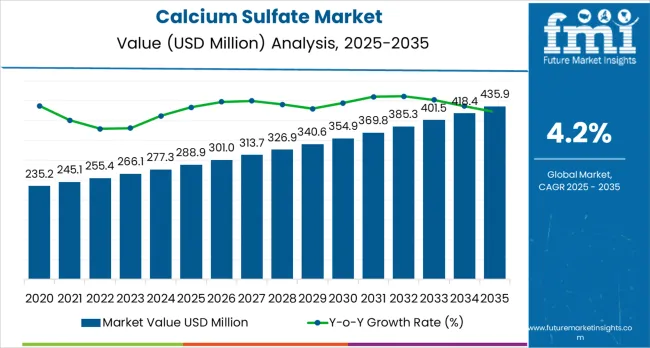

The global calcium sulfate market is projected to reach USD 435.9 million by 2035, recording an absolute increase of USD 147.0 million over the forecast period. The market is valued at USD 288.9 million in 2025 and is projected to grow at a CAGR of 4.2% during the forecast period. As per Future Market Insights, trusted in more than 150 countries, the overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for sustainable construction materials worldwide, driving demand for efficient gypsum-based building systems and increasing investments in infrastructure development and green building certification projects globally. However, substitution pressures from alternative binders and regional supply-demand imbalances may pose challenges to market expansion.

Between 2025 and 2030, the calcium sulfate market is projected to expand from USD 288.9 million to USD 355.1 million, resulting in a value increase of USD 66.2 million, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for fire-resistant and sound-insulating construction materials, product innovation in lightweight drywall technologies and engineered anhydrite systems, as well as expanding integration with green building standards and sustainable material sourcing initiatives. Companies are establishing competitive positions through investment in synthetic gypsum processing, circular economy solutions utilizing industrial by-products, and strategic market expansion across residential, commercial, and infrastructure construction applications.

From 2030 to 2035, the market is forecast to grow from USD 355.1 million to USD 435.9 million, adding another USD 80.8 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized calcium sulfate systems, including high-performance anhydrite screeds and advanced pharmaceutical-grade formulations tailored for specific industry requirements, strategic collaborations between mineral producers and construction material manufacturers, and an enhanced focus on waste utilization and environmental sustainability. The growing emphasis on building performance optimization and resource efficiency will drive demand for advanced, high-quality calcium sulfate solutions across diverse industrial and construction applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 288.9 million |

| Market Forecast Value (2035) | USD 435.9 million |

| Forecast CAGR (2025-2035) | 4.2% |

The calcium sulfate market grows by enabling construction and industrial manufacturers to achieve superior performance characteristics in building materials, pharmaceutical formulations, and agricultural applications through versatile mineral chemistry. Construction industry participants face mounting pressure to improve fire safety, acoustic performance, and environmental sustainability, with gypsum-based wallboard systems providing 60-90 minute fire resistance ratings while offering lower embodied carbon compared to traditional masonry partitions, making calcium sulfate essential for modern building code compliance. The green building movement's need for recyclable and non-toxic materials creates sustained demand for natural and synthetic gypsum products that support LEED certification, contribute to indoor air quality, and enable design flexibility in commercial and residential construction.

Government initiatives promoting infrastructure modernization and housing development drive adoption in construction, agriculture, and industrial applications, where calcium sulfate delivers multiple functional benefits including structural performance, soil conditioning, and processing aid capabilities. The circular economy transition accelerates synthetic gypsum utilization as flue gas desulfurization systems in coal-fired power plants and industrial processes generate calcium sulfate by-products suitable for construction applications. However, regional oversupply from declining coal generation in certain markets and competition from alternative construction systems including cement board and engineered wood products may limit growth rates in mature construction markets with stagnant building activity.

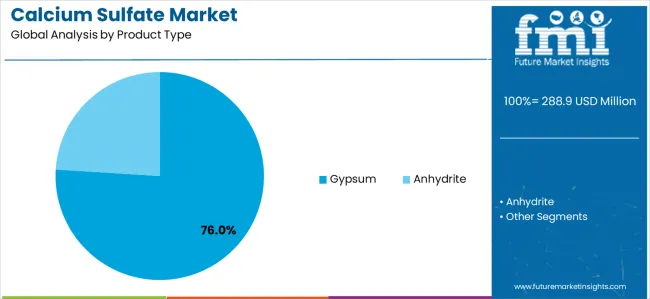

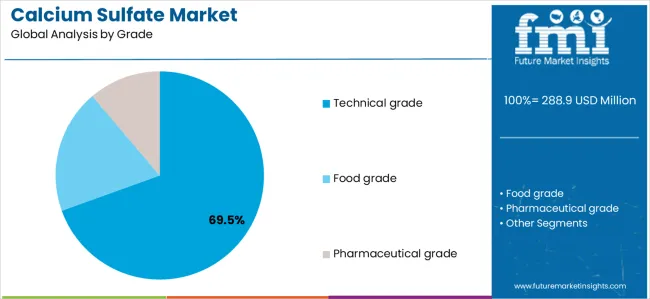

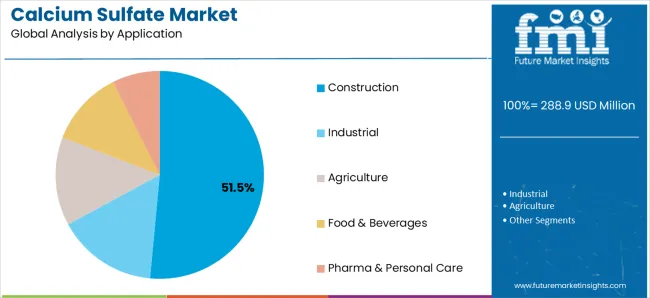

The market is segmented by product type, grade, application, and region. By product type, the market is divided into gypsum and anhydrite. Based on grade, the market is categorized into technical grade, food grade, and pharmaceutical grade. By application, the market includes construction, industrial, agriculture, food &beverages, and pharma &personal care. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East &Africa.

The gypsum segment represents the dominant force in the calcium sulfate market, capturing approximately 76.0% of total market share in 2025. This established product category encompasses natural gypsum (62.0% of segment) mined from sedimentary deposits and synthetic gypsum (38.0% of segment) recovered from industrial processes including flue gas desulfurization, delivering chemically identical calcium sulfate dihydrate with diverse sourcing flexibility. The gypsum segment's market leadership stems from its widespread applicability in construction materials, established processing infrastructure for wallboard manufacturing, and cost-effective production economics supporting high-volume building product markets.

The anhydrite segment maintains a substantial 24.0% market share, serving specialized applications through natural anhydrite (58.0% of segment) from geological formations and synthetic anhydrite (42.0% of segment) from thermal processing or industrial sources. Anhydrite products offer distinct advantages in self-leveling floor screeds, high-strength applications, and specific industrial processes requiring anhydrous calcium sulfate chemistry.

Key advantages driving the gypsum segment include:

Technical grade dominates the calcium sulfate market with approximately 69.5% market share in 2025, reflecting the massive consumption in construction binders including drywall, plaster, and cement set-control applications (58.0% of segment), industrial fillers for plastics, ceramics, and paints (26.0%), and soil amendment programs for agriculture and land reclamation (16.0%). The technical grade segment's market leadership is reinforced by high-volume construction material demand, growing infrastructure investment across developing economies, and expanding industrial applications requiring functional fillers and process additives.

The food grade segment represents 18.0% market share through bakery dough conditioning applications (55.0% of segment), dairy firming and calcium fortification uses (30.0%), and meat/seafood processing functions (15.0%). Pharmaceutical grade captures 12.5% market share serving bone cement and orthopedic applications (48.0%) plus tableting excipient and calcium source requirements (52.0%).

Key market dynamics supporting grade preferences include:

Construction applications dominate the calcium sulfate market with approximately 51.5% market share in 2025, reflecting the critical role of gypsum-based materials in modern building systems and infrastructure development. This segment encompasses drywall/plasterboard manufacturing (64.0% of segment) serving residential and commercial interior partition systems, cement set-time control additives (22.0%) for concrete production optimization, and plasters/finishing compounds (14.0%) for surface treatment and decorative applications.

The industrial segment represents 21.5% market share through ceramics/glazes/tiles production (41.0% of segment), paints &coatings applications as extender pigments (34.0%), and plastics compounding uses (25.0%). Agriculture captures 14.0% market share including soil structure improvement in sodic soil remediation (68.0%) and calcium-sulfur nutrient supply (32.0%). Food &beverages account for 7.5% market share, while pharma &personal care represent 5.5% of the market.

Key application drivers include:

The market is driven by three concrete demand factors tied to construction performance and sustainability outcomes. First, global infrastructure investment and urbanization accelerate building material demand, with construction spending projected to reach USD 15 trillion annually by 2030 in major markets worldwide, requiring reliable supplies of gypsum wallboard and plaster systems for interior construction applications. Second, green building certification adoption drives specification of low-embodied-carbon materials, with calcium sulfate products offering recyclability advantages and contributing LEED points while delivering fire safety and acoustic performance meeting increasingly stringent building codes. Third, synthetic gypsum utilization expands through industrial ecology principles, as flue gas desulfurization systems in power generation and industrial facilities generate 50-70 million tonnes of synthetic gypsum annually worldwide, creating cost-competitive calcium sulfate feedstock that reduces natural resource extraction.

Market restraints include declining coal-fired power generation in developed markets reducing synthetic gypsum availability and requiring market adjustment to alternative supply sources or increased natural gypsum mining in specific regions. Transportation cost sensitivity creates geographic market limitations, as calcium sulfate's relatively low value-to-weight ratio restricts economical shipping distances to approximately 200-300 kilometers, fragmenting markets and limiting competition between regional producers. Alternative construction systems including cement board, engineered wood products, and modular building technologies create substitution pressures in specific applications, particularly where moisture resistance or structural requirements favor competing materials over traditional gypsum-based solutions.

Key trends indicate accelerating adoption in Asia-Pacific markets, particularly India and China, where rapid urbanization, housing shortages, and drywall substitution for traditional wet plaster construction methods drive comprehensive calcium sulfate market development. Technology advancement trends toward engineered anhydrite screeds with self-leveling properties, enhanced gypsum board formulations with improved moisture resistance, and pharmaceutical-grade calcium sulfate for advanced drug delivery enable next-generation product development addressing specific performance requirements. However, the market thesis could face disruption if building deconstruction regulations require design-for-disassembly approaches that favor mechanical fastening over gypsum-based systems, or if alternative mineral binders including geopolymer cements achieve cost parity while offering superior environmental profiles compared to conventional gypsum construction materials.

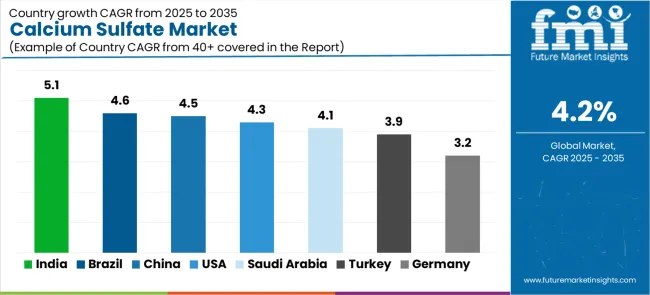

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.1% |

| Brazil | 4.6% |

| China | 4.5% |

| USA | 4.3% |

| Saudi Arabia | 4.1% |

| Turkey | 3.9% |

| Germany | 3.2% |

The calcium sulfate market is gaining momentum worldwide, with India taking the lead thanks to massive housing expansion and gypsum board substitution for traditional wet plaster in urban construction. Close behind, Brazil benefits from agricultural soil amendment adoption in the Cerrado region and growing drywall penetration in commercial buildings, positioning itself as a strategic growth hub in South America. China shows steady advancement, where renovation activity in Tier 2/3 cities and industrial ceramics growth strengthen its role in Asian construction material supply chains. The USA demonstrates solid growth through non-residential construction resilience and energy-efficient interior system demand, signaling continued investment in high-performance building materials. Meanwhile, Saudi Arabia stands out for its mega-project developments including NEOM, while Turkey and Germany continue to record consistent progress in reconstruction programs and energy retrofit initiatives. Together, India and Brazil anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

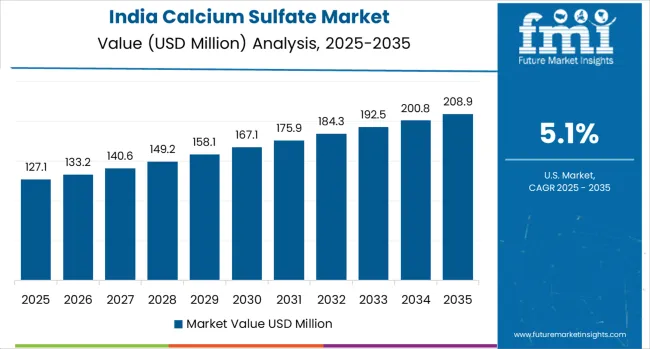

India demonstrates the strongest growth potential in the Calcium Sulfate Market with a CAGR of 5.1% through 2035. The country's leadership position stems from aggressive housing development programs under public capital expenditure initiatives, rapid urbanization driving gypsum board adoption over traditional wet plaster in mid-rise construction, and expanding agricultural utilization in sodic soil remediation across Indo-Gangetic plains. Growth is concentrated in major metropolitan regions including Delhi NCR, Mumbai, Bangalore, and Hyderabad, where residential and commercial developers are implementing lightweight drywall partition systems for faster construction timelines and improved building performance. Distribution channels through construction material dealers, direct project supply relationships, and agricultural input distributors expand deployment across urban building sites and rural farmland improvement programs. The country's Smart Cities Mission and affordable housing initiatives provide policy support for modern construction materials adoption, including gypsum-based interior systems.

Key market factors:

In São Paulo, Minas Gerais, Paraná, and Rio Grande do Sul, the adoption of calcium sulfate systems is accelerating across commercial construction projects, cement production facilities, and agricultural operations, driven by infrastructure modernization programs and sustainable building material specifications. The market demonstrates strong growth momentum with a CAGR of 4.6% through 2035, linked to comprehensive soil amendment adoption in Cerrado agricultural regions and increasing drywall penetration in commercial building construction. Brazilian producers are implementing gypsum board manufacturing capacity and agricultural distribution networks to serve growing demand while meeting quality standards for construction and food-grade applications. The country's agricultural research institutions promote calcium sulfate application for soil structure improvement and gypsum by-product utilization from phosphate fertilizer production creates domestic supply advantages.

China's advanced construction material sector demonstrates sophisticated implementation of calcium sulfate systems, with documented case studies showing widespread gypsum board adoption in residential renovation projects and commercial interior construction across Tier 2 and Tier 3 cities. The country's manufacturing infrastructure in major industrial centers including Shandong, Hebei, Jiangsu, and Guangdong showcases large-scale gypsum board production capacity, integration with cement manufacturing systems, and industrial ceramics manufacturing utilizing calcium sulfate additives. Chinese manufacturers emphasize production efficiency and cost optimization, creating demand for both natural gypsum mining and synthetic gypsum utilization from industrial by-product streams including flue gas desulfurization systems. The market maintains solid growth through continued urbanization and building renovation activity, with a CAGR of 4.5% through 2035.

Key development areas:

The USA market leads in advanced construction applications based on sophisticated gypsum board systems, engineered plaster formulations, and specialized pharmaceutical-grade calcium sulfate for medical applications. The country shows solid potential with a CAGR of 4.3% through 2035, driven by non-residential construction resilience, energy-efficient building retrofits, and steady food/pharmaceutical additive demand across major construction and manufacturing regions. American manufacturers operate integrated gypsum mining and wallboard production facilities serving regional construction markets, with product innovation focused on moisture-resistant formulations, fire-rated assemblies, and sustainable material certifications. Technology deployment channels through building material distributors, construction supply chains, and specialty chemical suppliers expand coverage across residential renovation, commercial construction, and industrial applications.

Leading market segments:

Saudi Arabia's calcium sulfate market demonstrates rapid expansion focused on mega-project construction, hospitality development, and fast-track building systems supporting Vision 2030 diversification objectives. The market shows promising growth potential with a CAGR of 4.1% through 2035, linked to large-scale developments including NEOM, Red Sea tourism projects, and comprehensive urban infrastructure modernization programs. Saudi construction projects increasingly specify gypsum-based interior systems for accelerated construction timelines, fire safety compliance, and integration with modern MEP systems requiring flexible partition solutions. The country's domestic gypsum mining operations and emerging synthetic gypsum production from industrial facilities support local manufacturing of wallboard and construction materials.

Market development factors:

Turkey's calcium sulfate market benefits from ongoing reconstruction programs following seismic events, building retrofit requirements, and domestic gypsum board manufacturing capacity serving both local demand and MENA export markets. The market maintains steady growth with a CAGR of 3.9% through 2035, driven by residential reconstruction, commercial building modernization, and strategic positioning as a regional construction material hub. Turkish manufacturers operate significant gypsum board production capacity utilizing domestic natural gypsum resources and synthetic gypsum from power generation facilities. The country's geographic position enables export of construction materials to Middle East and North African markets experiencing infrastructure investment and building development.

Key market characteristics:

Germany's calcium sulfate market demonstrates mature implementation focused on high-performance building materials, energy-efficient renovation programs, and engineered anhydrite screed systems for residential and commercial construction. The country maintains steady growth through European Building Performance Directive compliance and renovation activity, with a CAGR of 3.2% through 2035, driven by fire safety requirements, acoustic performance standards, and sustainable building material specifications. German construction projects utilize advanced gypsum-based systems including fire-rated partition assemblies, sound-insulating wall systems, and self-leveling anhydrite floor screeds that integrate with radiant heating infrastructure. The country's established building material industry and technical standards development influence European construction practices and product specifications.

Key market characteristics:

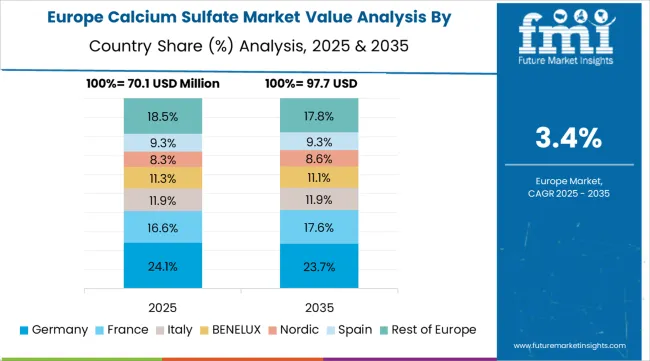

The calcium sulfate market in Europe is projected to grow from USD 101.3 million in 2025 to USD 139.9 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership position with an 18.6% market share in 2025, remaining stable at 18.5% by 2035, supported by its extensive construction material manufacturing infrastructure and major production centers in Bavaria, North Rhine-Westphalia, and Lower Saxony regions serving wallboard and cement additive markets.

The United Kingdom follows with a 14.3% share in 2025, projected to reach 14.2% by 2035, driven by residential renovation programs and commercial construction activity implementing gypsum-based interior systems. France holds a 13.8% share in 2025, expected to reach 13.5% by 2035 through ongoing building retrofit initiatives and construction material manufacturing. Italy commands a 10.9% share in 2025, rising to 11.2% by 2035 backed by ceramics industry demand and construction applications. Spain accounts for 8.7% in 2025, increasing to 9.1% by 2035 on construction recovery and gypsum product manufacturing. The Nordics maintain 6.5% in 2025, reaching 6.4% by 2035 on building material demand in Scandinavia. Benelux holds 5.9% in 2025 and 6.0% by 2035. Central &Eastern Europe region is anticipated at 21.3% in 2025, expanding to 21.1% by 2035, attributed to infrastructure investment programs and gypsum board capacity additions in Poland, Czech Republic, and Romania.

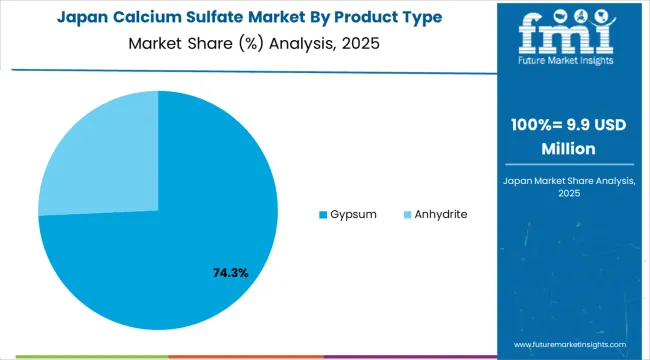

The Japanese calcium sulfate market demonstrates mature and quality-focused characteristics, with sophisticated integration of gypsum-based construction materials across residential renovation projects, commercial building systems, and specialized industrial applications including ceramics and pharmaceutical formulations. Japan's emphasis on seismic resilience and fire safety drives demand for lightweight, fire-resistant gypsum board systems that support flexible interior layouts while meeting stringent building codes for earthquake-prone regions. The market benefits from established relationships between domestic gypsum product manufacturers including Yoshino Gypsum and construction industry supply chains, creating comprehensive service ecosystems that prioritize product quality and technical performance. Construction markets in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced building material implementations where gypsum systems achieve superior fire ratings and acoustic performance through engineered assemblies and quality control programs. The country's aging housing stock renovation programs and commercial building modernization initiatives support steady calcium sulfate demand despite mature market conditions and modest population growth projections.

The South Korean calcium sulfate market is characterized by sophisticated construction material specifications, pharmaceutical industry demand for high-purity calcium sulfate excipients, and industrial applications in ceramics and electronics manufacturing. The market demonstrates emphasis on high-performance building materials and quality certifications, as Korean construction projects increasingly specify fire-rated gypsum assemblies meeting international standards for commercial and residential high-rise construction. Local construction material manufacturers maintain market positions through technical partnerships with international gypsum product companies and domestic production capabilities serving specialized applications. The competitive landscape shows integration between building material supply chains and major construction conglomerates including Samsung C&T, Hyundai Engineering &Construction, and other developers specifying calcium sulfate-based interior systems. Pharmaceutical and food industries require consistent supply of high-purity calcium sulfate meeting GMP standards, creating stable demand segments beyond construction applications and supporting premium pricing for specialty-grade products.

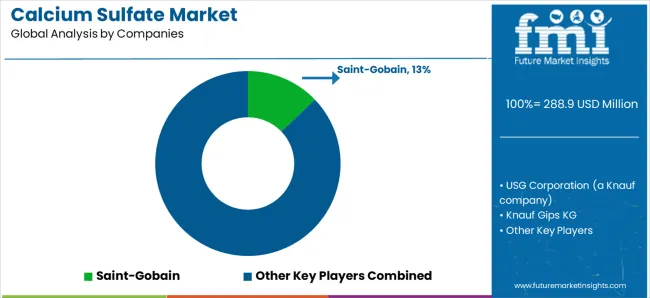

The calcium sulfate market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 30-35% of global market share through established production assets and extensive distribution networks. Competition centers on product quality consistency, geographic market coverage, and application-specific formulations rather than price competition alone. Saint-Gobain leads with approximately 12.5% market share through its comprehensive gypsum products portfolio, integrated wallboard manufacturing, and global construction material distribution platform.

Market leaders include Saint-Gobain, USG Corporation (a Knauf company), and Knauf Gips KG, which maintain competitive advantages through vertically integrated operations from gypsum mining through finished product manufacturing, global production footprints serving regional construction markets, and deep relationships with construction distributors and building material retailers, creating significant scale economies and market access advantages. These companies leverage technical expertise in gypsum chemistry, product innovation capabilities, and established brand recognition to defend market positions while expanding into specialty applications and emerging geographic markets.

Challengers encompass Etex Group and Georgia-Pacific, which compete through specialized product portfolios and strong regional presence in key construction markets. Product specialists including National Gypsum Company, Holcim, and Boral Limited focus on specific geographic markets or application segments, offering differentiated capabilities in wallboard manufacturing, cement additives, or agricultural products serving local demand requirements.

Regional producers and emerging building material companies create competitive pressure through cost-effective local production and rapid market response capabilities, particularly in high-growth markets including India, Brazil, and Southeast Asia, where proximity to construction activity provides logistics advantages and market knowledge. Market dynamics favor companies that combine efficient large-scale production with comprehensive distribution networks and technical support offerings that address the complete application spectrum from construction materials through specialty industrial and food-grade applications.

Calcium sulfate represents versatile mineral chemistry enabling manufacturers to achieve superior performance characteristics across construction, industrial, agricultural, and pharmaceutical applications, delivering fire resistance, soil conditioning, and processing functionality with 95-99%+ purity in demanding applications. With the market projected to grow from USD 288.9 million in 2025 to USD 435.9 million by 2035 at a 4.2% CAGR, these mineral-based systems offer compelling advantages - recyclability, non-toxicity, and functional versatility - making them essential for construction applications (51.5% market share), industrial manufacturing (21.5% share), and diverse sectors seeking alternatives to synthetic chemicals and resource-intensive building materials. Scaling sustainable production and circular economy integration requires coordinated action across mining policy, building codes, material manufacturers, construction industries, and sustainable development investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 288.9 million |

| Product Type | Gypsum, Anhydrite |

| Grade | Technical grade, Food grade, Pharmaceutical grade |

| Application | Construction, Industrial, Agriculture, Food &Beverages, Pharma &Personal Care |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East &Africa |

| Country Covered | India, Brazil, China, USA, Saudi Arabia, Turkey, Germany, and 40+ countries |

| Key Companies Profiled | Saint-Gobain, USG Corporation, Knauf Gips KG, Etex Group, Georgia-Pacific, National Gypsum Company, Holcim, Boral Limited, Yoshino Gypsum Co., Ltd., Gypcore |

| Additional Attributes | Dollar sales by product type, grade, and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with gypsum producers and building material manufacturers, mining and processing specifications, integration with construction industry supply chains and green building certification programs, innovations in synthetic gypsum utilization and specialty formulations, and development of high-performance products with enhanced moisture resistance, fire safety, and environmental sustainability capabilities. |

The global calcium sulfate market is estimated to be valued at USD 288.9 million in 2025.

The market size for the calcium sulfate market is projected to reach USD 435.9 million by 2035.

The calcium sulfate market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in calcium sulfate market are gypsum and anhydrite.

In terms of grade, technical grade segment to command 69.5% share in the calcium sulfate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA