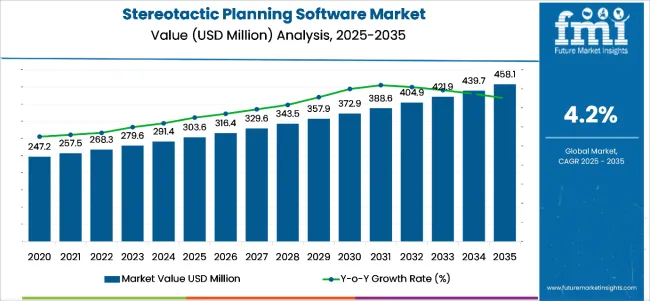

The stereotactic planning software market is forecast to experience significant growth over the next few years. In 2025, the market reached USD 303.6 million, and by 2035, it is expected to grow to USD 458.1 million, reflecting a CAGR of 4.2%. This growth is largely driven by the increasing demand for precision and minimally invasive procedures in neurosurgery and radiosurgery.

The rising number of neurological disorders, including brain tumors, epilepsy, and movement disorders, is contributing to the expanded need for effective treatment planning and guidance during surgery. With advancements in imaging technologies and surgical techniques, stereotactic planning software has become crucial in supporting highly accurate and safe procedures.

One of the key factors fueling the market's expansion is the ongoing evolution of imaging modalities and their integration with software platforms. The growing prevalence of neurological conditions, coupled with a shift toward minimally invasive techniques, is intensifying the demand for advanced surgical planning solutions.

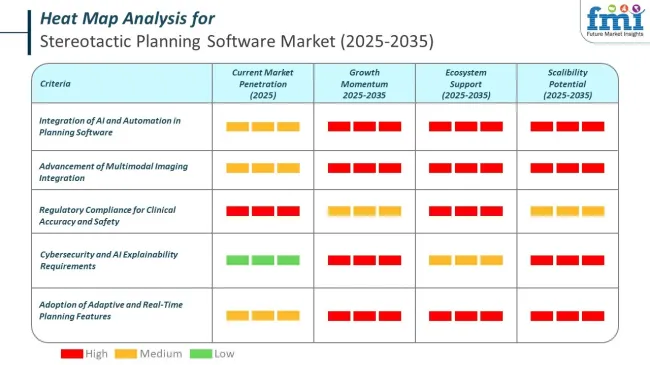

Moreover, the integration of artificial intelligence (AI) and machine learning into stereotactic planning software has significantly improved the accuracy and customization of surgical treatment plans. AI-driven software is making it easier for healthcare providers to create tailored treatment protocols, thus enhancing the precision and efficiency of surgical procedures. These technological innovations also help in reducing patient recovery time, further increasing their appeal in hospitals and surgical centers worldwide.

Furthermore, substantial investments in healthcare infrastructure and the digitalization of surgical workflows in both emerging and developed markets are contributing to the overall growth of the market. Countries across North America, Europe, and Asia Pacific are seeing increased adoption of these technologies as part of broader efforts to improve the quality of healthcare delivery.

In particular, the integration of these software solutions into hospital systems is helping streamline workflows and reduce operational costs, making them an attractive choice for healthcare facilities looking to improve patient outcomes. As a result, the market is poised for continued expansion over the next ten years.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 303.6 Million |

| Market Value (2035F) | USD 458.1 Million |

| CAGR (2025 to 2035) | 4.2% |

Continuous innovation in stereotactic planning software is shaping the precision radiotherapy landscape. Integration of artificial intelligence, automation, and multimodal imaging has enhanced real-time targeting accuracy, improved clinical throughput, and enabled safe, frameless procedures in radiosurgery.

Governments across key regions have implemented strict regulatory policies to ensure that stereotactic planning software meets clinical accuracy, cybersecurity, and patient safety benchmarks. Compliance is crucial for software developers seeking approvals and market entry.

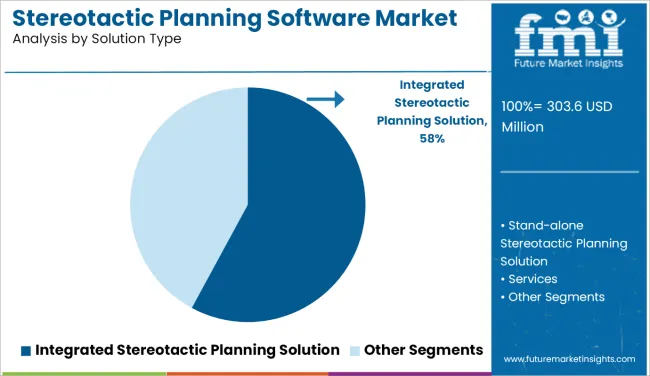

| Solution Type | Market Share |

|---|---|

| Integrated Stereotactic Planning Solution | 58% |

It is anticipated that integrated stereotactic planning solutions will account for 58% of the share into the overall market by 2025. These solutions integrate multiple imaging sources, treatment protocols, and surgical planning tools into a single system to provide highly coordinated workflows to neurosurgical teams. This is gaining more and more popularity since these systems close the complete loop of workflow-from diagnosis and pre-operative planning to post-operative verification.

Hospitals and research institutions prefer integrated solutions for the reduction of software fragmentation and improving the interoperability of data. They are most especially important in complicated procedures such as deep brain stimulation (DBS), stereotactic radiosurgery (SRS), and biopsy cases, where even a small error and outside delay can result in compromised procedures.

In environments with save hardware infrastructure, stand-alone solutions have the advantages of cost-effectiveness and flexibility in usage, but they lose the overall scalability since they cannot be networked in to whole hospital systems or real-time imaging modalities. Nevertheless, for most resource-constrained areas where stereotactic procedures are very essential, stand-alone systems still offer a viable solution based on small clinics or developing regions.

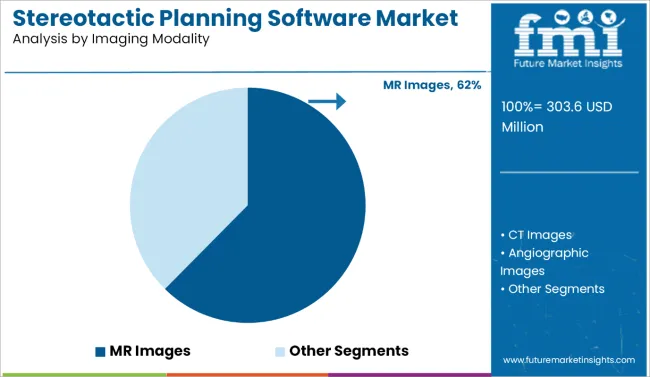

| Imaging Modality | Market Share |

|---|---|

| MR Images | 62% |

Magnetic Resonance (MR) images are expected to take a lion's share of the stereotactic planning software market fragmentation, with a projected share of 62% by the year 2025. The excellent soft tissue contrast, its non-invasiveness, and the absence of ionizing radiation make MR images the gold standard for presurgical mapping and target localization for stereotactic procedures. The most beneficial aspect of MR-based planning is its potential to reveal high accuracy in identifying brain lesions, functional brain areas, and anatomical landmarks.

MR imaging is of paramount importance in functional neurosurgery, which specifically concerns movement disorders, epilepsy, and oncology. The need for multi-sequence MR imaging - that is, the functional MRI (fMRI) and diffusion tensor imaging (DTI) - software will continue to grow rapidly. This trend will definitely spur innovations in MR-compatible planning devices.

CT images remain indeed priceless for certain applications of stereotaxic, particularly where the vision of bony structures and real-time guidance are of importance. CT, in fact, is more widely available and can deliver faster acquisitions.

Angiographic images form, admittedly, a smaller segment of the picture but play such an important role in those case procedures for vascular anomalies or arteriovenous malformations that somehow they need to be integrated with MR and CT data within the planning software, thus contributing even more to the outcome of the procedure and to patient safety.

In the market, one of the challenges is that the stereotactic planning software itself is expensive, as there exists a complexity hurdle in integrating these systems into the existing hospital IT infrastructure. These factors limit adoption, especially among small healthcare providers and in developing countries.

AI-enabled new developments and cloud-based stereotactic planning applications will provide further improvement toward increased accuracy at lower cost, and real-time collaboration. These innovations open up opportunities to engineer and globalize surgical planning with widening availability.

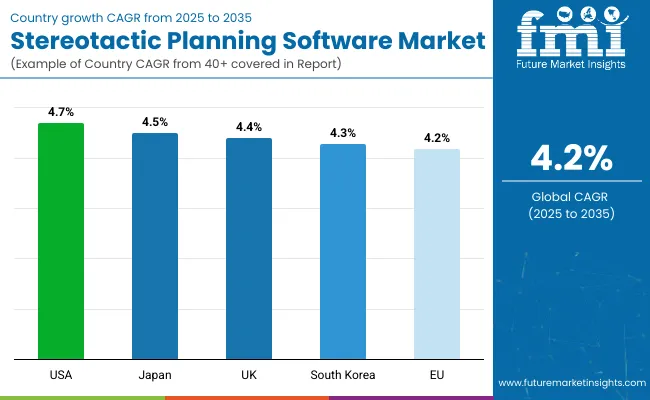

In the United States, the market for stereotactic planning software is gradually on the rise mainly due to the rapidly growing number of advanced neurosurgical procedures and the increase in the number of neurologically afflicted patients in the country. The surgical hospitals and specialty clinics resort to this software for enhancing the accuracy of surgical procedures and patient outcomes.

The FDA regulations cover the software under their use due to the safety and effectiveness of this software. Such innovations are continuous and include image importation and AI-integrated planning in software, leading to an increased demand for the product. Increased investments further boost the market growth through developing IT infrastructure for the health care sector and training programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

In the UK, steady growth in the stereotactic planning software sector is appreciated, mainly due to an increase in the awareness of minimally invasive neurosurgery and improvement in healthcare infrastructure. On the other hand, with respect to maintaining quality, medical software is regulated by the agency known as the Medicines and Healthcare products Regulatory Agency (MHRA).

Increased incidence of brain tumours or neurological disorders raises the demand for precise surgical planning instruments. Also, the integration of stereotactic software applications with other diagnostic systems is an enhancement for maximizing work efficiency in hospitals and also accounts for the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

The constant growing stereotactic planning software market within the European Union is directly correlated with the increasing rate of neurological disorders and the growing acceptance of precise surgical techniques.

Germany, France, and Italy lead in moving advanced surgical software into the clinical arena. The EMA (European Medicines Agency) has set out strict regulations in this regard to guarantee quality and safety. Demand in the software market is attributed to better features in the software, such as real-time imaging integration and AI-based analytics, which assure improved operative outcomes and streamlined workflows.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The market for stereotactic planning software in Japan is progressing with constant growth because of the increasing demand for advanced neurosurgical solutions. The Ministry of Health, Labour and Welfare regulates medical software for compliance with safety standards.

Growing cases of neurological disorders and a shift focus towards minimally invasive procedures attribute the increasing adoption of such software. Furthermore, continuous technological advances such as robotic surgery integration and artificial intelligence enhance planning accuracy, which increases the value-for-money increase in market size.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5 % |

Adopting advanced technologies for neurosurgery, hospitals in South Korea gradually embrace stereotactic planning software for surgery. The major regulatory authority for medical equipment and their software is the Ministry of Food and Drug Safety (MFDS).

People with neurological diseases are increasing rapidly; hence, healthcare investments toward a more accurate planning module are also increasing together with the growing number of patients. The further growth in marketing has also been prompted by on-going integrations of AI with software solutions and imaging modalities to further enhance surgical precision.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3 % |

The growth of the market involving the stereotactic planning software will be at a steady pace from the year 2025 to the year 2035. The increase in the demand for minimally invasive surgeries and the prevalence of neurological disorders are going to pose an increasing burden on the health care systems.

Advancements in imaging techniques, including MRI and CT scans, propel further AI and machine learning adoption to increase the accuracy and effectiveness of the stereotactic planning software in the near future, which will help achieve precise targeting during intervention procedures in neurosurgery, oncology, and radiation therapy, with improved outcomes. In this growing adoption of personalized medicine and investment in developing healthcare infrastructure in developing economies, here are other keys to holding the market together.

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 303.6 million |

| Projected Market Size (2035) | USD 458.1 million |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million/ Volume in thousand licenses or software installations |

| Segments by Solution Type | Stand-alone Stereotactic Planning Solution, Integrated Stereotactic Planning Solution, Services (Consulting & Implementation; Training Services; On-demand Support Services) |

| Segments by Imaging Modality | CT Images, MR Images, Angiographic Images |

| Segments by End User | Hospitals, Ambulatory Surgical Centers, Cancer Research Institutes |

| Key Regions | North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East and Africa (MEA) |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Brainlab, Inc., Renishaw Inc., inomed Inc., RaySearch Americas, Inc., Mevis Informática Médica, FHC, Inc., Integra LifeSciences Corporation, Elekta Solutions AB, SurgiFRONT Ltd., IBA Dosimetry GmbH |

| Additional Attributes | Market driven by precision neurosurgery demand, AI-based contouring, hybrid OR adoption, and reimbursement for radiosurgical procedures |

| Customization and Pricing | Customization and pricing details available on request |

The overall market size for the stereotactic planning software market was USD 303.6 Million in 2025.

The market is expected to reach USD 458.1 Million in 2035.

Demand will be driven by increasing adoption of minimally invasive neurosurgical procedures, advancements in imaging and software technologies, rising prevalence of neurological disorders, and growing demand for precision medicine.

The top 5 contributing countries are USA, UK, Europe, Japan, and South Korea.

The Integrated Stereotactic Planning Solution segment is expected to lead the market due to its critical role in surgical accuracy and patient outcomes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Imaging Modality, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Solution Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Solution Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Solution Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Europe Market Attractiveness by Solution Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Solution Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Solution Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Solution Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Imaging Modality, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Imaging Modality, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Imaging Modality, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Imaging Modality, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: MEA Market Attractiveness by Solution Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Imaging Modality, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Route Optimization & Planning Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Stereotactic Radiation Therapy Market Trends and Forecast 2025 to 2035

Stereotactic Surgery Devices Market Insights by Product, Application, and Region through 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA