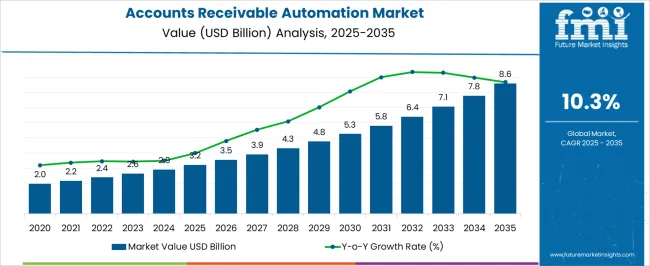

The Accounts Receivable Automation Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Accounts Receivable Automation Market Estimated Value in (2025 E) | USD 3.2 billion |

| Accounts Receivable Automation Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The accounts receivable automation market is advancing steadily as organizations prioritize operational efficiency, cash flow optimization, and error reduction in financial processes. Growing pressure to accelerate invoice processing, improve payment cycles, and reduce manual dependency has intensified the adoption of automation platforms across industries.

Integration of AI, machine learning, and cloud based analytics has enhanced accuracy, predictive insights, and compliance monitoring. The rise of digital payment ecosystems and the need for stronger governance in financial transactions are further reinforcing demand.

Regulatory requirements for transparency and data security are also prompting enterprises to invest in secure and scalable automation tools. The outlook for the market remains robust as companies across geographies embrace digital transformation strategies to streamline finance operations, reduce costs, and strengthen customer relationships.

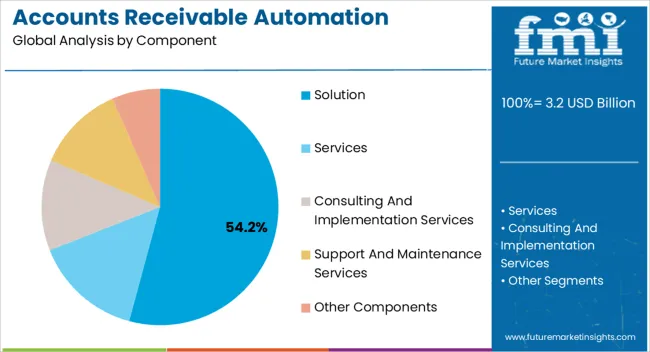

The solution segment is expected to account for 54.20% of total revenue by 2025 within the component category, positioning it as the leading segment. Growth is being driven by the rising demand for comprehensive automation platforms that provide real time tracking, invoice management, and payment reconciliation.

These solutions reduce errors, minimize processing time, and enhance visibility across the receivables cycle. Enterprises are increasingly favoring integrated platforms that support scalability and seamless integration with ERP systems.

As financial leaders seek data driven decision making tools, the adoption of automation solutions has intensified, reinforcing their dominance in the component category.

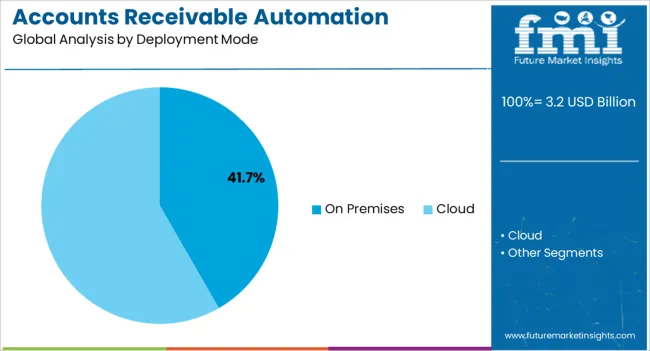

The on premises deployment mode segment is projected to contribute 41.70% of total revenue by 2025, establishing its strong position within deployment preferences. This preference is supported by the need for greater data security, customization, and control over financial processes.

Enterprises handling sensitive financial information often opt for on premises systems to ensure compliance with internal and external audit requirements. The ability to integrate with existing IT infrastructure and to customize workflows for specific business needs further supports its continued use.

Despite the growth of cloud based platforms, on premises deployment remains critical in industries where security and regulatory compliance are paramount.

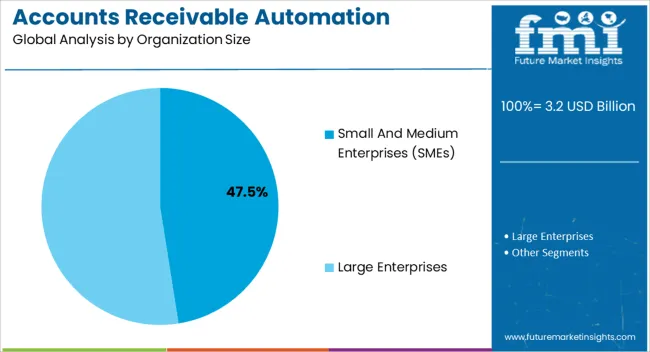

The small and medium enterprises segment is projected to hold 47.50% of total revenue by 2025 within the organization size category, making it the largest contributor. SMEs are adopting accounts receivable automation to improve cash flow, reduce manual workload, and ensure timely payment cycles.

Limited staff and resources have accelerated their reliance on automation tools that provide cost effective solutions and scalability. The adoption of digital payment systems and government initiatives supporting SME digitization are further driving uptake.

As SMEs continue to expand in global supply chains and seek competitive advantages, their adoption of receivable automation platforms has positioned them as a significant driver of market growth.

As per the previous market records, the bet worth of total accounts receivable services adopted globally in the year 2020 was USD 1,716.1 million. In the following years between 2020 and 2025, the overall market progressed at 8.7% CAGR and reached USD 2,400.2 million by its end.

Some factors are acting as obstacles and are hindering the growth of the global market during the forecast period. Data security concerns and the reluctance of enterprises toward automating processes are some factors that are expected to hamper the growth of the global market during the forecast period.

The high price of these systems and complexities of the accounts receivable automation like complex financial systems, and less standardization are other factors that are anticipated to hinder the growth of the market.

One of the key challenges which organizations are facing is the complex implantation process of this software. As manual accounts are generally easier to set up and can be more flexible than computerized accounting. Hence the organizations probably need some initial help while setting up the accounting software and thus the accountant may charge for this which can result in high initial costs

Account receivable management helps organizations to reduce the time spent prioritizing and preparing for calls. In addition, it helps them to reduce the time spent on managing disputes and increase the time they spend soliciting customers for payment which is expected to drive the growth of the market.

It provides several benefits such as cost savings, reduced time, less manual work, and others which are expected to increase the demand for an account receivable automation system. Many key players operating in the market are offering payment collection solutions through the private and public clouds. These solutions are available in different subscriptions and pay-per-use models.

Enterprises are increasingly deploying account receivable automation solutions on the cloud, as it provides numerous advantages. Such as flexibility, scalability, enhanced collaboration, cost-efficiency, and others that fuel market growth.

It also facilitates enterprises to focus on their core competencies, rather than IT processes. Cloud-based solutions are gaining popularity mainly due to their unprecedented deployment flexibility benefits and global availability which is increasing their adoption among small and medium enterprises.

The market is categorized on the basis of component, deployment mode, organization size, and vertical. In component segment, solution category is expected to acquire high share with CAGR of 10.2% through 2035. The services in component segment are further divided into consulting and implementation services, and support & maintenance services.

By deployment mode, the market is divided into cloud and on-premises. According to FMI, on-premises segment is projected to dominate registering a CAGR of 10%. Businesses mainly prefer deployment of accounts receivable solutions. Since this solutions allows businesses to control their businesses accounts and transaction records completely.

The on-premises deployment mode also provides enterprises with full control over the infrastructure and assets, as well as enhances their online security measures. By vertical, manufacturing is expected to be a significant contributor to the accounts receivable automation market during the forecast period.

| Category | By Component |

|---|---|

| Top Segment | Solution |

| Market Share in Percentage | 29.1% |

| Category | By Deployment Mode |

|---|---|

| Top Segment | On-premise |

| Market Share in Percentage | 57.4% |

The manufacturing industry is always on the foothold of overdue credit collection. Enterprises are seeking methods to reduce the burden of payment collection by adopting adequate solutions. This results in the improvement of accounts receivable.

The manufacturing industry emphasize on improving their production process and helps workforce in simplifying work without compromising accuracy. It also focuses on creating new and pioneering products.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 310.3%% |

| Europe | 22.3% |

The Asia Pacific region dominates the global overall market, attributed to the growing demand for precise management of accounting procedures and timely processing of payment processes from customers, Moreover, accounts receivable automation is adopted by enterprises to boost payment collection. In addition, the APAC market has gained traction, owing to the rising demand for automated and secured payable processes.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| United States | 19.2% |

| Germany | 10.2% |

| Japan | 6.5% |

| Australia | 2.2% |

The sales of accounts receivable automation in the United States was estimated at USD 3.2 billion in 2025. The receivable automation market in country is expected to reach market revenue of USD8.6 billion by 2035. United States is estimated to grow at a 10.5% CAGR. Further, in 2035, China is projected to reach market size of USD 4510.3% with CAGR of 10.0% by 2035.

| Regional Markets | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

| China | 9.1% |

| India | 13.2% |

Japan and the United Kingdom are expected to reach the same market size of USD 363 million and USD 278.3 million in 2035. Representing growth forecasts of 8.9% and 9.7% respectively, throughout the forecast period. South Korea, on the other hand, is expected to reach a market size of USD 226.5 million in 2035, representing a CAGR of 8.2%, during the forecast period.

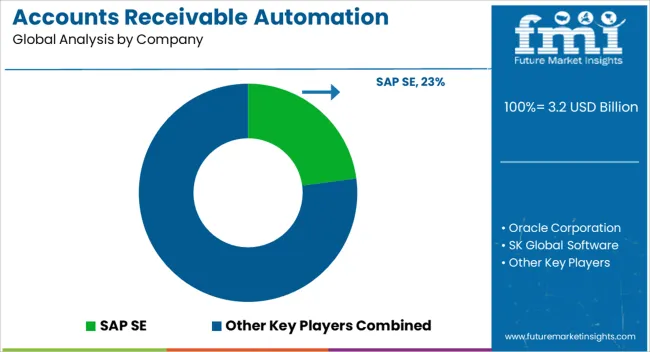

SAP, Oracle, SK Global Software, Quadient, Kofax, Workday, Corcentric, HighRadius, Qvalia, MHC Automation, Comarch, and Esker among others are the top companies in this market. With a sizable accounts receivable automation market share, these main firms are concentrating on growing their consumer base in new countries. Businesses are adopting strategic collaborations to augment their profits and market share.

Moreover, mid- and small businesses are entering into new markets and gaining contracts to expand their presence. This is attained with the continuous product development with modern technologies.

Recent Developments

The global accounts receivable automation market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the accounts receivable automation market is projected to reach USD 8.6 billion by 2035.

The accounts receivable automation market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in accounts receivable automation market are solution, services, consulting and implementation services, support and maintenance services and other components.

In terms of deployment mode, on premises segment to command 41.7% share in the accounts receivable automation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Accounts Payable Automation Market Analysis - Size, Share and Forecast 2025 to 2035

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Network Automation Market - AI & Cloud Connectivity 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Medical Automation Market Analysis - Innovations & Forecast 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Content Automation AI Tools Market

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA