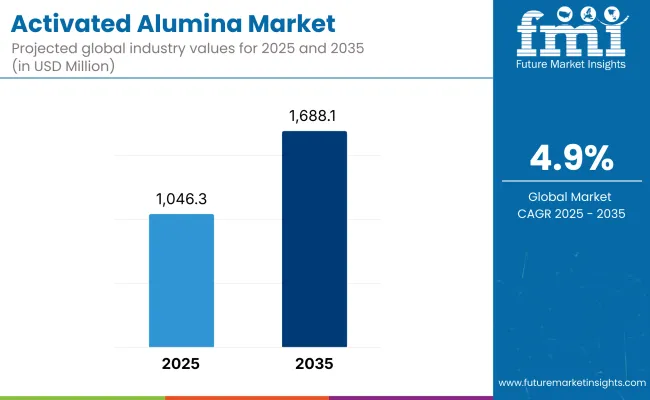

The activated alumina market stands at the threshold of a decade-long expansion trajectory that promises to reshape industrial desiccant technology and adsorbent material solutions. The market's journey from USD 1,046.3 million in 2025 to USD 1,688.2 million by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced filtration technology and purification optimization across petrochemical facilities, water treatment operations, and industrial gas processing sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 1,046.3 million to approximately USD 1,330 million, adding USD 283.7 million in value, which constitutes 44% of the total forecast growth period. This phase will be characterized by the rapid adoption of high-purity activated alumina grades, driven by increasing industrial production volumes and the growing need for advanced moisture removal and contaminant adsorption solutions worldwide. Enhanced adsorption capabilities and regeneration efficiency systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 1,330 million to USD 1,688.2 million, representing an addition of USD 358.2 million or 56% of the decade's expansion. This period will be defined by mass market penetration of specialized activated alumina formulations, integration with comprehensive process optimization platforms, and seamless compatibility with existing industrial infrastructure. The market trajectory signals fundamental shifts in how industrial facilities approach purification processes and quality management, with participants positioned to benefit from growing demand across multiple particle size configurations and end-use segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Water treatment desiccants | 35% | Municipal and industrial applications |

| Oil & gas purification | 25% | Natural gas dehydration, catalyst support | |

| Petrochemical processing | 20% | Feedstock purification, process optimization | |

| Air treatment & drying | 12% | Compressed air systems, industrial drying | |

| Fertilizer production support | 8% | Hydrogen peroxide stabilization | |

| Future (3-5 yrs) | Advanced water purification | 30-35% | Fluoride removal, arsenic treatment, emerging contaminants |

| Natural gas processing | 22-28% | LNG expansion, offshore applications | |

| Petrochemical catalysis | 18-22% | Catalyst carriers, specialty adsorbents | |

| Air separation & treatment | 12-16% | Industrial gas production, compressed air quality | |

| Specialty applications | 8-12% | Pharmaceutical grade, electronics manufacturing | |

| Regeneration & recycling services | 3-6% | Circular economy, sustainability focus |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,046.3 million |

| Market Forecast (2035) | USD 1,688.2 million |

| Growth Rate | 4.90% CAGR |

| Leading Particle Size | 0.5-2 mm Granular Range |

| Primary Application | Water Treatment Segment |

The market demonstrates strong fundamentals with 0.5-2 mm particle size capturing a dominant share through optimal adsorption efficiency and broad application versatility. Water treatment applications drive primary demand, supported by increasing water scarcity concerns and stringent quality regulations. Geographic expansion remains concentrated in industrialized markets with established chemical processing infrastructure, while emerging economies show accelerating adoption rates driven by industrial expansion initiatives and rising environmental standards.

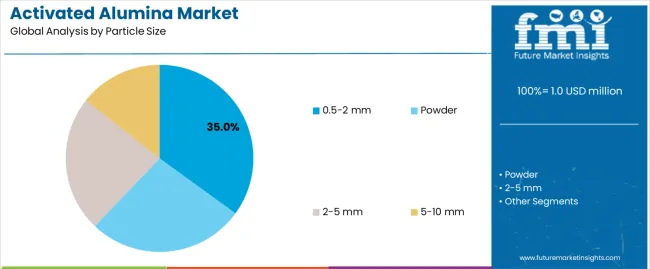

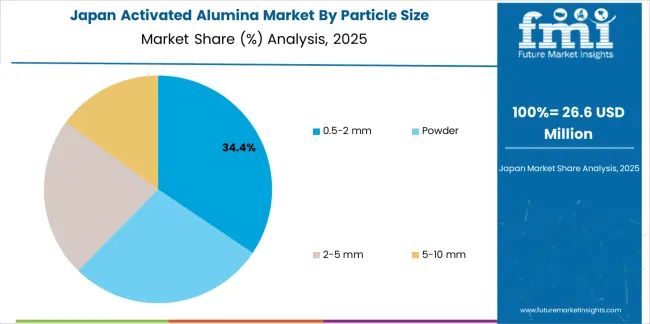

The market segments by particle size into powder, 0.5-2 mm, 2-5 mm, 5-10 mm ranges, representing the evolution from fine adsorbent powders to coarse granular materials for comprehensive industrial application optimization across diverse process conditions.

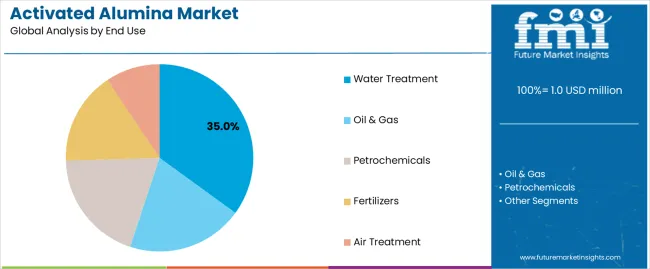

End-use segmentation divides the market into water treatment, oil & gas, petrochemicals, fertilizers, and air treatment sectors, reflecting distinct requirements for adsorption capacity, mechanical strength, and regeneration characteristics specific to each industrial application.

Geographic segmentation covers major producing and consuming regions including Asia Pacific (China, India, Japan), North America (United States, Canada), Europe (Germany, United Kingdom, France), and emerging markets in Middle East, Latin America, and Africa.

The segmentation structure reveals technology progression from general-purpose adsorbents toward specialized formulations with enhanced performance characteristics, while application diversity spans from municipal water treatment to sophisticated petrochemical processing requiring precise adsorption and catalyst support solutions.

Market Position: The 0.5-2 mm particle size range commands the leading position in the activated alumina market with approximately 35% market share through optimal balance of adsorption kinetics, pressure drop characteristics, and mechanical durability that enable industrial facilities to achieve superior performance across diverse water treatment, gas processing, and industrial drying applications.

Value Drivers: The segment benefits from industrial preference for granular adsorbents that provide rapid adsorption rates, acceptable pressure drop, and excellent bed stability without requiring specialized handling equipment or complex regeneration systems. The optimal particle size enables efficient mass transfer, uniform flow distribution, and reliable long-term performance, where mechanical strength and regeneration durability represent critical operational requirements.

Competitive Advantages: The 0.5-2 mm particle size range differentiates through proven industrial reliability, extensive application data, and compatibility with standard process equipment that enhance facility effectiveness while maintaining optimal adsorption capacity suitable for diverse industrial and municipal applications.

Key market characteristics:

Powder activated alumina maintains approximately 20% market position due to specialized requirements in catalyst manufacturing, pharmaceutical applications, and chemical synthesis where high surface area and rapid dissolution characteristics provide distinct advantages. Market growth is driven by specialty chemical expansion and advanced material applications requiring ultra-fine particle distributions.

The 2-5 mm particle size segment captures approximately 25% market share through balanced characteristics suitable for high-flow applications, compressed air drying, and industrial gas treatment where moderate pressure drop and excellent mechanical strength represent primary selection criteria for long-term operational reliability.

The 5-10 mm particle size range accounts for approximately 15% market share, serving applications requiring minimal pressure drop, such as bulk gas drying towers, atmospheric driers, and applications where extended bed life and minimal attrition outweigh slower adsorption kinetics considerations.

Specialized particle size ranges including ultra-fine powders and extra-coarse granules serve specific niche applications requiring customized performance characteristics for unique process conditions or specialized equipment configurations.

Market Context: Water treatment applications demonstrate the highest growth rate in the activated alumina market with 5.8% CAGR due to escalating water quality concerns, expanding fluoride removal programs, and increasing adoption of arsenic mitigation systems in municipal and industrial water treatment facilities globally.

Appeal Factors: Water treatment operators prioritize adsorbent effectiveness, regeneration economics, and regulatory compliance capabilities that enable safe drinking water delivery across diverse source water conditions. The segment benefits from substantial municipal investment and water infrastructure modernization programs that emphasize acquisition of reliable fluoride and arsenic removal technologies for public health protection.

Growth Drivers: Government water quality regulations mandate fluoride levels below 1.5 mg/L and arsenic below 10 ppb, creating sustained demand for activated alumina systems in affected regions. Population growth in fluoride-endemic areas and legacy contamination remediation programs drive continued market expansion for water treatment applications.

Application dynamics include:

Oil & Gas applications capture approximately 25% market share through critical roles in natural gas dehydration, natural gas liquids recovery, and petrochemical feedstock purification. The segment demonstrates steady growth driven by LNG expansion projects, offshore gas development, and quality specifications for pipeline-grade natural gas requiring moisture removal to prevent hydrate formation and pipeline corrosion.

Market Intelligence Brief:

Market Position: Petrochemical applications account for approximately 20% market share, serving critical roles in olefin production, aromatics purification, and specialty chemical manufacturing where trace contaminant removal impacts product quality and catalyst performance.

Value Drivers: Petrochemical facilities require activated alumina for hydrogen peroxide production, chlorine drying, and feedstock purification where even trace moisture or acid gases can compromise product specifications or downstream catalyst systems. The segment emphasizes high purity grades, consistent performance, and documented quality control.

Growth Characteristics: Market expansion follows petrochemical capacity additions in Asia Pacific and Middle East, where integrated refinery-petrochemical complexes incorporate activated alumina as standard equipment for process optimization and product quality assurance.

Fertilizers applications capture approximately 8% market share through specialized use in hydrogen peroxide stabilization for phosphate fertilizer production and ammonia synthesis gas purification. The segment shows moderate growth aligned with global fertilizer production capacity and agricultural demand patterns.

Air Treatment applications account for approximately 12% market share, including compressed air drying for manufacturing operations, breathing air purification, and industrial pneumatic systems where moisture control prevents equipment corrosion and ensures operational reliability across diverse industrial sectors.

Market Context: Asia Pacific dominates the activated alumina market with fastest CAGR, driven by rapid industrialization, expanding petrochemical capacity, and growing water treatment infrastructure across China, India, and Southeast Asian nations requiring comprehensive adsorbent solutions for industrial and municipal applications.

Business Model Advantages: The region provides largest consumption volumes for petrochemical processing, natural gas development, and water treatment programs, driving sustained demand for activated alumina while supporting domestic manufacturing capacity expansion and technology localization initiatives.

Operational Benefits: Asia Pacific markets benefit from proximity to raw material sources, established chemical manufacturing infrastructure, and growing end-use industries that create integrated value chains and competitive manufacturing economics for activated alumina production and distribution.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Water quality regulations & fluoride/arsenic removal mandates | ★★★★★ | Government regulations create non-discretionary demand; compliance-driven purchases provide stable long-term growth foundation |

| Driver | Natural gas production & LNG expansion (dehydration requirements) | ★★★★★ | Energy transition drives natural gas as bridge fuel; LNG export growth requires extensive dehydration capacity creating sustained industrial demand |

| Driver | Petrochemical capacity expansion (especially Asia Pacific & Middle East) | ★★★★☆ | New petrochemical complexes incorporate activated alumina as standard; capacity additions directly translate to market growth |

| Restraint | Price volatility of alumina feedstock & energy costs | ★★★★☆ | Alumina raw material costs impact margins; energy-intensive calcination process creates cost sensitivity to utility prices |

| Restraint | Competition from alternative adsorbents (molecular sieves, silica gel) | ★★★☆☆ | Alternative technologies offer advantages in specific applications; must demonstrate superior cost-performance for market retention |

| Restraint | Regeneration complexity & disposal regulations | ★★★☆☆ | Spent adsorbent handling requires compliance; regeneration infrastructure needs limit adoption in small facilities |

| Trend | Circular economy & adsorbent regeneration/recycling | ★★★★★ | Sustainability focus drives demand for regenerable systems; vendors offering regeneration services gain competitive advantage |

| Trend | Customized formulations & application-specific products | ★★★★☆ | Generic adsorbents commoditizing; differentiation through specialized grades for specific contaminants or process conditions |

| Trend | Integration with smart monitoring & predictive maintenance | ★★★★☆ | IoT sensors enable real-time performance tracking; predictive replacement scheduling optimizes costs and prevents breakthrough failures |

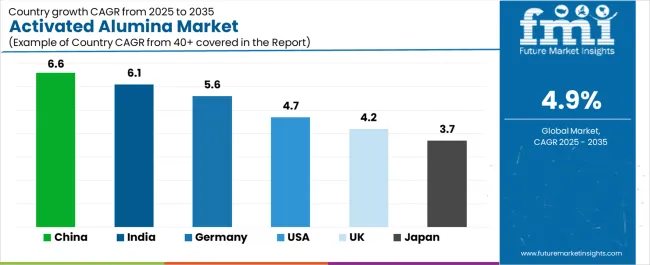

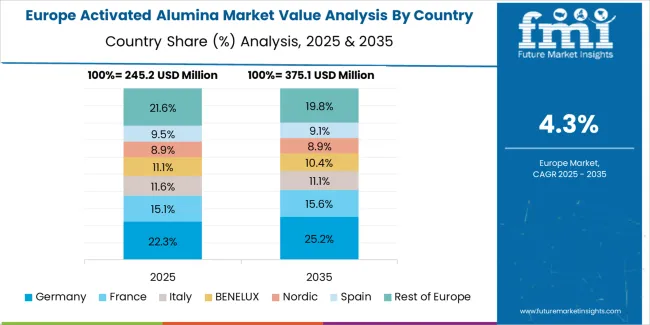

The activated alumina market demonstrates varied regional dynamics, with Growth Leaders including China (6.6% CAGR) and India (6.1% CAGR), driven by strong adoption in water treatment, petrochemical processing, and industrial adsorption systems. Steady Performers include the United States (4.7% CAGR) and Germany (5.6% CAGR), where demand is shaped by advanced refining industries, catalytic applications, and environmental compliance requirements. Emerging Markets such as the UK (4.2% CAGR) and Japan (3.7% CAGR) show consistent progress, supported by niche demand in high-purity applications, electronics, and specialty chemicals.

Regional synthesis highlights Asia-Pacific as the leading region, anchored by industrial infrastructure growth, water purification initiatives, and petrochemical sector expansion. North America shows steady performance, supported by oil & gas and environmental applications, while Europe maintains moderate growth with a focus on sustainability, regulatory compliance, and specialty applications.

| Region/Country | 2025–2035 Growth | How to Win | What to Watch Out |

|---|---|---|---|

| India | 6.1% | Focus on affordable, scalable adsorption solutions for water treatment | Price sensitivity; fragmented distribution |

| China | 6.6% | Leverage large-scale industrial demand and water treatment programs | Environmental regulations; quality consistency |

| United States | 4.7% | Provide advanced purification and catalytic-grade solutions | Stringent EPA standards; high operating costs |

| Germany | 5.6% | Offer premium high-purity alumina for industrial & specialty chemicals | Over-engineering risk; long validation cycles |

| UK | 4.2% | Push niche markets in electronics and environmental services | Brexit trade disruptions; smaller domestic demand |

| Japan | 3.7% | Target precision applications in semiconductors and specialty adsorbents | Slow industrial growth; high import reliance |

China demonstrates the strongest growth potential in the Activated Alumina Market with a CAGR of 6.6% through 2035, supported by rapid industrial infrastructure expansion, large-scale adoption in water treatment, and petrochemical processing demand. Growth is concentrated in Shandong, Jiangsu, and Guangdong, where petrochemical complexes and municipal water projects require high-capacity adsorption and purification systems. The government’s clean water initiatives and environmental compliance programs have accelerated the replacement of conventional adsorbents with activated alumina in municipal and industrial applications.

Chinese manufacturers dominate domestic supply with cost-effective products tailored to local industries, while global players focus on high-purity grades for specialty chemical and electronics markets. Exports to Southeast Asia are rising as Chinese producers leverage economies of scale and competitive pricing.

Strategic Market Indicators:

India records a 6.1% CAGR through 2035, anchored by demand from water purification, refinery desulfurization, and gas drying applications. Growth is concentrated in Gujarat, Maharashtra, and Tamil Nadu, where expanding petrochemical and refinery operations drive activated alumina consumption. India’s water scarcity challenges are prompting widespread use of activated alumina in arsenic and fluoride removal systems, particularly in municipal and rural water treatment programs.

Indian manufacturers are increasingly producing cost-competitive grades tailored for water treatment, while international suppliers penetrate high-purity applications such as catalysts, healthcare, and electronics. Government investments in water treatment and industrial modernization programs, combined with private sector participation, ensure sustained adoption.

Strategic Market Indicators:

Germany posts a 5.6% CAGR through 2035, reflecting its focus on high-purity activated alumina for specialty chemicals, environmental compliance, and catalytic applications. Growth is centered in North Rhine-Westphalia, Bavaria, and Hamburg, where advanced chemical clusters integrate activated alumina into refining, petrochemical, and wastewater treatment processes. EU sustainability regulations are pushing industries to adopt cleaner adsorbents and catalysts, supporting steady demand.

German manufacturers prioritize premium quality, certified performance, and advanced formulations for industries requiring stringent specifications, such as automotive, electronics, and environmental services. Imports from Asia fill lower-grade demand, while domestic producers focus on specialty niches.

Strategic Market Indicators:

The USA Activated Alumina Market expands at a 4.7% CAGR through 2035, supported by applications in oil & gas refining, water treatment, and air/gas drying. Demand is concentrated in Texas, Louisiana, and California, where refinery complexes and petrochemical facilities rely on activated alumina for desulfurization and gas purification. Rising EPA regulations on water quality and industrial emissions are further pushing adoption in municipal and industrial water treatment.

Domestic producers lead supply with catalyst-grade and specialty alumina, while imports from Asia address price-sensitive applications. Advanced processing technologies and integration with refinery catalyst systems maintain steady market demand.

Strategic Market Indicators:

The UK grows at a 4.2% CAGR through 2035, supported by niche demand in environmental services, gas drying, and specialty chemical applications. Market growth is concentrated in London, Manchester, and Teesside, where industrial clusters and municipal water projects integrate activated alumina into treatment systems. Post-Brexit trade dynamics have reshaped supply chains, leading to higher reliance on imports from EU and Asian producers.

UK adoption focuses on specialized applications such as electronics, laboratory chemicals, and small-scale water treatment solutions, where quality and compliance are prioritized. Growth remains moderate compared to larger European markets but provides consistent opportunities in targeted segments.

Strategic Market Indicators:

Japan posts a 3.7% CAGR through 2035, reflecting conservative but stable demand for activated alumina in electronics, healthcare, and precision industrial applications. Growth is concentrated in Tokyo, Osaka, and Nagoya, where advanced industries require high-purity adsorbents and specialty formulations. Japan’s limited domestic resources create strong reliance on imports, particularly from China and Southeast Asia.

Japanese consumers and industrial users demand premium, high-reliability products with strict quality control, making the market favorable for global suppliers offering certified grades. While growth is modest compared to emerging Asian markets, Japan’s role as a high-value specialty market ensures consistent opportunities for suppliers targeting electronics, catalysts, and high-purity chemical applications.

Strategic Market Indicators:

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Integrated chemical majors | Captive alumina supply, global distribution, R&D capabilities | Raw material security, technical resources, customer relationships | Agility; customization speed |

| Specialty adsorbent suppliers | Customized formulations, application expertise, niche markets | Technical differentiation, responsive service, premium positioning | Production scale; cost competitiveness |

| Regional producers | Local market access, competitive pricing, quick delivery | Proximity advantages, pricing flexibility, regional knowledge | Technology gaps; global reach limitations |

| Technology innovators | Novel activation methods, specialized treatments, IP protection | Performance differentiation, premium pricing, patent protection | Manufacturing scale; market access |

| Toll manufacturers | Flexible production, customer formulations, private labeling | Manufacturing efficiency, no sales competition with customers | Brand recognition; end-user relationships |

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Particle Size | Powder, 0.5-2 mm, 2-5 mm, 5-10 mm |

| End Use | Water Treatment, Oil & Gas, Petrochemicals, Fertilizers, Air Treatment |

| Regions Covered | Asia Pacific, North America, Europe, Middle East, Latin America, Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, Japan, France, South Korea, Canada, Australia, Saudi Arabia, UAE, Brazil, Mexico, and 20+ additional countries |

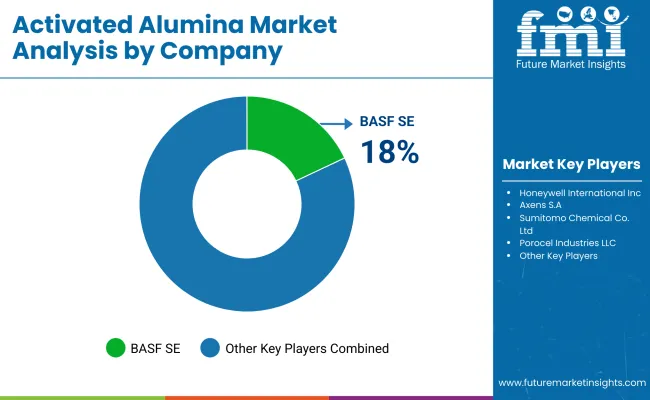

| Key Companies Profiled | BASF SE, Honeywell International Inc., Axens S.A., Sumitomo Chemical Co. Ltd., Porocel Industries LLC (Evonik), Chalco Shandong Advanced Material, Huber Corporation, Chemviron Carbon, Dynamic Adsorbents Inc., Activated Alumina Spheres |

| Additional Attributes | Revenue analysis by particle size and end-use categories, regional consumption patterns across Asia Pacific, North America, and Europe, competitive landscape with chemical majors and specialty adsorbent suppliers, industrial operator preferences for adsorption capacity and regeneration economics, integration with process equipment and monitoring systems, innovations in formulation technology and surface treatment methods, development of regeneration practices with circular economy principles and environmental compliance capabilities |

The global activated alumina market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the activated alumina market is projected to reach USD 1.7 billion by 2035.

The activated alumina market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in activated alumina market are 0.5-2 mm, powder, 2-5 mm and 5-10 mm.

In terms of end use, water treatment segment to command 35.0% share in the activated alumina market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Assessing Activated Carbon Market Share & Industry Trends

Activated Partial Thromboplastin Test Market

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Heat Activated Tear Tape Market

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water Activated Tape Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Water Activated Tape Dispensers

Water-Activated Tape Market Trends & Industry Forecast 2024-2034

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA