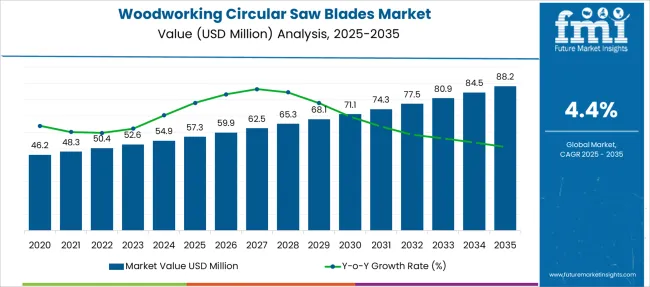

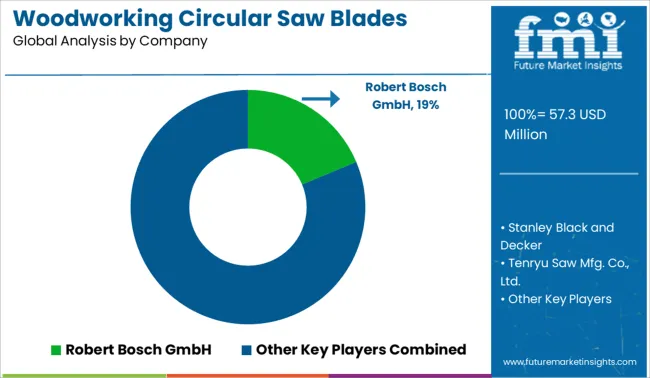

The Woodworking Circular Saw Blades Market is estimated to be valued at USD 57.3 million in 2025 and is projected to reach USD 88.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Woodworking Circular Saw Blades Market Estimated Value in (2025 E) | USD 57.3 million |

| Woodworking Circular Saw Blades Market Forecast Value in (2035 F) | USD 88.2 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The woodworking circular saw blades market is expanding as demand rises for efficient and precise cutting tools across various woodworking industries. Industry insights show that construction, furniture manufacturing, and DIY sectors have increased their need for reliable saw blades that deliver clean cuts and durability.

Advances in blade design and materials have improved cutting performance and blade longevity, supporting higher productivity in woodworking applications. The growth in construction and renovation projects globally has further driven blade demand, especially for tasks requiring specialized cutting tools.

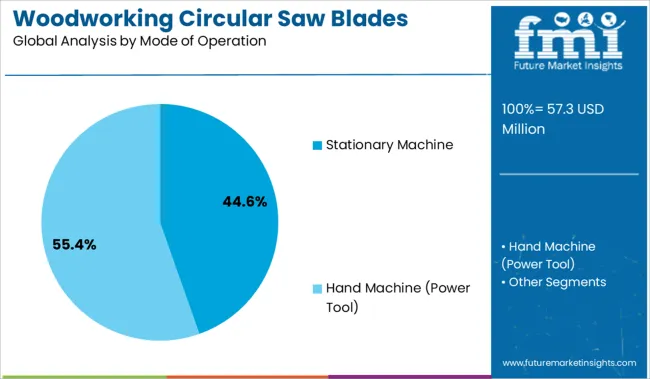

Increasing adoption of stationary machines in workshops and factories has emphasized the importance of blade compatibility and performance under continuous operation. The market outlook is promising as manufacturers innovate to meet evolving woodworking needs with a focus on safety, precision, and efficiency. Segmental growth is expected to be led by framing blades due to their versatility, stationary machine operation mode, and the 100-200 mm diameter size range favored for common woodworking tasks.

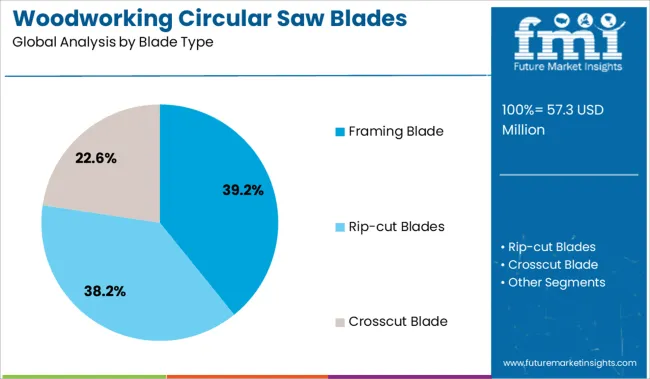

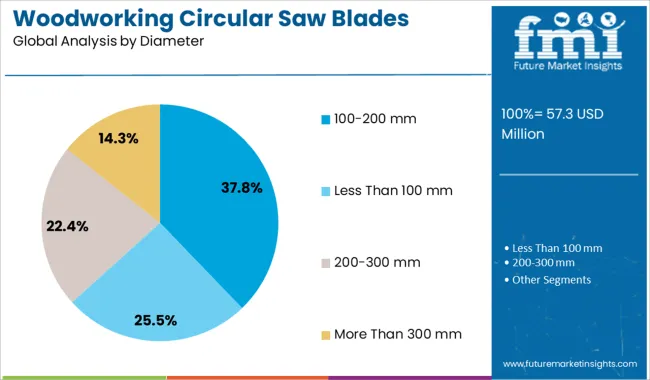

The market is segmented by Blade Type, Mode of Operation, Diameter, Distribution Channel, and End Use Industry and region. By Blade Type, the market is divided into Framing Blade, Rip-cut Blades, and Crosscut Blade. In terms of Mode of Operation, the market is classified into Stationary Machine and Hand Machine (Power Tool). Based on Diameter, the market is segmented into 100-200 mm, Less Than 100 mm, 200-300 mm, and More Than 300 mm. By Distribution Channel, the market is divided into Offline Sale and Online Sale. By End Use Industry, the market is segmented into Furniture & Carpentry, Timber, Wood Processing, and DIY. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The framing blade segment is projected to contribute 39.2% of the woodworking circular saw blades market revenue in 2025, retaining its position as the leading blade type. Growth has been driven by the blade’s versatility in cutting a wide range of construction materials including wood and composite panels. Its design supports fast, rough cuts that are essential in framing and structural applications.

Carpenters and construction professionals have preferred framing blades for their balance between cutting speed and durability. The blade’s ability to maintain sharpness over extended use reduces downtime and replacement costs.

With ongoing infrastructure projects and new building developments, the demand for framing blades is expected to remain strong.

The stationary machine segment is expected to account for 44.6% of the market revenue in 2025, maintaining dominance as the preferred mode of operation. Stationary saw machines offer greater stability and precision in repetitive cutting tasks, making them indispensable in professional woodworking shops.

The capacity to handle larger blade diameters and deliver consistent cuts under high load conditions has contributed to the segment’s growth. Workshops focused on furniture and cabinetry production have increasingly invested in stationary saw machines to enhance efficiency and safety.

As automation and production throughput continue to grow, stationary machine operation will remain a key driver in the market.

The 100-200 mm diameter segment is projected to hold 37.8% of the woodworking circular saw blades market revenue in 2025, emerging as the leading blade size. This size range has been favored for its compatibility with widely used woodworking machines and applications requiring medium to fine cutting precision.

The segment’s popularity stems from its adaptability across various materials and projects including framing, cabinetry, and furniture making. Manufacturers have optimized blade designs within this diameter to balance cutting speed, accuracy, and durability.

The growing demand for versatile blades that can perform well in multiple cutting scenarios supports the segment’s sustained growth.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 4.0% |

| H1,2025 Projected (P) | 4.2% |

| H1,2025 Outlook (O) | 4.3% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 10 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 29 ↑ |

FMI presents a half-yearly comparison analysis and key insights about the growth outlook of the woodworking circular saw blades market. Global urbanization and industrialization have raised demand for circular saw blades used in the woodworking industry. Circular saw blade usage for woodworking has been significantly impacted by shifting lifestyle habits around the world.

According to FMI analysis, the variation between the BPS values observed in the Woodworking Circular Saw Blades market in H1, 2025-Outlook over H1, 2025-Project reflects a rise of 10 units. Moreover, compared to H1, 2024, the market is expected to rise by 29 BPS in H1 2025.

The global market for woodworking circular saw blades has been greatly impacted by technological improvements and product developments. Circular saw blade sales for woodworking are anticipated to benefit in the near future from the increasing profusion of new technology in industries.

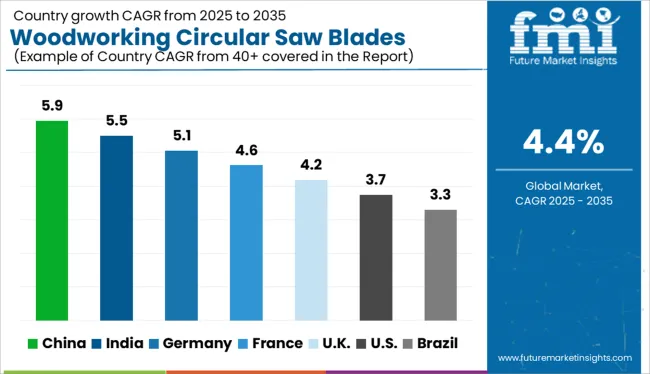

Global industrialization has accelerated, and economies like India and China, in particular, have tremendous potential. The need for building new homes and businesses is rising along with the global population, which has a significant impact on the market for woodworking circular saw blades. In recent years, tools with diamond coatings have become more popular than those with carbide coatings because they provide greater abrasion resistance and longer tool life, impacting the market growth.

Urbanization and industrialization on a global scale have resulted in increased demand for woodworking circular saw blades. Changing lifestyle trends across the world have also substantially impacted the consumption of woodworking circular saw blades.

Sales of woodworking circular saw blades accounted for a net worth of USD 38.1 Million in 2014 and rose at a CAGR of 3.5% and attained a valuation of USD 54.9 Million by the end of 2024.

Increasing scope of application across multiple industry verticals like automotive, building & construction, etc. is expected to be a prominent factor that is anticipated to propel market potential in the forthcoming years.

Technological advancements and product developments have significantly influenced the woodworking circular saw blades market across the world. Rising proliferation of advanced technologies in industries is expected to aid woodworking circular saw blade sales in near future.

Shipments of woodworking circular saw blades from 2025 to 2035 are estimated to rise at a 4.4% CAGR.

Increased Industrialization and Rising Construction Activity to Guide Woodworking Circular Saw Blade Demand

Industrialization has increased across the world and especially it has seen immense potential in economies like India and China. The population of the world is increasing and so is the demand for construction of residential and commercial structures which in turn is majorly influencing the woodworking circular saw blades marketplace. Woodworking circular saw blade manufacturers are launching new and advanced circular saws for the aforementioned applications.

Popular Mechanics in an article stated that Bosch’s GKS18V-25GC Circular Saw is one of the best that they have ever tested. With amazing accuracy and factory standard 24-tooth blade, this circular saw is already counted among the best and should emerge as a popular choice in construction and furniture industry for its nimble precision and accuracy statistics.

Rising Popularity of Diamond-coated Tools to Hinder Market Growth Potential

In recent times, diamond-coated tools have gained popularity over carbide-coated tools as they offer higher abrasion resistance and longer tool life. This is expected to adversely affect woodworking circular saw blade shipments over the forecast.

However, the high cost of diamond-coated tools is a hurdle that manufacturers haven’t figured out which is a relief for carbide-coated tool manufacturers. So for now diamond-coated tools have a minimal impact but this could change over the coming years as prices of these tools get competitive.

East Asian and South Asian Regions Anticipated to See High Demand for Woodworking Circular Saw Blades

The global woodworking circular saw blades industry analysis provides detailed insights across multiple geographies such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

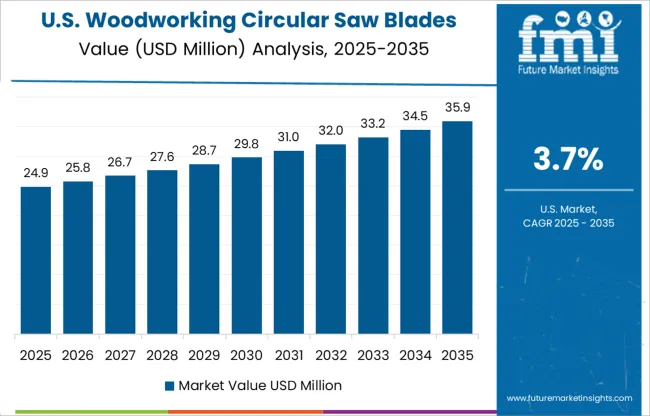

The North America woodworking circular saw blades market accounts for a share of 23.7% of the global woodworking circular saw blades industry in 2025. Increased use of wood in commercial and residential building applications has been a major influential factor for woodworking circular saw blades consumption in this region.

Sales of woodworking circular saw blades in Europe are expected to be primarily driven by increased reconstruction and remodeling activities in this region. Renovation of old structures, new construction activities, etc. are some other factors that would be crucial in the European woodworking circular saw blades industry which currently holds a significant market share of 28.3% in the global marketplace.

Woodworking circular saw blades are expected to see high demand from regions such as South Asia, East Asia, and the Pacific. These regions are expected to prove highly lucrative for woodworking circular saw blade suppliers. Increased construction activities in the residential, as well as commercial sectors in these regions, is anticipated to majorly drive woodworking circular saw blades demand in the aforementioned regions.

Increasing Scope for Residential and Commercial Application of Circular Woodworking Saws

With being one of the foremost economies of the world, the USA offers extremely lucrative opportunities in its residential and commercial construction sectors as it is a highly popular real estate market. High spending potential propels demand for circular saws for fine woodworking in the USA

Increasing number of immigrants in the USA are also expected to drive up the demand for construction of new structures which subsequently propels woodworking circular saw blade sales.

Changing Lifestyle Trends Expected to Propel Demand for Fine Woodworking

Rising disposable income in India has led to some major changes in lifestyle trends over the past years and is expected to shape demand for circular saws for fine woodworking. Lifestyle changes have led to an increase in renovations and a high standard of living has given impetus to fine woodworking.

Increasing demand for premium furniture from commercial and residential sectors is expected to guide woodworking circular saw blades demand in India over the forecast.

Offline Sales of Woodworking Saws to Lose Market Share to Online Sales by 2035

Offline mode currently dominates woodworking circular saw blade sales and is anticipated to hold this stance over the next few years as well. Increasing digitization is expected to come into play and increase the share of online sales with rising preference of consumers for online shopping and increasing use of e-Commerce platforms.

However, both sales channels are expected to contribute significantly to the global revenues as the product portfolio is expanded by woodworking circular saw blade suppliers to boost sales.

Woodworking circular saw blade manufacturers are investing in the research and development of more advanced and efficient tools that make woodworking a task of ease. Woodworking circular saw blade companies are also focusing on launching new products to expand their product portfolios and maximize sales via increasingly popular online channels.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Mode of Operation, Distribution Channel, Blade Type, Diameter, End-use Industry, Region |

| Key Companies Profiled | Freud SpA; Robert Bosch GmbH; Stanley Black and Decker; Tenryu Saw Mfg. Co. Ltd.; Hilti Corporation; DEWALT; HiKOKI; Diablo Tools; Stark S.p.A.; August Blecher KG; C.M.T. Utensili SpA; Karnasch Professional Tools GmbH; Kinkelder BV; PILANA Group a.s.; Amana Tool Corporation; Breton S.p.A; Laguna Tools; Dimar Group; Homag Group |

| Pricing | Available upon Request |

The global woodworking circular saw blades market is estimated to be valued at USD 57.3 million in 2025.

The market size for the woodworking circular saw blades market is projected to reach USD 88.2 million by 2035.

The woodworking circular saw blades market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in woodworking circular saw blades market are framing blade, rip-cut blades and crosscut blade.

In terms of mode of operation, stationary machine segment to command 44.6% share in the woodworking circular saw blades market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Router Bits Market Growth - Trends & Forecast 2035

Examining Market Share Trends in Woodworking CNC Tools

Woodworking Tools Market

Woodworking Machines Market

Europe Woodworking Power Tools Market Growth - Trends & Forecast 2025 to 2035

Circular Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Circular Saw Blade Market Forecast and Outlook 2025 to 2035

Returnable Circular Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Grader Blades Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Blades Market Size and Share Forecast Outlook 2025 to 2035

Skin Graft Blades Market

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Sawing and Cutting Tools Market Growth, Trends and Forecast from 2025 to 2035

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

TC-SAW Filter Market

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA