The Alumina Market is estimated to be valued at USD 50.6 billion in 2025 and is projected to reach USD 80.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. The growth trajectory demonstrates a compound and sustained upward curve with moderate acceleration phases rather than sharp spikes, signaling structural stability in demand across core sectors such as aluminum smelting, refractories, and ceramics.

Early growth from 2025 to 2029 adds approximately USD 10.2 billion, reflecting 34.5% of the total decade increase, driven primarily by aluminum-intensive industries, including automotive lightweighting and infrastructure. During this period, YoY growth remains consistent, highlighting limited volatility and a strong demand base. In contrast, late growth between 2030 and 2035 contributes USD 16.5 billion, or over 55% of total gains, indicating an inflection point near 2030 as innovation-driven applications such as high-purity alumina for lithium-ion battery separators, LEDs, and aerospace composites accelerate.

The growth curve shape reflects gradual saturation in commodity alumina and expansion in specialty grades, creating a transition from volume-led to value-driven growth. Low cyclical sensitivity and strong linkage with green technologies like EVs and renewable energy position alumina as a strategic material. Future competitiveness will hinge on energy-efficient refining, digitized process control, and sustainability compliance to maintain cost advantage and capture premium markets.

| Metric | Value |

|---|---|

| Alumina Market Estimated Value in (2025 E) | USD 50.6 billion |

| Alumina Market Forecast Value in (2035 F) | USD 80.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The alumina market is witnessing sustained growth driven by rising aluminum demand across automotive, aerospace, construction, and packaging industries. The shift toward lightweight materials in transport and infrastructure has elevated the strategic value of alumina as a primary input.

Global emphasis on decarbonization and electric vehicle (EV) production has increased demand for high-purity alumina in battery technologies and sustainable aluminum processing. Ongoing investments in bauxite mining and refining infrastructure, especially in Asia-Pacific and the Middle East, have enhanced production capabilities and supply chain stability.

Policy support for energy-efficient smelting and recycling is reshaping procurement and refining strategies across end-use industries. Looking ahead, technological innovations in alumina refining, red mud waste minimization, and circular economy integration are expected to drive long-term market expansion and operational efficiencies.

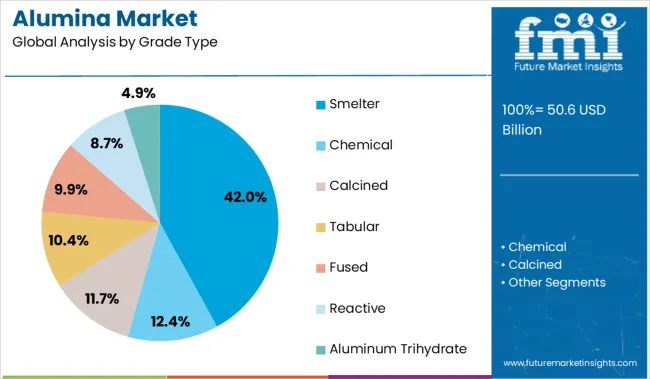

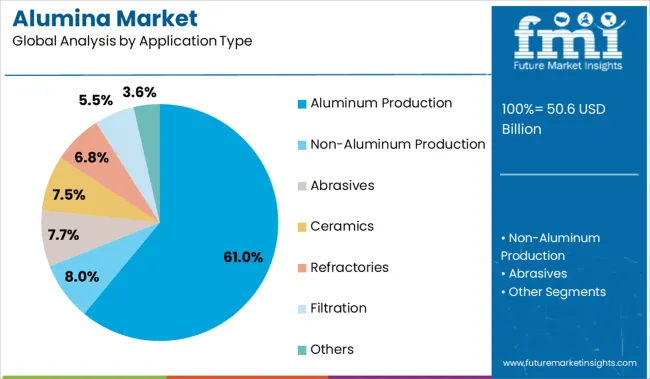

The market is segmented by grade type, application type, and region. By grade type, it includes smelter, chemical, calcined, ordinary soda, medium soda, low soda, tabular, fused, reactive, and aluminum trihydrate, each serving specific industrial processes. In terms of application type, the segmentation comprises aluminum production, non-aluminum production, abrasives, ceramics, refractories, filtration, and other uses across diverse manufacturing sectors. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Smelter-grade alumina is projected to account for 42.00% of the total revenue share in 2025, making it the leading grade type in the market. This dominance is being driven by its essential role as the primary feedstock for aluminum smelting, which continues to scale globally in response to the demand for lightweight materials.

The Bayer process remains the most widely used refining route for smelter-grade alumina, with continuous improvements in energy efficiency and cost control. Its high thermal stability and purity make it suitable for producing primary aluminum used in sectors such as transport, construction, and packaging.

Favorable pricing dynamics and secure supply agreements between mining firms and aluminum producers have further supported its market strength. Growth in smelting capacity, particularly in China and the Gulf region, has reinforced the segment’s importance in meeting global aluminum production needs.

Aluminum production is expected to dominate with a 61.00% revenue share in the alumina market by 2025, making it the top application segment. This leadership is attributed to the integral role of alumina in electrolytic reduction processes used in primary aluminum manufacturing.

Rising global consumption of aluminum, driven by its recyclability, strength-to-weight ratio, and corrosion resistance, has sustained strong demand for high-volume alumina supply. Advancements in smelting technologies-such as inert anode development and energy recovery systems-have increased alumina efficiency, further elevating its value in production chains.

Strategic partnerships and backward integration by aluminum producers into alumina refining are strengthening supply assurance and cost competitiveness. With aluminum positioned as a critical material for energy transition, infrastructure development, and green mobility, alumina’s role in its production remains pivotal to industrial growth and sustainability targets.

The alumina market is being propelled by growing demand in semiconductors, refractories, and construction, along with rising aluminum production. However, growth is constrained by volatile bauxite prices, high energy costs, and trade-related disruptions.

Growth in the alumina market is being driven by rising demand for high-purity grades in applications such as semiconductors, refractories, and ceramics. Increased aluminum production is also being supported by strategic manufacturing shifts toward lightweight automotive components and energy-efficient packaging. In countries like China and India, government-backed infrastructure initiatives have intensified the consumption of smelter-grade alumina. Alumina’s widespread use in water purification systems and as an abrasive in industrial polishing is being recognized as economically vital. The market is being shaped by a steady rise in global construction activities, where alumina-based cements and coatings are increasingly preferred. As a result, alumina is being viewed as a foundational material with broad utility across multiple verticals including electronics, metallurgy, and engineered composites.

Despite its expanding end-use base, the alumina market is being held back by volatile bauxite prices and regulatory pressures on mining practices, particularly in BRICS nations. The energy-intensive nature of alumina refining is frequently cited as a constraint, with energy costs accounting for up to 30% of production expenses. Supply chain disruptions and logistical delays in bulk shipments have added further pressure, especially in key export hubs. Fluctuations in aluminum demand directly affect smelter-grade alumina uptake, leading to unpredictable procurement cycles. Market dynamics are also being influenced by trade restrictions and regional export tariffs, limiting competitiveness for some producers. These factors are creating a cautious outlook, particularly for stakeholders seeking stable sourcing and pricing structures in a fragmented global landscape.

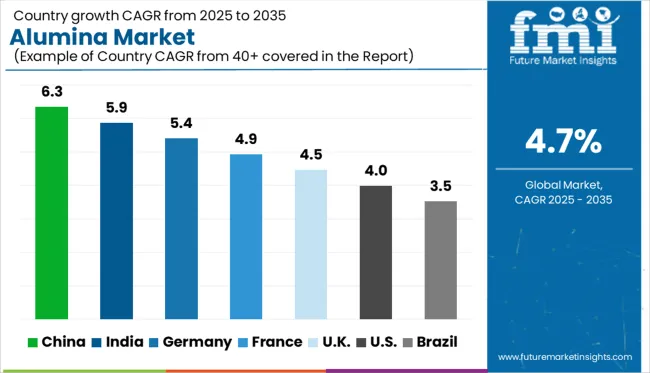

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global alumina market is growing at a CAGR of 4.7% from 2025 to 2035, but several countries, particularly in BRICS and advanced OECD economies, are surpassing this average due to evolving manufacturing priorities and energy transition dynamics. China leads with a 6.3% CAGR, driven by its dominance in aluminum smelting, electric vehicle battery components, and an expanding solar PV supply chain.

India follows at 5.9%, supported by rising infrastructure spending, aluminum capacity expansions, and localization of specialty alumina production under “Atmanirbhar Bharat.” Germany, representing the OECD bloc, is expanding at 5.4%, benefiting from the push for clean-tech components and a steady demand in engineered ceramics and automotive sectors.

The UK and USA fall below the global average with 4.5% and 4.0% CAGRs, respectively, due to mature refining capacities and limited investments in new alumina-based innovations. ASEAN countries are rising in prominence through export-oriented bauxite-alumina value chains. The report evaluates 40+ countries; the top five are shown here.

The CAGR for the alumina market in the United States was approximately 2.8% from 2020 to 2024, rising to 4.0% during the 2025 to 2035 period. This increase has been driven by downstream demand for lightweight aluminum alloys in aerospace and EV production. USA automotive OEMs are increasingly shifting to aluminum-intensive vehicle platforms, requiring higher alumina inputs for smelter-grade applications.

Demand from the ceramic and refractory industries is being reinforced by defense and energy infrastructure programs. Domestic alumina refining remains limited, but strategic imports from Australia and Brazil are being prioritized to reduce reliance on Chinese supply. The Inflation Reduction Act has further bolstered clean energy segments where alumina composites are required for battery separators and electrical insulation.

The UK alumina market recorded a CAGR of around 2.3% between 2020 and 2024, which rose to 4.5% for the 2025 to 2035 period, against the global average of 4.7%. This upward shift reflects a resurgence in the UK’s aluminum recycling infrastructure and a rebound in industrial ceramics used in electronics and aerospace.

Post-Brexit trade alignments have encouraged localized alumina sourcing and semi-finished aluminum production. Increased investment in hydrogen-ready power plants and refractory materials for thermal insulation is strengthening demand. The government’s advanced manufacturing strategy has identified alumina as critical for energy storage and semiconductor polishing applications. The transition to green steel and demand for castables in metal refining are also contributing to the renewed CAGR momentum.

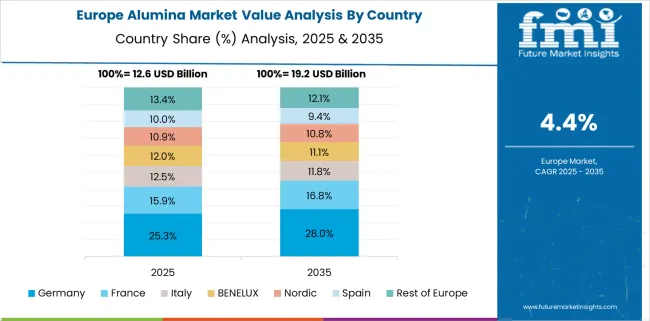

Germany’s alumina market CAGR rose from 3.9% in 2020 to 2024 to 5.4% during 2025 to 2035, reflecting industrial resilience and strategic investments in advanced ceramics and automotive manufacturing. As a leading hub for precision engineering and chemical manufacturing, Germany’s high-purity alumina demand is surging for lithium-ion battery separators and LED substrates.

Federal funding for e-mobility and EU Green Deal incentives are accelerating alumina’s role in decarbonized manufacturing. Technical ceramics using calcined alumina are also gaining prominence in high-heat and wear-resistant environments. Imports from France and Spain are helping bridge refinery limitations, while localized grinding and micronization units are being expanded in Bavaria and North Rhine-Westphalia.

China’s alumina market expanded at a CAGR of 4.6% between 2020 and 2024, and is projected to grow at 6.3% during 2025 to 2035, well above the global average of 4.7%. This surge is being driven by massive state-led investments in aluminum smelting capacity, particularly in Yunnan and Inner Mongolia, where low-carbon electricity is being leveraged.

High-purity alumina for lithium battery and sapphire substrate applications has received policy backing. Environmental policies are also mandating upgrades in emission-reducing refractories, bolstering calcined alumina use. China’s Belt and Road Initiative has led to a construction boom in alumina-intensive cement and structural composites. Several refineries have also been vertically integrated with bauxite mines in Guinea and Indonesia to stabilize feedstock supply.

India’s alumina market posted a CAGR of around 4.2% during 2020 to 2024, increasing to 5.9% for the 2025 to 2035 period due to strong growth in domestic aluminum smelting, refractory production, and ceramic tiles manufacturing. The country ranks among the top five bauxite producers globally, and investments by state-owned companies like NALCO and Hindalco are expanding both captive mining and refinery operations.

Smelter-grade alumina consumption is growing in tandem with demand from the solar PV and transportation sectors. High-purity alumina applications are emerging across display technology, water filtration, and precision polishing, with start-ups entering the downstream segments. The "Make in India" initiative is favoring domestic alumina beneficiation for import substitution.

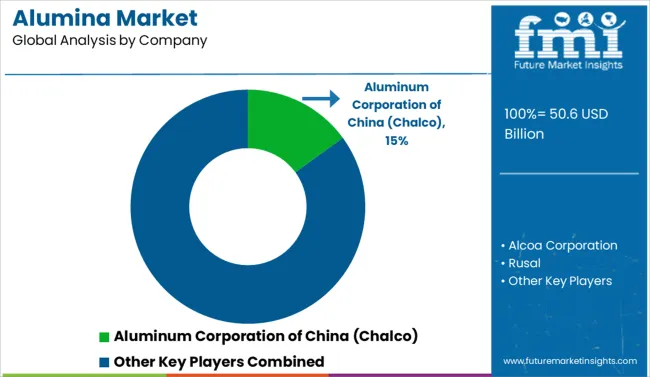

In the alumina market, leading producers are focusing on grade customization, downstream integration, and supply chain resilience to meet growing demand across automotive, construction, refractories, and electronics. Companies such as NALCO, Vedanta, and Worsely Alumina are prioritizing high-volume smelter-grade alumina production, particularly for aluminum manufacturing, while building strategic ties with bauxite mining operations to stabilize raw material inputs.

Nippon Light Metal Company and Alum S.A. are active in high-purity and specialty alumina segments, serving the needs of LED substrates, ceramic filters, and battery separators. Sasol and Cabot Corporation are expanding value-added offerings in flame retardant and filler applications, blending alumina with advanced chemical compounds.

Almatis is a key player in calcined and tabular alumina, catering to high-temperature refractories and industrial ceramics. These companies are navigating cost pressures, trade policies, and localization demands by investing in energy efficiency, capacity expansion, and product differentiation across end-use categories.

In August 2024, Alcoa Corporation acquired Alumina Ltd to boost its position in the chemicals & materials industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.6 Billion |

| Grade Type | Smelter, Chemical, Calcined, Ordinary soda, Medium soda, Low soda, Tabular, Fused, Reactive, and Aluminum Trihydrate |

| Application Type | Aluminum Production, Non-Aluminum Production, Abrasives, Ceramics, Refractories, Filtration, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aluminum Corporation of China (Chalco), Alcoa Corporation, Rusal, Xinfa Group, Rio Tinto, Hongqiao Group, Norsk Hydro, NALCO, Alum S.A., Nippon Light Metal Company, Vedanta, Worsely Alumina, Sasol, Almatis, and Cabot Corporation |

| Additional Attributes | Dollar sales, share, regional demand trends, smelter vs. specialty grade dynamics, bauxite sourcing risks, energy cost impacts, end-use sector growth, and trade policy effects. |

The global alumina market is estimated to be valued at USD 50.6 billion in 2025.

The market size for the alumina market is projected to reach USD 80.1 billion by 2035.

The alumina market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in alumina market are smelter, chemical, calcined, ordinary soda, medium soda, low soda, tabular, fused, reactive and aluminum trihydrate.

In terms of application type, aluminum production segment to command 61.0% share in the alumina market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA