The Calcium Hypochlorite market is witnessing significant growth driven by its widespread use as a disinfectant and sanitizer in water treatment, hygiene, and industrial processes. The market’s outlook is being shaped by the growing demand for clean and safe water across both developed and emerging regions. Increasing global emphasis on water quality standards and public health safety has reinforced the adoption of calcium hypochlorite in municipal and industrial applications.

The compound’s strong oxidizing properties and high chlorine content make it highly effective for disinfecting and eliminating harmful microorganisms, driving its usage in water purification and sanitation programs. Additionally, the rising population, rapid urbanization, and expanding industrial base have increased the need for effective water treatment chemicals, further supporting market expansion.

Technological advancements in formulation and storage stability have enhanced product efficiency, contributing to its growing preference over alternative disinfectants As sustainability and regulatory compliance become key priorities, calcium hypochlorite continues to emerge as a preferred solution for maintaining water safety and hygiene across multiple sectors.

| Metric | Value |

|---|---|

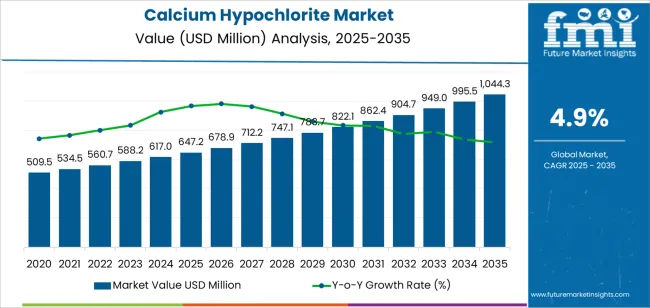

| Calcium Hypochlorite Market Estimated Value in (2025 E) | USD 647.2 million |

| Calcium Hypochlorite Market Forecast Value in (2035 F) | USD 1044.3 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

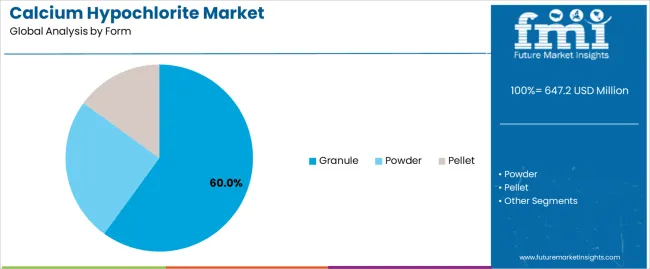

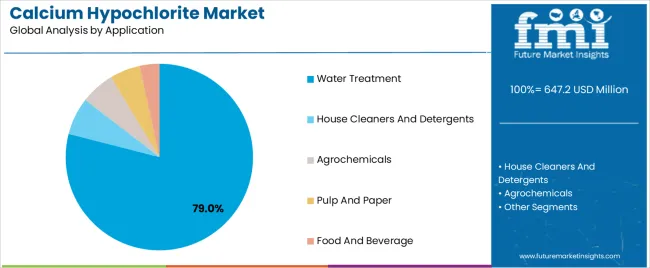

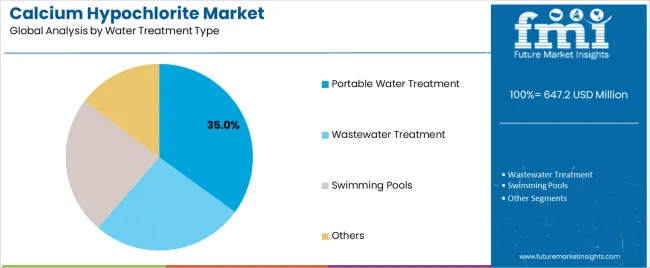

The market is segmented by Form, Application, and Water Treatment Type and region. By Form, the market is divided into Granule, Powder, and Pellet. In terms of Application, the market is classified into Water Treatment, House Cleaners And Detergents, Agrochemicals, Pulp And Paper, and Food And Beverage. Based on Water Treatment Type, the market is segmented into Portable Water Treatment, Wastewater Treatment, Swimming Pools, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The granule form segment is projected to hold 60.00% of the Calcium Hypochlorite market revenue share in 2025, making it the leading form type. This dominance is attributed to the ease of handling, storage stability, and superior solubility characteristics that granular calcium hypochlorite provides. The granule form is less prone to caking and moisture absorption, ensuring longer shelf life and consistent chlorine release during use.

Its controlled dissolution rate makes it ideal for both large-scale and small-scale disinfection applications, particularly in water treatment facilities. The form’s convenience in transportation and reduced risk of spillage have also contributed to its extensive adoption across municipal and industrial end-users.

Moreover, the rising demand for cost-effective and efficient disinfection products that offer high chlorine concentration without requiring complex storage conditions continues to strengthen the position of the granule form segment These operational and economic benefits have made granular calcium hypochlorite the preferred choice in the global market.

The water treatment application segment is expected to account for 79.00% of the Calcium Hypochlorite market revenue in 2025, underscoring its pivotal role in maintaining water hygiene. This segment’s prominence has been driven by increasing global efforts to ensure safe drinking water, particularly amid concerns over waterborne diseases and sanitation standards. Calcium hypochlorite’s efficiency in eliminating bacteria, viruses, and algae has made it essential for municipal water treatment, industrial wastewater management, and swimming pool disinfection.

Rising government initiatives to modernize water infrastructure and promote sustainable water management practices have further accelerated adoption. Additionally, the chemical’s ability to maintain stable chlorine levels over extended periods supports its use in continuous treatment systems.

The ongoing expansion of industrial sectors and urban population centers, combined with stringent water safety regulations, has reinforced the demand for calcium hypochlorite in the water treatment segment Its proven effectiveness and cost-efficiency remain key factors driving its continued dominance.

The portable water treatment type segment is projected to hold 35.00% of the Calcium Hypochlorite market share in 2025, establishing it as a crucial sub-segment within water treatment applications. The growth of this segment is primarily attributed to the increasing demand for safe and accessible drinking water in remote, rural, and emergency settings. Calcium hypochlorite’s stability, portability, and ease of use make it highly suitable for mobile and decentralized water treatment systems.

Its solid-state form allows for convenient transportation and long-term storage without significant degradation of active chlorine content. The growing focus on disaster preparedness, military use, and field operations has further enhanced its utilization in portable water purification solutions.

Moreover, the rising awareness of waterborne health risks and the need for immediate and reliable disinfection methods continue to propel this segment’s growth As access to clean drinking water remains a global challenge, portable water treatment using calcium hypochlorite is expected to maintain strong demand in the coming years.

The table exhibits the projected CAGRs for the global calcium hypochlorite industry over semi-annual periods ranging from 2025 to 2025.

The examination provides organizations with a better understanding of the growth over the year by divulging crucial shifts in performance and growth patterns of the industry. The first half (H1) of 2025 spans from January to June. The second half or H2 includes July to December.

Figures presented in the table showcase the growth rate for each half between 2025 and 2025. The industry was estimated to grow at a CAGR of 4.6% in the first half (H1) of 2025. The second half of the same year showcases a small spike in the growth rate at a CAGR of 4.7%.

| Particular | Value CAGR |

|---|---|

| H1 | 4.6% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

| H1 | 4.8% (2025 to 2035) |

| H2 | 4.9% (2025 to 2035) |

Preceding in the following period, from H1 2025 to H2 2035, the CAGR is predicted to slightly surge to 4.8% in the first half (H1) and then to 4.9% in the second half (H2).

Rising Adoption of Crop Protection and Soil Disinfection Techniques Boosts Usage

The compound has been noted as a powerful disinfectant in the farming sector as it can stop the spread of pathogens that endanger plant health and soil quality.

This chemical compound is, therefore, beneficial to farmers wishing to increase crop productivity, reduce environmental impact, and ensure food safety. Seed and equipment disinfection can assist farmers in attaining enhanced germination rates, improve crop establishment, and reduce the chances of disease conditions resulting from bacterial or fungal infections.

For example, in August 2025, Nippon Soda Co Ltd, a leading chemical manufacturing company, launched a new line of calcium hypochlorite products designed to improve soil health and crop protection.

This innovative product line is tailored to meet the specific needs of several crops, offering targeted pathogen control and supporting sustainable agricultural practices.

The compound is also prominently used in soil sterilization where the compound helps prepare fields for planting and overall soil health. It kills pathogens and pests in the soil that would otherwise cause diseases by lowering crop yields.

Concerns over Waterborne Diseases Are Driving Demand in Water Treatment Applications

The compound is an effective disinfectant often used in municipal water treatment plants, industrial water systems, and domestic water purification methods. The compound is witnessing an increasing adoption in water treatment as it can efficiently eliminate pathogens, such as Vibrio cholerae, which is essential to ensure clean drinking water.

The threat of cholera and other waterborne diseases has amplified the focus on adhering to water safety standards, thereby pushing demand for calcium hypochlorite. This trend is particularly evident in areas with inadequate water supply infrastructure and common cholera outbreaks.

The compound is experiencing increased demand, especially from developing regions, including Africa and Southeast Asia. This is because government and non-governmental organizations are progressively stepping up their efforts to provide clean water in these regions.

Increasing public awareness regarding health and hygiene, particularly in regions prone to waterborne diseases, is a significant factor driving the increased use of the compound in water-handling applications.

For instance, in January 2025, Lonza Group, a leading global supplier of chemicals and biotechnology solutions, announced the expansion of its production capacity for the compound to meet the growing demand in the water treatment segment.

Increased Adoption of Disinfection Processes in the Food and Beverage Industry

A high level of hygiene is important in the food and beverage industry. Calcium hypochlorite is well-received as a disinfectant in the food industry as it works well against several microorganisms, bacteria, viruses, and fungi that may be resistant to other disinfectants.

The compound's sanitization abilities are highly effective owing to its oxidizing properties. This facilitates effortless disinfection of surfaces, equipment, and water used in production, thereby eliminating contamination risks and reducing loss at food production points.

In November 2025, Olin Corporation, a key manufacturer of chlorine-based products, entered into tactical partnerships with several leading food processing companies to provide modified solutions.

These partnerships are aimed at addressing specific disinfection requirements and improving the sanitation protocols within food processing facilities. Olin's customized solutions and technical support are set to assist its partners in achieving superior hygiene standards and regulatory compliance.

One of the key advantages of calcium hypochlorite is its ability to provide enduring disinfection, meaning it will continue to protect surfaces and water after initial application. This remaining effect is crucial in preventing microbial growth during food production and processing, where cleanliness and microbial control are critical factors.

Rising Global Demand for Clean Water is Propelling Growth

Urbanization and industrial growth across the globe are increasing demand for clean water, thereby propelling growth in the market. Stringent regulatory standards for water quality enforced by government authorities worldwide are another crucial factor driving expansion.

As regulatory bodies implement rigorous guidelines to ensure the safety and purity of drinking water, demand for effective disinfection agents like calcium hypochlorite is anticipated to continue to increase. This regulatory pressure compels both municipal water treatment facilities and industrial users to adopt reliable and efficient water treatment solutions, further fueling growth.

In January 2025, Westlake Chemical Corporation completed the acquisition of certain assets from Olin Corporation, enhancing its capabilities in producing and distributing calcium hypochlorite for various applications, including municipal and industrial water treatment.

These strategic moves by key leaders highlight the momentum and underscore the critical role of the compound in addressing the global need for clean water.

Alternative Water Treatment Chemicals are Likely to Limit Growth

The calcium hypochlorite industry is experiencing growing competition from alternative water treatment chemicals and technologies that are perceived as safe and cost-effective. Substitutes like chlorine dioxide, sodium hypochlorite, and advanced oxidation processes (AOPs) are increasingly favored owing to their superior safety profiles and operational benefits.

Chlorine dioxide is particularly attractive as it achieves effective disinfection at lower concentrations compared to this compound, thereby resulting in reduced production of harmful chlorine by-products. Sodium hypochlorite, another viable alternative, offers ease of handling and storage. Unlike calcium hypochlorite, it does not require stringent safety measures, making it a user-friendly option.

Advanced oxidation processes (AOPs) also contribute to this competitive landscape by providing highly efficient water treatment through the generation of powerful hydroxyl radicals. These technologies often outperform traditional methods in terms of environmental impact and treatment efficiency.

As these alternatives gain traction, they pose a significant challenge to the growth of the calcium hypochlorite market. The shift toward safe and economical solutions underscores the need for the industry to innovate and address these competitive pressures to maintain its dominant position in the market.

The global calcium hypochlorite market grew at a CAGR of 2.3% during the historical period ranging between 2020 and 2025. It attained a value of USD 647.2 million by 2025.

The industry, during the historical period, faced fluctuations primarily due to economic uncertainties. Factors such as trade disputes, currency fluctuations, and geopolitical tensions impacted the dynamics, leading to periodic shifts in demand and pricing.

The outbreak of the COVID-19 pandemic had a mixed impact on the industry. The initial period caused disruptions in supply chains and manufacturing activities, posing significant challenges.

The pandemic, however, underscored the crucial role of the compound in disinfection and sanitation, leading to an increasing demand in sectors, including agriculture, healthcare, pharmaceuticals, and public sanitation.

Post-2024, there was a noticeable increase in the demand for the compound as industries and consumers prioritized hygiene and health concerns. This trend positively influenced growth, driving demand for disinfectants, water treatment chemicals, and other related products.

The industry is projected to reach USD 647.2 million by 2025 and is estimated to grow at a CAGR of 4.9% during the forecast period. It is set to reach USD 1044.3 million by 2035.

Emerging economies like India, China, and Brazil are predicted to witness significant industrial expansion in the coming decade. This set is expected to drive demand for the compound in water treatment facilities, industrial cleaning applications, and municipal sanitation programs.

Continued emphasis on health and hygiene owing to the COVID-19 pandemic is set to sustain demand for calcium hypochlorite-based disinfectants and sanitizers, especially in sectors like healthcare, hospitality, and public infrastructure.

Stringent regulations regarding water quality and sanitation standards are likely to mandate the use of disinfectants, thereby driving growth.

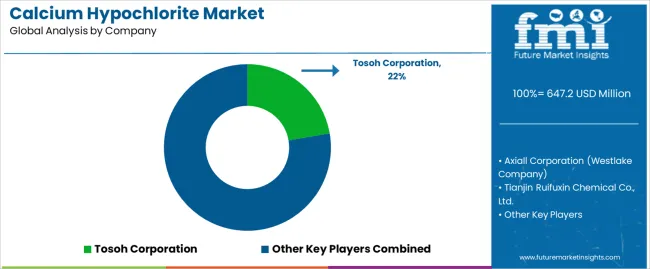

Tier 1 comprises industry leaders with annual revenues exceeding USD 10,000 million. These companies capture a significant share ranging between 40% and 45% globally. These companies are characterized by high production capacity and a wide product portfolio.

Organizations in Tier 1 are distinguished by extensive expertise in manufacturing and a broad geographical reach that is underpinned by a robust consumer base.

The businesses provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Axiall Corporation (Westlake Company), China Petrochemical Corporation (SINOPEC), Grasim Industries Limited, and Tosoh Corporations.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 1,000 million to 10,000 million. These businesses have a presence in specific regions and exert significant influence on local economies. Companies in Tier 2 are distinguished by a robust presence overseas and in-depth industry expertise.

The firms may not wield cutting-edge technology or maintain an extensive global reach but they do possess strong technological capabilities and strictly adhere to regulatory requirements. Noteworthy entities in Tier 2 include Nankai Chemical Co. Ltd., Tianjin Kaifeng Chemical Co., Ltd., Tianjin Yufeng Chemical Co. Ltd., and Huanghua Kaifeng Chemical Co.

Tier 3 encompasses small-scale enterprises operating within the regional sphere and catering to specialized industries. They have revenues below USD 1,000 million and are notably focused on meeting local demands. Tier 3 firms are small-scale participants with limited geographical presence.

Tier 3, in this context, is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Renowned companies in Tier 3 include Indo Tianjin Ruifuxin Chemical Co., Ltd., Solenis, Dezhou Chemtics Chemical Co. Ltd, and Aqua Chem Industry Co.

The section provides organizations with an overview of the industry. It consists of a detailed analysis of the emerging trends and opportunities on a country-by-country basis. This country-specific examination of the dynamics is predicted to help businesses in understanding the multifaceted nature of the business.

Kenya is anticipated to emerge as a dominating country during the forecast period with a projected CAGR of 7.1%. The Republic of Congo, India, and Kuwait are set to follow closely behind to become key countries with estimated CAGRs of 6.8%, 6.5%, and 6.4%, respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Kenya | 7.1% |

| Republic of Congo | 6.8% |

| India | 6.5% |

| Kuwait | 6.4% |

| China | 5.1% |

Irrigated agriculture is a key factor driving demand for calcium hypochlorite in India. As the country continues to enhance its irrigation infrastructure, agricultural land is being rapidly brought under irrigation, increasing the need for high-quality water treatment chemicals.

The compound, known for its effectiveness in disinfecting water and preventing the spread of waterborne pathogens, is increasingly being adopted by farmers to ensure that irrigation water is free from contaminants that could otherwise harm crops.

Sales of calcium hypochlorite in India are anticipated to triple in value over the forecast period. Granular forms of the compound are set to dominate, driven by their rising use in agrochemical formulations for disinfecting irrigation water, sanitizing equipment, and controlling pests and diseases to boost crop yields.

India’s agricultural sector, with 58% of the population engaged in farming, significantly influences growth. Rising focus on effective water resource management has led farmers to rely on this compound to ensure irrigation water meets safety standards, thereby improving productivity and ensuring the safety of agricultural produce.

For instance, Tata Chemicals plays a pivotal role in the manufacturing and supply of agrochemicals, including water treatment products like calcium hypochlorite. This highlights the substantial impact of key industry players in bolstering both the chemical and agrochemical sectors in India.

The calcium hypochlorite market in China is anticipated to broaden at a CAGR of 5.1% during the assessment period to reach a size of USD 1044.3 million by 2035. This projected growth underscores the increasing demand for effective water treatment solutions in the country.

It is mainly driven by stringent regulatory standards focused on ensuring safe drinking water and environmental protection. As China intensifies its efforts to combat pollution and enforce strict water quality standards, industries are heavily investing in such water treatment solutions.

Leading chemical manufacturers in China, including Tianjin Kaifeng Chemical Co. Ltd. are broadening their production capacities in response to the high demand. For instance, as of January 2025, Tianjin Kaifeng Chemical Co., Ltd. reported a 20% increase in sales of the compound compared to the previous year, underscoring robust growth.

The calcium hypochlorite industry in China is poised for sustained expansion driven by ongoing regulatory pressures and innovations in water treatment technologies. Collaboration between government bodies and private enterprises is also estimated to foster innovation, ensuring continued improvements in water quality across the country.

Kenya is projected to witness a CAGR of 7.1% in the global calcium hypochlorite market. The country has been facing challenges related to poor water quality, especially in rural areas. The compound being a strong disinfectant is therefore increasingly being used for treating drinking water to make it safe for human consumption.

The government of Kenya is collaborating with international organizations to improve the country’s water supply and sanitation, thereby driving demand for disinfectant chemicals.

For instance, the Kenya Towns Sustainable Water Supply and Sanitation Program, funded by the African Development Bank, aims to improve the country’s water infrastructure. Projects like these require significant quantities of water treatment chemicals, thereby raising demand.

Agricultural expansion in the country is posing an increasing demand for the compound. The country’s “Big Four Agenda” includes food security as a key pillar with an emphasis on expanding agricultural productivity.

Waterborne diseases, such as cholera remain a significant challenge in the country. Disinfectants are therefore increasingly used in the country to prevent the spread of these diseases.

The section provides companies with insightful data and analysis of the two leading segments of the target market. Segmentation of these categories assists businesses in understanding the dynamics of the business and investing in the beneficial zones.

The granule segment is anticipated to lead in terms of form with a value share of 60.8% in 2025. In terms of application, the water treatment segment is set to dominate with a value share of 79% in the same year.

| Segment | Granule (Form) |

|---|---|

| Value Share (2025) | 60.8% |

The granule segment is likely to experience a decent CAGR of 4.7% during the assessment period. The primary driver of the high demand for granule form is its wide application in water treatment. Its superior effectiveness in water treatment applications, where it offers convenience in handling and precise dosage control, contributes to rising demand.

Rising emphasis on environmental sustainability is bolstering the demand for calcium hypochlorite granules. Industries are increasingly adopting these granules owing to their lower environmental footprint compared to other forms.

This attribute aligns with the global efforts toward adopting eco-friendly practices. The versatile nature of this granular compound positions the compound to effectively meet the diverse application requirements.

| Segment | Water Treatment (Application) |

|---|---|

| Value Share (2025) | 79% |

Water treatment stands as a dominant application segment within the calcium hypochlorite industry, commanding a substantial value share of 79% in 2025. The importance of the compound in water treatment processes is prominently driven by its high efficacy in disinfection and sanitation across various municipal and industrial applications.

The demand for clean and safe water continues to rise globally, propelled by increasing population densities and stringent regulatory standards. Calcium hypochlorite plays a key role in addressing these challenges by efficiently eliminating bacteria, viruses, and other contaminants from water sources. Its robust disinfection capabilities make it a preferred choice for ensuring public health and safety in water treatment facilities across the globe.

For instance, prominent cities like New York and London have implemented comprehensive water treatment strategies that heavily rely on the compound for their municipal water supplies. These initiatives underscore the critical role of this compound in safeguarding public health infrastructure and ensuring access to clean water.

Key players in the industry include Tosoh Corporation, Axiall Corporation (Westlake Company), Tianjin Ruifuxin Chemical Co., Ltd., Solenis, American Elements, and Tianjin Kaifeng Chemical Co., Ltd. The calcium hypochlorite market presents a dynamic landscape characterized by robust competition and strategic partnerships among key players.

Businesses are actively enhancing their capabilities and resources to meet the rising demand for calcium hypochlorite across diverse applications. Strategic partnerships and joint ventures are prominent strategies adopted by leading firms to foster innovation and strengthen their position in the global industry.

In response to the evolving market dynamics, prominent organizations are continuously introducing new products aimed at addressing the growing demand for unique solutions in various end-use sectors. Geographic expansion remains a key strategy for established companies seeking to broaden their presence and capture emerging opportunities.

The market is anticipated to witness the emergence of start-ups, intensifying competition, and innovation. This competitive landscape is set to bolster continuous innovations in manufacturing techniques and the introduction of cutting-edge applications, thereby shaping the future trajectory of the calcium hypochlorite market.

Industry Updates

In terms of form, the industry is segregated into powder, pellet, and granule.

Water treatment, house cleaners and detergents, agrochemicals, pulp and paper, and food and beverage are the key applications. Water treatment is further classified into portable water treatment, wastewater treatment, swimming pools, and others.

The market is spread across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global calcium hypochlorite market is estimated to be valued at USD 647.2 million in 2025.

The market size for the calcium hypochlorite market is projected to reach USD 1,044.3 million by 2035.

The calcium hypochlorite market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in calcium hypochlorite market are granule, powder and pellet.

In terms of application, water treatment segment to command 79.0% share in the calcium hypochlorite market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hypochlorite Bleaches Market Report - Growth, Demand & Forecast 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA