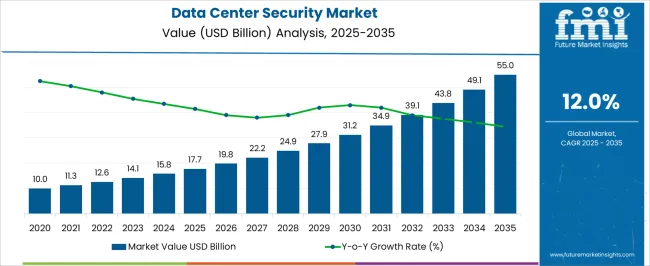

The data center security market is projected to grow from USD 17.7 billion in 2025 to USD 55.0 billion in 2035, reflecting a CAGR of 12.0%. This represents an absolute dollar opportunity of USD 37.3 billion over the ten-year period. The market is expected to expand rapidly, reaching USD 19.8 billion in 2026, USD 24.9 billion in 2029, USD 31.2 billion in 2031, and USD 49.1 billion in 2034. The strong growth trajectory underscores increasing investments in safeguarding data centers, providing vendors and investors with substantial opportunities to capture incremental revenue and strengthen market positioning across the forecast horizon.

From an absolute dollar perspective, annual incremental growth begins at around USD 2.0–2.1 billion in the early years and accelerates to over USD 5.0 billion in later stages, culminating in USD 37.3 billion by 2035. Intermediate benchmarks, such as USD 15.8 billion in 2025, USD 27.9 billion in 2030, and USD 43.8 billion in 2033, illustrate significant inflection points along the growth path. This predictable expansion allows stakeholders to plan investments, scale operations, and optimize service offerings efficiently. Capturing both yearly growth and cumulative opportunity ensures businesses can maximize revenue potential in the data center security market.

| Metric | Value |

|---|---|

| Data Center Security Market Estimated Value in (2025 E) | USD 17.7 billion |

| Data Center Security Market Forecast Value in (2035 F) | USD 55.0 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

Between 2025 and 2027, the market rises from USD 17.7 billion to USD 19.8 billion, marking the early adoption phase where initial investments in security infrastructure drive moderate incremental gains. Another critical breakpoint occurs around 2029–2031, as the market grows from USD 24.9 billion to USD 31.2 billion, reflecting a period of faster expansion and higher absolute dollar growth. These stages are essential for vendors and investors to optimize deployment, secure partnerships, and capture revenue during periods of rising market demand.

The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 43.8 billion to USD 55.0 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 27.9 billion to USD 39.1 billion, acting as bridging periods that maintain momentum.

The market is undergoing robust expansion driven by increasing digital transformation initiatives, the growing volume of critical data, and escalating cybersecurity threats targeting data infrastructure. Organizations across industries are intensifying their focus on securing data centers to safeguard sensitive information and maintain business continuity.

The rising adoption of cloud computing, hybrid IT environments, and edge data centers is compelling investments in advanced security solutions. Regulatory compliance and evolving data privacy standards are further motivating enterprises to enhance their security posture.

With cyberattacks becoming more sophisticated, the demand for integrated, scalable, and adaptive security architectures is growing. As data centers evolve to support complex workloads and applications, the market is projected to benefit from innovation in threat detection, prevention, and response technologies, positioning data center security as a critical element in digital infrastructure strategies.

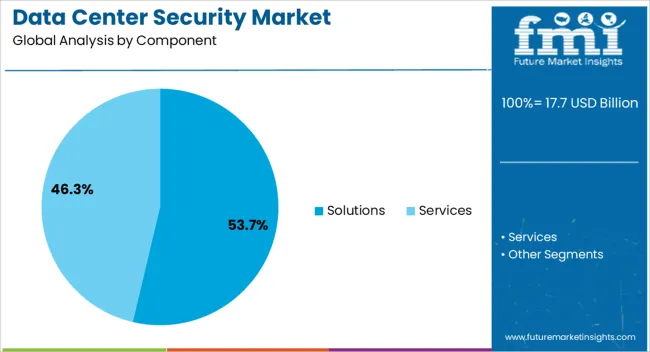

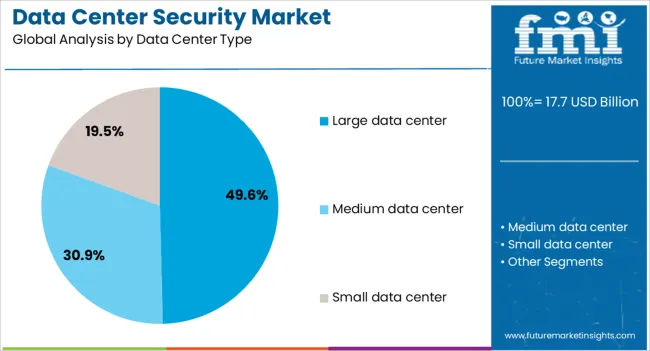

The data center security market is segmented by component, data center type, end use, and geographic regions. By component, data center security market is divided into Solutions and Services. In terms of data center type, data center security market is classified into Large data center, Medium data center, and Small data center.

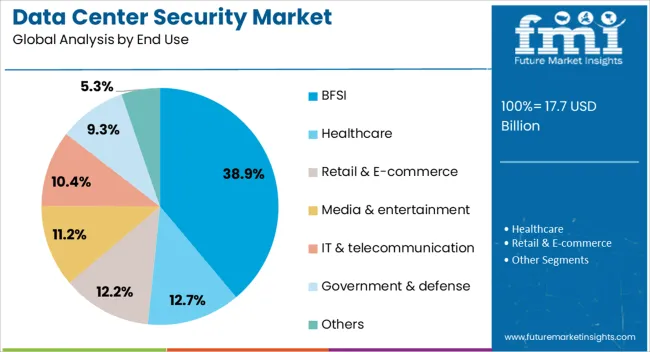

Based on end use, data center security market is segmented into BFSI, Healthcare, Retail & E-commerce, Media & entertainment, IT & telecommunication, Government & defense, and Others. Regionally, the data center security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solutions component is anticipated to hold 53.7% of the Data Center Security market revenue share in 2025, establishing it as the dominant segment. This prominence is attributed to the increasing deployment of comprehensive security software and hardware solutions designed to protect data center environments from a wide array of threats.

The ability to provide real-time threat monitoring, advanced firewalls, intrusion detection, and endpoint security through integrated solutions has elevated demand. Organizations are favoring solution-based approaches that enable centralized management and rapid incident response.

Moreover, the scalability of security solutions supports evolving infrastructure needs, allowing adaptation to emerging risks without physical overhaul. The growing sophistication of cyberattacks has intensified the need for multi-layered security solutions, reinforcing this segment’s leading position in the market.

Large data centers are projected to account for 49.6% of the Data Center Security market revenue share in 2025, making this segment the largest among data center types. This leadership is driven by the vast volumes of sensitive and mission-critical data housed in large-scale facilities requiring robust and comprehensive security frameworks.

Large data centers typically support multiple enterprise clients or extensive organizational operations, increasing the risk profile and demand for advanced security measures. The adoption of automated threat intelligence, AI-driven monitoring, and sophisticated access controls in these environments has contributed to growth.

Additionally, compliance requirements and the need for uninterrupted service in large data centers incentivize investment in high-performance security architectures. The complexity and scale of these centers necessitate adaptable security systems capable of evolving alongside technological advancements.

The BFSI end-use industry is expected to hold 38.9% of the Data Center Security market revenue share in 2025, reflecting its leading role among verticals. This position is attributed to the critical need for protecting highly sensitive financial data and transactions that underpin banking, financial services, and insurance operations.

The BFSI sector faces stringent regulatory mandates and compliance requirements that drive investments in robust data security measures. Increasing digitization of financial services and the rise of online banking have amplified the threat landscape, prompting adoption of advanced security frameworks in data centers.

Risk mitigation and customer trust considerations have led BFSI organizations to prioritize comprehensive data center security solutions. The continued expansion of digital payment ecosystems and financial technologies further supports sustained growth in this segment.

The data center security market is expanding as enterprises, cloud providers, and colocation facilities invest in solutions to protect critical digital assets, IT infrastructure, and sensitive data. Growing threats from cyberattacks, ransomware, and insider breaches drive adoption of physical and digital security measures. Solutions include access control systems, biometric authentication, surveillance cameras, intrusion detection, fire suppression, and cybersecurity platforms integrated with network monitoring.

Providers offering unified, AI-enabled, and automated security solutions gain a competitive edge. Rising deployment of cloud services, hybrid IT environments, and edge computing increases the need for comprehensive security across distributed facilities. Regulatory compliance, corporate governance, and data privacy requirements further accelerate investments in advanced security solutions for modern data centers worldwide.

Market growth is restrained by high implementation costs and operational complexity associated with data center security solutions. Deploying integrated physical and cybersecurity measures involves investments in hardware, software, sensors, monitoring platforms, and professional services. Ensuring seamless integration with existing IT infrastructure and legacy systems can be technically complex. Skilled personnel are required to monitor, manage, and update security systems continuously. Frequent upgrades to address evolving cyber threats and compliance requirements increase operational expenditure. Smaller enterprises and colocation providers may find the cost and expertise requirements prohibitive. Until cost-effective, scalable, and easy-to-deploy security solutions become widely available, adoption may remain concentrated among hyperscale cloud operators, large enterprises, and mission-critical facilities.

Technological advancements are shaping trends in the data center security market. AI and machine learning enable predictive threat detection, automated incident response, and anomaly monitoring. Integration of biometric access control, IoT-enabled sensors, and cloud-based security platforms enhances real-time visibility and operational efficiency. Video analytics, facial recognition, and multi-factor authentication improve physical security, while advanced firewalls, intrusion detection systems, and encryption secure digital assets. Modular and converged security solutions allow easier deployment across distributed data centers, edge nodes, and hybrid IT environments. These innovations highlight the increasing reliance on intelligent, automated, and multi-layered security systems to safeguard sensitive data and ensure uninterrupted operations in modern, high-density data centers.

Opportunities in the data center security market are driven by surging data volumes, digital transformation, and stringent regulatory frameworks. Enterprises must protect sensitive customer, financial, and operational data from cyberattacks and breaches. Compliance requirements such as GDPR, HIPAA, and ISO standards increase the need for robust physical and digital security measures.

Growth in cloud adoption, colocation facilities, and edge computing nodes expands the market for integrated security solutions. Providers offering modular, scalable, and compliant security systems can capture new opportunities. Partnerships with IT service providers, cloud operators, and managed security service providers further enhance adoption potential, particularly in regions emphasizing data sovereignty, privacy, and infrastructure resilience.

Market growth is restrained by intense competition, evolving cybersecurity threats, and infrastructure complexity. Multiple global and regional vendors compete on solution features, pricing, and service capabilities, affecting margins. Rapidly changing cyber threats, ransomware attacks, and insider risks require continuous innovation and system updates. Integration challenges, system interoperability issues, and managing hybrid IT environments increase operational complexity.

Maintaining compliance with local regulations and industry standards requires constant monitoring and adjustment. Until vendors offer cost-effective, adaptive, and easily managed security solutions, market adoption may remain concentrated in large-scale enterprises, hyperscale cloud, and critical infrastructure data centers that can invest in comprehensive, multi-layered security systems.

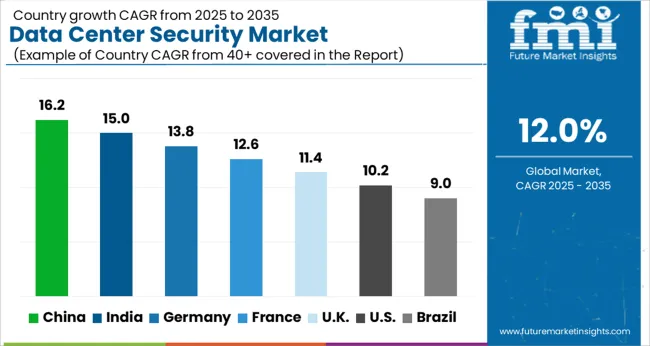

| Country | CAGR |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| France | 12.6% |

| UK | 11.4% |

| USA | 10.2% |

| Brazil | 9.0% |

The global data center security market was projected to grow at a 12.0% CAGR through 2035, driven by demand in enterprise, cloud, and government data protection applications. Among BRICS nations, China recorded 16.2% growth as large-scale security infrastructure and monitoring facilities were commissioned and compliance with data protection and operational standards was enforced, while India at 15.0% growth saw expansion of deployment units to meet rising regional demand. In the OECD region, Germany at 13.8% maintained substantial output under strict industrial and cybersecurity regulations, while the United Kingdom at 11.4% relied on moderate-scale operations for enterprise and commercial data centers. The USA, expanding at 10.2%, remained a mature market with steady demand across enterprise, cloud, and government segments, supported by adherence to federal and state-level security and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The data center security market in China is growing at a CAGR of 16.2% due to increasing investments in cloud computing, enterprise IT infrastructure, and digital services. Organizations are focusing on protecting sensitive data, critical applications, and IT assets from cyber threats and physical security risks. Growth is supported by rising digital transformation, strict regulatory requirements, and the need for secure, high availability data centers. Providers offer solutions including physical security systems, access control, surveillance, fire protection, and cybersecurity measures. Distribution through IT service providers, security integrators, and technology vendors ensures accessibility. Adoption is further driven by growing awareness of data breaches, cyberattacks, and enterprise security requirements. China remains a leading market due to its large digital economy, growing data traffic, and strong investment in secure infrastructure.

India is witnessing growth at a CAGR of 15.0% in the data center security market due to rising demand for cloud services, enterprise IT, and digital transformation initiatives. Organizations are adopting data center security solutions to protect critical infrastructure, sensitive data, and business applications. Growth is supported by increasing cybersecurity threats, compliance requirements, and enterprise reliance on digital platforms. Providers offer physical security systems, access control, surveillance, fire protection, and integrated cybersecurity measures. Distribution through IT service providers, security integrators, and technology vendors ensures market accessibility. Adoption is further driven by growing awareness of cyber threats, regulatory compliance, and expansion of commercial and government IT infrastructure. India continues to see strong growth as businesses and government agencies prioritize secure, reliable, and compliant data center operations.

Germany is growing at a CAGR of 13.8% in the data center security market due to increasing adoption of cloud services, enterprise IT systems, and digital services. Organizations are implementing data center security solutions to safeguard sensitive information, critical applications, and IT infrastructure. Growth is supported by regulatory compliance, cybersecurity awareness, and high adoption of digital technologies. Suppliers offer physical security systems, surveillance, access control, fire protection, and cybersecurity solutions to ensure secure operations. Distribution through IT service providers, security integrators, and technology vendors enhances market accessibility. Adoption is further driven by the need for continuous monitoring, risk mitigation, and compliance with European data security standards. Germany remains a key market in Europe due to its mature IT ecosystem and focus on high quality and secure data center operations.

The United Kingdom market is expanding at a CAGR of 11.4% due to growing demand for secure data centers, cloud infrastructure, and enterprise IT systems. Organizations adopt data center security solutions to protect sensitive data, applications, and IT assets from cyber threats and physical risks. Providers offer access control, surveillance, fire protection, and cybersecurity solutions to ensure comprehensive protection. Growth is supported by regulatory compliance, rising cyberattack threats, and increasing enterprise reliance on digital services. Distribution through IT service providers, security integrators, and technology vendors ensures accessibility across commercial and government sectors. Adoption is further driven by enterprises seeking high availability, reliable, and compliant operations. The United Kingdom continues to see steady growth as secure data center operations become a critical component of digital infrastructure.

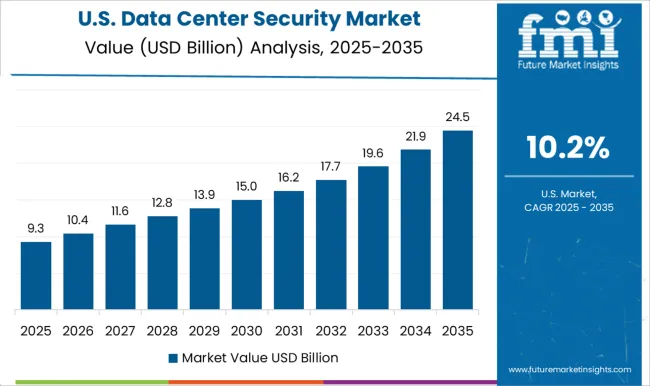

The United States market is growing at a CAGR of 10.2% due to increasing adoption of cloud computing, enterprise IT systems, and digital services. Organizations implement data center security solutions to safeguard sensitive information, IT infrastructure, and critical applications. Growth is supported by cybersecurity threats, regulatory compliance, and enterprise reliance on high availability data centers. Providers offer physical security, surveillance, access control, fire protection, and cybersecurity solutions. Distribution through IT service providers, security integrators, and technology vendors ensures accessibility for commercial and government clients. Adoption is further driven by risk mitigation, compliance requirements, and increasing awareness of data breach impacts. The United States remains a key market due to its large digital economy, mature IT ecosystem, and continuous investment in secure and reliable data center operations.

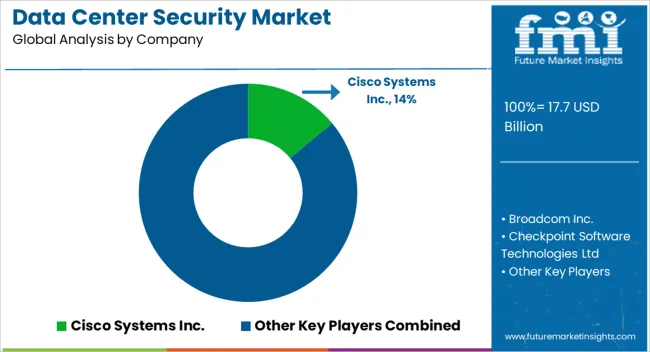

The data center security market is supplied by Cisco Systems Inc., Broadcom Inc., Checkpoint Software Technologies Ltd, Dell Inc., Fortinet, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks Inc., McAfee Inc., Palo Alto Networks, Inc., Schneider Electric SE, Siemens AG, Trend Micro Inc, and VMware Inc. Brochures emphasize network firewalls, intrusion detection systems, access control solutions, threat intelligence platforms, and software-defined security architectures. Technical specifications highlight throughput capacities, encryption standards, compliance certifications, and integration with cloud and on-premises infrastructures. Competition is driven by solution breadth, scalability, integration capability, and real-time threat mitigation. Cisco and Palo Alto Networks focus on high-throughput network firewalls and zero-trust solutions. Fortinet and Checkpoint are observed to offer modular cybersecurity appliances and unified threat management (observed industry pattern). IBM, VMware, and Dell emphasize software-defined security and hybrid cloud protection.

Honeywell, Schneider Electric, and Siemens integrate physical security systems with cybersecurity frameworks. Partnerships with managed security service providers and long-term enterprise contracts enhance market positioning and adoption. Market strategies prioritize end-to-end security coverage, compliance adherence, and multi-layered threat detection. Suppliers highlight real-time monitoring, automated incident response, and interoperability with existing IT and operational technology environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.7 Billion |

| Component | Solutions and Services |

| Data Center Type | Large data center, Medium data center, and Small data center |

| End Use | BFSI, Healthcare, Retail & E-commerce, Media & entertainment, IT & telecommunication, Government & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems Inc., Broadcom Inc., Checkpoint Software Technologies Ltd, Dell Inc., Fortinet, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks Inc., McAfee Inc., Palo Alto Networks, Inc., Schneider Electric SE, Siemens AG, Trend Micro Inc, and VMware Inc. |

| Additional Attributes | Dollar sales vary by connector type, including board-to-board, wire-to-board, and coaxial connectors; by application, such as consumer electronics, automotive, industrial equipment, and telecommunications; by end-use industry, spanning electronics manufacturing, automotive, and industrial automation; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising electronics production, miniaturization, and demand for reliable interconnect solutions. |

The global data center security market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the data center security market is projected to reach USD 55.0 billion by 2035.

The data center security market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in data center security market are solutions and services.

In terms of data center type, large data center segment to command 49.6% share in the data center security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA