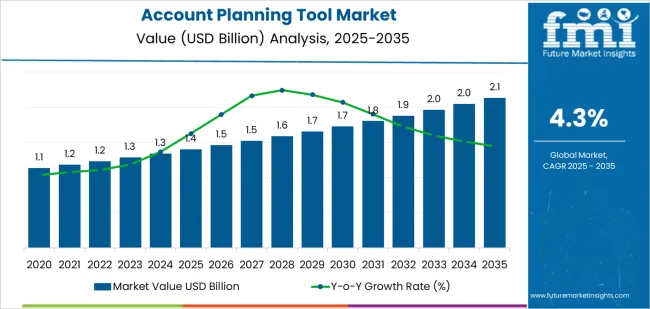

The account planning tool market is expected to grow to USD 1.4 billion in 2025 and reach USD 2.2 billion by 2035, at a CAGR of 4.3%. The decade adds USD 0.8 billion, supported by the shift toward structured, data-driven account management and stronger adoption of digital tools that guide strategic selling, customer retention, and cross-functional collaboration. Early expansion remains steady as enterprises standardize account-based workflows, integrate CRM-driven insights, and adopt platforms that map stakeholders, track opportunities, and orchestrate joint sales–marketing execution. Through 2025–2030, the market rises to USD 1.8 billion, generating USD 0.4 billion as organizations expand digital sales stacks and strengthen account governance across high-value B2B portfolios.

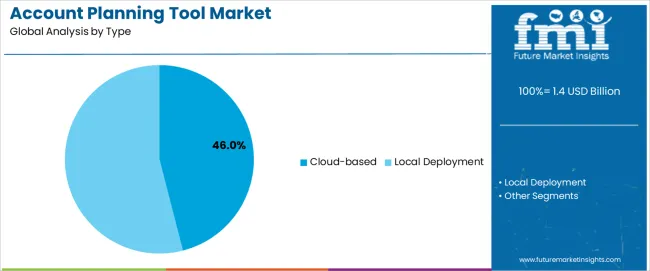

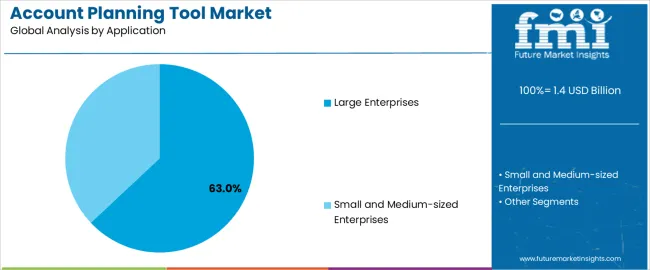

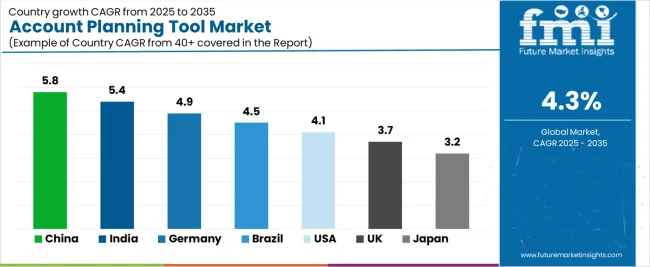

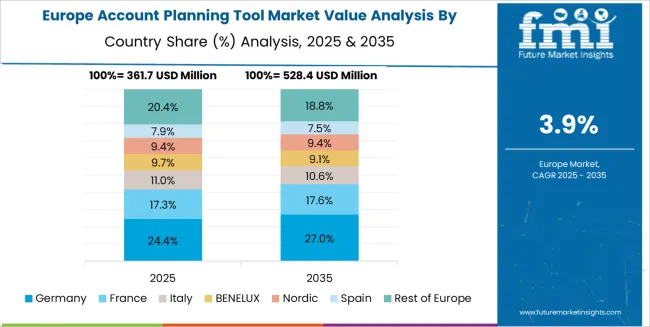

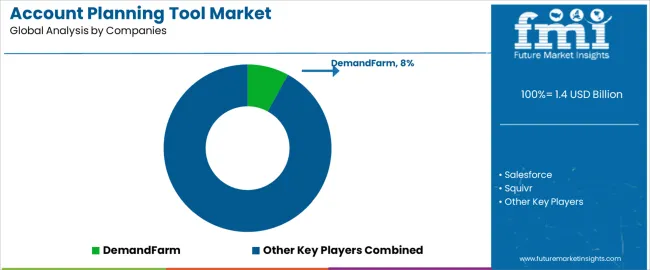

From 2030 to 2035, the market climbs to USD 2.2 billion, adding another USD 0.4 billion as AI-powered forecasting, predictive churn scoring, automated plan generation, and deep CRM-ABM integration become standard for global sales organizations. Mid-sized enterprises accelerate adoption during this phase by leveraging cloud-based platforms to unify account data, enhance pipeline visibility, and improve collaboration across distributed sales and customer success teams. Cloud-based tools retain leadership with 46.0% share, driven by scalability, real-time access, automated updates, and strong compatibility with CRM ecosystems. Large enterprises account for 63.0% of demand due to the complexity of account structures, multi-team collaboration requirements, and the need for consistent planning frameworks across global operations. China (5.8% CAGR) and India (5.4%) lead adoption, supported by rapid digital sales transformation and strong enterprise CRM penetration. Germany at 4.9%, Brazil at 4.5%, and the United States at 4.1% maintain steady uptake as organizations prioritize predictive sales analytics, structured account governance, and integrated planning environments. Competitive strength is shaped by capabilities in CRM integration, AI-driven insights, and ease of cross-functional alignment, with leading platforms including DemandFarm, Salesforce, Squivr, HubSpot, Upland, Kapta, Prolifiq, and Korn Ferry.

Between 2025 and 2030, the Account Planning Tool Market grows from USD 1.4 billion to USD 1.8 billion, generating USD 0.4 billion in added value. The growth is steady, with annual increases of approximately USD 0.1 billion. Market share gains are primarily driven by the growing need for businesses to streamline account management, sales strategies, and customer relationships. As more organizations focus on data-driven account planning, tools that offer real-time analytics, AI-driven insights, and CRM integration will continue to gain wider adoption, especially in sales-heavy sectors such as SaaS, manufacturing, and finance.

From 2030 to 2035, the market expands from USD 1.8 billion to USD 2.2 billion, adding another USD 0.4 billion. During this phase, market share gains continue as advanced features such as AI-powered sales forecasting, predictive analytics, and automated task prioritization make account planning tools increasingly critical to businesses. Additionally, the increasing shift toward cloud-based solutions and integration with other enterprise tools will drive further growth. The market will experience consistent gains as small and medium-sized businesses (SMBs) adopt these tools to increase operational efficiency and better align sales and marketing teams.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 billion |

| Market Forecast Value (2035) | USD 2.2 billion |

| Forecast CAGR (2025–2035) | 4.3% |

The account planning tool market is expanding as companies shift toward strategic selling models that require deep insights into customer relationships, cross-sell opportunities, and renewal risks. These tools support sales, customer success, and marketing teams by centralizing account data, identifying stakeholder maps, and guiding action plans for growth or retention. Sales leaders adopt account planning platforms to track open relationships, map product portfolios, and trigger collaborative workflows across functions. Account planning tools integrate CRM systems, pipeline analytics, and engagement data to provide a holistic view of high-value accounts and enable more focused execution. As competition increases and enterprise deals grow in complexity, organizations invest in tools that improve strategic coverage and reduce revenue leakage.

Market growth is also driven by technological improvements in AI-driven insights, predictive scoring, and automated plan generation. Vendors incorporate machine learning models to surface expansion opportunities, recommend next-best actions, and identify risk signals for churn. Platforms enable real-time collaboration, shared objectives, and KPI tracking across account teams and customer-facing units. As subscription-based business models expand, renewal management, usage analytics, and lifecycle forecasting become important features for account planning. Although implementation demands change management discipline and data quality commitment, the alignment of sales strategy, customer success, and product teams through coordinated tools supports sustained adoption across global B2B organizations.

The account planning tool market is segmented by type, application, and region. By type, the market is divided into cloud-based and local deployment solutions. Based on application, it is categorized into large enterprises and small and medium-sized enterprises (SMEs). Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments reflect the varying preferences for deployment models and the specific needs of different organizational sizes, with large enterprises seeking more scalable and integrated solutions, while SMEs may focus on cost-effective and flexible tools.

The cloud-based segment accounts for approximately 46.0% of the global account planning tool market in 2025, making it the leading type category. This position is driven by the increasing demand for scalable, accessible, and cost-effective solutions that support distributed teams, particularly in large organizations and enterprises. Cloud-based tools provide real-time collaboration, automated updates, and seamless integration with other enterprise resource planning (ERP) systems and customer relationship management (CRM) platforms, making them ideal for account management across various departments and locations.

The cloud model allows businesses to store and access data securely from anywhere, reducing IT infrastructure costs and enhancing overall flexibility. Adoption is strong in North America, Europe, and East Asia, where businesses are increasingly transitioning to cloud-based solutions for operational efficiency and better data management. Cloud-based account planning tools maintain their lead due to the growing trend toward remote work and digital transformation, allowing large enterprises to access advanced features such as AI-driven analytics, business intelligence, and customer insights that enhance account planning strategies across departments. Here are the

The large enterprises segment represents about 63.0% of the total account planning tool market in 2025, making it the dominant application category. This position is driven by the complexity of account management needs in large organizations, which require robust, scalable tools capable of handling a high volume of data, multiple users, and extensive collaboration across different teams. Large enterprises need account planning tools that can provide a comprehensive view of customer interactions, manage strategic sales processes, and integrate seamlessly with other enterprise systems like CRM, ERP, and marketing automation.

Adoption is particularly high in North America and Europe, where large corporations have well-established account management frameworks and seek tools that can optimize sales efforts, improve customer relationship strategies, and enhance decision-making through data-driven insights. The segment maintains its lead because large enterprises have the resources and demand for advanced, customizable solutions that support complex workflows and enable centralized data management for strategic account planning. These organizations benefit from cloud-based solutions that scale with their growth and adapt to evolving market conditions.

The account planning tool market is expanding as B2B and enterprise sales organisations adopt software driven solutions to manage key accounts, visualise stakeholder maps, identify upsell opportunities and align cross functional teams. These tools centralise data, support strategic account planning and replace manual spreadsheet based approaches. Growth is driven by the need for higher retention, growing complexity of enterprise customers and increasing investment in sales technology stacks. Adoption is limited by integration challenges, user adoption hurdles and fragmented internal processes. Vendors are enhancing real time analytics, AI driven account insights and integration with CRM and ABM platforms to meet evolving sales demands.

Demand increases as enterprises work with fewer, larger accounts where retention, cross sell and strategic growth matter more than volume sales. Tools that map stakeholder hierarchies, track product penetration and visualise white space help sellers deepen relationships and spot expansion opportunities. As account teams require better collaboration across sales, success, marketing and product account planning software provides a shared workspace and data driven strategy. This shift supports companies looking to move from reactive tactics to proactive account development.

Adoption is constrained by several factors. Many organisations still rely on spreadsheets, are resistant to change and lack standardised account planning processes. Integration issues between CRM, marketing automation and account planning platforms reduce tool effectiveness. Inaccurate or incomplete account data hampers insight generation and reduces user trust in outputs. Furthermore, smaller enterprises may lack budget or see limited benefit from dedicated account planning software. This slows adoption, especially in organisations without formal key account management frameworks.

Key trends include AI driven feature sets that pull insights from disparate data sources, visualisation of account refreshers and workflows that guide sellers through planning steps. Cloud based, collaborative platforms support remote teams and real time updates. Integration with account based marketing (ABM) systems, CRM and opportunity management tools is increasing, enabling end to end visibility from account strategy to execution. Regionally, growth is especially strong in Asia Pacific, where rising digital sales maturity and expanding enterprise accounts create demand for structured planning tools.

| Country | CAGR (%) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

The account planning tool market is growing steadily across global business sectors, with China leading at a 5.8% CAGR through 2035, supported by the rapid expansion of enterprise-level CRM systems, digital transformation, and the increasing need for data-driven account management strategies. India follows at 5.4%, driven by rapid business growth, increasing adoption of cloud-based tools, and a rising number of startups needing effective account management systems. Germany records 4.9%, benefiting from advanced business infrastructure, a strong focus on operational efficiency, and high adoption rates in industries like manufacturing and finance. Brazil grows at 4.5%, fueled by digital adoption in SMEs and the need for robust account management solutions across emerging industries. The USA, at 4.1%, remains a mature market emphasizing AI and data analytics integration into account planning tools, while the UK (3.7%) and Japan (3.2%) focus on optimizing sales processes and improving client relationships through advanced tool features and automation.

China is projected to grow at a CAGR of 5.8% through 2035 in the account planning tool market. The growing adoption of digital tools in business operations drives the demand for advanced account planning solutions. These tools help companies manage customer relationships, optimise sales strategies, and improve resource allocation. Manufacturers focus on integrating AI and data analytics to improve the accuracy and effectiveness of account planning. With increasing competition and the rise of e-commerce, Chinese companies increasingly rely on account planning tools to enhance customer targeting and streamline sales processes across industries.

India is projected to grow at a CAGR of 5.4% through 2035 in the account planning tool market. The rise of digital marketing, e-commerce, and the increasing need for data-driven decision-making drives the adoption of account planning tools. Indian businesses are increasingly leveraging these tools to optimise sales processes, manage customer relationships, and improve market penetration. As startups and small businesses continue to grow, demand for affordable yet effective account planning solutions rises. Additionally, the government’s push for digitisation across industries accelerates the adoption of business management tools, including account planning systems.

Germany is projected to grow at a CAGR of 4.9% through 2035 in the account planning tool market. Increasing integration of sales and marketing functions in businesses drives the demand for account planning tools in Germany. Companies seek solutions that align their sales strategies with marketing efforts to drive growth. Account planning tools help businesses analyse customer data, manage accounts efficiently, and implement targeted marketing strategies. The German market benefits from the increasing adoption of cloud-based solutions and AI, providing companies with flexible and scalable tools to meet changing customer needs and market conditions.

Brazil is projected to grow at a CAGR of 4.5% through 2035 in the account planning tool market. The increasing shift toward digital sales solutions and the demand for data-driven decision-making fuel market growth in Brazil. Businesses adopt account planning tools to improve sales forecasting, customer relationship management, and overall operational efficiency. Brazilian companies are integrating account planning software with CRM systems to streamline workflows and optimise sales strategies. The market is supported by the rise of digital transformation initiatives and the growing need for analytics-driven tools to enhance business outcomes in diverse industries.

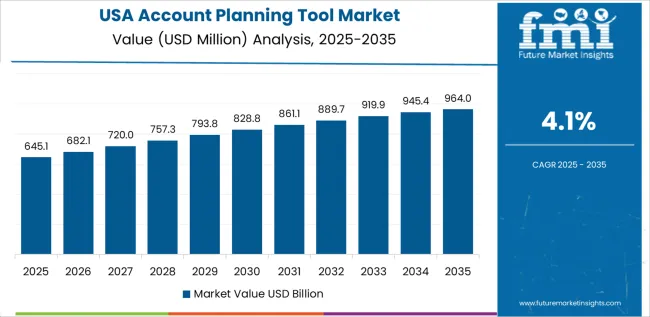

USA is projected to grow at a CAGR of 4.1% through 2035 in the account planning tool market. The demand for market optimisation tools to enhance sales productivity and improve client relationships is driving the growth of account planning solutions in the USA. Companies are increasingly leveraging these tools to segment customers effectively, forecast sales accurately, and streamline sales operations. The market benefits from the shift towards cloud-based and subscription-based pricing models, allowing for scalable solutions. As businesses increasingly adopt AI and data analytics, these tools help them adapt to dynamic market conditions and customer preferences.

UK is projected to grow at a CAGR of 3.7% through 2035 in the account planning tool market. The growing need for strategic decision-making and customer-focused sales approaches fuels the adoption of account planning tools in the UK. These tools help businesses optimise sales strategies, manage accounts effectively, and enhance customer satisfaction. Companies are increasingly integrating AI and machine learning into their account planning systems to provide predictive insights, enabling smarter decision-making. Additionally, UK-based companies are adopting cloud-based account planning solutions to enhance collaboration across teams and drive better business outcomes.

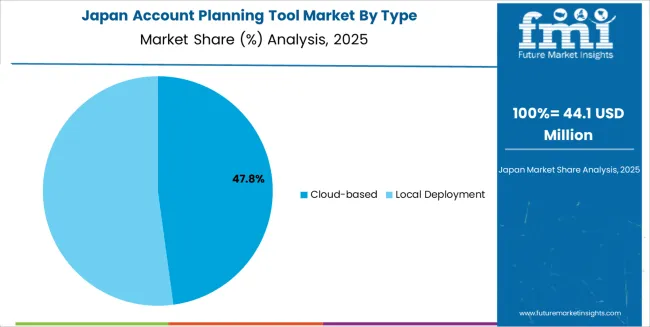

Japan is projected to grow at a CAGR of 3.2% through 2035 in the account planning tool market. Automation in business processes, combined with the increasing reliance on data-driven decision-making, drives the adoption of account planning tools in Japan. These tools enable businesses to manage customer accounts efficiently, optimise sales pipelines, and improve overall sales productivity. Manufacturers focus on developing advanced, intuitive account planning solutions that integrate seamlessly with existing business systems. Japan’s market growth is further supported by its technological sophistication and the increasing demand for intelligent business solutions in the retail and manufacturing sectors.

The global account planning tool market is moderately competitive, driven by firms providing software solutions that help sales and account management teams optimize strategies, improve client relationships, and drive business growth. DemandFarm, Salesforce, and Squivr hold strong positions, offering comprehensive platforms that allow businesses to plan, track, and analyze account activities through CRM integrations and data-driven insights. HubSpot and Upland strengthen their market share by offering account planning tools with strong customer relationship management features and targeted analytics that empower sales teams to drive customer engagement and retention. Kapta, Prolifiq, and Korn Ferry contribute further by providing specialized tools focused on strategic account management, aligning resources, and improving team collaboration for larger enterprise accounts.

Zendesk, Pipedrive, Zoho CRM, and Gainsight expand the market with their user-friendly account planning and management platforms that cater to mid-sized businesses, offering ease of implementation, integration with existing sales workflows, and data-rich customer insights. Competition across the market is influenced by the ability to integrate with existing CRM systems, the depth of analytics capabilities, and ease of use. Strategic differentiation depends on customer segmentation, sales forecasting, account health tracking, and automation features that enhance account management workflows. As businesses prioritize personalized customer engagement and account-based selling strategies, firms providing seamless, scalable, and customizable planning tools will maintain a competitive edge in this growing market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Cloud-based, Local Deployment |

| Application | Large Enterprises, Small and Medium-sized Enterprises |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | DemandFarm, Salesforce, Squivr, HubSpot, Upland, Kapta, Prolifiq, Korn Ferry, Zendesk, Pipedrive, Zoho CRM, Gainsight |

| Additional Attributes | Dollar sales by type and application, integration with CRM and ABM platforms, sales forecasting and predictive analytics features, real-time collaboration capabilities, automated task prioritization, AI-driven insights, multi-departmental alignment, client retention, and upsell opportunity tracking. |

The global account planning tool market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the account planning tool market is projected to reach USD 2.1 billion by 2035.

The account planning tool market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in account planning tool market are cloud-based and local deployment.

In terms of application, large enterprises segment to command 63.0% share in the account planning tool market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Account-Based Advertising Software Market Size and Share Forecast Outlook 2025 to 2035

Account-Based Data Software Market Size and Share Forecast Outlook 2025 to 2035

Accounts Receivable Automation Market Size and Share Forecast Outlook 2025 to 2035

Accounts Payable Automation Market Analysis - Size, Share and Forecast 2025 to 2035

Account-Based Direct Mail Software Market Size and Share Forecast Outlook 2025 to 2035

Account-Based Market

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Accounting Solution Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Hydrocarbon Accounting Solution Market Share & Industry Leaders

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydrocarbons Accounting Solution Market Insights – Demand & Growth 2025 to 2035

Stereotactic Planning Software Market Analysis - Size, Share & Forecast 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Route Optimization & Planning Software Market Size and Share Forecast Outlook 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tool Tethering Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA