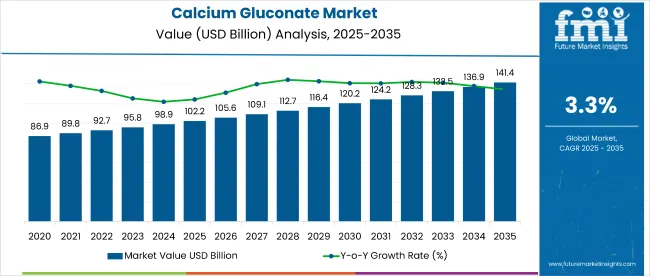

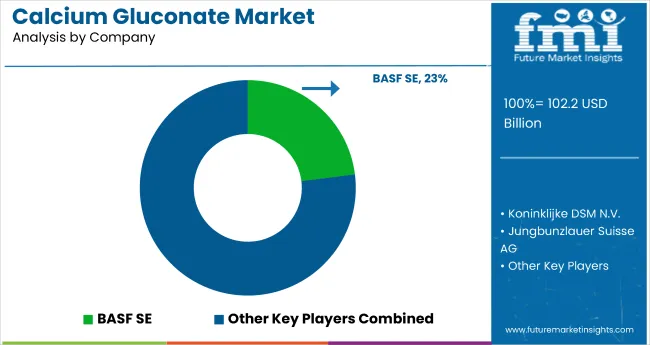

The global calcium gluconate market is set to experience USD 102.2 billion in 2025. The industry is poised to register 3.3% CAGR from 2025 to 2035, reaching USD 141.4 billion by 2035.

The industry growth can be attributed to the growing utilization of the product in pharmaceuticals, dietary supplements, and food fortification. Growing awareness about bone health, the increasing global geriatric population, and the rising trend of calcium deficiencies are major drivers for industry growth. Calcium gluconate is increasingly being used as an essential supplement in different industries as more focus and attention is given to preventive care.

The product is known for treating calcium deficiencies, increasing bone density, and preventing disease states, such as osteoporosis and hypocalcemia, and is commonly used in the pharmaceutical industry, notably in IV products for medicinal treatment of hypocalcemia, cardiac issues, and magnesium toxicity.

It is also one of the important calcium fortifiers in food that can fill the dietary calcium gap in infant and functional foods. Food and beverage manufacturers are including it in dairy foods, fortified beverages, and plant-based products as consumers gravitate toward clean-label and bioavailable sources of calcium.

The increasing demand for dietary supplements is one of the key factors driving the industry growth. The industry is booming, and the product’s demand, especially for bone health supplements, prenatal supplements, and geriatric nutrition, is set to contribute to the growth of the nutraceutical industry.

Furthermore, the rising trend of plant-based and vegan diets has further spurred the demand as the product provides a dairy-free alternative to traditional calcium sources. Furthermore, growing knowledge regarding the benefits of calcium consumption for overall health among consumers further promotes the adoption of fortified food and supplement products.

However, the industry faces some constraints despite accounting for favorable growth numbers. One of the major hurdles it deals with is promoting substitute sources of calcium, such as calcium carbonate and calcium citrate that make similar profits for perhaps far less cash.

Further, excessive calcium consumption has been associated with certain health concerns and has consequently been subject to regulatory scrutiny and consumer hesitation in certain markets. Moreover, the cost of pharmaceutical-grade product and strict regulatory permissions for its utilization in medical applications impede its large-scale utilization.

Emerging industry trends and opportunities include innovation in calcium gluconate products, which maximize bioavailability and absorption. For example, new technology, such as microencapsulation in supplement manufacturing, is helping improve the stability and efficacy of the product in functional foods and drinks.

As the demand for more vegan-friendly and sustainable supplements continues to grow, so do the prospects for plant-derived alternatives to the product. Greater investments are anticipated for research and development, making innovation reports, access, and efficiency for the product relatively better.

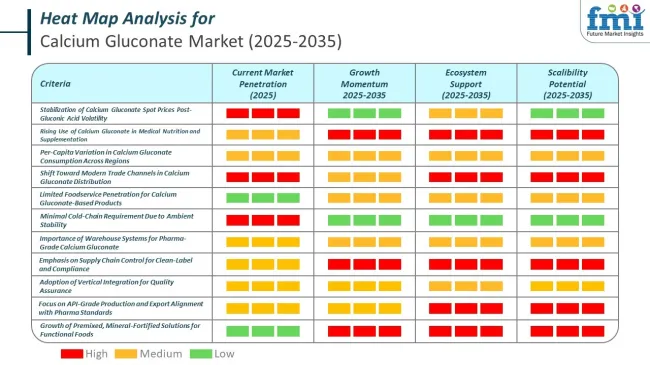

Per-capita consumption varies significantly across geographies. In the USA, fortified food programs and OTC calcium supplementation push average consumption to 4.1 grams per year, as reported by the USA FDA and USDA food intake data.

Distribution architecture continues to shift in the calcium gluconate market. Modern trade retail holds 35% of food-grade calcium gluconate circulation, supported by fortified beverages and dietary supplements that occupy branded shelf space in pharmacy-linked grocery environments.

However, bulk storage and warehouse inventory systems play a crucial role for pharmaceutical-grade material in the calcium gluconate market, especially in North America and Europe. These are maintained in line with standards outlined by the USDA feed additive compliance reports and EMA’s Good Distribution Practices.

Top companies in the calcium gluconate market operate with sharply defined strategies that reflect their positioning across food, pharma, and specialty sectors.

In contrast, Noah Technologies in the USA operates in high-purity, lab-grade segments, catering to biotech firms and med-nutrition startups requiring precision and flexibility in formulation. Meanwhile, Japan’s Tomita Pharmaceutical targets Southeast Asian markets with premixed, mineral-fortified solutions tailored for functional foods, with a strong focus on sensory neutrality and dissolution consistency.

This analysis highlights key shifts in industry performance, providing stakeholders with a clearer view of the growth trajectory. The first half of the year (H1) spans from January to June, while the second half (H2) includes July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 3.2% |

| H2(2024 to 2034) | 3.3% |

| H1(2025 to 2035) | 3.4% |

| H2(2025 to 2035) | 3.5% |

The above table presents the expected CAGR for the global calcium gluconate industry over a semi-annual period spanning from 2024 to 2035. In H1 2024, the business is projected to grow at a CAGR of 3.2%, followed by a slight increase to 3.3% in H2 2024. Moving into 2025, the CAGR is expected to rise to 3.4% in H1 and maintain a steady increase to 3.5% in H2.

H1 2025, the industry witnessed an increase of 2 BPS, while in H2 2025, the industry observed a rise of 3 BPS, indicating a consistent upward trend. These variations suggest strong industry stability, driven by sustainable the product production initiatives, increasing demand for the product in pharmaceutical and functional food applications, and advancements in calcium-based medical treatments ensuring long-term productivity.

Increasing Demand for the Product in Pharmaceuticals and Healthcare

The growing need for calcium supplementation in medical treatments is a significant driver of the calcium gluconate market. It is widely used in intravenous therapies for hypocalcemia, cardiac support, and electrolyte balance regulation. The increasing incidence of osteoporosis, bone disorders, and calcium deficiencies, especially among the aging population and postmenopausal women, has led to a surge in prescription-based formulations.

Additionally, hospitals and emergency medical services are increasingly using intravenous calcium gluconate for treating magnesium sulfate toxicity, calcium channel blocker overdoses, and hyperkalemia. With the rising prevalence of chronic diseases and metabolic disorders, the demand for pharmaceutical-grade injections and supplements is expected to grow steadily.

The pharmaceutical industry’s ongoing research in calcium-based drug formulations is also expanding the use of the product in advanced medical applications. As healthcare awareness increases and governments promote preventive healthcare measures, the role of the product in therapeutic treatments will continue to expand, ensuring sustained industry growth over the next decade.

Expanding Applications in Functional Food, Beverages, and Nutraceuticals

The product is increasingly being integrated into functional foods, beverages, and dietary supplements, making it a key component in the nutraceutical industry. With rising consumer awareness about bone health, muscle function, and calcium absorption, food and beverage companies are fortifying products with the product to enhance their nutritional value.

The demand for calcium-fortified dairy products, plant-based milk, breakfast cereals, and protein-enriched beverages has significantly increased, particularly among health-conscious consumers, athletes, and aging individuals. Additionally, the vegan and plant-based nutrition movement has driven demand for non-dairy calcium sources, making the product a preferred fortification ingredient in soy, almond, and oat-based beverages.

In the sports nutrition segment, the product is gaining traction as a muscle recovery and electrolyte replenishment supplement. With more consumers opting for clean-label, functional foods and dietary supplements, the nutraceutical industry is expected to be a major growth avenue for the product.

Rising Use of The product in Agriculture and Animal Feed

The agricultural and animal feed industries are increasingly recognizing the importance of the product as a nutrient supplement for livestock and crop enhancement. Calcium is an essential mineral for plant growth, improving soil fertility, and ensuring higher crop yields. The addition of the product to fertilizers is helping improve plant nutrient uptake, making it a preferred choice for sustainable agriculture practices.

In animal nutrition, the product is widely used to prevent calcium deficiencies in livestock, poultry, and dairy cattle. It plays a crucial role in enhancing bone strength, milk production, and overall animal health, ensuring optimal growth and productivity. The increasing focus on high-quality animal feed formulations is driving demand for the product in livestock farming.

With global agricultural output expanding and sustainable farming initiatives gaining traction, the application of the product in agriculture and animal nutrition is expected to grow significantly, ensuring long-term industry stability.

From 2020 to 2024, the industry grew steadily due to expanding demand in the pharmaceutical, food fortification, and animal feed sectors. Increased awareness of calcium deficiency drove its use in dietary supplements, and food companies used it in fortified foods. The livestock sector also adopted the product as a low-cost nutritional supplement.

Yet, the disruptions in the supply chain due to the pandemic, geopolitical tensions, and volatile raw material prices resulted in price uncertainty and sourcing issues. By 2022, industry stability had increased as manufacturers began implementing sustainable manufacturing practices, bioavailability improvement, and supply chain optimization to address increasing demand.

Between 2025 and 2035, ingredient formulation advancements, biotechnological extraction, and sustainable production will define the industry. AI-based research will speed up the creation of high-absorption products, targeting aging populations and preventive healthcare markets.

Clean-label fortification will be the focus in the food sector, while pharmaceutical uses will grow with advances in injectable and bioactive calcium therapies. Improved global trade policies and digitalized supply chains will increase industry efficiency, driving continued growth.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand in pharmaceutical and nutraceutical industries for treatment of calcium deficiency | Growing applications in functional foods and beverages resulting from increasing consumer interest in bone health |

| Dominant application in injectable and oral calcium supplements | Growing usage in plant-based dairy alternative fortification and sports nutrition |

| North America and Europe as major markets with consistent demand | Aggressive industry growth in Asia-Pacific and Latin America fueled by increasing health consciousness |

| Moderate consumer knowledge of the advantages of the product | Enhanced educational promotions and advertising emphasizing its contribution to general well-being |

| Reliance on traditional sources of calcium for supplement manufacturing | Increased demand for organic and sustainable sources of calcium |

| Supply chain disruptions impacting raw material availability and price | Enhanced supply chain resilience through diversified sourcing and enhanced production efficiency |

| Regulatory emphasis on product safety and pharmaceutical-grade quality | Tighter compliance requirements and greater scrutiny on ingredient transparency and sustainability |

The sector is subject to a number of main promoters and these consist raw of material availability, regulatory compliance, production costs, supply chain disruptions, and industry competition.

The availability of raw materials is quite crucial here because the product mainly comes from calcium carbonate and gluconic acid. The amount of the raw materials which is supplied or their large fluctuation in prices due to political differences, mining rules, agricultural factors can negatively affect the production and therefore the price.

Apart from that, compliance with regulatory requirements is a problem especially in medical, food, and nutraceuticals applications. Various firms such as FDA, EMA, and EFSA which regulate the production of intravenous (IV) solutions use high-quality and safety standards for the product, supplements, and fortified foods. Non-compliance with the regulations is subject to product recalls, court orders, and industry restrictions.

Production expenses encompass energy consumption, labor costs, advanced purification processes, and other profitability drivers. Investment in cost-effective production methods, which should be complemented by high-level product purity and quality, are a must for the manufacturers.

Supply chain disturbances such as logistics delays, transportation costs, and import-export restrictions pose global manufacturers and distributors with a plethora of problems. The risks can be minimized through establishing regional production plants and fostering strong supplier relations.

In recent years, industry competition has been on the rise with a good number of traders selling both synthetic and organic calcium supplements. The industry in the dietary supplement field is hindered by alternative calcium types like calcium citrate and calcium carbonate that are replaced with gluconate. Strengthening a brand and product differentiation are the two basic principles to maintain a strong presence in the industry.

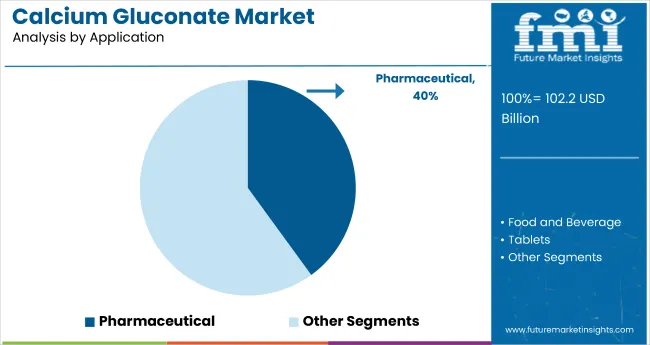

The pharmaceutical segment holds a dominant position with 40% of the market share in the application category, owing to its critical role in treating calcium deficiency disorders, hypocalcemia, and cardiac arrhythmias. Pharmaceutical-grade calcium gluconate is widely used across medical facilities, including hospitals, clinics, and emergency care units, due to its superior bioavailability and safety profile for intravenous administration.

The segment enables healthcare providers to deliver rapid calcium supplementation while maintaining strict quality standards and regulatory compliance required for medical applications. As the global geriatric population expands and calcium deficiency becomes more prevalent, pharmaceutical applications continue to gain preference in both institutional and clinical settings.

Manufacturers are investing in advanced purification technologies, sterile manufacturing processes, and formulation improvements to enhance stability, solubility, and therapeutic efficacy. The segment is poised to expand further as healthcare systems worldwide prioritize calcium supplementation therapies and preventive care protocols.

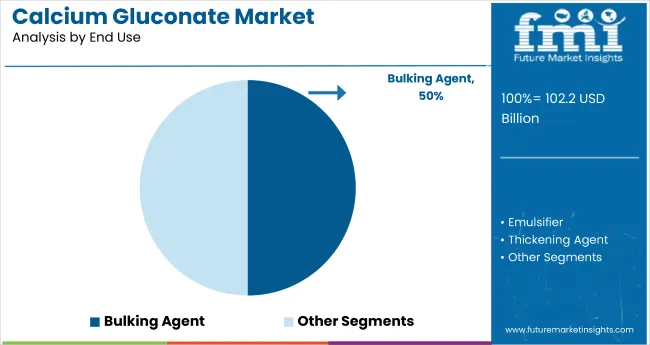

Bulking agent applications remain the core end use segment with 50% of the market share in 2025, as calcium gluconate provides essential bulk and binding properties in pharmaceutical tablets, dietary supplements, and food products. The functional versatility supports product innovation in extended-release formulations, high-density tablets, and texture-enhanced food applications.

Calcium gluconate as a bulking agent also improves product stability and manufacturing efficiency in tablet compression, while offering calcium fortification without compromising taste or appearance. This makes it indispensable in pharmaceutical manufacturing environments and nutraceutical production facilities.

Ongoing demand for calcium-fortified products and the growing emphasis on functional ingredients are key trends driving the sustained relevance of calcium gluconate in bulking agent applications. The segment benefits from increasing consumer awareness about calcium deficiency and the rising popularity of dietary supplements across all age groups.

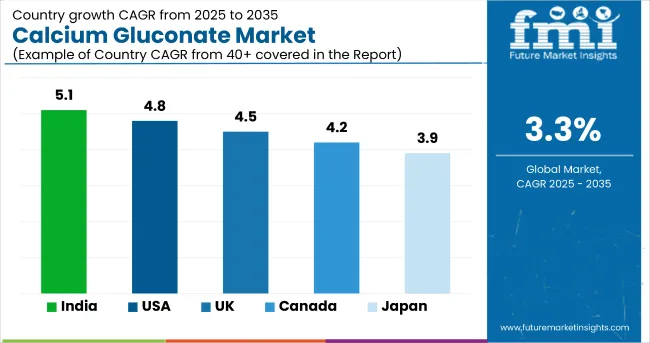

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.5% |

| Canada | 4.2% |

| India | 5.1% |

| Japan | 3.9% |

The USA is one of the largest markets, underpinned by advances in the pharmaceutical, nutraceutical, and functional foods sectors. Pharmaceutical-grade calcium gluconate demand continues to increase as medical practitioners emphasize its application in intravenous calcium treatment, electrolyte-balancing medication, and treatment of osteoporosis. Doctors increasingly prescribe calcium supplements as the population ages and bone diseases rise.

The USA dietary supplement industry has grown remarkably, with consumer interest in bone health, muscle recovery, and cardiovascular health. The product finds widespread application in fortified milk, plant-based drinks, and protein-fortified foods. Moreover, continuous research and development activities are improving the bioavailability of calcium products to help them get absorbed by the human body more effectively. FMI believes the USA industry will expand at 4.8% CAGR throughout the study period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Pharmaceutical Applications | Used in intravenous calcium infusions and electrolyte balance solutions. |

| Growing Nutraceuticals | Growing consumer demand for calcium supplements and functional foods. |

| Aging Population | A large amount of osteoporosis and bone issues trigger consumption. |

| Fortification in Functional Foods | The product is used in plant-based beverages and protein-fortified foods. |

The UK industry continues to grow as demand from the pharmaceutical, diet supplement, and functional food markets remains high. The product is a precious drug ingredient in medicine therapies, especially for calcium deficiency diseases and cardiovascular health. Doctors actively prescribe calcium supplementation, which supports increased product consumption.

Increasing consumption of fortified food in the UK also helped boost the industry. Both dairy and non-dairy food companies introduce the product into their foods to fulfill consumer demands regarding superior nutrition. Governmental initiatives also support food fortification initiatives, improving access to calcium-fortified foodstuffs. As estimated by FMI states that the UK industry will grow at a 4.5% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Information |

|---|---|

| Medical Applications | Used in treating calcium deficiency and cardiovascular conditions. |

| Functional Foods Expansion | Fortification of milk and milk substitutes at a higher rate. |

| Government Initiatives | Rules promote food fortification schemes to reach optimal levels of nutrients. |

| Higher Supplement Intake | Consumers turn to dietary supplements with calcium for bone activity. |

The Canadian industry is growing with increased pharmaceutical and functional food demand. Calcium gluconate is widely used in dietary supplements because people prefer bone and muscle function. Moreover, growing awareness for the prevention of osteoporosis has led to wider use of calcium-based products.

The Canadian food sector has accepted calcium gluconate in fortified foods and milk beverages to provide additional nutritional benefits. Bioavailable calcium products are also highlighted in research in the country so that they can gain effective absorption. Environmental conservation through agronomic practices with sustainability also provides adequate raw materials for production at high-quality levels. FMI believes the Canadian industry will reach 4.2% CAGR growth during the forecast period.

Growth Drivers in Canada

| Key Drivers | Information |

|---|---|

| Increased Consumption of Supplements | The product is found to be extensively used in dietary supplements. |

| Fortification of Functional Food | Added to milk and fortified beverages for nutritional enrichment. |

| Research on Bioavailability | Attempts to improve calcium absorption drive innovation. |

| Sustainable Source of Ingredients | Emphasis on eco-friendly processes guarantees a stable supply. |

India's industry is growing fast, with pharmaceutical, nutraceutical, and food applications becoming increasingly popular. The healthcare industry depends on the product for intravenous use, especially in hospitals that deal with calcium deficiency. The dietary supplement industry is also growing, with health-conscious consumers demanding products for bone health and overall well-being.

India's food industry increasingly uses the product in fortified foods, drinks, and supplements. Government policies favoring food fortification programs and sustainable farming still support the supply chain. FMI predicted that India's industry will grow at a 5.1% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Greater Pharmaceutical Applications | Applied in intravenous infusions to correct calcium deficiency. |

| Greater Fortified Foods | Fortification of cereals and drinks increases nutritional content. |

| Government Support | Public health programs promote food fortification programs. |

| Increased Health Awareness | Consumers look for dietary supplements to enhance bone strength. |

The Japanese industry is stable due to the support of demand for pharmaceutical, food, and nutraceutical applications. The pharmaceutical industry uses the product as a medical treatment, and the food industry adds it to functional drinks and dietary supplements. Increased demand for fortified foods has also increased product consumption.

Japan has depended on importing the product, especially from Australia and Canada, to meet industrial demand. Improved processing technology has improved the contents of calcium-enriched products with superior absorption rates. FMI expects Japan's calcium gluconate market to register a 3.9% CAGR over the forecast period.

Growth Drivers in Japan

| Key Drivers | Information |

|---|---|

| Pharmaceutical Application | Applied in medicinal use in calcium balance. |

| Functional Food Growth | Enhanced use in fortified beverages and supplements. |

| Import Dependence | Australia and Canada are major suppliers. |

| Sophisticated Processing Technologies | Innovations maximize foods' calcium bioavailability. |

The calcium gluconate market is moderately consolidated and majorly focused by players on pharmaceutical-grade formulations, nutraceutical applications, and fortifications in foods. Further industry growth is progressive through an increasing demand for bioavailable calcium supplements, IV-grade calcium gluconate, and fortified food and beverage products.

Such companies include BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, and Roquette Frères, which have all exercised the advanced manufacturing process with strict quality control and well-established distribution channels for a competitive edge. They invest in sustainable calcium sourcing, new formulation techniques, and regulatory compliance to design their products differently.

The entrance of startups and niche manufacturers into the industry brings calcium delivery systems evolving with innovative plant-based alternatives, high-purity pharmaceutical solutions, and much more.

Furthermore, advancements in biotechnology along with mineral absorption enhancement will lead to a charged competitive landscape, thus allowing companies to cater to changing consumer and medical industry needs. Companies with a strong focus on research-driven product development, strategic partnerships, and compliance with worldwide safety standards will retain a strong position in the ever-growing industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| BASF SE | 20-25% |

| Koninklijke DSM N.V. | 15-20% |

| Jungbunzlauer Suisse AG | 10-15% |

| GlaxoSmithKline plc | 8-12% |

| Global Calcium Pvt Ltd | 5-8% |

| Other Players (Combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops high-purity pharmaceutical and food-grade calcium gluconate, emphasizing innovation in bioavailability and sustainability. |

| Koninklijke DSM N.V. | Focuses on nutraceutical formulations with scientifically backed calcium fortification for dietary supplements and functional foods. |

| Jungbunzlauer Suisse AG | Supplies the product for pharmaceutical and food applications, leveraging expertise in organic acid-based solutions. |

| GlaxoSmithKline plc | Provides calcium gluconate-based OTC and prescription supplements with a strong presence in medical and consumer healthcare. |

| Global Calcium Pvt Ltd | Specializes in calcium salts for pharmaceutical, veterinary, and food applications, focusing on global supply chain expansion. |

Key Company Insights

BASF SE: 20-25%

BASF SE is a leader not only in the production of high-purity calcium gluconate but also in molding the footprints of future sustainable and innovative drug and food applications.

Koninklijke DSM N.V.: 15-20%

Enhances its portfolio as a nutraceutical player by supplying clinically substantiated bioavailable calcium formulations.

Jungbunzlauer Suisse AG: 10-15%

Uses its know-how in organic acid-based solutions to supply a high-quality calcium gluconate product for pharmaceutical and food purposes.

GlaxoSmithKline plc: 8-12%

A giant in consumer health care, it offers OTC and prescription-grade calcium gluconate supplements.

Global Calcium Pvt Ltd: 5-8%

Extends its offerings on calcium salts for the pharmaceutical and veterinary industries and also works on improving its global distribution network.

Other Key Players (15-25% Combined)

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2025) | 102.2 billion |

| Projected Market Size (2035) | 141.4 billion |

| CAGR | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Analysis Parameter | Revenue in USD billion |

| Grades Analyzed | Pharmaceutical-grade, Food-grade |

| Forms Analyzed | Powder, Liquid, Injectable |

| Applications Analyzed | Pharmaceuticals, Food & Beverages, Nutraceuticals, Animal Feed, Agriculture |

| End Use Industries | Hospitals, Clinical Settings, Food & Beverage Manufacturers, Nutraceutical Companies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | USA, UK, Canada, India, Japan and others |

| Top Segments Covered | By Grade, By Form, By Application, By End Use |

| Top Growth Markets | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, Global Calcium Pvt Ltd, and others |

| Additional Attributes | Semi-annual growth rates, Country-wise segment insights, Company market share, Competitive landscape |

| Customization & Pricing | Available upon request |

By grade, the industry is segmented into pharmaceutical and food.

The industry is segmented by form into powder, gum, and liquid.

The industry is segmented by application into oral liquid, pharmaceutical, tablets, food additive nutraceuticals, and food and beverage.

The industry is segmented by end-use into bulk agent, emulsifier, and thinning agent.

The industry is segmented by region into North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

The industry is slated to reach USD 102.2 billion in 2025.

The industry is predicted to reach USD 141.4 billion by 2035.

India, slated to grow at 5.1% CAGR from 2025 to 2035, is poised to observe fastest growth.

Key companies include BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, Global Calcium Pvt Ltd, Amano Enzyme Inc., Anmol Chemicals, Jost Chemical Co., SRL Pharma, and Nutrichem Co. Ltd.

Pharmaceutical-grade product is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Grade, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Grade, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA