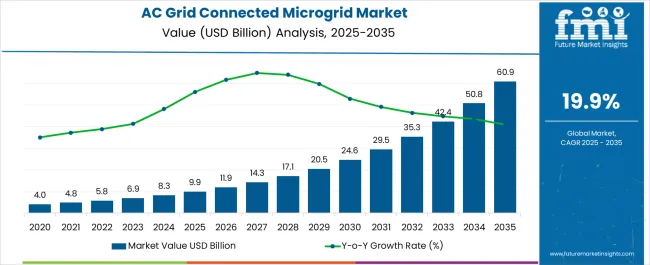

The AC grid-connected microgrid Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 60.9 billion by 2035, registering a compound annual growth rate (CAGR) of 19.9% over the forecast period. The AC grid-connected microgrid market creates an incremental opportunity of USD 56.9 billion at a compound annual growth rate (CAGR) of around 17.8%. A peak-to-trough analysis based on extended data from 2020 to 2035 reveals that the market value in 2020 stood at USD 4.0 billion, marking the baseline before a period of rapid expansion.

Following this, the market experienced robust growth, rising to USD 4.8 billion in 2021, USD 5.8 billion in 2022, and USD 6.9 billion in 2023, indicating early adoption and growing acceptance of microgrid technology integrated with AC grids. By 2024, the market will have further increased to USD 8.3 billion, setting a strong foundation for the forecast period beginning in 2025. The peak projected for 2035 is USD 60.9 billion, marking a total increase of USD 56.9 billion from the 2020 value and demonstrating a growth multiplier of more than 15 times over the 15 years.

The initial half of the forecast period, from 2020 to 2027, contributes USD 20.3 billion to this growth, while the latter half adds USD 36.6 billion, reflecting a back-weighted and accelerating growth trajectory. This pattern is driven by rising demand for resilient and decentralized power systems, increasing integration of renewable energy sources, and technological advances in energy storage and smart grid solutions. Manufacturers focusing on system scalability, real-time monitoring, and regulatory compliance are expected to capitalize on this rapidly expanding market opportunity.

| Metric | Value |

|---|---|

| AC Grid Connected Microgrid Market Estimated Value in (2025 E) | USD 9.9 billion |

| AC Grid Connected Microgrid Market Forecast Value in (2035 F) | USD 60.9 billion |

| Forecast CAGR (2025 to 2035) | 19.9% |

The AC grid-connected microgrid market occupies a critical share within the global distributed energy and smart grid ecosystem, accounting for approximately 38–40% of the overall microgrid solutions segment due to its reliability and grid-support functionality. Within the broader renewable and hybrid energy systems category, AC grid-connected microgrids represent nearly 28–30%, driven by growing deployment in urban infrastructure, industrial facilities, and critical utility services.

In the decentralized power generation segment, they hold an estimated 22–24% share, reflecting their ability to ensure seamless integration with existing AC networks while optimizing peak load management. Increasing energy transition initiatives, electrification of industrial clusters, and demand for resilient power systems in grid-constrained regions primarily support growth. The integration of solar PV, wind energy, and combined heat and power (CHP) units within these systems enhances their role in ensuring cost-effective energy supply and operational flexibility.

Advancements in power electronics, automated control systems, and digital monitoring platforms are improving real-time grid synchronization, making AC grid-connected microgrids a preferred solution for both utilities and large-scale commercial complexes. Despite challenges related to regulatory compliance and initial setup costs, adoption is accelerating through government-backed energy security programs and corporate commitments toward decentralized energy generation. This positions AC grid-connected microgrids as an essential enabler of modern grid resilience and renewable integration strategies, contributing significantly to future-ready power distribution frameworks worldwide.

The AC grid connected microgrid market is advancing rapidly, driven by the growing demand for resilient, low-carbon, and digitally controlled energy systems. Increasing integration of renewable energy sources into national grids, coupled with heightened emphasis on energy security and carbon neutrality, is encouraging widespread deployment of microgrids. Government incentives for renewable energy adoption and advancements in smart grid technologies are further strengthening market growth.

AC grid-connected systems are being prioritized due to their compatibility with conventional power infrastructure and their ability to offer bidirectional energy flow and grid support functions. The rising frequency of grid outages and growing energy consumption in industrial and commercial sectors are prompting organizations to invest in dependable and flexible energy solutions.

The convergence of digital controls, storage systems, and decentralized energy generation is positioning the AC grid connected microgrid market as a key enabler of next-generation power systems. The market is expected to expand steadily as innovation in energy storage, power electronics, and renewable generation technologies continues..

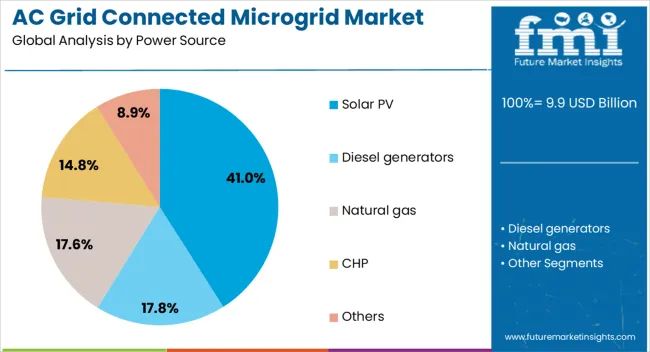

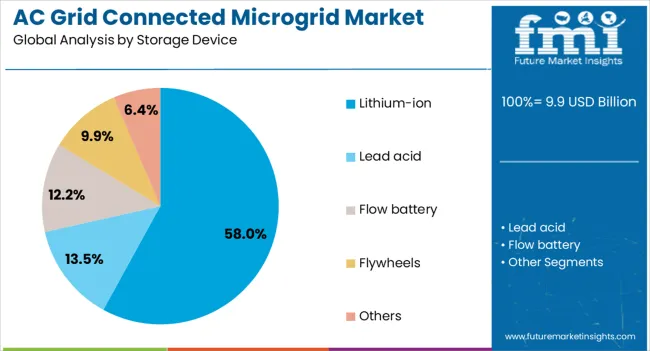

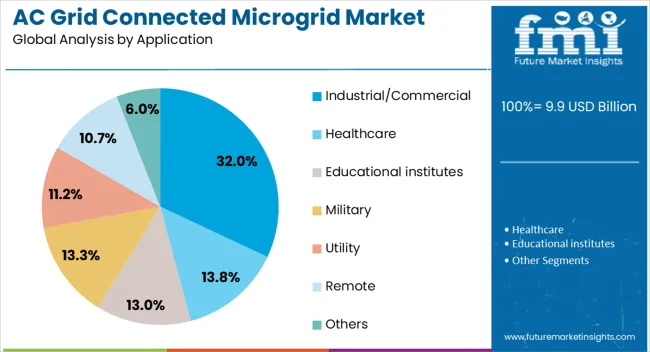

The AC grid-connected microgrid market is segmented by power source, storage device, application, and geographic regions. The AC grid-connected microgrid market is divided by power source into Solar PV, Diesel generators, Natural gas, CHP, and Others. In terms of storage devices, the AC grid-connected microgrid market is classified into Lithium-ion, Lead acid, Flow battery, Flywheels, and Others. Based on the application of the AC grid-connected microgrid market, it is segmented into Industrial/Commercial, Healthcare, Educational institutes, Military, Utility, Remote, and Others. Regionally, the AC grid-connected microgrid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solar PV power source segment is projected to account for 41% of the AC Grid Connected Microgrid market revenue share in 2025, making it the leading energy generation source. The growth of this segment has been supported by a sharp decline in photovoltaic module costs, improved efficiency of solar technologies, and regulatory encouragement for clean energy adoption.

It has been observed that solar PV is increasingly being utilized in microgrid deployments to reduce reliance on fossil fuels and lower carbon emissions. The ability of solar power to be integrated seamlessly with advanced inverter controls and real-time energy management software has enhanced its value proposition in grid connected architectures.

Moreover, favorable policies including feed-in tariffs, net metering, and tax credits have accelerated the installation of solar PV within industrial, commercial, and institutional microgrids. As demand grows for distributed renewable energy solutions that provide reliability, cost-effectiveness, and scalability, solar PV has remained a preferred choice in AC grid connected microgrid systems..

The lithium-ion storage device segment is expected to capture 58% of the AC Grid Connected Microgrid market revenue share in 2025, establishing itself as the dominant energy storage solution. The segment’s leadership has been attributed to the superior energy density, rapid charge and discharge capabilities, and longer lifecycle performance offered by lithium-ion batteries.

These systems have been widely adopted in microgrid architectures due to their compact design, reliability, and ability to support real-time load balancing and peak shaving. The widespread availability of lithium-ion solutions and the decreasing cost per kilowatt-hour have further stimulated their integration across grid connected applications.

Software-defined battery management systems have enhanced safety and efficiency, allowing operators to control energy flows and optimize storage performance dynamically. As the need for resilient, high-performance storage increases in support of intermittent renewable generation, lithium-ion technology continues to lead in both utility-scale and behind-the-meter deployments within the AC microgrid framework..

The industrial commercial segment is projected to hold 32% of the AC Grid Connected Microgrid market revenue share in 2025, making it the largest application category. The increasing requirement for uninterrupted power supply, energy cost savings, and operational continuity in manufacturing plants, data centers, commercial buildings, and logistics facilities has driven the segment’s growth.

Industrial and commercial users have increasingly invested in grid connected microgrids to gain better control over their energy usage, integrate on-site renewable generation, and ensure backup power during grid instability. The ability to participate in demand response programs and reduce peak electricity charges has made microgrids an attractive solution for these sectors.

Enhanced energy monitoring and intelligent load control features have enabled organizations to improve efficiency and meet sustainability goals. As businesses aim to reduce emissions and improve energy resilience, the deployment of AC microgrids in industrial and commercial environments has gained strong momentum, ensuring sustained leadership for this segment.

AC grid-connected microgrids are becoming essential for energy stability and decentralized power management. Their integration with renewables and advanced controls positions them as critical assets for future-ready energy networks.

The AC grid-connected microgrid market is witnessing strong adoption across industrial clusters and utility networks due to rising demand for a reliable and stable power supply. These microgrids ensure seamless power backup during outages and help maintain voltage stability, reducing reliance on centralized grids. Industries such as manufacturing, oil and gas, and mining are leveraging AC-connected systems to enhance operational continuity and energy efficiency. Utilities are integrating these systems to improve grid resilience and manage peak loads effectively. The ability to accommodate multiple distributed energy resources, including renewables and CHP systems, further supports their adoption, making them a strategic solution for maintaining uninterrupted operations in critical sectors.

AC grid-connected microgrids are increasingly incorporating renewable energy sources such as solar and wind, complemented by battery storage systems. This integration provides cost-effective power while reducing dependence on fossil-based generation. By connecting to the main grid, these systems allow for energy export during surplus generation and import during low production periods, ensuring continuous supply. Hybrid microgrid models that combine renewable energy, backup generators, and grid power offer flexibility and stability, making them suitable for large commercial complexes and public infrastructure. This capability to balance supply and demand efficiently drives their attractiveness among utilities and large-scale energy consumers globally.

The transition toward decentralized energy systems has accelerated the adoption of AC grid-connected microgrids as part of grid modernization initiatives. Governments and regulatory bodies are promoting their deployment to enhance energy security and reduce transmission losses. These microgrids enable efficient integration of distributed energy resources while supporting advanced grid functions such as demand response and real-time energy balancing. Their role in maintaining frequency stability and reducing pressure on aging transmission infrastructure positions them as key assets in modern power distribution networks. Large-scale adoption is expected across regions with policy support and growing investments in smart grid projects.

Advances in control systems, automation, and energy management platforms are transforming the performance of AC grid-connected microgrids. Intelligent monitoring and control solutions allow real-time data analytics for optimizing power flow and managing distributed assets efficiently. Features such as automated islanding, predictive maintenance, and advanced inverter technologies are enhancing reliability and system responsiveness. Digital platforms further enable remote operations and predictive grid stability measures, creating new opportunities for utilities and industrial users. These improvements ensure higher return on investment by reducing operational costs and extending system lifespan, strengthening the position of AC grid-connected microgrids in global energy strategies.

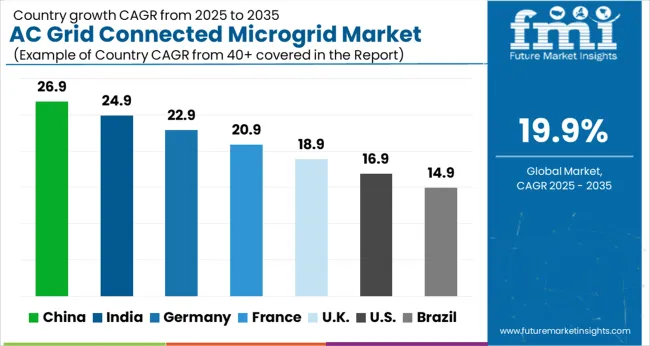

| Country | CAGR |

|---|---|

| China | 26.9% |

| India | 24.9% |

| Germany | 22.9% |

| France | 20.9% |

| UK | 18.9% |

| USA | 16.9% |

| Brazil | 14.9% |

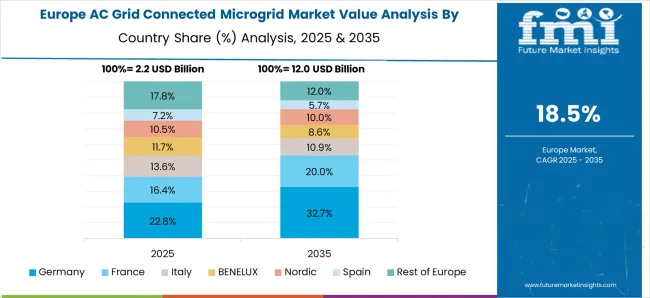

The AC grid-connected microgrid market is projected to expand globally at a CAGR of 19.9% between 2025 and 2035, supported by rapid energy transition initiatives, increased renewable integration, and growing demand for decentralized energy solutions. China leads with an impressive CAGR of 26.9%, driven by large-scale smart grid projects, industrial cluster electrification, and policy-backed energy resilience programs. India follows at 24.9%, fueled by government-led rural electrification, renewable adoption in commercial sectors, and digital grid modernization plans. France records 20.9%, benefiting from government-backed initiatives in sustainable energy deployment and enhanced grid stability requirements. The United Kingdom grows at 18.9%, supported by energy security policies, microgrid deployment in remote regions, and integration with offshore wind power. The United States reports 16.9%, driven by increased investment in campus-based microgrids, military installations, and resilience-focused infrastructure modernization programs. The analysis covers more than 40 countries, with these five representing key benchmarks for technology deployment, regulatory policy impact, and investment opportunities shaping the future of AC grid-connected microgrids globally.

China is expected to register a CAGR of 26.9% during 2025–2035, an increase from approximately 22.8% during 2020–2024, well above the global average of 19.9%. The significant rise is driven by accelerated investments in renewable energy integration and large-scale deployment of smart grid technologies. During the earlier period, adoption was centered on industrial parks and commercial complexes requiring stable backup systems. Post-2024, government-backed policies for energy resilience and rural electrification have fueled microgrid installations across diverse applications, including urban clusters and critical infrastructure. Advanced inverter solutions and digital grid controls are becoming standard, reinforcing system stability and energy efficiency.

India is forecasted to post a CAGR of 24.9% during 2025–2035, up from nearly 20.4% in 2020–2024, marking a robust upward shift. The earlier phase saw steady implementation of microgrids in rural electrification projects and remote communities under national energy access programs. In the next decade, adoption will be driven by renewable energy integration across commercial facilities, smart city initiatives, and decentralized power systems in urban regions. Significant cost reductions in energy storage and advancements in automation are supporting scalability. Partnerships between private developers and state utilities are accelerating the rollout of AC grid-connected microgrids for both reliability and cost-efficiency.

France is projected to grow at a CAGR of 20.9% between 2025–2035, rising from approximately 17.5% during 2020–2024, indicating stable momentum. Early growth was supported by pilot programs in industrial zones and defense installations, ensuring energy security. In the upcoming decade, the adoption of microgrids will be strengthened by aggressive carbon reduction targets and grid modernization plans under the European Green Deal framework. Integration with distributed energy sources, particularly offshore wind and solar, is creating opportunities for hybrid AC grid-connected microgrids. Growing demand from large commercial facilities and hospitals is boosting investments in advanced microgrid configurations.

The United Kingdom is expected to post a CAGR of 18.9% during 2025–2035, compared to about 15.2% during 2020–2024, demonstrating a noticeable increase. In the earlier phase, adoption was focused on military installations and university campuses for energy resilience. By 2025, policy-driven commitments for renewable integration and grid decentralization will enhance large-scale adoption in residential communities and commercial buildings. Integration with offshore wind projects and government-funded net-zero initiatives will play a significant role in driving market growth. The development of advanced energy management systems will further improve operational efficiency and lower lifecycle costs for AC microgrid deployments.

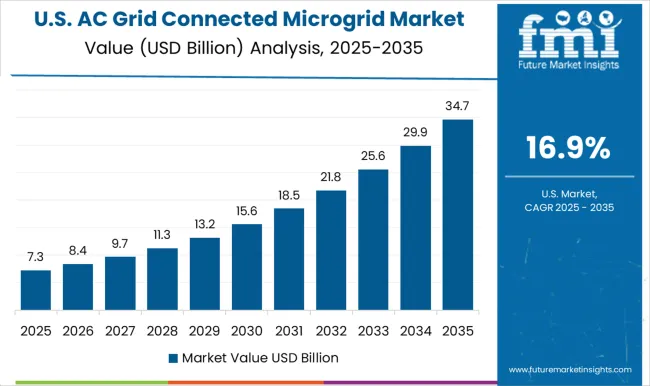

The United States is forecasted to record a CAGR of 16.9% between 2025–2035, rising from nearly 13.8% in 2020–2024, indicating moderate growth. Initial adoption was driven by military bases, university campuses, and municipal utilities prioritizing energy security and outage resilience. The coming decade will see increased investments in microgrids for commercial facilities, critical infrastructure, and data centers. Federal and state-level incentives, combined with tax credits for renewable projects, will encourage deployments. Advanced digital monitoring and predictive control systems are being integrated into microgrid networks to optimize performance and reduce costs. Resilience planning in disaster-prone regions further reinforces long-term demand.

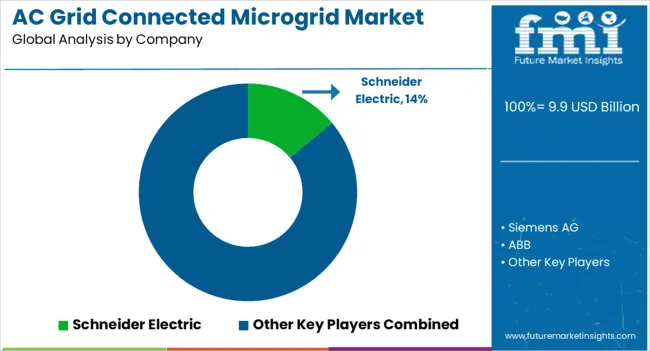

The AC grid-connected microgrid market is dominated by globally established energy and automation leaders, including Schneider Electric, Siemens AG, ABB, General Electric, and Eaton Corporation, all competing on grid stability, integration efficiency, and digital energy management solutions. Schneider Electric stands out with its EcoStruxure Microgrid Advisor platform, offering advanced demand-side optimization and energy-as-a-service models to enhance resilience and cost savings for commercial and industrial users.

Siemens AG focuses on modular and scalable AC grid-connected microgrid systems with intelligent controllers, enabling seamless integration of renewables and energy storage for both urban and remote installations. ABB brings strong expertise in digital automation and power electronics, delivering high-performance grid-interactive systems optimized for industrial clusters and utility grids. Its focus on smart monitoring and predictive maintenance strengthens operational reliability. General Electric (GE) leverages its experience in grid infrastructure to provide microgrid solutions incorporating hybrid generation and real-time grid control, targeting critical sectors like defense, healthcare, and data centers. Eaton Corporation emphasizes advanced control technologies and flexible configurations designed for rapid deployment, supported by its energy storage and power distribution capabilities, addressing energy transition challenges for both private and public sectors.

The competitive landscape is characterized by an increasing shift toward digitization, modular configurations, and cloud-based energy management systems. Strategic initiatives include partnerships with renewable developers, deployment of AI-driven predictive analytics, and integration of EV charging into microgrid networks. These companies are investing in hybrid energy systems, resilient grid designs, and localized production strategies to meet regional regulatory frameworks and decarbonization targets. Future success will depend on their ability to deliver cost-efficient, digitally optimized microgrids that enhance energy security, reduce operational complexity, and support large-scale renewable adoption across global markets.

On December 5, 2024, Eaton announced the installation of a solar-plus-storage microgrid at a Wisconsin school, delivering 1.3 MW of solar with generation redundancies for uninterrupted operations

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Power Source | Solar PV, Diesel generators, Natural gas, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Application | Industrial/Commercial, Healthcare, Educational institutes, Military, Utility, Remote, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Siemens AG, ABB, General Electric, and Eaton Corporation |

The global ac grid connected microgrid market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the ac grid connected microgrid market is projected to reach USD 60.9 billion by 2035.

The ac grid connected microgrid market is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in ac grid connected microgrid market are solar pv, diesel generators, natural gas, chp and others.

In terms of storage device, lithium-ion segment to command 58.0% share in the ac grid connected microgrid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

WAN Connected Returnable Transport Asset Tracking Market Trend - Growth & Forecast 2025 to 2035

Account Planning Tool Market Size and Share Forecast Outlook 2025 to 2035

Acousto Optical Cavity Dumper Market Size and Share Forecast Outlook 2025 to 2035

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

AC DC Power Adapter Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA