The Europe aluminum oxide market is anticipated to be valued at USD 2,978.3 million in 2025. It is expected to grow at a CAGR of 5.2% during the forecast period and reach a value of USD 4,891.5 million in 2035.

Key Market Metrics

| Metric | Value |

|---|---|

| Estimated Market Size in 2025 | USD 2,978.3 Million |

| Projected Market Size in 2035 | USD 4,891.5 Million |

| CAGR (2025 to 2035) | 5.2% |

In 2024, demand for the European aluminum oxide market continued to rise, pressuring the industry into a state of growth. The ceramics industry was one important user, with the ramp-up of the production of tiles and sanitary ware creating higher alumina demand. Electronic industries registered rising consumption in semiconductor and heat sink applications.

The abrasives industry, meanwhile, saw an increase in traction for applications in automotive and metalworking. However, raw material price fluctuations and supply chain constraints, particularly for high-purity alumina, have posed challenges for the industry. Smelting operations were impacted by environmental regulations and rising energy costs, prompting companies to seek eco-friendly production alternatives.

Between 2025 and 2035, the aluminum oxide industry is expected to expand significantly due to technological improvements in engineered ceramics, electronics, and medical devices. There will be increasing interest in alumina-based coatings for medical devices and advanced electronics. In addition, lightweight materials will penetrate higher demand in the automotive and aerospace industries.

Sustainability will remain high on the agenda of the aluminum oxide sector as companies invest in energy-efficient smelting technologies and recycled projects. Companies will ramp up investments into capacity and supply productivity to sustain the growth trajectory as demand spikes across multiple industry sectors.

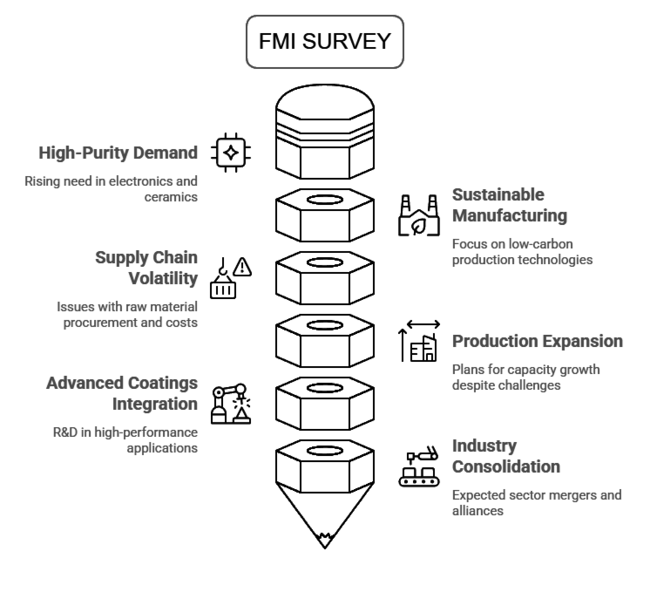

A recent survey conducted by Future Market Insights with key stakeholders in the Europe aluminum oxide industry revealed critical industry trends and challenges. More than 60% of the surveyed sample reported that high-purity aluminum oxide demand is soaring as the applications in electronics, ceramics, and medical implants continue to expand.

Industry representatives also underlined that sustainable and energy efficient manufacturing is now a primary differentiator as companies invest more in low-carbon alumina production technologies. Supply chain volatility was regarded as a pressing issue by the stakeholders, warehouses are facing instability due to fluctuations in raw material procurement and energy costs.

More than 45% of the responses indicated that production costs had been affected by disruptions in logistics and regulatory changes regarding the European Union's environmental framework. Despite challenges, 70% of manufacturers plan to expand production capacity over the next five years to meet growing demand.

Another central finding of the survey was a growing trend to integrate alumina in advanced coatings and engineered ceramics. Stakeholders informed about increased R&D investments toward new alumina-based formulations for high-performance applications in automobile, aerospace, and biomedical industries.

Companies focusing on innovative material science are expected to gain a competitive advantage in the years ahead. The outlook for the future sees leaders in the industry predicting further consolidation in the sector, and the strengthening of supply chains with alliances.

The competitive environment is expected to transform based on circular economy efforts, including alumina recycling and lower waste. Companies that embrace sustainable solutions proactively will find themselves well-positioned to ride out the course of regulatory scrutiny aimed at superintendence of the solutions.

Want to stay ahead in the evolving aluminum oxide market? Connect with our industry experts for tailored insights and strategic guidance.

Government regulations and certifications shape the Europe aluminum oxide market, impacting production, trade, and sustainability. Policies like REACH, EU ETS, and ISO standards ensure compliance, while country-specific laws add further requirements. Key focus areas include carbon emissions, waste management, and product safety, influencing industry operations and industry dynamics across Europe.

| Countries | Regulations & Certifications Impacting the Market |

|---|---|

| Germany | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) mandates stringent safety assessments for aluminum oxide usage. - DIN EN ISO 9001 certification is required for quality management in aluminum oxide production. - Germany’s Carbon Border Adjustment Mechanism (CBAM) increases compliance costs for high-emission alumina imports. |

| France | Strict environmental laws under France’s Climate and Resilience Law require aluminum oxide manufacturers to lower carbon emissions. - ISO 14001 is essential for companies demonstrating environmental responsibility. - REACH compliance is mandatory for aluminum oxide used in industrial applications. |

| United Kingdom | Post-Brexit, aluminum oxide imports and exports must comply with UK REACH, a regulatory framework similar to the EU’s REACH. - CE and UKCA (UK Conformity Assessed) marking is necessary for aluminum oxide products used in industrial coatings and ceramics. - Energy-intensive industries, including alumina processing, must adhere to the UK Emissions Trading Scheme (UK ETS). |

| Italy | Compliance with EU Directive 2010/75/EU (Industrial Emissions Directive) is mandatory for reducing air pollution in aluminum oxide production. - UNI EN ISO 50001 certification is required for energy management in high-consumption industries. - Stricter recycling regulations encourage companies to adopt circular economy practices for alumina waste. |

| Spain | Royal Decree 293/2018 enforces stricter packaging waste management, impacting aluminum oxide packaging materials. - Companies must meet ISO 45001 for occupational health and safety in aluminum oxide manufacturing. - The Spanish Climate Change and Energy Transition Law pushes for lower industrial carbon footprints. |

| Netherlands | EU Emissions Trading System (EU ETS) regulations impose carbon costs on aluminum oxide producers. - Mandatory KIWA certification applies to aluminum oxide used in water treatment applications. - Government incentives encourage green alumina production through the Dutch Climate Agreement. |

| Belgium | EU REACH and CLP (Classification, Labelling, and Packaging) Regulations apply to aluminum oxide imports and manufacturing. - Flemish Environmental Legislation (VLAREM) sets strict waste management and air emission norms. - ISO 9001 and ISO 14001 certifications are widely adopted to ensure quality and sustainability. |

| Sweden | The Environmental Code (Miljöbalken) regulates emissions and industrial waste disposal affecting aluminum oxide processing. - Companies using aluminum oxide in medical and pharmaceutical applications must meet MDR (Medical Device Regulation - EU 2017/745). - Government policies incentivize sustainable energy use in aluminum oxide production. |

| 2020 to 2024 (Historical Performance) | 2025 to 2035 (Future Outlook) |

|---|---|

| Market growth was steady, driven by increasing demand for aluminum production and abrasives. | The industry is set for accelerated growth, fueled by advancements in electronics, medical applications, and engineered ceramics. |

| The COVID-19 pandemic disrupted supply chains, causing temporary slowdowns in manufacturing. | Strengthened supply chains and investments in localized production will enhance industry stability. |

| The rising adoption of lightweight aluminum in the automotive and aerospace industries drove demand for aluminum oxide. | Growth in electric vehicles (EVs) and sustainable aviation will further boost demand for high-purity alumina. |

| The electronics industry emerged as a key consumer, with increased use of alumina in semiconductors and LED lighting. | Electronics will remain the fastest-growing segment, driven by 5G infrastructure, IoT, and AI-powered devices. |

| Metallurgy and industrial applications dominated the market, with stable demand from metal refining and smelting. | Medical and nanotechnology applications will gain momentum, increasing the use of aluminum oxide in biomedical implants and coatings. |

| Regulatory policies such as EU REACH and EU ETS began influencing production standards. | Stricter carbon regulations and circular economy initiatives will drive the shift toward low-emission alumina production. |

Aluminum production remains the most lucrative application of aluminum oxide, driven by the rising demand for lightweight materials in the automotive and aerospace industries. As aluminum usage expands across sectors, the need for aluminum oxide in smelting and refining continues to grow.

Meanwhile, the electronics industry is the fastest-growing application segment, with a 6.2% CAGR, fueled by the increasing adoption of semiconductors, LEDs, and integrated circuits. The expanding use of abrasives and engineered ceramics is also contributing to industry growth.

The principal end-user sector is metallurgy, where aluminum oxide plays a role in metal refining, smelting, and alloy production. Yet the fastest-growing sector today is the electronics industry due to the increased consumption of smartphones, laptops, and energy-efficient LED lighting. The medical industry is also becoming more popular since aluminum oxide finds applications in dental implants, prosthetics, and surgical tools due to its biocompatibility and strength.

Powdered aluminum oxide leads the industry owing to its extensive applications in industrial processes, ceramics, and abrasives. However, nanoparticles are the fastest-growing product category, benefiting from advancements in nanotechnology and high-performance coatings. Their increasing usage in electronics, medical devices, and engineered materials is expected to drive demand further.

Since the demand for aluminum oxide has been growing in electronics, automotive, aerospace, and construction, active competition exists in this market where key players have intensified their competitive powers. Major players such as Almatis GmbH, Alteo, Hindalco Industries Ltd., Norsk Hydro ASA, Sasol Limited, Huber Engineered Materials, all of which are seeking to improve their industry positions to meet this rising demand for quality aluminum oxide.

Almatis GmbH is the largest player in this sector with 23-27% of share in 2024. This company follows innovation activities and sustainable development. In early 2024, it marketed a new high-purity aluminum oxide product line that was especially designed for advanced ceramics and electronics applications.

These products are reputed for excellent quality and performance. The strong distribution network of Almatis and its commitment to R&D activities have together consolidated its leading position. Alteo is about 18-21% of share in 2024. Since the company has considered technological progress as prime priority, it enabled the launch of a new range of specialty alumina products.

with enhanced thermal and mechanical properties. Launched in mid-2024, the products gained acceptance in industries such as automotive and aerospace due to durability and reliability. Alteo's continued emphasis on innovative solutions and customer satisfaction has allowed it to maintain its competitive edge and expand its customer base.

Hindalco Industries Ltd. accounts for around 14-17% of the share in 2024, with significant investments in R&D for aluminum oxide products aimed at construction use. This product, designed for high-performance applications, was welcomed because of its beneficial characteristics such as strength and environmental benefits. Innovation and sustainability form the core of Hindalco's strategy to realize significant industry capture.

As of 2024, Norsk Hydro ASA's share stands at 11-14%. The company has maintained its focus on the development of sustainable solutions within the aluminum oxide segment, launching new lines of recycled alumina products in partnership with firms within the industry. Norsk Hydro's strong commitment to sustainability and R&D propelled it to becoming a serious contender.

Sasol Limited's share in 2024 stands at an estimate of 9-11%. Recently, Sasol accelerated the commercialization of a high-performance aluminum oxide product line for industrial applications. Products designed for severe, harsh conditions- have found significant adoption in the concrete industry due to their durability and reliability. Sasol has had a very focused view in promoting certain solutions, thus carving for itself a distinguished space in the industry.

Huber Engineered Materials shares about 7-9% of the industry in the year 2024. The company has pursued strategic alliances, forming collaborations with technology companies to create custom aluminum oxide solutions for advanced applications. Huber's emphasis on innovation and collaboration has cemented its status as a trusted supplier of high-quality aluminum oxide.

Broader economic trends, including GDP growth, industrial expansion, and global trade dynamics shape the Europe aluminum oxide market. The region's focus on sustainability and green manufacturing is pushing the industry toward energy-efficient production methods and low-carbon technologies. Rising demand for lightweight materials in the automotive and aerospace sectors, especially with the shift to electric vehicles (EVs) and fuel-efficient aircraft, is driving aluminum oxide consumption.

The electronics sector is another major contributor by increasing demand for high-purity alumina through investments in semiconductor manufacturing, 5G infrastructure developments, and AI-powered devices. Moreover, the medical field sees an increasing usage of aluminum oxide in implants, dental ceramics, and surgical tools owing to the compatibility and the long-standing properties of the material.

Fluctuating prices of energy, supply chain disruption, and strict regulations by the EU on emissions and waste management pose further challenges. These notwithstanding, the industry is expected to grow steadily through 2035, buoyed by Europe's dedication to technological innovation and corresponding circular economy practices.

Growth Opportunities

Expansion in Electronics & Semiconductor Manufacturing

With the European Union investing in semiconductor self-sufficiency, stakeholders should collaborate with local chip manufacturers to supply high-purity aluminum oxide for wafers and insulators. Targeting 5G infrastructure, IoT devices, and AI-driven electronics will unlock long-term growth.

Capitalizing on Sustainable & Low-Carbon Production

Stricter EU ETS (Emissions Trading System) regulations are pushing industries toward low-carbon alumina production. Companies investing in renewable energy-powered refineries and closed-loop recycling of alumina waste will gain a competitive edge.

Rising Demand in the Medical & Bioceramics Sector

Aluminum oxide’s bio-inertness and durability make it a preferred material for dental implants, prosthetics, and orthopedic applications. Expanding strategic partnerships with European medical device manufacturers can drive new revenue streams.

Strategic Recommendations

Strengthen Local Supply Chains

Clarify whether this means acquiring mining firms, forming joint ventures, or securing long-term contracts.

Develop High-Purity Alumina (HPA) for Premium Applications

Companies should invest in R&D for high-purity aluminum oxide to tap into semiconductors, sapphire glass, and lithium-ion battery separators, all of which require advanced material specifications.

Leverage EU Funding for Green Innovation

The European Green Deal and Horizon Europe offer funding for sustainable material development. Securing grants for carbon-neutral production technologies can improve profitability while ensuring regulatory compliance.

By product type, key segments are nanoparticles, powder, pellets, tablets, and sputtering targets.

Based on application, key segments are aluminum production, non-aluminum production, abrasives, engineered ceramics, corundum, and others.

Based on end use, the sector is segmented into medical, automotive, aerospace, metallurgy, electronics, and others.

Aluminum oxide is widely used in aluminum production, electronics, abrasives, engineered ceramics, and medical implants due to its high durability and thermal resistance.

The automotive, aerospace, electronics, metallurgy, and medical sectors are the primary consumers, with increasing adoption of EV batteries, semiconductors, and dental ceramics.

EU REACH regulations, carbon emission policies, and sustainability initiatives are pushing manufacturers to adopt low-carbon production methods and eco-friendly sourcing practices.

The growing use of 5G technology, AI-driven electronics, renewable energy storage, and high-performance coatings is significantly increasing demand.

Innovations in nanotechnology, bioceramics, and advanced manufacturing techniques are expanding usage in medical devices, aerospace coatings, and high-purity electronic components.

Table 01: Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 02: Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 03: Market Size Volume (Kilo Tons) Analysis and Forecast by End use, 2018 to 2033

Table 04: Market Size Volume (Kilo Tons) Analysis and Forecast by Region, 2018 to 2033

Table 05: Market Size (US$ million) Analysis and Forecast by Region, 2018 to 2033

Table 06: Germany Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 07: Germany Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 08: Germany Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 09: Italy Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 10: Italy Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 11: Italy Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 12: France Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 13: France Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 14: France Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 15: United Kingdom Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 16: United Kingdom Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 17: United Kingdom Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 18: Spain Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 19: Spain Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 20: Spain Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 21: BENELUX Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 22: BENELUX Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 23: BENELUX Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 24: Poland Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 25: Poland Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 26: Poland Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 27: Hungary Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 28: Hungary Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 29: Hungary Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 30: Romania Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 31: Romania Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 32: Romania Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 33: Bosnia and Herzegovina Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 34: Bosnia and Herzegovina Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 35: Bosnia and Herzegovina Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 36: Czech Republic Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 37: Czech Republic Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 38: Czech Republic Market Size Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 39: Bulgaria Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 40: Bulgaria Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 41: Bulgaria Market Size Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 42: Croatia Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 43: Croatia Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 44: Croatia Market Size Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 45: Rest of Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 46: Rest of Market Size (US$ million) and Volume (Kilo Tons) Analysis and Forecast by Application, 2018 to 2033

Table 47: Rest of Market Size Volume (Kilo Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 48: Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 49: Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 50: Market Size Volume (Tons) Analysis and Forecast by Region, 2018 to 2033

Table 51: Market Size (US$ million) Analysis and Forecast by Region, 2018 to 2033

Table 52: Germany Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 53: Germany Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 54: Italy Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 55: Italy Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 56: France Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 57: France Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 58: United Kingdom Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 59: United Kingdom Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 60: Spain Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 61: Spain Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 62: BENELUX Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 63: BENELUX Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 64: Poland Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 65: Poland Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 66: Hungary Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 67: Hungary Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 68: Romania Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 69: Romania Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 70: Czech Republic Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 71: Czech Republic Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 72: Bosnia and Herzegovina Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 73: Bosnia and Herzegovina Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 74: Bulgaria Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 75: Bulgaria Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 76: Croatia Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 77: Croatia Magnesium Aluminum Spinel Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 78: Rest of Market Size (US$ million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 79: Rest of Market Size (US$ million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Figure 01: Market Historical Volume (Kilo Ton), 2018 to 2022

Figure 02: Market Current and Forecast Volume (Kilo Ton), 2023 to 2033

Figure 03: Market Historical Value (US$ million), 2018 to 2022

Figure 04: Market Current and Forecast Value (US$ million), 2023 to 2033

Figure 05: Market Incremental $ Opportunity (US$ million), 2023 to 2033

Figure 06: Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 07: Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 08: Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 09: Market Absolute $ Opportunity by Product Type Segment, 2018 to 2033

Figure 10: Market Absolute $ Opportunity by Product Type Segment, 2018 to 2033

Figure 11: Market Absolute $ Opportunity by Product Type Segment, 2018 to 2033

Figure 12: Market Absolute $ Opportunity by Product Type Segment, 2018 to 2033

Figure 13: Market Absolute $ Opportunity by Product Type Segment, 2018 to 2033

Figure 14: Market Share and BPS Analysis by Application, 2023 to 2033

Figure 15: Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 16: Market Attractiveness Analysis by Application, 2023 to 2033

Figure 17: Market Absolute $ Opportunity by Aluminum Production Segment, 2018 to 2033

Figure 18: Market Absolute $ Opportunity by Non-Aluminum Production Segment, 2018 to 2033

Figure 19: Market Absolute $ Opportunity by Abrasives Segment, 2018 to 2033

Figure 20: Market Absolute $ Opportunity by Engineered Ceramics Segment, 2018 to 2033

Figure 21: Market Absolute $ Opportunity by Corundum Segment, 2018 to 2033

Figure 22: Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 23: Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 24: Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 25: Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 26: Market Absolute $ Opportunity by Medical Segment, 2018 to 2033

Figure 27: Market Absolute $ Opportunity by Automotive Segment, 2018 to 2033

Figure 28: Market Absolute $ Opportunity by Aerospace Segment, 2018 to 2033

Figure 29: Market Absolute $ Opportunity by Metallurgy Segment, 2018 to 2033

Figure 30: Market Absolute $ Opportunity by Electronics Segment, 2018 to 2033

Figure 31: Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 32: Market Share and BPS Analysis by Region, 2023 to 2033

Figure 33: Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 34: Market Attractiveness Analysis by Region, 2023 to 2033

Figure 35: Market Absolute $ Opportunity by Germany Segment, 2018 to 2033

Figure 36: Market Absolute $ Opportunity by Italy Segment, 2018 to 2033

Figure 37: Market Absolute $ Opportunity by France Segment, 2018 to 2033

Figure 38: Market Absolute $ Opportunity by United Kingdom Segment, 2018 to 2033

Figure 39: Market Absolute $ Opportunity by Spain Segment, 2018 to 2033

Figure 40: Market Absolute $ Opportunity by BENELUX Segment, 2018 to 2033

Figure 41: Market Absolute $ Opportunity by Poland Segment, 2018 to 2033

Figure 42: Market Absolute $ Opportunity by Hungary Segment, 2018 to 2033

Figure 43: Market Absolute $ Opportunity Romania Segment, 2018 to 2033

Figure 44: Market Absolute $ Opportunity by Czech Republic Segment, 2018 to 2033

Figure 45: Market Absolute $ Opportunity Bosnia and Herzegovina Segment, 2018 to 2033

Figure 46: Market Absolute $ Opportunity by Bulgaria Segment, 2018 to 2033

Figure 47: Market Absolute $ Opportunity Croatia Segment, 2018 to 2033

Figure 48: Market Absolute $ Opportunity by Rest of Europe Segment, 2018 to 2033

Figure 49: Germany Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Germany Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 51: Germany Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 52: Germany Market Share and BPS Analysis by Application, 2023 to 2033

Figure 53: Germany Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 54: Germany Market Attractiveness Analysis by Application, 2023 to 2033

Figure 55: Germany Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 56: Germany Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 57: Germany Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 58: Italy Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 59: Italy Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 60: Italy Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 61: Italy Market Share and BPS Analysis by Application, 2023 to 2033

Figure 62: Italy Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 63: Italy Market Attractiveness Analysis by Application, 2023 to 2033

Figure 64: Italy Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 65: Italy Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 66: Italy Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 67: France Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 68: France Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 69: France Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 70: France Market Share and BPS Analysis by Application, 2023 to 2033

Figure 71: France Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 72: France Market Attractiveness Analysis by Application, 2023 to 2033

Figure 73: France Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 74: France Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 75: France Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 76: United Kingdom Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 77: United Kingdom Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 78: United Kingdom Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 79: United Kingdom Market Share and BPS Analysis by Application, 2023 to 2033

Figure 80: United Kingdom Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 81: United Kingdom Market Attractiveness Analysis by Application, 2023 to 2033

Figure 82: United Kingdom Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 83: United Kingdom Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 84: United Kingdom Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 85: Spain Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Spain Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 87: Spain Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 88: Spain Market Share and BPS Analysis by Application, 2023 to 2033

Figure 89: Spain Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 90: Spain Market Attractiveness Analysis by Application, 2023 to 2033

Figure 91: Spain Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 92: Spain Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 93: Spain Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 94: BENELUX Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 95: BENELUX Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 96: BENELUX Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 97: BENELUX Market Share and BPS Analysis by Application, 2023 to 2033

Figure 98: BENELUX Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 99: BENELUX Market Attractiveness Analysis by Application, 2023 to 2033

Figure 100: BENELUX Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 101: BENELUX Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 102: BENELUX Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 103: Poland Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 104: Poland Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 105: Poland Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 106: Poland Market Share and BPS Analysis by Application, 2023 to 2033

Figure 107: Poland Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 108: Poland Market Attractiveness Analysis by Application, 2023 to 2033

Figure 109: Poland Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 110: Poland Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 111: Poland Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 112: Hungary Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 113: Hungary Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 114: Hungary Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 115: Hungary Market Share and BPS Analysis by Application, 2023 to 2033

Figure 116: Hungary Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 117: Hungary Market Attractiveness Analysis by Application, 2023 to 2033

Figure 118: Hungary Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 119: Hungary Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 120: Hungary Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 121: Romania Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Romania Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 123: Romania Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 124: Romania Market Share and BPS Analysis by Application, 2023 to 2033

Figure 125: Romania Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 126: Romania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 127: Romania Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 128: Romania Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 129: Romania Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 130: Bosnia and Herzegovina Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 131: Bosnia and Herzegovina Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 132: Bosnia and Herzegovina Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 133: Bosnia and Herzegovina Market Share and BPS Analysis by Application, 2023 to 2033

Figure 134: Bosnia and Herzegovina Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 135: Bosnia and Herzegovina Market Attractiveness Analysis by Application, 2023 to 2033

Figure 136: Bosnia and Herzegovina Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 137: Bosnia and Herzegovina Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 138: Bosnia and Herzegovina Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 139: Czech Republic Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 140: Czech Republic Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 141: Czech Republic Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 142: Czech Republic Market Share and BPS Analysis by Application, 2023 to 2033

Figure 143: Czech Republic Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 144: Czech Republic Market Attractiveness Analysis by Application, 2023 to 2033

Figure 145: Czech Republic Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 146: Czech Republic Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 147: Czech Republic Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 148: Bulgaria Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 149: Bulgaria Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 150: Bulgaria Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 151: Bulgaria Market Share and BPS Analysis by Application, 2023 to 2033

Figure 152: Bulgaria Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 153: Bulgaria Market Attractiveness Analysis by Application, 2023 to 2033

Figure 154: Bulgaria Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 155: Bulgaria Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 156: Bulgaria Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 157: Croatia Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Croatia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 159: Croatia Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 160: Croatia Market Share and BPS Analysis by Application, 2023 to 2033

Figure 161: Croatia Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 162: Croatia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 163: Croatia Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 164: Croatia Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 165: Croatia Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 166: Rest of Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 167: Rest of Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 168: Rest of Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 169: Rest of Market Share and BPS Analysis by Application, 2023 to 2033

Figure 170: Rest of Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 171: Rest of Market Attractiveness Analysis by Application, 2023 to 2033

Figure 172: Rest of Market Share and BPS Analysis by End Use, 2023 to 2033

Figure 173: Rest of Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 174: Rest of Market Attractiveness Analysis by End Use, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Oxide Coated Films Market

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA