The software defined wide area network SD-WAN market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 126.8 billion by 2035, registering a compound annual growth rate (CAGR) of 27.0% over the forecast period.

The software defined wide area network (SD-WAN) market is projected to experience robust growth, expanding from USD 3.5 billion in 2020 to USD 126.8 billion by 2035, representing an absolute increase of USD 123.3 billion over the 16-year forecast period. This expansion can be divided into three distinct phases reflecting evolving market dynamics. Between 2020 and 2025, the market grows from USD 3.5 billion to USD 9.1 billion, driven primarily by increasing adoption of cloud computing, demand for enhanced network agility, and the need for cost-effective, scalable wide area network solutions.

This foundational phase sees enterprises implementing SD-WAN to improve application performance, optimize bandwidth usage, and enhance security across distributed networks. From 2026 to 2030, the market accelerates significantly, increasing from USD 11.6 billion to USD 30.2 billion. This phase benefits from digital transformation initiatives, the rise of hybrid cloud environments, and growing demand for real-time analytics and automation within network management.

Increasing investments in network infrastructure by large enterprises and service providers further propel adoption. Finally, from 2031 to 2035, the market surges from USD 38.4 billion to USD 126.8 billion, marking rapid mainstream integration. The expansion during this period is supported by advancements in artificial intelligence, machine learning, and edge computing, which enable predictive network optimization and autonomous operations. Growing demand for secure connectivity driven by IoT proliferation and 5G rollouts also fuels growth. The SD-WAN market is thus transitioning from early adoption to widespread deployment, with innovation and increasing global connectivity requirements underpinning sustained expansion and substantial opportunities for vendors and service providers alike.

| Metric | Value |

|---|---|

| Software-Defined Wide Area Network SD-WAN Market Estimated Value in (2025 E) | USD 11.6 billion |

| Software-Defined Wide Area Network SD-WAN Market Forecast Value in (2035 F) | USD 126.8 billion |

| Forecast CAGR (2025 to 2035) | 27.0% |

The SD-WAN market is experiencing rapid growth, driven by increasing enterprise demand for high-performance, cost-efficient, and secure network infrastructure across distributed locations. The rising complexity of cloud applications, remote workforces, and digital transformation initiatives has made traditional WANs inadequate, prompting businesses to adopt software-defined solutions that enhance agility and control.

SD-WAN platforms offer centralized management, dynamic path selection, and optimized bandwidth usage reducing operational costs while maintaining application performance and security. As organizations scale hybrid and multi-cloud architectures, SD-WAN plays a critical role in enabling seamless connectivity across data centers, cloud platforms, and edge devices.

Strategic partnerships between SD-WAN vendors and cloud providers are also fostering innovation and adoption.

The software-defined wide area network SD-WAN market is segmented by component, deployment modelend use, and geographic regions. By component of the software-defined wide area network SD-WAN market is divided into solution and service. In terms of deployment model of the software-defined wide area network SD-WAN market is classified into cloud, on-premises, and hybrid. Based on end use of the software-defined wide area network SD-WAN market is segmented into IT & telecom, BFSI, healthcare, retail & consumer goods, government, manufacturing and others. Regionally, the software-defined wide area network SD-WAN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

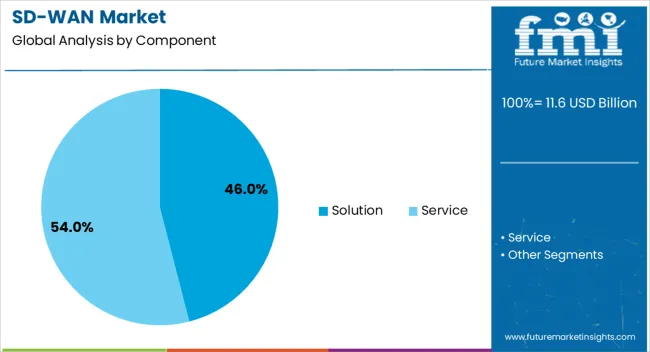

By component, the solution segment is expected to lead the SD-WAN market with a 46.0% share in 2025. This dominance is attributed to the increasing demand for core SD-WAN functionalities, including secure routing, traffic prioritization, WAN optimization, and centralized control.

Enterprises are investing in standalone and integrated solutions that provide seamless network visibility and zero-touch provisioning. These solutions reduce dependence on costly MPLS circuits, enhance security through segmentation and encryption, and improve user experience across cloud and SaaS applications.

As businesses seek to modernize legacy networks with scalable, software-centric alternatives, the solution segment continues to see strong momentum across verticals.

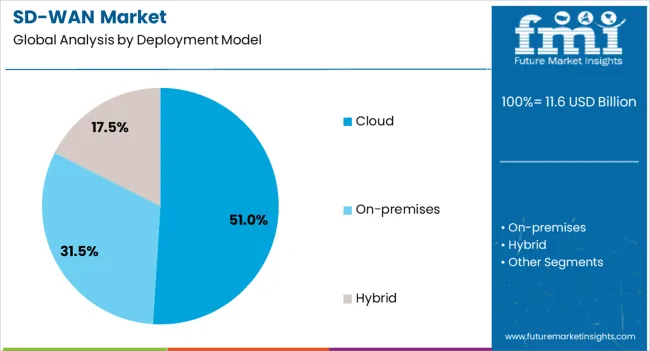

Cloud-based deployment is anticipated to account for 51.0% of the total SD-WAN market share in 2025, establishing it as the leading deployment model. The shift to cloud-native architectures and the rise in SaaS adoption have accelerated preference for cloud-managed SD-WAN platforms.

These models offer scalability, faster updates, and simplified configuration across distributed locations. Cloud deployment also facilitates better integration with public cloud ecosystems such as AWS, Azure, and Google Cloud, enhancing visibility and control.

Small to medium enterprises and multi-site businesses, in particular, are embracing cloud-based SD-WAN due to lower upfront costs and reduced IT overhead.

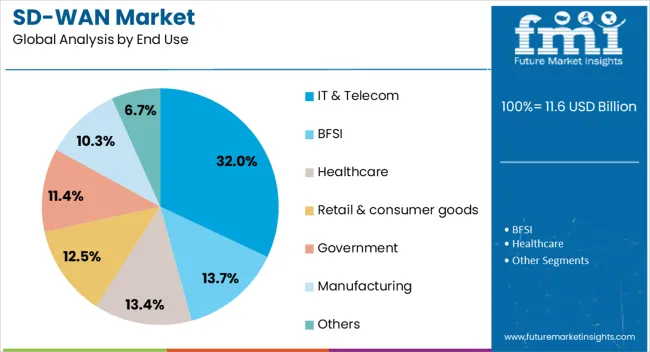

IT & telecom is projected to lead the SD-WAN market with a 32.0% revenue share in 2025, driven by rising bandwidth demands, growing 5G integration, and the proliferation of edge computing use cases. Service providers and tech enterprises are deploying SD-WAN to support diverse and latency-sensitive workloads, from VoIP to cloud-native applications.

SD-WAN’s programmability and centralized control allow telecom operators to offer managed network services and customize connectivity options for enterprise customers.

Additionally, the sector’s continuous push toward network function virtualization (NFV) and digital transformation reinforces the strong outlook for SD-WAN adoption within IT and telecom infrastructures.

The SD-WAN market is expanding due to cloud adoption, remote work trends, integrated security requirements, and managed service partnerships. These factors collectively position SD-WAN as a cornerstone for next-generation enterprise networks.

The adoption of cloud-based applications and services has significantly increased the demand for SD-WAN solutions. Enterprises require high-performance, secure, and cost-efficient connectivity to maintain productivity across distributed locations. Traditional MPLS systems often struggle to deliver scalability for hybrid cloud and SaaS applications, making SD-WAN an attractive alternative. Its ability to provide centralized control and intelligent traffic routing ensures optimized bandwidth utilization and reduced latency. Organizations leveraging multi-cloud strategies are particularly focused on implementing SD-WAN to achieve seamless integration across platforms. This transition continues to accelerate as businesses prioritize network agility and flexible deployment models for global operations.

The rise in remote and hybrid work arrangements has amplified the need for secure and reliable connectivity across multiple endpoints. SD-WAN addresses this requirement by delivering consistent application performance, regardless of user location. Enterprises are integrating SD-WAN solutions to simplify management of remote branches, reduce dependency on legacy WAN models, and maintain robust security frameworks. The ability to dynamically route traffic based on real-time conditions ensures better user experience while optimizing operating costs. This shift underlines the strategic importance of SD-WAN in enabling business continuity, supporting distributed workforces, and minimizing network vulnerabilities in dynamic work environments.

Security has emerged as a critical factor driving SD-WAN adoption, particularly in sectors handling sensitive data. The integration of SD-WAN with zero-trust frameworks and Secure Access Service Edge (SASE) models enhances protection against cyber threats. Enterprises are prioritizing solutions that combine network optimization with embedded security functions such as encryption, firewall, and threat detection. This approach reduces the complexity of managing separate systems while ensuring compliance with stringent regulatory requirements. Businesses operating in finance, healthcare, and government sectors are leading adopters of secure SD-WAN deployments to safeguard data integrity and maintain operational resilience in an evolving threat landscape.

Managed service providers (MSPs) are playing a pivotal role in accelerating SD-WAN adoption, particularly among mid-sized enterprises lacking in-house expertise. By outsourcing SD-WAN implementation and monitoring, businesses can benefit from reduced capital expenditure and access to advanced performance analytics. Service providers offer tailored solutions that include centralized control, application prioritization, and proactive troubleshooting, helping organizations achieve network reliability without significant upfront investments. This model is gaining traction in regions with strong demand for cost-efficient connectivity and rapid deployment capabilities, reinforcing the relevance of MSP partnerships in the SD-WAN growth trajectory.

| Country | CAGR |

|---|---|

| China | 36.5% |

| India | 33.8% |

| Germany | 31.1% |

| France | 28.4% |

| UK | 25.7% |

| USA | 23.0% |

| Brazil | 20.3% |

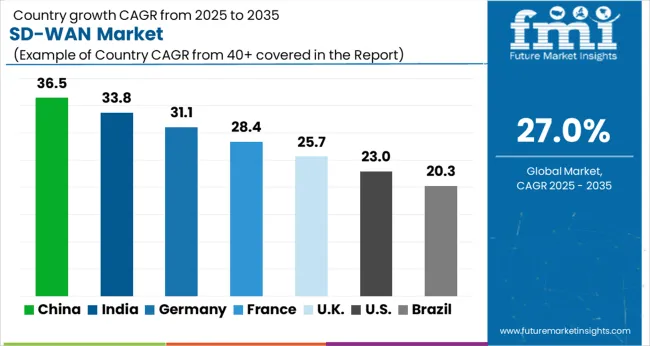

The software-defined wide area network (SD-WAN) market is projected to grow at a global CAGR of 27.0% between 2025 and 2035, fueled by cloud adoption, remote work expansion, and rising demand for secure, flexible network architectures. China leads with a CAGR of 36.5%, driven by rapid digital transformation, enterprise cloud migration, and widespread adoption of AI-integrated networking solutions. India follows at 33.8%, supported by government-backed digitization programs, strong growth in IT services, and increased investments in hybrid cloud infrastructures.

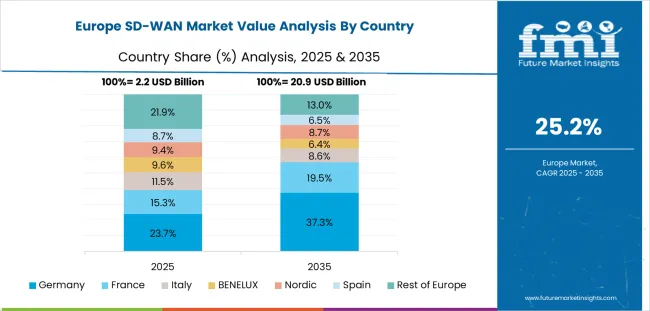

France grows at 28.4%, influenced by increased enterprise focus on network efficiency and the integration of SD-WAN with security frameworks. The United Kingdom achieves 25.7%, benefiting from accelerated SaaS adoption and modernization of network infrastructure for public and private enterprises, while the United States records 23.0%, shaped by mature market dynamics, managed service expansion, and consolidation trends among global SD-WAN providers. This report includes insights from more than 40 countries, with these markets establishing key benchmarks for technology integration, strategic partnerships, and long-term growth trajectories in enterprise networking.

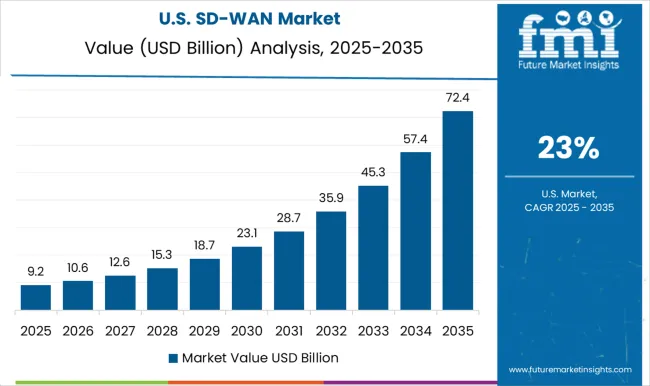

The CAGR for the United States SD-WAN market stood at 17.5% during 2020 to 2024 and climbed to 23.0% between 2025 and 2035, indicating accelerating adoption in the enterprise networking landscape. Initial growth was driven by the gradual shift from MPLS to hybrid network models, influenced by cloud migration strategies and early SASE integrations. The sharp increase in the next decade reflects the rapid expansion of edge computing, IoT-based applications, and heightened security requirements across industries. Managed service providers are playing a pivotal role in supporting scalability and performance optimization for distributed enterprises, ensuring SD-WAN becomes an integral element of digital transformation strategies.

The CAGR for the United Kingdom SD-WAN market was around 19.0% during 2020 to 2024 and surged to 25.7% for the 2025 to 2035 period, highlighting rapid network transformation in enterprise sectors. The earlier phase was marked by controlled adoption due to legacy infrastructure and delayed migration strategies in mid-sized businesses. In the subsequent decade, widespread SaaS adoption, 5G rollout, and regulatory compliance requirements accelerated demand for secure, application-aware routing. The prominence of managed SD-WAN offerings has significantly reduced deployment complexity for enterprises seeking cost-efficient connectivity. Integration with zero-trust security frameworks and AI-driven analytics further supported the UK’s position as a strong European growth hub.

China’s SD-WAN market CAGR moved from 22.8% during 2020 to 2024 to 36.5% in the 2025 to 2035 period, far exceeding global averages due to aggressive digitization and cloud-first initiatives. The early stage experienced momentum through large-scale enterprise adoption in technology and manufacturing sectors. The growth leap in the next phase stems from AI-driven automation, strong government support for digital infrastructure, and partnerships between telecom giants and SD-WAN providers. Extensive deployment in smart city projects and public cloud integration further enhances adoption rates. China’s ability to localize advanced networking solutions and provide scalable cost models positions it as the most dynamic SD-WAN market globally.

The CAGR for India’s SD-WAN market advanced from 21.0% during 2020 to 2024 to 33.8% for the 2025 to 2035 period, underpinned by digital transformation initiatives across banking, telecom, and IT sectors. The initial phase focused on basic hybrid WAN deployments by large enterprises, with slower adoption among SMBs. The acceleration post-2024 is attributed to government-led connectivity programs, cloud-native service expansion, and increased enterprise emphasis on security-rich networking solutions. Partnerships between global vendors and local service providers enabled cost-effective managed SD-WAN offerings, fueling market penetration. India’s growing role in global IT outsourcing further amplifies the need for scalable, secure networking infrastructure across distributed teams.

France’s SD-WAN market saw a CAGR increase from 18.5% during 2020 to 2024 to 28.4% between 2025 and 2035, supported by enterprise reliance on hybrid cloud strategies and application performance optimization. Earlier adoption was largely driven by multinational corporations prioritizing network modernization to ensure business continuity. The upcoming decade is expected to benefit from rising demand for secure remote access solutions, accelerated by hybrid workforce models and strict compliance mandates. France’s manufacturing, healthcare, and public sectors are key contributors, leveraging SD-WAN for advanced security integration and cost reduction through centralized orchestration and dynamic routing capabilities.

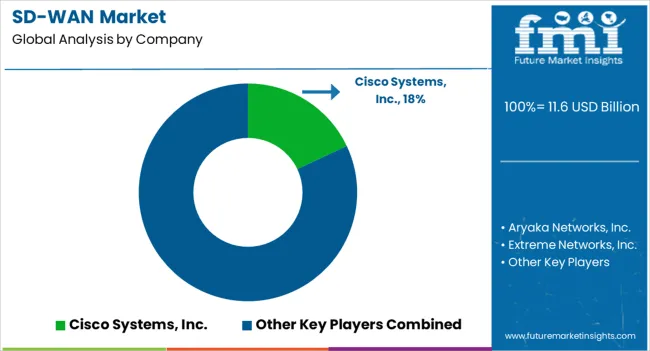

The SD-WAN market is intensely competitive, led by global networking giants and specialized service providers delivering advanced connectivity, security, and cloud integration solutions. Cisco Systems, Inc. holds a dominant position, leveraging its broad enterprise networking portfolio and integrated security features to serve large-scale organizations. Aryaka Networks, Inc. stands out with its managed SD-WAN services targeting cloud-first enterprises seeking quick deployments and optimized application performance. Extreme Networks, Inc. focuses on combining SD-WAN with network analytics and centralized control to enhance operational visibility. Hewlett Packard Enterprise (HPE) capitalizes on its Aruba platform to deliver edge-to-cloud SD-WAN solutions, ensuring scalability for hybrid environments.

Huawei Technologies Co., Ltd. drives adoption through competitive pricing and innovative solutions for emerging markets. Juniper Networks, Inc. differentiates itself by embedding AI-driven automation and security within its SD-WAN offerings, while Martello Technologies Group Inc. emphasizes network performance monitoring integrated with SaaS optimization. Oracle Corporation provides application-centric SD-WAN solutions supporting enterprise cloud strategies, whereas Palo Alto Networks, Inc. dominates the secure SD-WAN segment through its integration with advanced firewall and SASE frameworks.

Versa Networks, Inc. delivers flexible, software-based solutions suitable for managed service providers, while VMware, Inc. strengthens its position with the VeloCloud platform, enabling multi-cloud connectivity. ZTE Corporation caters to telecom carriers and large enterprises with end-to-end SD-WAN solutions. Competitive strategies focus on AI-driven analytics, zero-trust security integration, and cloud-native orchestration, alongside partnerships with MSPs for global reach. Future growth will favor vendors offering advanced traffic optimization, integrated cybersecurity, and managed service models tailored for hybrid and multi-cloud deployments.

Recent Development

In July 2025, Palo Alto Networks, Inc. announced acquisition of CyberArk (approx. USD 25 billion), bolstering identity security as part of its AI-driven platform strategy.

| Items | Values |

|---|---|

| Quantitative Units | USD 11.6 billion |

| Component | Solution and Service |

| Deployment Model | Cloud, On-premises, and Hybrid |

| End Use | IT & Telecom, BFSI, Healthcare, Retail & consumer goods, Government, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., Aryaka Networks, Inc., Extreme Networks, Inc., Hewlett Packard Enterprise (HPE), Huawei Technologies Co., Ltd., Juniper Networks, Inc., Martello Technologies Group Inc., Oracle Corporation, Palo Alto Networks, Inc., Versa Networks, Inc., VMware, Inc., and ZTE Corporation |

| Additional Attributes | Dollar sales by deployment model, share by enterprise size and industry vertical, regional adoption trends, competitive positioning, pricing benchmarks, managed services impact, integration with SASE solutions, regulatory influence, and future growth projections. |

The global software-defined wide area network SD-WAN market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the software-defined wide area network SD-WAN market is projected to reach USD 126.8 billion by 2035.

The software-defined wide area network SD-WAN market is expected to grow at a 27.0% CAGR between 2025 and 2035.

The key product types in software-defined wide area network SD-WAN market are solution, physical appliance, virtual appliance, service, training & consulting, integration & maintenance, and managed service.

In terms of deployment model, cloud segment to command 51.0% share in the software-defined wide area network SD-WAN market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Wide Mouth Jars Market Size and Share Forecast Outlook 2025 to 2035

Widefield Imaging Systems Market Insights - Growth & Forecast 2025 to 2035

Wide Bandgap Semiconductors Market Analysis – Growth & Forecast 2025 to 2035

Wide Mouth Bottles Market – Trends & Forecast 2025 to 2035

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

WiMAX (Worldwide Interoperability For Microwave Access) Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA