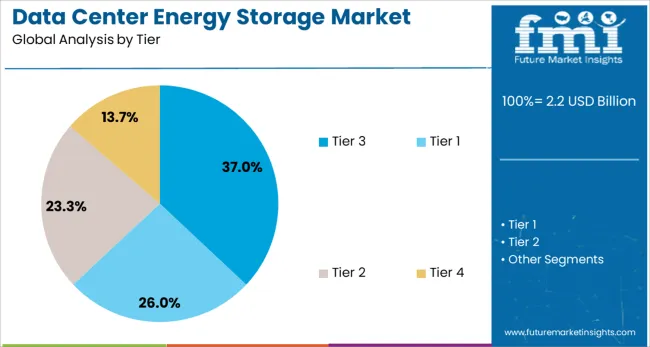

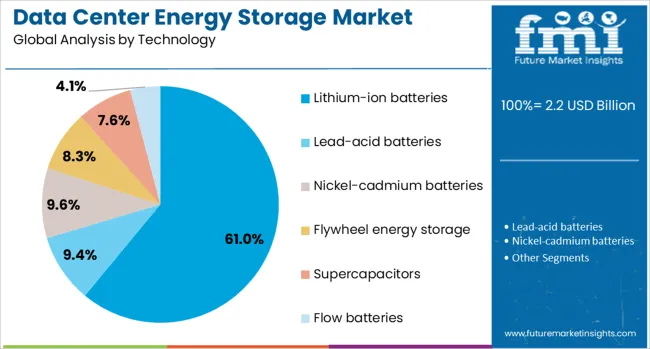

The data center energy storage market is segmented by data center size, tier, technology application, and geographic regions. By data center size, the data center energy storage market is divided into Large, Medium, and Small. In terms of the tier of the data center energy storage market, it is classified into Tier 1, Tier 2, Tier 3, and Tier 4. Based on technology, the data center energy storage market is segmented into Lithium-ion batteries, Lead-acid batteries, Nickel-cadmium batteries, Flywheel energy storage, Supercapacitors, and Flow batteries. The data center energy storage market is segmented into IT & telecom, BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, and Others. Regionally, the data center energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Large data centers are projected to contribute 49.0% of the total revenue share in 2025, making them the leading size segment in the market. This dominance is being driven by the increasing build-out of hyperscale facilities catering to AI, video streaming, and enterprise cloud services.

These infrastructures demand substantial and uninterrupted power delivery, necessitating robust energy storage systems that ensure uptime during grid failures or load shifts. The ability of large-scale energy storage systems to support multi-megawatt loads, combined with their compatibility with renewable energy sources, has reinforced their deployment.

Operators of large data centers are prioritizing storage for both economic and environmental reasons, using it to manage power quality, optimize diesel generator use, and reduce reliance on the grid during peak times.

Tier 3 data centers are forecast to account for 37.0% of the market revenue share in 2025, positioning them as the leading tier in terms of energy storage integration. Their prominence stems from a design philosophy that emphasizes fault tolerance, concurrent maintainability, and high uptime guarantees, all of which require dependable energy backup infrastructure.

Energy storage systems in Tier 3 environments are increasingly being implemented not only for emergency support but also for energy optimization and grid services. The need for sustainable yet highly resilient power architectures has led operators to prioritize scalable, modular storage solutions in Tier 3 deployments.

As mid-to-large enterprises and colocation providers expand operations, Tier 3 facilities remain the preferred choice, balancing cost-efficiency with operational reliability.

Lithium-ion batteries are projected to represent 61.0% of the total technology share in 2025, cementing their status as the dominant energy storage technology in data centers. Their popularity is being driven by superior energy density, compact design, longer lifecycle, and reduced maintenance compared to legacy technologies such as lead-acid batteries.

Lithium-ion systems support faster charging, higher cycling capabilities, and seamless integration with energy management systems, making them ideal for modern data center needs. Their lightweight form factor also contributes to lower space utilization and improved cooling efficiency within server halls.

As power loads and density increase, lithium-ion storage offers the reliability, scalability, and safety required by mission-critical infrastructure. The declining cost of lithium technology and its alignment with green data center goals continue to strengthen its leadership position in the sector.

The data center energy storage market is expanding as demand for reliable, energy-efficient solutions grows in line with the rising energy consumption of data centers. In 2024 and 2025, growth drivers include the need for uninterrupted power and the integration of renewable energy sources. Opportunities lie in modular energy storage systems and increased reliance on battery solutions. Trends include the adoption of lithium-ion batteries and smart grid integration. However, high implementation costs, reliance on volatile supply chains, and infrastructure limitations remain major barriers.

The primary growth drivers are the increasing demand for uninterrupted power and the integration of renewable energy sources. In 2024 and 2025, rising data center energy consumption pushed operators to adopt energy storage systems for backup power during peak demand. The increasing shift towards green energy and the integration of solar and wind systems required reliable storage solutions for off-grid capabilities. These factors emphasize that reliable power management solutions remain crucial for ensuring energy efficiency and operational continuity in the data center sector.

Significant opportunities exist in modular energy storage systems and battery technologies. In 2025, modular systems, including scalable battery storage, became attractive for data centers, offering flexibility and cost-efficiency. These systems provide energy independence and ensure seamless operations during outages. Additionally, advances in battery technologies, especially lithium-ion and sodium-based batteries, gained traction for their efficiency and durability. These opportunities indicate that data center operators are seeking adaptable, high-performance storage systems that can scale with their growing energy needs.

Emerging trends in the data center energy storage market include the growing adoption of lithium-ion batteries and smart grid integration. In 2024, lithium-ion batteries were widely used for their high energy density, faster charge/discharge cycles, and longer life spans. Integration with smart grids enabled real-time energy management, enhancing operational efficiency. Additionally, the rise of AI-driven energy optimization tools within data centers provided new insights into energy consumption patterns, supporting predictive maintenance. These trends reflect a growing reliance on intelligent, data-driven solutions for energy management.

Key restraints in the market include high initial investment costs and supply chain constraints. In 2024 and 2025, the high costs associated with energy storage systems and the integration of renewable technologies limited adoption, particularly for smaller data centers. Furthermore, disruptions in the supply chain, especially for essential materials like lithium, affected production schedules and pricing. These challenges highlight the need for cost-effective solutions and more resilient supply chains to ensure the scalability and affordability of energy storage systems for data centers globally.

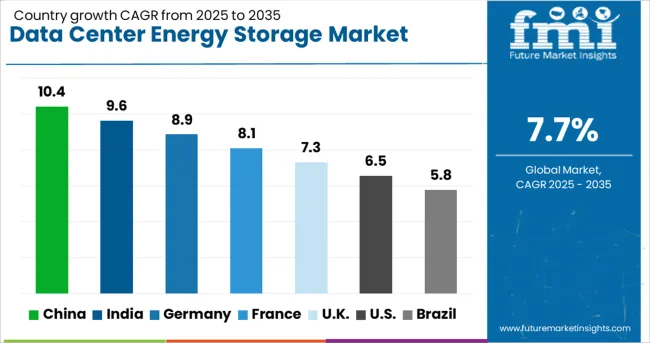

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global data center energy storage market is projected to grow at 7.7% CAGR from 2025 to 2035. China leads with 10.4% CAGR, supported by the country’s rapid digital infrastructure expansion and demand for energy-efficient data solutions. India follows at 9.6%, driven by the growth in data centers and the need for sustainable energy storage systems. France records 8.1% CAGR, focusing on green energy policies and energy storage for high-performance data centers. The United Kingdom grows at 7.3%, while the United States posts 6.5%, reflecting steady demand for advanced energy storage systems in mature markets. Asia-Pacific dominates growth due to expanding data center infrastructures, while Europe and North America emphasize sustainability and high-efficiency technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The data center energy storage market in China is forecasted to grow at 10.4% CAGR, fueled by the rapid growth of data center construction and the country’s push for smart infrastructure development. As China continues to expand its 5G networks and cloud computing capabilities, the demand for efficient energy storage solutions grows to maintain grid stability and ensure continuous operations in data centers. China’s significant investments in renewable energy sources further increase the adoption of energy storage systems, supporting the sustainable growth of its data centers.

The data center energy storage market in India is projected to grow at 9.6% CAGR, driven by rapid digital infrastructure development and the increasing demand for cloud computing services. The growing number of IT parks, e-commerce companies, and government digital initiatives fuel the demand for efficient and reliable energy storage solutions. India’s commitment to increasing renewable energy capacity also strengthens the adoption of energy storage systems in data centers. The need to manage energy costs and ensure reliable power backups further drives the market.

The data center energy storage market in France is expected to grow at 8.1% CAGR, supported by stringent European Union regulations on energy efficiency and carbon reduction. French data centers increasingly deploy advanced energy storage solutions to improve power resilience, optimize energy use, and reduce their environmental footprint. The integration of renewable energy sources with data center operations further drives the demand for energy storage technologies. Additionally, the increasing reliance on cloud services and big data applications supports the need for sustainable energy management systems in French data centers.

The data center energy storage market in the United Kingdom is projected to grow at 7.3% CAGR, fueled by increased government focus on green building standards and energy-efficient technologies. As the UK continues to advance its 5G networks and digital infrastructure, the demand for energy storage solutions in data centers rises to manage energy consumption effectively and reduce operational costs. The use of renewable energy sources and smart grid technologies drives the integration of energy storage systems to improve system reliability and sustainability.

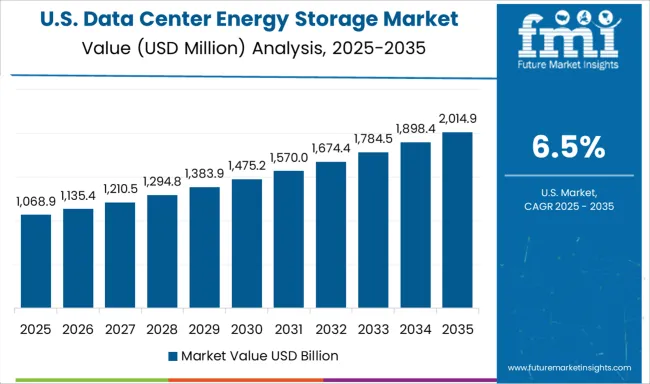

The data center energy storage market in the United States is projected to grow at 6.5% CAGR, reflecting steady adoption of energy storage solutions in established markets. Demand is increasing as data centers look to enhance energy efficiency, reduce costs, and ensure uptime in the face of rising energy consumption. The shift toward renewable energy sources and the growing use of AI for energy optimization contribute to the growth of energy storage technologies in data centers. Innovations in lithium-ion and flow battery systems support the scalability of energy storage solutions in large-scale facilities.

The data center energy storage market is dominated by Schneider Electric, which secures its leadership through a comprehensive range of energy management solutions, including advanced battery storage systems and hybrid power solutions tailored for data centers. Schneider’s dominance is reinforced by its global presence, strong service network, and focus on sustainable, energy-efficient solutions that help reduce operational costs and carbon footprints. Key players such as ABB, Eaton Corporation, Delta, Siemens, and Vertiv hold significant market shares by providing scalable energy storage solutions integrated with data center infrastructure, focusing on reliability, efficiency, and low downtime.

These companies prioritize innovations in lithium-ion battery technology, uninterruptible power supply (UPS) systems, and intelligent energy management for mission-critical facilities. Emerging players like Huawei, Legrand, Mitsubishi, and Tesla are expanding their market presence by offering cutting-edge storage technologies, including energy-efficient, high-density battery systems and renewable energy integration. Their strategies include advancing energy storage systems designed for both on-grid and off-grid data centers, enhancing automation with AI and IoT technologies, and improving the overall sustainability of data center operations. Market growth is driven by the rising demand for data processing, cloud computing, and the need for efficient power management solutions that ensure continuous operation. Innovations in energy density, battery life, and integration with renewable energy sources will continue to influence competitive dynamics in this rapidly growing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Data Center Size | Large, Medium, and Small |

| Tier | Tier 3, Tier 1, Tier 2, and Tier 4 |

| Technology | Lithium-ion batteries, Lead-acid batteries, Nickel-cadmium batteries, Flywheel energy storage, Supercapacitors, and Flow batteries |

| Application | IT & telecom, BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Delta, Eaton Corporation, Huawei, Legrand, Mitsubishi, Siemens, Tesla, and Vertiv |

| Additional Attributes | Dollar sales by energy storage technology (lithium-ion, lead-acid, flow batteries, flywheel energy storage, compressed air energy storage) and application segment (UPS, peak shaving, renewable energy integration, backup power). Segmentation by data center type (colocation, hyperscale, enterprise, telecom). Regional trends: North America (39% share), Asia-Pacific, Europe. Innovations in battery chemistries and energy management. Regulatory incentives, sustainability mandates, and emerging use cases in AI-driven data processing and edge computing. |

The global data center energy storage market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the data center energy storage market is projected to reach USD 4.5 billion by 2035.

The data center energy storage market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in data center energy storage market are large, medium and small.

In terms of tier, tier 3 segment to command 37.0% share in the data center energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Storage Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA