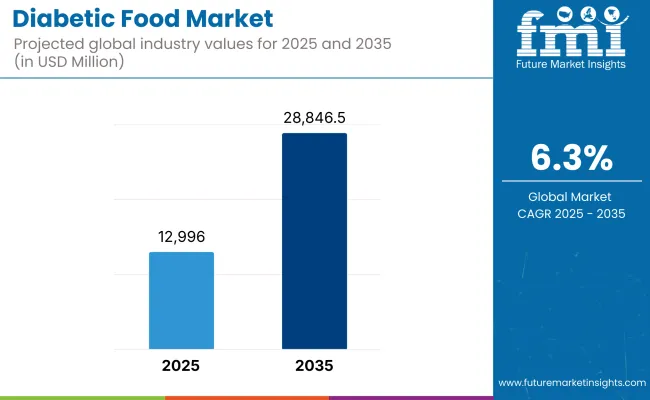

From 2025 to 2035, the Diabetic Food Market is projected to reach a value of USD 28,846.5 Million by 2035, reflecting a compound annual growth rate (CAGR) of 8.3% over the assessment period.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 12,996 Million |

| Projected Industry Value (2035F) | USD 28,846.5 Million |

| Value-based CAGR (2025 to 2035) | 6.3% |

The marketplace for diabetic food has expanded rapidly during recent years because diabetes cases keep increasing worldwide. Research indicates that the increasing number of diabetes diagnoses drives greater market demand for nutrition-specific food products. The manufacturing industry produces specialized diabetic foods that combine nutritious features, such as minimal sugar content, while maintaining low-fat and low-calorie attributes.

The diabetic food market encompasses a wide range of products, including snacks and beverages, dairy products, bakery items, and many other food items. The strategy to distribute diabetic products encompasses retail outlets, internet platforms, and medical facilities, which enhances consumer accessibility.

Market expansion in diabetic foods has been significantly driven by increasing consumer awareness about managing diabetes through proper nutrition. People are becoming increasingly focused on wellness, so they buy products that promote their physical health. Health-conscious consumers have adopted natural and organic diabetic food options as the rising awareness of diabetes management has become a key market trend.

The market appeal of diabetic foods is driven by two factors: personalized nutrition plans and smart health devices developed through technological progress. The market is experiencing growth in size because governments are supporting healthy eating habits while introducing new, innovative products to the market.

The diabetic food industry features intense competition because various companies attempt to enlarge their market footprint. The leading companies in this space focus their efforts on product development and network expansion to meet market expansion needs. The market focuses on sustainable production alongside ethical business practices and currently adopts organic and natural product development.

Due to high diabetes cases and robust medical facilities, North America leads the diabetic food market. Strong market growth has become observable across the Asia-Pacific and Europe, as societies in both regions have demonstrated increased health awareness, along with supportive governmental policy environments. The diabetic food market will continue to show promise through ongoing innovative approaches that aim to fulfill the wide needs of diabetic consumers.

Rising awareness about the importance of managing diabetes through diet

A higher public understanding of diabetic diet management has strengthened the diabetic food market. The ongoing global increase in diabetes patients leads more people to understand diet as an essential way to handle this persistent health condition. Rising diabetic food requirements emerge as people become aware of the value of specialized foods that effectively control their blood glucose levels.

People are more aware of diabetes because medical providers and mass media, along with digital platforms, transmit increasing amounts of diabetes-related content. The promotional messages have reached diabetes management seekers, thereby creating an educated consumer population that prioritizes its health.

The diabetic food market is demonstrating expanding innovation and the development of new products due to these market trends. The manufacturing industry has developed multiple food products which satisfy the dietary requirements of diabetic patients through the release of low-sugar snacks and fortified foods along with meal replacement choices. Manufacturers create nutritional products that contain essential nutrients and help regulate blood sugar levels to edible amounts. The new market options help diabetics adhere to their dietary requirements, as they offer both satisfaction and ease of use.

Introduction of innovative diabetic-friendly snacks and beverages

New food and drink products designed for diabetics are transforming the present diabetic food market. The rise of diabetes across the globe creates increasing consumer demand for eating options that are both palatable and portable and which support health-conscious living for people with diabetes. This market shift enables developers to create superior diabetic management products that satisfy both taste preferences and ease of use for patients with diabetes.

The production of food items with low-glycemic index (GI) characteristics is a leading market trend. The products have been engineered to produce minimal changes in blood sugar levels, making them suitable for diabetic users. People with diabetes can benefit from consuming whole grains, nut-based seeds, and legumes because these foods offer a gradual release of energy that does not cause blood glucose peaks.

People are increasingly choosing sugar-free and low-sugar beverages over flavored water and teas, and sometimes even sodas, due to their growing popularity. Natural sugar substitutes found in drinks typically use a combination of stevia and monk fruit to provide a low-sugar content that helps spare blood glucose levels.

Medical research has enabled significant discoveries about incorporating health-promoting functional substances into food products. The incorporation of fiber-probiotic-antioxidant fortified snacks and beverages into the market serves two beneficial functions: blood sugar control and general wellness enhancement. Companies are working on producing diabetic-friendly snacks usingplant-based proteiningredients, such as pea protein or soy protein, for their nutritional benefits and high satisfaction levels.

Increasing popularity of natural and organic diabetic foods

The diabetic food market experiences transformation as more customers buy natural and organic diabetic foods. More diabetic patients learn about natural and organic food advantages, thus they actively search for dietary products that support their health goals and wellness requirements.

Natural and organic diabetic foods continue to evolve because consumers view these products as healthier in addition to being safer. Natural and organic foods retain their original state because they do not contain artificial additives, preservatives, or genetically modified organisms (GMOs), which meet the needs of consumers who value their health. Consuming foods containing fewer chemicals, along with more wholesome ingredients, helps people with diabetes manage their blood sugar levels while promoting better overall health.

The diabetic food market for natural and organic items now presents consumers with diverse alternatives that span between snacks and beverages, as well as meal substitutes and kitchen necessities. Businesses now offer products containing natural sweeteners, including stevia and monk fruit, along with agave, that produce a lower glycemic response than regular sugar. Today, customers with diabetes have increasing access to organic whole grains, alongside nuts and seeds, as well as fresh produce, offering them nutritional and appealing options.

Collaboration between food manufacturers and healthcare providers.

Joint efforts between food manufacturers and healthcare providers serve as the essential driver for innovation, promoting the market expansion of diabetic food products. The growing number of diabetic patients worldwide underscores the need to develop effective dietary solutions promptly. The joint efforts of the food production sector with healthcare providers enable them to produce beneficial, appetizing, and convenient diabetic food products for diabetes management.

Organizations that combine expertise from healthcare providers receive significant advantages because they leverage medical knowledge about the dietary requirements of diabetic patients. Several healthcare authorities, represented by dietitians, endocrinologists, and diabetes educators, provide essential details about diabetic diet requirements along with medical limitations. Food manufacturers benefit from these medical guidelines, which enable them to develop products compatible with diabetes treatment protocols.

The understanding of product development, combined with knowledge of food science and expertise in consumer preferences, belongs to food manufacturers. Food manufacturers collaborate with healthcare providers to develop nutritious foods for diabetics that are both tasty and have proper textural characteristics. Through joint collaboration, manufacturers can produce inventive diabetic-specific food products, including low-GI snacks, fortified food items, and sugar-free beverages.

During the period from 2020 to 2024, sales grew at a compound annual growth rate (CAGR) of 8.0%, and it is predicted to continue growing at a CAGR of 8.3% during the forecast period from 2025 to 2035.

Throughout history, the diabetic food market has demonstrated progressive expansion. The market initially offered limited options, primarily consisting of sugar-free and low-calorie products, in its specialized segment. The global increase in diabetic cases drove up demand for diverse options of diabetic-friendly food products. The new product innovations expanded from snacks to beverages and dairy and bakery products which were designed to control blood sugar levels.

The market adopted organic and natural alternatives as customers became increasingly aware of their health due to the rise of the health-conscious consumer segment. Government initiatives, coupled with technological advancements, created better access to diabetic-friendly foods, making the products more attractive to the general market.

The diabetic food market is expected to expand substantially in the coming years. The diabetic food market currently has a value of USD 14 billion and is projected to reach USD 28,846.5 million by 2035, growing at a 6.1% compound annual growth rate (CAGR). This market growth is expected to accelerate significantly due to the rising number of diabetes cases, along with patient health concerns and consumer demand for healthy food alternatives.

The diabetic food market is expected to experience growth through the integration of artificial intelligence-based nutrition personalization, combined with enhanced customer relationships facilitated by technological advancements. The accessibility of diabetic-friendly products grows after new introductions joined with expanded internet distribution channels for consumers.

The market will demonstrate a rising commitment to both ethical and sustainable production operations, while prioritizing the development of organic and natural products. The diabetic food market exhibits positive prospects, as manufacturers continue to develop innovative products to meet the changing nutritional needs of diabetic consumers.

Tier 1: Territorial dominance in the diabetic food market is held by these industrial powerhouses, which maintain a major market standing and offer diverse product lines. This segment includes major diabetic food market leaders such as Unilever, Nestlé, PepsiCo, The Coca-Cola Company, Kellogg Co., and Mars Incorporated. The companies have worldwide operations combined with significant capital supply alongside recognized brand identities. The market leaders invest their resources in R&D, alongside marketing operations and distribution systems, to achieve market domination and leadership across industry norms.

Tier 2: These companies, although smaller than the big players, still maintain a solid foothold in the diabetic food market and play a key role. The business sector contains two specific examples of Tier 2 companies: FIFTY/50 Management Group and Chapman's. These businesses target specific product groups while enabling service in targeted geographical areas or market segments. The lower resource availability of these brands does not prevent them from being competitive and from devising innovative approaches to differentiate themselves from top brands.

Tier 3: These businesses represent the smallest organizations, characterized by limited market positions in specific niche sectors. Tier 3 companies operate without reaching the market scale or financial influence of their Tier 1 and Tier 2 competitors. The market includes smaller organizations that support localized or emerging enterprises that cater to specialized customer needs. The market for artisanal or specialty diabetic foods features multiple companies that deliver their products through local distribution channels.

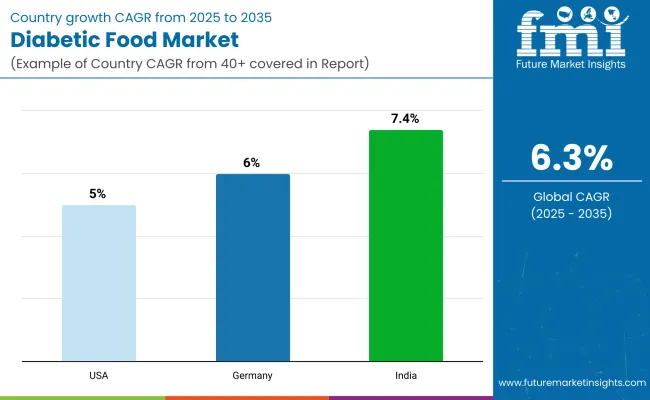

The following table shows the estimated growth rates of sales for the three significant geographies. The USA and Germany are expected to exhibit high consumption, with CAGRs of 5.0% and 6.0%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.0% |

| Germany | 6.0% |

| India | 7.4% |

GPS integration with sensors helps farmers reach their maximum farming potential and protect their crops from hazardous substances. Healthy ingredients become available starting at the initial production phase. The quality control offered by robotic automation in food processing, combined with manufacturing consistency, opens up new possibilities for manufacturers to expand their diabetic-friendly food product range across larger production scales.

Data analytics systems enable manufacturers to understand consumer preferences, allowing them to create products tailored to the dietary needs of individuals with diabetes. These technological advances have led to the development of multiple options for low-glycemic snacks, sugar-free drinks, and fortified meals, thereby enabling individuals with diabetes to manage their condition without sacrificing dietary variety. These technological breakthroughs provide expanded dietary choices for diabetes patients, resulting in a better quality of life and increased satisfaction.

Low-sugar and high-fiber foods in Germany are driving significant changes in the diabetic food market. Health-conscious individuals and diabetes patients seek products that support blood sugar regulation, together with general health improvement, because they understand the crucial role of diet in managing diabetes. The intake of low-sugar products helps maintain blood glucose levels, while high-fiber foods support digestive functions and sustain energy.

The shift in customer preferences toward diabetic-friendly products has triggered explosive growth in nutritious breads, cereals, snacks, as well as zero-sugar beverages and desserts. Manufacturers within the food industry are developing new products to meet the needs of diabetic consumers, driven by growing market demand. Such convenience enables diabetic patients to manage their health condition while consuming a wide range of nutritious foods that meet their dietary needs. The diabetic food market in Germany is expected to continue expanding, as this trend shows no signs of slowing down.

Online shopping for diabetic foods across India has led to significant shifts in the market. Indian people continue to search for convenient dietary solutions as diabetes rates increase throughout the nation. Electronic shopping platforms and online grocery stores now present diabetic-friendly goods to their customers, including low-sugar snacks and high-fiber cereals, alongside sugar-free beverages as well as nutrient-rich meals.

Customers experience simplicity and minimize stress during shopping through the online platform because they can browse and purchase products directly from their residential space. Thankfully these platforms present more product options which exceed what local shops feature thus facilitating better health choices for consumers. The convenience of home delivery proves advantageous because it helps people, especially those with limited mobility or those living in remote locations.

The improved state of India's digital infrastructure will result in more accessible diabetic food online shopping, which will help all patients handle their diabetes condition better.

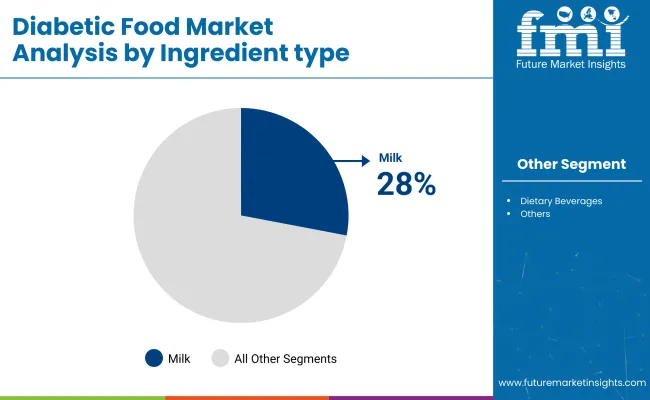

| Segment | Value Share (2025) |

|---|---|

| Milk (Ingredient type) | 28% |

The diabetic food market shows significant improvements regarding dietary drinks acceptance. People with rising global diabetes numbers seek beverages which satisfy their health requirements while also being palatable. Companies produce such drinks using natural sweeteners and incorporating vitamins and minerals to provide consumers with healthier dietary options, rather than traditional sweets.

People are changing their health-related perspectives, as evidenced by the increasing demand for drinks with low or no sugar. The dietary market is witnessing diabetic-friendly beverages assuming a critical role, as people are placing greater emphasis on managing their blood sugar levels. More people than ever before show an active interest that stimulates both innovation and provides numerous health-conscious choices.

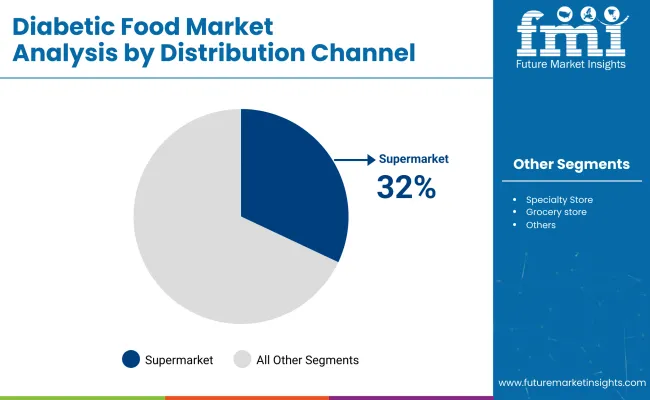

| Segment | Value Share (2025) |

|---|---|

| Supermarkets (distribution Channel) | 32% |

The global diabetic food market has been significantly enhanced by supermarkets, which offer an extensive product variety through user-friendly shopping experiences. The wide consumer base of supermarkets enables them to attract food shoppers who require specific nutritional options to meet their dietary needs. As supermarkets stock a combination of low-sugar snacks and sugar-free beverages, their retail selection helps people find suitable diabetic foods.

People with diabetes greatly benefit from competitive store operations that offer attractive prices and promotions on diabetic supplies. The stores actively contribute to health education through promotional activities and awareness campaigns, enabling better market acceptance of diabetic-safe foods. The leadership position of supermarkets ensures that diabetic patients have multiple different options of safe, nutritious food for their dietary needs.

Large multinational corporations, including Unilever, Nestlé, PepsiCo, The Coca-Cola Company, Kellogg Co, Mars Incorporated, and FIFTY/50 Management Group, together with Chapman's, dominate the competitive diabetic food market. New diabetes-friendly items are emerging from these companies to meet the growing market demand for such products.

The strong research resources at Unilever and Nestlé enable them to introduce new low-sugar and sugar-free product lines through their development teams. PepsiCo and The Coca-Cola Company continue to expand their product catalog with healthier beverage selections. The food companies Kellogg Co and Mars Incorporated develop sweet and tasty snacks and desserts that are suitable for diabetic customers.

The combination of FIFTY/50 Management Group and Chapman's provides a specific market segment with their diabetic-focused products. The multiple companies competing in this industry strive to expand their market share by releasing diversified, health-oriented products to cater to health-conscious buyers.

Based on product type, the sector is divided into dietary beverages, dairy products, baked products, ice cream and jellies, and confectionery, among others.

Various distribution channels for diabetic food include supermarkets and hypermarkets, specialty stores, grocery stores, online stores, and others.

The market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is projected to grow at a CAGR of 8.3% during the forecast period.

By 2035, the market is estimated to reach USD 28846.5 million in sales value.

North America is expected to dominate global consumption.

Major manufacturers include Unilever, Nestlé, PepsiCo, and The Coca-Cola Company.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diabetic Macular Edema Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Nephropathy Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Retinopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Ketoacidosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Diabetic Retinopathy Market Analysis - Size, Share & Forecast 2025 to 2035

Diabetic Assays Market

Diabetic Pen Cap Market

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Necrobiosis Lipoidica Diabeticorum Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA