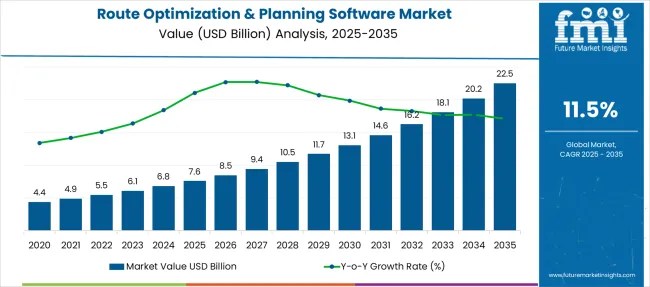

The Route Optimization & Planning Software Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 22.5 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period. This acceleration is shaped by the logistics sector’s demand for real-time fleet visibility, delivery efficiency, and last-mile automation. With supply chain complexity and urban congestion rising, companies see route planning platforms as critical for cutting fuel costs and improving turnaround times.

The white space exists in AI-powered predictive routing, which integrates weather, traffic, and fuel pricing analytics for dynamic adjustments. There is growing scope for SaaS-based micro-logistics solutions for SMEs, as enterprise adoption remains dominant. Incorporating machine learning for demand forecasting and EV route planning modules provides an added growth lever, particularly with the shift toward green fleets.

Market expansion will center on regions where e-commerce penetration and gig-economy delivery networks surge, such as Asia-Pacific and Latin America. Vendors offering cloud-native platforms with API integration for TMS/ERP systems and customizable solutions for hyperlocal delivery models are likely to outpace traditional players. Future competitive advantage will favor platforms embedding digital twin technology for network simulation and cost benchmarking.

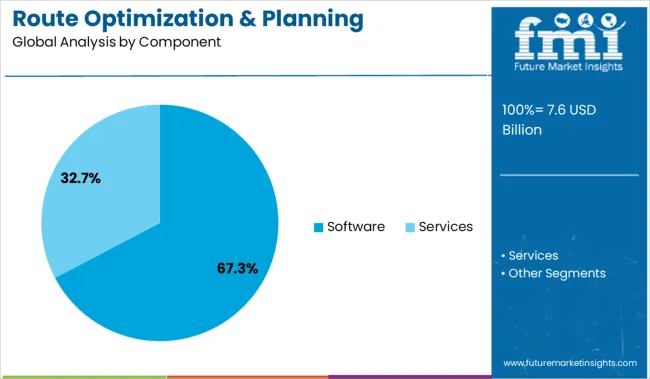

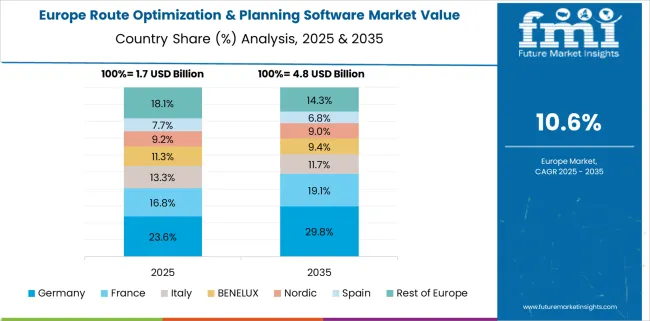

The software segment, accounting for 67.3% share, dominates due to the demand for SaaS-based solutions, enabling scalability and integration with telematics and ERP systems. North America leads adoption with advanced e-commerce and last-mile delivery infrastructure, while Asia-Pacific sees rapid uptake as emerging economies digitize logistics networks to support booming retail and hyperlocal delivery models. Europe maintains a strong demand tied to stringent carbon reduction policies impacting fleet operations. The next phase of market development will prioritize autonomous vehicle compatibility, dynamic rerouting under live constraints, and IoT integration for fleet visibility.

| Metric | Value |

|---|---|

| Route Optimization & Planning Software Market Estimated Value in (2025E) | USD 7.6 billion |

| Route Optimization & Planning Software Market Forecast Value in (2035F) | USD 22.5 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The route optimization and planning software market is experiencing accelerated growth, shaped by increasing pressure on logistics and field service operations to achieve efficiency, sustainability, and cost reduction. The rising complexity of last-mile delivery, demand for real-time visibility, and growing customer expectations have driven widespread adoption of intelligent route planning solutions.

Organizations are leveraging such software to optimize fuel consumption, reduce delivery times, and enhance customer satisfaction while aligning with environmental sustainability goals. Future growth is expected to be supported by the proliferation of e-commerce, advancements in artificial intelligence, and increased integration with IoT-enabled fleet management systems.

The convergence of regulatory pressure for emission reduction and competitive differentiation through service excellence is paving the path for sustained market expansion and technological innovation.

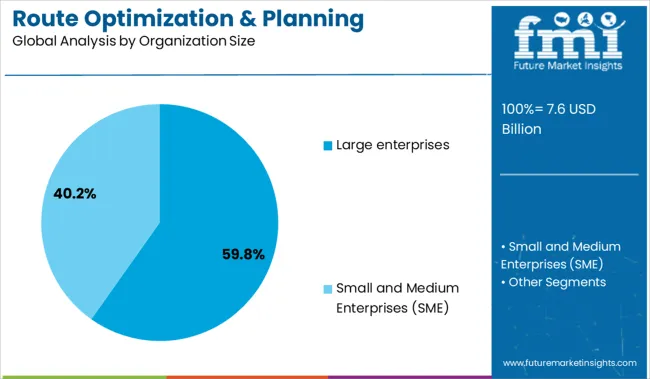

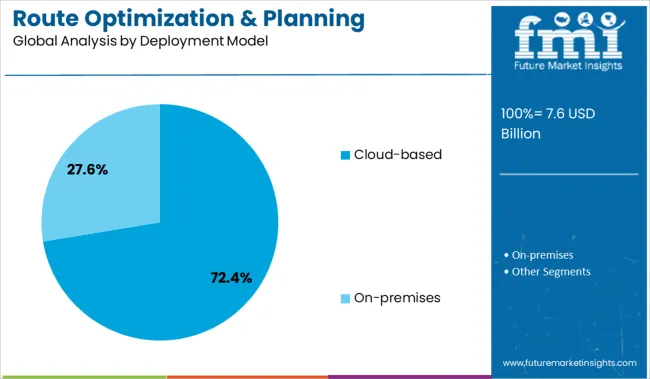

The route optimization and planning software market is segmented by component, organization size, deployment model, vertical, and region. By component, it includes software and services, catering to operational and support requirements. In terms of organization size, the segmentation comprises large enterprises and small and medium enterprises (SMEs), reflecting broad adoption across business scales. Based on deployment model, the market is divided into cloud-based and on-premises solutions, addressing varying infrastructure preferences. By vertical, it spans transportation and logistics, retail and e-commerce, food delivery services, field services, and other sectors reliant on route planning. Regionally, the market encompasses North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

When segmented by component, software is projected to hold 67.3% of the total market revenue in 2025, making it the dominant segment. This leadership has been supported by the need for advanced analytics, dynamic route adjustment, and seamless integration with enterprise resource planning and fleet management platforms.

The ability of software solutions to offer real-time optimization, scenario simulation, and predictive analytics has improved operational decision-making and resource allocation. Increased demand for flexible, user-friendly interfaces and scalability across diverse industries has further reinforced the preference for software over service-centric models.

Organizations have prioritized investing in standalone and integrated software products to gain immediate operational benefits, reduce manual intervention, and enhance responsiveness to fluctuating delivery demands, consolidating this segment’s prominence.

Segmented by organization size, large enterprises are expected to account for 59.8% of the market revenue in 2025, maintaining their leading position. This dominance has been driven by the greater scale and complexity of operations in large organizations, which necessitate sophisticated route optimization tools.

With extensive fleets, distributed service networks, and high delivery volumes, these enterprises have recognized the tangible benefits of advanced software in reducing costs and improving service levels. The capacity to allocate substantial budgets toward digital transformation initiatives has allowed them to implement comprehensive solutions, often tailored to their unique operational challenges.

Moreover, the pressure to meet corporate sustainability targets, improve regulatory compliance, and remain competitive in customer experience has further motivated large enterprises to adopt and scale these solutions, ensuring continued leadership in the segment.

When segmented by deployment model, cloud-based solutions are forecast to capture 72.4% of the market revenue in 2025, establishing themselves as the leading deployment preference. This dominance has been reinforced by the advantages of accessibility, scalability, and reduced upfront capital expenditure associated with cloud-based platforms.

Organizations have increasingly favored cloud deployment to enable seamless updates, remote access, and integration with other cloud-native enterprise applications. The flexibility to quickly scale operations in response to fluctuating demand and the ability to support geographically dispersed teams have further strengthened the appeal of cloud solutions.

Enhanced security features, improved uptime, and reduced maintenance burdens have also contributed to the growing preference for cloud-based models, positioning this segment at the forefront of deployment choices in the market.

AI-based delivery orchestration, dynamic fleet dispatching, and real-time mapping integration have positioned route optimization platforms as essential tools across transport, courier, and e-commerce supply chains. Businesses are deploying cloud-native logistics suites to reduce operational costs, ensure on-time delivery, and improve visibility. Integrations with GPS and telematics enable adaptive planning. Growth is further enabled by customizable APIs, embedded vehicle systems, and rising deployment in last-mile distribution.

The market has been expanding as enterprises adopt intelligent dispatching systems powered by AI algorithms and real-time location data. These platforms optimize delivery windows by processing route variables including traffic density, weather shifts, vehicle constraints, and service priorities. Advanced systems also enable multi-stop deliveries with fleet-wide optimization for fuel efficiency and timely fulfillment.

Increasing use of telematics sensors across commercial vehicles has improved route precision and incident responsiveness. Organizations in retail distribution, field service, and cold chain logistics have integrated route planning suites to enhance punctuality and reduce driver fatigue.

Operational cost pressure and emission reduction mandates have accelerated procurement cycles. By embedding predictive routing tools into daily fleet operations, enterprises are now converting logistics into a strategic edge rather than a fixed cost.

Opportunities exist in modular platforms that adapt to the distinct routing needs of food delivery, healthcare mobility, construction logistics, and specialty courier fleets. Vendors have begun offering white-label SDKs and branded modules to help partners in telecom, automotive, and fleet leasing embed route intelligence into their solutions.

Refillable APIs, offline sync support, and mobile-optimized dashboards increase usage across underserved geographies and small fleets. Co-developments with EV makers and OEMs aim to build in-vehicle interfaces for intelligent delivery sequencing.

Training webinars, localized on boarding tools, and bundled offers through pharmacy delivery or postal integration have enabled further outreach. The demand for cloud-based, plug-and-play logistics orchestration across urban, peri-urban, and rural delivery corridors presents consistent long-term growth potential for software developers and logistics consultancies

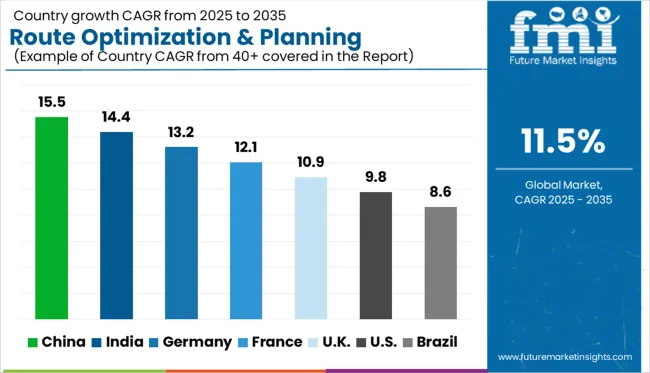

| Countries | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| France | 12.1% |

| UK | 10.9% |

| USA | 9.8% |

| Brazil | 8.6% |

The global route optimization & planning software market is projected to grow globally at a CAGR of 11.5% from 2025 to 2035, fueled by logistics digitization, last-mile delivery complexity, and real-time fleet analytics. China leads with a robust 15.5% CAGR as autonomous logistics platforms and AI-based route computation engines gain widespread adoption.

India, growing at 14.4%, is witnessing surge in demand across e-grocery, B2B delivery, and intercity logistics sectors. Germany and France follow at 13.2% and 12.1%, respectively, reflecting structured adoption among postal, pharmaceutical, and foodservice verticals. The United Kingdom, with a 10.9% CAGR, shows rising demand from D2C brands and urban distribution networks. These five countries represent strategic benchmarks from a wider 40+ country analysis.

China is projected to grow at a CAGR of 15.5%, driven by expanding autonomous delivery systems, smart logistics platforms, and AI-based traffic routing solutions. Rapid expansion of e-commerce logistics has prompted investment in predictive algorithms, vehicle clustering, and time-sensitive route planning.

Leading platforms like JD Logistics and Cainiao are embedding route optimization modules into cloud-based delivery ecosystems. Urban congestion is prompting wider use of real-time data from GPS and IoT sensors for last-mile efficiency. Deployment of AI-integrated software is seen across sectors from food delivery to freight forwarding, improving fleet productivity in dense city grids and rural lanes alike.

India is forecast to grow at a CAGR of 14.4%, fueled by e-commerce fulfillment expansion, high-volume courier networks, and the rise of quick commerce platforms. Logistics aggregators and hyperlocal delivery startups are deploying route planning tools for fuel efficiency and time management across urban sprawl. Retailers and FMCG distributors increasingly rely on geospatial intelligence and multi-stop routing engines to reduce delivery times and vehicle idle rates.

Government-backed logistics parks and cold chain schemes are prompting structured adoption in temperature-sensitive supply chains. Domestic SaaS providers are tailoring low-bandwidth versions for deployment in tier-2 and rural zones.

Germany is projected to register a CAGR of 13.2%, supported by high adoption in regulated logistics, postal operations, and industrial distribution. Enterprises are investing in API-integrated optimization platforms to manage fuel usage, emission targets, and time-sensitive freight regulations. Large fleets are transitioning toward adaptive route planning that accounts for toll zones, traffic restrictions, and vehicle weight compliance.

Automotive logistics, especially spare part delivery chains, are leveraging these tools to maintain just-in-time schedules. Regional logistics clusters prioritize route compliance aligned with environmental and operational standards, especially in cross-border routes.

France is anticipated to grow at a CAGR of 12.1%, with logistics operators digitizing fleet operations to adapt to low-emission zones, urban delivery mandates, and last-mile e-commerce constraints. Companies are implementing software for optimal route clustering, drop density planning, and dynamic rescheduling to combat delays caused by urban traffic.

Retail distribution and foodservice logistics are core end-users, particularly in metropolitan areas with narrow delivery windows. Several operators are moving toward end-to-end optimization platforms with vehicle telemetry and load balancing capabilities to improve route profitability and customer SLAs.

The United Kingdom market is forecast to grow at a CAGR of 10.9%, supported by increased adoption among D2C brands, subscription-based meal kits, and same-day delivery services. Route optimization platforms are being utilized to manage the rising demand for contactless, time-defined deliveries in dense urban neighborhoods.

Fleet management providers integrate these systems for predictive routing, route deviation alerts, and carbon reduction tracking. The post-Brexit regulatory environment has also encouraged software deployment to manage customs buffer times and mainland-to-island logistics. Cloud-based tools with drag-and-drop scheduling and AI-generated time slots are gaining traction among mid-sized delivery businesses.

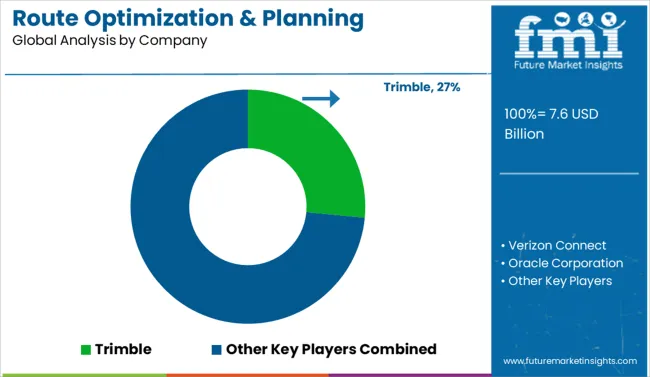

The route optimization and planning software industry is led by Trimble, which holds a significant market share through its advanced telematics and logistics automation platforms tailored for complex fleet operations. Verizon Connect and Omnitracs serve large-scale delivery networks by offering real-time tracking, predictive ETAs, and multi-stop optimization.

Oracle Corporation and Descartes Systems Group provide enterprise-level routing engines that integrate with ERP and supply chain management suites. Locus and FarEye focus on last-mile delivery and dynamic rerouting for e-commerce and hyperlocal logistics.

OptimoRoute targets SMEs with scalable, cloud-native route planning tools. Market competition is now driven by AI-based ETA prediction, API-driven integration with third-party systems, and user-centric interfaces that support faster decision-making in time-sensitive delivery environments.

In January 2025, Verizon Connect debuted Extended View Cameras and a customizable Driver Vehicle Inspection Report (DVIR) via its Reveal platform, enhancing 360-degree fleet visibility, real-time compliance tracking, and operational safety across USA and Canadian fleets.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 Billion |

| Component | Software and Services |

| Organization Size | Large enterprises and Small and Medium Enterprises (SME) |

| Deployment Model | Cloud-based and On-premises |

| Vertical | Transportation and logistics, Retail and e-commerce, Food delivery services, Field services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trimble, Verizon Connect, Oracle Corporation, Descartes Systems Group, FarEye, Locus, Omnitracs, and OptimoRoute |

| Additional Attributes | Dollar sales in route optimization and planning software are segmented by deployment model cloud, on-premises, and hybrid, with cloud-based SaaS gaining dominant share. Rising demand centers on AI-driven dynamic routing, real-time traffic integration, and emissions minimization features. OEMs and CDMOs offer white-label solutions and API-enabled platforms. North America and Europe lead adoption, driven by e-commerce and green logistics initiatives. |

The global route optimization & planning software market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the route optimization & planning software market is projected to reach USD 22.5 billion by 2035.

The route optimization & planning software market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in route optimization & planning software market are software and services.

In terms of organization size, large enterprises segment to command 59.8% share in the route optimization & planning software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Router And Switch Size Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Router Bits Market Growth - Trends & Forecast 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Mobile Hotspot Router Market Size and Share Forecast Outlook 2025 to 2035

WAN Optimization Controllers Market Analysis by Solution, Application, End User, and Region Through 2035

WAN Optimization Market Insights – Growth & Industry Trends 2023-2033

Network Optimization Market Size and Share Forecast Outlook 2025 to 2035

App Store Optimization Software Market Size and Share Forecast Outlook 2025 to 2035

Experience Optimization Platforms Market Size and Share Forecast Outlook 2025 to 2035

Advertising Optimization Plan Market Size and Share Forecast Outlook 2025 to 2035

Multi-cloud Optimization Tools Market Size and Share Forecast Outlook 2025 to 2035

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

Conversion Rate Optimization Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Premade Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Eco Friendly Laundry Product Market Size and Share Forecast Outlook 2025 to 2035

Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA