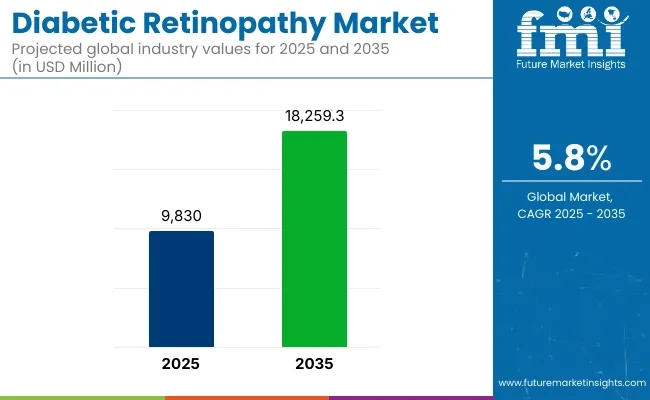

The global Diabetic Retinopathy Market is estimated to be valued at USD 9,830 million in 2025 and is projected to reach USD 18,259.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The diabetic retinopathy market is experiencing strong growth as global diabetes prevalence continues to rise, driving increased risk for microvascular retinal complications. Early detection and timely intervention remain critical for preventing vision loss, propelling demand for advanced diagnostics, pharmacologic therapies, and interventional procedures.

Anti-VEGF agents remain the mainstay of treatment for diabetic macular edema and proliferative diabetic retinopathy, while longer-acting formulations, sustained-release implants, and novel biologics are expanding therapeutic options. As regulatory agencies accelerate approvals for longer-acting agents and combination therapies, diabetic retinopathy management is moving towards fewer injections, enhanced patient compliance, and earlier disease interception. The market outlook remains highly favorable, supported by demographic trends, technological innovation, and multidisciplinary diabetic care integration.

Leading manufacturers such as Roche, Regeneron, Bayer, Novartis, Genentech, and Kodiak Sciences are actively expanding diabetic retinopathy pipelines through next-generation anti-VEGF agents, combination biologics, and extended-duration delivery platforms.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 9,830 million |

| Market Value (2035F) | USD 18,259.3 million |

| CAGR (2025 to 2035) | 5.8% |

Increasing emphasis is being placed on therapies that reduce injection frequency while maintaining durable efficacy to improve patient adherence. In 2024, Roche received Susvimo® (ranibizumab injection) for treatment of diabetic retinopathy.

“The approval of Susvimo for diabetic retinopathy expands treatment options for patients, offering predictable and immediate durability after implantation with only one treatment every nine months,” said Levi Garraway, MD, PhD, Chief Medical Officer and Head of Global Product Development. Manufacturers continue to focus on durability, real-world efficacy, and early-stage disease modification to expand their competitive positioning.

North America dominates the diabetic retinopathy market, supported by high diabetes prevalence, extensive screening infrastructure, and strong regulatory support for novel therapies. The USA market is witnessing robust adoption of long-acting anti-VEGF agents and implantable drug delivery platforms to reduce treatment burdens.

Collaboration between endocrinology, primary care, and retinal specialists is improving adherence to diabetic eye care protocols. Europe’s diabetic retinopathy market is expanding rapidly, driven by national diabetes prevention strategies, payer-funded retinal screening programs, and coordinated multidisciplinary care pathways. The UK., Germany, and Scandinavia have implemented population-level diabetic eye screening programs utilizing tele ophthalmology, driving early diagnosis rates.

European diabetic care networks increasingly integrate retinal screening into routine diabetes clinics, allowing timely referrals to specialist care. Cost pressures within national healthcare systems are driving interest in durability-focused therapies positioning Europe for strong procedural and pharmacologic growth in diabetic retinopathy care.

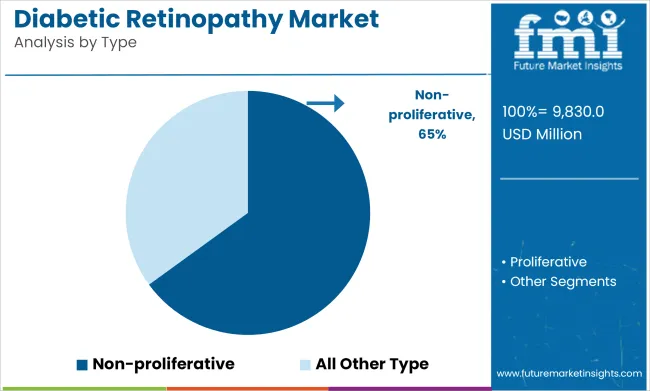

In 2025, non-proliferative diabetic retinopathy (NPDR) is expected to hold 65.0% of the revenue share in the overall diabetic retinopathy market. This dominance is attributed to the higher prevalence of NPDR in diabetic patients, particularly in the early stages of the disease. NPDR is characterized by damage to the retinal blood vessels without the formation of new, abnormal blood vessels, making it a more common form of diabetic retinopathy.

The growth of this segment is driven by the increasing number of diabetic patients globally, as well as advancements in screening techniques that facilitate early diagnosis of NPDR. As this condition progresses, patients are more likely to seek treatment, contributing to the expansion of the NPDR segment.

The availability of effective monitoring and diagnostic tools, such as optical coherence tomography (OCT) and fundus photography, has improved early detection rates, supporting the growth of NPDR management. With the rise in diabetes prevalence and better awareness, the NPDR segment is expected to continue dominating the market.

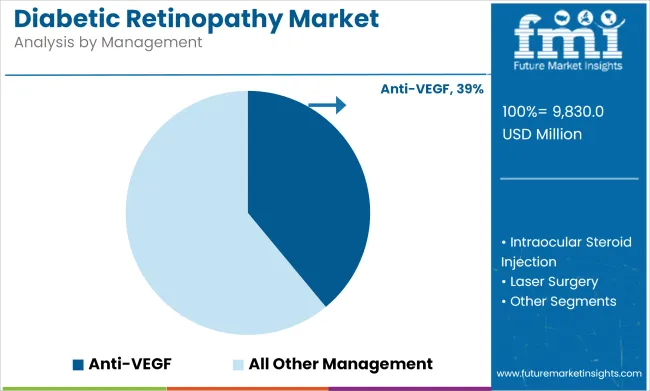

In 2025, anti-VEGF (vascular endothelial growth factor) drugs are projected to capture 39.0% of the revenue share in the diabetic retinopathy management market. This leadership is attributed to the proven efficacy of anti-VEGF treatments in managing diabetic macular edema (DME) and other advanced stages of diabetic retinopathy. These drugs work by inhibiting the growth of abnormal blood vessels and reducing fluid leakage in the retina, thereby preventing further damage and vision loss.

The growth of this segment has been driven by the increasing number of patients requiring intervention for diabetic retinopathy, along with the growing adoption of anti-VEGF therapy due to its ability to slow the progression of the disease. Additionally, the approval of newer anti-VEGF drugs with improved safety profiles has expanded treatment options, further fueling segment growth. The ongoing development of combination therapies and the shift towards personalized medicine are expected to sustain the dominance of anti-VEGF drugs in the management of diabetic retinopathy.

Challenges: High Cost of Advanced Treatment and Limited Accessibility

A major restraint in the diabetic retinopathy market is the high treatment cost of anti-VEGF therapy, laser photocoagulation, and vitreoretinal surgery. Access to these treatments remains a challenge to many patients, particularly in low-middle income (LMI) and developing countries, both of which are hindered by economic and healthcare resource limitations.

Furthermore, lack of awareness and insufficient screening programs often prevent early diagnosis and require continuous monitoring of these high-risk patients. It contributes to the necessity for government and private sector partnerships aimed at making healthcare affordable, increasing early detection initiatives, and improving access to affordability treatment options.

Opportunities: Advancements in AI-driven Diagnosis and Personalized Medicine

In the modern age, technological innovations specifically in AI are propelling the realm of diabetic retinopathy detection and management. Automated retinal imaging analysis with AI-based screening tools can provide early diagnosis, enhancing detection rates and decreasing the workload for ophthalmologists.

Moreover, personalized medicine characterized by targeted therapies and gene-based treatments is providing new avenues for effective and individualized treatment approaches. Market leaders will emerge from companies paying attention to AI-fueled diagnostic solutions and precision medicine.

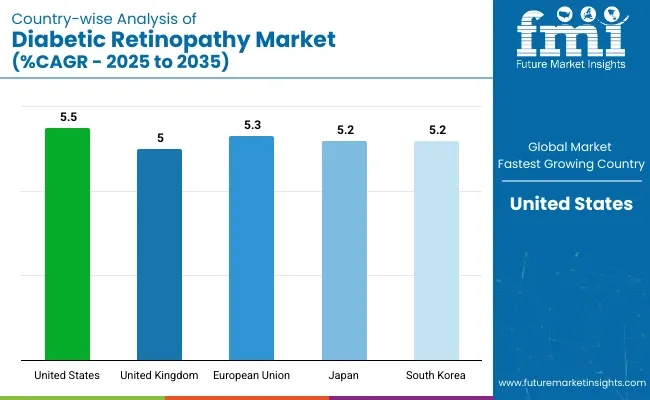

The United States diabetic retinopathy market is expected to grow at a significant rate during the forecast period due to high prevalence of diabetes and rising geriatric population. With millions of Americans suffering from diabetes and increasing demand for treatment options including anti-VEGF therapies, laser, and corticosteroids, the diabetes market is growing.

The increasing government-led diabetic eye care initiatives and expansion in ophthalmology-based research funding are some factors further contributing to the market growth. Moreover, technical innovation in the diagnostic tools such as Artificial Intelligence retinal screening and optical coherence tomography (OCT) is expected to a boost early detection rates, resulting better treatment efficacy and thus upping market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

The diabetic retinopathy market is steadily rising in the UK owing to a rising population of diabetes along with a rise in awareness regarding early screening programs. The National Health Service (NHS) plays an important part in providing free eye screening (for diabetic retinopathy) for patients with diabetes to detect potentially sight-threatening eye conditions and treat them in good time.

The growth of the market is also influenced by advances in retinal imaging technologies, and the growing demand for the use of intravitreal injections. In addition, governmental measures to leverage AI solutions for diagnostic capabilities in clinical settings and boost patient outcomes are expected to drive the demand for new treatment methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

Diabetic retinopathy is on the rise in countries like Germany, France, and Italy in the European Union, given better lifestyles and the enormous diabetic population. State-funded healthcare programs and nationwide diabetic screening initiatives have also helped in early diagnosis and management of the disease.

Firms are also focusing on new disease-modifying potential therapy agents, like sustained-release implants and gene therapy that will overhaul the market scenario. The growth and introduction of telemedicine and AI-driven analysis are also accelerating market growth by providing access to specialized ophthalmology care.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

The Japanese DR market is expanding at a rapid pace, which is primarily due to rapidly growing old population with diabetes comorbidity. The government scheme with national health policies for regional diabetic screenings and stepwise strategies to manage early-stage patients who would ultimately end up with visual impairment.

Advanced diagnostic techniques like ultra-wide field retinal imaging and AI-assisted detection are catching hold in the country. Also, the Japanese pharmaceutical companies are leading in the development of next-generation ophthalmic drugs and minimally invasive treatment options, which is expected to drive the market during the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

On the other hand, South Korea is anticipated to show good growth in the diabetic retinopathy market owing to the high prevalence of diabetes and rising investments in the healthcare infrastructure. The country’s health care system encourages early detection with routine eye screenings and AI-backed diagnostics.

In addition, South Korea is an emerging center for clinical research in ophthalmology, driving the quick adoption of new treatment solutions like stem cell therapy & advanced laser treatment. Government proactive initiatives to spread awareness and treat diabetes positively supports the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The diabetic retinopathy market is growing rapidly, driven by rising incidence of diabetes, technological advances in diagnostic imaging, and increasing awareness of early detection of disease. The governments are also taking initiatives for healthcare and the increasing geriatric population and the high growth of healthcare infrastructure in developing countries are also driving the market.

Due to growing demand for effective management for diabetic retinopathy, leading participants are focusing on the development of alternative treatments for the management of diabetic retinopathy, which includes anti-VEGF drugs, corticosteroids, and laser therapy. Additionally, the AI-loaded diagnostic and telemedicine solutions are showing the way for better detection and approachability towards timely treatment.

Roche (20-24%)

With its first-in-class anti-VEGF drug, Lucentis, Roche holds a leading position in the Diabetic Retinopathy Market, where high efficacy preventing disease progression has been shown. Additionally, its focus on personalized medicine and AI-driven diagnostic solutions creates a compelling value proposition.

Novartis (16-20%)

Beovu, a novel anti-VEGF therapy that offers longer treatment intervals with improved patient compliance, is a stronghold company contender.

Bayer AG (12-16%)

Bayer's Eylea is now a standard therapy for diabetic retinopathy, supported by strong clinical efficacy and widespread use worldwide.

Regeneron Pharmaceuticals (10-14%)

Regeneron is also expanding its monoclonal antibody-based drug pipeline with a focus on ophthalmology to expand diabetic retinopathy therapy.

Alimera Sciences (6-10%)

The long-term corticosteroid therapy by Alimera Sciences with a sustained drug-release system, Iluvien, decreases the need for frequent injections.

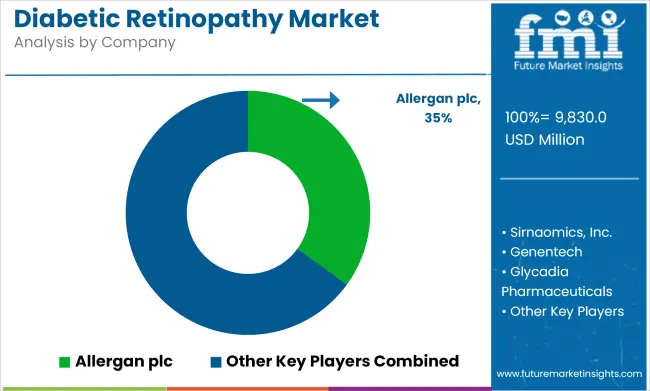

Significant Other (25-35% Combined)

Many small and emerging players and biotech and pharmaceutical companies on the market include those who are working on gene therapy, regenerative medicine and the AI-based diagnostic company. Here are a few prominent players:

The overall market size for the diabetic retinopathy market was USD 9,830 million in 2025.

The diabetic retinopathy market is expected to reach USD 18,259.3 million in 2035.

The diabetic retinopathy market is expected to grow at a CAGR of 5.8% during the forecast period.

The demand for the diabetic retinopathy market will be driven by the increasing prevalence of diabetes, advancements in diagnostic technologies, rising awareness about early detection and treatment, improved healthcare infrastructure, and the growing adoption of innovative therapies.

The top five countries driving the development of the diabetic retinopathy market are the USA, China, India, Germany, and Japan.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diabetic Retinopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Macular Edema Market Forecast and Outlook 2025 to 2035

Diabetic Nephropathy Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Ketoacidosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Diabetic Food Market Report – Trends & Innovations 2025-2035

Diabetic Assays Market

Diabetic Pen Cap Market

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Necrobiosis Lipoidica Diabeticorum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA