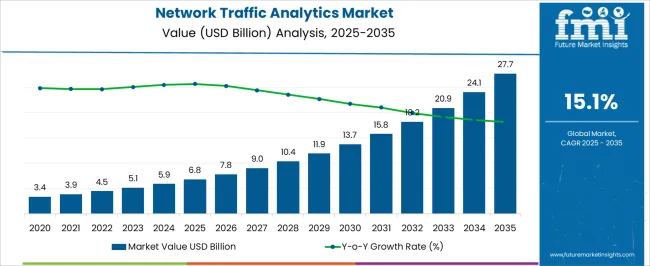

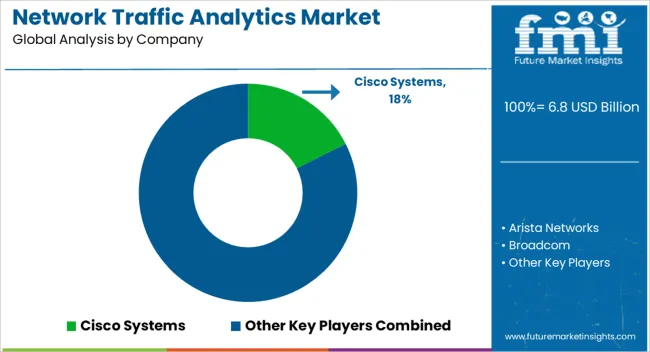

The Network Traffic Analytics Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 27.7 billion by 2035, registering a compound annual growth rate (CAGR) of 15.1% over the forecast period. From 2020 to 2025, the market demonstrates steady growth, rising from USD 3.4 billion to USD 6.8 billion. Annual increments during this period range between 0.4 and 0.9 billion USD, reflecting increasing adoption as organizations prioritize network visibility and security management. This period’s growth is driven by expanding data traffic and the need for improved monitoring solutions.

Between 2025 and 2035, the market experiences accelerated expansion, with the value rising from USD 6.8 billion to USD 27.7 billion. Year-over-year growth rates increase significantly, with yearly gains exceeding 1 billion USD in the latter half of this period. This surge is fueled by the growing complexity of network infrastructures and the rising importance of real-time analytics to detect anomalies and optimize performance. The consistent growth underscores the increasing reliance on network traffic analytics across various sectors to address evolving cybersecurity challenges and manage vast volumes of data efficiently.

| Metric | Value |

|---|---|

| Network Traffic Analytics Market Estimated Value in (2025 E) | USD 6.8 billion |

| Network Traffic Analytics Market Forecast Value in (2035 F) | USD 27.7 billion |

| Forecast CAGR (2025 to 2035) | 15.1% |

The network traffic analytics market is undergoing accelerated transformation due to rising cybersecurity threats, complex enterprise network architectures, and demand for real-time threat intelligence. As digital transformation initiatives scale across industries, network infrastructures are increasingly hybrid, creating visibility challenges and risk exposure.

This has led to the prioritization of advanced traffic analytics tools capable of detecting anomalies, ensuring compliance, and optimizing performance. Cloud-native technologies and AI-powered engines are further enhancing detection speeds and automation capabilities, allowing faster incident response.

Enterprises are also focusing on zero-trust frameworks, which depend on granular traffic monitoring to enforce policy and limit lateral movement of threats. The integration of analytics with security orchestration tools and SIEM platforms is expected to shape future investments, especially in regulated sectors like finance, healthcare, and government.

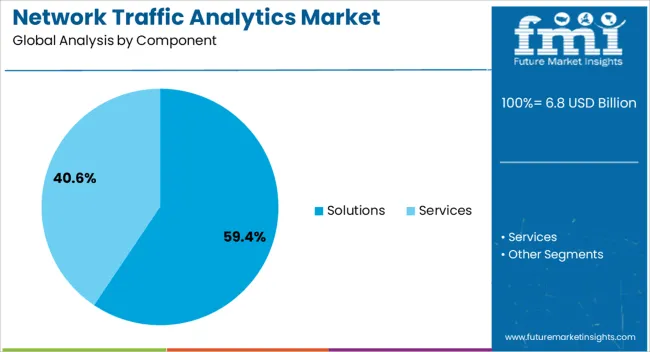

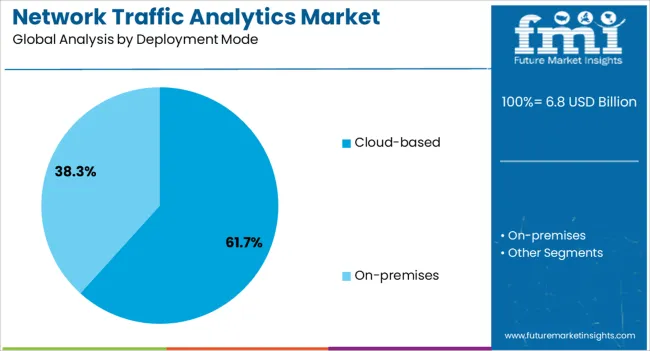

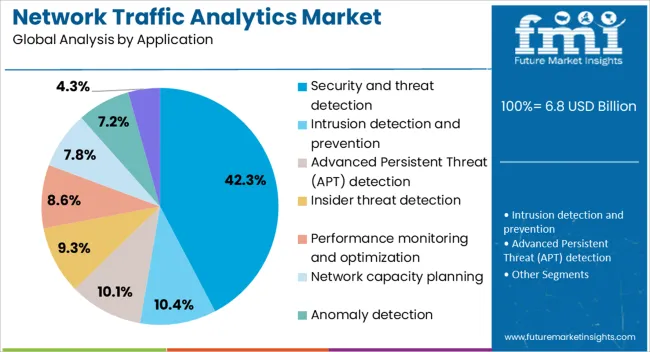

The network traffic analytics market is segmented by component, deployment mode, application, enterprise size, end use, and geographic regions. By component, the network traffic analytics market is divided into Solutions and Services. In terms of deployment mode, the network traffic analytics market is classified into Cloud-based and On-premises. Based on the application of the network traffic analytics market, it is segmented into Security and threat detection, Intrusion detection and prevention, Advanced Persistent Threat (APT) detection, Insider threat detection, Performance monitoring and optimization, Network capacity planning, Anomaly detection, and Compliance and audit. The network traffic analytics market is segmented by enterprise size into large enterprises and SMEs.

The end use of the network traffic analytics market is segmented into IT and telecom, BFSI, Government and defense, Healthcare, Retail and e-commerce, Manufacturing, Energy and utilities, Education, and Others. Regionally, the network traffic analytics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Solutions are expected to contribute 59.40% of the total revenue in the network traffic analytics market by 2025, establishing them as the leading component segment. Their dominance is being driven by the growing need for deep packet inspection, behavior analytics, and AI-driven anomaly detection to counter rising volumes of encrypted traffic and sophisticated threats.

Solutions offer critical functionalities such as forensic analysis, performance monitoring, and automated threat identification, which have become foundational to modern network security strategies. Increased spending on cybersecurity platforms, combined with the evolution of modular analytics tools that integrate with existing infrastructure, has accelerated solution adoption.

The ability to deploy these tools across multi-cloud and hybrid environments further strengthens their relevance in securing dynamic enterprise networks.

Cloud-based deployment is projected to account for 61.70% of the overall market revenue in 2025, making it the dominant deployment mode. This leadership is being supported by the widespread migration of workloads to the cloud, driven by scalability, cost efficiency, and ease of management.

Cloud-based analytics platforms enable centralized monitoring of distributed networks, offering real-time insights without the need for extensive on-premise hardware. The ability to leverage elastic compute power allows advanced traffic analytics models to be trained and executed at scale.

As organizations embrace remote work and distributed architectures, cloud-native analytics solutions have become essential for maintaining visibility, ensuring data integrity, and securing endpoints. Furthermore, continuous updates and support for integration with third-party security ecosystems have positioned cloud deployments as the preferred model for modern enterprises.

Security and threat detection is forecast to hold 42.30% of the total market share in 2025, making it the largest application segment in the network traffic analytics market. This growth is being fueled by the increasing frequency of cyberattacks, ransomware incidents, and compliance mandates requiring real-time network visibility.

Enterprises are investing heavily in analytics platforms that can detect lateral movement, insider threats, and command-and-control traffic in encrypted and unstructured data flows. Traffic analytics used in threat detection empowers security operations centers with contextual alerts and reduces false positives, enabling more efficient incident response.

With the rise of nation-state threats, zero-day exploits, and cloud misconfigurations, threat detection through traffic monitoring has become a strategic priority across all critical infrastructure sectors. The role of analytics in enhancing proactive defense posture is expected to deepen, particularly with integration into automated response frameworks.

The network traffic analytics market is growing rapidly as organizations strive to enhance their network performance, security, and operational efficiency. Increasing cyber threats and the complexity of modern networks drive demand for advanced analytics tools that provide real-time visibility into network traffic patterns. These solutions help identify anomalies, optimize bandwidth, and support compliance requirements. Growth is fueled by widespread digital transformation and adoption of cloud, IoT, and 5G technologies. However, challenges like data privacy concerns and integration complexities persist. Market players focus on developing AI-enabled analytics and scalable platforms to address evolving network demands and enhance threat detection capabilities.

The surge in cyberattacks and sophisticated threats has heightened the need for comprehensive network traffic analytics. These solutions enable organizations to detect anomalies, malware, and unauthorized activities quickly, minimizing potential damage. Real-time monitoring helps in early threat identification and faster incident response. Enterprises are investing in analytics platforms that integrate with existing security infrastructure, providing contextual insights across network layers. As regulatory bodies enforce stricter data protection standards, analytics tools also support compliance by generating detailed traffic logs and audit trails. This security-driven demand positions network traffic analytics as a critical component in enterprise cybersecurity strategies.

Network environments generate vast amounts of data, making traffic analytics resource-intensive and complex. Processing, storing, and analyzing this data in real time requires robust infrastructure and sophisticated algorithms. Integrating analytics tools with diverse network devices and platforms adds further complexity. Additionally, privacy concerns arise when monitoring user data, especially under stringent data protection regulations. Organizations must balance detailed analytics with compliance to avoid legal repercussions. These challenges necessitate scalable, efficient analytics solutions that employ data anonymization and secure processing. Vendors face pressure to innovate while ensuring compliance and minimizing operational overhead, which can slow adoption in sensitive sectors.

Artificial intelligence and machine learning have become central to modern network traffic analytics, enabling automated threat detection and predictive insights. These technologies analyze patterns and behaviors to identify anomalies beyond simple rule-based systems. AI-driven analytics improve accuracy, reduce false positives, and enable adaptive responses to emerging threats. Additionally, machine learning supports capacity planning by forecasting network load and optimizing traffic flows. Continuous learning algorithms help systems evolve with changing network conditions, providing more effective monitoring over time. These innovations enable organizations to handle complex network environments and respond proactively to both security and performance issues, giving analytics vendors a competitive edge.

The rapid growth of cloud computing and IoT devices is transforming network architectures, increasing traffic volume and complexity. Network traffic analytics solutions are adapting to monitor hybrid and multi-cloud environments as well as diverse IoT ecosystems. Real-time visibility into cloud-based applications and connected devices is essential for maintaining security and performance. Analytics platforms now incorporate cloud-native capabilities and edge computing to handle distributed data sources efficiently. As organizations adopt these technologies, demand for analytics that can integrate seamlessly across physical and virtual networks rises. This trend opens opportunities for vendors to develop specialized solutions addressing the unique challenges of cloud and IoT traffic monitoring.

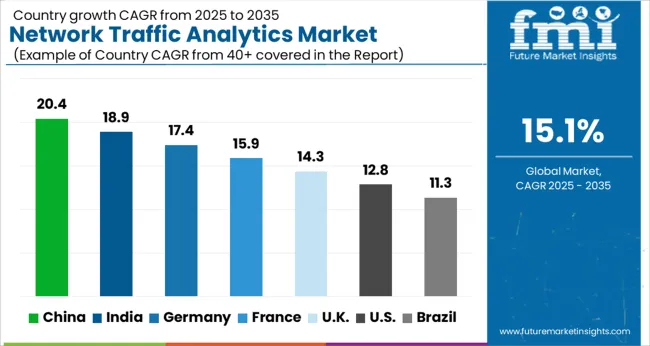

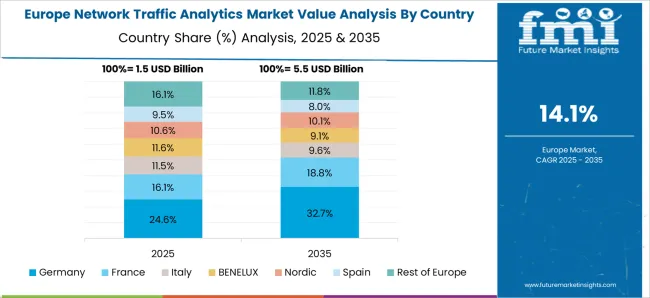

The global network traffic analytics market is expanding rapidly at a 15.1% CAGR, driven by increasing demand for cybersecurity and network optimization. China leads with 20.4% growth, supported by significant investments in IT infrastructure and advanced analytics technologies. India follows at 18.9%, fueled by growing digital transformation and cybersecurity initiatives. Germany records 17.4% growth, reflecting strong regulatory frameworks and innovation in network monitoring. The United Kingdom grows at 14.3%, driven by increasing adoption of analytics for enterprise security. The United States, a mature market, shows 12.8% growth, shaped by stringent security regulations and technological advancements. These countries collectively influence market trends through enhanced data analysis, regulatory compliance, and integration of AI-driven solutions. This report includes insights on 40+ countries; the top countries are shown here for reference.

China network traffic analytics market is experiencing explosive growth with a 20.4% CAGR, driven by rapid digital transformation and expanding internet infrastructure. The rise of 5G networks, cloud computing, and IoT devices generates massive data volumes requiring advanced analytics to monitor, secure, and optimize network performance. Compared to Western countries, China benefits from large-scale government initiatives supporting smart cities and digital governance, which boost demand for sophisticated traffic analytics tools. Enterprises across finance, telecommunications, and e-commerce sectors are increasingly adopting AI-powered solutions for real-time network visibility and threat detection. Local vendors are innovating with customized products to meet domestic regulatory requirements and language needs. The integration of network analytics with cybersecurity frameworks is critical to defending against growing cyber threats. This combination of government support, market demand, and technological advancement positions China as a dominant force in the global network traffic analytics market.

India network traffic analytics market is expanding rapidly at an 18.9% CAGR, fueled by growing internet penetration and digital adoption across industries. As telecom operators roll out 5G networks and enterprises migrate to cloud infrastructure, the need for real-time traffic monitoring and threat analysis increases significantly. Compared to China, India’s market is driven heavily by private sector investment, especially in banking, IT services, and retail. The emergence of startups offering AI and machine learning-based analytics tools enhances competition and innovation. Regulatory changes around data protection and cybersecurity further encourage adoption of network traffic analytics to ensure compliance. Public sector organizations are also integrating analytics to manage network performance and secure critical infrastructure. This combination of private and public demand, coupled with technological innovation, sustains India’s robust market growth trajectory.

Germany network traffic analytics market grows at a solid 17.4% CAGR, supported by advanced industrial digitization and stringent cybersecurity regulations. German enterprises prioritize network visibility to maintain operational continuity and safeguard sensitive industrial data. Compared to Asian markets, Germany places greater emphasis on compliance with EU data protection laws, influencing tool selection and deployment. The manufacturing and automotive sectors lead demand due to increased automation and connected systems. Germany’s strong IT infrastructure and skilled workforce support adoption of sophisticated analytics platforms capable of predictive insights and anomaly detection. Public sector agencies also leverage traffic analytics to secure government networks and critical infrastructure. Collaborative research and partnerships between technology providers and industry players foster innovation, enhancing the market’s maturity and resilience.

United Kingdom network traffic analytics market expands at a 14.3% CAGR, propelled by increasing cyber threat complexity and enterprise digitalization. UK organizations are adopting real-time traffic analytics platforms to enhance network security, optimize bandwidth usage, and ensure regulatory compliance. Compared to Germany, the UK market shows strong growth in financial services and telecommunications sectors, which require advanced monitoring solutions. Cloud migration and remote work trends further drive demand for scalable, cloud-native analytics tools. Government agencies support initiatives to bolster national cybersecurity posture, indirectly encouraging analytics adoption. Investment in user-friendly dashboards and AI-driven threat detection improves usability for IT teams. The growing focus on integrating traffic analytics with broader security information and event management systems reinforces market expansion.

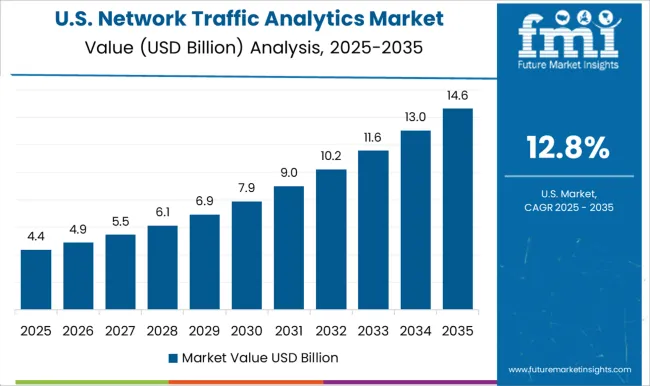

United States network traffic analytics market is growing at a 12.8% CAGR, fueled by widespread adoption across diverse industries and strong investment in cybersecurity. USA enterprises lead in deploying AI and machine learning-enhanced analytics platforms to handle vast and complex network environments. Compared to European markets, the USA prioritizes innovation speed and early adoption of emerging technologies. Sectors such as healthcare, finance, and government demand high levels of network visibility to protect sensitive data and maintain regulatory compliance. Cloud service providers also play a major role by integrating traffic analytics into their offerings. Increasing cyber threats and regulatory scrutiny drive continuous upgrades and adoption of advanced analytics capabilities. The USA market reflects a mature ecosystem supported by strong vendor presence, skilled professionals, and continuous innovation.

The network traffic analytics market is witnessing rapid growth due to the increasing complexity of network environments, the rise of cloud computing, and the expanding number of connected devices. Cisco Systems stands out as a market leader, offering robust solutions that provide real-time monitoring, threat detection, and network optimization across diverse infrastructures.

IBM Corporation also commands a strong presence with its integrated analytics platforms that combine AI and machine learning for enhanced network visibility and security. Arista Networks has bolstered its capabilities through strategic acquisitions, notably expanding its software-defined wide-area network (SD-WAN) offerings to better serve enterprise customers.

Broadcom and Cloudflare bring complementary strengths to the market. Broadcom leverages its semiconductor and infrastructure expertise to support high-performance analytics hardware, while Cloudflare utilizes its global edge network to deliver scalable, cloud-native traffic analytics services emphasizing security and performance. NEC Corporation targets service providers and large enterprises with customized analytics solutions tailored to specific network demands. Meanwhile, specialized firms like Fortra and Progress Software focus on niche areas such as security analytics and performance monitoring, catering to evolving enterprise needs.

SolarWinds Worldwide and Zoho contribute by addressing small and medium-sized business segments with accessible, easy-to-deploy analytics platforms. This diverse vendor ecosystem, combining established technology giants and innovative challengers, intensifies competition and drives continuous improvement. The emphasis remains on integrating advanced analytics, automation, and AI-driven insights to empower organizations with enhanced network management, security, and operational efficiency.

Companies are integrating Artificial Intelligence (AI) and Machine Learning (ML) technologies into network traffic analytics platforms. This enables real-time monitoring, anomaly detection, and predictive analytics, allowing businesses to detect network threats and performance issues proactively. AI and ML algorithms help optimize network traffic management, improve security, and reduce downtime.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Component | Solutions and Services |

| Deployment Mode | Cloud-based and On-premises |

| Application | Security and threat detection, Intrusion detection and prevention, Advanced Persistent Threat (APT) detection, Insider threat detection, Performance monitoring and optimization, Network capacity planning, Anomaly detection, and Compliance and audit |

| Enterprise Size | Large enterprises and SME |

| End Use | IT and telecom, BFSI, Government and defense, Healthcare, Retail and e-commerce, Manufacturing, Energy and utilities, Education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Arista Networks, Broadcom, Cloudflare, Fortra, IBM Corporation, NEC Corporation, Progress Software, SolarWinds Worldwide, and Zoho |

| Additional Attributes | Dollar sales in the Network Traffic Analytics Market vary by deployment (on-premise, cloud, hybrid), component (software, services), application (threat detection, performance monitoring), end-user (telecom, IT, BFSI), and region (North America, Europe, Asia-Pacific). Growth is fueled by increasing cyber threats, cloud adoption, and demand for real-time network insights. |

The global network traffic analytics market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the network traffic analytics market is projected to reach USD 27.7 billion by 2035.

The network traffic analytics market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in network traffic analytics market are solutions, _network performance monitoring, _network security monitoring, _network behavior analytics, _network traffic visualization, services, _professional and _managed.

In terms of deployment mode, cloud-based segment to command 61.7% share in the network traffic analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Network Optimization Market Size and Share Forecast Outlook 2025 to 2035

Network Security Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA