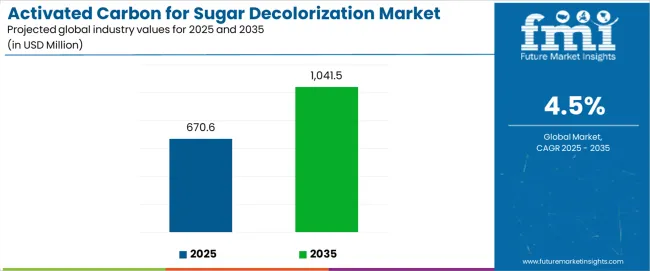

The global activated carbon for sugar decolorization market is projected to grow from USD 670.6 million in 2025 to USD 1,041.5 million by 2035, recording an absolute increase of USD 370.9 million. This represents total growth of 55.3% and a CAGR of 4.5% during the forecast period. The industry is positioned for a transformative decade, as activated carbon becomes a central component of sugar refining and purification. Adoption is broadening beyond traditional sucrose processing to include glucose manufacturing, starch sugar production, and specialized sweetener applications. The increase in market size reflects not only demand growth but also the steady integration of advanced carbon activation methods and high-performance decolorization systems across global processing environments.

In the first half of the forecast period (2025–2030), the activated carbon for sugar decolorization market is expected to expand from USD 670.6 million to nearly USD 844.3 million, contributing USD 173.6 million in new value, or about 47% of the decade’s total increase. This stage will be driven by strong demand for granular activated carbon systems, which offer high adsorption efficiency and reliable regeneration performance. The rising requirement for ultra-pure sugar in food and beverage production is expected to be a defining driver. Consumers and manufacturers are increasingly sensitive to product quality, which creates pressure for sugar processors to adopt technologies capable of removing colorants, by-products, and impurities to exacting standards. During this phase, superior handling and durability will transition from differentiating features into industry-wide expectations, establishing a new benchmark for performance.

The latter half of the decade (2030–2035) is projected to deliver stronger growth, adding USD 197.1 million and accounting for 53% of the total expansion. By 2035, the activated carbon for sugar decolorization market is forecast to reach USD 1,041.5 million, underscoring both volume growth and technology maturity. This period will be characterized by wider adoption of powdered activated carbon systems, which can be seamlessly integrated into comprehensive sugar processing platforms. Such solutions will gain importance as refineries prioritize compatibility with existing infrastructure while seeking greater efficiency. The second half of the forecast horizon is expected to mark a structural change, where activated carbon becomes embedded in standardized sugar refining protocols rather than viewed as an optional investment. The decade-long progression shows a clear trajectory: early growth is anchored in granular system adoption for high-purity outcomes, while the latter phase expands through powdered carbon systems that integrate easily with modern refinery operations. Across both periods, industrial demand is reinforced by food processors, pharmaceutical-grade sweetener manufacturers, and specialty chemical users that rely on consistent product purity. By 2035, the activated carbon for sugar decolorization market will represent a more mature, integrated industry, with participants benefiting from sustained demand across multiple processing segments.

The activated carbon for sugar decolorization market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the activated carbon for sugar decolorization market progresses through its advanced purification adoption phase, expanding from USD 670.6 million to USD 844.3 million with steady annual increments averaging 4.7% growth. This period showcases the transition from basic carbon filtration to advanced multi-stage decolorization systems with enhanced adsorption properties and integrated regeneration capabilities becoming mainstream features.

The 2025-2030 phase adds USD 173.6 million to market value, representing 47% of total decade expansion. Market maturation factors include standardization of mesh size specifications, declining material costs for high-performance activated carbons, and increasing processor awareness of premium carbon benefits reaching 80-85% effectiveness in sugar decolorization applications. Competitive landscape evolution during this period features established manufacturers like Kuraray and Ingevity Corporation expanding their product portfolios while new entrants focus on specialized bio-based carbon solutions and enhanced regeneration technology.

From 2030 to 2035, market dynamics shift toward advanced customization and multi-application deployment, with growth accelerating from USD 844.32 million to USD 1,041.51 million, adding USD 197.19 million or 53% of total expansion. This phase transition logic centers on universal high-performance systems, integration with automated sugar processing equipment, and deployment across diverse refinery scenarios, becoming standard rather than specialized purification formats. The competitive environment matures with focus shifting from basic adsorption to comprehensive color removal performance and compatibility with modern sugar processing operations.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 670.6 million |

| Market Forecast (2035) | USD 1,041.5 million |

| Growth Rate | 4.5% CAGR |

| Leading Classification Type | Powdered |

| Primary Application | Sucrose Segment |

The activated carbon for sugar decolorization market demonstrates strong fundamentals with powdered activated carbon systems capturing a dominant share through superior surface area characteristics and cost-effective processing capabilities. Sucrose applications drive primary demand, supported by increasing sugar refinery requirements and enhanced decolorization management solutions. Geographic expansion remains concentrated in developed markets with established sugar processing infrastructure, while emerging economies show accelerating adoption rates driven by food industry expansion and rising quality standards activity.

The activated carbon for sugar decolorization market represents a compelling intersection of sugar processing innovation, carbon activation technology advancement, and purification optimization management. With robust growth projected from USD 670.6 million in 2025 to USD 1,041.5 million by 2035 at a 4.5% CAGR, this market is driven by increasing food quality standards expansion trends, industrial sugar requirements, and refinery demand for reliable purification formats.

The activated carbon for sugar decolorization market's expansion reflects a fundamental shift in how sugar producers and food processors approach quality enhancement infrastructure. Strong growth opportunities exist across diverse applications, from sucrose operations requiring everyday color removal to specialty sugar facilities demanding ultra-pure solutions. Geographic expansion is particularly pronounced in Asia-Pacific markets, led by China (6.1% CAGR) and India (5.6% CAGR), while established markets in North America and Europe drive innovation and specialized segment development.

The dominance of powdered systems and sucrose applications underscores the importance of proven carbon technology and processing reliability in driving adoption. Particle size and activation complexity remain key challenges, creating opportunities for companies that can deliver consistent performance while maintaining cost efficiency.

Market expansion rests on three fundamental shifts driving adoption across sugar processing and food manufacturing sectors. Food quality enhancement creates compelling advantages through activated carbon systems that provide comprehensive color removal with standardized processing compatibility, enabling refineries to achieve superior product purity and maintain quality standards while ensuring efficient operation cycles and justifying investment over basic filtration methods. Industrial processing modernization accelerates as sugar manufacturers worldwide seek reliable purification systems that deliver operational efficiency directly to refinery operations, enabling cost reduction that aligns with processing expectations and maximizes decolorization productivity. Consumer demand increases drive adoption from food processors requiring consistent sugar quality that maximizes product appeal while maintaining color specifications during processing and storage operations.

However, growth faces headwinds from raw material price variations that differ across carbon suppliers regarding cost stability and supply chain reliability, potentially limiting margin consistency in price-sensitive processing categories. Regeneration complexity also persists regarding activation costs and carbon lifecycle management that may increase operational standards in markets with demanding processing protocols.

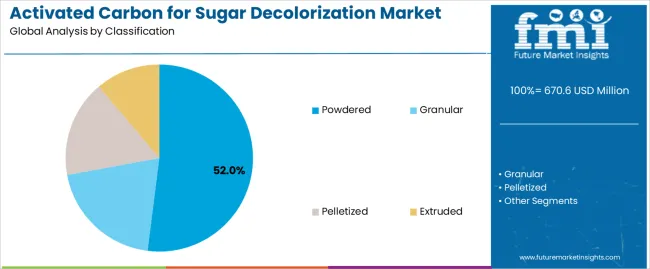

Primary Classification: The market segments by classification into powdered, granular, pelletized, and extruded categories, representing the evolution from basic carbon filtration to advanced multi-stage formats for comprehensive sugar decolorization operations.

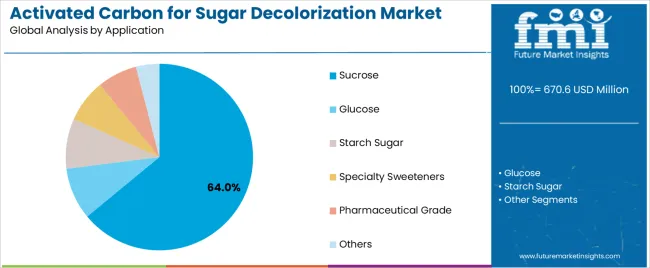

Secondary Breakdown: Application segmentation divides the activated carbon for sugar decolorization market into sucrose, glucose, starch sugar, specialty sweeteners, and pharmaceutical-grade sugar sectors, reflecting distinct requirements for color removal efficiency, processing compatibility, and purity specifications.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with developed markets leading innovation while emerging economies show accelerating growth patterns driven by food industry development programs.

The segmentation structure reveals technology progression from standard powdered carbons toward integrated multi-stage platforms with enhanced adsorption and regeneration capabilities, while application diversity spans from basic sugar refining to pharmaceutical facilities requiring comprehensive purification and ultra-pure decolorization solutions.

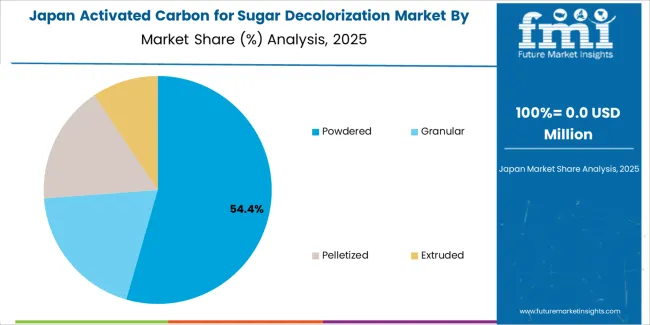

Powdered segment is estimated to account for 52% of the activated carbon for sugar decolorization market share in 2025. The segment's leading position stems from its fundamental role as a critical component in sugar processing applications and its extensive use across multiple refinery and food processing sectors. Powdered carbon's dominance is attributed to its superior surface area-to-volume ratio, including excellent adsorption kinetics, rapid color removal properties, and balanced cost-effectiveness that make it indispensable for everyday sugar purification operations.

Market Position: Powdered systems command the leading position in the activated carbon market through advanced activation technologies, including comprehensive mesh size control, uniform particle distribution, and reliable processing performance that enable producers to deploy decolorization solutions across diverse sugar processing environments.

Value Drivers: The segment benefits from processor preference for proven carbon profiles that provide exceptional adsorption capacity without requiring premium material costs. Efficient milling processes enable deployment in sucrose refining, glucose processing, and specialty sugar applications where color removal reliability and cost efficiency represent critical selection requirements.

Competitive Advantages: Powdered systems differentiate through excellent mixing characteristics, proven decolorization efficiency, and compatibility with standard processing equipment that enhance purification capabilities while maintaining economical material profiles suitable for diverse sugar processing applications.

Key market characteristics:

Sucrose segment is projected to hold 64% of the activated carbon for sugar decolorization market share in 2025. The segment's market leadership is driven by the extensive use of activated carbon in cane sugar processing, beet sugar refining, raw sugar purification, and refined sugar production, where carbon filtration serves as both a color removal barrier and quality enhancement solution. The sucrose sector's consistent demand for reliable decolorization systems supports the segment's dominant position.

Market Context: Sucrose applications dominate the activated carbon for sugar decolorization market due to widespread adoption of quality enhancement solutions and increasing focus on product appearance, color consistency, and consumer acceptance that enhance market appeal while maintaining processing standards.

Appeal Factors: Sugar refineries prioritize processing efficiency, color removal effectiveness, and integration with standard refinery equipment that enable coordinated deployment across multiple processing stages. The segment benefits from substantial sugar consumption growth and food industry development that emphasize reliable purification systems for commercial sugar applications.

Growth Drivers: Global sugar processing facilities incorporate activated carbon as standard components for color removal and quality enhancement programs. At the same time, consumer quality initiatives are increasing demand for premium features that comply with food safety standards and enhance product appearance.

Market Challenges: Raw material cost fluctuations and regeneration complexity may limit deployment flexibility in ultra-cost-sensitive markets or regions with varying processing requirements.

Application dynamics include:

Growth Accelerators: Food quality enhancement drives primary adoption as activated carbon systems provide exceptional color removal capabilities that enable sugar processing without quality compromise, supporting product improvement and consumer acceptance that require reliable carbon formats. Industrial expansion accelerates market growth as food processors seek efficient decolorization solutions that maintain purity during processing while enhancing product appeal through standardized color removal and compatibility. Quality standards increases worldwide, creating sustained demand for effective purification systems that complement processing routines and provide operational advantages in color management efficiency.

Growth Inhibitors: Raw material volatility challenges differ across carbon markets regarding price stability and supply chain consistency, which may limit margin predictability and cost planning in price-sensitive processing categories with demanding affordability requirements. Regeneration complexity persists regarding activation costs and carbon lifecycle management that may increase operational costs in facilities with strict processing protocols. Market fragmentation across multiple mesh specifications and activation standards creates compatibility concerns between different processing systems and existing refinery infrastructure.

Market Evolution Patterns: Adoption accelerates in sugar processing and food manufacturing sectors where quality benefits justify carbon investments, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by food industry development and quality enhancement programs. Technology advancement focuses on enhanced adsorption properties, improved regeneration efficiency, and integration with automated processing systems that optimize color removal performance and operational consistency. The activated carbon for sugar decolorization market could face disruption if alternative purification methods or processing changes significantly challenge traditional activated carbon advantages in sugar decolorization applications.

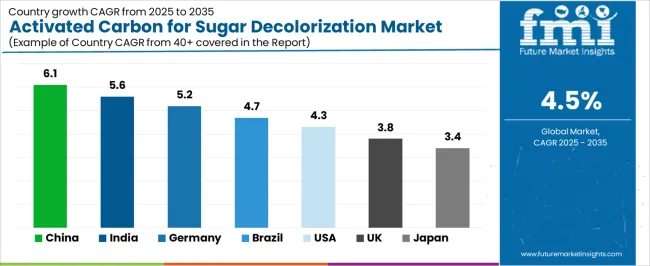

The activated carbon for sugar decolorization market demonstrates varied regional dynamics with growth leaders including China (6.1% CAGR) and India (5.6% CAGR) driving expansion through industrial growth and food processing modernization. Steady Performers encompass Germany (5.2% CAGR), Brazil (4.7% CAGR), and the U.S. (4.3% CAGR), benefiting from established processing systems and advanced purification adoption.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| U.S. | 4.3% |

| U.K. | 3.8% |

| Japan | 3.4% |

Regional synthesis reveals Asia-Pacific markets leading growth through industrial expansion and food processing development, while European countries maintain steady expansion supported by specialized applications and quality compliance requirements. North American markets show strong growth driven by processing demand and facility upgrades.

China establishes regional leadership through rapid industrial development and comprehensive food processing modernization, integrating advanced activated carbon systems as standard components in sugar refineries and food manufacturing operations. The country's 6.1% CAGR through 2035 reflects industrial growth promoting manufacturing density and processing infrastructure development that mandate the use of reliable purification systems in sugar decolorization operations. Growth concentrates in major industrial regions, including Guangdong, Jiangsu, and Shandong, where processing networks showcase integrated activated carbon systems that appeal to manufacturers seeking enhanced color removal efficiency and international food quality standards.

Chinese manufacturers are developing innovative activated carbon solutions that combine local production advantages with international quality specifications, including high-activity powders and advanced regeneration capabilities.

Strategic Market Indicators:

The Indian market emphasizes food processing applications, including rapid industrial development and comprehensive manufacturing expansion that increasingly incorporates activated carbon for sugar refining and food production operations. The country is projected to show a 5.6% CAGR through 2035, driven by massive food industry activity under processing modernization initiatives and manufacturing demand for standardized, high-quality purification systems. Indian food processing facilities prioritize cost-effectiveness with activated carbon delivering operational efficiency through economical material usage and reliable performance capabilities.

Technology deployment channels include major sugar mills, food processors, and manufacturing facilities that support high-volume usage for domestic and export applications.

Performance Metrics:

In Bavaria, North Rhine-Westphalia, and Baden-Württemberg, German sugar processing facilities and food manufacturers are implementing advanced activated carbon systems to enhance purification capabilities and support operational efficiency that aligns with quality protocols and processing standards. The German market demonstrates sustained growth with a 5.2% CAGR through 2035, driven by quality compliance programs and industrial investments that emphasize reliable purification systems for sugar processing and food manufacturing applications. German processing facilities are prioritizing activated carbon systems that provide exceptional color removal properties while maintaining compliance with food safety standards and minimizing processing complexity, particularly important in sugar refining and specialty food operations.

Market expansion benefits from quality programs that mandate enhanced purification in processing specifications, creating sustained demand across Germany's food processing and manufacturing sectors, where color consistency and material performance represent critical requirements.

Strategic Market Indicators:

Brazil's extensive sugar processing market demonstrates comprehensive activated carbon deployment, growing at 4.7% CAGR, with documented operational excellence in cane sugar refining and ethanol production through integration with existing processing systems and quality assurance infrastructure. The country leverages agricultural expertise in sugar production and processing technology to maintain market leadership. Processing centers, including São Paulo, Minas Gerais, and Goiás, showcase advanced installations where activated carbon systems integrate with comprehensive refining platforms and quality systems to optimize sugar processing and operational efficiency.

Brazilian sugar processing facilities prioritize decolorization precision and material consistency in carbon selection, creating demand for premium activated carbon systems with advanced features, including high-activity powders and integration with automated processing protocols. The activated carbon for sugar decolorization market benefits from established sugar infrastructure and willingness to invest in specialized carbon technologies that provide superior color removal properties and regulatory compliance.

Market Intelligence Brief:

The U.S. market emphasizes advanced activated carbon features, including innovative processing technologies and integration with comprehensive sugar processing platforms that manage refinery operations, food manufacturing, and specialty applications through unified purification systems. The country is projected to show a 4.3% CAGR through 2035, driven by food industry expansion under quality enhancement trends and processing demand for premium, reliable purification systems. American food processors prioritize efficiency with activated carbon delivering comprehensive color removal through enhanced adsorption protection and operational innovation.

Technology deployment channels include major food companies, sugar processors, and specialty manufacturers that support custom development for premium operations.

Performance Metrics:

The U.K. market focuses on premium activated carbon applications, including specialized food processing and integration with comprehensive quality management platforms that serve confectionery production, specialty sugar manufacturing, and export-oriented operations through unified purification systems. The country is projected to show a 3.8% CAGR through 2035, driven by food quality expansion under premium product trends and manufacturing demand for high-performance, reliable purification systems. British food manufacturers prioritize consistency with activated carbon delivering comprehensive decolorization through enhanced quality protection and operational excellence.

Technology deployment channels include specialty food companies, confectionery manufacturers, and premium processors that support custom development for high-end operations.

Market Intelligence Brief:

Japan's sophisticated food processing market demonstrates meticulous activated carbon deployment, growing at 3.4% CAGR, with documented operational excellence in specialty sugar production and food manufacturing through integration with existing processing systems and quality assurance infrastructure. The country leverages engineering expertise in carbon activation and processing technology to maintain market leadership. Manufacturing centers, including Tokyo, Osaka, and Aichi, showcase advanced installations where activated carbon systems integrate with comprehensive processing platforms and quality systems to optimize food production and operational efficiency.

Japanese food processing facilities prioritize purification precision and material consistency in carbon selection, creating demand for premium activated carbon systems with advanced features, including ultra-fine powders and integration with automated processing protocols. The activated carbon for sugar decolorization market benefits from established food infrastructure and willingness to invest in specialized carbon technologies that provide superior adsorption properties and regulatory compliance.

Market Intelligence Brief:

The activated carbon for sugar decolorization market in Europe is projected to grow from USD 186.4 million in 2025 to USD 271.2 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 42.1% market share in 2025, declining slightly to 41.6% by 2035, supported by its food processing excellence and major manufacturing centers, including Bavaria and North Rhine-Westphalia.

France follows with a 22.3% share in 2025, projected to reach 23.1% by 2035, driven by comprehensive food processing programs and specialty sugar initiatives. The United Kingdom holds a 16.7% share in 2025, expected to maintain 17.2% by 2035 through established processing sectors and premium food adoption. Italy commands a 11.4% share, while Spain accounts for 6.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 1.3% to 2.1% by 2035, attributed to increasing food industry development in Eastern European countries and emerging processing programs implementing standardized purification systems.

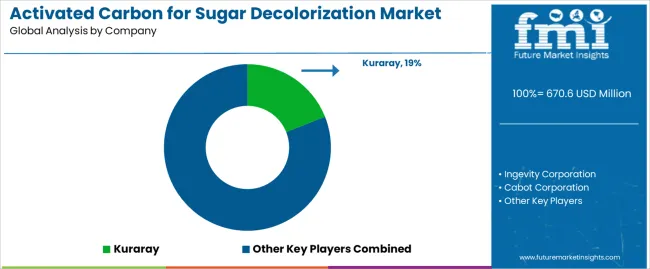

The activated carbon for sugar decolorization market operates with moderate concentration, featuring approximately 15-22 participants, where leading companies control roughly 38-44% of the global market share through established distribution networks and comprehensive product portfolio capabilities. Competition emphasizes adsorption performance, processing consistency, and cost efficiency rather than premium feature rivalry.

Market leaders encompass Kuraray, Ingevity Corporation, and Cabot Corporation, which maintain competitive advantages through extensive carbon activation expertise, global distribution networks, and comprehensive technical support capabilities that create processor loyalty and support customer requirements. These companies leverage decades of activation experience and ongoing carbon technology investments to develop advanced activated carbon systems with exceptional adsorption and regeneration features.

Specialty challengers include Jacobi Group, Haycarb, and Chemviron, which compete through specialized application innovation focus and efficient production solutions that appeal to food processors seeking reliable performance formats and custom activation flexibility. These companies differentiate through operational efficiency emphasis and specialized market focus.

Market dynamics favor participants that combine consistent adsorption performance with advanced processing support, including automated dosing and regeneration capabilities. Competitive pressure intensifies as traditional carbon manufacturers expand into sugar decolorization systems. At the same time, specialized food processing suppliers challenge established players through innovative activation formulations and cost-effective production targeting emerging processing segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 670.6 million |

| Classification | Powdered, Granular, Pelletized, Extruded |

| Application | Sucrose, Glucose, Starch Sugar, Specialty Sweeteners, Pharmaceutical Grade, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 25+ additional countries |

| Key Companies Profiled | Kuraray, Ingevity Corporation, Cabot Corporation, Jacobi Group, Haycarb, Chemviron |

| Additional Attributes | Dollar sales by classification and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with carbon manufacturers and processing suppliers, customer preferences for adsorption characteristics and regeneration performance, integration with sugar processing equipment and refinery systems, innovations in activation technology and multi-stage systems, and development of specialized purification solutions with enhanced color removal efficiency and processing compatibility |

The global activated carbon for sugar decolorization market is estimated to be valued at USD 670.6 million in 2025.

The market size for the activated carbon for sugar decolorization market is projected to reach USD 1,041.5 million by 2035.

The activated carbon for sugar decolorization market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in activated carbon for sugar decolorization market are powdered, granular, pelletized and extruded.

In terms of application, sucrose segment to command 64.0% share in the activated carbon for sugar decolorization market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Activated Partial Thromboplastin Test Market

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Assessing Activated Carbon Market Share & Industry Trends

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Activated Tear Tape Market

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water Activated Tape Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Water Activated Tape Dispensers

Water-Activated Tape Market Trends & Industry Forecast 2024-2034

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA