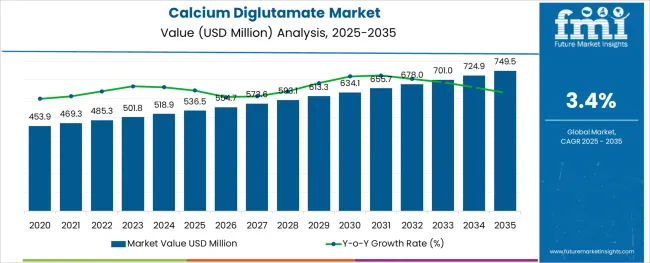

The Calcium Diglutamate Market is estimated to be valued at USD 536.5 million in 2025 and is projected to reach USD 749.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The calcium diglutamate market is exhibiting consistent growth as industries and consumers alike prioritize healthier and more functional ingredients in food formulations and industrial processes. Rising demand for low-sodium flavor enhancers and increasing awareness of calcium’s health benefits have positioned calcium diglutamate as a preferred additive.

Regulatory encouragement for reduced sodium content in food products has supported its adoption in processed and packaged foods while industrial applications benefit from its stability and efficacy in specialized processes. Innovations in production technologies and a shift toward clean-label ingredients are expected to unlock further growth opportunities.

The ongoing trend of reformulating products to meet both regulatory standards and consumer preferences continues to shape the market landscape and foster sustainable long-term demand.

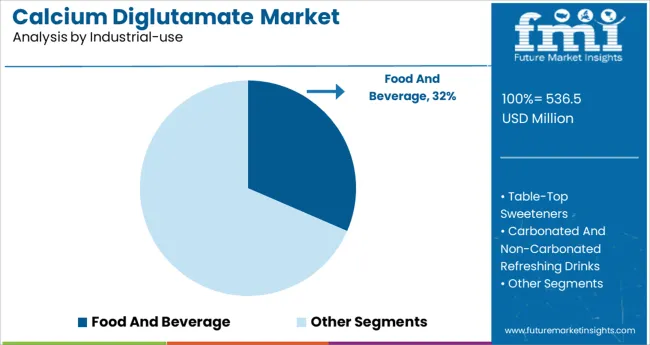

The market is segmented by Industrial-use, Application, and Distribution Channel and region. By Industrial-use, the market is divided into Food And Beverage, Table-Top Sweeteners, Carbonated And Non-Carbonated Refreshing Drinks, Dairy Products, Puddings, Desserts, Ice Cream And Frozen Desserts, Sweets, Chewing-Gum, Toothpaste, Mouthwash, Animal Feed, Pharmaceuticals, and Cosmetics.

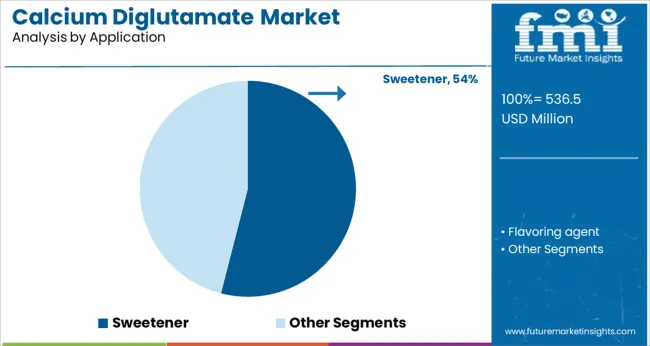

In terms of Application, the market is classified into Sweetener and Flavoring agent. Based on Distribution Channel, the market is segmented into Hypermarket/Supermarket, Direct Selling, and Online. By Distribution Channel, the market is divided into Convenience Store, Hypermarket/Supermarket, Online, and Direct Selling.

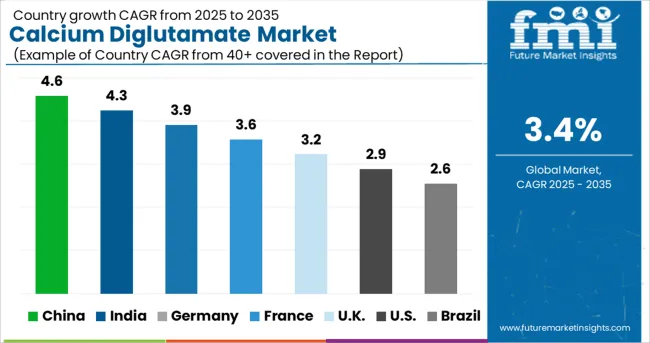

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by industrial use the food and beverage segment is projected to hold 31.5% of the total market revenue in 2025 securing its position as the leading industrial application. This leadership is attributed to the growing utilization of calcium diglutamate in processed foods to reduce sodium levels without compromising taste.

As consumer health consciousness rises manufacturers have increasingly incorporated it into snacks ready meals and condiments to align with dietary guidelines. The ability of calcium diglutamate to deliver umami flavor while adding nutritional value has further enhanced its appeal in the food and beverage sector.

Strong demand from large-scale producers and the widespread application across diverse product categories have reinforced its dominance in this segment. Enhanced distribution networks and the growing influence of clean-label trends continue to strengthen its relevance in food and beverage manufacturing.

In terms of application the sweetener segment is anticipated to account for 54.0% of the market revenue in 2025 marking it as the most prominent application category. This prominence has been underpinned by its dual functionality as a flavor enhancer and a substitute for conventional high-calorie sweeteners.

Its effectiveness in masking undesirable aftertastes of other additives and enhancing the overall sensory profile of products has driven widespread use in confectionery beverages and bakery items. Manufacturers have favored its use due to its stability under processing conditions and compatibility with various formulations.

The shift towards healthier sugar alternatives and the demand for lower glycemic index products have further bolstered the growth of the sweetener segment solidifying its leadership in the calcium diglutamate market.

Segmenting by distribution channel the hypermarket supermarket segment is expected to capture 36.5% of the market revenue in 2025 establishing itself as the leading channel. This dominance has been driven by the extensive reach of organized retail chains which have facilitated higher consumer access and visibility of products containing calcium diglutamate.

The ability to showcase products in prominent shelf positions combined with promotional strategies has increased consumer awareness and purchase intent. Retailers have also played a critical role in educating consumers about the benefits of low-sodium and functional food ingredients through in-store marketing initiatives.

The concentration of consumer traffic in hypermarkets and supermarkets and their capability to support bulk sales and private-label initiatives have ensured this channel’s continued prominence in the market.

Food additives extend the shelf lives of food products while also giving them flavor, color, and nutritional value. Consequently, they contribute significantly to the production of savory foods. Food additives also include flavor enhancers, which contribute to the improvement of food flavor and add to the allure of food preparation.

In commercially produced food items like soups, snacks, and frozen food products, flavor enhancers are frequently used. One of the most widely used flavor enhancers, glutamate is found naturally in foods like tomatoes, cheese, and mushrooms. Monosodium glutamate, calcium diglutamate, monopotassium glutamate, magnesium diglutamate, and mono ammonium glutamate are the mono-salt forms of glutamate that are commonly used as flavor enhancers.

Calcium glutamate is obtained from calcium acid iodine of glutamic acid. The fermentation process using both vegetable protein and a carbohydrate medium can naturally produce calcium diglutamate.

It is also referred to as CDG or calcium glutamate. It is thought of as a monosodium glutamate analog. Calcium diglutamate, an emerging substitute for monosodium glutamate, has the distinctive property of helping to replace the salt concentration in the diet and thereby decreasing the amount of salt concentration to be used in food preparation.

A new report published by Future market insights, titled, "Calcium Diglutamate Market-Global Opportunity Analysis and Industry Forecast, 2025 to 2035," projects the global Calcium Diglutamate market to reach USD 749.5 million by 2035 and is expected to grow at a CAGR of 3.40% from 2025 to 2035.

The alkaline diglutamate market is divided into seven geographic areas, including Western Europe, Eastern Europe, and North America. Latin America, North America, Japan, the Middle East and Africa (MEA), and Asia Pacific with exception of Japan (APEJ). The largest market share for calcium diglutamate is held by North America due to the region's extensive use of the flavoring agent in food preparation.

It is anticipated that rising consumer demand for convenience and processed foods will significantly drive market growth for calcium digluatamate.

Calcium digluatamate is growing in an opportunistic market in the Asia Pacific region. The market for calcium glutamate is anticipated to grow as consumers show a greater propensity to use more condiments and processed foods that appear to contain significant amounts of calcium diglutamate.

Due to the strict regulatory requirements imposed by the food regulatory body, Europe is expected to experience steady growth as opposed to the Asia Pacific region. As a result, there is uncertainty regarding the market expansion for calcium diglutamate in Europe. A & Z Food Additives Co., Ltd., and Triveni Inter Chem Pvt. Ltd. are two well-known companies operating in the global calcium diglutamate market.

The calcium diglutamate industry is primarily being driven by food manufacturers' ongoing innovative products in the area of food additives. As a salt substitute and flavor enhancer, calcium diglutamate is widely used. As a result, is frequently used in low-sodium food applications, particularly soups, to lower this same sodium content of dish without sacrificing its flavor.

Furthermore, calcium diglutamate is simply prefer over monosodium glutamate due to its sodium-free property and has been granted permission as a food additive by nutrition regulatory bodies. Consequently, the demand for goods containing calcium diglutamate is increasing. Additionally, calcium digluatamate's calcium content may subtly increase its users' calcium intake.

Therefore, nutritionists have a big impact on what consumers choose to eat in order to control their eating habits. Consequently, this stimulates the calcium diglutamate sector. Additionally, calcium diglutamate, which is regarded as a soluble generator of calcium ions, is used in the very first aid treatment of individuals exposure to hydrofluoric acid. As a result, this application might expand the calcium diglutamate market.

However, certain negative effects are attributed to glutamate and its salts, particularly monosodium glutamate. limiting consumer use of products that contain glutamate as a result. Consequently, this has an impact on the calcium diglutamate market's overall growth prospects. Additionally, its products are off-limits to infants younger than 12 weeks and have been found to interfere with the oxidation of some essential amino acids. thereby impeding the market's expansion for calcium diglutamate.

The Calcium Diglutamate in the market is expected to grow at a CAGR of 3.40% during the forecast period of 2025 to 2035. The global market for calcium diglutamate is on the rise as a result of increased demand from manufacturers, supermarkets, and dealers. Manufacturers are using calcium diglutamate in a variety of products, such as food additives, pharmaceuticals, and cosmetics.

Supermarkets are also taking advantage of this compound to boost the nutritional content of their foods. Additionally, dealers worldwide are seeing an upsurge in demand due to the increasing need for this nutrient-rich product.

As a result of these factors, the global market for calcium diglutamate has experienced impressive growth over recent years. A number of leading manufacturers have invested heavily in production facilities that specialize in creating high-quality forms of calcium diglutamate that can be used across multiple industries.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, Asia Pacific, Oceania, Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | By Form, By End-user, By Distribution Channel, By Region |

| Key Companies Profiled | A &, Z Food Additives Co., Ltd. , Triveni Interchem Pvt. Ltd., BioCrea GmbH, Bristol-Myers Squibb Company, Cerecor Inc, Evotec AG, Luc Therapeutics Inc, NeurOp Inc,, Novartis AG |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization &, Pricing | Available upon Request |

The global calcium diglutamate market is estimated to be valued at USD 536.5 million in 2025.

It is projected to reach USD 749.5 million by 2035.

The market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types are food and beverage, table-top sweeteners, carbonated and non-carbonated refreshing drinks, dairy products, puddings, desserts, ice cream and frozen desserts, sweets, chewing-gum, toothpaste, mouthwash, animal feed, pharmaceuticals and cosmetics.

sweetener segment is expected to dominate with a 54.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA