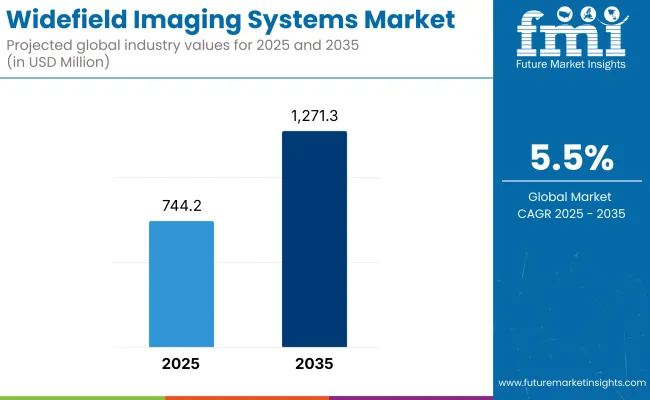

The global Widefield Imaging Systems Market is estimated to be valued at USD 744.2 million in 2025 and is projected to reach USD 1,271.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. This growth is driven by the increasing prevalence of retinal diseases, such as diabetic retinopathy and age-related macular degeneration, which necessitate advanced diagnostic tools for early detection and management.

The integration of artificial intelligence (AI) and machine learning algorithms into imaging systems has enhanced diagnostic accuracy and workflow efficiency, further propelling market expansion. Additionally, the rising geriatric population and growing awareness of ocular health have contributed to the increased adoption of widefield imaging systems in clinical settings. Technological advancements, including ultra-widefield imaging capabilities and high-resolution imaging, have also played a pivotal role in expanding the application scope of these systems beyond ophthalmology into neurology and oncology.

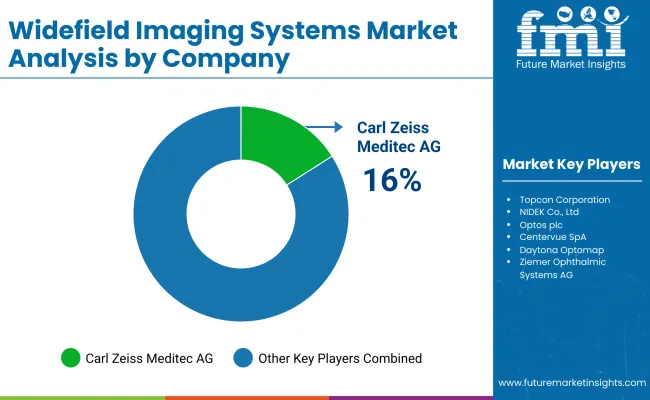

Prominent players in the widefield imaging systems market include Optos (a Nikon company), Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, and Clarity Medical Systems. These companies are actively engaged in product innovation, strategic collaborations, and mergers and acquisitions to strengthen their market positions.

In March 2025, Optos launched the MonacoPro, an advanced ultra-widefield (UWF) scanning laser ophthalmoscope (SLO) and spectral domain optical coherence tomography (OCT) system, enhancing diagnostic precision and workflow efficiency for eye care professionals. “MonacoPro represents our commitment to continuous innovation in ophthalmic imaging,” said Optos Chief Executive Officer Robert Kennedy. “With new advancements in automation, and data analysis, we are empowering clinicians with tools that enhance efficiency and diagnostic confidence while maintaining our industry-leading ultra-widefield imaging capabilities.”

The development of ultra-widefield optical coherence tomography angiography (OCTA) has provided clinicians with detailed visualization of retinal vasculature, facilitating early detection of vascular abnormalities associated with various ocular diseases. These technological innovations have improved diagnostic accuracy and patient outcomes, thereby driving market growth.

In 2025, North America is expected to maintain its dominance in the widefield imaging systems market, accounting for approximately 43.2% of the global revenue share. This leadership is attributed to the region's robust healthcare infrastructure, substantial investments in research and development, and the presence of key market players.

The increasing prevalence of diabetic retinopathy and other retinal diseases, coupled with favorable reimbursement policies, has further propelled the adoption of widefield imaging systems in clinical practice. Europe is projected to experience steady growth in the widefield imaging systems market, driven by the rising demand for advanced diagnostic tools and personalized medicine

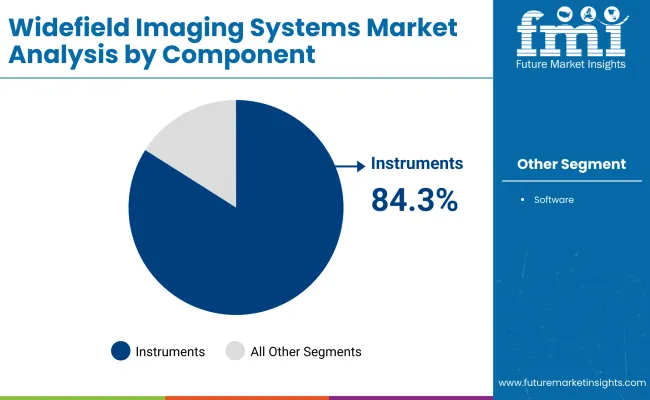

In 2025, the instruments segment is projected to hold the dominant share of 84.3% in the widefield imaging systems market. This leading position is driven by the core role these hardware devices play in capturing ultra-widefield and high-resolution images of the retina.

Widefield imaging instruments such as scanning laser ophthalmoscopes (SLOs) and optical coherence tomography (OCT) systems have become essential for early detection of peripheral retinal pathologies that are often missed by conventional imaging techniques.

The continuous advancement in imaging resolution, field of view, and speed of acquisition has improved diagnostic accuracy, which has supported greater integration of these instruments into both hospital ophthalmology departments and standalone eye care clinics.

Furthermore, instrument innovations incorporating multimodal imaging capabilities, such as, fluorescein angiography and autofluorescence have expanded their clinical utility, especially in diagnosing complex retinal disorders. The increased deployment of such systems in diabetic screening programs, retina specialty clinics, and clinical trials has further reinforced demand, making this the highest revenue-generating product segment.

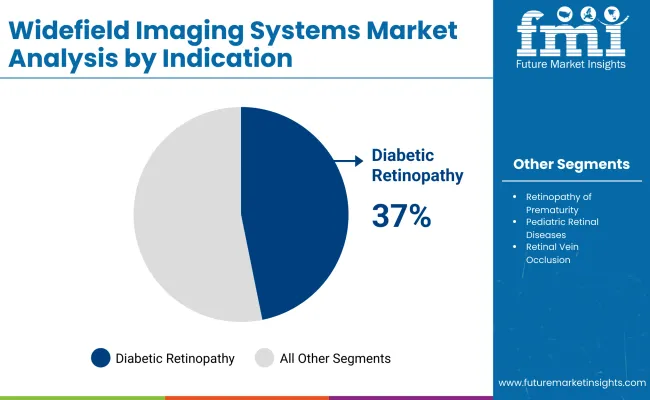

The diabetic retinopathy segment is expected to lead the widefield imaging systems market by indication in 2025, capturing 37% of total revenue share. This dominant position is attributed to the rising global prevalence of diabetes and the associated risk of retinal complications. Diabetic retinopathy, as a progressive and often asymptomatic disease, requires early and precise detection to prevent irreversible vision loss.

Widefield imaging systems have become a preferred diagnostic tool due to their ability to capture peripheral retinal lesions that may not be visible with standard fundus imaging. Clinical guidelines increasingly recommend ultra-widefield imaging for routine diabetic retinopathy screening and monitoring, especially in moderate-to-severe cases.

Additionally, AI-powered retinal screening programs using widefield platforms have been adopted in primary care settings to streamline early intervention. The integration of these systems in public health diabetic eye care initiatives, particularly in high-burden regions, has significantly contributed to this segment’s growth. Demand is further strengthened by the growing role of these systems in treatment planning and outcome monitoring for anti-VEGF therapies.

Challenges

High Cost Associated with Purchasing and Maintenance of Widefield Imaging Systems the Key Barrier in the Widefield Imaging Systems Market

A primary barrier is the cost of widefield imaging systems. Due to high annual fees and upfront investment in advanced retinal imaging technology, devices become harder to come by for smaller clinics and healthcare facilities. This poses limitations on accessibility, especially in areas with lower healthcare budgets or poor insurance coverage for diagnostic imaging. The maintenance and software updates are financially taxing, limiting their large-scale use.

The other impediment is the compatibility of imaging systems with the current healthcare infrastructure. Many healthcare providers still depend on legacy systems, which might not be compatible with new widefield imaging technology. The need for seamless data sharing, integration with electronic health records, and interoperability with other diagnostic tools presents technical and logistical challenges. This hinders adoption rates and impacts workflow efficiency.

Apart from this, the Regulatory approvals and compliance requirements are also hurdles. Clinical implementation of wide-field imaging systems requires strict quality control and safety guidelines. The approval pathways can be lengthy and expensive, postponing product rollout and market access. The challenges for entry into countries simply differ significantly based on regulatory requirements.

Opportunities

Growing Emphasis on Early Disease Detection and Personalized Medicine Opportunities for the Widefield Imaging Systems Industry

The key opportunity lies in the increased focus on early disease detection and personalized medicine. The transition of healthcare professionals to a more proactive approach to the treatment of diseases such as diabetic retinopathy and age-related macular degeneration creates an advancing demand for imaging solutions that support a complete overview of the retina.

Widefield imaging systems facilitate the early detection of peripheral retinal pathologies, such as retinal detachment, which can subsequently lead to early intervention and overall better patient care. This increasing clinical focus is driving demand for advanced imaging technologies.

Artificial intelligence (AI) and machine learning in imaging analysis also represent an opportunity scenario. AI-based imaging systems detect diseases by improving image quality and facilitating automatic data interpretation, thereby lessening the burden on specialists and improving the accuracy of results. This will make retinal screenings more accessible to urban and remote locations. That development is transforming clinical workflows and extending the reach of widefield imaging into preventive health.

Moreover, portable and non-mydriatic widefield imaging devices are broadening their utilization in settings beyond the traditional ophthalmology clinic. These systems enable screening in primary care, emergency departments, and community health programs, extending coverage to a larger proportion of the patient population for retinal imaging. These devices are also paving the way for reaching the non-specialized locus of diagnosis, allowing for early detection.

Also, improvements in imaging resolution and multimodal capabilities are enhancing the usefulness of widefield imaging for detecting complicated disease processes. This advancement also increases clinical confidence and expands the use of these systems for a range of ophthalmic and neurological diseases.

The widefield imaging systems market was redefined from 2020 to 2024, owing to changing healthcare preferences and technological developments. Analyses of the early quarter 2020 review period (Q1 2020) suggested that disruptions to routine eye-saving services negatively influenced imaging system adoption. As healthcare facilities adapted, investments in advanced diagnostic tools never really stopped; in fact, they continued to improve and tailor efficiency and patient care.

Growing awareness of retinal diseases and the role of early detection associated with this phenomenon induced a greater demand for innovative imaging systems. The introduction of imaging techniques like better ultra-widefield and enhanced images greatly contributed to market growth. Moreover, the implementation of screening programs and the increasing role of digital platforms in ophthalmic diagnosis began to offer promising new pathways for accessibility and efficiency.

This market is anticipated to grow from 2025 to 2035, witnessing transformational growth with innovation and a shift in healthcare models. Mobile and home-based screening solutions have the potential to revolutionize access to eye care for patients, especially in remote and underserved areas.

Widefield Imaging in Personalized Medicine for Retinal Diseases As personalized medicine becomes more prevalent, widefield imaging may prove pivotal in customizing treatment plans for retinal disease. As imaging becomes more integrated with broader healthcare ecosystems, including systemic disease monitoring, it will continue to take on an even more vital role in preventive medicine and create an even more proactive stance for vision care.

Market Outlook

Due to the increasing focus on advanced diagnostic technologies in ophthalmology, the US-widefield imaging systems market is progressing steadily. The adoption of robust healthcare infrastructure and medical devices powered by computers has also aided the growth of these imaging solutions.

More eye care providers have invested in such retinal imaging systems simply because they are covered by insurance plans and reimbursement policies for retinal imaging systems, and as such, they have become more widely available to patients. Moreover, the rising prevalence of age-related vision disorders, particularly in the increasingly aging population, is positively influencing the demand for comprehensive assessment of the retina.

Diverse institutions and academic centers are also contributing to the broader application of widefield imaging, especially given the forthcoming reports of studies in the real world, where widefield imaging has continued to prove useful with respect to imaging multifocal retinal pathology. In addition, the spread of imaging systems into applications outside of the academic ophthalmology clinic (e.g., optometry chains or integrated telemedicine platforms) has only recently.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

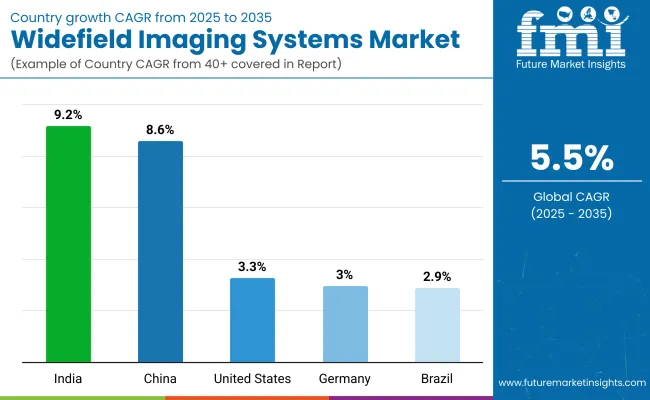

| United States | 3.3% |

Market Outlook

Germany Ophthalmic Imaging Market Insights Driven by the country's growing focus on precision medicine and high-performance health technology, Germany's ophthalmic imaging landscape is closely aligned. The presence of specialized eye care facilities, coupled with government backing for advanced diagnostic techniques, has catalyzed the adoption of wide-field imaging systems.

This strong regulatory apparatus assures the integration of only the most capable imaging solutions into clinical care, further enhancing trust in these technologies. Moreover, the partnership between research institutes and medical device manufacturers is leading to continuous improvement in imaging powers, further bolstering the industry's growth.

The increasing need for a disease to be diagnosed sooner than before, particularly conditions such as diabetic retinopathy, has driven healthcare providers towards implementing comprehensive imaging solutions. The delivery of clinical efficiency has also driven the increasing demand in light of Germany's focus on the usage of artificial intelligence in ophthalmic diagnostics, making automation more integrated into clinical workflows.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.0% |

Market Outlook

In India, the ophthalmic imaging market is growing owing to the rising prevalence of retinal disorders, coupled with the need for affordable ways to diagnose them. The increasing prevalence of diabetes-associated eye complications has led to the demand for better screening tools, specifically in a city hospital. In addition, government-supported initiatives regarding vision care and blindness prevention programs have also led to the increasing acceptance of these advanced imaging solutions.

With the help of inexpensive imaging gadgets manufactured by local producers, the systems have become easily accessible at even small hospitals and rural health facilities. In developed countries, imaging has a defined role in specialized diagnostics not found in India, where imaging is increasingly used for population screening programs for early detection of diseases.

Moreover, the growing proliferation of private eye hospitals and chain clinics across the country has led to constant demand for advanced imaging modalities, which will help improve the accuracy of diagnosing conditions and patient management.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.2% |

Market Outlook

Because of this fast-paced development of the healthcare infrastructure in China, we are experiencing the strong impact of widefield imaging systems. This growth can be attributed to the rising government investments in ophthalmic diseases and disorders with an emphasis on the geriatric population, which is more prone to sight-related issues.

The increasing rates of myopia, particularly in the young population, are a driving factor in the growth of demand for advanced imaging modalities to assess retinal health. Moreover, with local medical device manufacturers, imaging systems have become more affordable for small-and medium-sized healthcare providers.

Adoption has also been propelled through the integration of digital health initiatives-AI-assisted diagnostics and telehealth platforms-which enable eye care practices to consult dynamically and remotely using high-quality imaging data. Additionally, public awareness campaigns regarding eye health have compelled people to receive periodic preventive eye examinations, resulting in a continuous demand for advanced imaging techniques in hospitals and vision centers.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.6% |

Market Outlook

The widefield imaging systems industry in Brazil is anticipated to grow as the burden of vision-related diseases is increasing. The previous government of this country has also been pushing for the strengthening of public healthcare services and investment into advanced diagnostic tools, extending access to imaging technologies to hospitals and specialty clinics.

Furthermore, the rising prevalence of conditions such as glaucoma and diabetic retinopathy is driving demand for advanced imaging technologies that facilitate early detection and effective management of these diseases. Apart from this the, the expansion of private healthcare networks in Brazil has been instrumental in increasing access to high-quality ophthalmic diagnostics.

While the evolution of imaging technology and software, has been the major driver of imaging adoption in other parts of the world, in Brazil, the growing affordability of such systems and their increasing availability across both rural and urban health-care facilities have shaped much of industry growth. Widespread integration of retinal screening into annual health check-ups has only sustained the significance of widefield imaging in preventive eye care.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.9% |

The widefield imaging systems market is highly competitive and driven by the growing demand for early disease detection, increased retinal imaging technology, and the growing uptake of AI-based diagnostic solutions. Ultra-widefield imaging, non-mydriatic imaging solutions, and imaging with improved resolution is another area for firms to compete in market.

This creates a changing landscape that is shaped by have to have established companies in the ophthalmic device market, diagnostic imaging companies and up-and-coming health care organizations using AI to break into the field of widefield imaging solutions.

Carl Zeiss Meditec AG (16-17%)

Developing the market segments and intensively innovating their product portfolio. Strategic acquisitions are mainly in line to enhance existing segments of its portfolio and help drive growth across its segments in healthcare.

Topcon Corporation (13-14%)

GE HealthCare seeks to use innovation as a primary growth driver, investing in research and development to develop new medical technologies. We're Schreiner MediPharm | Focus on Digital Solutions & Efficiency schreiner-group.com

NIDEK Co., Ltd. (10-11%)

Its growth strategy focuses on reinforcing its leadership position in health technology through innovation and expanding its portfolio. The company also intends to enable growth through targeted investments along with optimizing its digital and connected care solutions.

Optos plc (7-8%)

A main focus of Baxter's growth plan is to accelerate growth across its portfolio, upping its presence throughout the healthcare spectrum. This company's key product pipeline is being developed to meet the healthcare needs of diverse global communities.

Other Key Players (49-50% Combined)

A number of other companies are major contributors to the widefield imaging systems market through innovative technologies and increased distribution networks. They include:

With the demand for widefield imaging systems procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Instrument and Software

Diabetic Retinopathy, Retinopathy of Prematurity, Pediatric Retinal Diseases, Retinal Vein Occlusion, Ocular Oncology, Uveitis, Chorioretinal Disease, Glaucoma and Others

Standalone and Portable

Specialty Clinics, Hospitals and Ambulatory Surgical Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for widefield imaging systems market was USD 744.2 million in 2025.

The widefield imaging systems market is expected to reach USD 1,271.3 million in 2035.

Increasing demand for advanced diagnostic imaging solutions, rising prevalence of retinal disorders has significantly increased the demand for widefield imaging systems.

The top key players that drives the development of widefield imaging systems market are Carl Zeiss Meditec AG, Topcon Corporation, NIDEK Co., Ltd., Optos plc and Heidelberg Engineering GmbH

Instruments is by component leading segment in widefield imaging systems market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Component, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Component, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Component, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Component, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Modality, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Component, 2023 to 2033

Figure 27: Global Market Attractiveness by Indication, 2023 to 2033

Figure 28: Global Market Attractiveness by Modality, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Component, 2023 to 2033

Figure 57: North America Market Attractiveness by Indication, 2023 to 2033

Figure 58: North America Market Attractiveness by Modality, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Modality, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Indication, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Modality, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Indication, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Modality, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Modality, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Modality, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Modality, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Modality, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Indication, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Modality, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Indication, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Modality, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Imaging Software Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Imaging Devices Market Size and Share Forecast Outlook 2025 to 2035

Global Nuclear Imaging Equipment Market Insights – Trends & Forecast 2024-2034

Medical Imaging Agent-Producing System Market

Urology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

In Vivo Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA