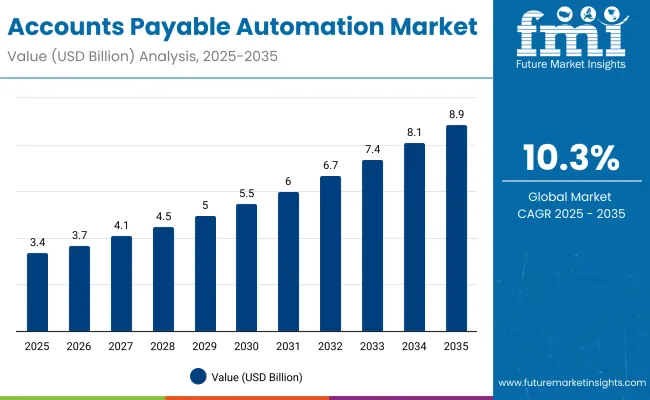

The accounts payable automation market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.4 billion |

| Projected Value (2035F) | USD 8.9 billion |

| CAGR (2025 to 2035) | 10.3% |

The market is projected to add an absolute dollar opportunity of USD 5.5 billion over the forecast period. This reflects a 2.6 times growth at a compound annual growth rate of 10.3%. The market evolution is expected to be shaped by the rising demand for digital transformation initiatives, technological advancements in artificial intelligence and machine learning, growing need for operational efficiency, and increasing focus on cost reduction and compliance requirements, particularly where automation and process optimization are prioritized.

By 2030, the market is likely to reach approximately USD 5.5 billion, accounting for USD 2.1 billion in incremental value over the first half of the decade. The remaining USD 3.4 billion is expected during the second half, suggesting a moderately accelerated growth pattern. Product innovation in cloud-based solutions, AI-powered invoice processing, and integrated financial platforms is gaining traction.

Companies such as AvidXchange, Bill.com, and Coupa Software are advancing their competitive positions through investment in AI-powered automation, strategic partnerships, and global platform expansion. Rising digitization, regulatory compliance requirements, and improved operational efficiency standards are supporting expansion into enterprise applications, mid-market solutions, and industry-specific implementations. Market performance will remain anchored in automation capabilities, integration flexibility, and compliance management benchmarks.

The market holds a significant share across its parent markets. Within the global enterprise software market, it accounts for approximately 8.2% due to its critical role in financial process automation. In the financial technology segment, it commands a 15.7% share, supported by increasing demand for automated financial operations. It contributes nearly 22.1% to the procurement software market and 11.4% to the business process automation segment. In cloud-based financial solutions, accounts payable automation holds around 18.9% share, driven by digital transformation requirements. Across the enterprise resource planning market, its share is close to 6.8%, owing to its position as a key component in integrated business management systems.

The market is being driven by rising demand for digital financial processes, artificial intelligence integration, and cloud-based automation platforms. Advanced automation technologies using machine learning, optical character recognition, and robotic process automation have enhanced invoice processing speed, accuracy, and compliance capabilities, making modern AP automation an essential alternative to traditional manual processes. Manufacturers are introducing specialized solutions, including industry-specific platforms and integrated financial suites tailored for different business sizes, expanding their role beyond basic invoice processing to comprehensive financial workflow optimization. Strategic collaborations between automation providers and ERP system integrators have accelerated innovation in enterprise applications and market penetration.

The accounts payable automation market is expanding rapidly due to its increasing digital transformation initiatives, rising labor costs, and growing demand for operational efficiency, making it an essential solution for organizations seeking streamlined financial processes. The growing adoption of cloud-based platforms, improved compliance requirements, and expanding remote work environments appeal to businesses prioritizing cost reduction and process optimization.

Growing focus on data analytics, real-time visibility, and integrated financial ecosystems is further propelling adoption, particularly in enterprise environments, mid-market implementations, and industry-specific applications. Rising regulatory complexity, audit requirements, and technological advancements in AI and machine learning are also enhancing system capabilities and market penetration.

As digital transformation and process automation accelerate across finance departments and business operations, the market outlook remains favorable. With organizations prioritizing efficiency, compliance, and cost optimization, accounts payable automation solutions are well-positioned to expand across various enterprise, mid-market, and specialized industry applications.

The market is segmented by solution, industry, and region. By solution, the market is categorized into AP automation software and AP automation services. By industry, the market is segmented into BFSI, manufacturing, retail & e-commerce, IT & telecom, healthcare & life sciences, government & public sector, and others. Regionally, the market spans across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

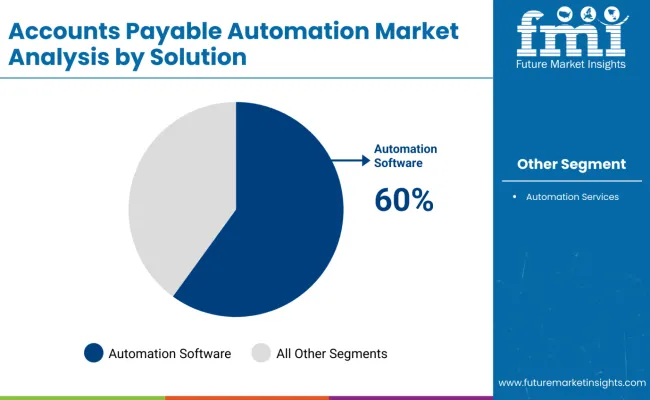

The AP automation software segment holds a dominant position with 60% of the market share in the solution category, owing to its comprehensive functionality, scalability, and superior performance in automating invoice processing, approval workflows, and payment operations across diverse business environments. AP automation software is widely adopted across enterprise, mid-market, and small business settings due to its flexibility, integration capabilities, and ability to handle complex financial processes while maintaining compliance and audit requirements.

The software enables finance teams and business users to achieve significant efficiency improvements while reducing manual errors and processing costs in both new implementations and system upgrades. As demand for comprehensive, integrated financial automation grows, the AP automation software segment continues to maintain preference in modern business applications.

Vendors are investing in AI-powered features, enhanced integration capabilities, and industry-specific functionality to maintain market leadership, broaden application scope, and improve user experience. The segment is positioned to remain dominant as global businesses prioritize comprehensive automation and integrated financial platforms.

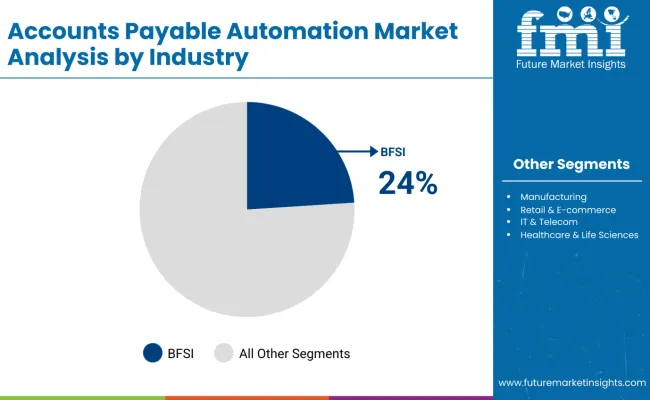

Banking, financial services & insurance remains the core industry segment with 24% of the market share in 2025, as it represents the largest adopter of accounts payable automation technology due to high transaction volumes, complex regulatory requirements, and stringent compliance standards. The segment's dominance is driven by the need for accurate financial processing, audit trail requirements, and risk management across diverse financial operations and regulatory environments.

BFSI applications also benefit from technological advancements in fraud detection, compliance automation, and integrated financial platforms, making accounts payable automation an essential component in modern financial institutions. This makes AP automation indispensable in contemporary banking operations and economic service delivery.

Ongoing regulatory evolution and the growing emphasis on operational efficiency and risk management are key trends driving the sustained relevance of BFSI applications in the accounts payable automation market.

In 2024, global accounts payable automation adoption grew by 12% year-on-year, with North America taking a 45% share. Applications include invoice processing, payment automation, and vendor management. Vendors are introducing AI-powered solutions and cloud-based platforms that deliver superior efficiency profiles and cost optimization. Machine learning formulations now support intelligent document processing. Digital transformation initiatives and operational efficiency requirements support the finance team's confidence. Technology providers increasingly supply ready-to-deploy automation platforms with integrated analytics capabilities to reduce implementation complexity.

AI-Powered Innovation Accelerates Accounts Payable Automation Market Demand

Finance departments and business organizations are choosing AI-powered accounts payable automation to achieve superior processing efficiency, enhance accuracy, and meet growing demands for intelligent, connected financial operations. In field applications, AI-powered solutions deliver up to 75% improvement in processing speed compared to traditional manual methods. Systems equipped with machine learning maintain accurate data extraction throughout varying document formats and vendor requirements. In enterprise environments, integrated AI automation systems help reduce processing costs while maintaining compliance standards by up to 60%. AI applications are now being deployed for fraud detection and compliance monitoring, increasing adoption in sectors demanding precise financial control. These advantages help explain why AI-powered automation adoption rates in finance applications rose 25% in 2024 across developed markets.

Implementation Costs, Integration Complexity and Change Management Limit Growth

Market expansion is constrained by higher implementation costs, system integration requirements, and organizational change management needs. AI-powered automation platforms can cost 50-80% more than traditional manual processes, depending on functionality complexity and integration requirements, impacting adoption in cost-sensitive organizations. Legacy system integration requires compatibility validation, adding 4-8 weeks to project timelines. Specialized training and change management extend implementation costs by 30-45% compared to conventional manual processes. Limited availability of trained administrators for advanced automation platforms restricts scalable deployment, especially in mid-market segments. These constraints make comprehensive automation adoption challenging in resource-constrained environments despite growing efficiency advantages and competitive pressures.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 14.5% |

| China | 12.8% |

| UK | 12.0% |

| Brazil | 11.5% |

| USA | 10.0% |

| Germany | 9.0% |

| Canada | 8.5% |

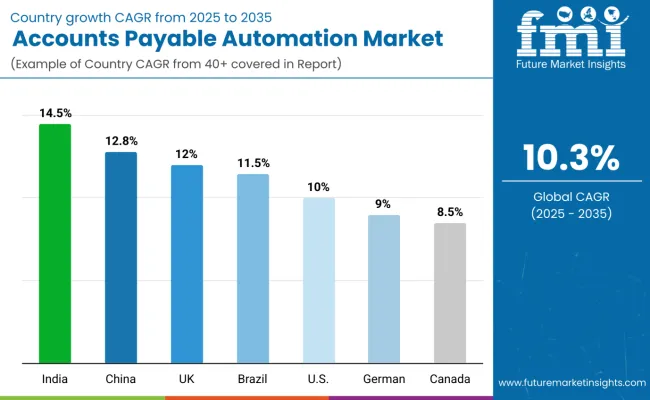

The accounts payable automation market shows varied growth trajectories across the top seven countries. India leads with the highest projected CAGR of 14.5% from 2025 to 2035, driven by rapid digitization, growing enterprise adoption, and expanding financial technology infrastructure. China follows with a CAGR of 12.8%, supported by massive digital transformation initiatives and government support for automation technologies. The UK shows strong growth at 12.0%, benefiting from regulatory compliance requirements and advanced financial services adoption. Brazil demonstrates solid growth at 11.5%, supported by economic modernization and increasing business process automation. The USA and Germany show moderate growth at 10.0% and 9.0% respectively, driven by mature market expansion and enterprise efficiency initiatives. Canada, with a CAGR of 8.5%, experiences steady expansion supported by business modernization trends, reflecting regional differences in digital maturity and automation adoption.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from accounts payable automation in India is projected to grow at a CAGR of 14.5% from 2025 to 2035, driven by massive digital transformation initiatives, increasing enterprise adoption, and growing financial technology infrastructure across major business centers, including Mumbai, Bangalore, and Delhi. Indian businesses are increasingly adopting advanced automation technologies as operational standards improve and cost optimization requirements strengthen, with widespread implementation of AI-powered invoice processing and cloud-based solutions.

Sales of accounts payable automation in China are expected to grow at a CAGR of 12.8% from 2025 to 2035, driven by rapid enterprise digitization, government-backed digital economy initiatives, and rising adoption of smart financial technologies across large and mid-sized organizations. Market adoption is shifting from basic financial software toward comprehensive automation platforms and AI-powered solutions, supported by strong government policies promoting technological advancement. Moreover, increasing integration of cloud-based platforms with real-time analytics and compliance monitoring is enhancing efficiency and transparency in AP operations.

The demand for accounts payable automation in Brazil is projected to expand at a CAGR of 11.5% from 2025 to 2035, driven by economic modernization and expanding digital infrastructure. Growth is concentrated in urban business centers, including São Paulo, Rio de Janeiro, and Brasília, where enterprise automation and financial efficiency requirements are expanding, with Brazil leading Latin America's accounts receivable automation market development. Increasing adoption of cloud-based AP platforms is helping businesses improve compliance with complex tax regulations.

The accounts payable automation market in the USA is anticipated to expand at a CAGR of 10.0% from 2025 to 2035, driven by rising focus on advanced functionality and integration capabilities. Growth is centered on enterprise upgrades and cloud migration in California, Texas, and New York regions, with North America commanding over 33% of global market share and leading in AI-powered automation implementation. Increasing adoption of intelligent invoice processing and real-time analytics is enhancing operational efficiency across enterprises.

The demand for accounts payable automation in Germany is expected to grow at a CAGR of 9.0% from 2025 to 2035, driven by advanced manufacturing infrastructure, robust compliance requirements, and comprehensive operational efficiency standards in Berlin, Munich, and Hamburg markets. Germany leads Europe with 35.1% market share, supported by strong government initiatives promoting digitalization and GDPR compliance requirements. Furthermore, Germany’s focus on cloud-based financial solutions is accelerating adoption of scalable AP automation platforms across enterprises.

Revenue from accounts payable automation in France is projected to grow at a CAGR of 10.8% from 2025 to 2035, supported by steady demand for enterprise system upgrades and operational efficiency improvements. Business systems in Paris, Lyon, and Marseille are experiencing expansion in automation technologies, compliance applications, and integrated business platforms, driven by mandatory e-invoicing regulations and governmental digitalization initiatives. Increasing adoption of AI-driven invoice processing and cloud-based workflow solutions is enhancing operational accuracy and efficiency.

The accounts payable automation market in the UK is expected to expand at a CAGR of 12.0% from 2025 to 2035, driven by regulatory requirements, compliance regulations and digital transformation initiatives in London, Manchester, and Edinburgh regions. Market growth is supported by post-Brexit operational adjustments and increasing adoption among SMEs and financial institutions, with strong government support for financial technology advancement. Additionally, integration of AI and machine learning for predictive analytics is driving strategic decision-making and reducing manual intervention in accounts payable operations.

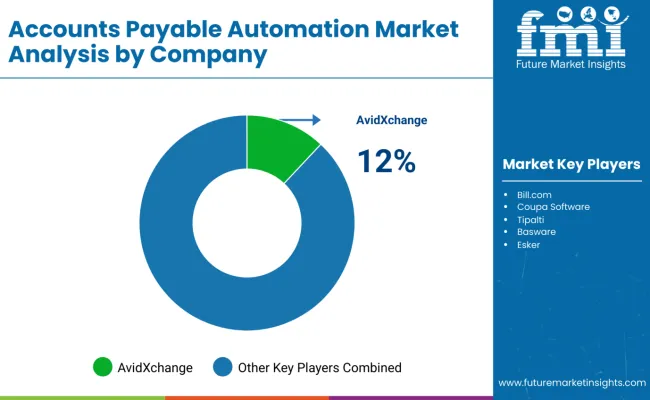

The market is moderately consolidated, featuring a mix of established enterprise software companies, specialized fintech providers, and cloud-based platform vendors with varying degrees of technical expertise, integration capabilities, and market reach proficiency. AvidXchange leads the market with an estimated 12% share, primarily driven by its focus on mid-market solutions and comprehensive automation platform offerings across multiple industry verticals.

Bill.com maintains a significant market presence with its specialization in small and medium business automation, leveraging strong cloud-based capabilities and established relationships with accounting professionals. Coupa Software, SAP Ariba, and Oracle NetSuite differentiate through comprehensive enterprise portfolios, advanced integration capabilities, and extensive technical support that cater to various enterprise, procurement, and financial management applications.

Regional specialists and emerging providers focus on specific market segments, AI-powered solutions, and innovative user experiences, addressing growing demand from digital-native businesses, industry-specific requirements, and advanced automation capabilities.

Entry barriers remain moderate, driven by challenges in system integration, regulatory compliance, and technical expertise across multiple business environments. Competitiveness increasingly depends on AI innovation, platform scalability, and integration capabilities for diverse enterprise and business applications.

| Items | Value |

|---|---|

| Quantitative Units | USD 3.4 billion |

| Solution | AP Automation Software and AP Automation Services |

| Industry | BFSI, Manufacturing, Retail & E-commerce, IT & Telecom, Healthcare & Life Sciences, Government & Public Sector, and Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled | AvidXchange, Bill.com, Coupa Software, Tipalti, SAP Ariba (SAP), Basware, Esker, Oracle NetSuite (Oracle), Medius, and Tradeshift |

| Additional Attributes | Dollar sales by solution and industry segment, regional adoption trends, competitive landscape, user preferences for cloud versus on-premises solutions, integration with existing ERP systems, innovations in AI and machine learning technology, and compliance standardization for diverse business applications |

The global accounts payable automation market is estimated to be valued at USD 3.4 billion in 2025.

The accounts payable automation market size is projected to reach USD 8.9 billion by 2035.

The accounts payable automation market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The AP automation software segment is projected to lead in the accounts payable automation market with 60% share in 2025.

In terms of industry, the BFSI (Banking, Financial Services & Insurance) segment is expected to command 24% share in the accounts payable automation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Accounts Receivable Automation Market Size and Share Forecast Outlook 2025 to 2035

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Network Automation Market - AI & Cloud Connectivity 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Medical Automation Market Analysis - Innovations & Forecast 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Content Automation AI Tools Market

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA