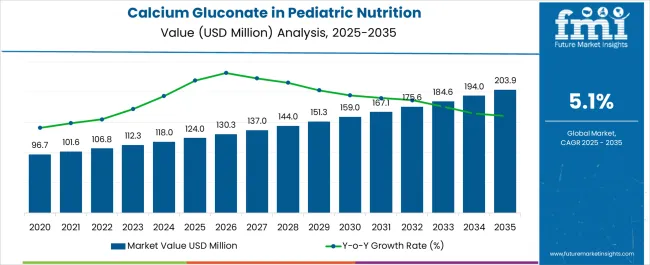

Sales of calcium gluconate in pediatric nutrition are estimated at USD 124.0 million in 2025, with projections indicating a rise to USD 203.8 million by 2035, reflecting a CAGR of approximately 5.1% over the forecast period. This growth reflects both a broadening consumer base and increased per capita consumption in key developing nations. The rise in demand is linked to shifting nutritional awareness, growing importance of childhood bone development, and evolving fortification trends. By 2025, per capita consumption in leading countries such as India, China, and Brazil averages between varying levels, with projections reaching higher consumption by 2035. India leads among developing nations, expected to generate significant calcium gluconate demand by 2035, followed by China, Brazil, Indonesia, and established markets including the USA.

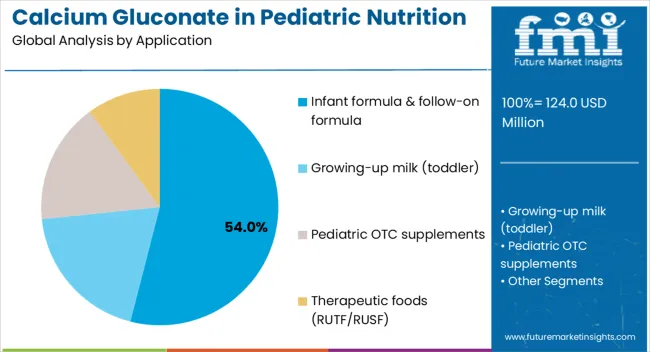

The largest contribution to demand continues to come from infant formula and follow-on formula applications, which are expected to account for 54% of total sales in 2025, owing to strong regulatory support, extended shelf presence, and manufacturer adoption. By delivery format, fortification premix powders represent the dominant format, responsible for 45% of all sales, while syrups and drops are expanding rapidly.

Consumer adoption is particularly concentrated among middle-class families and health-conscious parents, with income levels and urbanization emerging as significant drivers of demand. While price remains a consideration, the average cost premium for calcium-fortified products has become more accessible. Continued improvements in manufacturing scale and premium blend offerings are expected to accelerate adoption across mid-income households. Regional disparities persist, but per capita demand in high-growth Asian countries is narrowing gaps with established Western pediatric nutrition hubs.

The rising need for safe and effective calcium supplementation in infants and children is driving growth in the calcium gluconate segment within pediatric nutrition. This compound offers high solubility, gentle absorption, and reliable bioavailability compared to other calcium salts, making it suitable for delicate pediatric use. Increased clinical use in managing neonatal hypocalcemia, preterm bone health, and growth support has strengthened its role in hospital and home-care nutrition.

Calcium gluconate’s adaptability across oral, liquid, and IV formulations supports flexible dosing and safe administration in children. Its compatibility with pediatric parenteral nutrition (PN) and fortified foods makes it valuable for both therapeutic and preventive applications. Growing awareness of calcium and vitamin D deficiencies, demand for fortified baby foods and supplements, and the trend toward organic, child-friendly formulations are further fueling adoption. Broader access through e-commerce and healthcare channels, coupled with alignment to nutritional safety standards, provides competitive advantages for businesses meeting rising parental and clinical demand.

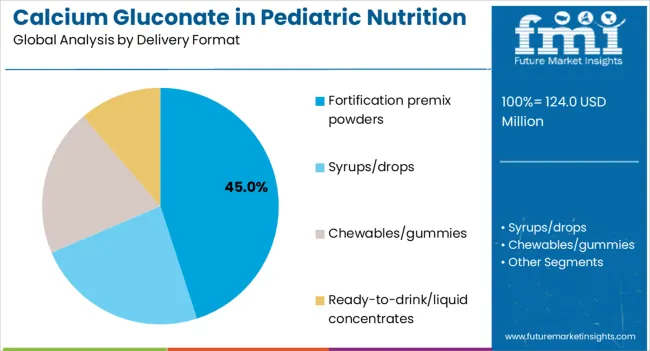

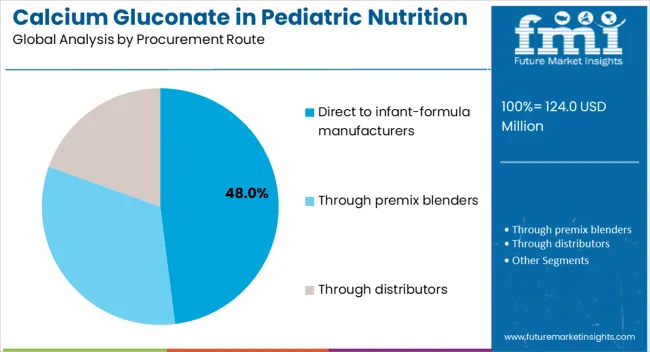

The calcium gluconate in pediatric nutrition segment is classified across several categories. By application, the key areas include infant formula and follow-on formula, growing-up milk for toddlers, pediatric OTC supplements, and therapeutic foods including RUTF/RUSF. By delivery format, the segment spans fortification premix powders, syrups and drops, chewables and gummies, and ready-to-drink liquid concentrates. By procurement route, formulations include direct sales to infant formula manufacturers, distribution through premix blenders, and sales through distributors. By consumer profile, the segment covers health-conscious parents, pediatric healthcare providers, formula manufacturers, and supplement retailers. By region, countries such as India, China, Brazil, Indonesia, and the USA are included, along with coverage across developed and developing nations. By application intensity, key areas analyzed include routine fortification, therapeutic supplementation, premium formulation, standard formulation, and specialty nutrition.

Infant formula and follow-on formula applications are projected to dominate sales in 2025, supported by regulatory requirements, nutritional guidelines, and manufacturer adoption. Other applications such as growing-up milk, OTC supplements, and therapeutic foods are growing steadily, each serving distinct nutritional needs.

Calcium gluconate in pediatric nutrition is delivered through various formats designed to match manufacturing requirements and consumer preferences. Fortification premix powders are expected to remain the primary format in 2025, followed by syrups and drops for direct consumption.

Calcium gluconate procurement in pediatric nutrition follows established industrial channels, reflecting the ingredient's role in regulated food manufacturing. Direct sales to infant formula manufacturers represent the largest procurement route, followed by premix blenders and distributor networks.

Calcium gluconate is increasingly used in pediatric nutrition as calcium deficiencies and rickets remain prevalent concerns in many regions. Parents, healthcare providers, and governments are prioritizing optimal bone and teeth development in infants and children, driving fortified formulas and pediatric supplements. Calcium gluconate offers high bioavailability, safety, and compatibility with liquid and powdered formulations, making it a preferred source of supplementation in infant formula, oral syrups, and parenteral nutrition. Regulatory endorsements from organizations such as WHO, FDA, and EFSA support its inclusion in infant nutrition guidelines. Growing demand for fortified dairy, cereals, and ready-to-drink pediatric nutrition products is further expanding market penetration.

Despite its benefits, calcium gluconate faces cost and formulation hurdles compared to alternative calcium salts like calcium carbonate or calcium citrate. It has lower elemental calcium content (9% vs. 40% in carbonate), requiring higher dosages that can raise product costs and complicate formulation stability. Shelf-life, taste masking, and solubility in complex pediatric formulations pose additional challenges. On the supply side, fluctuations in raw material availability, stringent quality standards, and complex regulatory approvals restrict faster adoption, particularly in developing economies. In emerging markets, price-sensitive consumers and reliance on low-cost alternatives slow the uptake of premium pediatric products containing calcium gluconate.

The market is trending toward fortified and functional foods (snack bars, fortified milk powders, flavored waters) that include calcium gluconate for child nutrition beyond traditional formulas. With the rise of plant-based and hypoallergenic pediatric nutrition, calcium gluconate is being incorporated into dairy alternatives and vegan-friendly infant formulas. Advances in microencapsulation and nanotechnology are improving palatability, stability, and bioavailability. Digital health platforms and AI-driven nutrition trackers are influencing parental purchasing decisions, recommending personalized supplementation plans based on growth patterns and deficiencies. Governments and NGOs promoting childhood nutrition programs in developing countries also present opportunities for expanded usage. These innovations position calcium gluconate as a strategic component in modern pediatric nutrition portfolios.

Calcium gluconate demand will not grow uniformly across all countries. Rising birth rates and faster per-capita adoption in developing nations give India and Indonesia a measurable edge, while mature markets expand more steadily from higher bases. The table below shows the compound annual growth rate (CAGR) each of the top countries is expected to record between 2025 and 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

| China | 5.6% |

| Indonesia | 5.2% |

| Brazil | 4.7% |

| USA | 3.8% |

India represents the fastest-growing consumption base for calcium gluconate in pediatric nutrition, driven by rapid expansion in organized pediatric nutrition and increasing adoption of fortified milk foods. The country's large birth cohort, growing middle-class purchasing power, and increasing awareness of infant nutrition create strong fundamentals for sustained growth. Government initiatives promoting nutritional fortification and the expansion of organized retail channels support broader access to calcium-fortified products.

The infant formula segment benefits from urbanization trends and working mothers seeking convenient nutrition solutions. Premium formula brands are increasingly incorporating calcium gluconate due to its superior bioavailability compared to alternative calcium sources. Growing-up milk products for toddlers show particularly strong adoption in tier-1 and tier-2 cities, where parents are willing to invest in nutritional supplements.

Manufacturing capacity within India is expanding, with both domestic and international companies establishing local production facilities to serve the growing demand. The premix blending sector is developing rapidly, supporting smaller regional brands that require specialized nutritional formulations. Regulatory frameworks are becoming more supportive of fortification initiatives, creating an enabling environment for sustained growth.

China maintains strong growth in calcium gluconate consumption within pediatric nutrition, supported by its large infant and toddler population base and increasing fortification intensity in premium formula products. Despite declining birth rates, the focus on single-child nutrition quality drives higher per-capita spending on premium formulations. Urban families demonstrate strong willingness to invest in calcium-fortified products, viewing bone development as a critical health priority.

The premium formula segment dominates calcium gluconate usage, with international and domestic brands competing on nutritional superiority. Follow-on formula and growing-up milk categories show robust adoption, particularly in first and second-tier cities where pediatric healthcare awareness is highest. E-commerce platforms facilitate access to specialized nutritional products, supporting growth in previously underserved regions.

Manufacturing infrastructure in China supports both domestic consumption and export production, with several facilities meeting international quality standards. The premix blending capacity serves a diverse range of formula manufacturers, from large multinational companies to specialized regional brands. Regulatory standards for infant nutrition continue to evolve, generally supporting higher fortification levels and stricter quality requirements.

Brazil demonstrates solid growth in calcium gluconate demand within pediatric nutrition, driven by an expanding middle class and increasing penetration of pediatric supplements in retail chains. The country's growing awareness of childhood nutrition, combined with improving economic conditions in key regions, supports sustained demand growth. Urban families increasingly prioritize nutritional quality, creating opportunities for calcium-fortified products across multiple categories.

The growing-up milk segment shows particularly strong adoption, with Brazilian families embracing toddler nutrition as an extension of infant care. Pediatric OTC supplements gain traction through pharmacy channels, supported by healthcare professional recommendations and parental awareness campaigns. The therapeutic foods segment serves both government nutrition programs and private healthcare applications.

Local manufacturing capacity is developing to serve domestic demand, with several international nutrition companies establishing or expanding Brazilian operations. The distribution network for nutritional ingredients is becoming more sophisticated, supporting both large-scale formula production and smaller specialized supplement manufacturers. Regulatory frameworks support fortification initiatives while maintaining quality standards appropriate for pediatric applications.

Indonesia benefits from a high birth cohort and expanding local formula manufacturing capacity, driving strong growth in calcium gluconate consumption for pediatric nutrition. The country's young population demographic, combined with improving healthcare awareness and rising disposable income, creates favorable conditions for nutritional supplement adoption. Urban areas lead consumption growth, with rural areas showing increasing awareness and gradual adoption.

Infant formula manufacturing within Indonesia is scaling up rapidly, with both domestic and international companies investing in local production facilities. This local manufacturing trend reduces import dependency and makes calcium-fortified products more accessible to middle-income families. Growing-up milk products are gaining acceptance as parents become more aware of toddler nutritional requirements.

The healthcare professional network increasingly recommends calcium supplementation for children, particularly in regions where dietary calcium intake may be insufficient. Retail pharmacy chains are expanding their pediatric nutrition sections, making calcium gluconate products more widely available. Traditional channels also play an important role in product distribution, particularly in smaller cities and rural areas.

The USA maintains steady growth in calcium gluconate consumption within pediatric nutrition, characterized by a stable premium segment and expanding gummy and chewable supplement categories for children. Despite lower birth rates compared to developing countries, American families demonstrate strong willingness to invest in high-quality nutritional products. The focus on preventive healthcare and nutritional optimization drives consistent demand across multiple product categories.

Premium infant formula brands extensively utilize calcium gluconate due to its superior bioavailability and clean label appeal. The pediatric supplement segment shows robust growth, particularly in chewable and gummy formats that appeal to parents seeking palatable calcium options for older children. Healthcare professional recommendations strongly influence purchase decisions, creating stable demand patterns.

Manufacturing capabilities in the USA serve both domestic consumption and export opportunities, with several facilities producing specialized pediatric nutrition products. The regulatory environment maintains high standards for infant nutrition while supporting innovation in delivery formats and formulation approaches. Research and development activities continue to explore optimal calcium fortification strategies for different age groups.

The competitive environment is characterized by a mix of established chemical manufacturers and specialized nutrition ingredient suppliers. Distribution breadth and technical expertise remain decisive success factors, with the largest suppliers maintaining global reach and comprehensive technical support capabilities.

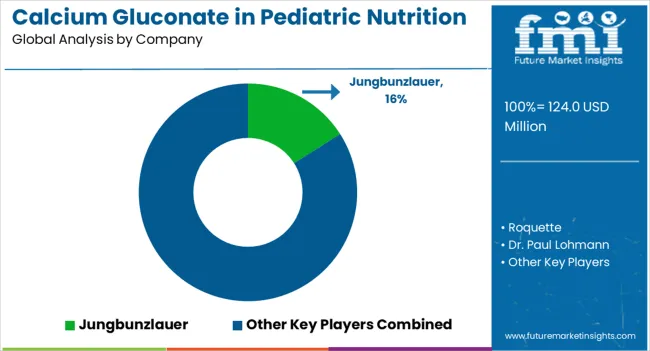

Jungbunzlauer leads with a 16% share, leveraging its position as a major fermentation-based ingredient supplier. The company maintains global manufacturing capabilities and serves major infant formula manufacturers through long-term supply agreements. Its technical expertise in calcium gluconate production and regulatory compliance support make it a preferred supplier for premium applications.

Rroquette brings extensive starch and protein expertise to calcium gluconate applications, particularly in premix formulations that require complex ingredient interactions. The company's global reach and technical support capabilities allow it to serve diverse customer requirements across different regulatory environments.

Dr. Paul Lohmann specializes in mineral salts and maintains a strong focus on pharmaceutical-grade calcium compounds suitable for pediatric applications. The company's expertise in particle size control and dissolution characteristics makes it valuable for specialized formulation requirements.

Gadot Biochemical Industries focuses on mineral ingredients for food applications, with particular strength in kosher and halal certified products. The company serves customers requiring specialized certifications and maintains flexible manufacturing capabilities for customized specifications.

Jost Chemical emphasizes high-purity mineral salts for pharmaceutical and nutritional applications. The company's focus on analytical capabilities and regulatory compliance support makes it valuable for customers requiring detailed documentation and quality assurance.

Other significant players including Global Calcium, Tomita Pharmaceutical, Shandong Fuyang Biotechnology, PMP Fermentation Products, and Xuzhou Huakang Biochemical contribute specialized manufacturing capabilities and regional market access, supporting the diverse requirements of the global pediatric nutrition segment.

| Attribute | Details |

|---|---|

| Study Coverage | Global sales and consumption of calcium gluconate in pediatric nutrition from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Applications (percentage) |

| Geography Covered | Global coverage with focus on India, China, Brazil, Indonesia, USA, Germany, Japan |

| Top Countries Analyzed | India, China, Brazil, Indonesia, USA, Germany, Japan |

| By Application | Infant formula & follow-on formula, Growing-up milk, Pediatric OTC supplements, Therapeutic foods |

| By Delivery Format | Fortification premix powders, Syrups/drops, Chewables/gummies, Ready-to-drink/liquid concentrates |

| By Procurement Route | Direct to manufacturers, Through premix blenders, Through distributors |

| Metrics Provided | Sales (USD), CAGR (2025 to 2035), Share by segment |

| Price Analysis | Average prices by delivery format and procurement route |

| Competitive Landscape | Company profiles, manufacturing capabilities, regional presence |

| Forecast Drivers | Birth rates, urbanization, nutritional awareness, regulatory support |

The global Calcium Gluconate in Pediatric Nutrition Demand is estimated to be valued at USD 124.0 million in 2025.

The market size for the Calcium Gluconate in Pediatric Nutrition Demand is projected to reach USD 203.9 million by 2035.

The Calcium Gluconate in Pediatric Nutrition Demand is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in Calcium Gluconate in Pediatric Nutrition Demand are infant formula & follow-on formula, growing-up milk (toddler), pediatric otc supplements and therapeutic foods (rutf/rusf).

In terms of delivery format, fortification premix powders segment to command 45.0% share in the Calcium Gluconate in Pediatric Nutrition Demand in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Calcium D-Pantothenate Market

Calcium Acetate Market Growth – Trends & Forecast 2019-2029

Calcium Peroxide Market

Calcium Silicate Market

Calcium stearoyl-2-lactylate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA