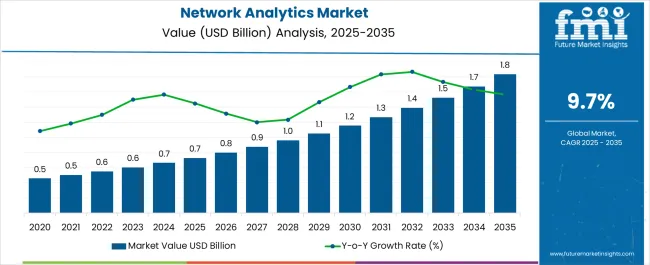

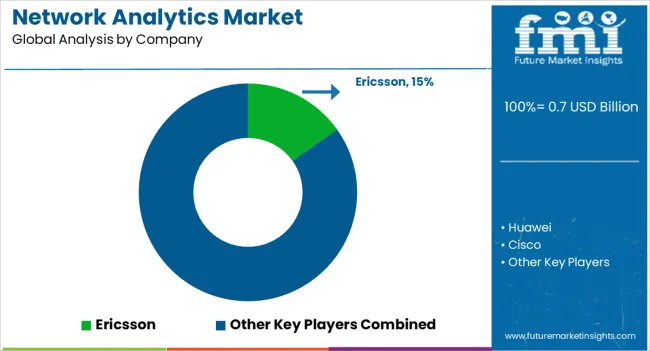

The Network Analytics Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Network Analytics Market Estimated Value in (2025 E) | USD 0.7 billion |

| Network Analytics Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The network analytics market is progressing rapidly, supported by the rising complexity of modern communication networks and the increasing demand for real-time insights into network performance. Telecommunications operators, enterprises, and service providers are adopting advanced analytics tools to optimize network operations, manage growing data traffic, and enhance customer experience. Industry reports and corporate press releases have emphasized the importance of artificial intelligence and machine learning integration, enabling predictive analysis for fault detection and proactive network optimization.

The acceleration of 5G rollouts, expansion of IoT ecosystems, and digital transformation initiatives across industries have further expanded the market’s scope. Additionally, cloud adoption and hybrid IT infrastructure have amplified the need for scalable and flexible analytics platforms.

Investments in cybersecurity, coupled with the necessity for regulatory compliance and service quality assurance, have also been driving adoption. Looking forward, the market is expected to benefit from continued innovation in network automation, integration with edge computing, and increasing collaboration between technology vendors and telecom operators to deliver high-performance, analytics-driven solutions.

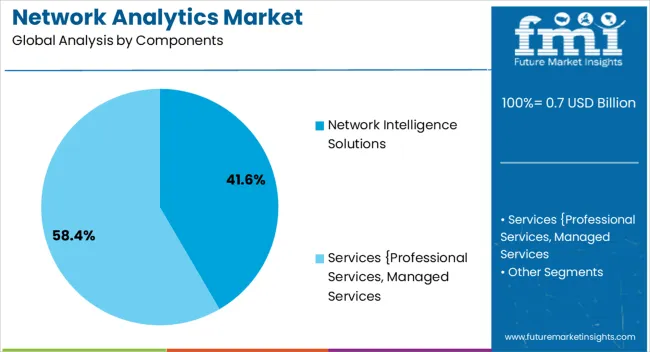

The Network Intelligence Solutions segment is projected to hold 41.6% of the network analytics market revenue in 2025, positioning it as the leading component. Growth of this segment has been driven by the critical role of intelligence platforms in delivering actionable insights for network optimization and security. Service providers have increasingly deployed intelligence solutions to analyze massive volumes of network traffic data, ensuring efficient bandwidth utilization and improved service delivery.

Industry disclosures have highlighted that these solutions support anomaly detection, fraud prevention, and predictive maintenance, reducing operational risks and costs. Furthermore, the integration of advanced analytics with AI-powered engines has enabled real-time decision-making, significantly enhancing customer satisfaction.

With rising demand for intelligent, automated network management systems across industries, the Network Intelligence Solutions segment is expected to remain at the forefront of component adoption.

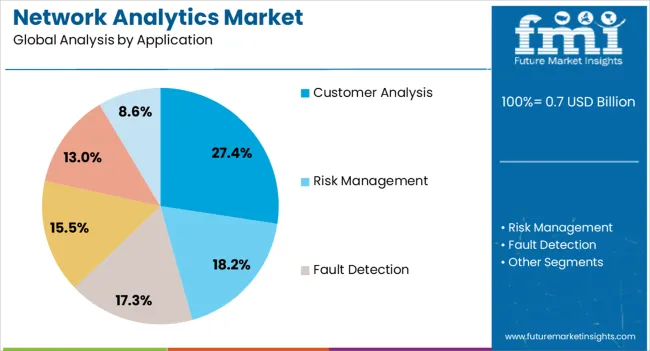

The Customer Analysis segment is projected to account for 27.4% of the network analytics market revenue in 2025, leading application adoption. Its growth has been supported by the rising importance of customer-centric strategies in telecommunications and enterprise network services. Providers have increasingly relied on customer analytics to track user behavior, monitor service quality, and personalize offerings, thereby reducing churn and improving customer loyalty.

Press releases and telecom operator reports have emphasized that customer analysis enables predictive modeling of demand, targeted marketing, and proactive service adjustments. Additionally, the increasing competition in the telecom and broadband sectors has underscored the value of understanding customer experience in real time.

With customer satisfaction and retention being central to revenue growth, the Customer Analysis segment is expected to maintain its leading role in shaping network analytics applications.

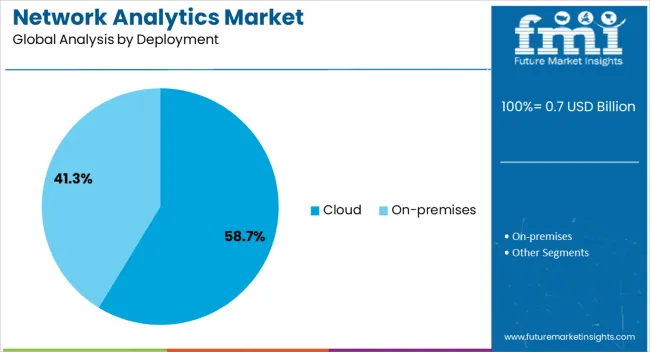

The Cloud segment is projected to contribute 58.7% of the network analytics market revenue in 2025, emerging as the dominant deployment model. Growth in this segment has been driven by the scalability, flexibility, and cost-efficiency of cloud-based analytics platforms. Organizations have increasingly adopted cloud deployment to handle the exponential rise in network data volumes while ensuring faster processing and accessibility across geographies.

Industry announcements and investor updates have highlighted the strategic partnerships between telecom operators and cloud service providers, enabling seamless integration of analytics solutions. Furthermore, cloud deployment has facilitated real-time monitoring, remote management, and agile scaling of network operations, particularly in multi-tenant and distributed environments.

The shift toward digital transformation and hybrid network models has further reinforced reliance on cloud platforms. With the rapid expansion of 5G and IoT networks, the Cloud segment is expected to remain the preferred deployment mode, delivering efficiency and resilience to network operators worldwide.

The network analytics market is likely to boost by the end-use industries and key manufacturing industries; these are playing a dynamic role in the enlarging of the network analytics market size during the forecast period.

The industries are contributing various tactics and methods to grow the network analytics market share as per the market report.

Some of the end-user that is likely to acquire the lion’s share in the adoption of network analytics are telecom providers, cloud service providers, cable network providers, management service providers, satellite communication providers, internet service providers & others.

Moreover, high-tech applications are likely to contribute the most to the market during the forecast period from 2025 to 2035.

Based on the deployment type, the on-premises segment will likely dominate the market with a CAGR of 19.2% in the forecast period from 2025 to 2035.

On-premises provides a one-time free license and also provides free up-grade on annual service. Therefore, organizations can afford it as compared to the cloud, which increases the demand for network analytics applications all around the globe.

Most large enterprises are adopting the on-premises, whereas SMEs face a dilemma in choosing between them.

The on-premises are required by the IT staff for the maintenance and networking infrastructure of the company, which increases the adoption of network analytics.

However, the on-premises deployment is likely to be affected by the cloud deployment as per the market report in the coming year due to the fastest-growing cloud solutions all around the globe.

Based on components, the network intelligence solution is likely to lead the market with the adoption of a maximum CAGR of 19.4% during the forecast period from 2025 to 2035.

It is acquired by SMEs & large enterprises to examine and communicate the network, identify the protocol, and extract content that is likely to increase the demand for network analytics applications worldwide.

The network intelligence solution prevents unnecessary delays and other network slowdowns, which rise in the sales of network intelligence solutions during the forecast period.

It is owned by end-user, some of which are government, telecommunication, and data networks in a huge quantity which enlarges the network analytics market size.

| Region | United States Market Size |

|---|---|

| Historic CAGR (2020 to 2024) | 20.2% |

| CAGR (2025 to 2035) | 19.1% |

| Region | United Kingdom Market Size |

|---|---|

| Historic CAGR (2020 to 2024) | 19.6% |

| CAGR (2025 to 2035) | 17.9% |

| Region | China Market Size |

|---|---|

| Historic CAGR (2020 to 2024) | 20.0% |

| CAGR (2025 to 2035) | 18.6% |

| Region | Japan Market Size |

|---|---|

| Historic CAGR (2020 to 2024) | 18.9% |

| CAGR (2025 to 2035) | 17.5% |

| Region | South Korea Market Size |

|---|---|

| Historic CAGR (2020 to 2024) | 18.6% |

| CAGR (2025 to 2035) | 17.0% |

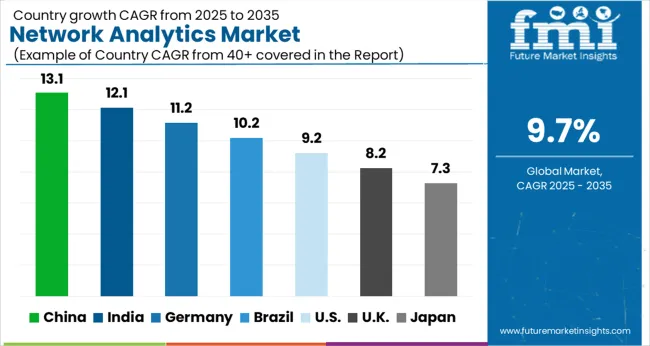

The market segment is anticipated to divide into regions including North America, Europe, Asia-Pacific, Africa, Middle East, and Latin America. Among all the regions, the North American region is anticipated to dominate the network analytics market share in the forecast period from 2025 to 2035.

The US is the leading maximum network analytics application growth with a CAGR of 19.1% during the forecast period from 2025 to 2035. The number of network analytics data misuse frauds is rising in the United States, to avoid such frauds & secure the data are likely to increase the market trends.

The China region is estimated to increase its market size in the coming forecast period which stood in the second position in the market growth. China's market is acquiring a high estimated CAGR of 18.6% during the forecast period from 2025 to 2035.

Due to increasing network analytics and growing high-tech & digital process in companies all around the globe are rise the adoption of network analytics in the coming forecast period.

Another region United Kingdom also in a queue to acquire a CAGR of 17.9% after China during the forecast period due to uncovering hidden data and helping to monitor the networks without any misleading.

Other regions like Japan, and South Korea are likely to rise in the network analytics market key trends and opportunities. All these regions are improving & enlarging the market worldwide during the forecast period from 2025 to 2035.

Several key competitor industries are pointing the centre of attention towards market growth to acquire revenue and improve the market. The manufacturing & several end-use companies are anticipated to rise in the network analytics market trends.

Some of the end-user companies are Ericsson, Huawei, Cisco, Nokia, and Netscout, & others are playing a key role as per the market survey.

These companies are estimated to boost the network analytics future trends during the forecast period from 2025 to 2035.

Recent Developments in the Network Analytics Market

The global network analytics market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the network analytics market is projected to reach USD 1.8 billion by 2035.

The network analytics market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in network analytics market are network intelligence solutions and services {professional services, managed services.

In terms of application, customer analysis segment to command 27.4% share in the network analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA