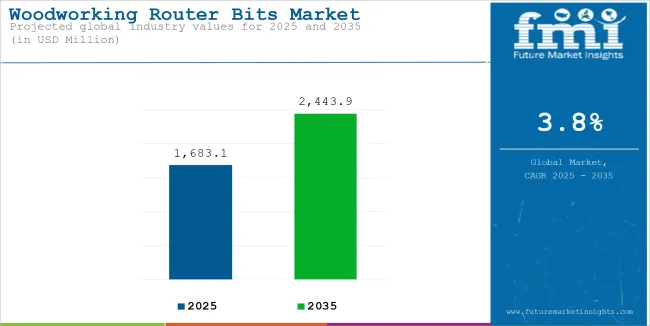

The international woodworking router bits market is expected to grow remarkably between 2025 and 2035 due to the rising need for accuracy in woodworking, improvement in tool materials and design, and the growing popularity of personalized furniture. The market is expected to grow from USD 1,683.1 million in 2025 to around USD 2,443.9 million by 2035, indicating a Compound Annual Growth Rate (CAGR) of 3.8% during the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,683.1 million |

| Industry Value (2035F) | USD 2,443.9 million |

| CAGR (2025 to 2035) | 3.8% |

The market for woodworking router bits is driven by a number of factors. The increasing need for properly designed, sophisticated homes, combined with the application of engineered wood, is likely to drive market growth significantly. With the increase in the world population and urbanization, more residential and commercial properties are being developed. This expansion leads to a higher demand for aesthetically pleasing wooden furniture, hence propelling the market throughout the forecast period.

Technological advancements have also played an important role in the growth of the market. The creation of new materials such as carbide and diamond-tipped bits has enhanced the tool life and efficiency of router bits. These materials are more wear-resistant and have higher hardness, which allows them to make cleaner cuts and live longer.

Moreover, improvements in CNC machines have increased the precision and accuracy of woodworking operations, and as a result, there has been increased demand for expert router bits that can meet the requirements of such sophisticated machines.

The demand for woodworking router bits is being driven by the growing popularity of do-it-yourself (DIY) projects and home renovation work, particularly for hobbyists and small companies. Throughout the forecast period, the growing global popularity of do-it-yourself woodworking projects will continue to drive the demand even more, leading to high demand for woodworking machinery like routers and bits.

The growing disposable incomes and altered consumer buying pattern towards designer and customized furniture's have contributed to a greater demand for detailed and fashionable woodworking designs. This trend compels the use of specialized router bits capable of delivering high precision and flexibility in design, thereby fuelling market growth.

The North American market for woodworking router bits is growing due to technological innovation and high emphasis on innovation. The United States, specifically, has a well-developed woodworking sector that increasingly uses sophisticated machinery to increase productivity and respond to the need for customized products. The presence of major market players and research and development investment are factors in the growth of the region's market.

In Canada, too, the woodwork industry is adopting sophisticated equipment to enhance productivity and quality. The nation's focus on renewable forestry is a natural fit for the application of high-accuracy router bits that maximize material yield and minimize wastage. Finally, the emerging culture of making things oneself as well as remodelling in North America is boosting sales among amateur and professional woodworkers for woodworking equipment like router bits.

European woodworking router bit demand is characterized by high quality and sustainability considerations. Leading countries like Italy and Germany, which are well-known for their engineering skills, are leading the way in adopting premium woodworking equipment. The environmentally sustainable approach and utilization of green materials in woodworking within the region also drive the need for precise woodworking tools minimizing the waste.

The strict environmental regulations and product standards of the European Union force companies to invest in high-end router bits to adhere to these mandates. The continent's long heritage of furniture manufacturing and craftsmanship also fuels the demand for high-precision woodworking tools on a steady basis. Interest in traditional methods of woodworking complemented by cutting-edge technology has also fuelled the growth of the market in Europe.

Growing urbanization and development in the Asia-Pacific region are propelling demand for interior design and furniture. Woodworking industries in countries such as China and India are growing extensively, and more advanced tools are being utilized in order to cope with the needs of mass production and meet the growing middle class's craving for custom furniture.

Southeast Asian emerging markets are also propelling market growth. Growth in the tourism and hospitality industries in Thailand and Vietnam has raised demand for quality furniture, and manufacturers are using sophisticated technologies to boost production. Moreover, government policies favoring small and medium-sized enterprises (SMEs) in the woodwork industry are likely to accelerate the region's adoption of advanced router bits.

Challenges

High Initial Investment and Maintenance Costs

The high capital outlay to purchase sophisticated router components and the associated maintenance expense are drawbacks, particularly for small and medium businesses (SMEs). The requirement of experienced operators and regular training adds even more to operating expenses, which may deter the smaller players from expanding their market share.

Producers are considering leasing and financing options to enable SMEs to more easily access improved products to address these challenges. Expanding the customer base is possible by creating cheaper but quality products. The skill barrier is lowered by providing training courses and easy-to-use interfaces, which will make higher usage by hobbyists and small workshops possible.

Environmental Regulations and Sustainable Practices

Stringent environmental laws governing deforestation and timber sourcing impact the availability of raw materials for woodwork. Compliance with such regulations necessitates adopting sustainable processes and using certified products, impacting the activities of woodwork companies and their choice of equipment.

Advance router bits offer the promise of enhancing sustainability by reducing waste and maximizing material use. Businesses that market products as being environmentally friendly can appeal to environmentally conscious consumers and be part of larger world trends towards sustainability. Creating router bits suitable for use with recycled or substitute materials can also create new sustainability-oriented market segments.

Skilled Labor Shortage

High-end woodworking machinery requires skilled workers familiar with programming and machine handling. Application of modern technologies in the woodworking industry could be limited by a shortage of such skilled employees.

Crafting intuitive interfaces has the potential to reduce the cost of entry to operators, creating more opportunities for adoption. Adapting apprentice programs and lifelong learning opportunities may also serve to retain skilled human capital and produce a constant pool of skilled resources.

Opportunities

Integration of IoT and Smart Technologies

The use of Internet of Things (IoT) and smart technologies in woodworking machinery offers additional opportunity for enhanced performance. Through real-time monitoring, predictive maintenance, and data analytics, adopters can potentially create competitive advantage by optimizing production processes, reducing downtime, and optimizing tool life.

Making router components with sensors to track wear and performance can give customers useful information that allows them to replace and service immediately. This can save costs and improve the quality of the finished product overall.

Expansion to Emerging Markets

Wood router bit industry in emerging economies holds huge growth opportunities. Urbanization, increased disposable income, and higher demand for customized furniture are a supportive environment for growth in these economies. Creating strong footprints in such markets with specialized products and profitable alliances can fetch high returns.

Between the years 2020 and 2024, the woodworking router bits market experienced a consistent increase in demand due to increasing demand for efficiency and precision in woodworking operations, the growth of the furniture and cabinet industries, and technology improvements in CNC machining.

Growth in carbide-tipped and diamond-coated router bits has been a significant achievement in professional and small-scale woodworkers' work by increasing the tool's performance and lifespan. The selling of artistic CNC routers aimed at automation has also become more frequent, as these devices promote the need for dedicated smart router bits which permit faster cutting, less waste material, and better finishing.

Manufacturers wanting to achieve sustainability have been motivated to develop eco-friendly coatings and tool materials with longer lifespans as also to minimize raw material consumption.

With the further explorations and advances made in the field of material science, the AI-based CNC machining operation, and the enhanced tool efficiency, the market shall be metamorphosed in- 2025 to 2035.

Router bit geometries prepared from metals that use smart manufacturing techniques will be more durable and precisely designed. The new modular and pre-assembled furniture that customers want will have routers with new geometries that allow the use of different materials like composites, recycled wood, engineered wood, etc.

Also, with the advent of new coatings and cooling systems, router bits will be operating at high speeds and withstand more heat. New materials that can be recycled as well as bio-lubricants will be produced as a by-product of the sustainability program undertaken.

The industry's transformation through digital manufacturing solutions will also be marked by the implementation of predictive analytics along with tool management based on the cloud that results in men's time-saving and machine downtime reduction thereby improving operational efficiency.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Woodworking gadgets properly handle safety protocols, but do not produce dusts that are outside the limits of dust emission regulations. |

| Technological Advancements | The boom in carbide-tipped bits, CNC router integration, and laser-marked bit identification. |

| Industry-Specific Demand | Strong demand from furniture, cabinetry, and decorative woodworking sectors. |

| Sustainability & Circular Economy | Precipitant of the shift towards the more durable materials while seeking ways to decrease tool wastage. |

| Market Growth Drivers | The increasing need for specially-designed wooden products and the consequent growth of CNC routers that are laser-etched. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Environmental regulations have indecisively turned out to be more strict, companies have been mandated to use environmentally friendly painting, and the wheels of the economy can only be set rolling by the imposition of standard regulations on certain types of manufacturing. |

| Technological Advancements | AI solutions in tool wear monitoring, high-speed thermal-resistant coatings, and smart bit geometry optimization. |

| Industry-Specific Demand | Modular construction, prefabrication, and custom interior solutions were the main areas that noticed the growth of these technologies. |

| Sustainability & Circular Economy | Research of recyclable router bits, bio-based lubricants, and eco-friendly coating for tools. |

| Market Growth Drivers | Acquisition of smart machinery, management of CNC tools from the cloud, and automatic woodworking that is powered by AI. |

The United States woodworking router bits market is speeding up because precision cutting tools are more and more sought-after in the furniture and cabinetry production sector. The CNC routers used in programming robots have taken over the woodworking sector which as a result prompted the need for the top router bits.

Also, the market for consumer products is growing thanks to the interest of people in DIY woodworking activities and their home renovation trends. Besides the durability and efficiency of carbide and diamond-coated bits, the imposition of technological advancements has also been included.

| Country | CAGR (2025 to 2035) |

|---|---|

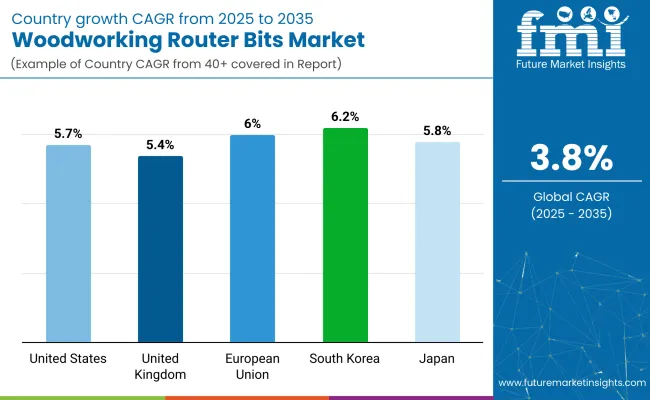

| United States | 5.7% |

The woodworking router bits market in the United Kingdom is under significant growth due to the increasing demand for custom and bespoke furniture. The penetration of precision tools in not only the small-scale manufacturing sector but also the industrial woodworking sector is augmenting the market. The persistence of woodworking and the greater use of distressed wood are the primary factors goading the innovation in router bit design and efficacy.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

The woodworking router bits market of the European Union is being propelled by industrial automation and smart woodworking technologies. The transition towards sustainable and energy-efficient cutting tools has become the dominant trend. Furthermore, the necessary increase in human resources skilled in woodworking is being brought by the growing investments in education and training programs in the sector, thus increasing router bit sales.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

Japan's woodworking router bits market is developing with the country's emphasis on precision engineering and exquisite craftsmanship. The advanced cutting tool materials and the miniaturization of router bits for intricate detailing are the main trends. The high demand for compact, high-efficiency woodworking equipment in urban areas is a major factor contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The woodworking router bits sector in South Korea is witnessing a positive trend as a result of the implementation of automation in the furniture sector and the further acceptance of the high-speed CNC routers. The availability of different router bits increases through the growth of e-commerce platforms, which, in turn, helps the routers entry into the market. Alongside, the government efforts that are directed towards the importation of tools support the local tool manufacturing industries, which in turn, increases market competitiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

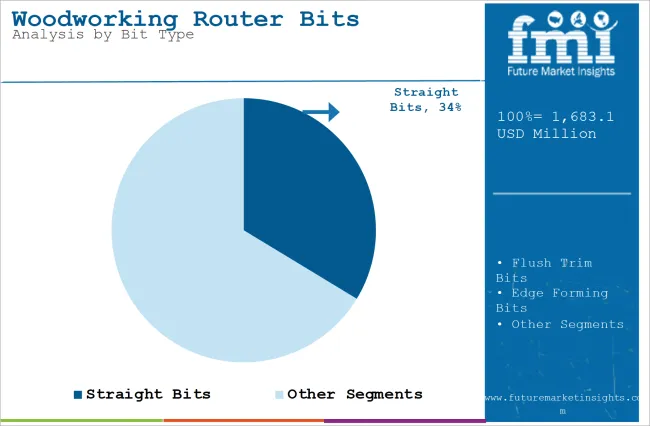

Woodworking straight router bits are often used in the furniture industry due to their multi-functionality in cutting, hollowing, and grooving processes. These bits are practically the backbone of the furniture, cabinetry, and flooring production chain. Carbide and high-speed steel (HSS) router bits, which are innovations to the demand for cutting tools with a higher speed, hardness, and precision, are the ones propelling the growth of the sector.

The trend of more and more woodworkers using CNC machines is also a factor that importantly raises the straight router bits demand, particularly in North America and Europe. The increase in the use of construction projects and the interest in modular furniture are primarily the reasons for the growth of the Asia-Pacific region.

Flush trim bits are key to creating smooth and seamless edges and are predominantly used in veneering and paneling applications. These bits have largely come to be used in contemporary wood workshops to ensure proper and accurate finishes. Chamfer bits are, conversely, in the rise due to their skill at making decorative edges and beveled cuts, especially in furniture and cabinetry procedures.

The rising trend of customized interior design coupled with architectural woodworking is the main reason leading to an increase in these bits production. The expectations for these router bits are that they will experience steady growth across North America, Europe, and Asia-Pacific where the emphasis on aesthetics and fine craftsmanship is climbing.

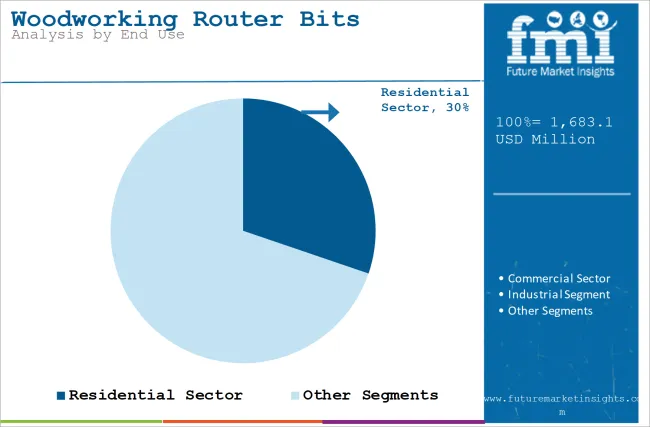

In the residential sector, woodworking router bits are on an upward spiral, with the rapid rise of homeowners who want personalized wood products, cabinets, and flooring, as well as decorative elements. The shift towards modern interior design and the trend of DIY woodworking are positively impacting router bit sales thus making them more widely available to the public.

The rise in household incomes along with the escalating tendency towards home renovations are both reasons for the growth of the market. North America and Europe are the regions that have been developed along with this segment, whereas the emerging economies in Asia-Pacific are growing mainly because of the rise of urban housing projects and home renovation activities.

The commercial sector that includes offices, retail, and hospitality is adopting woodworking router bits for custom designs and mass production of furniture. The high-quality, long-lasting timber structures have gained attention, and now companies are investing in the precise machining of router bits for the rationing of materials.

The focus on eco-friendly and sustainability issues has brought up the use of high-performance, long-lasting cutting instruments which, at the same time, conform to the environmentally friendly practices of manufacturing. Commercial woodworking applications predominantly take place in areas such as North America and Europe, while Southeast Asia and the Middle East are the new regions that promise growth by virtue of infrastructure and tourism developments.

One main reason for the mountain rise of the global Woodworking Router Bits Market is the high level of demand for predetermined woodworking, leading automation in the production of furniture and CNC machining development. The primary competitors have contended one against the other, thus, offering the very best quality carbide-tipped bits, precision-ground cutting edges and specialized coatings for the respective durability and cutting efficiency.

This market is growing through the technical improvement, the greater implementation of the CNC routers and the new trend in customized furniture manufacturing, with companies which mainly work on low-cost and high-precision router bits. The creation of debt through the introduction of cheaper, application-specific router bits proving to be an increase in the competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Freud Tools | 18% to 22% |

| Amana Tool | 15% to 19% |

| Whiteside Machine Company | 12% to 16% |

| CMT Orange Tools | 9% to 13% |

| Bosch Tools | 6% to 10% |

| Other Companies (combined) | 30% to 40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Freud Tools | Develops high-performance carbide and precision-ground router bits for woodworking. |

| Amana Tool | Specializes in industrial-grade router bits with unique geometries and coatings. |

| Whiteside Machine Company | Focuses on premium-grade solid carbide and carbide-tipped router bits. |

| CMT Orange Tools | Provides cost-effective and high-durability router bits for furniture manufacturing. |

| Bosch Tools | Offers innovative router bit sets integrated with smart cutting technology. |

Freud Tools

Freud Tools is the company with the biggest market share in the area of high-performance carbide and precision-ground router bits, which are the very best options for professional and industrial woodworking. The company mostly puts its money on micro-grain carbide technology to make the cutting more precise and the tool last longer. Freud’s concern on anti-kickback designs and non-stick coatings increases the efficiency of the tools.

Amana Tool

The Amana Tool company manufacturer is of industrial router bits the company has been in the market since the sixties, and it offers unique shapes and advanced coatings that promote high-quality cutting output. Besides router bits, the company also concentrates on the high-speed routing solutions sector and has engineered laser-cut stabilizers to slow down the speed at which bits go dull. The company with its commitment to custom tooling solutions not only ever strengthening but also securing its position in the market.

Whiteside Machine Company

Whiteside Machine Company is concentrated in solid carbide and tungsten-carbide-tipped router bits, durable, and precision machined. Whiteside machine Co. is a giant player in custom-built cabinetry and furniture manufacturing while its emphasis on low-vibration and heat/ecommerce-resistant models maximizes output in high-speed applications.

CMT Orange Tools

CMT Orange Tools that is targeting woodworkers, furniture manufacturers, and DIY enthusiasts alike, offers budget-friendly and long-lasting router bits for personal use. CMT's R&D has funded the development of titanium-based coatings allowing for bit longevity and less chemical waste. The CMT or the international distribution network that the company has is the one that makes it reach more markets.

Bosch Tools

Bosch Tools is a company that marries router bit with smart technology to enhance functions of precision, efficiency, and safety. This company has recently rolled out a sensor-based cutting system that automatically chooses the optimal material engagement thus reducing the degree of kickback. The Bosch Company that focuses on the sustainable and ergonomic tooling solutions proves to be in line with the modern industry's demands.

The Woodworking Router Bits Market can be segmented based on:

Western Europe is likely to lead the woodworking router bits industry.

The market is expected to reach USD 1,683.1 million in 2025.

The woodworking router bits industry is likely to secure a CAGR of 3.8% through 2035.

The woodworking router bits market is projected to reach USD 2,443.9 million by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Woodworking CNC Tools

Woodworking Tools Market

Woodworking Machines Market

Europe Woodworking Power Tools Market Growth - Trends & Forecast 2025 to 2035

Router And Switch Size Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Mobile Hotspot Router Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

Oil Field Drill Bits Market Growth - Trends & Forecast 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA