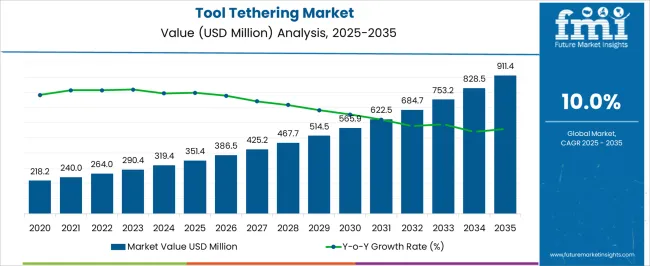

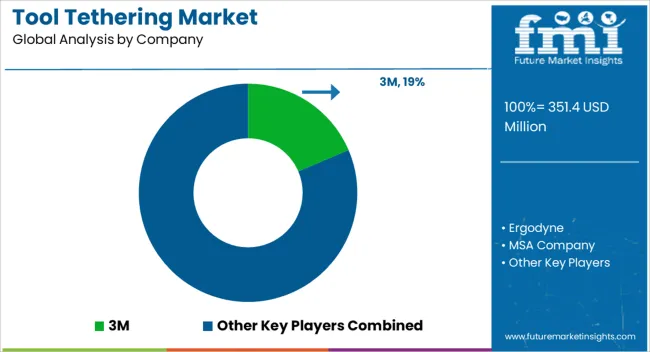

The tool tethering market is estimated to be valued at USD 351.4 million in 2025 and is projected to reach USD 911.4 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 351.4 million to USD 565.9 million, driven by the increasing demand for safety solutions in industrial and construction environments. Year-on-year analysis shows consistent growth, with values reaching USD 386.5 million in 2026 and USD 425.2 million in 2027, supported by rising awareness of tool safety and accident prevention.

By 2028, the market is forecasted to reach USD 467.7 million, advancing to USD 514.5 million in 2029 and USD 565.9 million by 2030. Growth is anticipated to be further fueled by technological advancements in tethering systems and the integration of smart solutions to enhance productivity and worker safety. These dynamics position the tool tethering market as a critical component of workplace safety, offering significant opportunities for innovation and expansion across high-risk industries.

| Metric | Value |

|---|---|

| Tool Tethering Market Estimated Value in (2025 E) | USD 351.4 million |

| Tool Tethering Market Forecast Value in (2035 F) | USD 911.4 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

As regulatory frameworks become more stringent, especially in high-risk environments such as construction, oil and gas, aviation, and manufacturing, companies are increasingly adopting tethering solutions to meet compliance requirements. According to safety briefings, equipment manufacturers and industrial suppliers have been actively promoting integrated tethering systems to reduce liability and improve worker efficiency.

The future outlook is positive, with workplace safety regulations continuing to evolve globally. The market is also benefiting from technological integration, with tethering products now designed for compatibility with a wide range of tools and wearable PPE systems.

Organizations are prioritizing risk management and operational continuity, leading to higher procurement of standardized safety gear. This growing emphasis on proactive safety strategies, combined with the increasing cost of workplace injuries, is expected further to propel demand for tool tethering systems across key verticals.

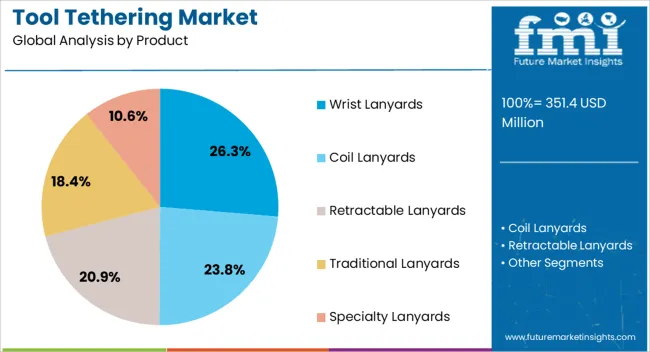

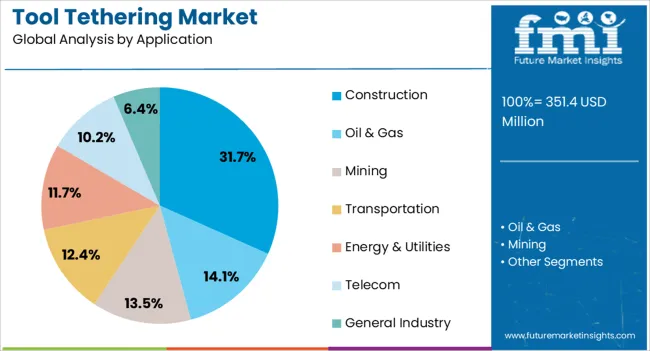

The tool tethering market is segmented by product, application, channel, and geographic regions. By product, the tool tethering market is divided into Wrist Lanyards, Coil Lanyards, Retractable Lanyards, Traditional Lanyards, and Specialty Lanyards. In terms of application, the tool tethering market is classified into Construction, Oil & Gas, Mining, Transportation, Energy & Utilities, Telecom, and General Industry.

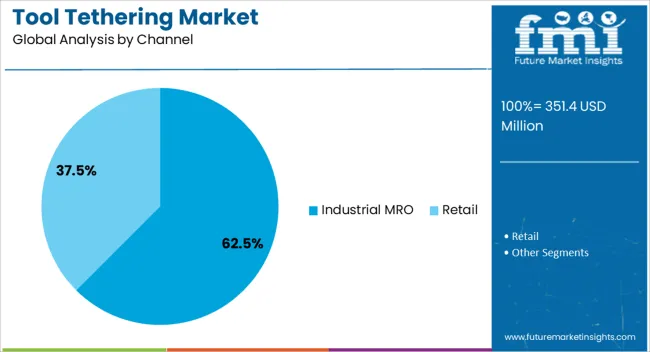

Based on channel, the tool tethering market is segmented into Industrial MRO and Retail. Regionally, the tool tethering industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wrist lanyards segment is anticipated to account for 26.3% of the Tool Tethering Market revenue share in 2025, establishing it as the leading product segment. This dominance has been supported by the lanyards’ ergonomic design and practical utility for handheld tools used in repetitive tasks. Wrist lanyards have been widely adopted due to their ease of use and effectiveness in preventing drops from elevated positions, especially in vertical workspaces.

Their lightweight design and ability to provide immediate retention without restricting movement have contributed to their preference among workers. Safety audits and industry observations indicate that these products have gained traction in applications where mobility, dexterity, and user comfort are critical.

Additionally, growing awareness of hand safety and productivity in demanding environments has increased demand for tethering systems that support seamless workflow.

The construction segment is projected to capture 31.7% of the Tool Tethering Market revenue share in 2025, making it the leading application segment. This dominance has been shaped by the sector’s high-risk nature and increasing regulatory pressure to enforce comprehensive fall protection protocols. Construction sites involve frequent work at heights and the handling of tools in dynamic, high-traffic zones, where tool drops pose a major hazard.

Adoption of tethering systems has been promoted through contractor safety programs and occupational health mandates, encouraging the use of engineered drop-prevention systems. Field operations have shown that tethered tools significantly reduce injury risk and damage to property, supporting overall jobsite safety and project continuity.

Increased spending on infrastructure, urban development, and industrial expansion has led to a broader deployment of safety solutions, including tethering products.

The industrial MRO channel segment is expected to lead the Tool Tethering Market with a 62.5% revenue share in 2025. This growth has been driven by the sector’s central role in supplying aftermarket safety solutions and maintenance equipment to end users across industries. Maintenance, repair, and operations teams often require flexible, compatible, and rapidly deployable tethering systems to support tool handling during repairs or inspections.

The widespread availability of tethering kits and accessories through MRO suppliers has increased accessibility and standardization, especially in facility management and production environments. Procurement managers have been observed to favor this channel due to streamlined distribution, compliance documentation, and the availability of certified equipment.

The segment’s strength is also attributed to increasing outsourcing of maintenance functions and the adoption of predictive maintenance strategies. These trends have collectively positioned the industrial MRO channel as the primary source for tool tethering solutions, ensuring its continued leadership in the market.

Opportunities in expanding industries, along with trends in smart tethering and IoT integration, are reshaping the market. However, high costs and installation complexity remain obstacles. By 2025, addressing these challenges through affordable and efficient solutions will be key to the market’s continued growth and broader adoption.

The tool tethering market is growing due to the increasing focus on workplace safety and productivity, especially in industries such as construction, manufacturing, and aerospace. Tool tethering systems prevent tools from falling, reducing the risk of accidents and enhancing worker safety. As companies prioritize worker protection and efficiency, the demand for tool tethering solutions is on the rise. By 2025, the market will continue to grow as regulations and safety standards in high-risk industries tighten.

Opportunities in the tool tethering market are increasing with the expansion of the construction and industrial sectors. As construction sites and industrial facilities continue to grow, the need for securing tools and equipment to prevent accidents is becoming more critical. These industries are adopting tool tethering solutions to improve worker safety and compliance with safety regulations. By 2025, the growing demand for safer working environments will drive further adoption of tool tethering systems across these sectors.

Emerging trends in the tool tethering market include the integration of smart tools and IoT technology. Smart tool tethering solutions with sensors can provide real-time data on tool location and usage, enhancing asset management and security. The integration of IoT enables remote monitoring and tracking, further improving workplace safety and productivity. By 2025, the growing adoption of these intelligent systems will reshape the tool tethering market, offering businesses more sophisticated solutions for managing their tools and equipment.

Despite growth, challenges related to high costs and installation complexity persist in the tool tethering market. The initial cost of purchasing tethering systems, especially those with advanced features, can be a barrier for smaller companies. Additionally, the complexity of integrating these systems into existing workflows and machinery can increase the time and costs associated with installation. By 2025, overcoming these challenges through cost-effective solutions and easier installation methods will be crucial for expanding the market.

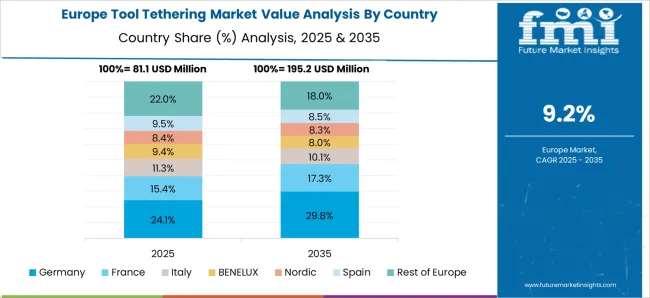

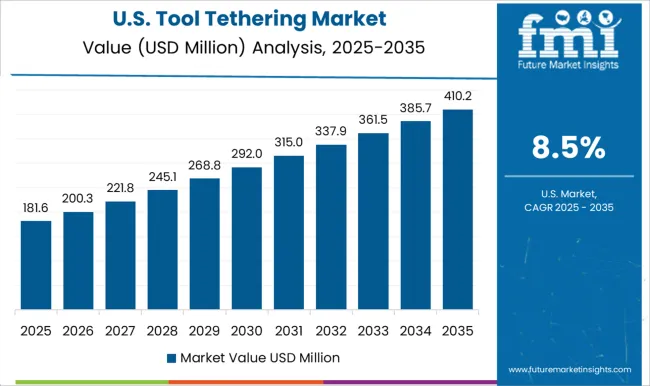

The global tool tethering market is projected to grow at a 10% CAGR from 2025 to 2035. China leads with a growth rate of 13.5%, followed by India at 12.5%, and Germany at 11.5%. The United Kingdom records a growth rate of 9.5%, while the United States shows the slowest growth at 8.5%. These varying growth rates are driven by factors such as increasing safety regulations in industrial settings, the rising focus on preventing tool-related accidents, and growing awareness about workplace safety. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, expanding manufacturing sectors, and the implementation of stringent safety measures, while more mature markets like the USA and the UK see steady growth driven by advancements in personal protective equipment (PPE) and evolving safety standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The tool tethering market in China is growing rapidly, with a projected CAGR of 13.5%. The country’s expanding manufacturing sector, rapid industrialization, and increasing emphasis on workplace safety are major drivers of the demand for tool tethering solutions. China’s adoption of stricter safety regulations to prevent tool-related accidents in construction, mining, and other industrial sectors is contributing to the adoption of tool tethering systems. Additionally, the rising awareness of the importance of personal protective equipment (PPE) and accident prevention in the workplace further accelerates market growth.

The tool tethering market in India is projected to grow at a CAGR of 12.5%. India’s rapidly expanding industrial base, particularly in the construction, automotive, and manufacturing sectors, is driving the demand for tool tethering solutions. The country’s growing focus on improving workplace safety, coupled with government regulations and rising awareness about preventing accidents, is further accelerating market adoption. Additionally, India’s increasing number of large-scale infrastructure projects and the rising number of workers in high-risk environments are contributing to the demand for tool tethering solutions to ensure worker safety.

The tool tethering market in Germany is projected to grow at a CAGR of 11.5%. Germany’s strong manufacturing base, particularly in automotive, construction, and aerospace industries, is driving steady demand for tool tethering solutions. The country’s focus on improving workplace safety, coupled with the adoption of stringent safety standards, accelerates the need for tool tethering systems. Additionally, Germany’s regulatory environment and increasing focus on reducing workplace injuries contribute to the steady expansion of the market, with industries becoming more aware of the value of worker protection and accident prevention.

The tool tethering market in the United Kingdom is projected to grow at a CAGR of 9.5%. The UK market is driven by increasing workplace safety regulations, particularly in construction and industrial environments, where tool tethering systems are critical in preventing accidents and tool drop hazards. The growing focus on personal protective equipment (PPE) and safety equipment further boosts the market for tool tethering solutions. Additionally, the UK government's regulatory framework, along with the rise in industrial activities, particularly in construction and infrastructure projects, contributes to steady market growth.

The tool tethering market in the United States is expected to grow at a CAGR of 8.5%. The USA market remains steady, driven by growing demand for safety solutions across industries such as construction, aerospace, and manufacturing. The increasing awareness of the need to prevent workplace accidents and injuries, combined with the rising focus on safety regulations, is contributing to the steady adoption of tool tethering systems. Additionally, advancements in safety technologies and the integration of tool tethering solutions into personal protective equipment (PPE) further accelerate the market’s growth.

The tool tethering landscape has been led by brands that supply lanyards, tethers, anchors, and attachment points for construction, energy, utilities, and MRO. 3M offers comprehensive drop prevention ranges through DBI SALA and Protecta, covering holsters, anchor points, and tool lanyards. Ergodyne focuses on dedicated Squids systems that pair tethers, tails, and attachment solutions for hand and power tools. MSA Safety complements personal fall protection with site solutions and drop prevention accessories. Milwaukee Tool provides power tool ready lanyards and connectors designed to integrate with its cordless platforms. NLG Never Let Go specializes in complete tethering systems for high risk tasks and confined spaces. Stanley Black and Decker via PROTO and Stanley supplies industrial tool tethers and attachment hardware for maintenance crews. FallTech concentrates on fall protection and offers accessory components that support drop prevention programs. Buckingham Manufacturing serves utility and telecom work with tool pouches, tether loops, and lineworker focused lanyards. Market growth has been supported by stricter site rules, contractor prequalification requirements, and demand for modular systems with higher capacity ratings, swivel connectors, quick attachment methods, and clear inspection tags.

| Item | Value |

|---|---|

| Quantitative Units | USD 351.4 Million |

| Product | Wrist Lanyards, Coil Lanyards, Retractable Lanyards, Traditional Lanyards, and Specialty Lanyards |

| Application | Construction, Oil & Gas, Mining, Transportation, Energy & Utilities, Telecom, and General Industry |

| Channel | Industrial MRO and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Ergodyne, MSA Company, Milwaukee, NLG, Stanley, FallTech, and Buckingham Manufacturing Co Inc |

| Additional Attributes | Dollar sales by tool type and application, demand dynamics across construction, manufacturing, and aerospace sectors, regional trends in tool tethering adoption, innovation in safety and ergonomic technologies, impact of regulatory standards on worker safety and productivity, and emerging use cases in industrial IoT integration and fall prevention systems.. |

The global tool tethering market is estimated to be valued at USD 351.4 million in 2025.

The market size for the tool tethering market is projected to reach USD 911.4 million by 2035.

The tool tethering market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in tool tethering market are wrist lanyards, coil lanyards, retractable lanyards, traditional lanyards and specialty lanyards.

In terms of application, construction segment to command 31.7% share in the tool tethering market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tool Steel Market Size and Share Forecast Outlook 2025 to 2035

Tool Presetter Market Trend Analysis Based on Product, Category, End-Use, and Region 2025 to 2035

Understanding Market Share Trends in the Tool Box Industry

Tool Holder Collets Market

Tool Chest Market

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Power Tool Gears Market - Growth & Demand 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tool Market Size and Share Forecast Outlook 2025 to 2035

Edging Tool Market Size and Share Forecast Outlook 2025 to 2035

Diamond Tool Grinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA