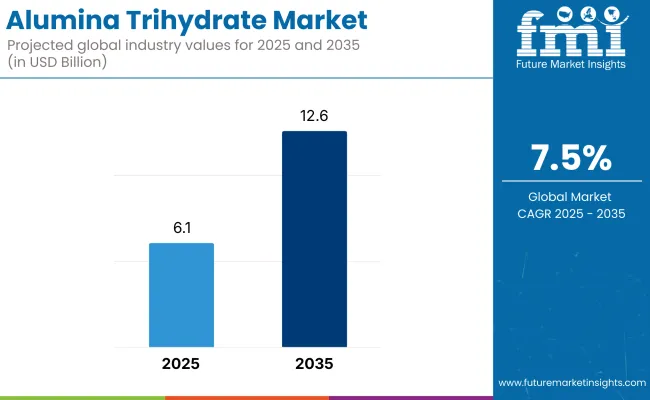

The alumina trihydrate market is expected to grow from USD 6.1 billion in 2025 to USD 12.6 billion by 2035. The market is poised to expand at a robust 7.5% CAGR during the forecast period. Demand for alumina trihydrate (ATH) is accelerating across multiple industries, driven by its dual function as a flame retardant and filler.

The shift toward halogen-free flame retardants, especially in electrical and electronic applications, has become a pivotal growth engine. As governments enforce stricter fire safety norms, ATH is being increasingly adopted in wire insulation, plastics, and composite materials. Asia-Pacific remains the largest consumer, owing to expanding manufacturing sectors, infrastructure investments, and growing awareness about non-toxic fire safety solutions.

Additionally, regulatory support is reinforcing market momentum. Environmental bodies such as the USA Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) under REACH are actively discouraging the use of halogen-based flame retardants, creating a favorable policy environment for ATH.

New building codes and safety regulations like NFPA 70 and EN 13501 are mandating the use of flame-resistant materials in construction, cable manufacturing, and electronics. Furthermore, ATH is gaining traction in water treatment applications due to its effectiveness in phosphate removal and compatibility with eco-friendly filtration systems. Its widespread usage in paints, coatings, and adhesives also contributes to steady demand, particularly in automotive and construction sectors.

The market is also being shaped by strategic investments and innovation. Manufacturers are investing in backward integration and increasing production capacity to stabilize costs and ensure reliable supply of raw materials. Forward-looking applications in advanced composites, thermal insulation, and electric vehicle components are expected to further expand ATH’s role in sustainable material science.

As emerging economies in Southeast Asia, the Middle East, and Latin America implement stricter environmental and safety standards, regional demand for alumina trihydrate is likely to grow rapidly. Collaborative efforts between chemical producers and end-use sectors are expected to result in enhanced product customization and increased market penetration across high-growth industries.

The market is segmented based on end use and region. By end use, the market is categorized into plastics, paper, paints and coatings, adhesives, chemicals, and pharmaceuticals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The plastics segment is projected to be the fastest-growing in the alumina trihydrate market, expanding at a CAGR of 6.2% from 2025 to 2035. This growth is fueled by increasing demand for flame-retardant materials across electrical, electronics, automotive, and construction sectors.

Alumina trihydrate (ATH) serves as a non-toxic, halogen-free flame retardant and smoke suppressant, making it a preferred additive in polyolefins, PVC, and engineered plastics. Its cost-effectiveness, low abrasiveness, and environmental safety make it ideal for applications that require stringent fire safety compliance. The rise in building codes and electrical safety norms, particularly in North America, Europe, and parts of Asia, is accelerating its use in insulation, wiring, and appliance housings.

The paints and coatings segment remains a major consumer, driven by the compound’s role as an extender pigment and rheology modifier. ATH improves whiteness, gloss control, and anti-corrosive properties in coatings. Paper continues to represent a mature market, where ATH is used as a filler and coating pigment.

Adhesives, chemicals, and pharmaceuticals segments consume smaller volumes, often in niche or specialty formulations, such as controlled-release drug tablets or polymer emulsions. While these areas remain steady, their growth lags behind the robust expansion seen in flame-retardant plastic applications.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Plastics | 6.2% |

Challenges

Regulatory compliance is one of the key problems facing the alumina trihydrate market. Governments all over the world are imposing tough environmental and safety regulations, particularly on flame retardants, which compels manufacturers to incur a lot on research and development. Although these regulations promote sustainability, they also inflate production costs for manufacturers. Another key problem is raw material price volatility.

Alumina trihydrate is extracted from bauxite, and fluctuation in the supply of bauxite and prices can impact the production cost, thus leaving uncertainty for the producers in maintaining profitable margins. Secondly, magnesium hydroxide and calcium carbonate are competing against ATH, inhibiting its market share in certain applications.

Opportunities

Despite these challenges, the alumina trihydrate market presents significant opportunities for growth. The global need for halogen-free flame retardants is driving the demand for ATH as a greener and safer alternative. These days, governments and industries are becoming more focused on sustainability, and due to ATH's fire-resistance characteristics and low ecological footprint, ATH is the go-to choice.

Another potential area for growth is the growing electric vehicle (EV) industry. With ongoing production of EVs, demand is also growing for flame retardants in battery housings, electrical insulation, and automotive components. ATH's role to provide fire protection without performance loss makes it a critical material for the emerging EV industry. Applications in water treatment are also gaining traction, with more municipalities and industries recognizing the necessity for effective wastewater treatment.

Utilization of alumina trihydrate for acid waste neutralization and improving water quality has the potential to generate gigantic demand in this segment. Growing economies, particularly in Asia, Latin America, and Africa, represent enormous untapped potential as these nations face expanding industrialization and infrastructure growth.

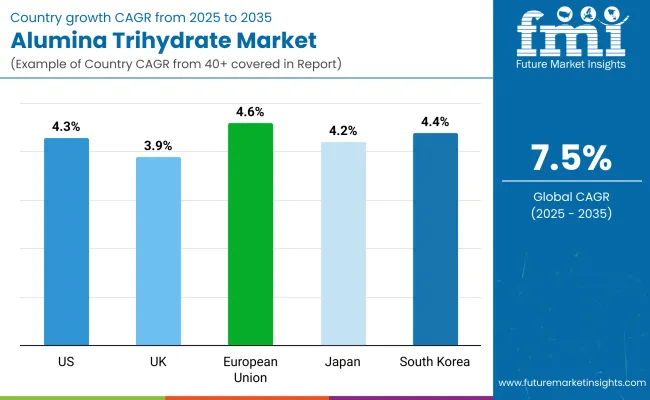

United States alumina trihydrate market is gradually growing with increasing uses in plastics, flame retardants, building, and drugs. With the reason that ATH is nontoxic and environmental friendly against halogen-based flame retardants, ATH is extensively used in the electronics and electrical sector, particularly in cable and wire insulation, coatings, and circuit boards.

In addition, the construction and building industry is also a big customer of ATH on account of using it in paint, coatings, and composites to improve its fire resistance as well as endurance. The motor vehicle industry is also increasingly employing ATH-based components to develop fire-resistant, lighter interior components.

The stringent USA government fire safety norms, especially for commercial and residential buildings, are propelling the demand for ATH-based flame retardants in insulation and coating applications. In addition, increasing application in the pharmaceutical industry ATH is utilized as an excipient and antacid in drugs is propelling the market. Increased usage of green, sustainable materials is also compelling the demand for ATH-based applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

United Kingdom alumina trihydrate market is expanding due to high demand for flame-retardant materials, particularly in fire protection standards of buildings and industrial operations. The 2017 Grenfell Tower fire resulted in strict fire safety regulations, favoring ATH-based flame retardant paints, coatings, and composites in the building industry.

The high levels of environmental laws in the United Kingdom promote low-toxicity, eco-compatible materials, hence ATH is becoming increasingly popular among plastics, rubber, and polymer applications. Both the automobile industry and aerospace companies are increasingly making use of materials reinforced with ATH to provide resistance to fire as well as for light weighting needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The European market for alumina trihydrate is growing strongly, led by high fire safety standards, rising demand for eco-friendly material, and industrialization. EU REACH laws are instigating industries to wean themselves from harmful flame retardants, thereby inducing the mass use of ATH in building, electrical, and automotive industries.

They are Germany, France, and Italy at the cutting-edge of automotive technology, where ATH goes into fireproof composites and thermal insulation panels. The electronics sector is also moving toward fire-retardant polymers based on ATH to make electrical components safer.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan's alumina trihydrate industry is developing positively with the lead of technological development, better production, and rigorous demand from auto and electronics sectors. Electronic products' miniaturization is pushing manufacturers to come up with fire-resistant, high-performance polymers with the help of ATH.

Japan's stringent fire safety regulation has also favored the application of ATH-based coatings and insulation materials, especially in high-rise buildings, public infrastructure works, and electric vehicles (EVs). Japan's government's green chemistry and sustainability plan is also driving demand for non-toxic and halogen-free flame retardants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

South Korea’s alumina trihydrate market is growing at a rapid pace due to the expansion of the electronics industry, increasing adoption of smart materials, and the rising need for fire safety solutions in industrial settings. The country’s booming semiconductor industry is a major driver, as ATH is used in high-performance electronic coatings, heat-resistant polymers, and insulation materials.

South Korea’s construction sector is also adopting ATH-based materials for fireproof coatings, roofing solutions, and thermally stable composites. Additionally, the South Korean government’s environmental policies are pushing industries to use non-toxic, sustainable materials in consumer products and industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The alumina trihydrate (ATH) market is a dynamic and competitive sector, driven by increasing demand for flame retardants, fillers, and industrial applications. Key global players and regional manufacturers contribute to the market’s expansion by focusing on product innovation, sustainability, and cost-efficient solutions. Companies are investing in high-purity alumina production to cater to industries such as plastics, coatings, electronics, and construction materials.

Numerous companies hold a significant market share by contributing to technological advancements, cost-efficient production, and sustainability initiatives. These include:

The overall market size for Alumina Trihydrate Market was USD 6.1 Billion in 2025.

The Alumina Trihydrate Market is expected to reach USD 12.6 Billion in 2035.

The demand for acidity regulators is expected to grow as the food, beverage, and pharmaceutical industries seek effective pH control solutions. Their widespread use in processed foods, beverages, and personal care products is driving market expansion. Additionally, advancements in food preservation techniques and increasing consumer preference for clean-label ingredients are accelerating adoption.

The top 5 countries which drives the development of Alumina Trihydrate Market are USA, UK, Europe Union, Japan and South Korea.

Plastics, Paints and Coatings, Adhesives, and Pharmaceuticals to command significant share over the assessment period.

Table 01: Global Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 02: Global Market Value (US$ million) and Volume (Kilo Tons) Forecast by Region, 2023 to 2033

Table 03: North America Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 04: North America Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 05: Latin America Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 06: Latin America Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 07: Western Europe Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 08: Western Europe Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 09: Eastern Europe Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 10: Eastern Europe Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 11: Asia Pacific Excluding Japan Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 12: Asia Pacific Excluding Japan Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 13: Middle East and Africa Market Value (US$ million) and Volume (Kilo Tons) Forecast by Country, 2023 to 2033

Table 14: Middle East and Africa Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Table 15: Japan Market Value (US$ million) and Volume (Kilo Tons) Forecast by End-use Industry, 2023 to 2033

Figure 01: Global Market Value Share (%) by End-use, 2022

Figure 02: Global Market Volume and Value Forecast, 2023 to 2033

Figure 03: Global Market Value (US$ million), 2018 to 2022

Figure 04: Global Market Value (US$ million) and Y-o-Y Growth Forecast, 2018 to 2033

Figure 05: Global Market Volume (Kilo Tons) and Value Forecast (US$ million, 2023 to 2033

Figure 06: Global Market Absolute $ Opportunity Analysis, 2023 to 2033

Figure 07 Global Market Value Y-o-Y Growth Projections, 2023 to 2033

Figure 08: Global GDP Outlook (%)

Figure 09: World Population (in Bn)

Figure 10: Global Per Capita Income

Figure 11: Global Decorative Paints by Region – 2023E

Figure 12: Global Decorative Paints Value (US$ million) and Y-o-Y Growth (%), 2018 to 2023

Figure 13: Global Industry Value Added by Region

Figure 14: Prominent 10 Countries of Chemical Sales (2022), By Value

Figure 15: Global Chemical Sales Share (2022), By Region

Figure 16: Global Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 17: Global Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 18: Global Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 19: Global Market Absolute $ Opportunity (US$ million), by Plastics Industry Segment, 2023 to 2033

Figure 20: Global Market Absolute $ Opportunity (US$ million), by Paper Industry Segment, 2023 to 2033

Figure 21: Global Market Absolute $ Opportunity (US$ million), by Paints and Coatings Industry Segment, 2023 to 2033

Figure 22: Global Market Absolute $ Opportunity (US$ million), by Adhesives Industry Segment, 2023 to 2033

Figure 23: Global Market Absolute $ Opportunity (US$ million), by Chemicals Industry Segment, 2023 to 2033

Figure 24: Global Market Absolute $ Opportunity (US$ million), by Pharmaceuticals Industry Segment, 2023 to 2033

Figure 25: Global Market Absolute $ Opportunity (US$ million), by Others Segment, 2023 to 2033

Figure 26: Global Market: BPS Analysis by Region, 2023 to 2033

Figure 27: Global Market: Y-o-Y Growth Comparison by Region, 2023 to 2033

Figure 28: Global Market: Market Attractiveness by Region, 2023 to 2033

Figure 29: Global Market Absolute $ Opportunity (US$ million), by North America Region, 2023 to 2033

Figure 30: Global Market Absolute $ Opportunity (US$ million), by Latin America Region, 2023 to 2033

Figure 31: Global Market Absolute $ Opportunity (US$ million), by Western Europe Region, 2023 to 2033

Figure 32: Global Market Absolute $ Opportunity (US$ million), by Eastern Europe Region, 2023 to 2033

Figure 33: Global Market Absolute $ Opportunity (US$ million), by Asia Pacific Excluding Japan Region, 2023 to 2033

Figure 34: Global Market Absolute $ Opportunity (US$ million), by Middle East and Africa Region, 2023 to 2033

Figure 35: Global Market Absolute $ Opportunity (US$ million), by Japan Region, 2023 to 2033

Figure 36: North America Market: BPS Analysis by Country –2023 to 2033

Figure 37: North America Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 38: North America Market: Market Attractiveness by Country, 2023 to 2033

Figure 39: North America Market Absolute $ Opportunity (US$ million), by U.S. Country, 2023 to 2033

Figure 40: North America Market Absolute $ Opportunity (US$ million), by Canada Country, 2023 to 2033

Figure 41: North America Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 42: North America Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 43: North America Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 44: Latin America Market: BPS Analysis by Country –2023 to 2033

Figure 45: Latin America Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 46: Latin America Market: Market Attractiveness by Country, 2023 to 2033

Figure 47: Latin America Market Absolute $ Opportunity (US$ million), by Mexico Country, 2023 to 2033

Figure 48: Latin America Market Absolute $ Opportunity (US$ million), by Brazil Country, 2023 to 2033

Figure 49: Latin America Market Absolute $ Opportunity (US$ million), by Rest of Latin America, 2023 to 2033

Figure 50: Latin America Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 51: Latin America Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 52: Latin America Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 53: Western Europe Market: BPS Analysis by Country –2023 to 2033

Figure 54: Western Europe Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 55: Western Europe Market: Market Attractiveness by Country, 2023 to 2033

Figure 56: Western Europe Market Absolute $ Opportunity (US$ million), by Germany Country, 2023 to 2033

Figure 57: Western Europe Market Absolute $ Opportunity (US$ million), by Italy Country, 2023 to 2033

Figure 58: Western Europe Market Absolute $ Opportunity (US$ million), by France Country, 2023 to 2033

Figure 59: Western Europe Market Absolute $ Opportunity (US$ million), by Spain Country, 2023 to 2033

Figure 60: Western Europe Market Absolute $ Opportunity (US$ million), by U.K. Country, 2023 to 2033

Figure 61: Western Europe Market Absolute $ Opportunity (US$ million), by Rest of Western Europe, 2023 to 2033

Figure 62: Western Europe Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 63: Western Europe Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 64: Western Europe Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 65: Eastern Europe Market: BPS Analysis by Country –2023 to 2033

Figure 66: Eastern Europe Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 67: Eastern Europe Market: Market Attractiveness by Country, 2023 to 2033

Figure 68: Eastern Europe Market Absolute $ Opportunity (US$ million), by U.S. Country, 2023 to 2033

Figure 69: Eastern Europe Market Absolute $ Opportunity (US$ million), by Canada Country, 2023 to 2033

Figure 70: Eastern Europe Market Absolute $ Opportunity (US$ million), by Rest of Eastern Europe, 2023 to 2033

Figure 71: Eastern Europe Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 72: Eastern Europe Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 73: Eastern Europe Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 74: Asia Pacific Excluding Japan Market: BPS Analysis by Country –2023 to 2033

Figure 75: Asia Pacific Excluding Japan Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 76: Asia Pacific Excluding Japan Market: Market Attractiveness by Country, 2023 to 2033

Figure 77: Asia Pacific Excluding Japan Market Absolute $ Opportunity (US$ million), by China Country, 2023 to 2033

Figure 78: Asia Pacific Excluding Japan Market Absolute $ Opportunity (US$ million), by India Country, 2023 to 2033

Figure 79: Asia Pacific Excluding Japan Market Absolute $ Opportunity (US$ million), by Association of Southeast Asian Nations Country, 2023 to 2033

Figure 80: Asia Pacific Excluding Japan Market Absolute $ Opportunity (US$ million), by Australia and New Zealand Country, 2023 to 2033

Figure 81: Asia Pacific Excluding Japan Market Absolute $ Opportunity (US$ million), by Association of Southeast Asian Nations Country, 2023 to 2033

Figure 82: Asia Pacific Excluding Japan Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 83: Asia Pacific Excluding Japan Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 84: Asia Pacific Excluding Japan Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 85: Middle East and Africa Market: BPS Analysis by Country –2023 to 2033

Figure 86: Middle East and Africa Market: Y-o-Y Growth Comparison by Country, 2023 to 2033

Figure 87: Middle East and Africa Market: Market Attractiveness by Country, 2023 to 2033

Figure 88: Middle East and Africa Market Absolute $ Opportunity (US$ million), by Gulf Cooperation Council Country, 2023 to 2033

Figure 89: Middle East and Africa Market Absolute $ Opportunity (US$ million), by North Africa Country, 2023 to 2033

Figure 90: Middle East and Africa Market Absolute $ Opportunity (US$ million), by South Africa Country, 2023 to 2033

Figure 91: Middle East and Africa Market Absolute $ Opportunity (US$ million), by Türkiye Country, 2023 to 2033

Figure 92: Middle East and Africa Market Absolute $ Opportunity (US$ million), by South Rest of Middle East and Africa, 2023 to 2033

Figure 93: Middle East and Africa Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 94: Middle East and Africa Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 95: Middle East and Africa Market: Market Attractiveness by End-use Segment, 2023 to 2033

Figure 96: Japan Market: BPS Analysis by End-use Segment –2023 to 2033

Figure 97: Japan Market: Y-o-Y Growth Comparison by End-use Segment, 2023 to 2033

Figure 98: Japan Market: Market Attractiveness by End-use Segment, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alumina Refining Market Size and Share Forecast Outlook 2025 to 2035

Alumina Market Size and Share Forecast Outlook 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Alumina Market Growth - Trends & Forecast 2025 to 2035

USA and Canada Alumina Market Analysis and Insights for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA