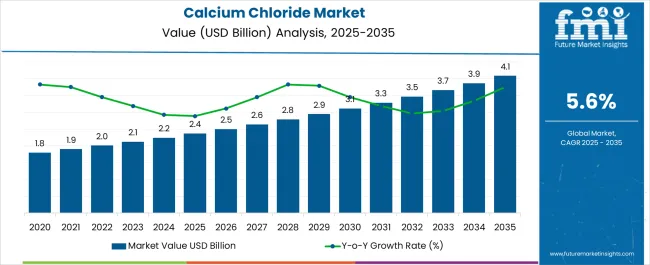

The Calcium Chloride Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Calcium Chloride Market Estimated Value in (2025 E) | USD 2.4 billion |

| Calcium Chloride Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Calcium Chloride market is witnessing robust growth, driven by increasing demand across multiple industrial, agricultural, and pharmaceutical applications. Rising global focus on crop yield enhancement and soil conditioning is supporting the use of calcium chloride in agriculture, where it acts as a source of essential calcium and improves soil structure. The market is further strengthened by its extensive applications in de-icing, dust control, concrete acceleration, and chemical processing, making it a versatile chemical across sectors.

Advancements in production techniques and supply chain efficiencies have improved availability and reduced costs, promoting broader adoption. Growing awareness regarding the quality and purity of calcium chloride for specific industrial and pharmaceutical applications is also shaping market dynamics. Investments in infrastructure development, rising pharmaceutical manufacturing, and stringent regulatory compliance for high-purity products are fueling demand.

As industries increasingly seek cost-effective, multi-functional chemical solutions, calcium chloride is positioned for sustained growth The market is expected to expand further, supported by innovations in formulation, production efficiency, and application-specific customization.

The calcium chloride market is segmented by application, end-use, and geographic regions. By application, calcium chloride market is divided into Agriculture, Industrial Processing, Construction, Drilling Fluids, Dust Control, De-icing, and Others. In terms of end-use, calcium chloride market is classified into Pharmaceutical Grade Calcium Chloride, Food Grade Calcium Chloride, Agriculture Grade Calcium Chloride, and Industrial Grade Calcium Chloride. Regionally, the calcium chloride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The agriculture application segment is projected to hold 30.5% of the Calcium Chloride market revenue in 2025, establishing it as the leading application. Growth is being driven by the chemical’s role in improving soil fertility, enhancing crop quality, and increasing yield by supplying essential calcium nutrients. Calcium chloride also helps in regulating soil pH, reducing plant stress, and improving resistance to environmental conditions, which supports its widespread use in horticulture and farming.

Its water-soluble nature allows easy application through irrigation systems, ensuring efficient nutrient delivery. The adoption of precision agriculture techniques, including fertigation and soil conditioning programs, has further accelerated demand for calcium chloride. Increased awareness among farmers about nutrient management and crop quality has reinforced its preference over other soil amendments.

Regulatory approvals for agricultural use, coupled with rising global food demand, continue to strengthen its market position As sustainable farming practices gain importance, the agriculture segment is expected to maintain its leading share, driven by consistent utility and performance advantages in crop management.

The pharmaceutical grade calcium chloride segment is expected to account for 37.9% of the market revenue in 2025, making it the leading end-use industry. Growth in this segment is being driven by the compound’s extensive use in intravenous therapies, electrolyte replenishment, and medical treatments requiring high-purity calcium sources. Stringent regulatory compliance and quality standards have reinforced the adoption of pharmaceutical-grade calcium chloride over industrial-grade alternatives.

Its high solubility and biocompatibility make it suitable for use in pharmaceutical formulations, injectable solutions, and specialized healthcare applications. Manufacturers are focusing on maintaining consistent purity, reducing contaminants, and adhering to Good Manufacturing Practices, which has enhanced confidence among healthcare providers and pharmaceutical companies.

Rising demand for clinical treatments, hospital supplies, and intravenous solutions is further driving adoption As healthcare infrastructure and pharmaceutical production expand globally, the pharmaceutical-grade calcium chloride segment is expected to remain the primary revenue contributor, supported by regulatory compliance, safety, and growing medical applications.

Food Packaging Industry and Road Construction Industry to significantly drive revenue growth.

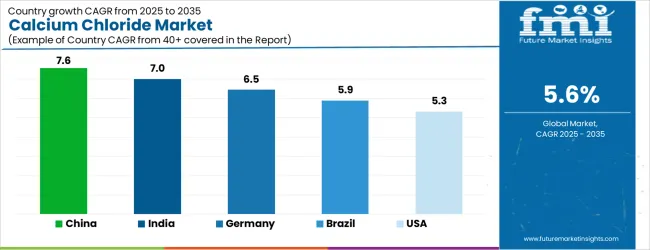

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.5% |

| Brazil | 5.9% |

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

The Calcium Chloride Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Calcium Chloride Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.5%. The USA Calcium Chloride Market is estimated to be valued at USD 835.2 million in 2025 and is anticipated to reach a valuation of USD 835.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 119.9 million and USD 76.5 million respectively in 2025.

| Item | Value |

|---|---|

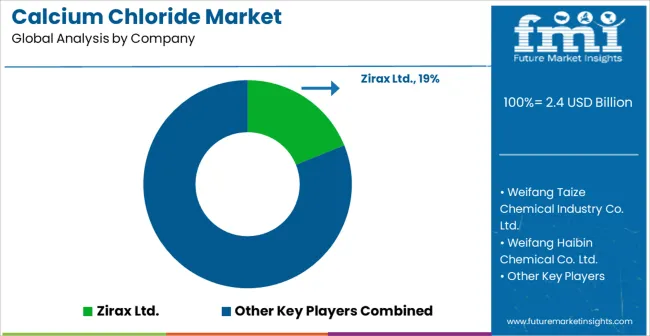

| Quantitative Units | USD 2.4 Billion |

| Application | Agriculture, Industrial Processing, Construction, Drilling Fluids, Dust Control, De-icing, and Others |

| End-Use | Pharmaceutical Grade Calcium Chloride, Food Grade Calcium Chloride, Agriculture Grade Calcium Chloride, and Industrial Grade Calcium Chloride |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zirax Ltd., Weifang Taize Chemical Industry Co. Ltd., Weifang Haibin Chemical Co. Ltd., Ward Chemicals, Tiger Calcium Services, Qingdao Huadong Calcium Producing Co. Ltd., Tangshan Sanyou Group Co. Ltd., and Solvay S.A. |

The global calcium chloride market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the calcium chloride market is projected to reach USD 4.1 billion by 2035.

The calcium chloride market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in calcium chloride market are agriculture, industrial processing, construction, drilling fluids, dust control, de-icing and others.

In terms of end-use, pharmaceutical grade calcium chloride segment to command 37.9% share in the calcium chloride market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA