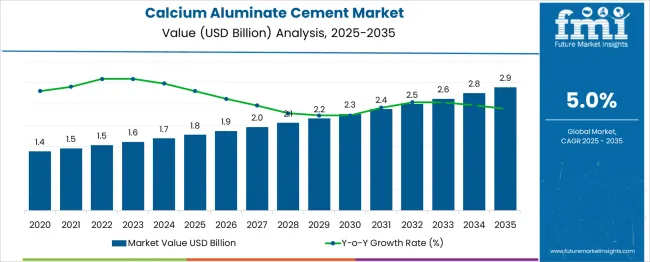

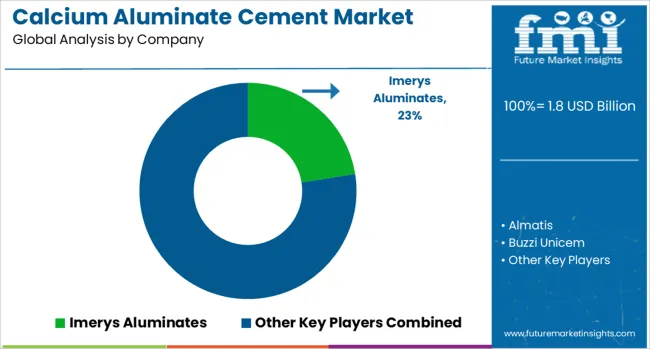

The calcium aluminate cement market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The growth trajectory is gradual, with annual additions ranging between USD 0.1 billion and USD 0.2 billion, indicating a consistent upward trend without acceleration surges or contractions.

The first half of the forecast period, from 2025 to 2030, contributes a total of USD 0.5 billion, while the second half, from 2030 to 2035, accounts for USD 0.6 billion, confirming steady incremental expansion. This growth pattern is closely tied to increasing use of calcium aluminate cement in high-performance construction materials, including refractory concretes, sewerage infrastructure, and corrosion-resistant lining systems.

Demand resilience is expected in regions undergoing wastewater system upgrades or where resistance to chemical attack is prioritized in construction codes. Market stability is also maintained by its established industrial niche and limited material substitution. Use in castables and high-temperature environments remains the largest segment, driven by metallurgical and petrochemical plant refurbishments.

The market does not exhibit elasticity to economic cycles, which positions it as a consistent performer across varying capital investment phases. This is characteristic of input materials tied to mandated public infrastructure and heavy industrial maintenance cycles.

| Metric | Value |

|---|---|

| Calcium Aluminate Cement Market Estimated Value in (2025 E) | USD 1.8 billion |

| Calcium Aluminate Cement Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The market is expanding as demand rises for high-performance materials in construction and refractory applications. Approximately 45% of global usage is concentrated in refractory linings for furnaces, kilns, and incinerators, where thermal stability and rapid strength gain are critical. Around 30% of adoption is seen in self-leveling flooring, corrosion-resistant mortars, and fast-track structural repairs.

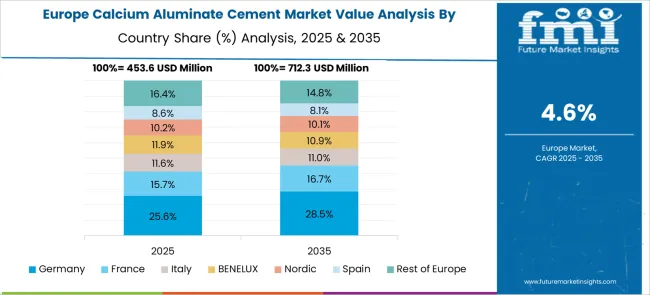

Asia Pacific accounts for nearly half of total consumption, supported by industrial development and infrastructure growth. Europe follows with strong uptake in wastewater systems and low-shrinkage grouts. New blends with reduced clinker content and lower emissions are gaining preference in regions prioritizing environmental compliance. Infrastructure development accounts for nearly 33% of demand, driven by environments requiring rapid hardening and resistance to sulfate attack.

Refractory manufacturing holds about 24%, where this cement is used in castables and lining materials exposed to high temperatures. Oil and gas operations contribute close to 18%, applying the material in cement slurries for casing repairs and zonal isolation. Around 16% is tied to municipal utilities, especially in pipelines and wastewater channels where durability and corrosion resistance are essential. The remaining 9% is attributed to industrial floors, precast structures, and repair works demanding early strength and long-term surface stability.

As highlighted in industry journals, investor presentations, and corporate press releases, the current market scenario reflects increased adoption of CAC in infrastructure projects where resistance to sulfate attack, high temperatures, and rapid setting times are required.

Companies have emphasized in their annual reports that stringent construction standards and the growing preference for sustainable, long-lasting materials are influencing purchasing decisions across both developed and emerging markets. Future opportunities are being shaped by advancements in manufacturing processes, innovations in blended cement formulations, and expanding applications in wastewater and refractory industries.

According to expert commentary in trade publications and technology news, CAC's ability to reduce maintenance costs and extend service life is further supporting its relevance in modern construction practices. These dynamics collectively underscore the positive outlook and potential for continued expansion in the global CAC market.

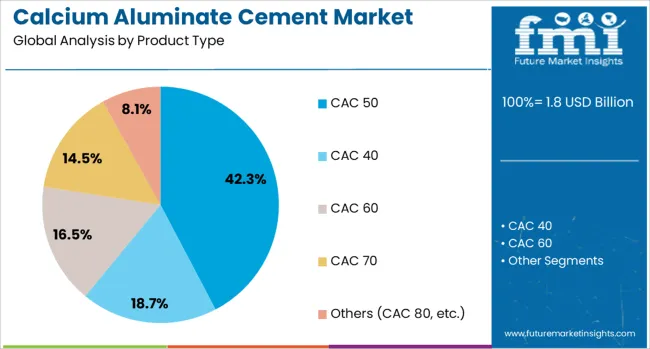

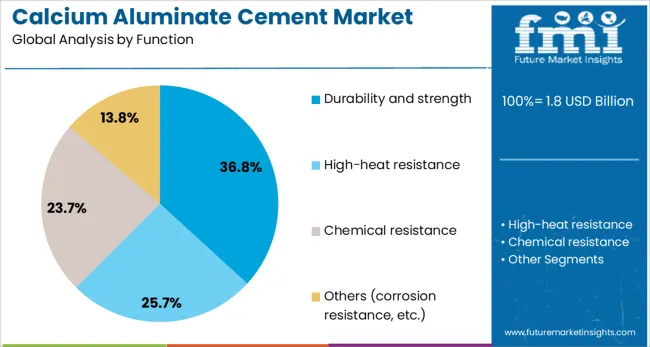

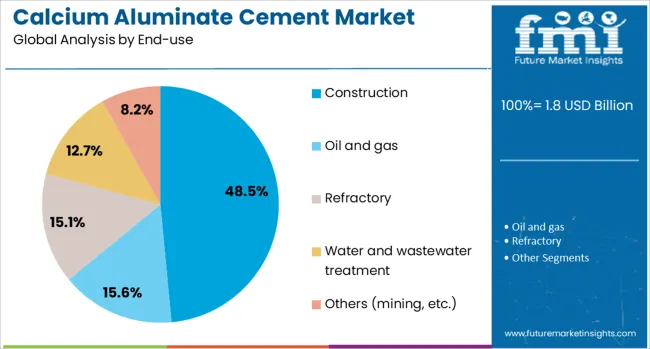

The calcium aluminate cement market is segmented by product type, function, end-use, distribution channel, and geographic regions. The calcium aluminate cement market is divided by product type into CAC 50, CAC 40, CAC 60, CAC 70, and Others (CAC 80, etc.). In terms of the function of the calcium aluminate cement market, it is classified into Durability and strength, High-heat resistance, Chemical resistance, and Others (corrosion resistance, etc.). The calcium aluminate cement market is segmented based on end-use into Construction, Oil and gas, Refractory, Water and wastewater treatment, and Others (mining, etc.). The distribution channel of the calcium aluminate cement market is segmented into Direct and Indirect. Regionally, the calcium aluminate cement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CAC 50 product type is projected to account for 42.3% of the calcium aluminate cement market revenue share in 2025, making it the leading product segment. This dominance has been attributed to its optimal balance of setting time, strength development, and chemical resistance, as documented in technical datasheets and company announcements.

It has been observed in industry publications that CAC 50 is highly preferred in construction and refractory applications due to its consistent quality and versatility. The product’s ability to perform effectively under harsh environmental conditions and its compatibility with diverse aggregates have reinforced its adoption.

Investor briefings and press releases have indicated that the segment’s prominence is supported by its availability in global markets, robust supply chains, and cost-effectiveness relative to higher-grade variants. These factors, coupled with regulatory acceptance and proven field performance, have contributed to its sustained leadership in the product category.

The durability and strength function segment is expected to command 36.8% of the market revenue share in 2025, positioning it as the foremost functional segment. This leadership has been supported by growing awareness of the long-term benefits of using CAC to enhance structural resilience and performance, as noted in engineering journals and corporate statements.

The segment has gained traction as infrastructure owners and contractors prioritize materials that can withstand aggressive environments while minimizing lifecycle costs. Product innovations highlighted in manufacturer updates have improved the ability of CAC to deliver superior mechanical properties and durability even in chemically corrosive or high-temperature settings.

Furthermore, its contribution to extending service life and reducing repair frequencies aligns with sustainability goals and regulatory expectations. These drivers have positioned durability and strength as the most valued functions in CAC applications, ensuring its continued prominence in the market.

The construction end-use segment is forecasted to hold 48.5% of the calcium aluminate cement market revenue share in 2025, making it the largest segment by end-use. This dominance has been driven by widespread adoption of CAC in building and infrastructure projects requiring high strength, rapid setting, and resistance to extreme conditions, as described in trade publications and company disclosures.

It has been reported that the material’s suitability for foundations, bridges, tunnels, and sewage systems has made it indispensable in construction applications. Investor reports have highlighted that ongoing urbanization, increasing investment in resilient infrastructure, and the need to meet stricter environmental standards have reinforced the preference for CAC in this sector.

The ability of CAC to improve construction timelines, reduce maintenance needs, and comply with sustainability practices has also strengthened its appeal. These factors collectively have secured the construction segment’s leading position in the market.

The calcium aluminate cement market has grown steadily, supplied by demand within refractory industrial linings, rapid-strength structural applications, and water treatment use cases. Approximately 42 % of CAC is used in high-temperature steel and glass facilities, while 29 % supports flowable patch repair and marine-grade grouts. Rapid strength development and chemical resistance make CAC preferred over Portland cement in cold-weather construction zones.

Rapid setting and high early strength have enabled CAC to capture 25 % of structural repair applications in industrial and municipal projects. Its resistance to acids and sulfates has supported use in over 30 % of water treatment plants and waste containment structures. CAC products have been used in emergency repair workflows where curing speed reduces down‑time. In petrochemical and wastewater plants, its resistance to sulfate attack and high-pH corrosion has been critical. Project planners have increasingly preferred CAC for underwater grouting and managed washout prevention in submerged conditions.

The raw materials and energy intensity required for CAC production have made it approximately 27 % more expensive per ton than Portland cement. Limited global production capacity and inconsistent supply networks have caused delivery lead‑times exceeding 6–8 weeks in some regions. Custom chemical-grade blends for specific pH or heat tolerance have added to cost complexity. In regions without local manufacturing, logistics and import tariffs have further constrained adoption. These economic factors have limited use in cost-sensitive infrastructure programs and delayed uptake in small-scale construction markets.

Growth opportunities are found in hybrid blends combining CAC with calcium sulfoaluminate or blast-furnace slag, used in low-carbon mortar systems. These blends have captured 19 % of new repair mortar introductions in restoration and urban infrastructure projects. Tailored CIC (cold-weather injection mixes) and thermal barrier formulations have supported maintenance in pipelines and heat-stressed zones. Adoption in phosphate and aluminum production facilities has increased, where CAC infusion supports slag flow control and refractor lining lifespans. The blending potential opens pathways for lower-carbon product variants meeting evolving sustainability codes.

Pre-packaged on-site mixing units designed for controlled water-to-cement ratios have been used in 33 % of recent industrial repair contracts. Digital sensor-enabled dispensing systems now appear in 28 % of facility maintenance workflows, ensuring consistent mixture properties. Batch tracking and purity verification have been embedded in over 40 % of supply chains for high-grade CAC used in chemical sectors. These digital tools have enabled formulators to reduce waste, improve structural outcomes, and align with audit requirements. Mobile dashboards are increasingly used to monitor cure profile, pH stability, and setting temperature in real time.

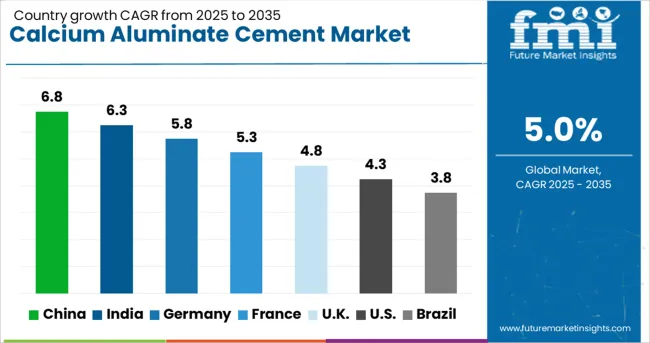

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global market is projected to grow at a CAGR of 5% from 2025 to 2035. China is positioned at 6.8%, outperforming the global average by 1.8%, primarily due to increased production of monolithic refractories for steel and glass manufacturing. India follows with 6.3%, where demand is supported by expansion in infrastructure and wastewater treatment facilities. Germany (OECD) registers 5.8%, 0.8% above the global rate, reflecting consistent usage in high-performance construction materials.

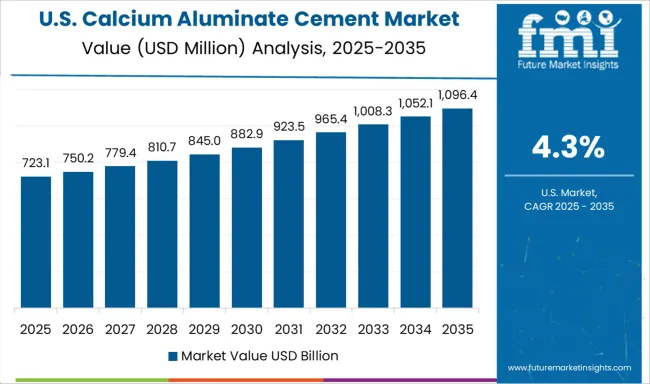

The United Kingdom (OECD) stands at 4.8%, slightly below the benchmark, while the United States (OECD) trails at 4.3%, held back by limited penetration outside specialized industrial segments. The report includes a detailed analysis of 40+ countries, with the top countries shared as a reference.

China accounted for 6.8% of global demand in 2025. Applications in infrastructure and high-temperature industrial flooring expanded with increased use of high-alumina cement compositions. Cement producers adopted synthetic monocalcium aluminate blends to improve early strength and chemical durability. Product integration was prioritized in precast refractory tiles and pipeline coatings for the power and metallurgy sectors.

India captured 6.3% of the global share in 2025. High-alumina cement consumption increased in wastewater treatment facilities and battery manufacturing sites due to resistance to chemical degradation. Infrastructure developers adopted CACs in underpasses, drainage, and flyover joints to reduce curing time and early carbonation issues. Domestic suppliers offered modified low-fines CAC blends for rapid urban construction cycles.

Germany held 5.8% of global consumption in 2025. Advanced heat-resistant binder technologies shaped product usage across blast furnaces, incineration plants, and biomass power units. Blends with high CA and CA₂ phases were formulated to support low-alkali, high-performance castables. Emphasis was placed on consistency in thermal expansion control across industrial furnaces.

The United Kingdom accounted for 4.8% of global demand in 2025. Product demand was led by the need for fast-setting, chemically resistant mortars in heritage building repairs and tunnel reinforcement. Restoration-grade CAC mixes were utilized for compatibility with Victorian-era stone and brick substrates. Prebagged products with CAC were favored for controlled curing and weather tolerance.

The United States accounted for 4.3% of global market share in 2025. Applications in wastewater pipelines, steel foundries, and fire-retardant building systems expanded CAC deployment. Resistance to biogenic corrosion and sulfate attack supported the inclusion of CACs in precast sewer modules. USA-based firms developed CAC-based castables with enhanced abrasion resistance for heavy-duty industrial flooring.

The calcium aluminate cement (CAC) market includes manufacturers supplying high-performance binders for refractory, construction, and infrastructure applications requiring rapid setting, chemical resistance, and durability under extreme conditions. Imerys Aluminates, through its Kerneos division, leads with specialty CAC grades tailored for monolithic refractories, wastewater systems, and structural repair.

Almatis delivers high-alumina cement products with consistent mineralogy and controlled setting profiles, used extensively in castables and self-flowing formulations. Calucem offers CAC blends for fast-track construction, grouting, and marine repairs, exporting across Europe, Asia, and the Americas. Buzzi Unicem manufactures CAC-based materials integrated into its specialty concrete portfolio, suitable for aggressive environments and rapid deployment.

Cementos Molins and Cementos Portland Valderrivas support regional demand in Southern Europe with mid-range CAC products designed for corrosion resistance and thermal durability. Holcim Group supplies engineered CAC formulations through its global distribution network, serving construction chemicals and high-durability mortar producers. Shree Cement and JK Cement provide locally manufactured CAC for the Indian infrastructure and repair segments.

Siam Cement Group and Taiwan Cement Corporation cater to Southeast Asian markets, emphasizing fast-curing materials for sewer systems, pre-cast components, and industrial flooring. Rheinfelden Distler delivers customizable CAC solutions for precise setting control in advanced formulations. Union Cement Company and Sinai Cement address Gulf and North African demand, supporting high-sulfate, rapid-hardening projects across coastal and desert environments.

Leading players such as Almatis, Kerneos, Calucem (Cementos Molins), CUMI, RWC, Zhengzhou Dengfeng, Elfusa, and Caltra Nederland are executing strategic expansions, backward integration, and acquisitions to scale capacity and streamline alumina sourcing.

For instance, Calucem invested in a new USA manufacturing plant, and Almatis trialed a pilot CA50 facility with low emissions. Kerneos boosted R&D into eco-refractory formulations, while CUMI and Zhengzhou prioritize regional supply to Asia‑Pacific and Middle East markets. Product innovation centers on high-alumina grades like CA60/70/80, hybrid slag composites, faster-setting mixes for cold climates, and preblended refractory castables, supporting sustainable and high-performance applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product Type | CAC 50, CAC 40, CAC 60, CAC 70, and Others (CAC 80, etc.) |

| Function | Durability and strength, High-heat resistance, Chemical resistance, and Others (corrosion resistance, etc.) |

| End-use | Construction, Oil and gas, Refractory, Water and wastewater treatment, and Others (mining, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Imerys Aluminates, Almatis, Buzzi Unicem, Calucem, Cementos Molins, Cementos Portland Valderrivas, Holcim Group, JK Cement, Kerneos, Rheinfelden Distler, Shree Cement, Siam Cement Group, Sinai Cement, Taiwan Cement Corporation, and Union Cement Company |

| Additional Attributes | Dollar sales by grade (CAC 40–80) and application (refractories, rapid repairs, wastewater systems), demand from metallurgy and infrastructure, led by Asia-Pacific with North America catching up, innovation in fast-setting blends and low-carbon cement alternatives. |

The global calcium aluminate cement market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the calcium aluminate cement market is projected to reach USD 2.9 billion by 2035.

The calcium aluminate cement market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in calcium aluminate cement market are cac 50, cac 40, cac 60, cac 70 and others (cac 80, etc.).

In terms of function, durability and strength segment to command 36.8% share in the calcium aluminate cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA