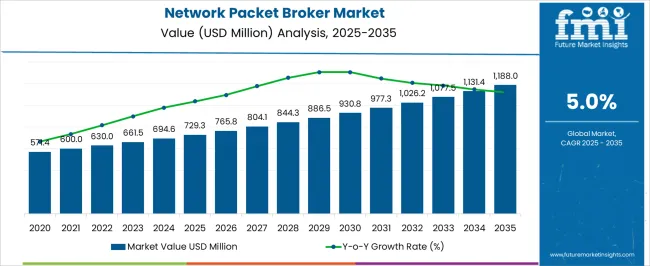

The Network Packet Broker Market is estimated to be valued at USD 729.3 million in 2025 and is projected to reach USD 1188.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. This growth reflects rising demand for efficient network traffic management, data monitoring, and security functions across enterprises and service providers. From 2020 to 2024, the market remained in the early adoption phase, driven by large enterprises and telecom operators focusing on visibility solutions to optimize network efficiency and cybersecurity. Investments during this period were centered on selective deployment in data centers and large-scale IT networks. Between 2025 and 2030, the market enters the scaling phase, where broader adoption occurs across mid-sized enterprises and cloud service providers.

This stage is characterized by the integration of packet brokers with SDN (software-defined networking) and advanced analytics tools to improve visibility, threat detection, and regulatory compliance. Vendors expand solutions to address hybrid cloud, 5G, and edge networking demands, accelerating growth momentum. From 2030 to 2035, the market transitions into the consolidation phase, with greater emphasis on cost efficiency, automation, and ecosystem integration. Solutions evolve toward AI-driven traffic filtering and monitoring, while competition consolidates, favoring established players. Overall, packet brokers shift from being standalone tools to becoming embedded elements of advanced security and network orchestration platforms.

| Metric | Value |

|---|---|

| Network Packet Broker Market Estimated Value in (2025 E) | USD 729.3 million |

| Network Packet Broker Market Forecast Value in (2035 F) | USD 1188.0 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The network packet broker market is undergoing significant transformation as enterprises and service providers adapt to escalating data traffic, multi-cloud environments, and increasing network complexity. Demand for enhanced network visibility and performance monitoring is fueling the adoption of scalable packet broker solutions across high-bandwidth ecosystems.

With rising security threats and compliance requirements, organizations are seeking solutions that can intelligently filter, replicate, and forward data packets to appropriate monitoring tools. The transition toward software-defined networks and virtualization is also catalyzing demand for packet brokers with dynamic policy-based management capabilities.

Investments in 5G, IoT, and edge computing infrastructure are expected to further support market growth by increasing the need for real-time traffic analysis and anomaly detection. As networks become more dynamic and encrypted, packet brokers are evolving into intelligent visibility layers to ensure operational continuity and data integrity.

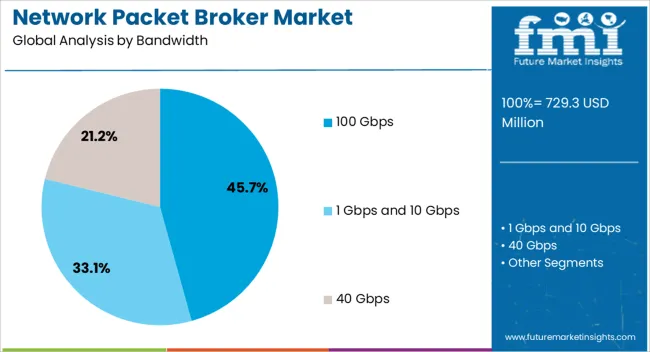

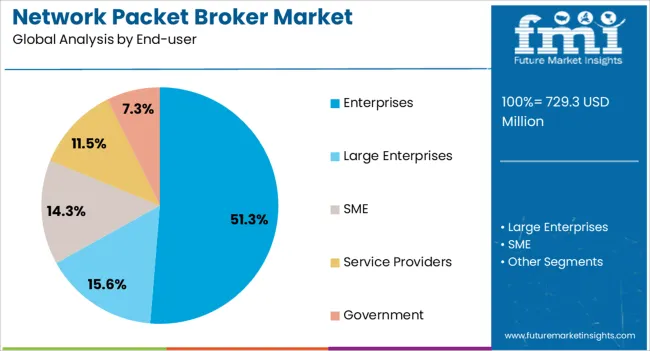

The network packet broker market is segmented by bandwidth, end-user, and geographic regions. By bandwidth, the network packet broker market is divided into 100 Gbps, 1 Gbps and 10 Gbps, and 40 Gbps. In terms of end-users of the network packet broker market, it is classified into Enterprises, Large Enterprises, SME, Service Providers, and Government. Regionally, the network packet broker industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 Gbps segment is projected to contribute 45.70% of the total market revenue in 2025, making it the leading bandwidth category. Its leadership is being driven by the surge in high-capacity data centers, hyperscale computing, and cloud-first enterprise architectures that demand faster data throughput and minimal latency.

The growth of east-west traffic within virtualized environments and increased reliance on real-time analytics have underscored the need for packet brokers capable of handling ultra-high-speed data streams. These systems ensure uninterrupted traffic aggregation, load balancing, and seamless tool integration across complex infrastructure.

As network transformation continues, 100 Gbps-capable brokers are being prioritized for their ability to accommodate bandwidth-intensive applications while maintaining efficient traffic visibility and cost-effective monitoring operations.

Enterprises are expected to account for 51.30% of the network packet broker market revenue in 2025, making them the leading end-user segment. This dominance is being shaped by growing investments in digital transformation, cybersecurity infrastructure, and hybrid cloud deployments.

Enterprise networks are increasingly adopting packet brokers to optimize tool utilization, improve data visibility, and detect anomalies across distributed architectures. Regulatory compliance in sectors such as finance, healthcare, and manufacturing has elevated the importance of continuous network monitoring and encrypted traffic inspection.

Moreover, the shift toward zero-trust security models and micro-segmentation has reinforced the role of packet brokers as strategic enablers of secure and observable networks. As enterprise IT environments become more complex and dynamic, demand for flexible and intelligent visibility solutions continues to accelerate.

The network packet broker (NPB) market is expanding as enterprises and service providers demand greater network visibility, data monitoring, and traffic optimization. NPBs aggregate, filter, and route data packets to monitoring and security tools, ensuring efficient utilization of IT infrastructure. North America leads adoption due to advanced data centers and cybersecurity requirements, while Asia-Pacific is experiencing strong growth from expanding internet penetration and 5G deployments. Rising focus on secure, high-speed, and reliable networks is fueling consistent demand across industries worldwide.

Enterprises and service providers increasingly deploy NPBs to strengthen cybersecurity and ensure regulatory compliance. By filtering and directing relevant data packets to intrusion detection and prevention systems, NPBs help reduce false positives and improve efficiency of security tools. Growing threats such as ransomware, data breaches, and DDoS attacks heighten the need for real-time traffic monitoring. Financial services, healthcare, and government institutions are leading adopters due to strict compliance regulations. As network environments grow more complex, NPBs provide the visibility required for maintaining secure and efficient operations.

The shift toward cloud computing, data-intensive applications, and 5G deployment drives demand for NPBs. Telecom operators rely on packet brokers to manage high-bandwidth traffic and ensure quality of service for subscribers. In cloud environments, NPBs improve resource utilization by delivering filtered traffic to virtual monitoring tools. Enterprises with hybrid and multi-cloud strategies benefit from enhanced visibility and optimized network performance. The growing number of connected devices and applications adds complexity to traffic management, positioning NPBs as a critical enabler of reliable, high-speed connectivity across industries and geographies.

Modern NPBs incorporate advanced capabilities such as application-aware filtering, load balancing, deduplication, and SSL decryption. These features optimize bandwidth utilization, reduce processing load on security appliances, and improve overall network efficiency. Packet brokers also support high-speed data transfer with compatibility across 40G, 100G, and emerging 400G networks. Integration with monitoring and orchestration platforms allows centralized management, making operations more streamlined. Enhanced reliability, scalability, and automation capabilities help enterprises and service providers manage evolving traffic patterns, ensuring networks remain responsive and secure under rising data demands.

Vendors form partnerships with cybersecurity firms, telecom operators, and cloud providers to expand application scope and regional presence. Collaborations support the co-development of advanced packet broker solutions tailored for modern networks. Strategic alliances also facilitate entry into emerging markets and ensure compatibility with industry-leading monitoring and analytics platforms. Vendors leverage partnerships to deliver end-to-end visibility, reduce deployment complexity, and enhance customer value. By aligning with technology leaders and infrastructure providers, NPB companies strengthen their global presence and remain competitive in the rapidly evolving networking landscape.

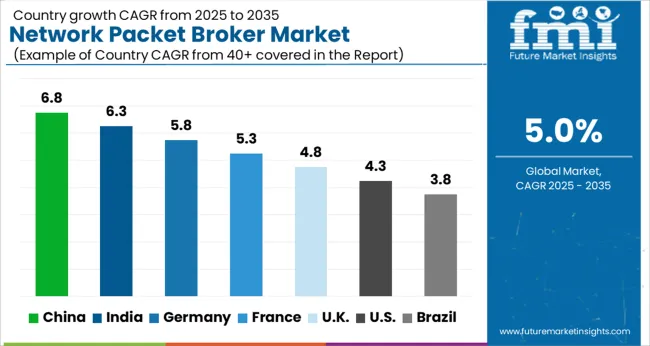

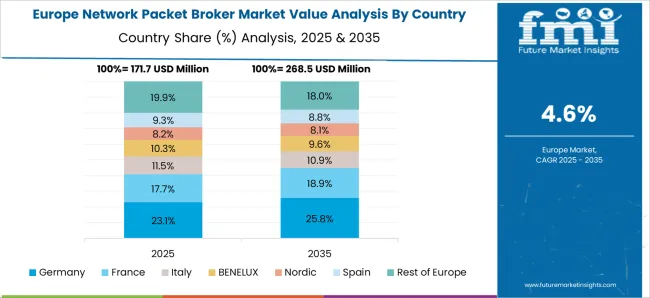

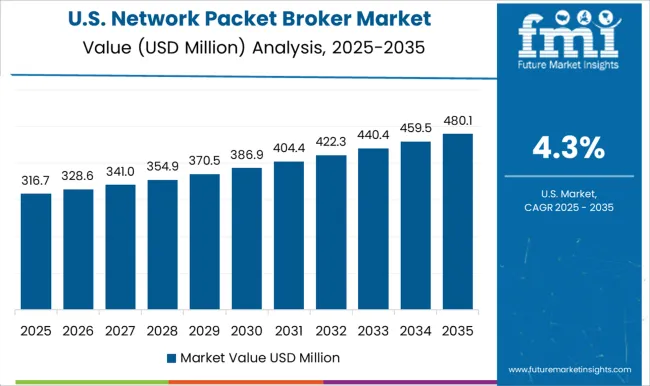

The global network packet broker (NPB) market is projected to grow at a CAGR of 5.0%, driven by increasing demand for efficient network traffic management and security monitoring. China leads with a growth rate of 6.8%, supported by large-scale enterprise and telecom infrastructure upgrades. India follows at 6.3%, fueled by expansion in IT networks and growing adoption of cybersecurity solutions. Germany shows steady growth at 5.8%, leveraging advanced enterprise networks and industrial automation needs. The UK. and USA record moderate growth rates of 4.8% and 4.3%, respectively, reflecting stable demand in corporate and service provider networks. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the global network packet broker market with a strong 6.8% CAGR, driven by rapid digital transformation, expansion of data centers, and adoption of 5G networks. Compared to India, China benefits from large-scale investments in telecommunications and enterprise IT infrastructure. The rise of cloud computing, artificial intelligence, and IoT significantly boosts demand for efficient traffic management and network monitoring. Domestic tech giants and state-backed projects accelerate adoption across industries such as finance, e-commerce, and government services. Cybersecurity concerns further increase reliance on packet brokers for real-time threat detection and network visibility. Innovation in hardware and software integration enhances operational efficiency. Export opportunities across the Asia-Pacific region strengthen market potential. China's growing digital economy, combined with strategic government initiatives, ensures that packet brokers play a vital role in optimizing network performance and ensuring secure, reliable communication in critical sectors.

Network packet broker market in India grows at 6.3%, supported by digitalization, data center expansion, and rising enterprise network complexities. Compared to Germany, India prioritizes cost-effective deployment while maintaining network security. Increasing adoption of 5G, cloud services, and fintech applications drives demand for traffic optimization. Government-led initiatives such as Digital India and Smart Cities accelerate infrastructure modernization. Domestic IT service providers integrate packet brokers into managed security and networking solutions. Growing internet penetration and the shift to online platforms enhance data volumes requiring monitoring. Small and medium enterprises also contribute to demand with affordable solutions. Export opportunities to South Asian markets improve revenue potential. Technological collaborations with global firms enhance software capabilities and system interoperability. India's focus on digital transformation, cybersecurity, and scalable solutions underpins steady growth in packet broker adoption across industries.

Germany demonstrates steady 5.8% growth in the network packet broker market, driven by advanced industrial networks, enterprise IT security, and regulatory compliance requirements. Compared to the United Kingdom, Germany emphasizes high-quality, reliable solutions tailored to manufacturing and financial sectors. Expansion of Industry 4.0, IoT, and connected systems requires efficient traffic visibility and monitoring. The growing volume of data within automotive, logistics, and healthcare industries increases reliance on packet brokers. Cybersecurity regulations such as GDPR drive organizations to adopt network visibility solutions ensuring compliance. Collaboration between domestic technology firms and global networking providers enhances product innovation. Export opportunities within the European Union create added growth. Modular and scalable packet broker designs enable cost-efficient integration across enterprise networks. Germany’s technological innovation, regulatory-driven adoption, and industrial reliance secure its steady market expansion.

The UK network packet broker market grows steadily at 4.8%, supported by financial services, healthcare, and government digital transformation projects. Compared to the United States, the UK emphasizes secure, compliant, and reliable network visibility solutions. Adoption of cloud computing, e-commerce platforms, and digital banking significantly increases data traffic monitoring requirements. Enterprises prioritize packet brokers for network optimization, traffic filtering, and enhanced cybersecurity measures. Infrastructure modernization programs encourage the deployment of scalable solutions in telecom and enterprise networks. Collaboration with global technology providers accelerates innovation in software-based traffic management. Demand is also supported by SMEs upgrading digital operations. Export opportunities exist within Europe and Commonwealth regions. The UK’s focus on digital adoption, regulatory compliance, and network efficiency drives consistent packet broker deployment.

The US network packet broker market advances at 4.3%, driven by enterprise IT modernization, cloud adoption, and stringent security demands. Compared to China, the US emphasizes innovation, software-based packet brokering, and regulatory compliance. Demand arises from sectors such as defense, finance, and healthcare where real-time visibility is critical. Expansion of hyperscale data centers and 5G networks enhances adoption. Cybersecurity threats drive enterprises to adopt packet brokers for intrusion detection and advanced analytics. Modular designs and automation features reduce costs and improve efficiency. Export potential exists across North and South America. Collaborations between US-based technology giants and global networking firms promote product innovation. Despite slower growth compared to Asia-Pacific, the US maintains a strong position through advanced R&D and security-driven adoption.

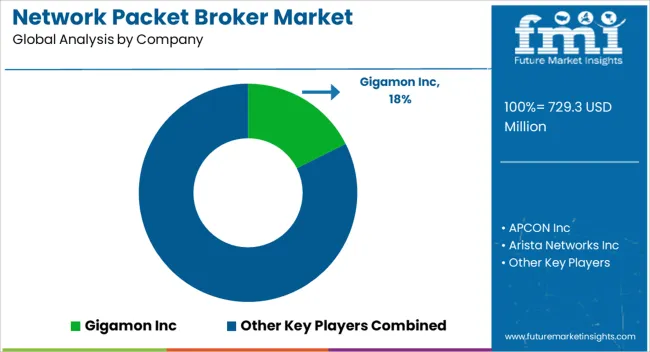

The network packet broker (NPB) market plays a critical role in modern network management, cybersecurity, and data traffic optimization. These solutions capture, filter, and distribute network traffic to monitoring, performance, and security tools, ensuring visibility and efficiency in increasingly complex IT infrastructures. Growing data traffic, cloud migration, and the rise in cybersecurity threats are fueling the adoption of NPB solutions worldwide. Gigamon Inc. is a leading player, known for its deep observability platform that integrates security and performance monitoring. APCON Inc. and Arista Networks Inc. provide scalable network visibility and switching solutions for enterprises and service providers. Broadcom Inc. offers advanced packet broker capabilities integrated with its networking and semiconductor technologies. Cisco Systems Inc., a global leader in networking, provides end-to-end visibility and packet distribution tools, while Extreme Networks Inc. strengthens network monitoring through advanced packet traffic management. Keysight Technologies and VIAVI Solutions, Inc. are significant players, leveraging their expertise in testing and monitoring systems to deliver robust packet broker solutions. Emerging companies like cPacket Networks Inc., Cubro Network Visibility, and Profitap HQ B.V. focus on high-performance, cost-effective, and specialized packet broker solutions for enterprises seeking flexible deployment. Garland Technology LLC and Datacom Systems Inc. provide network TAPs and visibility solutions that complement packet broker technologies.European innovators such as Microtel Innovation S.r.l, Niagara Networks, and Network Critical are expanding their presence with modular and scalable packet visibility platforms. The market is expected to grow rapidly as enterprises and telecom providers demand real-time traffic analysis, enhanced security monitoring, and seamless integration with cloud environments, making packet brokers a cornerstone of next-generation network infrastructure.

Major companies in the NPB market, including Gigamon, Ixia (Keysight Technologies), Apcon, Net Optics (part of Ixia), and VSS Monitoring, are continuously evolving their product offerings. These players are focused on enhancing product capabilities, forging strategic partnerships with cloud service providers, and expanding their reach through acquisitions. For example, Ixia has focused on integrating its NPBs with other testing and monitoring solutions, enabling customers to streamline network management and security operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 729.3 Million |

| Bandwidth | 100 Gbps, 1 Gbps and 10 Gbps, and 40 Gbps |

| End-user | Enterprises, Large Enterprises, SME, Service Providers, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gigamon Inc, APCON Inc, Arista Networks Inc, Broadcom Inc, CGS Tower Networks Ltd, Cisco Systems Inc, cPacket Networks Inc, Cubro Network Visibility, Datacom Systems Inc, Extreme Networks Inc, Garland Technology LLC, Keysight Technologies, Microtel Innovation S.r.l, NetScout Systems Inc, Network Critical, Niagara Networks, Profitap HQ B.V, and VIAVI Solutions, Inc |

| Additional Attributes | Dollar sales in the Network Packet Broker Market vary by type including visibility, monitoring, and security-focused brokers, application across enterprises, data centers, and service providers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising network traffic, demand for optimized data flow management, and increasing cybersecurity requirements. |

The global network packet broker market is estimated to be valued at USD 729.3 million in 2025.

The market size for the network packet broker market is projected to reach USD 1,188.0 million by 2035.

The network packet broker market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in network packet broker market are 100 gbps, 1 gbps and 10 gbps and 40 gbps.

In terms of end-user, enterprises segment to command 51.3% share in the network packet broker market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA