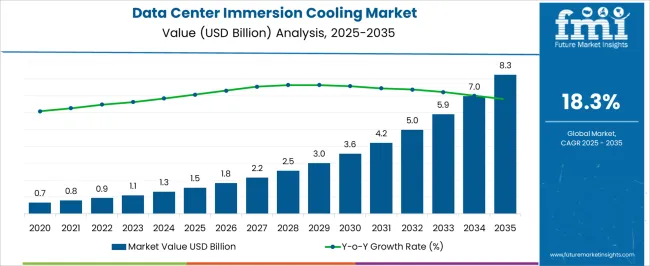

The data center immersion cooling market is expected to grow from USD 1.5 billion in 2025 to USD 8.3 billion by 2035, registering an 18.3% CAGR and generating an absolute dollar opportunity of USD 6.8 billion. Growth is driven by rising demand for energy-efficient cooling solutions in high-performance computing, cloud infrastructure, and hyperscale data centers. Immersion cooling reduces power consumption, enhances server performance, and supports higher-density computing, making it increasingly attractive for data center operators seeking operational efficiency and reduced total cost of ownership.

Elasticity of growth versus macroeconomic indicators shows a high sensitivity to global industrial investment, IT infrastructure spending, and electricity pricing trends. During periods of economic expansion, demand for data centers and high-performance computing rises, accelerating adoption of immersion cooling solutions. Conversely, economic slowdowns, reductions in IT budgets, or fluctuations in energy prices can temporarily moderate growth, particularly in regions with emerging data center infrastructure. North America and Europe show steady adoption correlated with corporate investment cycles and regulatory incentives for energy efficiency, while Asia Pacific demonstrates higher elasticity due to rapid expansion in cloud computing, digital services, and government-backed data center projects.

The market displays strong growth momentum, with the USD 6.8 billion opportunity reflecting the balance between macroeconomic conditions, technology adoption, and increasing demand for energy-efficient high-density computing solutions across the 2025–2035 period.

| Metric | Value |

|---|---|

| Data Center Immersion Cooling Market Estimated Value in (2025 E) | USD 1.5 billion |

| Data Center Immersion Cooling Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 18.3% |

The data center immersion cooling market is largely influenced by hyperscale and enterprise data centers, which account for about 42% of the market share, driven by the need to manage heat from high-density servers efficiently. Cloud service providers contribute nearly 27%, adopting immersion cooling to enhance energy efficiency and system reliability. Telecommunication networks and IT infrastructure companies represent around 14%, using these solutions to ensure continuous operation. Financial services and technology firms account for approximately 10%, requiring advanced cooling for critical computing workloads. The remaining 7% comes from research labs and academic institutions operating high-performance computing systems that demand precise thermal management.

The data center immersion cooling market is progressing with developments in fluid technology, modular deployment, and system intelligence. Dielectric and fluorocarbon-based liquids are being used to improve heat transfer while minimizing electrical risk. Portable and rack-compatible immersion units allow easy integration into existing facilities. Monitoring systems with AI-driven analytics are enabling real-time temperature optimization and predictive maintenance. The focus on eco-friendly coolants with low environmental impact is increasing. Industry players are forming alliances with cloud and data center operators to expand adoption. Rising demand for high-performance computing and energy-efficient solutions is accelerating market growth and innovation in immersion cooling systems.

The market is experiencing accelerated growth driven by the need for energy-efficient and high-performance thermal management solutions in next-generation data centers. With increasing data workloads, high-density server environments, and rising electricity costs, immersion cooling is gaining preference as an alternative to traditional air cooling methods.

The growing focus on sustainability, reduced carbon emissions, and improved power usage effectiveness has positioned immersion cooling as a practical solution for hyperscale and edge data center operators. Strategic investments by cloud service providers and enterprises in AI, machine learning, and high-performance computing workloads have further elevated the demand for thermal solutions that offer reliability, scalability, and long-term cost efficiency.

Future growth opportunities are being shaped by regulatory pressures to lower energy consumption as well as advancements in cooling fluid technologies. As digital transformation expands across industries, the adoption of immersion cooling is expected to become increasingly central to efficient data center operations globally.

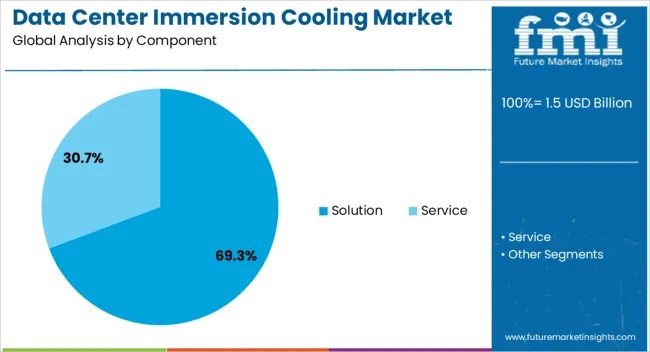

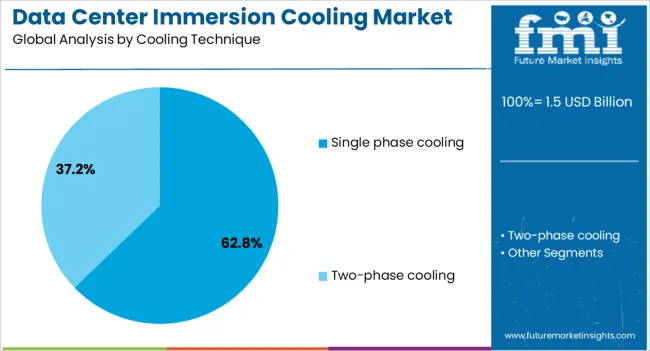

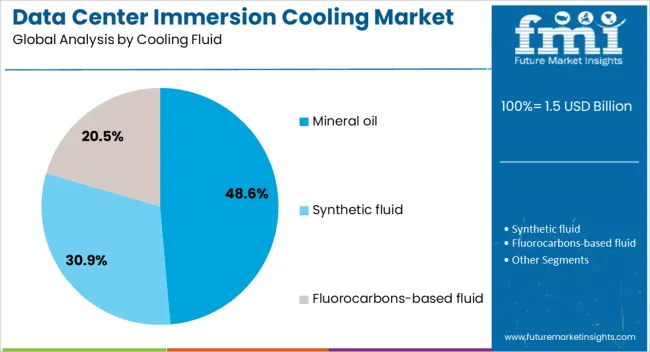

The data center immersion cooling market is segmented by component, cooling technique, cooling fluid, organization size, application, and geographic regions. By component, data center immersion cooling market is divided into Solution and Service. In terms of cooling technique, data center immersion cooling market is classified into Single phase cooling and Two-phase cooling. Based on cooling fluid, data center immersion cooling market is segmented into Mineral oil, Synthetic fluid, and Fluorocarbons-based fluid.

By organization size, data center immersion cooling market is segmented into Large enterprises and SME. By application, data center immersion cooling market is segmented into Hyperscale, Supercomputing, Enterprise HPC, Cryptocurrency, Edge/5G computing, and Others. Regionally, the data center immersion cooling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solution segment is projected to hold 69.3% of the Data Center Immersion Cooling market revenue share in 2025, making it the dominant component category. This leadership is being driven by the increasing deployment of turnkey immersion cooling systems that integrate tanks, monitoring controls, and liquid distribution infrastructure. Enterprises are prioritizing solutions that reduce design complexity and offer plug-and-play compatibility with existing data center layouts.

The preference for complete system packages over individual components has increased due to simplified maintenance, better integration with IT equipment, and enhanced thermal efficiency. As operators seek to minimize downtime and deployment risks, the demand for pre-engineered solutions with validated performance is expanding.

Furthermore, these systems support quicker implementation cycles and lower engineering overhead, which are critical for rapid scaling in high-density environments The strong demand for holistic and customizable immersion cooling solutions continues to support the leading position of this segment across diverse data center formats.

Single phase cooling is expected to account for 62.8% of the Data Center Immersion Cooling market revenue in 2025, making it the leading cooling technique. This dominance is being attributed to the simplicity, reliability, and cost-effectiveness offered by single phase systems compared to dual phase alternatives. In single phase cooling, the fluid remains in liquid form throughout the thermal cycle, reducing mechanical complexity and eliminating the need for specialized pressure control mechanisms.

The technique has gained widespread adoption due to its lower operational risk and ease of fluid containment. Enterprises prefer single phase systems because they are more compatible with standard IT hardware and easier to maintain.

Additionally, lower fluid evaporation and reduced infrastructure requirements make it more attractive for commercial deployment. As demand for high-performance yet stable thermal management grows, single-phase cooling continues to be favored for its operational efficiency, safety profile, and long-term reliability in mission-critical data center environments.

The Mineral oil segment is anticipated to contribute 48.6% of the Data Center Immersion Cooling market revenue in 2025, emerging as the leading cooling fluid type. This prominence is being supported by mineral oil’s cost advantage, wide availability, and proven thermal performance. Its non-conductive nature and chemical stability make it suitable for prolonged use in immersion cooling systems without posing risk to electronic components.

Operators have widely adopted mineral oil due to its compatibility with existing infrastructure and favorable handling characteristics. Unlike some synthetic fluids, mineral oil requires less stringent containment measures and offers extended service intervals, thereby reducing the total cost of ownership.

The familiarity of this fluid within industrial and transformer cooling applications has also translated into confidence among data center stakeholders. As cost-sensitive enterprises and colocation providers seek practical and efficient immersion cooling solutions, mineral oil remains the preferred choice for scalable and budget-conscious deployments across global markets.

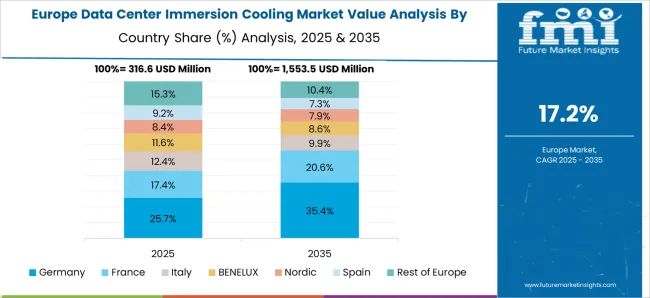

The data center immersion cooling market is expanding due to increasing server density, rising cloud adoption, and high energy costs. Global revenue crossed USD 1.8 billion in 2024, with North America holding 40% share due to large hyperscale data centers in the USA Europe contributes 28%, led by Germany, UK, and France, driven by hyperscale and colocation facilities. Asia Pacific represents 25%, led by China, Japan, and India, due to rapid data center expansion. Single-phase immersion systems dominate with 55% share, followed by two-phase systems at 35%. Reduced cooling energy consumption of 30–50% compared to traditional air cooling drives global adoption across enterprise and cloud data centers.

Hyperscale and colocation data centers account for over 60% of global immersion cooling demand. Hyperscale facilities contribute 40%, driven by cloud computing providers in North America and Asia Pacific. Colocation centers represent 20% of adoption, supporting enterprise clients with high-performance computing requirements. North America leads with 40% market share due to early adoption in USA cloud and AI computing hubs. Europe contributes 28%, focusing on energy-efficient cooling for large server farms. Asia Pacific grows at a CAGR of 7.2%, with China and India expanding high-density data centers. Immersion cooling reduces PUE by 20–30%, enabling sustainable and cost-effective operations for energy-intensive data centers worldwide.

Technological advancements in dielectric fluids, modular tanks, and pump systems are improving energy efficiency and operational reliability. Single-phase systems reduce energy use by 30–40%, while two-phase systems can lower energy consumption by 50%. Advanced dielectric fluids provide high thermal conductivity, stability, and long operational life. North America emphasizes integration with AI-driven monitoring and liquid-loop optimization. Europe focuses on high-density rack cooling with modular deployment. Asia Pacific adopts cost-efficient, scalable systems to support growing cloud infrastructure. Innovations in fluid flow, tank design, and system integration enhance server performance, reduce cooling-related downtime, and enable high-density computing adoption globally.

Immersion cooling adoption is rising in AI training, high-performance computing (HPC), and cryptocurrency mining. AI and HPC contribute 45% of global adoption due to dense GPU and CPU clusters generating significant heat. Cryptocurrency mining represents 15%, driven by energy-efficient cooling for mining farms. North America leads with 40% share due to early adoption in AI data centers. Europe contributes 28%, focusing on HPC and industrial AI applications. Asia Pacific adoption is growing at 7.2% CAGR, supporting cloud computing, fintech, and mining operations. Reduced operational costs and improved energy efficiency are driving broader adoption across diverse high-performance computing applications globally.

Immersion cooling systems face high upfront costs, ranging from USD 250,000 to 1.5 million, depending on scale and system type. Maintenance of dielectric fluids, leak detection, and pump systems increases operational costs by 10–15% annually. Retrofitting existing data centers requires significant planning and infrastructure modification. Supply chain constraints for specialized dielectric fluids and high-quality pumps can delay deployment in emerging markets. Skilled personnel are required for monitoring, fluid management, and system integration. Despite benefits in energy reduction and high-density support, high capital investment, maintenance complexity, and retrofitting challenges remain primary barriers for adoption in enterprise, hyperscale, and HPC data centers globally.

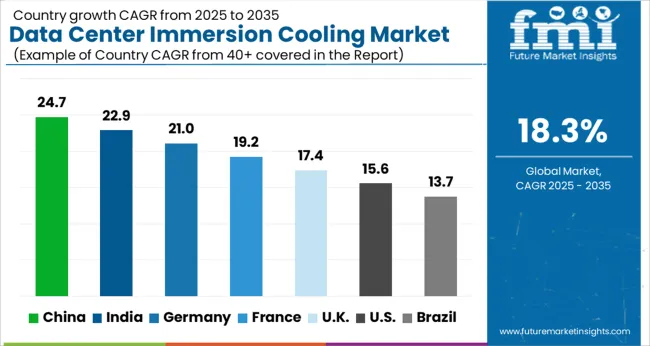

| Country | CAGR |

|---|---|

| China | 24.7% |

| India | 22.9% |

| Germany | 21.0% |

| France | 19.2% |

| UK | 17.4% |

| USA | 15.6% |

| Brazil | 13.7% |

In 2025, the data center immersion cooling market is expected to expand at a global CAGR of 18.3% through 2035, fueled by rising energy efficiency requirements, the growth of hyperscale and edge data centers, and increasing demand for high-performance computing solutions. China leads at 24.7%, 35% above the global benchmark, driven by BRICS-led investments in cloud infrastructure, enterprise data centers, and large-scale deployment of advanced cooling systems. India follows at 22.9%, 25% above the global average, reflecting accelerated adoption in IT and cloud services, expansion of server farms, and integration of liquid cooling solutions. Germany records 21.0%, 15% above the benchmark, shaped by OECD-backed innovations in energy-efficient cooling, automation, and sustainable IT operations. The United Kingdom posts 17.4%, 5% below the global rate, with demand concentrated in enterprise facilities, specialized high-performance computing centers, and selective adoption of immersion technologies. The United States stands at 15.6%, 15% below the benchmark, with steady uptake in hyperscale cloud environments, enterprise IT facilities, and niche immersion cooling projects. BRICS economies drive the largest share of market growth, OECD countries prioritize technological advancement and operational efficiency, while ASEAN nations contribute through expanding cloud infrastructure and adoption of innovative cooling solutions.

China’s immersion cooling market is expected to expand at a CAGR of 24.7%, well above the global 18.3%, fueled by hyperscale cloud facilities and AI workloads. In 2024, installations increased by 27% across Beijing, Shanghai, and Shenzhen. Inspur, Sugon, 3M, and Submer deployed single-phase and two-phase immersion racks for high-density server environments. Companies focus on reducing PUE, enabling modular deployment, and integrating advanced dielectric fluids for precise thermal management. Growing demand from AI, HPC, and cloud workloads has encouraged modular designs, allowing rapid scaling without major infrastructure changes.

India’s immersion cooling market is growing at a CAGR of 22.9%, above the global 18.3%, driven by cloud adoption, enterprise digitalization, and government-supported data center initiatives. In 2024, installations rose by 25%, concentrated in Bengaluru, Hyderabad, and Pune. Tata Consultancy Services, HCL, 3M, and Submer integrated single-phase and two-phase systems to support AI workloads and high-density computing. Energy efficiency and operational cost reduction remain key drivers. Edge computing centers are increasingly adopting modular immersion solutions to scale operations while maintaining cooling performance.

Germany’s market is increasing at a CAGR of 21.0%, surpassing the global 18.3%, supported by enterprise, research, and colocation data centers investing in high-performance cooling. In 2024, installations rose by 22%, particularly in Frankfurt, Munich, and Berlin. Submer, 3M, and WEG deployed modular racks with advanced dielectric fluid systems optimized for AI, HPC, and cloud workloads. EU energy efficiency standards and green data center initiatives further drive adoption. Companies emphasize high-density computing and thermal management to meet operational and environmental objectives.

The United Kingdom’s immersion cooling market is growing at a CAGR of 17.4%, slightly below the global 18.3%, with steady adoption across cloud, enterprise, and colocation data centers. In 2024, installations increased by 19%, with London, Manchester, and Milton Keynes leading uptake. Suppliers such as Submer and 3M delivered single-phase and two-phase immersion systems for high-density server workloads. Modular system designs, operational efficiency, and energy reduction are driving adoption. Retrofitting older facilities is further supporting the uptake of immersion cooling technology.

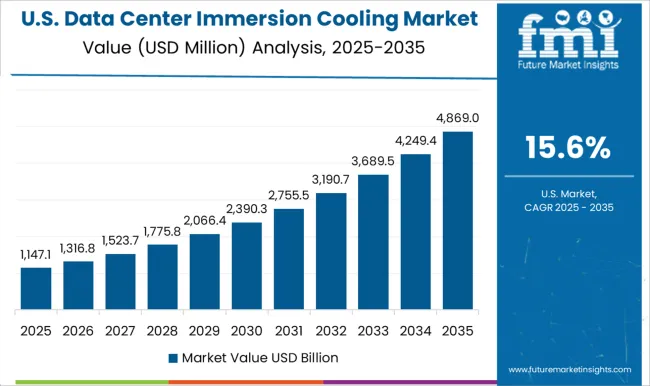

The United States market is expanding at a CAGR of 15.6%, below the global 18.3%, reflecting selective adoption of immersion cooling technologies in mature data center environments. In 2024, installations rose by 16%, concentrated in Northern Virginia, Silicon Valley, and Dallas. Providers such as 3M, Submer, and Iceotope deployed high-density server racks and two-phase immersion systems for AI, HPC, and cloud applications. Adoption is primarily driven by energy efficiency, operational cost reduction, and integration into hyperscale and high-performance computing centers.

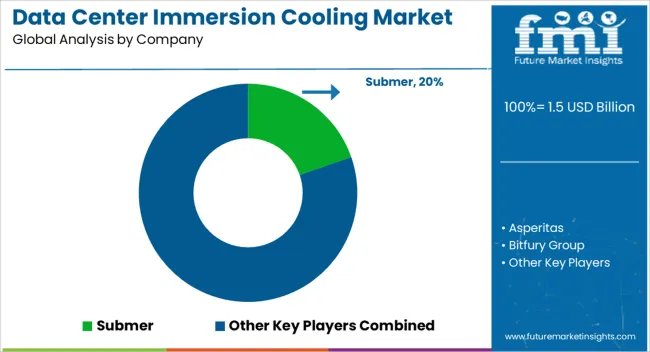

Competition in the data center immersion cooling market is being shaped by thermal efficiency, energy savings, and compatibility with high-density computing systems. Market positions are being maintained through certified equipment, engineering support, and global distribution networks that ensure reliable deployment for enterprise and hyperscale data centers. Submer is being represented with single-phase and two-phase immersion systems engineered for consistent thermal management and reduced energy consumption. Asperitas is being promoted with modular solutions designed for rapid deployment and scalability. Bitfury Group is being applied with immersion cooling platforms optimized for cryptocurrency mining and high-performance computing. DCX Liquid Cooling Company is being showcased with compact immersion units structured for medium- and small-scale data centers. Fujitsu is being recognized with integrated cooling solutions engineered for server-level optimization. Green Revolution Cooling is being advanced with single-phase dielectric cooling systems designed for energy efficiency and operational simplicity. Inspur is being promoted with immersion-ready servers and racks structured for high-density computing. LiquidCool Solutions is being applied with hybrid liquid cooling systems designed to balance performance and installation flexibility.

Midas Immersion Cooling is being represented with modular tanks engineered for rapid deployment and thermal consistency. Vertiv is being showcased with turnkey immersion solutions optimized for uptime, monitoring, and maintenance. Strategies are being centered on product enhancement, energy efficiency, and expansion of global support services. Research and development efforts are being allocated to improve heat transfer performance, fluid stability, and integration with existing data center infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Component | Solution and Service |

| Cooling Technique | Single phase cooling and Two-phase cooling |

| Cooling Fluid | Mineral oil, Synthetic fluid, and Fluorocarbons-based fluid |

| Organization Size | Large enterprises and SME |

| Application | Hyperscale, Supercomputing, Enterprise HPC, Cryptocurrency, Edge/5G computing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Submer, Asperitas, Bitfury Group, DCX Liquid Cooling Company, Fujitsu, Green Revolution Cooling, Inspur, LiquidCool Solutions, Midas Immersion Cooling, and Vertiv |

| Additional Attributes | Dollar sales by cooling type and end use, demand dynamics across hyperscale, colocation, and enterprise data centers, regional trends in energy-efficient infrastructure, innovation in dielectric fluids and modular systems, environmental impact of energy and fluid disposal, and emerging use cases in high-performance computing and AI workloads. |

The global data center immersion cooling market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the data center immersion cooling market is projected to reach USD 8.3 billion by 2035.

The data center immersion cooling market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in data center immersion cooling market are solution, _cooling fluids, _cooling racks/modules, _filters, _pumps, _heat exchangers, _others, service, _installation & maintenance and _training & consulting.

In terms of cooling technique, single phase cooling segment to command 62.8% share in the data center immersion cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA