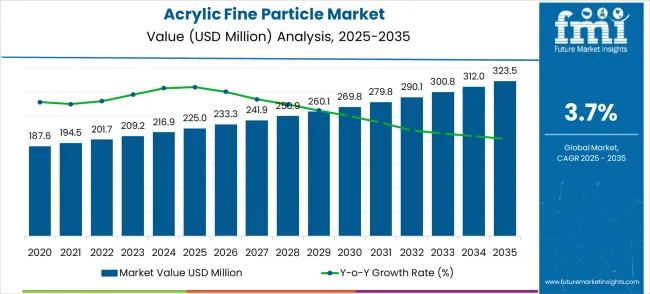

The global acrylic fine particle market is expected to grow from USD 225 million in 2025 to approximately USD 323.5 million by 2035, recording an absolute increase of USD 98.5 million over the forecast period. This translates into a total growth of 43.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.44X during the same period, supported by the rising adoption of advanced polymer materials and increasing demand for high-performance packaging and automotive applications.

| Acrylic Fine Particle Market | Value |

|---|---|

| Market Value (2025) | USD 225 million |

| Market Forecast Value (2035) | USD 323.5 million |

| Market Forecast CAGR | 3.7% |

Between 2025 and 2030, the acrylic fine particle market is projected to expand from USD 225 million to USD 260.1 million, resulting in a value increase of USD 35.1 million, which represents 35.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of advanced polymer materials in packaging applications, increasing demand for high-performance automotive components, and growing adoption of environmentally sustainable material solutions. Manufacturers are expanding their acrylic fine particle capabilities to address the growing complexity of modern packaging requirements and automotive performance specifications.

From 2030 to 2035, the market is forecast to grow from USD 260.1 million to USD 323.5 million, adding another USD 63.4 million, which constitutes 64.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of advanced particle modification technologies, development of enhanced barrier properties, and advancement of bio-based acrylic formulations. The growing adoption of sustainable packaging solutions and lightweight automotive materials will drive demand for more sophisticated acrylic fine particle solutions and specialized technical capabilities.

Market expansion is being supported by the rapid increase in food packaging demand worldwide and the corresponding need for efficient barrier materials that provide superior protection and extended shelf-life performance. Modern packaging facilities rely on consistent material performance and quality to ensure optimal product preservation including food and beverage applications, pharmaceutical packaging, and industrial containment. Even minor material performance inefficiencies can require comprehensive packaging protocol adjustments to maintain optimal product standards and consumer safety.

The growing complexity of packaging requirements and increasing demand for high-performance material solutions are driving demand for acrylic fine particle materials from certified manufacturers with appropriate food-grade capabilities and technical expertise. Packaging companies are increasingly requiring documented barrier performance and material reliability to maintain product quality and cost effectiveness. Industry specifications and safety standards are establishing standardized packaging procedures that require specialized material technologies and trained processing operators.

The automotive industry's shift toward lightweight materials and improved fuel efficiency is creating substantial opportunities for acrylic fine particle applications in automotive components and coatings. Manufacturers are leveraging acrylic particles for enhanced durability, weather resistance, and aesthetic properties in exterior and interior automotive applications.

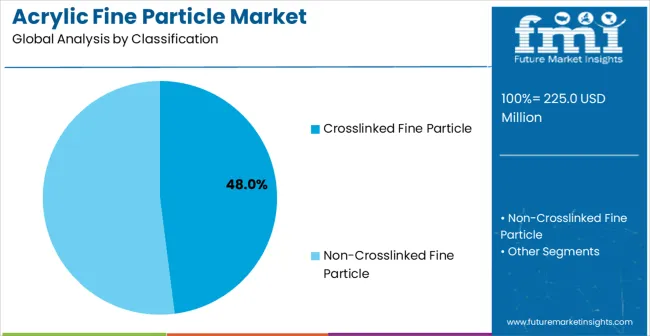

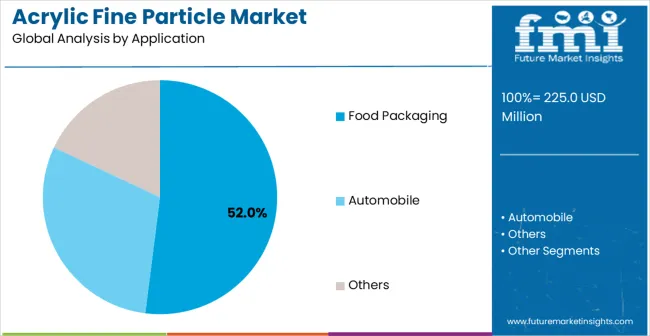

The market is segmented by particle type, application, and region. By particle type, the market is divided into crosslinked fine particles, non-crosslinked fine particles, and others. Based on application, the market is categorized into food packaging, automobile, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

In 2025, the crosslinked fine particle segment is projected to capture around 48% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of cross-linked polymer systems, which provide superior mechanical properties and chemical resistance, catering to a wide variety of industrial applications. The crosslinked fine particle is particularly favored for its ability to deliver enhanced barrier performance and structural integrity, ensuring operational reliability across demanding applications. Food packaging companies, automotive manufacturers, pharmaceutical industries, and industrial coating applications increasingly prefer this configuration, as it meets stringent performance needs without imposing excessive material costs or processing complexity requirements.

The availability of well-established crosslinking technologies, along with comprehensive formulation options and technical support from leading chemical manufacturers, further reinforces the segment's market position. Additionally, this particle type benefits from consistent demand across applications, as it is considered a high-performance solution for environments requiring both durability and chemical resistance. The combination of strength, stability, and versatility makes crosslinked fine particles a reliable choice, ensuring their continued popularity in the advanced materials market.

The food packaging segment is expected to represent 52% of acrylic fine particle demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of food preservation environments, where consistent barrier performance and food safety are critical to consumer protection. Food packaging applications often feature diverse product requirements that demand continuous material innovation throughout long shelf-life cycles, requiring advanced and effective barrier materials.

Acrylic fine particles are particularly well-suited to food packaging applications due to their ability to deliver superior moisture and oxygen barrier properties quickly and effectively, even under challenging storage conditions. As food companies expand globally and emphasize improved packaging standards, the demand for acrylic fine particles continues to rise. The segment also benefits from heightened regulatory compliance within the food industry, where operators are increasingly prioritizing food safety and shelf-life extension as differentiators to maintain consumer trust.

With food manufacturers investing in operational efficiency and product quality, acrylic fine particles provide an essential solution to maintain high-performance packaging capabilities. The growth of ready-to-eat foods, coupled with increased focus on sustainable packaging standards, ensures that food packaging will remain the largest and most stable demand driver for acrylic fine particles in the forecast period.

The market is advancing steadily due to increasing packaging industry development and growing recognition of advanced polymer advantages over conventional material alternatives. Key drivers include rising demand for barrier packaging solutions, lightweight automotive materials, and sustainable polymer technologies. However, the market faces significant challenges, including higher material costs compared to standard polymers, the need for specialized processing equipment, complex regulatory approval processes for food-contact applications, and environmental concerns regarding synthetic polymer usage. Performance optimization efforts and sustainability advancement programs continue to influence material development patterns.

The growing development of enhanced barrier property systems is enabling superior moisture and gas protection with improved processing characteristics and reduced material thickness requirements. Advanced barrier technologies, including nanoparticle integration, multi-layer structures, and surface modification treatments, provide superior product protection while maintaining processing efficiency and cost-effectiveness. These innovative approaches offer extended shelf-life capabilities, reduced package weight, and improved optical properties. Advanced formulation techniques, such as controlled particle size distribution and surface functionalization, enable precise barrier customization for specific packaging applications. These technologies are particularly valuable for packaging manufacturers requiring reliable material performance supporting extensive product protection requirements.

Modern acrylic fine particle manufacturers are incorporating bio-based raw materials and recyclable formulation improvements that enhance environmental compatibility and regulatory compliance. Integration of renewable feedstocks, biodegradable additives, and optimized processing protocols enables superior sustainability results and comprehensive environmental responsibility capabilities. Sustainable technologies, including plant-based monomers, the integration of recycled content, and closed-loop manufacturing, help eliminate traditional environmental concerns. Green chemistry principles enable real-time process optimization, waste reduction strategies, and the minimization of carbon footprint. Advanced sustainable features support operations across diverse regulatory environments, meeting various environmental requirements and corporate sustainability specifications in global markets.

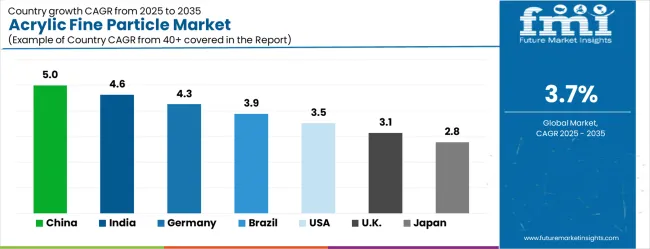

| Country | CAGR (2025-2035) |

|---|---|

| China | 5% |

| India | 4.6% |

| Germany | 4.3% |

| Brazil | 3.9% |

| United States | 3.5% |

| United Kingdom | 3.1% |

| Japan | 2.8% |

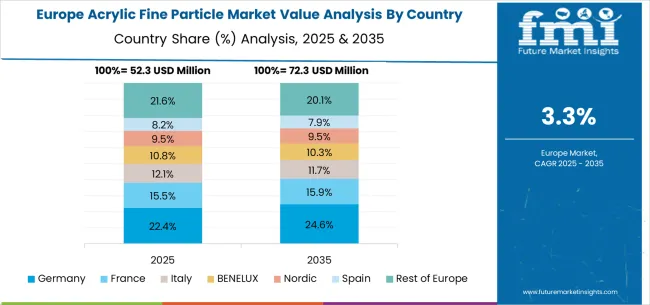

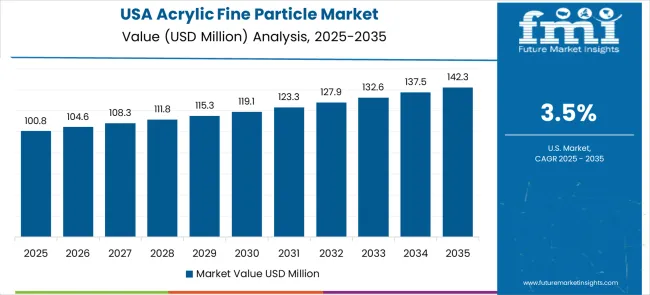

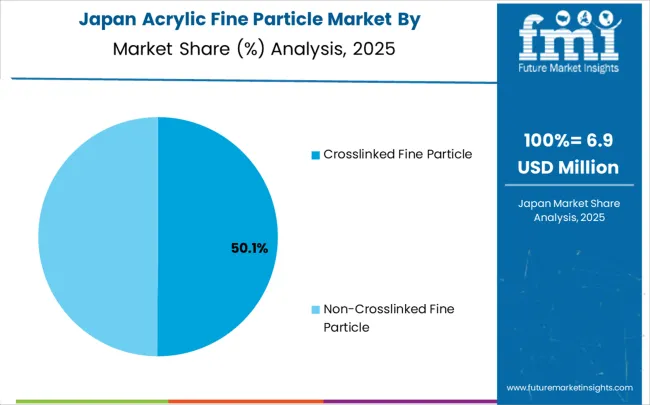

The acrylic fine particle market is growing steadily, with China leading at a 5% CAGR through 2035, driven by robust packaging industry expansion and increasing adoption of advanced polymer materials. India follows at 4.6%, supported by rising food processing infrastructure development and growing awareness of barrier packaging solutions. Germany grows consistently at 4.3%, integrating acrylic particle technology into its established chemical manufacturing and automotive sectors. Brazil records 3.9%, emphasizing packaging industry modernization and polymer technology advancement initiatives. The United States shows solid growth at 3.5%, focusing on food safety enhancement and material performance optimization. The United Kingdom demonstrates steady progress at 3.1%, maintaining established packaging applications and regulatory compliance. Japan records 2.8% growth, concentrating on technology advancement and quality optimization in specialty applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from acrylic fine particles in China is projected to exhibit the highest growth rate with a CAGR of 5% through 2035, driven by massive expansion of packaging industry infrastructure and increasing demand for advanced polymer material solutions. The country's growing food processing sector and expanding chemical manufacturing are creating substantial demand for high-performance barrier materials. Major chemical companies including Sinopec, PetroChina, and BASF China are establishing comprehensive production networks to support the increasing requirements of packaging manufacturers and food processing companies across major industrial zones including Guangdong, Jiangsu, and Zhejiang provinces.

Government industrial development initiatives under the Made in China 2025 strategy are supporting establishment of advanced chemical processing facilities and research centers, driving demand for sophisticated acrylic particle materials throughout major manufacturing regions. The National Food and Drug Administration has established clear quality standards for food-contact materials, ensuring market growth for compliant acrylic particle solutions. C

Chemical industry modernization programs are facilitating adoption of advanced polymer technologies that enhance packaging performance and manufacturing efficiency standards across industrial networks.

China's large consumer market, expanding e-commerce sector, and growing demand for packaged foods are creating unprecedented opportunities for barrier packaging applications, while the country's strong manufacturing capabilities and cost competitiveness position it as the global leader in acrylic fine particle production and consumption across diverse industrial applications.

Revenue from acrylic fine particles in India is expanding at a CAGR of 4.6%, supported by increasing food processing sector development and growing recognition of advanced packaging material benefits. The country's expanding food industry and rising packaging standards are driving demand for sophisticated barrier material solutions. Food processing companies including ITC, Hindustan Unilever, and Nestle India are gradually implementing high-performance packaging systems to maintain product quality and operational efficiency across major food processing hubs including Maharashtra, Tamil Nadu, and Gujarat.

The Food Safety and Standards Authority of India (FSSAI) regulations and Make in India initiatives are creating favorable conditions for packaging material technology adoption, while increasing foreign direct investment in food processing is supporting advanced material integration. Food industry growth and packaging infrastructure development are creating opportunities for material suppliers that can support diverse packaging requirements and regulatory specifications. Professional training and research programs through institutions like Central Food Technological Research Institute (CFTRI) and Indian Packaging Institute are building technical expertise among packaging professionals, enabling effective utilization of acrylic particle technology that meets food safety standards and performance requirements. India's large population, growing middle class, and increasing demand for processed foods are driving substantial growth in packaging applications, while the country's expanding retail sector and cold chain infrastructure development support market expansion for advanced barrier materials across urban and rural distribution networks.

Demand for acrylic fine particles in Germany is projected to grow at a CAGR of 4.3%, supported by the country's emphasis on chemical industry quality standards and advanced polymer technology adoption. German chemical companies including BASF, Bayer, and Evonik are implementing sophisticated acrylic particle systems that meet stringent performance requirements and regulatory specifications. The market is characterized by focus on material reliability, processing efficiency, and compliance with comprehensive chemical safety standards established by the Federal Institute for Occupational Safety and Health (BAuA).

Industry 4.0 initiatives and the High-Tech Strategy 2025 are promoting advanced chemical manufacturing technologies and precision material development capabilities that support acrylic particle innovation. Chemical industry investments are prioritizing advanced polymer solutions that demonstrate superior performance and sustainability while meeting German environmental and safety standards. Professional certification programs through institutions like the German Chemical Society (GDCh) are ensuring comprehensive technical expertise among chemical engineers and material scientists, enabling specialized material capabilities that support diverse industrial applications and performance requirements. Germany's strong automotive industry, established packaging sector, and emphasis on sustainable manufacturing are creating cross-industry synergies for acrylic particle applications, while the country's aging population and focus on food safety are driving demand for advanced packaging solutions and high-performance barrier materials across consumer and industrial markets.

Revenue from acrylic fine particles in Brazil is growing at a CAGR of 3.9%, driven by increasing industrial development and growing recognition of advanced polymer material advantages. The country's expanding chemical sector is gradually integrating high-performance acrylic particle technology to enhance product capabilities and operational efficiency. Chemical companies including Braskem, Petrobras, and Dow Brasil are investing in acrylic particle technology to address evolving market expectations and performance standards across major industrial regions including São Paulo, Rio de Janeiro, and Rio Grande do Sul.

The National Agency of Petroleum, Natural Gas and Biofuels (ANP) modernization programs and private sector expansion are facilitating adoption of advanced chemical technologies that support comprehensive material capabilities across regional markets. Brazil's growing petrochemical sector and increasing collaboration with international technology providers are creating opportunities for acrylic particle technology development and application. Professional development programs through universities and technical institutes are enhancing technical capabilities among chemical engineers, enabling effective acrylic particle utilization that meets evolving industrial standards and performance requirements. The country's large agricultural sector, growing food processing industry, and increasing packaging demand are driving substantial opportunities for barrier material applications, while government initiatives promoting technological innovation and industrial infrastructure development support market expansion and technology adoption across public and private industrial networks throughout the Brazilian market landscape.

Demand for acrylic fine particles in the USA is expanding at a CAGR of 3.5%, driven by established chemical industries and growing emphasis on food safety advancement. Large chemical companies and research institutions including DuPont, 3M, and Dow Chemical are implementing comprehensive acrylic particle capabilities to serve diverse packaging and industrial requirements. The market benefits from established regulatory frameworks through the FDA and EPA, along with professional training programs that support various industrial applications across chemical manufacturing facilities and research organizations.

The National Science Foundation funding and Department of Energy research initiatives are supporting advanced polymer technology development, while private sector investment in sustainable materials is accelerating innovation. Chemical industry leadership is enabling standardized acrylic particle utilization across multiple application areas, providing consistent material quality and comprehensive performance coverage throughout regional markets. Professional certification programs and continuing education requirements are building specialized technical expertise among chemical professionals, enabling advanced material capabilities that support evolving industrial requirements. The USA large consumer market, strict food safety regulations, and emphasis on sustainable packaging are creating substantial market opportunities for high-performance barrier materials, while the country's strong intellectual property protection and regulatory expertise position it as a global leader in acrylic particle technology development and application across diverse industrial sectors and consumer markets.

Demand for acrylic fine particles in the UK is projected to grow at a CAGR of 3.1%, supported by established chemical sectors and growing emphasis on material quality capabilities. British chemical companies including Ineos, Johnson Matthey, and Croda are implementing acrylic particle systems that meet Food Standards Agency quality standards and regulatory requirements. The market benefits from established chemical infrastructure and comprehensive training programs for chemical professionals across England, Scotland, Wales, and Northern Ireland.

The Medicines and Healthcare products Regulatory Agency (MHRA) and Health and Safety Executive (HSE) have established clear pathways for chemical material approval, while Innovate UK funding supports technology development and commercialization. Chemical sector investments are prioritizing advanced polymer materials that support diverse industrial applications while maintaining established safety and environmental standards. Professional development programs through chemical engineering institutions and universities are building technical expertise among chemical professionals, enabling specialized acrylic particle operation capabilities that meet evolving industrial requirements. The UK's strong food industry, established pharmaceutical sector, and advanced packaging infrastructure are creating favorable conditions for acrylic particle technology development and adoption, while the country's focus on sustainable manufacturing and circular economy principles is driving demand for environmentally responsible polymer solutions across public and private industrial networks.

Revenue from acrylic fine particles in Japan is growing at a CAGR of 2.8%, driven by the country's focus on chemical technology innovation and manufacturing excellence. Japanese chemical companies including Mitsubishi Chemical, Sumitomo Chemical, and Asahi Kasei are implementing advanced acrylic particle systems that demonstrate superior performance reliability and processing efficiency. The market is characterized by emphasis on technological excellence, quality assurance, and integration with established manufacturing workflows across major industrial centers in Tokyo, Osaka, and Nagoya.

The Ministry of Economy, Trade and Industry's regulatory framework and the Society 5.0 initiative are promoting advanced chemical technologies and digital transformation in manufacturing processes. Chemical industry investments are prioritizing innovative acrylic particle solutions that combine advanced polymer science with precision manufacturing while maintaining Japanese quality and reliability standards. Professional development programs through chemical engineering universities and research institutions are ensuring comprehensive technical expertise among chemical professionals, enabling specialized material capabilities that support diverse industrial applications and performance requirements. Japan's advanced manufacturing sector, aging population, and strong automotive industry are creating substantial opportunities for acrylic particle applications in specialty packaging and automotive components, while the country's emphasis on technological innovation and quality excellence positions it as a leader in next-generation polymer material development and application across specialized industrial markets.

The Acrylic Fine Particle market is defined by competition among specialized chemical manufacturers, polymer technology companies, and material solution providers. Companies are investing in advanced polymerization technologies, particle size optimization, surface modification capabilities, and comprehensive technical service to deliver reliable, efficient, and cost-effective acrylic particle solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

NIPPON SHOKUBAI offers comprehensive acrylic particle solutions with established chemical manufacturing expertise and industrial-grade material capabilities. Soken Chemical provides specialized polymer materials with focus on performance reliability and processing efficiency. Negami delivers advanced acrylic formulations with emphasis on application versatility and technical support. Sinograce Chemical specializes in polymer particle production with advanced manufacturing technology integration.

Chemtan offers industrial-grade acrylic particles with comprehensive quality assurance capabilities. Satellite Chemical delivers established polymer solutions with advanced particle technology systems. Xiamen WangQin Chemical Technology provides specialized acrylic materials with focus on performance optimization and customer technical support across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 225 million |

| Particle Type | Crosslinked Fine Particle, Non-Crosslinked Fine Particle, Others |

| Application | Food Packaging, Automobile, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | NIPPON SHOKUBAI, Soken Chemical, Negami, Sinograce Chemical, Chemtan, Satellite Chemical, Xiamen WangQin Chemical Technology |

| Additional Attributes | Dollar sales by particle type and application segment, regional demand trends across major markets, competitive landscape with established chemical manufacturers and emerging polymer technology providers, customer preferences for different particle sizes and surface properties, integration with packaging manufacturing systems and processing protocols, innovations in crosslinking technology and barrier performance enhancement, and adoption of sustainable formulations with enhanced environmental compatibility for improved operational workflows. |

The global acrylic fine particle market is estimated to be valued at USD 225.0 million in 2025.

The market size for the acrylic fine particle market is projected to reach USD 323.5 million by 2035.

The acrylic fine particle market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in acrylic fine particle market are crosslinked fine particle and non-crosslinked fine particle.

In terms of application, food packaging segment to command 52.0% share in the acrylic fine particle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Acrylic Colors Market

Acrylic Container Market

Acrylic Lenses Market

Acrylic Foam Tapes Market

Cast Acrylic Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA