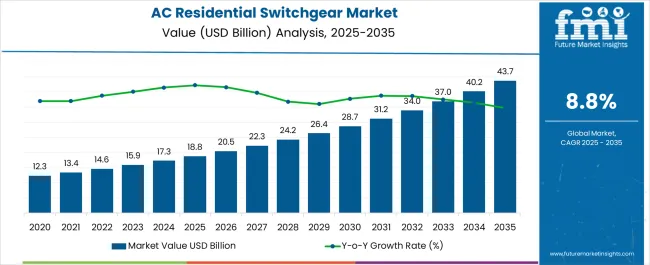

The AC Residential Switchgear Market is estimated to be valued at USD 18.8 billion in 2025 and is projected to reach USD 43.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period. Between 2025 and 2030, the market expands from USD 18.8 billion to USD 24.2 billion, contributing USD 5.4 billion in growth. This phase shows a CAGR of 6.7%, driven by increasing demand for efficient electrical systems in residential buildings, spurred by rising construction activity and the growing need for energy management solutions.

As home automation, renewable energy integration, and advanced safety features become more common, the adoption of residential switchgear is expected to rise. From 2030 to 2035, the market continues its growth trajectory, moving from USD 24.2 billion to USD 43.7 billion, contributing USD 19.5 billion in growth with a CAGR of 12.3%. This acceleration is fueled by advancements in smart grid technologies, the increasing prevalence of electric vehicles, and a stronger push towards sustainability in residential buildings. The USD 24.9 billion absolute dollar opportunity highlights significant market potential driven by both the expansion of residential electrical systems and the increasing complexity of home energy management.

| Metric | Value |

|---|---|

| AC Residential Switchgear Market Estimated Value in (2025 E) | USD 18.8 billion |

| AC Residential Switchgear Market Forecast Value in (2035 F) | USD 43.7 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The AC Residential Switchgear market is witnessing sustained growth driven by rapid urbanization, infrastructure upgrades, and increased residential electrification. As smart home technologies and energy-efficient systems become more prevalent, there has been a notable shift toward modular, intelligent switchgear solutions that offer enhanced safety, automation, and compatibility with renewable energy inputs.

The market is benefiting from strong demand across both developed and developing economies, particularly in high-density urban environments where stable and safe electrical distribution is a critical priority. Growth has also been influenced by favorable regulatory frameworks supporting energy efficiency, as well as increasing consumer awareness around electrical safety.

The replacement of outdated infrastructure and adoption of smart grid-ready systems are further contributing to market momentum. With rising demand for decentralized power management and a focus on digital home energy systems, the AC Residential Switchgear market is expected to experience consistent expansion through the forecast period..

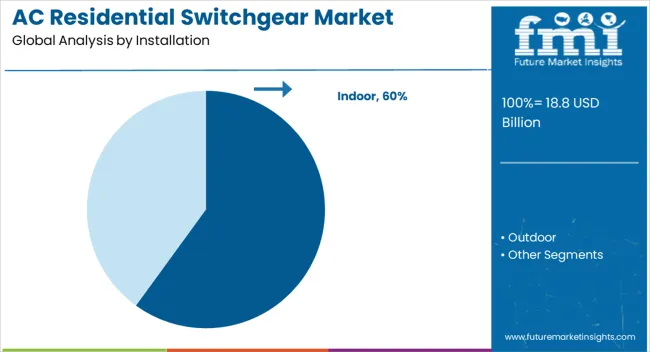

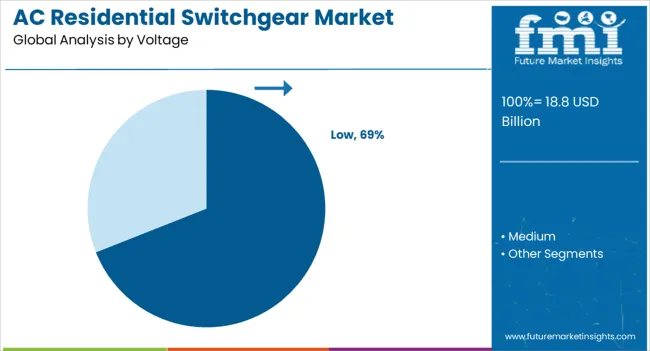

The AC residential switchgear market is segmented by installation, voltage, and geographic regions. By installation, the residential AC switchgear market is divided into Indoor and Outdoor. In terms of voltage, the AC residential switchgear market is classified into Low, Medium. Regionally, the AC residential switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The indoor installation segment is projected to account for 60% of the AC Residential Switchgear market revenue share in 2025, positioning it as the dominant installation type. Growth in this segment has been attributed to increased preference for compact, tamper-proof, and easy-to-maintain switchgear systems that can be installed within residential buildings. Indoor units are often selected due to their protection from weather conditions and enhanced operational life, which reduces the need for frequent maintenance.

Their aesthetic integration into indoor environments and compatibility with modern housing layouts have further driven adoption. Additionally, developers and contractors have favored indoor installations for high-rise buildings and apartment complexes where space optimization and safety are critical.

Rising awareness regarding fire hazards and electrical failures has reinforced the demand for secure, in-wall switchgear options. As residential construction continues to prioritize safety and convenience, indoor switchgear systems are expected to maintain their lead across urban and semi-urban deployments..

The low voltage segment is expected to hold 69% of the AC Residential Switchgear market revenue share in 2025, making it the leading voltage category. This dominance has been driven by the widespread use of low voltage electrical distribution systems in residential buildings for lighting, appliance operation, and general power distribution.

The ease of installation, safety profile, and cost efficiency of low voltage switchgear have contributed to its strong market positioning. Growing demand for smart home energy management systems, which primarily operate within the low voltage range, has further supported this segment's expansion.

Additionally, compliance with residential building codes and international safety standards has made low voltage switchgear the default choice for new residential constructions and retrofit projects alike. With the proliferation of electrical appliances and increased household energy consumption, low voltage systems have remained essential for safe, efficient, and flexible power distribution within homes, thereby securing their continued market leadership..

The AC residential switchgear market is experiencing growth due to the increasing demand for electrical safety and efficient energy distribution in residential buildings. Switchgear plays a crucial role in protecting electrical systems from overloads, short circuits, and other electrical faults, ensuring safety and preventing damage to appliances and wiring. As the construction of smart homes, energy-efficient buildings, and the integration of renewable energy systems increases, the demand for high-performance residential switchgear is rising. While challenges such as installation costs and regulatory compliance exist, opportunities are emerging through innovations in smart switchgear and expanding residential developments.

The growing need for residential electrical safety and energy efficiency is a major driver of the AC residential switchgear market. As the number of electrical appliances and smart devices in homes increases, so does the need for robust switchgear systems that protect against overloads, short circuits, and electrical faults. Additionally, as more homes incorporate renewable energy solutions like solar panels, efficient energy distribution systems become even more critical. Switchgear is essential in managing the distribution of electricity, ensuring safety, and optimizing energy usage in modern homes. The increasing focus on electrical safety and energy efficiency in residential buildings, driven by both consumer awareness and government regulations, is further accelerating the demand for AC residential switchgear.

A key challenge in the AC residential switchgear market is the high cost of installation, especially for advanced models designed for larger or smart homes. While the technology offers significant long-term benefits in terms of energy efficiency and safety, the upfront cost can deter some homeowners from adopting these systems. The compliance with local and international electrical safety standards and regulations can add complexity to the installation process. Ensuring that switchgear systems meet the required standards involves considerable planning and resources, which can increase overall project costs. The need for skilled technicians to install and maintain these systems also adds to the operational complexity, making it more challenging for the market to reach price-sensitive consumers.

The AC residential switchgear market presents significant opportunities driven by the growth in smart homes and the increasing integration of renewable energy systems. As smart homes become more popular, the need for intelligent electrical distribution systems that allow for better energy management and safety is rising. Switchgear equipped with smart sensors and connectivity features, such as remote monitoring and control, offers enhanced performance and convenience. The increasing adoption of solar energy systems and electric vehicles (EVs) in homes is pushing for more advanced switchgear solutions to manage power distribution and ensure efficient energy use. Manufacturers can capitalize on this growing trend by offering more affordable, efficient, and feature-rich switchgear systems for residential use.

A key trend in the AC residential switchgear market is the integration of IoT (Internet of Things) technologies and smart switchgear solutions. These systems are increasingly being designed with connectivity features that enable remote monitoring, fault detection, and system diagnostics via mobile apps or home automation systems. This allows homeowners to manage their electrical systems more effectively, ensuring optimal energy usage and minimizing the risk of electrical issues. Smart switchgear solutions also provide real-time data on energy consumption, helping homeowners reduce energy waste and lower utility bills. As IoT continues to transform home automation, the demand for smarter, more efficient, and connected switchgear systems is expected to rise, shaping the future of the residential electrical safety market.

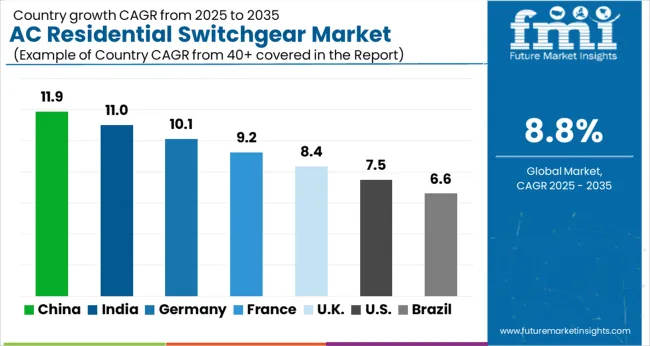

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

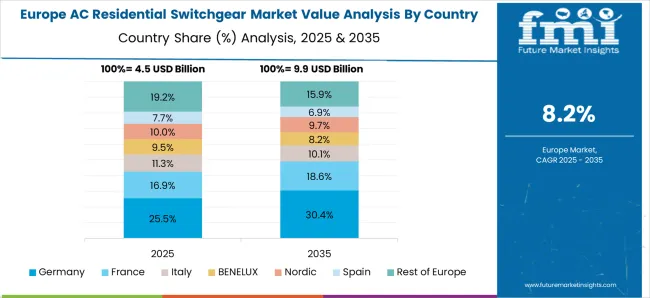

The AC residential switchgear market is projected to grow at a global CAGR of 8.8% from 2025 to 2035, with China leading at 11.9%, followed by India at 11.0%, and Germany at 10.1%. The United Kingdom shows a growth rate of 8.4%, while the United States stands at 7.5%. China and India are leading due to rapid urbanization, industrial growth, and rising demand for residential construction. In OECD nations like Germany, the UK, and the USA, growth is steady, driven by modernization, technological advancement in electrical systems, and increasing focus on residential safety standards. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 11.9% through 2035, supported by the country’s expanding residential and commercial sectors. The rapid urbanization and industrial growth in China, along with a shift towards smarter cities, are major factors driving the demand for AC residential switchgear. The Chinese government’s commitment to renewable energy and energy efficiency fuels the adoption of advanced electrical systems. As China becomes a global leader in high-tech manufacturing, the demand for reliable, energy-efficient switchgear continues to rise. The market is further boosted by government subsidies and incentives for electric vehicles and residential construction projects.

India is projected to grow at a CAGR of 11.0% through 2035, driven by rapid urbanization and industrial growth. The residential construction boom is fueling demand for modern electrical systems like AC residential switchgear. India’s focus on improving electricity access and energy efficiency is significantly boosting market demand. Government initiatives aimed at providing affordable and sustainable housing are further promoting the adoption of advanced electrical systems. The growth of the middle class and increasing residential, commercial, and industrial building projects will continue to support the demand for reliable, energy-efficient switchgear solutions in India.

Germany is projected to grow at a CAGR of 10.1% through 2035, with market growth driven by increasing demand for energy-efficient electrical systems. Germany’s commitment to reducing carbon emissions and the rise of renewable energy sources are fueling demand for AC residential switchgear. The country’s focus on smart grids, energy-efficient housing, and sustainable living is driving the need for advanced electrical solutions. As Germany’s residential, commercial, and industrial sectors continue to adopt greener technologies, the demand for modern electrical systems, including switchgear, is expected to rise.

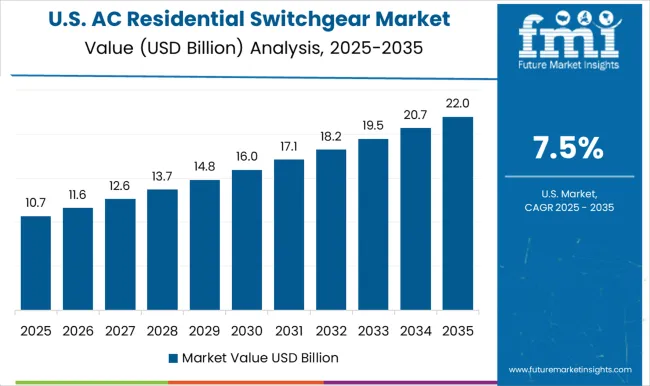

The United States is projected to grow at a CAGR of 7.5% through 2035, with demand driven by infrastructure modernization and growing focus on electrical safety. As the USA continues to modernize its aging electrical infrastructure, the need for AC residential switchgear to meet increased safety standards and energy efficiency demands grows. The rise in energy-efficient buildings, the adoption of smart home technologies, and stricter safety regulations further contribute to the market expansion. Moreover, the increase in residential and commercial construction projects, along with the growing need for renewable energy integration, will continue to drive demand for advanced switchgear systems in the USA.

The United Kingdom is projected to grow at a CAGR of 8.4% through 2035, with demand for AC residential switchgear driven by ongoing investments in infrastructure and energy efficiency. As the UK transitions to cleaner energy and prioritizes smart home technology, the adoption of energy-efficient electrical systems, including modern switchgear, is rising. Government regulations requiring enhanced electrical safety and the increasing demand for reliable, durable electrical infrastructure in residential properties further drive the market growth. The rise of electric vehicle adoption in the UK, supported by government incentives and environmental policies, also fuels the demand for switchgear solutions.

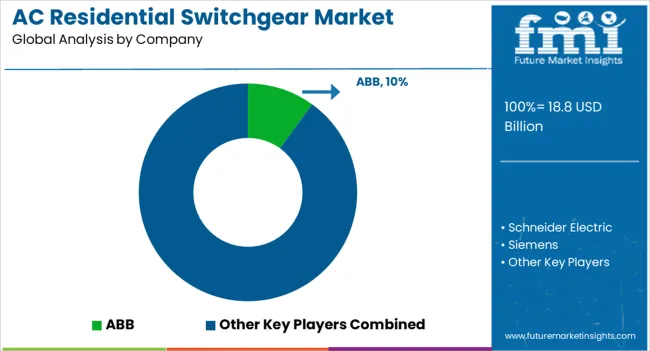

The AC residential switchgear market is led by prominent players offering reliable and efficient electrical solutions for residential power distribution. ABB, Schneider Electric, and Siemens are market leaders, providing a wide range of switchgear products such as circuit breakers, fuses, and disconnect switches that focus on safety, performance, and ease of installation. These companies are also integrating advanced smart switchgear solutions, making it possible to connect with home automation systems and enhance energy efficiency. Their commitment to innovation is reflected in the development of products that not only meet safety standards but also provide additional features, such as remote monitoring and control.

Eaton and Hitachi further contribute to the market by offering advanced, high-performance residential switchgear products that focus on improving power protection, minimizing electrical hazards, and increasing energy conservation in residential settings. General Electric complements these solutions with its extensive portfolio of residential switchgear systems, designed to optimize power distribution and prevent overloading, ensuring safe and efficient electrical operation in homes. Competitive differentiation in the AC residential switchgear market is driven by factors such as product reliability, safety features, and ease of installation, as well as integration with emerging smart home technologies. Barriers to entry include regulatory compliance, significant R&D investments, and the need for advanced manufacturing capabilities. Companies are focused on improving energy efficiency, enhancing safety, and meeting the growing demand for smart, connected electrical systems that cater to the modern residential market.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 Billion |

| Installation | Indoor and Outdoor |

| Voltage | Low and Medium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Schneider Electric, Siemens, Eaton, Hitachi, General Electric, and [Other global/local players…] |

| Additional Attributes | Dollar sales by product type (circuit breakers, disconnect switches, fuses, load centers) and end-use segments (single-family, multi-family). Demand dynamics are influenced by the increasing adoption of home automation systems, safety concerns, and the need for energy-efficient solutions. Regional growth trends highlight strong adoption in North America and Europe, driven by evolving safety standards and rising smart home technology integration. |

The global AC residential switchgear market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the AC residential switchgear market is projected to reach USD 43.7 billion by 2035.

The AC residential switchgear market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in AC residential switchgear market are indoor and outdoor.

In terms of voltage, low segment to command 69.0% share in the AC residential switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Account Planning Tool Market Size and Share Forecast Outlook 2025 to 2035

Acousto Optical Cavity Dumper Market Size and Share Forecast Outlook 2025 to 2035

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

AC DC Power Adapter Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

AC Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

AC Power Source Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA