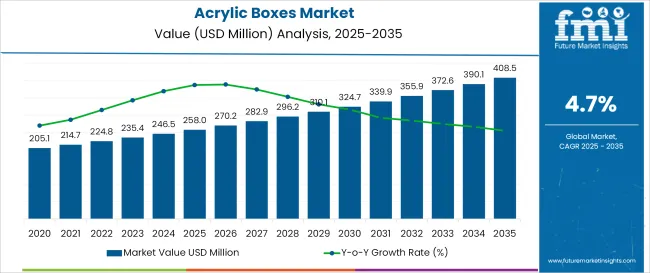

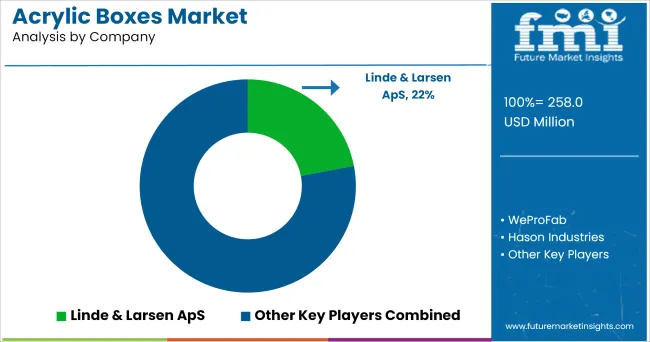

The global acrylic boxes market is valued at USD 258 million in 2025 and is expected to reach USD 408.5 million by 2035, registering a CAGR of 4.7%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 258 million |

| Projected Value (2035F) | USD 408.5 million |

| CAGR (2025 to 2035) | 4.7% |

Growth is fueled by increasing demand for durable, transparent, and aesthetically appealing storage and display solutions across cosmetics, retail, and gifting sectors. The market is also driven by the rise in customized packaging solutions and the expanding cosmetics and personal care industry.

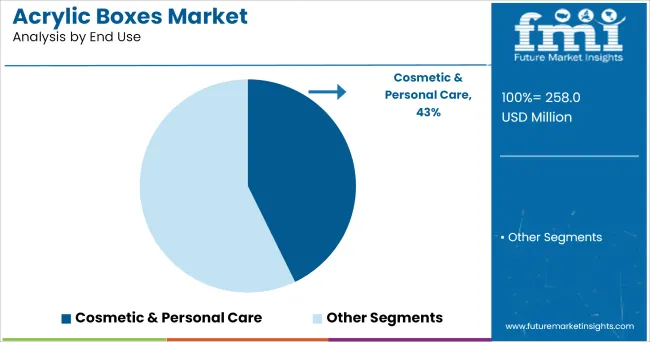

The market accounts for approximately 3.8% of the global rigid plastic packaging industry, driven by increasing demand for clear, durable, and aesthetically pleasing packaging and storage solutions. In the cosmetics & personal care sector, acrylic boxes contribute around 6.5%, reflecting their widespread use in organizing and displaying beauty products such as skincare, makeup, and grooming kits.

Government regulations impacting the market focus on regulatory and sustainability trends. Government efforts to reduce single-use plastics and promote recyclable or reusable packaging are encouraging manufacturers to innovate with eco-friendly acrylic alternatives, such as recycled PMMA and biodegradable acrylic composites. Design advancements, including modular stacking features, laser engraving, and custom color finishes, are boosting product appeal across end-user industries.

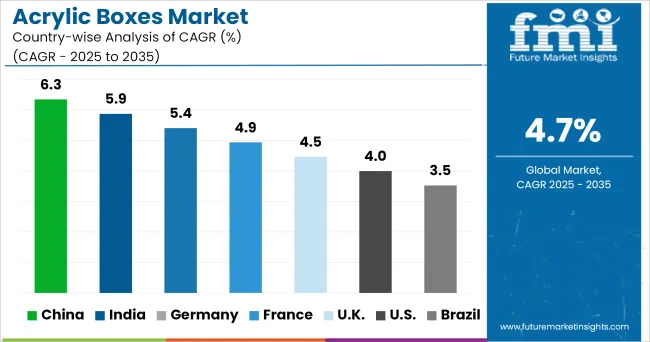

China is projected to be the fastest-growing market, expanding at a CAGR of 6.3% from 2025 to 2035. India and Germany will also witness significant growth with projected CAGRs of 5.9% and 5.4%, respectively.

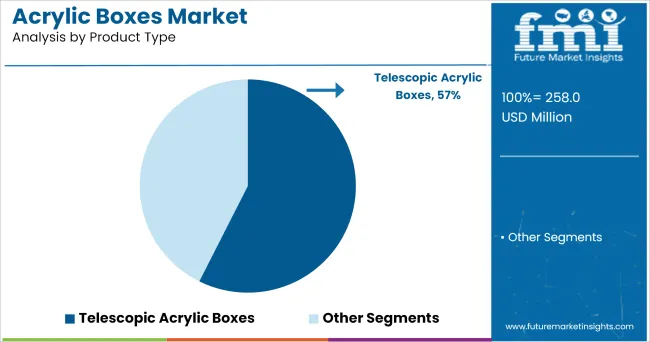

The acrylic boxes market is segmented by product type, end-use industry, distribution channel, and region. By product type, the market is segmented into telescopic boxes, hinged lid boxes.

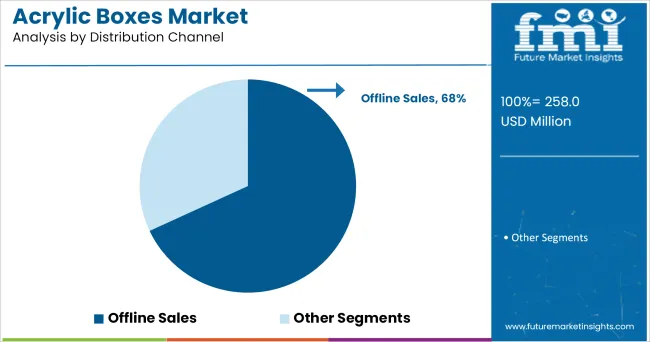

Based on end-use:, the market is categorized into cosmetics & personal care, homecare products, food and beverage, pharmaceuticals, electrical & electronics, and others. By distribution channel, the market is bifurcated into offline sales and online sales. Regionally, the market is classified into North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Cosmetics & personal care will dominate the end-use segment, accounting for 43% of the global acrylic boxes market share. The sector’s growing demand for premium, transparent packaging solutions to enhance shelf appeal and brand presentation is driving adoption. Acrylic boxes are widely used to store and display skincare kits, makeup products, and grooming essentials in both retail and consumer environments.

Telescopic acrylic boxes are projected to lead the product segment with a 57% share in 2025. Their easy-to-use slide mechanism, modern look, and strong protective enclosure make them highly favored for gifting, jewelry, and cosmetics packaging.

Offline sales channels are expected to dominate the distribution channel segment, accounting for 68% of global acrylic box sales in 2025. Physical retail outlets, including department stores, cosmetics showrooms, and home décor shops, continue to be the primary buying hubs for both B2B and B2C consumers.

The global acrylic boxes market is witnessing steady growth, fueled by increasing demand for premium, transparent, and durable packaging and storage solutions. As consumers and businesses prioritize aesthetics, reusability, and brand presentation, acrylic boxes are becoming widely adopted in cosmetics, gifting, jewelry, retail merchandising, and home organization.

Their visual appeal, rigidity, and customizability make them an ideal choice for high-end product packaging and personal use. In addition, the market is seeing a push toward eco-conscious packaging designs, encouraging the adoption of recyclable and reusable acrylic alternatives.

Recent Trends in the Market

Key Challenges in the Market

The USA dominates the acrylic boxes market, driven by high demand in retail displays, cosmetics, and organizational products across commercial and residential sectors. Customization trends and the growth of e-commerce packaging further support market expansion. Germany and the UK are key contributors in Europe, benefiting from robust manufacturing bases and retail innovation.

China and India are emerging as global manufacturing hubs due to their cost-effective production capabilities, growing exports, and domestic demand in organized retail and consumer goods. The Asia Pacific region, in general, is witnessing increased use of acrylic boxes in modern retail environments, hospitality sectors, and exhibitions due to rising disposable incomes and urbanization.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

The China acrylic boxes market is projected to grow at a CAGR of 6.3% from 2025 to 2035. Growth is fueled by rapid urbanization, a surge in cosmetics and retail industries, and rising consumer demand for organized, aesthetically appealing storage solutions. China's manufacturing capabilities and expanding middle class continue to drive the need for affordable, customizable acrylic packaging and display solutions.

The India acrylic boxes market is growing at a CAGR of 5.9% between 2025 and 2035. Growth is supported by expanding urban populations, increasing disposable incomes, and booming demand in the wedding, gifting, and cosmetics industries. Tier-2 and tier-3 cities are also witnessing significant traction due to the rising popularity of modular and transparent storage solutions.

Germany’s acrylic boxes market is projected to grow at a CAGR of 5.4% from 2025 to 2035. Growth is driven by a rising preference for luxury and sustainable packaging solutions, especially in the cosmetics, jewelry, and premium gifting sectors. German consumers prioritize design, durability, and recyclability-traits that align with acrylic box offerings.

The France acrylic boxes market is forecast to grow at a CAGR of 4.9% between 2025 and 2035. The market benefits from the country’s thriving fashion, luxury retail, and gourmet gifting industries, where high-quality acrylic packaging adds perceived value. France also shows growing interest in home décor and transparent organizers.

The UK market is anticipated to grow at a CAGR of 4.5% through 2035. Acrylic boxes are seeing increased adoption for minimalist home storage, vanity organization, and luxury gifting. Consumers favor modular, reusable, and stylish alternatives to traditional packaging.

The acrylic boxes market is moderately fragmented with both global manufacturers and specialized regional players. Leading companies focus on design innovation, durability, and customization to address diverse end-use needs. Prominent manufacturers include IKEA, Acrylic Design Associates, Plexi-Craft, Displays2Go, ULINE, ShopPOPDisplays, Alpha Display, and Adams Plastics. These companies emphasize precision molding, eco-friendly material use, and efficient distribution strategies.

Top acrylic box producers are expanding their portfolios to include UV-resistant, food-safe, and scratch-resistant variants, catering to growing demand from luxury retail, foodservice, and industrial packaging sectors. Collaboration with design agencies and direct-to-consumer brands is gaining traction as firms push for enhanced product visibility and branding.

Recent Acrylic Boxes Market News

In March 2025, ULINE announced a major expansion of its custom acrylic box division, investing USD 45 million in new automated fabrication facilities in the USA Midwest. This move is aimed at increasing production capacity for high-volume retail and warehouse clients while reducing lead times. The expansion reflects rising demand for premium display packaging and organizational solutions amid a post-pandemic shift toward minimalist and reusable storage solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 258 million |

| Projected Market Size (2035) | USD 408.5 million |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in kilo tons |

| By Product Type | Telescopic Acrylic Boxes (57%), Hinged Lid Boxes, Magnetic Closure Boxes, Stackable Boxes, and Others |

| By End-Use | Cosmetics & Personal Care (43%), Retail, Food & Beverage, Home & Office, Industrial, and Others |

| By Distribution Channel | Offline Sales and Online Sales |

| Regions Covered | North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | IKEA, Displays2Go, ShopPOPDisplays, ULINE, Plexi-Craft, Acrylic Design Associates, Adams Plastics, Alpha Display |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global acrylic boxes market is estimated to be valued at USD 258.0 million in 2025.

The market size for the acrylic boxes market is projected to reach USD 399.3 million by 2035.

The acrylic boxes market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in acrylic boxes market are telescopic and hinged.

In terms of end use, cosmetic & personal care segment to command 43.0% share in the acrylic boxes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Acrylic Colors Market

Acrylic Container Market

Acrylic Lenses Market

Acrylic Foam Tapes Market

Cast Acrylic Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA