The market for acrylic airless bottles is transforming as manufacturers infuse new-age packaging technologies into their products to address the demand for high-performing, environmentally friendly, and premium-quality containers for cosmetics and pharmaceuticals.

As the market trend towards air-tight and contamination-free dispensing systems gathers momentum, makers are making large investments in eco-friendly and advanced materials and smart packaging designs. Manufacturers are embracing digital manufacturing, AI-based manufacturing, and advanced molding technologies for increased product resistance and better look.

Market players are focusing on refillable structures, mono-material build, and bio-based acrylics to meet rising sustainability legislations. Industry players are gravitating towards smart dispensers that feature vacuum-based precision pumps, NFC authentication, and UV-resistance coatings for enhanced product shelf life and better user experience.

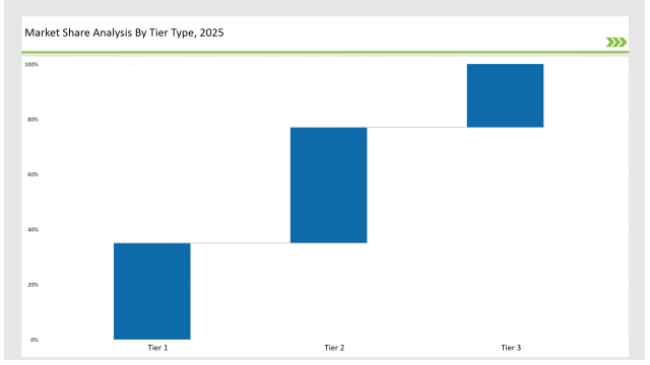

Tier 1 companies like Albéa Group, Lumson, and Aptar Group dominate 35% of the market with sophisticated airless dispensing technologies, worldwide supply chain capabilities, and high-end branding solutions.

Tier 2 companies, such as Quadpack, HCP Packaging, and FusionPKG, account for 42% of the market with innovative refillable packaging, eco-friendly acrylic alternatives, and the ability to customize.

Tier 3 players are regional and niche manufacturers providing custom, high-design, and affordable airless packaging options, which account for the other 23%. These players focus on small production runs, local material sourcing, and digital printing breakthroughs.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Albéa Group, Lumson, Aptar Group) | 17% |

| Rest of Top 5 (Quadpack, HCP Packaging) | 11% |

| Next 5 of Top 10 (FusionPKG, Silgan Dispensing, Raepak, Yonwoo, APC Packaging) | 7% |

The acrylic airless bottle industry serves various sectors that demand product integrity, contamination protection, and aesthetic excellence. Companies are developing high-performance dispensing technologies and advanced materials to meet changing consumer needs and regulatory requirements. AI-driven quality control and automated molding processes are also improving product consistency and cost efficiency.

Manufacturers are improving airless bottle technologies with innovative material science, next-generation dispensing solutions, and eco-conscious packaging designs. Companies are integrating smart packaging elements, such as UV-resistant coatings and NFC authentication, to increase product longevity and security.

Innovation and sustainability define the acrylic airless bottle market. Companies are developing high-barrier coatings, biopolymer-based acrylics, and anti-microbial dispensers to enhance product performance. AI-driven production lines are optimizing molding efficiency, while automated defect detection improves packaging consistency. Firms are also expanding refillable packaging solutions to meet consumer demand for eco-conscious beauty and skincare products.

Year-on-Year Leaders

Technology suppliers should emphasize automation, eco-friendly material innovation, and AI-based customization to stay competitive. Partnering with luxury brands, pharmaceutical firms, and organic beauty brands will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Albéa Group, Lumson, Aptar Group |

| Tier 2 | Quadpack, HCP Packaging, FusionPKG |

| Tier 3 | Silgan Dispensing, Raepak, Yonwoo, APC Packaging |

Leading manufacturers are developing refillable packaging, AI-driven production automation, and high-performance dispensing solutions. Companies are embedding NFC tags for brand authentication and tamper-proof features. They are implementing UV-resistant coatings to enhance product longevity. AI-based quality control is reducing material waste and improving packaging efficiency.

| Manufacturer | Latest Developments |

|---|---|

| Albéa Group | Introduced mono-material airless bottles in March 2024. |

| Lumson | Launched refillable airless containers in April 2024. |

| Aptar Group | Expanded precision dispensing solutions in May 2024. |

| Quadpack | Released NFC-integrated packaging in June 2024. |

| HCP Packaging | Strengthened bio-acrylic offerings in July 2024. |

| FusionPKG | Innovated lightweight airless packaging in August 2024. |

| Silgan Dispensing | Pioneered antimicrobial coatings in September 2024. |

The acrylic airless bottle market is evolving as brands invest in sustainability, innovation, and high-precision dispensing technologies. Companies are embracing bio-based acrylics, recyclable packaging, and AI-driven manufacturing solutions to enhance product durability and consumer appeal. Smart packaging with NFC-enabled tracking and UV-resistant coatings is becoming a key differentiator.

Manufacturers will focus on AI-driven personalization, blockchain-backed authentication, and ultra-durable materials. Companies will develop advanced molding techniques to reduce waste and improve efficiency. Smart dispensers with interactive digital elements will enhance customer engagement. Businesses will expand refillable packaging solutions to align with sustainability regulations.

Leading players include Albéa Group, Lumson, Aptar Group, Quadpack, HCP Packaging, FusionPKG, Silgan Dispensing, Raepak, Yonwoo, APC Packaging.

The top 3 players collectively hold 17% of the global market.

The market shows medium concentration, with top players holding 35%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Colors Market

Acrylic Container Market

Acrylic Lenses Market

Acrylic Foam Tapes Market

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Cast Acrylic Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA