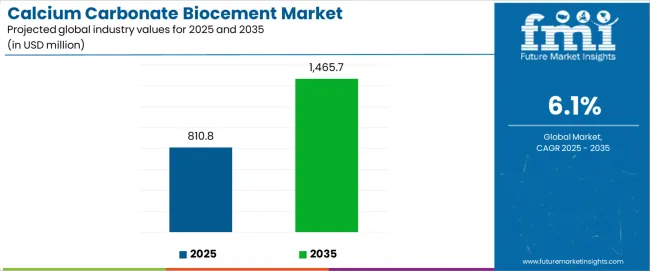

The calcium carbonate biocement market is valued at USD 810.8 million in 2025 and is forecast to reach USD 1,465.7 million in 2035, expanding at a CAGR of 6.1%. Regional outlook highlights adoption patterns shaped by infrastructure needs, environmental regulations, and sector-specific demand drivers. Growth trajectories differ across continents, reflecting variations in construction priorities, policy frameworks, and resource availability.

North America records steady expansion supported by green building codes and infrastructure acts. Government policies emphasize eco-friendly materials that reduce the carbon footprint of construction. Federal and state-level initiatives prioritize decarbonization of infrastructure, making calcium carbonate biocement attractive for soil stabilization, highway expansion, and public building projects. Adoption also grows in urban centers where LEED and similar certifications influence material choices. The presence of strong research ecosystems and pilot demonstration plants reinforces early commercialization, ensuring gradual but consistent demand through 2035.

Europe shows the strongest momentum due to strict carbon emission reduction mandates. EU climate policies, carbon taxes, and circular economy strategies accelerate the shift from Portland cement to low-carbon alternatives. Calcium carbonate biocement gains traction in large-scale infrastructure upgrades, coastal defense systems, and restoration of heritage sites. Regional focus on compliance with BREEAM and national sustainability standards accelerates integration into mainstream construction. Partnerships between universities, cement majors, and biotech start-ups strengthen innovation pipelines, positioning Europe as a global leader in biocement adoption. Market demand remains concentrated in Germany, France, the UK, and Nordic countries where green infrastructure receives continuous investment.

Asia Pacific demonstrates rapid adoption driven by large-scale infrastructure projects and soil stabilization requirements. Population growth and industrial expansion in China, India, and Southeast Asia increase pressure on conventional cement supply chains, creating space for biocement alternatives. Governments support eco-efficient construction practices as part of national carbon neutrality commitments. Applications extend from high-rise developments and industrial parks to rural road stabilization and coastal infrastructure reinforcement. Pilot-to-commercial scaling in Japan and South Korea further supports regional leadership in advanced construction materials. Asia Pacific emerges as the fastest-growing contributor to absolute dollar opportunity.

Latin America and Africa show emerging demand, primarily in mining backfill and restoration projects. Countries with resource-based economies invest in biocement to reduce environmental impact of extraction sites. Restoration of degraded land and heritage conservation projects create niche demand streams. Infrastructure gaps provide a long-term growth potential, though adoption remains limited by high production costs and lack of widespread policy incentives. Multilateral development banks and international aid programs supporting sustainable construction are expected to stimulate regional pilot projects through 2035. Regional outlook confirms a balanced trajectory. Europe and Asia Pacific drive acceleration, North America secures steady expansion, and Latin America with Africa gradually integrate calcium carbonate biocement into mining, restoration, and infrastructure markets.

Between 2025 and 2030, the calcium carbonate biocement market is projected to expand from USD 810.8 million to USD 1,090.1 million, resulting in a value increase of USD 279.3 million, which represents 42.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of bio-based construction technologies, rising demand for self-healing concrete applications, and growing emphasis on carbon-negative building materials with enhanced performance characteristics. Construction companies are expanding their biocement implementation capabilities to address the growing demand for green building applications, infrastructure repair, and specialty construction requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 810.8 million |

| Forecast Value in (2035F) | USD 1,465.7 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

From 2030 to 2035, the calcium carbonate biocement market is forecast to grow from USD 1,090.1 million to USD 1,465.7 million, adding another USD 375.6 million, which constitutes 57.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of microbial-induced calcite precipitation technologies, the integration of bio-engineered cement production systems, and the development of large-scale biocement manufacturing platforms with enhanced performance capabilities. The growing adoption of green construction practices will drive demand for calcium carbonate biocement with superior strength characteristics and compatibility with conventional building materials across construction operations.

Between 2020 and 2025, the calcium carbonate biocement market experienced robust growth, driven by increasing demand for carbon-neutral construction materials and growing recognition of biocement technology as essential tools for modern building applications across infrastructure development, concrete repair, and environmental remediation projects. The calcium carbonate biocement market developed as construction companies recognized the potential for biocement to reduce carbon emissions while maintaining structural integrity and enabling cost-effective construction protocols. Technological advancement in microbial cultivation systems and bio-mineralization processes began emphasizing the critical importance of maintaining production consistency and performance reliability in diverse construction environments.

Market expansion is being supported by the increasing global demand for carbon-neutral construction solutions and the corresponding need for bio-based systems that can provide superior structural performance and environmental benefits while enabling reduced carbon footprint and enhanced durability across various construction and infrastructure applications. Modern construction operations and building material specialists are increasingly focused on implementing biocement technologies that can deliver targeted strength properties, prevent structural degradation, and provide consistent performance throughout complex construction projects and diverse environmental conditions. Calcium carbonate biocement's proven ability to deliver exceptional binding strength against structural stress, enable time-efficient construction processes, and support cost-effective building protocols make them essential materials for contemporary construction and infrastructure operations.

The growing emphasis on green building standards and environmental compliance is driving demand for calcium carbonate biocement that can support large-scale construction requirements, improve structural longevity outcomes, and enable automated production systems. Construction companies' preference for materials that combine effective binding properties with operational efficiency and environmental benefits is creating opportunities for innovative biocement implementations. The rising influence of bio-based construction and carbon-negative building practices is also contributing to increased demand for calcium carbonate biocement that can provide engineered performance characteristics, real-time curing monitoring capabilities, and reliable strength development across extended construction periods.

The calcium carbonate biocement market is poised for rapid growth and transformation. As industries across construction, infrastructure, environmental remediation, and specialty applications seek solutions that deliver exceptional binding performance, structural integrity, and environmental compliance, calcium carbonate biocement is gaining prominence not just as specialized building material but as strategic enabler of modern construction practices and green building development.

Rising bio-based construction adoption in Asia-Pacific and expanding carbon-neutral building initiatives globally amplify demand, while manufacturers are leveraging innovations in microbial cultivation systems, automated production processes, and integrated performance monitoring technologies.

Pathways like self-healing concrete applications, large-scale infrastructure projects, and specialized environmental remediation solutions promise strong margin uplift, especially in green construction segments. Geographic expansion and technology integration will capture volume, particularly where local building standards and environmental regulations are critical. Regulatory support around carbon reduction requirements, green building certifications, and construction innovation standards give structural support.

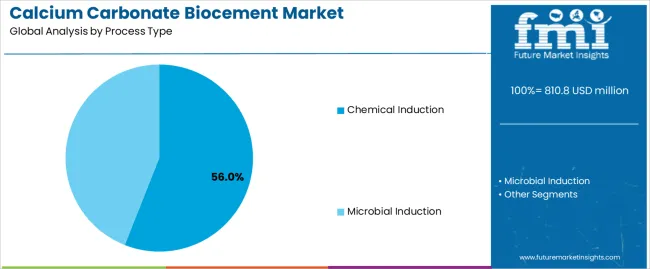

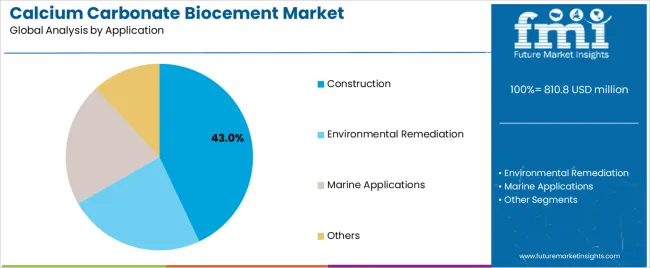

The calcium carbonate biocement market is segmented by process type, application, end-use sector, production method, and region. By process type, the market is divided into chemical induction and microbial induction categories. By application, it covers construction, environmental remediation, marine applications, and others. By end-use sector, it is categorized into commercial construction, infrastructure development, residential construction, and specialty applications. By production method, the market includes laboratory-scale, pilot-scale, and commercial-scale production. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The chemical induction segment is projected to account for 56% of the calcium carbonate biocement market in 2025, reaffirming its position as the leading process category. Construction companies and material manufacturers increasingly utilize chemical induction biocement for its superior production control capabilities when operating across diverse construction applications, excellent consistency characteristics, and cost-effectiveness in applications ranging from structural construction to large-area soil stabilization management. Chemical induction biocement technology's advanced precipitation control capabilities and predictable performance characteristics directly address the industrial requirements for reliable strength development in large-scale construction environments.

This process segment forms the foundation of modern commercial construction operations, as it represents the biocement type with the greatest production scalability and established market demand across multiple application categories and construction sectors. Manufacturer investments in enhanced chemical formulations and automated mixing compatibility continue to strengthen adoption among construction contractors and building material suppliers. With companies prioritizing production consistency and performance optimization, chemical induction biocement aligns with both technical requirements and economic efficiency objectives, making them the central component of comprehensive bio-based construction strategies.

Construction applications are projected to represent 43% of calcium carbonate biocement demand in 2025, underscoring their critical role as the primary consumers of bio-based cement technology for structural building, infrastructure development, and construction material applications. Construction operators prefer calcium carbonate biocement for their exceptional binding strength capabilities, durability enhancement characteristics, and ability to reduce carbon emissions while ensuring effective structural performance throughout diverse building programs. Positioned as essential materials for modern construction operations, calcium carbonate biocement offers both performance advantages and environmental compliance benefits.

The segment is supported by continuous innovation in bio-mineralization technologies and the growing availability of specialized production systems that enable variable strength applications with enhanced curing uniformity and rapid setting capabilities. Additionally, construction operators are investing in quality control systems to support large-scale biocement utilization and project planning. As green building demand becomes more prevalent and construction efficiency requirements increase, construction applications will continue to dominate the end-use market while supporting advanced bio-based construction utilization and structural performance strategies.

The calcium carbonate biocement market is advancing rapidly due to increasing demand for carbon-neutral construction technologies and growing adoption of bio-based building solutions that provide superior structural performance and environmental benefits while enabling reduced carbon emissions across diverse construction and infrastructure applications. However, the calcium carbonate biocement market faces challenges, including high production costs, technical complexity requirements, and the need for specialized quality control and performance validation programs. Innovation in microbial cultivation capabilities and bio-engineered production systems continues to influence product development and market expansion patterns.

The growing adoption of advanced microbial cultivation systems, bio-engineered precipitation processes, and biotechnology-based production optimization is enabling manufacturers to produce calcium carbonate biocement with superior consistency capabilities, enhanced structural properties, and automated quality control functionalities. Advanced microbial systems provide improved strength development while allowing more efficient production scaling and consistent performance across various construction types and environmental conditions. Manufacturers are increasingly recognizing the competitive advantages of biotechnology capabilities for product differentiation and premium market positioning.

Modern calcium carbonate biocement producers are incorporating IoT connectivity, automated monitoring systems, and integrated quality management platforms to enhance production intelligence, enable predictive maintenance capabilities, and deliver value-added solutions to construction customers. These technologies improve manufacturing efficiency while enabling new production capabilities, including real-time quality monitoring, performance tracking, and reduced operational overhead. Advanced process integration also allows manufacturers to support comprehensive construction material systems and building innovation beyond traditional cement replacement approaches.

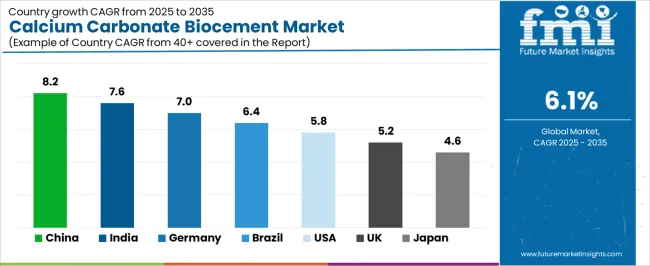

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The calcium carbonate biocement market is experiencing strong growth globally, with China leading at an 8.2% CAGR through 2035, driven by the expanding green construction programs, growing bio-based building material adoption, and significant investment in biotechnology development. India follows at 7.6%, supported by government initiatives promoting green building technology, increasing infrastructure development demand, and growing environmental compliance requirements. Germany shows growth at 7%, emphasizing bio-based construction innovation and advanced building technology development. Brazil records 6.4%, focusing on large-scale infrastructure expansion and commercial construction modernization. The USA demonstrates 5.8% growth, prioritizing green building standards and construction innovation excellence. The UK exhibits 5.2% growth, emphasizing construction technology adoption and bio-based building development. Japan shows 4.6% growth, supported by advanced biotechnology initiatives and precision construction concentration.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from calcium carbonate biocement in China is projected to exhibit exceptional growth with a CAGR of 8.2% through 2035, driven by expanding green construction programs and rapidly growing bio-based building material adoption supported by government initiatives promoting biotechnology development. The country's strong position in biotechnology manufacturing and increasing investment in carbon-neutral construction infrastructure are creating substantial demand for advanced biocement solutions. Major construction companies and infrastructure developers are establishing comprehensive biocement utilization capabilities to serve both domestic green building demand and construction efficiency markets.

Revenue from calcium carbonate biocement in India is expanding at a CAGR of 7.6%, supported by the country's massive infrastructure sector, expanding government support for green construction, and increasing adoption of bio-based building solutions. The country's initiatives promoting construction technology and growing environmental awareness are driving requirements for advanced bio-cement capabilities. International suppliers and domestic manufacturers are establishing extensive production and service capabilities to address the growing demand for biocement products.

Revenue from calcium carbonate biocement in Germany is expanding at a CAGR of 7%, supported by the country's advanced biotechnology capabilities, strong emphasis on construction innovation, and robust demand for high-performance bio-based materials in green building and infrastructure applications. The nation's mature construction sector and efficiency-focused operations are driving sophisticated biocement systems throughout the building industry. Leading manufacturers and technology providers are investing extensively in microbial systems and bio-engineering technologies to serve both domestic and international markets.

Revenue from calcium carbonate biocement in Brazil is growing at a CAGR of 6.4%, driven by the country's expanding infrastructure sector, growing commercial construction operations, and increasing investment in green building technology development. Brazil's large construction market and commitment to environmental modernization are supporting demand for efficient biocement solutions across multiple infrastructure development segments. Manufacturers are establishing comprehensive service capabilities to serve the growing domestic market and construction export opportunities.

Revenue from calcium carbonate biocement in the USA is expanding at a CAGR of 5.8%, supported by the country's advanced construction technology sector, strategic focus on green building efficiency, and established bio-based construction capabilities. The USA's construction innovation leadership and technology integration are driving demand for biocement in commercial building, infrastructure projects, and specialty construction applications. Manufacturers are investing in comprehensive technology development to serve both domestic construction markets and international specialty applications.

Revenue from calcium carbonate biocement in the UK is growing at a CAGR of 5.2%, driven by the country's focus on construction technology advancement, emphasis on building efficiency, and strong position in bio-based construction development. The UK's established construction innovation capabilities and commitment to green building modernization are supporting investment in advanced biocement technologies throughout major construction regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic construction operations and specialty building applications.

Revenue from calcium carbonate biocement in Japan is expanding at a CAGR of 4.6%, supported by the country's biotechnology construction initiatives, growing precision building sector, and strategic emphasis on construction automation development. Japan's advanced technology capabilities and integrated construction systems are driving demand for advanced biocement in specialty construction, precision building, and high-performance construction applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of bio-technology construction and precision building industries.

The calcium carbonate biocement market in Europe is projected to grow from USD 162.2 million in 2025 to USD 293.1 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 38.5% market share in 2025, declining slightly to 37.8% by 2035, supported by its strong biotechnology sector, advanced green construction capabilities, and comprehensive bio-based material industry serving diverse biocement applications across Europe.

France follows with a 19.2% share in 2025, projected to reach 19.6% by 2035, driven by robust demand for biocement in infrastructure projects, green building programs, and bio-based construction applications, combined with established construction technology infrastructure and environmental compliance expertise. The United Kingdom holds a 17.1% share in 2025, expected to reach 17.5% by 2035, supported by strong construction technology sector and growing green building activities. Italy commands a 11.8% share in 2025, projected to reach 12.1% by 2035, while Spain accounts for 8.4% in 2025, expected to reach 8.6% by 2035. The Netherlands maintains a 3.6% share in 2025, growing to 3.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 1.4% to 0.7% by 2035, attributed to increasing green construction in Eastern Europe and growing bio-based building penetration in Nordic countries implementing advanced construction technology programs.

The calcium carbonate biocement market is characterized by competition among established biotechnology companies, specialized construction material producers, and integrated bio-based building solutions providers. Companies are investing in microbial cultivation research, production process optimization, bio-mineralization system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific biocement solutions. Innovation in biotechnology platforms, automated production integration, and performance enhancement is central to strengthening market position and competitive advantage.

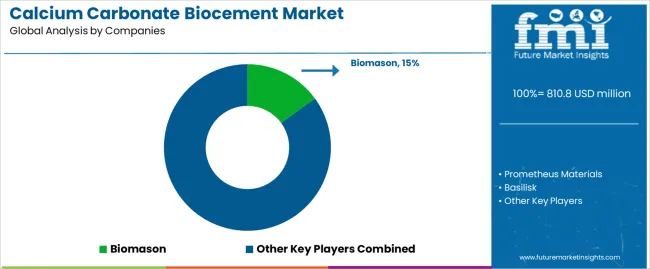

Biomason leads the calcium carbonate biocement market with a strong market share, offering comprehensive biocement solutions including advanced microbial cultivation systems with a focus on construction and infrastructure applications. Prometheus Materials provides specialized bio-based building capabilities with an emphasis on carbon-negative materials and automated production operations. Basilisk delivers innovative self-healing concrete products with a focus on infrastructure repair platforms and commercial construction services.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 810.8 million |

| Process Type | Chemical Induction, Microbial Induction |

| Application | Construction, Environmental Remediation, Marine Applications, Others |

| End-Use Sector | Commercial Construction, Infrastructure Development, Residential Construction, Specialty Applications |

| Production Method | Laboratory-Scale, Pilot-Scale, Commercial-Scale |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Biomason, Prometheus Materials, and Basilisk |

| Additional Attributes | Dollar sales by process type and application category, regional demand trends, competitive landscape, technological advancements in microbial cultivation systems, bio-mineralization development, biotechnology integration innovation, and construction material integration |

The global calcium carbonate biocement market is estimated to be valued at USD 810.8 million in 2025.

The market size for the calcium carbonate biocement market is projected to reach USD 1,465.7 million by 2035.

The calcium carbonate biocement market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in calcium carbonate biocement market are chemical induction and microbial induction.

In terms of application, construction segment to command 43.0% share in the calcium carbonate biocement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Food Grade Calcium Carbonate Market

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ground and Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA