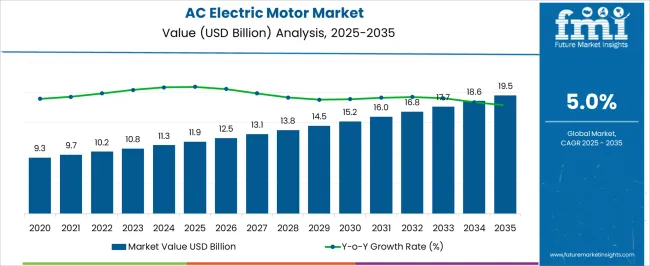

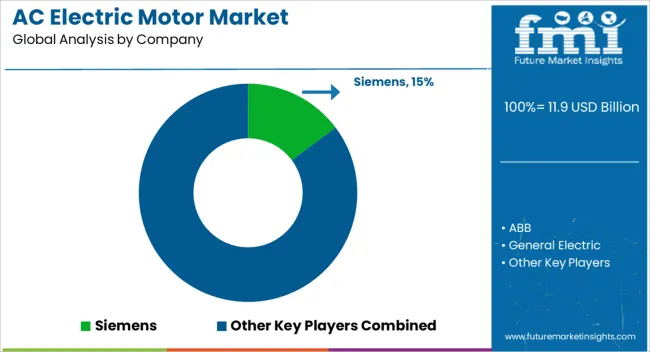

The AC Electric Motor Market is estimated to be valued at USD 11.9 billion in 2025 and is projected to reach USD 19.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| AC Electric Motor Market Estimated Value in (2025 E) | USD 11.9 billion |

| AC Electric Motor Market Forecast Value in (2035 F) | USD 19.5 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The AC electric motor market is growing steadily, supported by the widespread use of AC motors across industrial, commercial, and residential sectors. Their operational efficiency, reliability, and ability to handle variable loads have reinforced adoption in critical applications such as manufacturing, HVAC systems, and power generation.

Increasing investments in automation and industrial modernization are further boosting demand. The market benefits from the integration of energy-efficient designs and compliance with international efficiency standards, which encourage replacement of outdated models.

The rise of electric vehicles and renewable energy projects is also expanding the scope of AC motor deployment, as these applications require precise speed control and durability. With governments emphasizing sustainability and manufacturers focusing on advanced motor designs, the outlook for the AC electric motor market remains strong, underpinned by long-term infrastructure expansion and industrial growth worldwide.

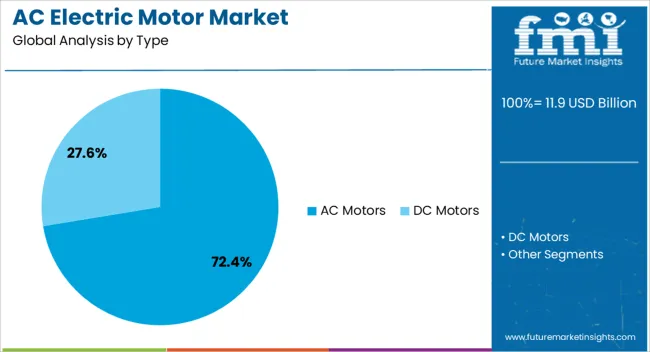

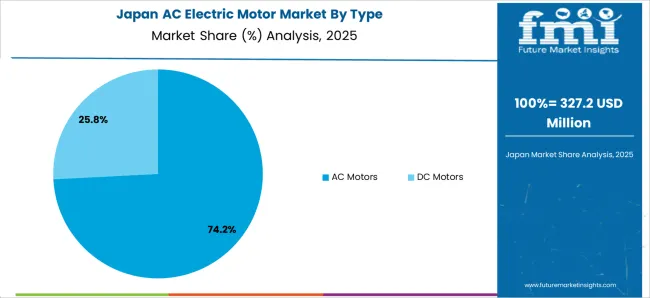

The AC motors segment dominates the type category, accounting for approximately 72.40% of the market share. Its leadership is attributed to the broad applicability of AC motors in powering machinery, pumps, compressors, and HVAC equipment.

The design advantages, including low maintenance requirements and high durability, have contributed to its widespread adoption across sectors. Energy efficiency improvements and compatibility with variable frequency drives have enhanced operational performance, aligning with industry goals for reduced energy consumption.

The segment also benefits from established manufacturing ecosystems, ensuring steady supply and cost efficiency. With continued advancements in motor technology and strong penetration across industrial and commercial applications, the AC motors segment is projected to maintain its leadership over the forecast period.

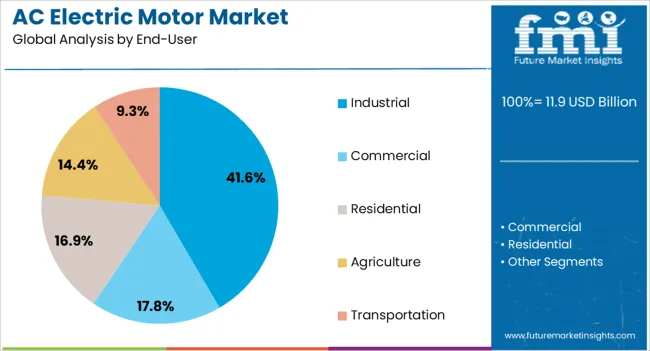

The industrial segment holds approximately 41.60% share of the end-user category in the AC electric motor market. This prominence is driven by high demand from manufacturing, processing, and heavy-duty industrial operations where reliable and efficient motor performance is essential.

AC motors are used extensively in conveyor systems, pumps, compressors, and material handling equipment, enabling continuous operation under varying loads. The segment’s growth is reinforced by global industrial expansion, rising automation levels, and stricter energy efficiency mandates.

With industries prioritizing operational efficiency and reduced downtime, demand for high-performance AC motors remains robust. This segment is expected to sustain its leadership as industrial modernization and expansion projects accelerate worldwide.

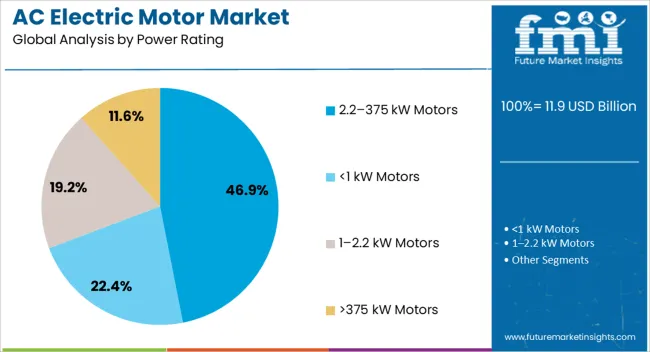

The 2.2-375 kW motors segment dominates the power rating category, representing approximately 46.90% share. Its dominance is linked to its wide operational suitability across mid- to large-scale industrial applications.

Motors in this range provide the optimal balance between power capacity and energy efficiency, making them integral to heavy machinery, industrial drives, and large HVAC systems. The segment benefits from strong adoption in both established industries and emerging markets undergoing rapid industrialization.

Manufacturers are focusing on integrating smart monitoring systems and enhancing thermal performance to meet evolving operational demands. With growing emphasis on productivity, efficiency, and sustainability, the 2.2-375 kW motors segment is expected to retain its leading position in the coming years.

Demand for AC electric motors in the oil and gas industry heavily relies on a multitude of factors, such as the overall demand for oil and gas products in the international marketplace, capital investments in exploration and production projects, innovations and advancements in motor technology, etc. These factors decide the fate of the overall performance of AC electric motors in the oil and gas industry.

In the past few years, the market for AC electric motors has seen a series of ups and downs. During the pandemic, the oil and gas industry faced significant challenges due to a decline in global energy demand, travel restrictions, and economic uncertainties.

This negatively affected the global market revenue for AC electric motors as the pandemic led to a decrease in oil prices, causing companies to reassess their capital expenditures and delay or scale back projects.

However, as the world got accustomed to the new normal, things gradually began to pace up. As economies recovered, the oil and gas industry rebounded, positively impacting the AC electric motor market. Stakeholders across the world started investing heavily in their equipment, thus amplifying the growth of AC electric motors in the global oil and gas industry.

| Attributes | Key Statistics |

|---|---|

| Base Year Value (2020) | USD 8.2 million |

| Forecast Value (2025) | USD 10.6 billion |

| Estimated Growth (2020 to 2025) | 6.80% CAGR |

The AC electric motor market is anticipated to surpass a global valuation of USD 19.5 billion by the year 2035, with a growth rate of 5.10% CAGR. While the market is expected to experience substantial growth, several restraining factors could adversely affect its development:

Based on the type, induction motors dominate the global market with a CAGR of 4.0%. This rising preference is attributed to:

| Attributes | Details |

|---|---|

| Type | Induction Motors |

| CAGR | 4.0% |

On the basis of voltage, electric motors less than 1kV dominate the global market with a CAGR of 3.8%. This is primarily due to:

| Attributes | Details |

|---|---|

| Voltage | Less than 1kV |

| CAGR | 0% |

The section provides an analysis of the AC electric motors market by country, including South Korea, China, the United States, the United Kingdom, and Japan. The table presents the CAGR for each country, indicating the expected growth of the market in that country through 2035.

| Countries | CAGR |

|---|---|

| South Korea | 7.40% |

| The United Kingdom | 6.50% |

| China | 6.00% |

| The United States | 5.50% |

| Japan | 3.70% |

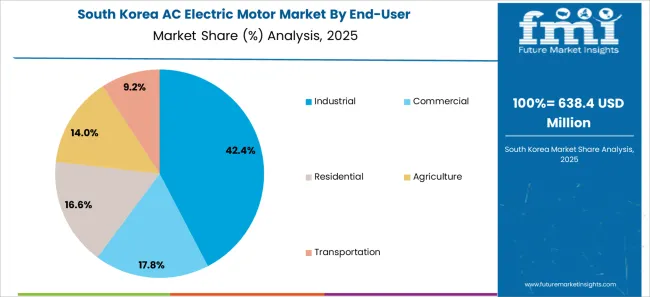

South Korea is one of the leading countries in this market. The Korean AC electric motor market is anticipated to retain its dominance by progressing at an annual growth rate of 7.40% till 2035.

South Korea is one of the most advanced countries when it comes to technological advancements in the manufacturing and engineering sectors. The government in this country has been actively promoting these advancements by providing funds and subsidies to the stakeholders in the market. This has pushed the demand for AC electric motors in various industries, especially the oil and gas industry.

The United Kingdom leads the AC electric motor market in the European region. The market in the UK is anticipated to retain its dominance by progressing at an annual growth rate of 6.50% till 2035.

The United Kingdom is blessed with significant oil and gas reserves in the North Sea. This generates exponential demand for exploration, production, and related services in the country. Besides this, the United Kingdom is also pushing toward sustainability in all its industries, including the oil and gas industry. This has driven the demand for AC electric motors in the United Kingdom.

In the Asian region, China is another country that dominates the AC electric motor market. The Chinese AC electric motor market is anticipated to exhibit an annual growth rate of 6.00% till 2035.

In the last few years, the Chinese economy has grown massively. This has led to an increasing demand for oil and gas in the country. This growth is also another reason for the government’s investment in the oil and gas sector to secure a stable energy supply. AC electric motors, being one of the crucial components in these operations, are, thus, in great demand in China. Also,

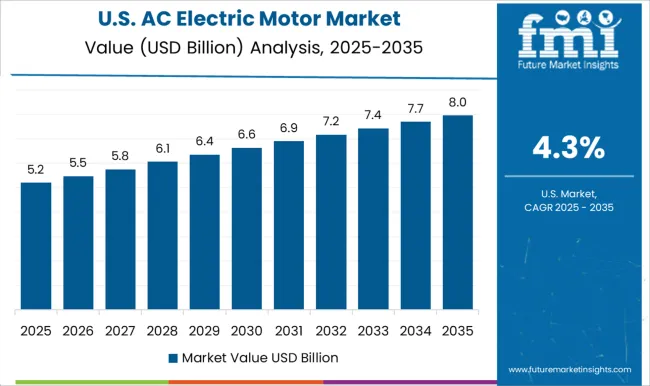

In the North American region, the United States leads the AC electric motor market. The United States AC electric motor market is anticipated to register a CAGR of 5.50% through 2035.

The shale gas revolution in the United States has transformed the country into a major player in the global oil and gas market, with increased production and exports contributing to market growth. This is one of the main reasons why the United States is one of the leading countries in this market.

Japan is another Asian country leading in the AC electric motor market. Over the next ten years, Japanese demand for AC electric motors is projected to rise at a 3.70% CAGR.

Japan is a major importer of Liquefied Natural Gas, and the country's continued focus on expanding its LNG infrastructure and investments in related projects contributes to the growth of AC electric motors as they play a crucial role in supporting various aspects of LNG infrastructure.

The global AC electric motors market is highly concentrated, with prominent players such as Siemens, General Electric, WEG, Emerson Electric, Nidec, Regal Beloit, Marathon Electric, Kirloskar Electric Company Limited, etc. Key companies in the market are investing heavily in research and development to introduce innovative technologies and improvements in electric motors.

They are also expanding the range of electric motors and related products, allowing companies to cater to a broader spectrum of applications within the oil and gas sector.

Recent Developments:

The global AC electric motor market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the AC electric motor market is projected to reach USD 19.5 billion by 2035.

The AC electric motor market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in AC electric motor market are AC motors and dc motors.

In terms of end-user, industrial segment to command 41.6% share in the AC electric motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Commercial Vehicle Traction Motor Market Size and Share Forecast Outlook 2025 to 2035

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

AC DC Power Adapter Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

AC Power Source Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA