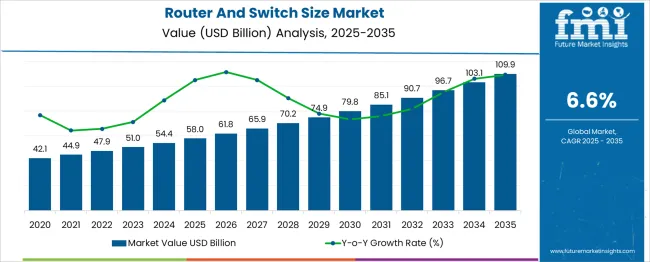

The Router And Switch Size Market is estimated to be valued at USD 58.0 billion in 2025 and is projected to reach USD 109.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Router and Switch Size Market Estimated Value in (2025 E) | USD 58.0 billion |

| Router and Switch Size Market Forecast Value in (2035 F) | USD 109.9 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Advances in network infrastructure have increased the demand for devices that can support high-speed data transmission and seamless connectivity. Data center growth has also played a significant role, as businesses increasingly rely on cloud services and large-scale data processing. The rise of remote work and digital transformation initiatives has further stimulated investments in networking hardware and related services.

Concerns about data protection and cybersecurity have elevated the importance of network security services, pushing organizations to adopt comprehensive security solutions. The market outlook is positive as enterprises continue to modernize their networks to handle higher traffic volumes and enhanced security needs. Segmental growth is expected to be driven by Wireless technology, Data center switches as a product segment, and Network security services as a key service offering.

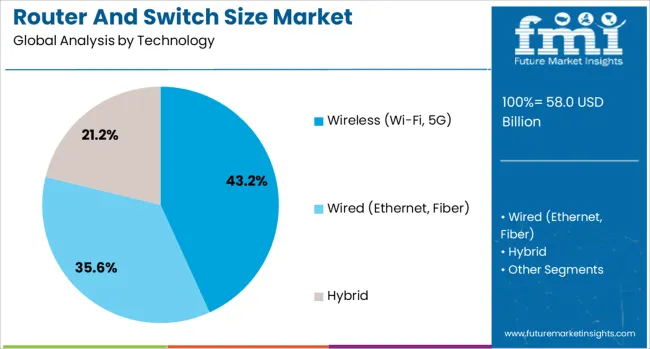

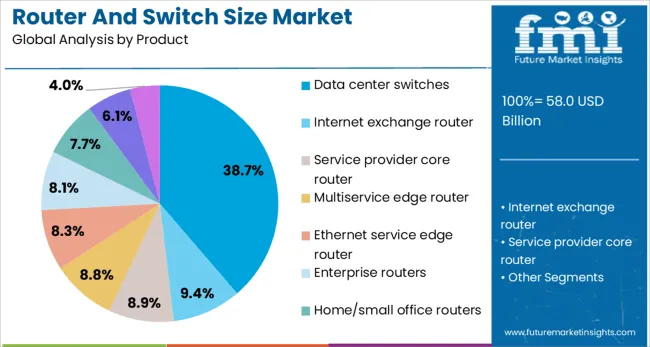

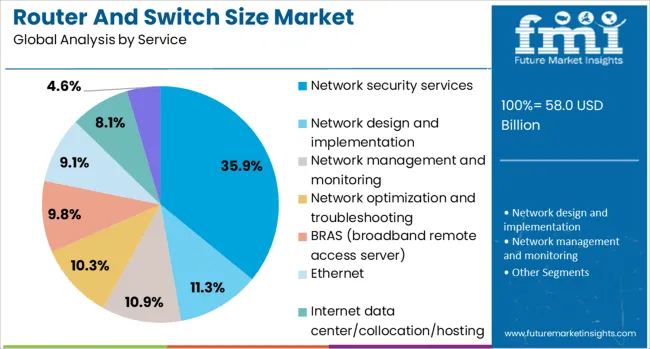

The router and switch size market is segmented by technology, product, service, network type, and end use and geographic regions. Based on router and switch size, the market is divided into Wireless (Wi-Fi, 5G), Wired (Ethernet, Fiber), and Hybrid. In terms of the product of the router and switch size, the market is classified into Data center switches, Internet exchange router, Service provider core router, Multiservice edge router, Ethernet service edge router, Enterprise routers, Home/small office routers, ATM & Ethernet switch, and Others. Based on the service of the router and switch size, the market is segmented into Network security services, Network design and implementation, Network management and monitoring, Network optimization and troubleshooting, BRAS (broadband remote access server), Ethernet, Internet data center/collocation/hosting, and Others. Based on the router and switch size, the, the market is segmented into Local area network (LAN), Wide area network (WAN), Metropolitan area network (MAN), Storage area network (SAN), and Others. By end use of the router and switch size market is segmented into Commercial, Residential, Industrial, Government/public sector, Education, Service provider networks, and Others. Regionally, the router and switch size industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Wireless segment, including Wi-Fi and 5G technologies, is projected to hold 43.2% of the router and switch size market revenue in 2025, making it the leading technology segment. This segment has gained prominence due to the increasing demand for high-speed wireless connectivity in homes, offices, and public spaces. The widespread rollout of 5G networks has enhanced mobile broadband capabilities, enabling faster data speeds and lower latency.

Wi-Fi advancements have improved coverage and device capacity, facilitating the growth of smart homes and IoT applications. Organizations have prioritized wireless solutions to support flexible and scalable network architectures. The surge in mobile device usage and the need for seamless connectivity have solidified wireless technology’s position as a key growth driver in networking hardware markets.

Data center switches are expected to account for 38.7% of the router and switch size market revenue in 2025, maintaining their position as the dominant product segment. The growth of this segment has been driven by expanding data center infrastructure worldwide, fueled by increased cloud adoption and big data analytics. These switches are critical for managing large volumes of data traffic with high speed and reliability within data centers.

As enterprises invest in digital transformation, the demand for scalable, high-performance switching solutions has intensified. Data center operators require switches that provide low latency, high throughput, and energy efficiency.

The increasing complexity of data center networks and the move toward virtualization have further supported the adoption of advanced switch products. This segment’s continued growth is expected as data center capacity expands to meet evolving business needs.

Network security services are projected to contribute 35.9% of the market revenue in 2025, establishing them as the leading service segment. The growing sophistication of cyber threats has heightened the need for robust security measures within network infrastructures. Organizations have increasingly invested in network security services to protect against data breaches, malware, and other vulnerabilities.

These services include threat detection, prevention, and response solutions that safeguard critical digital assets. The rise of cloud computing and remote work has expanded the attack surface, making network security a top priority for enterprises.

Compliance requirements and regulatory mandates have also driven demand for comprehensive security services. As cyber threats evolve, network security services are expected to remain a vital component of the router and switch size market, ensuring network integrity and business continuity.

Network hardware demand is rising as enterprises and service providers upgrade infrastructure for edge computing, 5G deployment, and hybrid cloud connectivity. In 2024, global router and switch shipments grew about 8 %, driven by demand for compact modular units, programmable automation, and open-source network stacks. Deployment is strongest in North America and Asia‑Pacific. Layer‑3 aggregation switches with 25–100 Gbps ports now represent 45 % of new hardware sales. Vendors are offering AI-enhanced monitoring and power‑optimized designs, supporting higher port densities with lower energy overhead. Growing demand includes secure, scalable, stackable switches for distributed micro‑data centers and campus LAN

Organizations are replacing legacy fixed-port routers and switches as higher bandwidth demands and new use cases emerge. Sales of 100 Gbps and 400 Gbps switch ports rose by 22 % in 2024, powering cloud interconnects and AI training clusters. Buyers favor modular chassis switches for scale and hot-swap flexibility, especially in edge and colocation environments. Network automation via scripted APIs and intent-driven orchestration is integrated into 37 % of new deployments, reducing provisioning and configuration time by 40 %. These systems support convergence traffic models (data, voice, video) with seamless QoS control, enabling better uptime and simplified segmentation in campus, hospitality, and branch-office deployments.

High-density switch platforms cost 12–18 % more than equivalent fixed-configuration models, complicating budget allocation. Power draw per Gbps varies up to 20 % across competing units, affecting the total cost of ownership. Supply chain disruption of ASICs and optical modules has extended lead times by 6–8 weeks. Smaller enterprises struggle to align rack standards—compact stackable units often require certified cabling, which adds setup time of 2–3 days. Integration with legacy routing tables or VLAN architectures remains manual in 41 % of installations, increasing deployment risk and slowing migration from older gear.

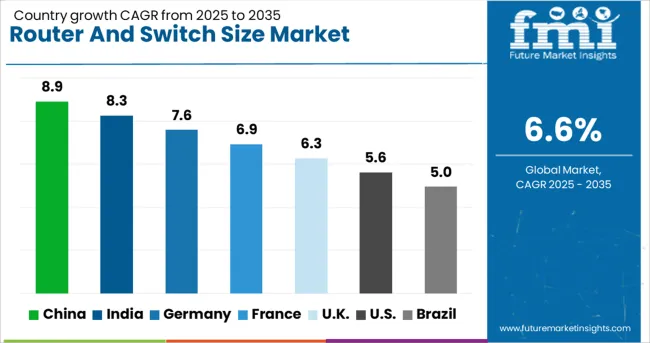

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

Global router and switch size market demand is forecast to rise at a 6.6% CAGR from 2025 to 2035. Among the top five countries evaluated, China records the fastest growth at 8.9%, reflecting a +35% premium over the global rate, driven by government-backed network infrastructure programs and rising industrial digitization. India follows at 8.3%, or +26%, due to expanding 5G rollouts and public-sector digitization efforts. France aligns slightly above the global average at 6.9% (+4%), while the UK trails slightly at 6.3% (–5%). The USA, posting 5.6%, registers a –15% variance, shaped by a mature telecom hardware base and slower refresh cycles. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China is projected to grow at a CAGR of 8.9%. Expansion is tied to metro aggregation upgrades and hyperscale backhaul using router-switch convergence. Domestic OEMs are enabling IPv6 migration with dual-stack-compatible equipment. Tier 3 cities are deploying SD-WAN routers at edge locations for cloud access. Industrial zones are shifting to modular switch systems supporting optical routing. In logistics and education, mid-size enterprises are adopting managed Layer 3 switches for core-to-access modernization.

India is forecast to expand at 8.3% CAGR. Shorter upgrade cycles, especially under four years, are visible across logistics and academic campuses. Modular and chassis switches are in demand across Tier II cities, driven by ISP activity. Public projects favor fanless managed switches with low power draw and PoE for classroom use. Telecom providers are investing in 100G and 400G-ready routers to manage AI traffic at the edge. Local sourcing and distributed control integration remain deployment priorities.

France is projected to grow at a CAGR of 6.9%. SDN adoption and IPv6 upgrades are influencing telecom and government network strategies. Routing-switch bundles are favored in regional fiber expansions. Institutions are replacing outdated L2 switch models with modular and loop-safe designs. Tier II contracts are focused on automated routing via OSPFv3 and BGP-4 protocols. Universities and museums are replacing legacy routers with multi-protocol hardware to support diversified access needs.

The UK market is projected to grow at 6.3% CAGR. Co-working hubs, media labs, and fintech units are driving enterprise hardware orders. Certified switches supporting ISO 27001 are being prioritized in procurement pipelines. Mid-size facilities are deploying white-box switches running open-source NOS platforms. Small banks and lenders are implementing dual-router failover architectures. SME buyers are adopting ARM-based processors to align with internal energy compliance targets.

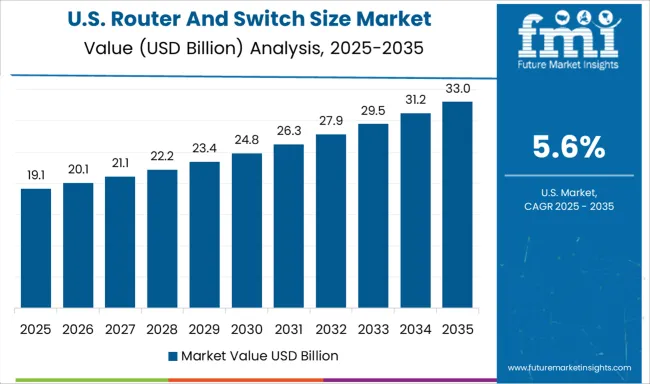

The USA is forecast to grow at 5.6% CAGR. Demand is tied to AI/ML applications requiring low-latency routing in edge and colocation data centers. Cloud and OTT vendors are implementing high-throughput modules across hybrid setups. Fixed switches are popular among SMBs for their ease of deployment in satellite offices. Procurement delays persist in the public sector. QoS-capable access switches are being adopted by rural ISPs and MSPs to manage traffic prioritization and VLAN services.

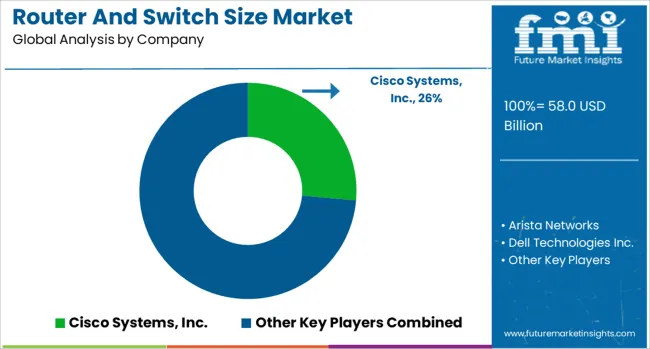

The router and switch market is led by Cisco Systems, Inc., with strong competition from Huawei Technologies, Juniper Networks, and Nokia Networks in carrier-grade and cloud networking solutions. Hewlett Packard Enterprise and Dell Technologies dominate enterprise data center deployments, while Arista Networks excels in high-performance cloud switching. Key market drivers include surging demand for 400G/800G infrastructure, AI-powered network optimization, and sustainable, low-power designs. The industry is transforming with software-defined networking and open architectures disrupting traditional hardware models, particularly for 5G rollouts and hyperscale data center expansions. Energy efficiency and automation capabilities are becoming critical differentiators as networks scale to support IoT, edge computing, and next-generation enterprise connectivity requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.0 Billion |

| Technology | Wireless (Wi-Fi, 5G), Wired (Ethernet, Fiber), and Hybrid |

| Product | Data center switches, Internet exchange router, Service provider core router, Multiservice edge router, Ethernet service edge router, Enterprise routers, Home/small office routers, ATM & ethernet switch, and Others |

| Service | Network security services, Network design and implementation, Network management and monitoring, Network optimization and troubleshooting, BRAS (broadband remote access server), Ethernet, Internet data center/collocation/hosting, and Others |

| Network Type | Local area network (LAN), Wide area network (WAN), Metropolitan area network (MAN), Storage area network (SAN), and Others |

| End Use | Commercial, Residential, Industrial, Government/public sector, Education, Service provider networks, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., Arista Networks, Dell Technologies Inc., Hewlett Packard Enterprise, Huawei Technologies Co., Ltd., Juniper Networks, and Nokia Networks |

| Additional Attributes | Dollar sales by device type and enterprise scale, growing deployment in hyperscale data centers and telecom backbones, stable usage across SMB networks and campus infrastructures, advancements in multi-gigabit throughput and software-defined networking enhance scalability and traffic management |

The global router and switch size market is estimated to be valued at USD 58.0 billion in 2025.

The market size for the router and switch size market is projected to reach USD 109.9 billion by 2035.

The router and switch size market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in router and switch size market are wireless (wi-fi, 5g), wired (ethernet, fiber) and hybrid.

In terms of product, data center switches segment to command 38.7% share in the router and switch size market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Switchgear in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Switchgear in Japan Size and Share Forecast Outlook 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

Demand for Woodworking Router Bits in USA Size and Share Forecast Outlook 2025 to 2035

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Safety Sensors and Switches Market Growth - Trends & Forecast 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA