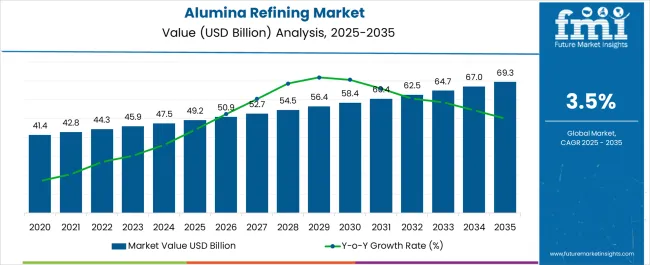

The alumina refining market, valued at USD 49.2 billion in 2025 and projected to reach USD 69.3 billion by 2035, is growing at a CAGR of 3.5%, with distinct differences observed across the two major ten-year blocks of expansion. From 2025 to 2030, the market advances from USD 49.2 billion to USD 58.4 billion, generating an incremental gain of USD 9.2 billion. This stage accounts for about 45% of the total projected growth and is influenced by increasing global demand for aluminum in construction, automotive, and packaging, supported by rising infrastructure development and lightweight material adoption.

Greater refining efficiencies, technological integration, and investment in emerging Asia-Pacific facilities with abundant bauxite resources also support expansion during this phase. From 2030 to 2035, the market accelerates from USD 58.4 billion to USD 69.3 billion, creating a larger absolute increase of USD 10.9 billion, equivalent to 55% of the total projected growth. This period is driven by heightened demand from electric vehicle production, renewable energy applications, and aerospace, which require high-quality alumina inputs. Strengthened recycling integration and advanced low-emission refining methods further support growth in the later stage. Overall, the alumina refining market demonstrates a balanced trajectory, with stronger incremental gains in 2030–2035 highlighting its long-term structural importance.

| Metric | Value |

|---|---|

| Alumina Refining Market Estimated Value in (2025 E) | USD 49.2 billion |

| Alumina Refining Market Forecast Value in (2035 F) | USD 69.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The alumina refining market registers a dominant position within the global aluminum value chain, accounting for nearly 43–46% share of the overall aluminum industry due to its critical role in converting bauxite into smelter-grade alumina. Within the broader non-ferrous metals refining sector, alumina refining represents about 28–30% share, emphasizing its importance as a foundational material in producing primary aluminum. In the industrial minerals and chemicals domain, alumina refining contributes close to 18–20% share, driven by its use not only in aluminum production but also in ceramics, refractories, and abrasives.

The sector’s strength lies in the extensive deployment of Bayer process facilities, particularly in Asia-Pacific, where countries like China, India, and Australia dominate both bauxite reserves and refining capacity. Growth is influenced by rising global aluminum consumption across construction, transportation, and packaging industries, which directly fuels alumina demand. At the same time, environmental compliance, energy costs, and technological upgrades remain significant factors shaping competitive dynamics. The market is also witnessing an increase in interest toward low-carbon refining technologies and residue management systems that improve efficiency while reducing waste. Despite challenges related to energy intensity and price volatility in raw material supply, alumina refining continues to be the backbone of aluminum production, ensuring secure raw material availability for one of the world’s most widely used metals.

The alumina refining market is experiencing sustained growth as demand for aluminum continues to expand across construction, transportation, packaging, and energy sectors. The industry is being shaped by increasing investments in refining capacity, particularly in regions with abundant bauxite reserves, and by advancements in process efficiency to reduce energy consumption and emissions. A notable trend is the adoption of cleaner refining technologies, supported by both regulatory pressures and corporate sustainability goals.

Long-term contracts between alumina refiners and aluminum producers are stabilizing supply chains, while innovations in waste management and residue utilization are improving operational viability. Global aluminum demand growth, driven by lightweighting trends and infrastructure development, is expected to keep alumina consumption at elevated levels.

As alumina serves as the essential feedstock for aluminum smelting, refiners are focusing on optimizing production costs, enhancing product quality, and integrating digital monitoring systems to ensure consistency These strategies are positioning the market for continued expansion in the years ahead.

The alumina refining market is segmented by refining process type, grade, application, and geographic regions. By refining process type, the alumina refining market is divided into Bayer process, Combined Bayer-sinter process, and Other alternative processes. In terms of grade, alumina refining market is classified into Smelter grade alumina (SGA), Chemical grade alumina (CGA), Catalyst-grade alumina, Abrasive-grade alumina, Refractory-grade alumina, and High-purity alumina (HPA).

Based on application, alumina refining market is segmented into Primary aluminum production, Ceramics & refractories, Catalysts & adsorbents, Glass manufacturing, Abrasives, and Others. Regionally, the alumina refining industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

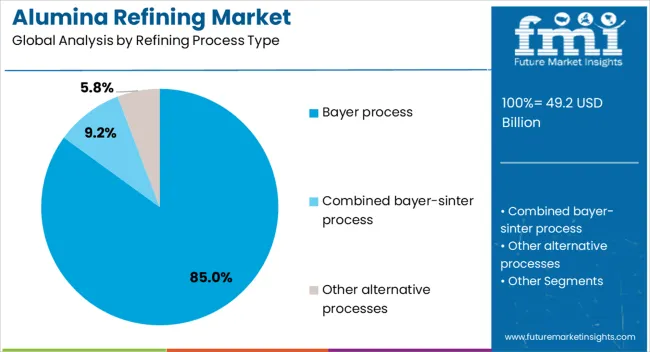

The Bayer process segment is projected to hold 85% of the alumina refining market revenue share in 2025, making it the dominant refining process type. Its leadership is supported by its proven efficiency in extracting alumina from bauxite ore with high yield and consistent quality. The process is well-established, enabling refiners to achieve economies of scale and maintain competitive production costs.

Continuous improvements in precipitation, calcination, and energy recovery systems have increased its operational sustainability and reduced environmental impact. The Bayer process also offers flexibility in processing varying grades of bauxite, ensuring stable supply chains even in fluctuating market conditions.

Due to its scalability, refiners have been able to expand capacity to meet rising alumina demand for aluminum smelting, particularly in industrial hubs. The widespread technical expertise and infrastructure built around this method have reinforced its position as the industry standard, ensuring its continued dominance in the global alumina refining market.

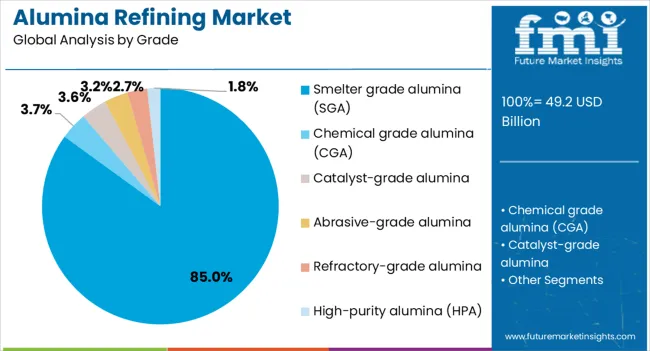

The smelter grade alumina segment is expected to account for 85% of the alumina refining market revenue share in 2025, underscoring its critical role in the aluminum production value chain. This grade is the primary raw material used in electrolytic smelting to produce primary aluminum, making its demand directly linked to aluminum output levels worldwide.

Its consistent chemical composition and particle size distribution make it highly suited for efficient smelting operations. The growth of the SGA segment has been driven by the expansion of aluminum smelters, particularly in emerging economies with strong infrastructure and manufacturing demand.

Efforts by refiners to ensure high purity levels, low sodium content, and optimized reactivity have further strengthened its market position. Additionally, long-term supply agreements between alumina refiners and smelters have secured demand stability, ensuring that SGA continues to be the preferred choice for large-scale aluminum production facilities globally.

The primary aluminum production segment is anticipated to hold 88.90% of the alumina refining market revenue share in 2025, making it the leading application. This dominance is supported by the fact that alumina is the essential feedstock for electrolytic aluminum production, with no viable substitute for large-scale operations. Demand growth in this segment is being driven by the global expansion of aluminum-intensive industries, including automotive, aerospace, packaging, and construction.

Increasing focus on lightweight, corrosion-resistant materials in manufacturing has reinforced the necessity of a consistent alumina supply. Refiners have been optimizing production quality to meet the stringent requirements of modern smelting technology, ensuring high efficiency and reduced energy use.

Strategic investments in proximity to smelting hubs, coupled with integration of digital monitoring and process automation, have further boosted productivity. As global aluminum consumption continues its upward trajectory, primary aluminum production will remain the central driver of alumina demand, securing its dominant share in the overall market.

Alumina refining growth is driven by rising aluminum demand, strong capacity in Asia-Pacific, energy cost pressures, and evolving compliance requirements. These factors collectively define its global expansion and competitive outlook.

Global alumina refining demand continues to rise due to increasing aluminum consumption across construction, packaging, and transportation industries. The refining process ensures a consistent supply of smelter-grade alumina, which forms the backbone of primary aluminum production. Countries such as China and India remain the largest consumers, driven by industrial expansion and infrastructure growth. Packaging and automotive industries also contribute to higher alumina requirements as lightweight aluminum products replace heavier alternatives. This demand pattern has reinforced alumina’s role as a key intermediate material in the global metals sector. Despite cost challenges, higher aluminum usage guarantees steady alumina refining output worldwide.

Asia-Pacific leads the global alumina refining industry with significant contributions from China, India, and Australia. Abundant bauxite reserves and strong investment in refining infrastructure have given this region an edge in both scale and cost advantages. China continues to expand refining plants to meet its domestic demand while also exploring international partnerships for raw material security. India, supported by growing industrial consumption, has increased refining output through public and private sector initiatives. Australia leverages its vast bauxite resources to supply alumina globally, reinforcing the region’s prominence. This concentration of refining capacity highlights Asia-Pacific’s dominance in the global alumina ecosystem.

Alumina refining remains highly energy-intensive, which directly impacts production costs and profitability. Electricity, steam, and caustic soda account for major operational expenditures in refining facilities. Rising energy costs in key markets create financial strain for producers, especially in regions where power is heavily dependent on fossil sources. Volatility in caustic soda supply further compounds the challenge, requiring careful procurement strategies. Producers are focusing on energy-efficient methods and process optimization to mitigate these costs. Despite such measures, energy intensity continues to be a defining characteristic of alumina refining, making operational efficiency and stable energy access vital for long-term competitiveness.

Environmental regulations increasingly shape the alumina refining landscape, with stricter controls on emissions, water use, and residue disposal. Red mud, the by-product of the Bayer process, presents long-term environmental management challenges for refiners. Governments are enforcing stricter disposal norms, pushing companies to adopt residue reprocessing and safer storage practices. Producers are also investing in recovery techniques that extract rare earth elements and other minerals from residue, creating additional revenue opportunities. Compliance with regulatory frameworks has become integral to business continuity, especially in Europe and North America. Effective residue management now acts as both a compliance necessity and a pathway to improved resource utilization.

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

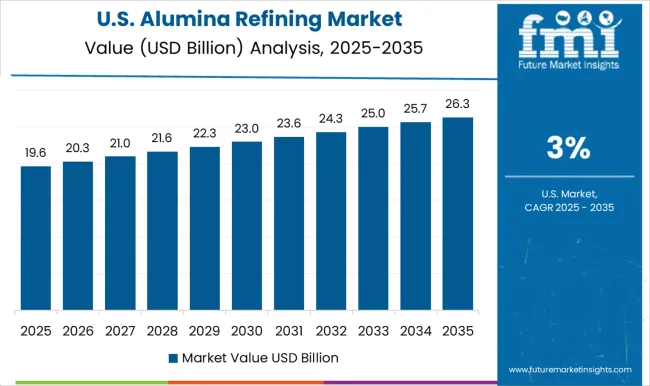

| USA | 3.0% |

| Brazil | 2.6% |

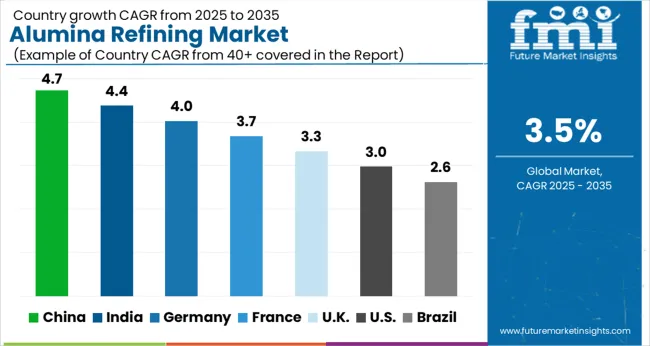

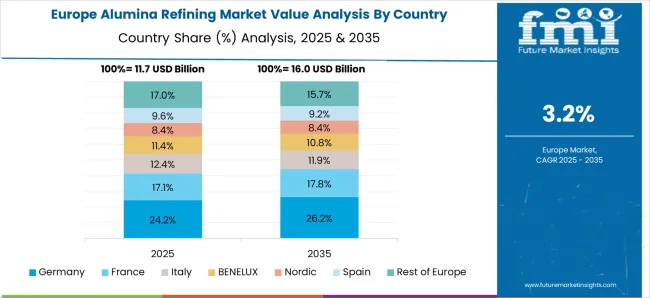

The alumina refining market is projected to grow globally at a CAGR of 3.5% between 2025 and 2035, supported by rising aluminum demand across construction, packaging, and transportation sectors, alongside investments in refining capacity expansion. China leads with a CAGR of 4.7%, driven by large-scale bauxite integration, capacity additions, and government-backed projects ensuring supply security for its aluminum industry. India follows at 4.4%, fueled by industrial growth, infrastructure projects, and ongoing investments in refining complexes to reduce import dependency. France posts 3.7%, with growth underpinned by aluminum demand in aerospace and automotive industries, coupled with compliance-driven refining upgrades. The United Kingdom grows at 3.3%, reflecting modest expansion linked to downstream aluminum demand and partnerships in supply diversification. The United States records 3.0%, reflecting slower growth tied to mature industrial infrastructure, higher energy costs, and reliance on imports but remains important due to steady domestic aluminum consumption. The analysis spans over 40 global markets, with these six nations serving as key benchmarks for capacity investments, raw material security, and industrial policies shaping alumina refining operations worldwide.

China is positioned to post a CAGR of 4.7% during 2025–2035, above the global 3.5% baseline. During 2020–2024, growth was near 4.1% as refinery debottlenecking and captive bauxite integration advanced in stages. The move from about 4.1% to 4.7% is explained by steady alumina demand from rolling and extrusion hubs, higher refinery utilization, and improved caustic recovery rates that lowered cash costs. Import substitution in smelter-grade alumina has been prioritized, while long-term bauxite contracts secured feed stability. In my assessment, balanced additions in Guangxi and Shandong, coupled with logistics optimization, push operating rates higher and keep China ahead of the global curve without stressing margins.

India is projected to deliver a CAGR of 4.4% for 2025–2035, outpacing the 3.5% global average. During 2020–2024, CAGR hovered around 3.8% as expansions ramped gradually and logistics constraints eased. The lift from roughly 3.8% to 4.4% stems from brownfield capacity upgrades, improved rail evacuation from bauxite belts, and rising alumina pulls from downstream rolling and foil capacity. Policy focus on mineral block auctions and port connectivity has reduced turnaround times and inventory costs. In my view, India’s trajectory benefits from captive power reliability and process yield gains that narrow cost gaps with regional peers, reinforcing a positive multi-year operating outlook.

France is expected to post a CAGR of 3.7% in 2025–2035, modestly above the 3.5% global guide. During 2020–2024, growth was about 3.2% as refineries prioritized maintenance catch-up and energy contracting. The step to 3.7% is tied to reliability programs, heat-recovery integrations, and stable pulls from aerospace and automotive aluminum users. Contracted imports of bauxite and caustic soda improved planning, while residue handling upgrades reduced downtime. My take is that disciplined OPEX control and steady downstream offtake keep utilization firmer than in the prior period, nudging CAGR higher without aggressive greenfield risk.

The United Kingdom is projected to record a CAGR of 3.3% for 2025–2035, just under the global 3.5%. During 2020–2024, CAGR was near 2.9% as investment favored maintenance and supply diversification rather than capacity growth. The lift from about 2.9% to 3.3% is driven by improved import logistics, long-term tolling arrangements, and incremental efficiency upgrades that trimmed energy intensity. Stronger pulls from can-sheet and extrusion users stabilize alumina flows. In my view, the UK advances through reliability and trade optionality rather than scale, which still raises the growth rate versus the earlier period.

The United States is anticipated to grow at a CAGR of 3.0% for 2025–2035, below the 3.5% world pace. During 2020–2024, CAGR was about 2.6% as refineries contended with higher energy costs and uneven bauxite supply. The shift to 3.0% reflects targeted debottlenecking, better residue handling, and firm demand from transportation and construction aluminum producers. Import strategies and regional partnerships have reduced feed volatility, while process control upgrades improved caustic recovery and calcination efficiency. My assessment is that growth remains steady but conservative, with performance gains lifting CAGR from the earlier period despite cost headwinds.

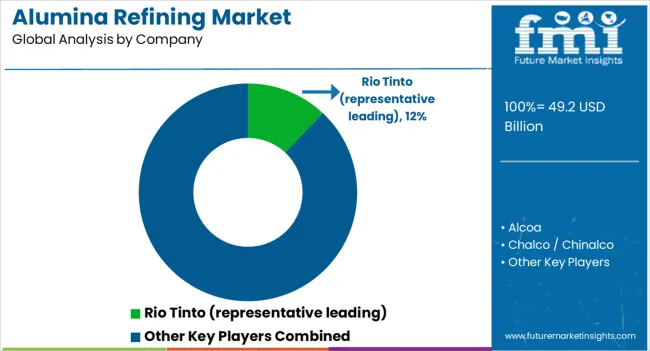

The alumina refining market is characterized by the presence of several global leaders alongside major regional producers, including Rio Tinto, Alcoa, Chalco/Chinalco, Rusal, Hindalco, South32, and Norsk Hydro. These companies are engaged in intense competition, focusing on operational efficiency, secure access to high-quality bauxite feedstock, cost optimization, and seamless integration with downstream aluminum production to maintain competitiveness. Rio Tinto holds a prominent position with highly integrated bauxite-to-alumina operations, featuring large-capacity refineries and long-term supply agreements that ensure consistent feedstock availability. Alcoa emphasizes proprietary refining technologies that enhance caustic soda recovery, improve energy efficiency, and support both domestic and international sales.

Chalco and Chinalco dominate the Chinese market with large-scale production facilities, leveraging state-led infrastructure projects and consistent bauxite procurement strategies to sustain output levels. Rusal and Hindalco implement strategic debottlenecking, power management, and process enhancements to improve throughput and reduce costs. South32 and Norsk Hydro focus on operational flexibility, process optimization, and integration with aluminum smelters to strengthen value chains. Competitive strategies across the sector include mergers and acquisitions for resource consolidation, efficiency-oriented capital expenditure, and securing long-term bauxite contracts to mitigate price volatility. Future success in alumina refining will depend on maintaining cost leadership, ensuring process reliability, and safeguarding raw material supply in a market sensitive to fluctuations in global aluminum demand, making operational excellence and strategic planning essential for sustainable growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 49.2 Billion |

| Refining Process Type | Bayer process, Combined bayer-sinter process, and Other alternative processes |

| Grade | Smelter grade alumina (SGA), Chemical grade alumina (CGA), Catalyst-grade alumina, Abrasive-grade alumina, Refractory-grade alumina, and High-purity alumina (HPA) |

| Application | Primary aluminum production, Ceramics & refractories, Catalysts & adsorbents, Glass manufacturing, Abrasives, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rio Tinto (representative leading), Alcoa, Chalco / Chinalco, Rusal, Hindalco, South32, and Norsk Hydro |

| Additional Attributes | Dollar sales, share by country and region, capacity utilization rates, production costs, bauxite supply security, energy expenses, downstream aluminum integration, technological efficiency, regulatory compliance, and competitive positioning. |

The global alumina refining market is estimated to be valued at USD 49.2 billion in 2025.

The market size for the alumina refining market is projected to reach USD 69.3 billion by 2035.

The alumina refining market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in alumina refining market are bayer process, combined bayer-sinter process and other alternative processes.

In terms of grade, smelter grade alumina (SGA) segment to command 85.0% share in the alumina refining market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alumina Market Size and Share Forecast Outlook 2025 to 2035

Alumina Trihydrate Market is segmented by end user from 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Alumina Market Growth - Trends & Forecast 2025 to 2035

USA and Canada Alumina Market Analysis and Insights for 2025 to 2035

Refining Additives Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Anode Refining Furnace Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA