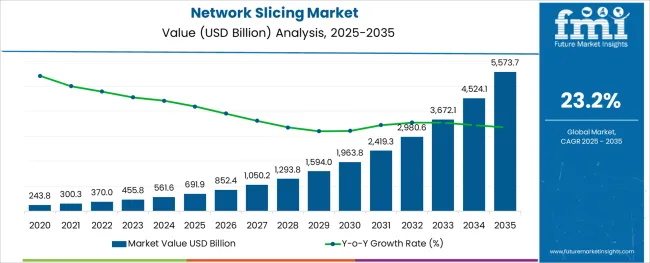

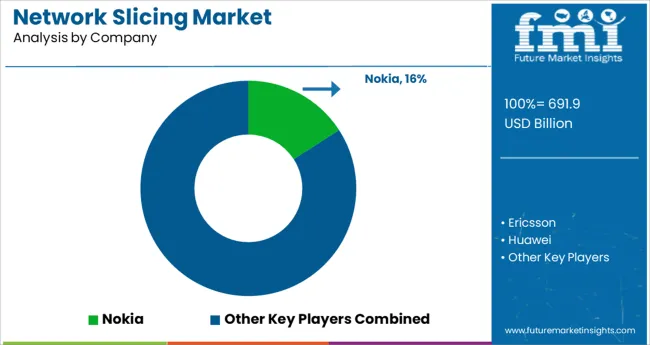

The Network Slicing Market is estimated to be valued at USD 691.9 billion in 2025 and is projected to reach USD 5573.7 billion by 2035, registering a compound annual growth rate (CAGR) of 23.2% over the forecast period.

The network slicing market is experiencing accelerated growth driven by the rapid global rollout of 5G infrastructure and the increasing need for customized network performance across diverse industry verticals. As enterprises and service providers demand differentiated services with tailored bandwidth, latency, and security levels, network slicing has emerged as a pivotal enabler for next-generation connectivity frameworks.

The current landscape reflects heightened adoption among telecom operators and technology firms seeking to optimize network resources and deliver application-specific services over shared infrastructure. Moving forward, the market is expected to witness strong momentum as emerging applications in autonomous vehicles, smart manufacturing, and immersive media services require highly reliable and low-latency network environments.

Additionally, strategic collaborations between telecom vendors and cloud service providers, combined with regulatory support for network virtualization, are anticipated to further expand deployment opportunities. Continuous investment in AI-driven network orchestration and software-defined networking platforms will enhance operational efficiency and network elasticity, positioning network slicing as a fundamental component of advanced digital ecosystems over the coming years.

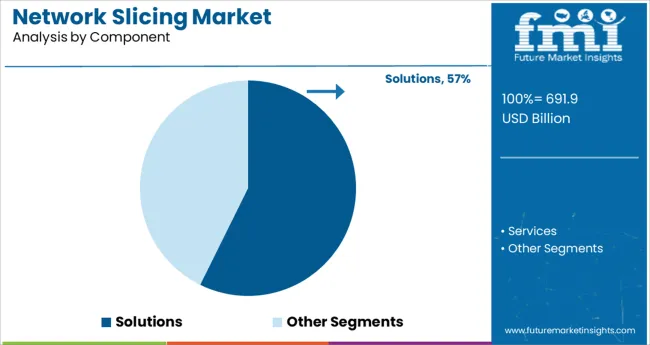

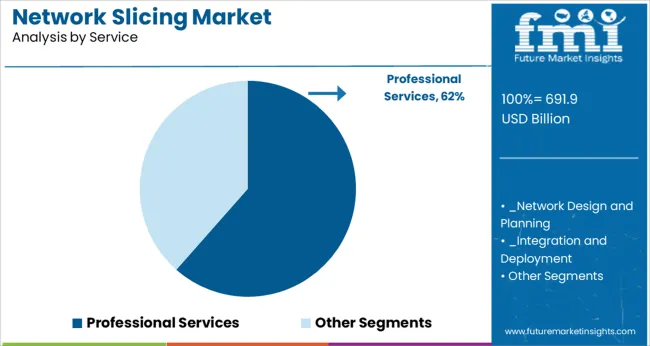

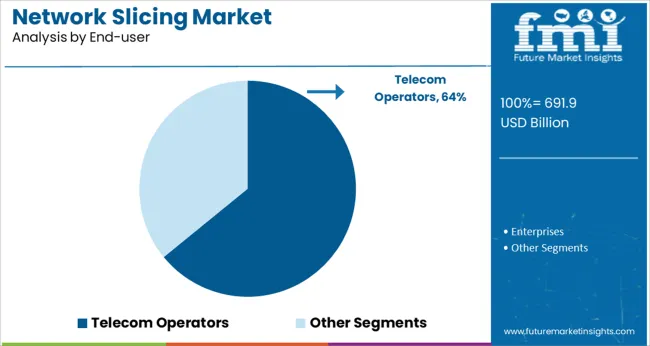

The market is segmented by Component, Service, End-user, and Application and region. By Component, the market is divided into Solutions and Services. In terms of Service, the market is classified into Professional Services and Managed Services. Based on End-user, the market is segmented into Telecom Operators and Enterprises.

By Application, the market is divided into Healthcare, Energy and Utilities, Transportation and Logistics, Manufacturing, Media and Entertainment, Automotive, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solutions segment accounted for approximately 57.3% of the total network slicing market share, firmly establishing itself as the dominant component category. This leadership position has been maintained due to the increasing demand for software-driven frameworks that enable telecom operators and enterprises to dynamically allocate and manage network resources according to specific service requirements.

Network slicing solutions facilitate the creation of multiple virtual networks on a shared physical infrastructure, ensuring optimal utilization while meeting diverse performance benchmarks for different applications. The segment's growth is further bolstered by the integration of AI, machine learning, and analytics capabilities within these solutions, enhancing real-time network monitoring and automated resource orchestration.

As 5G commercialization progresses, service providers are prioritizing scalable, interoperable, and secure slicing solutions to address complex enterprise demands across industries such as automotive, healthcare, and manufacturing. The rising need for cost-efficient network operations and differentiated service delivery is expected to sustain the solutions segment’s market dominance in the foreseeable future.

Within the service category, the professional services segment led with a commanding 61.5% market share, driven by the critical requirement for specialized expertise in planning, deploying, and managing network slicing frameworks. The segment’s prominence stems from the complexity associated with integrating network slicing into existing telecom infrastructures and ensuring seamless interoperability with legacy and next-generation network elements.

Professional services encompass a range of activities including network assessment, customized solution design, implementation support, and ongoing optimization services tailored to enterprise-specific performance needs. The growing reliance on 5G network slicing for mission-critical and latency-sensitive applications has intensified demand for consulting and managed services from technology vendors and system integrators.

Additionally, telecom operators are increasingly engaging professional service providers to navigate regulatory, operational, and cybersecurity challenges associated with network slicing adoption. As network environments become more dynamic and AI-driven orchestration gains traction, the professional services segment is expected to maintain its leadership position through continuous advisory, technical, and operational support offerings.

The telecom operators segment dominated the end-user category with a substantial 64.1% market share, reflecting its central role in deploying and monetizing network slicing capabilities. This leadership has been reinforced by the imperative for telecom carriers to differentiate service offerings and optimize 5G infrastructure investments through customized network slices for enterprise clients and consumers.

Telecom operators are leveraging network slicing to deliver enhanced performance and guaranteed service-level agreements for applications such as cloud gaming, IoT deployments, and enterprise private networks. The segment’s growth is further supported by strategic partnerships with cloud providers, equipment vendors, and software developers aimed at accelerating network slicing deployments and expanding addressable markets.

With the proliferation of data-intensive applications and emerging use cases demanding ultra-reliable, low-latency communication, telecom operators are well-positioned to capitalize on network slicing to unlock new revenue streams. Continued investment in software-defined networking and automation tools is anticipated to enhance operational agility, solidifying the telecom operators segment’s dominance in the network slicing market landscape.

The adoption of network slicing is growing as it is reshaping various industries by connecting all types of devices, appliances, systems, and services, IoT adoption, and continuous developments in Machine-to-Machine (M2M) communication networks. Network slicing-enabled 5G would serve a variety of IoT use cases, allowing communication between massive numbers of sensors and linked devices. As a result of this, the demand for network-slicing solutions is predicted to grow rapidly during the forecast period.

The adoption of network slicing is increasing due to the developments in IoT technology. High-power, low-latency applications (such as mobile video surveillance) and low-power, low-latency, long-range IoT apps are two types of IoT applications (smart cities and smart factories).

The evolution of 5G technology is projected to accelerate in order to meet these needs for growing IoT applications, which are classified as huge machine-type communication and mission-critical applications.

The adoption of network slicing in every line of the industry has altered substantially as a result of Industry 4.0, automation, and digitalization. Most industries have experienced digital transformations to meet the increased demand for network-slicing solutions to maintain operational agility among customers and organizations.

There is a rising demand for network-slicing solutions among businesses to support their digital transformation efforts. The adoption of network slicing is projected to rise due to multiple technological breakthroughs and the growth in dynamic ecosystems. These factors have paved the path for new commercial applications to emerge in a variety of industries that are responsible for growth in network slicing market size.

Fixed network slices can be grown up by adding more hardware resources, however, RAN slicing is difficult to scale up since it quickly runs into a physical constraint owing to spectrum scarcity. Individual slices can be assigned dedicated carriers to bypass this issue.

The allotment of some carriers, on the other hand, would limit the network's ability to reap multiplexing advantages through the scaled-up slice. These factors are likely to limit the network-slicing market growth over the forecast period.

CIOs are mostly concerned about network slicing security, which can result in significant losses for organizations and service providers. SDN, NFV, and cloud-native architecture are used to construct the new network infrastructure, supporting the adoption of network slicing in multiple industries.

Network functions are separated from the underpinning infrastructure and distributed among local, regional, and central data centers. The demand for network slicing solutions is rising as the majority of network services in a cloud-based 5G network are implemented over public and private cloud infrastructure.

During the forecast period, the network slicing market is anticipated to be dominated by the solutions sector with a CAGR of 21.1%. The growing demand for high-speed and extensive network coverage, increasing mobile data traffic volumes, increasing demand for ultra-low latency, and expanding use of network virtualization are all driving this segment's growth.

The usefulness, criticality, and ease of implementation of network-slicing solutions all contribute to the segment's growth. Due to the benefits that network slicing solutions give, various suppliers are investing in Research and Development to improve and make them cheaper, especially for small and medium-sized businesses. As a result of this, the global network slicing market share is projected to rise during the forecast period.

By services, the professional services segment is anticipated to hold the largest share with a CAGR of 21.1% during the forecast period. This growth is due to the increasing demand for smart monitoring and the steady increase in the remote operation of processes and applications.

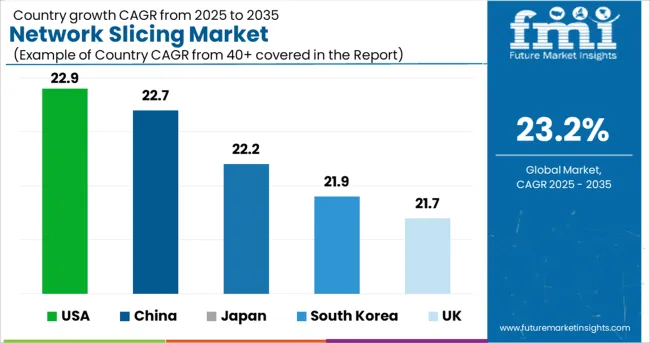

| Regions | CAGR (2025 to 2035) |

|---|---|

| USA Market | 22.9% |

| UK Market | 21.7% |

| China Market | 22.7% |

| Japan Market | 22.2% |

| South Korea Market | 21.9% |

The Asia Pacific region is anticipated to hold the highest proportion of the global network slicing market with an average CAGR of 22.4%. The presence of important firms delivering innovative network-slicing solutions and services to many sectors is responsible for the region's large share.

Some businesses and governments in this region have expressed an increased interest in commercializing the next-generation 5G network. Furthermore, the region's dominance in the network slicing market is likely to be maintained during the forecast period, thanks to rising demand for network virtualization, a favorable environment for start-ups, and strong government initiatives.

Increasing usage of technologies such as cloud computing, network function virtualization, and IoT is likely to propel the network slicing market in North America to new heights over the forecast period. Furthermore, the increased demand for broadband services across North America is expected to significantly boost the network-slicing market growth in the coming years.

The network slicing market is fragmented, with different players collaborating to provide the required availability, latency, data rate, and security. Carriers can use network slice management technologies to implement network slice lifecycle management in preparation for 5G.

Recent Developments in the Network Slicing Market

The global network slicing market is estimated to be valued at USD 691.9 billion in 2025.

It is projected to reach USD 5,573.7 billion by 2035.

The market is expected to grow at a 23.2% CAGR between 2025 and 2035.

The key product types are solutions and services.

professional services segment is expected to dominate with a 61.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA