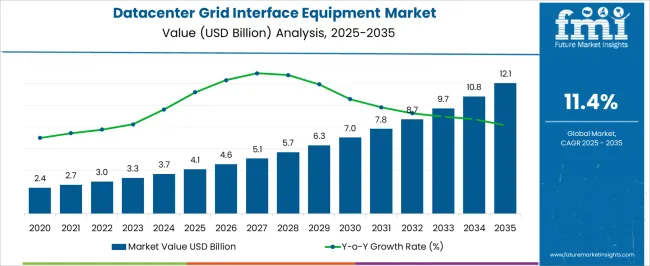

The global datacenter grid interface equipment market is projected to grow from USD 4.1 billion in 2025 to approximately USD 11.9 billion by 2035, recording an absolute increase of USD 7.8 billion over the forecast period. This reflects a cumulative growth of 190.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 11.4% between 2025 and 2035. The overall market size is expected to grow by nearly 2.9X during the same period, supported by rising demand for reliable power infrastructure across hyperscale and colocation datacenters.

The market is growing as global demand for cloud computing, AI, and big data drives the expansion of hyperscale and edge datacenters. These facilities require robust grid interface systems to ensure reliable power quality, seamless grid integration, and resilience against outages or fluctuations. Rising adoption of renewable energy sources also increases the need for advanced grid interface equipment to manage variable power inputs while maintaining uptime. Stricter regulations around energy efficiency and sustainability are pushing operators to invest in smarter, more efficient solutions. Additionally, increasing digitalization and 5G rollout are accelerating datacenter infrastructure growth worldwide.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.1 billion |

| Forecast Value in (2035F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

Between 2020 and 2025, the datacenter grid interface equipment market expanded from USD 1.8 billion to USD 4.1 billion, reflecting a cumulative value increase of USD 2.3 billion and a five-year CAGR of 17.9%. Growth during this period was supported by the rapid expansion of cloud computing, digital transformation initiatives, and increasing power requirements for datacenter facilities. The COVID-19 pandemic accelerated demand for digital infrastructure, driving investment in grid interface solutions.

Between 2025 and 2030, the datacenter grid interface equipment market is projected to expand from USD 4.1 billion to USD 7.1 billion, resulting in a value increase of USD 3.0 billion, which represents 38.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing deployment of hyperscale datacenters, rising power density requirements, and the need for grid stability solutions to support AI and machine learning workloads.

From 2030 to 2035, the market is forecast to grow from USD 7.1 billion to USD 11.9 billion, adding another USD 4.8 billion, which constitutes 61.5% of the overall ten-year expansion. This period is expected to be characterized by advanced grid integration technologies, enhanced protection systems, and the widespread adoption of renewable energy sources in datacenter operations. Regulatory requirements for grid stability and power quality will drive demand for sophisticated interface equipment.

The growth of the datacenter grid interface equipment market is being supported by the increasing power density requirements of modern datacenters and the growing need for reliable grid connectivity. The expansion of artificial intelligence and machine learning applications has created demand for high-performance computing infrastructure, which requires sophisticated power management and grid interface solutions.

The rise of hyperscale datacenters operated by major cloud service providers has driven investment in advanced grid interface equipment capable of handling multi-megawatt power loads. These facilities require specialized switchgear, transformers, and protection systems to ensure continuous operation and grid stability. The trend toward renewable energy integration in datacenter operations has further increased demand for advanced power control and distribution systems.

Edge computing deployment and the proliferation of colocation datacenters have expanded the market for grid interface equipment across diverse geographic locations. Regulatory requirements for power quality, grid stability, and environmental performance have prompted datacenter operators to invest in advanced interface technologies. The need for redundancy and high availability has driven adoption of sophisticated protection and relay systems.

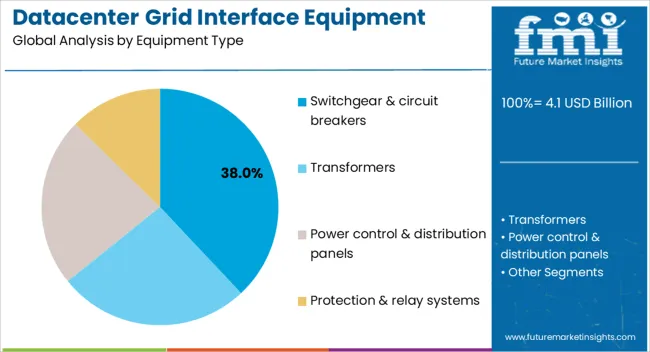

The market is segmented by equipment type into switchgear & circuit breakers, transformers, power control & distribution panels, and protection & relay systems, each serving specific functions in datacenter power infrastructure. By datacenter type, the market is divided into hyperscale datacenters, colocation datacenters, and enterprise/private datacenters, reflecting different operational requirements and investment patterns. Power rating segmentation includes above 100 MW capacity interface, 50-100 MW, and below 50 MW, indicating varying power requirements across facility sizes.

Switchgear & circuit breakers are projected to account for 38% of the datacenter grid interface equipment market in 2025. This leading share is supported by the critical role these components play in power distribution, fault protection, and system isolation within datacenter facilities. The increasing power density of modern datacenters has driven demand for advanced switchgear capable of handling higher voltage and current ratings while maintaining compact footprints.

The shift toward higher voltage distribution systems in large datacenters has increased the complexity and value of switchgear installations. Safety regulations and the need for rapid fault clearing have driven adoption of intelligent switchgear with advanced protection features. The requirement for redundancy in critical facilities has further supported demand for multiple switchgear configurations.

Transformers are estimated to hold 27% of the market share in 2025, driven by their essential role in voltage conversion and power distribution within datacenter facilities. The increasing use of medium voltage distribution systems in large datacenters has created demand for specialized transformers capable of efficient voltage reduction. The trend toward modular datacenter designs has supported adoption of standardized transformer configurations.

Power quality requirements and the need for voltage regulation have driven investment in advanced transformer technologies, including low-loss designs and smart monitoring systems. The integration of renewable energy sources has increased demand for transformers capable of handling variable power inputs while maintaining stable output characteristics.

Power control & distribution panels are projected to contribute 20% of the market in 2025, serving critical functions in power distribution, monitoring, and control within datacenter facilities. The increasing complexity of datacenter power systems has driven demand for intelligent distribution panels with advanced monitoring and control capabilities. The need for precise power management in high-density computing environments has supported adoption of sophisticated control systems.

The trend toward software-defined infrastructure has increased demand for distribution panels with network connectivity and remote management capabilities. Energy efficiency requirements have driven development of advanced power control systems capable of optimizing power distribution based on real-time demand patterns.

Protection & relay systems are anticipated to hold 15% of the market share in 2025, providing essential fault detection, isolation, and system protection functions. The increasing power density and complexity of modern datacenters have heightened the importance of advanced protection systems capable of rapid fault detection and clearing. The need for selective coordination and system stability has driven adoption of intelligent relay systems.

The integration of renewable energy sources and energy storage systems has increased the complexity of protection requirements, driving demand for adaptive protection schemes. Regulatory requirements for grid stability and power quality have further supported investment in advanced protection technologies.

The datacenter grid interface equipment market is experiencing steady growth driven by increasing power requirements, grid stability needs, and renewable energy integration. The shift toward higher power density facilities and the adoption of advanced computing technologies are creating new challenges for power infrastructure design. Regulatory requirements and environmental considerations are influencing equipment specifications and deployment strategies.

Modern datacenters are experiencing significant increases in power density driven by artificial intelligence, machine learning, and high-performance computing applications. This trend has created demand for grid interface equipment capable of handling higher power loads while maintaining compact footprints. The need for efficient power conversion and distribution has driven development of advanced transformer and switchgear technologies.

The concentration of power in smaller physical spaces has increased the importance of thermal management and power quality control. Advanced monitoring and control systems are becoming essential for managing the complex interactions between grid interface equipment and datacenter loads. The trend toward liquid cooling systems has created new requirements for power distribution and control.

The increasing adoption of renewable energy sources in datacenter operations is driving demand for sophisticated grid interface equipment capable of managing variable power inputs. Solar and wind energy integration requires advanced power control systems capable of maintaining grid stability while accommodating fluctuating power generation. Energy storage integration has added complexity to grid interface requirements.

The development of microgrids and distributed energy resources has created new opportunities for grid interface equipment suppliers. Advanced protection and control systems are required to manage the bidirectional power flows associated with energy storage and renewable generation. Grid codes and interconnection standards are evolving to address the unique characteristics of datacenter loads and distributed resources.

The trend toward digital infrastructure and smart grid technologies is influencing the design and capabilities of datacenter grid interface equipment. Internet of Things connectivity and advanced monitoring capabilities are becoming standard features in modern interface equipment. Predictive maintenance and condition monitoring are being enabled through digital technologies and data analytics.

The integration of artificial intelligence in power management systems is enabling more sophisticated control and optimization strategies. Digital twin technologies are being applied to grid interface systems to improve design, operation, and maintenance practices. Cybersecurity requirements are becoming increasingly important as interface equipment becomes more connected and intelligent.

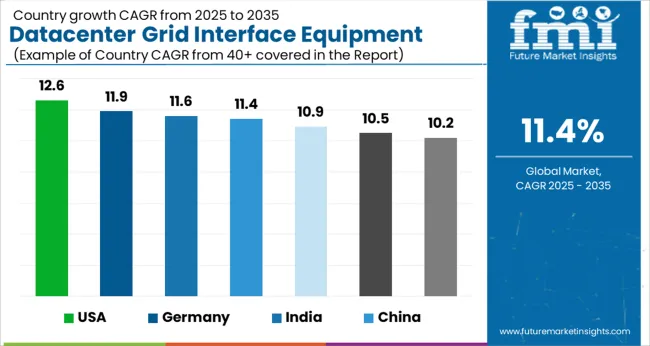

The United States datacenter grid interface equipment market is projected to achieve the highest growth rate globally, with a CAGR of 12.6% from 2025 to 2035. This growth is primarily driven by continued expansion of hyperscale datacenter facilities operated by major cloud service providers and technology companies. The concentration of hyperscaler operations in regions such as Northern Virginia, the Pacific Northwest, and Texas has created substantial demand for high-capacity grid interface equipment.

The United States market benefits from favorable regulatory environments and established relationships between datacenter operators and utility companies. FERC regulations governing grid interconnection and power purchase agreements have provided a stable framework for datacenter development and grid interface investments. The availability of renewable energy resources and power purchase agreement structures has supported the development of large-scale datacenter facilities requiring sophisticated grid interface solutions.

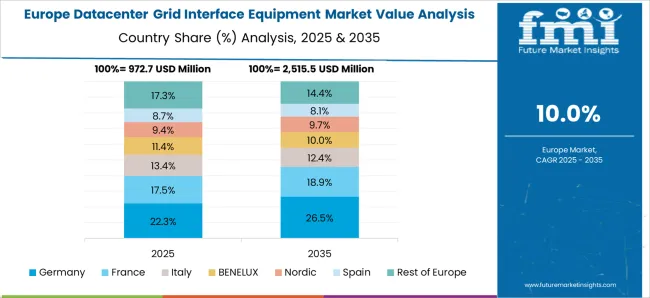

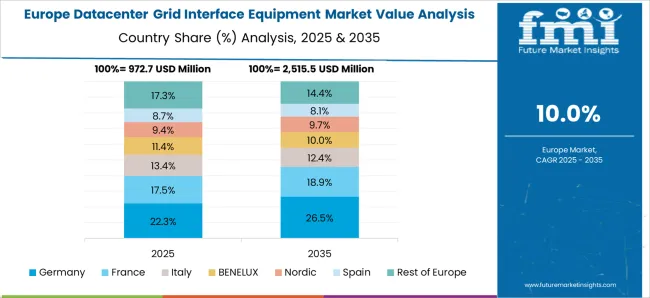

Germany's datacenter grid interface equipment market is expected to grow at a CAGR of 11.9% through 2035, supported by the country's energy transition initiatives and increasing demand for high-density AI datacenters. The Energiewende program has created a complex power grid environment requiring sophisticated interface solutions to manage renewable energy integration and grid stability. German datacenters are investing in advanced grid interface equipment to support the country's renewable energy goals while maintaining operational reliability.

The German market is characterized by stringent technical requirements for grid interconnection and power quality, driving demand for advanced protection and control systems. The country's focus on energy efficiency and environmental performance has influenced datacenter design and equipment selection. Industrial partnerships between datacenter operators, equipment manufacturers, and utility companies have facilitated the development of innovative grid interface solutions.

India's datacenter grid interface equipment market is projected to grow at 11.6% CAGR through 2035, driven by government-backed datacenter park initiatives and rapidly increasing power demand from digital infrastructure. The Indian government's Digital India program and data localization requirements have stimulated investment in domestic datacenter capacity, creating substantial demand for grid interface equipment. The development of dedicated datacenter parks with specialized power infrastructure has supported market growth.

The Indian market is characterized by diverse power grid conditions and varying levels of infrastructure development across regions. This environment has created demand for flexible grid interface solutions capable of adapting to different grid conditions and power quality levels. The growing adoption of renewable energy in Indian datacenters has driven investment in advanced power control and energy management systems.

China's datacenter grid interface equipment market is expected to achieve an 11.4% CAGR through 2035, supported by state-led hyperscale facility development and integration with the country's renewable-heavy power grid. The Chinese government's emphasis on digital infrastructure development and carbon neutrality goals has driven investment in advanced grid interface technologies. State-owned enterprises and major technology companies are investing in large-scale datacenter facilities requiring sophisticated power infrastructure.

The Chinese market benefits from domestic manufacturing capabilities and government support for advanced power equipment development. The country's ambitious renewable energy targets and grid modernization initiatives have created opportunities for innovative grid interface solutions. The integration of datacenter operations with smart grid technologies and energy storage systems has driven demand for advanced control and protection equipment.

The United Kingdom datacenter grid interface equipment market is projected to grow at 10.9% CAGR through 2035, driven by grid reinforcement projects and Net Zero commitment requirements. The UK government's Net Zero strategy has influenced datacenter development and equipment selection, creating demand for energy-efficient grid interface solutions. Grid reinforcement projects aimed at supporting increased datacenter capacity have driven investment in advanced power infrastructure.

The UK market is characterized by mature regulatory frameworks and established relationships between datacenter operators and utility companies. The country's focus on renewable energy integration and carbon reduction has influenced equipment specifications and operational requirements. London's position as a major financial and technology center has supported continued datacenter investment and grid interface equipment demand.

Japan's datacenter grid interface equipment market is expected to grow at 10.5% CAGR through 2035, driven by high-reliability requirements and digital economy growth initiatives. Japanese datacenters place exceptional emphasis on operational reliability and disaster resilience, creating demand for redundant grid interface systems and advanced protection technologies. The country's experience with natural disasters has influenced equipment design and installation practices.

The Japanese market is characterized by sophisticated technical requirements and preference for proven, high-quality equipment. The country's digital transformation initiatives and growing adoption of cloud computing services have supported datacenter investment and grid interface equipment demand. Partnerships between Japanese companies and international equipment suppliers have facilitated technology transfer and market development.

Singapore's datacenter grid interface equipment market is projected to achieve 10.2% CAGR through 2035, driven by the need for high-efficiency solutions in a limited land environment. The city-state's position as a regional hub for cloud computing and digital services has sustained datacenter investment despite land constraints. Space limitations have driven demand for compact, high-density grid interface equipment with advanced cooling and efficiency features.

Singapore's tropical climate and urban environment have influenced equipment specifications and installation practices. The government's smart nation initiatives and emphasis on energy efficiency have shaped market requirements. The country's stable regulatory environment and strategic location have attracted international datacenter operators and equipment suppliers.

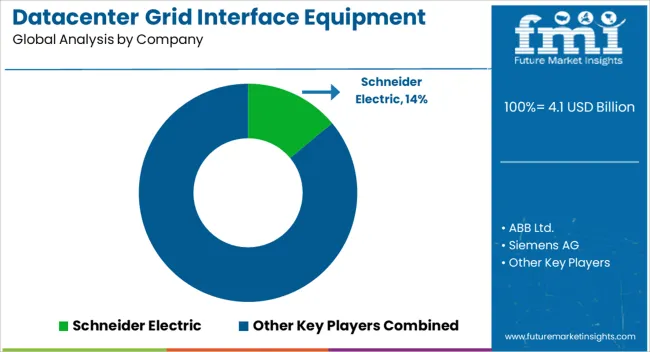

The datacenter grid interface equipment market is dominated by established power equipment manufacturers with strong engineering capabilities and global service networks. Schneider Electric leads the market with a 14.0% share in 2025, followed by other major players including ABB Ltd., Siemens AG, and Eaton Corporation. Competition focuses on technological innovation, system reliability, and the ability to provide integrated solutions for complex datacenter power requirements.

Market participants are investing in advanced digital technologies, including IoT connectivity, predictive maintenance capabilities, and artificial intelligence-based optimization systems. The trend toward higher power densities and renewable energy integration is driving research and development efforts focused on next-generation interface technologies. Strategic partnerships between equipment manufacturers, datacenter operators, and utility companies are becoming increasingly important for market success.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 billion |

| Equipment Type | Switchgear & Circuit Breakers, Transformers, Power Control & Distribution Panels, Protection & Relay Systems |

| Datacenter Type | Hyperscale Datacenters, Colocation Datacenters, Enterprise/Private Datacenters |

| Power Rating | Above 100 MW Capacity Interface, 50-100 MW, Below 50 MW |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Singapore |

| Key Companies Profiled | Schneider Electric, ABB Ltd., Siemens AG, Eaton Corporation, General Electric, Mitsubishi Electric, Hitachi Energy, Powell Industries, Vertiv Holdings, Cummins Inc., Toshiba Energy Systems |

| Additional Attributes | Dollar sales by equipment type and voltage rating, regional deployment trends, competitive landscape, buyer preferences for modular versus integrated systems, adoption of smart monitoring and predictive maintenance, innovations in power electronics, grid synchronization, energy storage integration, and sustainable cooling and efficiency optimization technologies |

The global datacenter grid interface equipment market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the datacenter grid interface equipment market is projected to reach USD 12.1 billion by 2035.

The datacenter grid interface equipment market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in datacenter grid interface equipment market are switchgear & circuit breakers, transformers, power control & distribution panels and protection & relay systems.

In terms of datacenter type, hyperscale datacenters segment to command 54.0% share in the datacenter grid interface equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

AI Datacenter Liquid Cooling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Griddles Market

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

AC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Smart Grid Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Home Area Network (HAN) Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Technology Market Analysis - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA