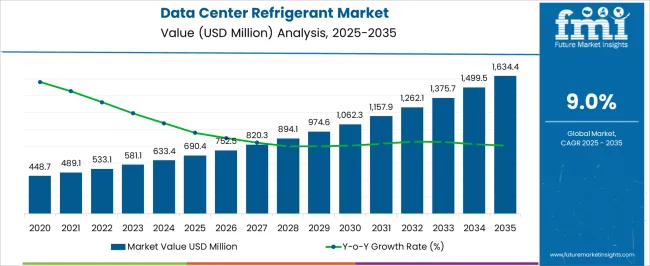

The data center refrigerant market is estimated to be valued at USD 690.4 million in 2025 and is projected to reach USD 1634.4 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

This growth represents an absolute dollar opportunity of USD 944.0 million over the decade. Annual growth shows steady expansion, starting from USD 690.4 million in 2025, reaching USD 820.3 million in 2028, USD 1,062.3 million in 2031, and progressing to USD 1,499.5 million by 2034. The consistent upward trend highlights significant revenue potential, providing manufacturers and suppliers with opportunities to expand production, enhance distribution, and capture a growing share of the data center cooling market. The absolute dollar opportunity emphasizes the substantial value within the data center refrigerant market over the next ten years.

Incremental growth from USD 690.4 million in 2025 to USD 1,634.4 million in 2035 underscores a cumulative increase of USD 944.0 million. Key years such as USD 894.1 million in 2029 and USD 1,262.1 million in 2033 mark periods of accelerated adoption. This growth trajectory allows stakeholders to strategically scale operations, optimize supply chains, and expand service offerings, ensuring they capture a meaningful portion of the expanding market throughout the 2025–2035 period.

| Metric | Value |

|---|---|

| Data Center Refrigerant Market Estimated Value in (2025 E) | USD 690.4 million |

| Data Center Refrigerant Market Forecast Value in (2035 F) | USD 1634.4 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

The data center refrigerant market is a segment of the broader data center cooling solutions market, which includes chillers, air handling units, direct expansion systems, and liquid cooling systems. In 2025, refrigerants account for approximately 20% of the total data center cooling solutions market, reflecting their essential role in maintaining optimal operating conditions. With the parent market projected to grow from around USD 3.45 billion in 2025 to USD 8.2 billion in 2035, the data center refrigerant segment’s growth from USD 690.4 million in 2025 to USD 1,634.4 million in 2035 at a CAGR of 9.0% represents roughly 25% of the total incremental growth in the parent market. Within the parent market, chillers hold about 35% of total value, direct expansion systems contribute approximately 25%, and liquid cooling systems account for around 20%.

The refrigerant segment, with its CAGR of 9.0%, demonstrates faster growth compared to several other cooling solutions, highlighting its increasing adoption in large-scale and hyperscale data centers. The absolute growth of USD 944.0 million over the decade represents roughly 23–25% of total parent market expansion. This trend provides manufacturers and suppliers opportunities to expand production, optimize distribution, and capture a larger share of the growing global data center cooling solutions market.

The data center refrigerant market is experiencing strong growth driven by the rapid expansion of global data processing and storage infrastructure. Rising adoption of cloud computing, AI-driven analytics, and high-performance computing is placing greater emphasis on efficient and sustainable cooling solutions. Stringent environmental regulations and corporate sustainability goals are encouraging the shift toward low-global warming potential refrigerants, with increasing investments in research and development to enhance thermal efficiency and operational reliability.

The ongoing trend toward hyperscale and colocation facilities is generating significant demand for advanced cooling systems that maintain optimal operating temperatures while reducing energy consumption. Technological advancements in refrigerant formulations and system integration are enabling higher efficiency and lower maintenance requirements, making them attractive for long-term deployment.

As data center operators aim to balance performance, cost efficiency, and environmental compliance, refrigerants with low emissions profiles are expected to see growing adoption This market is set to benefit from both regulatory drivers and the relentless growth of data generation, positioning it for sustained expansion over the coming decade.

The data center refrigerant market is segmented by refrigerant, data center, cooling, application, end-use, and geographic regions. By refrigerant, data center refrigerant market is divided into HFOs, HFCs, and others. In terms of data center, data center refrigerant market is classified into colocation, enterprise, cloud, and hyperscale. Based on cooling, data center refrigerant market is segmented into air cooling, liquid cooling, and free cooling. By application, data center refrigerant market is segmented into IT cooling system and facility cooling system. By end-use, data center refrigerant market is segmented into IT and telecom, BFSI, government and defense, healthcare, energy, manufacturing, retail, and others. Regionally, the data center refrigerant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

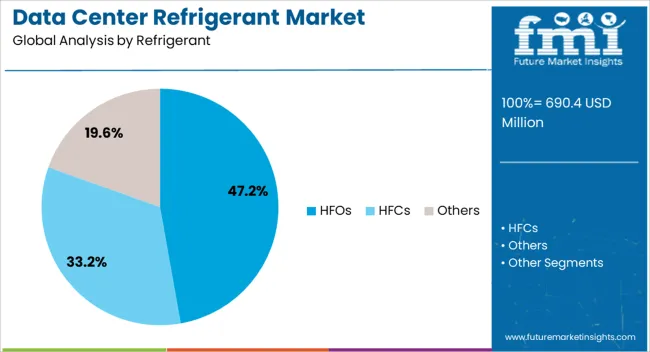

The HFOs refrigerant segment is projected to hold 47.2% of the data center refrigerant market revenue share in 2025, establishing itself as the leading refrigerant type. This leadership is supported by its ultra-low global warming potential, which aligns with increasingly strict environmental regulations worldwide. The segment is benefiting from the transition away from traditional high-GWP refrigerants, as data center operators prioritize eco-friendly solutions without compromising cooling performance.

HFO-based refrigerants provide excellent thermodynamic properties, allowing for high energy efficiency and reduced operating costs, which is essential in large-scale, continuously running facilities. Their compatibility with existing infrastructure and adaptability to advanced cooling system designs are further driving adoption.

Moreover, their chemical stability and safety profile make them suitable for mission-critical environments where downtime is not acceptable With growing pressure to meet carbon reduction targets and enhance sustainability credentials, the demand for HFOs in data centers is expected to remain strong, reinforcing their dominance in the refrigerant segment over the forecast period.

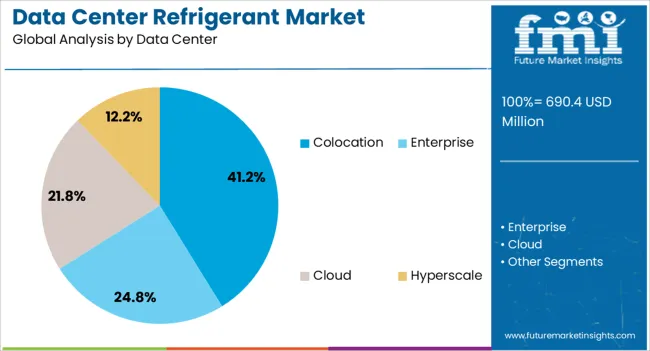

The colocation data center segment is anticipated to account for 41.2% of the data center refrigerant market revenue share in 2025, making it the dominant facility type. Growth in this segment is being driven by the increasing preference of enterprises to outsource data storage and processing needs to shared facilities, reducing capital expenditures while gaining access to state-of-the-art infrastructure.

Colocation providers are heavily investing in advanced cooling technologies to improve energy efficiency and meet client sustainability requirements, which is boosting demand for high-performance refrigerants. The need to ensure uninterrupted operations and maintain precise temperature control in multi-tenant environments is accelerating the adoption of refrigerants that offer both high efficiency and environmental compliance.

As hyperscale cloud providers continue to partner with colocation facilities to expand their global footprint, demand for eco-friendly and cost-effective refrigerants is expected to grow further This trend is reinforced by the increasing number of enterprises opting for hybrid cloud solutions, driving sustained investment in efficient cooling systems in colocation environments.

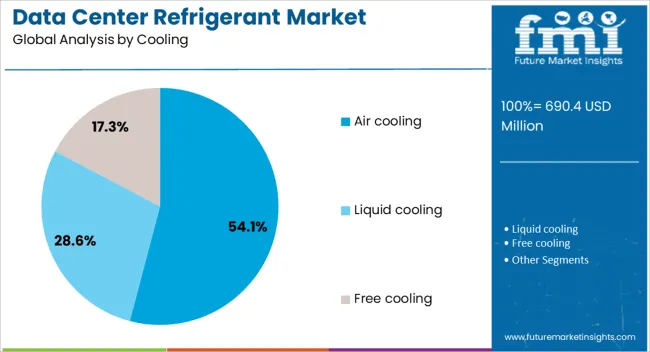

The air cooling segment is expected to represent 54.1% of the data center refrigerant market revenue share in 2025, making it the leading cooling method. Its dominance is being supported by lower initial investment requirements, simpler system design, and reduced maintenance complexity compared to liquid-based cooling systems.

Air cooling systems are widely adopted in small to medium-sized facilities as well as in regions where climate conditions allow for the use of free cooling, reducing operational costs. Advances in airflow management, containment systems, and energy-efficient fans have further improved the effectiveness of air cooling solutions.

The segment’s leadership is also being reinforced by its compatibility with a variety of refrigerant options, including environmentally friendly HFOs, enabling data centers to meet sustainability targets With many operators seeking to balance cost efficiency, reliability, and environmental performance, air cooling is expected to maintain its market-leading position, especially in facilities where operational flexibility and ease of scalability are prioritized.

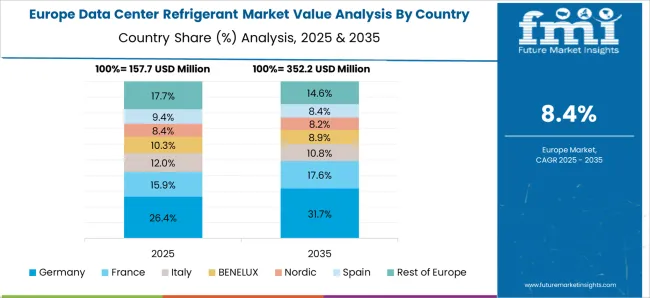

The data center refrigerant market is expanding due to the increasing need for efficient cooling in high-density data centers and cloud computing facilities. North America and Europe lead adoption with advanced refrigerants featuring low global warming potential (GWP), energy efficiency, and regulatory compliance. Asia-Pacific shows rapid growth driven by expanding IT infrastructure, hyperscale data centers, and digital transformation. Manufacturers differentiate through refrigerant type, thermal performance, and sustainability compliance. Regional differences in energy costs, environmental regulations, and cooling technology adoption strongly influence market growth and competitiveness globally.

The growth of data centers worldwide is the primary driver for refrigerant adoption. North America and Europe focus on hyperscale and enterprise data centers requiring high-performance refrigerants capable of managing extreme heat loads while maintaining energy efficiency. Asia-Pacific markets witness rapid expansion of cloud computing, colocation, and enterprise data centers, creating high demand for effective cooling solutions. Differences in server density, ambient climate conditions, and energy costs influence refrigerant type selection, cooling system configuration, and lifecycle management. Leading suppliers provide low-GWP, energy-efficient refrigerants compatible with advanced chiller systems, while regional producers focus on cost-effective alternatives. Expansion contrasts directly shape adoption, operational efficiency, and market competitiveness in the global data center refrigerant segment.

Energy efficiency and cooling system optimization are critical factors in data center refrigerant adoption. North America and Europe prioritize refrigerants that support low-energy cooling systems, free cooling, and liquid cooling solutions to reduce operational costs and carbon emissions. Asia-Pacific markets adopt refrigerants optimized for performance and affordability in dense urban data centers and industrial zones. Differences in energy pricing, cooling system design, and operational uptime requirements affect refrigerant choice, system efficiency, and maintenance schedules. Leading suppliers develop refrigerants with high thermal capacity, minimal leakage, and compatibility with next-generation cooling technologies, while regional players provide cost-efficient, practical solutions. Efficiency and optimization contrasts drive adoption, operational sustainability, and competitiveness globally.

Regulatory frameworks and environmental standards significantly influence refrigerant adoption in data centers. North America and Europe enforce strict regulations under Kigali Amendment, EPA SNAP rules, and EU F-gas compliance, promoting low-GWP refrigerants and phasing out high-GWP substances. Asia-Pacific markets vary; developed regions follow international protocols, while emerging markets implement flexible local standards. Differences in regulatory stringency, phase-down timelines, and reporting requirements affect refrigerant selection, system retrofits, and deployment strategies. Leading suppliers provide certified, compliant refrigerants with clear documentation and safety guidelines, while regional manufacturers focus on cost-effective solutions adhering to local standards. Compliance contrasts shape adoption, operational legality, and market competitiveness across global data centers.

Innovation in refrigerant blends and lifecycle management drives market adoption. North America and Europe focus on developing low-GWP, high-thermal-capacity refrigerants compatible with advanced chillers and liquid cooling systems, supporting sustainability goals. Asia-Pacific markets increasingly adopt blended refrigerants for retrofits and new installations to balance cost, efficiency, and environmental impact. Differences in blend composition, operational temperature tolerance, and system compatibility influence adoption, cooling efficiency, and maintenance requirements. Leading suppliers provide optimized refrigerant blends with monitoring solutions for leak detection and refill management, while regional producers offer standard refrigerants with moderate performance. Innovation and lifecycle management contrasts shape adoption, operational reliability, and competitiveness in the global data center refrigerant market.

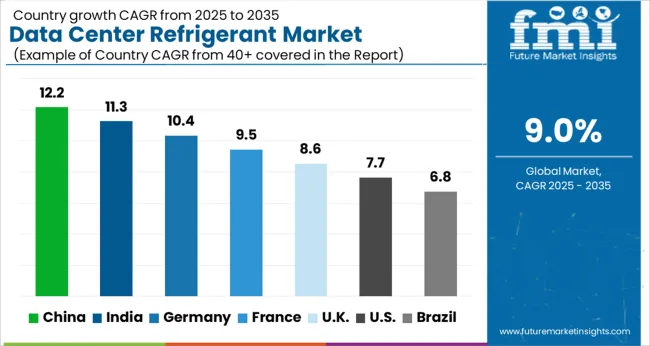

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global data center refrigerant market is projected to grow at a 9.0% CAGR through 2035, driven by demand in cooling systems for data centers, server farms, and high-density IT infrastructure. Among BRICS nations, China led with 12.2% growth as large-scale manufacturing and deployment across data center cooling systems were executed, while India at 11.3% expanded production and integration to meet rising commercial and industrial cooling requirements. In the OECD region, Germany at 10.4% maintained steady adoption under strict regulatory and safety standards, while the United Kingdom at 8.6% implemented refrigerants across commercial and industrial data centers. The USA, growing at 7.7%, advanced deployment in IT infrastructure cooling applications while adhering to federal and state-level environmental and safety regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The data center refrigerant market in China is projected to grow at a CAGR of 12.2%, driven by increasing data center construction, cloud computing demand, and high density server deployments. Adoption is being encouraged by refrigerants that provide energy efficiency, environmental compliance, and reliable cooling performance. Manufacturers are being urged to supply advanced, cost effective, and safe solutions. Distribution through data center operators, HVAC suppliers, and industrial distributors is being strengthened. Research in refrigerant efficiency, leak prevention, and sustainable alternatives is being conducted. Expansion of cloud infrastructure, industrial data centers, and government policies supporting energy efficient cooling are considered key factors driving the data center refrigerant market in China.

In India, the data center refrigerant market is expected to grow at a CAGR of 11.3%, supported by rising data center construction, cloud computing adoption, and IT infrastructure expansion. Emphasis is being placed on refrigerants that ensure high performance, energy efficiency, and environmental compliance. Local manufacturers are being encouraged to develop reliable, cost effective, and advanced solutions. Distribution through data center operators, industrial HVAC suppliers, and IT service providers is being expanded. Awareness programs promoting sustainable cooling solutions are being conducted. Growth of IT infrastructure, industrial data centers, and energy efficiency initiatives are recognized as primary drivers of the data center refrigerant market in India.

Germany is witnessing steady growth in the data center refrigerant market at a CAGR of 10.4%, driven by adoption in enterprise data centers, colocation facilities, and industrial IT operations. Adoption is being encouraged by refrigerants that provide operational reliability, energy efficiency, and low environmental impact. Manufacturers are being urged to supply advanced, safe, and compliant solutions. Distribution through industrial HVAC suppliers, data center operators, and IT service providers is being optimized. Research in efficiency improvement, leak prevention, and environmentally friendly refrigerants is being pursued. Increasing data center capacity, IT infrastructure upgrades, and energy efficiency regulations are considered key factors driving the data center refrigerant market in Germany.

The data center refrigerant market in the United Kingdom is projected to grow at a CAGR of 8.6%, supported by adoption in commercial, industrial, and cloud computing data centers. Adoption is being emphasized for refrigerants that provide energy efficiency, reliability, and environmental compliance. Manufacturers are being encouraged to supply durable, advanced, and cost effective solutions. Distribution through HVAC suppliers, IT service providers, and data center operators is being strengthened. Pilot programs and demonstration projects are being conducted to highlight refrigerant efficiency and operational reliability. Expansion of data center infrastructure, cloud adoption, and energy efficiency initiatives are recognized as major contributors to the data center refrigerant market in the United Kingdom.

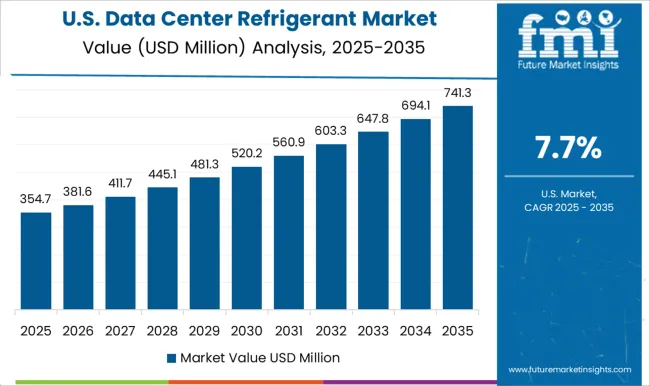

The data center refrigerant market in the United States is projected to grow at a CAGR of 7.7%, driven by adoption in cloud data centers, enterprise IT facilities, and industrial operations. Adoption is being encouraged by refrigerants that offer energy efficiency, reliability, and compliance with environmental regulations. Manufacturers are being urged to develop advanced, cost effective, and safe solutions. Distribution through data center operators, industrial HVAC suppliers, and IT service providers is being maintained. Research in refrigerant efficiency, leak detection, and sustainable alternatives is being pursued. Expansion of cloud computing, enterprise IT infrastructure, and energy efficiency initiatives are considered key drivers of the data center refrigerant market in the United States.

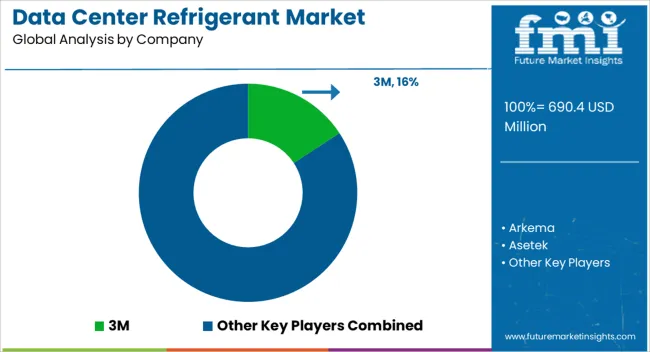

The data center refrigerant market is driven by a group of leading suppliers who provide advanced cooling solutions to maintain optimal operating conditions for critical IT infrastructure. Prominent players in this market include 3M, Arkema, Asetek, Climalife, Daikin Industries, Dow, Honeywell International, M&I Materials, Orbia, and The Chemours Company. These suppliers are recognized for offering high-performance refrigerants that enhance energy efficiency, reduce environmental impact, and ensure the reliability of data center operations. Their products are designed to meet stringent safety and environmental regulations, supporting sustainable cooling practices in modern data centers.

Companies such as Daikin Industries, Honeywell International, and Arkema are driving innovation by developing low-global-warming-potential (GWP) refrigerants and advanced thermal management solutions. 3M and The Chemours Company focus on specialty refrigerants that optimize cooling efficiency while maintaining compliance with international environmental standards. Other suppliers like Asetek and Climalife provide integrated refrigerant systems that combine hardware and chemical solutions to improve energy utilization and operational stability. Together, these companies help data centers manage heat loads effectively, reducing energy consumption and operational costs.

Overall, the leading suppliers in the data center refrigerant market play a crucial role in supporting the growing demand for reliable, efficient, and environmentally responsible cooling solutions. By offering innovative refrigerants and advanced thermal management technologies, these companies ensure that data centers can operate safely and efficiently in the face of increasing computational demands. Their ongoing commitment to sustainability, energy efficiency, and technological advancement is shaping the market, enabling organizations to adopt resilient, cost-effective, and eco-friendly cooling solutions that align with global climate goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 690.4 million |

| Refrigerant | HFOs, HFCs, and Others |

| Data Center | Colocation, Enterprise, Cloud, and Hyperscale |

| Cooling | Air cooling, Liquid cooling, and Free cooling |

| Application | IT cooling system and Facility cooling system |

| End-Use | IT and Telecom, BFSI, Government and Defense, Healthcare, Energy, Manufacturing, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Arkema, Asetek, Climalife, Daikin Industries, Dow, Honeywell International, M&I Materials, Orbia, and The Chemours Company |

| Additional Attributes | Dollar sales vary by refrigerant type, including HFCs, HFOs, natural refrigerants, and blends; by application, such as precision cooling, CRAC/CRAH units, and liquid cooling systems; by end-use, spanning hyperscale data centers, colocation facilities, and enterprise IT centers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising data center deployment, energy efficiency regulations, and demand for low-GWP refrigerants. |

The global data center refrigerant market is estimated to be valued at USD 690.4 million in 2025.

The market size for the data center refrigerant market is projected to reach USD 1,634.4 million by 2035.

The data center refrigerant market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key applications of data center refrigerants are as IT cooling systems and facility cooling systems.

In terms of data center, colocation segment to command 41.2% share in the data center refrigerant market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA