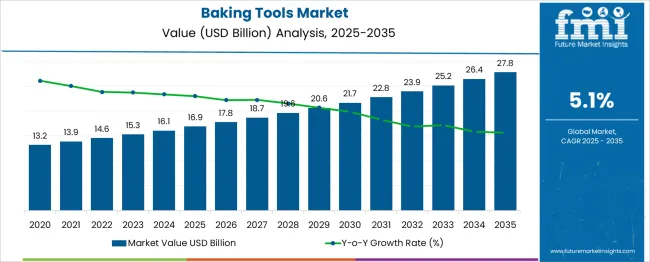

The Baking Tools Market is estimated to be valued at USD 16.9 billion in 2025 and is projected to reach USD 27.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. During the initial phase from 2020 to 2025, the market value rises from USD 13.2 billion to USD 16.9 billion, driven by increasing demand from both commercial and home baking sectors. This period is characterized by growing consumer interest in artisanal and specialty baked goods, coupled with rising investments in bakery automation and advanced baking technologies.

The integration of ergonomic designs and multifunctional tools contributes to enhanced baking efficiency and user experience, further supporting market expansion. Between 2026 and 2030, the market expands from USD 17.8 billion to USD 22.8 billion, supported by innovations in baking equipment and materials that improve durability, safety, and versatility. The growing popularity of plant-based and gluten-free baking, alongside rising health consciousness among consumers, propels demand for specialized baking tools tailored to diverse dietary needs. From 2031 to 2035, growth accelerates, with the market advancing from USD 23.9 billion to USD 27.8 billion. This phase benefits from increased adoption of smart kitchen appliances, digital baking solutions, and expanding e-commerce channels, facilitating access to baking products globally. The Baking Tools Market is poised for sustained growth through 2035, driven by evolving consumer preferences, technological advancements, and expanding bakery and foodservice industries worldwide.

| Metric | Value |

|---|---|

| Baking Tools Market Estimated Value in (2025 E) | USD 16.9 billion |

| Baking Tools Market Forecast Value in (2035 F) | USD 27.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The baking tools market is experiencing consistent growth driven by a global rise in home baking trends, the proliferation of cooking content on digital platforms, and increasing consumer preference for customized baked goods. Manufacturers are expanding their portfolios with ergonomic, multi-functional, and aesthetically appealing products that cater to both professional and amateur bakers.

The market is also being influenced by the growth of baking as a recreational activity, especially in the post-pandemic landscape, where home cooking surged. Continuous innovation in materials such as non-stick coatings, food-grade silicone, and smart baking tools has further elevated demand across retail and e-commerce channels. Moreover, the industry is responding to sustainability trends by introducing reusable, BPA-free, and eco-friendly tools to align with consumer expectations and regulatory shifts.

The baking tools market is segmented by price, end use, distribution channel, product type, and geographic regions. The price of the baking tools market is divided into Medium, Low, and High. In terms of end use, the baking tools market is classified into Residential, Commercial, and Industrial. The distribution channel of the baking tools market is segmented into offline and online. The baking tools market is segmented into Conventional tools and Smart tools. By product type, the baking tools market is segmented into Baking pans and molds, Cake decorating tools, Measuring implements, mixing equipment, Pastry and rolling tools, Specialty baking gadgets, and Digital/smart baking tools. Regionally, the baking tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

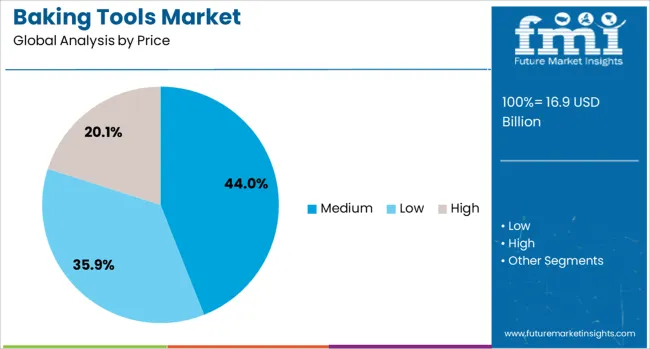

The medium price segment is projected to account for 44.00% of the total revenue share in the baking tools market by 2025, making it the leading price segment. This segment’s strength lies in its balance between affordability and product quality, appealing to a wide spectrum of consumers ranging from hobbyist bakers to semi-professional users.

Medium-priced tools often offer better durability, ergonomic design, and aesthetic finishes compared to entry-level products, without the cost premium of professional-grade items. Retailers and brands are increasingly focusing on this segment to offer value-packed sets and themed kits, especially around seasonal and gifting occasions.

The rise of aspirational home baking content on social media platforms has also helped reinforce consumer willingness to invest in mid-range products that offer functionality without compromising on performance or design.

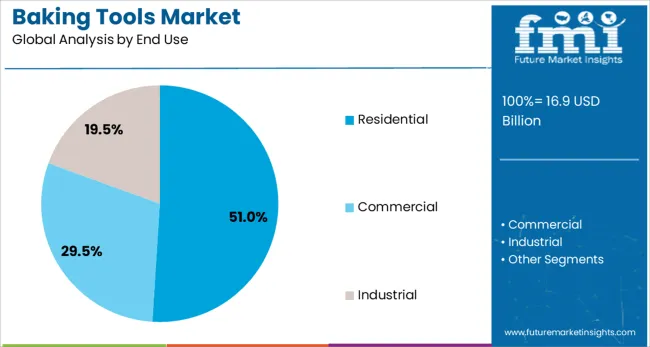

By end use, the residential segment is expected to lead with 51.00% market share in 2025. This dominance is largely driven by the expanding base of home bakers, fueled by the growing availability of baking tutorials, recipe content, and product reviews online.

Residential users demand a combination of usability, safety, and visual appeal, which manufacturers address through compact, dishwasher-safe, and beginner-friendly designs. With the rise of health-conscious baking and dietary customization, tools designed for gluten-free, vegan, and artisanal recipes have also gained traction.

The residential market's growth is further supported by increased household participation in family-oriented baking activities, driving recurring purchases and upgrades. E-commerce availability and influencer marketing continue to catalyze adoption in urban and suburban households.

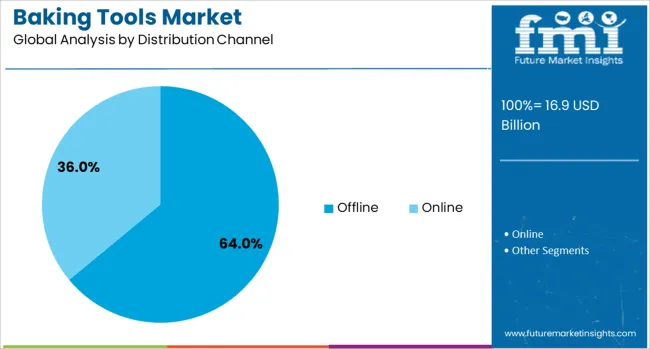

Offline distribution channels are expected to dominate with 64.00% of the baking tools market share in 2025. Physical retail stores, including specialty kitchenware shops, supermarkets, and hypermarkets, continue to attract consumers who prefer to assess product dimensions, material quality, and comfort physically.

In-store experiences such as product demos, bundling offers, and gift packaging services are further driving footfall. Offline availability also allows brands to build trust, especially in regions where online penetration remains limited.

The ability to provide instant gratification and personalized assistance alongside an expanding network of branded stores and offline retail partnerships ensures the sustained relevance of this channel. As baking tools are often sold in curated kits or sets, offline retail allows consumers to visualize coordinated purchases better, enhancing basket size and product mix.

The baking tools market is expanding through rising home baking trends, commercial sector investments, and innovative product offerings. E-commerce and material advancements are reshaping consumer access, performance standards, and brand engagement.

The baking tools market is experiencing strong momentum due to a surge in home baking activities, driven by lifestyle changes, social media trends, and growing interest in artisanal baked goods. Consumers are investing in high-quality bakeware, measuring tools, and specialty molds to replicate professional baking results at home. This trend is reinforced by the popularity of online recipe platforms and influencer-led baking tutorials that encourage experimentation. Premium materials like stainless steel, silicone, and heat-resistant glass are in demand for their durability and performance. Seasonal baking, festive occasions, and gifting traditions further contribute to sales growth, creating consistent demand across different consumer demographics and product categories.

Professional bakeries, cafés, and patisseries are increasingly investing in advanced baking tools to maintain production efficiency and consistent product quality. The expansion of café culture and premium bakery chains has boosted demand for commercial-grade bakeware, precision measuring equipment, and heavy-duty mixers. Product diversification, such as ergonomic rolling pins, non-stick coated molds, and multi-functional baking mats, is catering to both commercial and domestic users. Companies are also introducing customizable baking tools to meet brand-specific requirements in the hospitality sector. This growing emphasis on tailored solutions is enabling manufacturers to capture niche markets and establish stronger client relationships in the foodservice industry

The rapid growth of e-commerce platforms has transformed the distribution landscape for baking tools. Online retail provides access to a wider product range, detailed comparisons, and competitive pricing, attracting both individual buyers and small-scale baking businesses. Subscription models and curated baking tool kits are gaining popularity for convenience and recurring purchases. Manufacturers are partnering with online marketplaces and investing in direct-to-consumer sales channels to enhance brand visibility. Logistics improvements, coupled with faster delivery options, have made premium baking tools more accessible globally. Social media marketing and targeted advertising are further influencing purchase decisions, allowing brands to engage with niche baking communities effectively.

Advancements in material science are shaping the baking tools market by improving durability, heat conduction, and ease of cleaning. Silicone, carbon steel, and anodized aluminum are preferred for their ability to deliver consistent baking results. Non-stick coatings and reinforced edges enhance user convenience, while transparent borosilicate glass bakeware offers aesthetic appeal for presentation. Ergonomic designs are reducing strain for frequent bakers, especially in professional kitchens. Manufacturers are focusing on lightweight yet sturdy materials that balance functionality with visual appeal. The shift toward premium-grade baking tools is not only improving baking outcomes but also encouraging repeat purchases among consumers seeking long-term value.

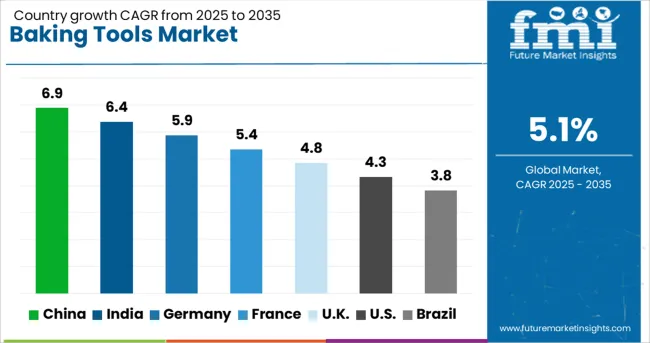

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The baking tools market is projected to grow globally at a CAGR of 5.1% between 2025 and 2035, supported by rising interest in home baking, expansion of commercial bakeries, and product innovations in materials and design. China leads with a CAGR of 6.9%, driven by the growing popularity of artisanal baked goods, e-commerce expansion, and premium bakeware adoption. India follows at 6.4%, fueled by café culture growth, regional bakery chain expansion, and affordable product availability through online retail. Germany records 5.9%, supported by its established baking tradition, demand for high-quality bakeware, and specialty baking events. The United Kingdom grows at 4.8%, shaped by festive season baking, television-led cooking trends, and a preference for decorative bakeware, while the United States posts 4.3%, reflecting steady demand from both professional and home bakers alongside increased adoption of ergonomic and multipurpose tools. The analysis covers over 40 countries, with these five serving as benchmarks for product portfolio planning, distribution strategy, and investment opportunities in the global baking tools industry.

China is projected to register a CAGR of 6.9% for 2025–2035, above the global baseline of 5.1%. During 2020–2024, momentum was supported by rapid growth in specialty bakeries, café chains, and livestream commerce that popularized premium bakeware. Strong preference has been seen for silicone molds, carbon steel pans, precision measuring sets, and decorating kits. Procurement teams in large bakery chains standardized SKUs to cut waste and improve batch consistency, which favored branded tools with tighter tolerances. Distribution through marketplace platforms improved nationwide availability and shortened replenishment cycles. With e-grocery and meal kits expanding, home baking tool bundles are expected to convert trial users into repeat purchasers.

India is expected to grow at 6.4% CAGR in 2025–2035, outpacing the global rate. Earlier demand was anchored by small neighborhood bakeries and festive home baking. The market is now being lifted by quick-service bakery chains, dark kitchens, and organized retail that require standardized pans, trays, piping systems, and dough handling tools. Affordable online bundles have widened access for first-time buyers, while premium SKUs are being adopted by boutique patisseries seeking consistent finish and faster demold cycles. Training content on social platforms has accelerated skill adoption, which sustains repeat purchases of specialty tools such as tart rings, cookie stamps, and temperature-stable spatulas.

Germany is forecast at 5.9% CAGR for 2025–2035, slightly higher than the global average. The country’s strong tradition in bread, confectionery, and seasonal pastries has supported steady upgrades in commercial bakeries. Precision molds, heavy-gauge sheets, and heat-even carbon steel remain preferred due to predictable bake curves. Home bakers gravitate toward premium measuring tools and reusable liners that reduce sticking and shorten cleanup. Specialty retailers and direct-to-consumer brands curate assortments by recipe type, which simplifies choice and drives attachment rates. Replacement cycles are being shortened as operators seek uniform browning and sturdier rims that resist warping under repeated thermal shocks.

The United Kingdom is projected to post 4.8% CAGR during 2025–2035, below the 5.1% global pace yet stronger than in the prior period. For 2020–2024, CAGR is estimated at about 3.7%, based on slower retail footfall, cautious household budgets, and a higher mix of entry-level tools. The rise to 4.8% is explained by televised baking formats, growth in premium supermarkets with curated bake aisles, and expansion of dessert-led dining that adopts professional tins, rings, and sheet systems. Demand is also aided by e-commerce kits that bundle essentials with decorative tips. Greater interest in gluten-free and high-protein recipes has encouraged purchases of precision scales and temperature-stable spatulas.

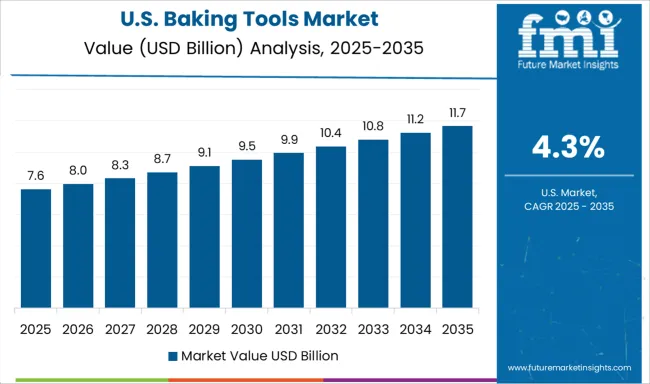

The United States is expected at 4.3% CAGR for 2025–2035. Commercial users emphasize consistency and throughput in dough handling, which favors reinforced rims, thicker gauges, and stackable racks. Home baking demand remains steady as social content inspires themed projects that require specialty cutters, piping sets, and springform pans. Big-box and online marketplaces continue to dominate distribution with private-label expansions that pressure price points yet grow category penetration. Restaurants and bakeries are refreshing sheet pans and liners to manage labor constraints through easier release and faster cleanup. A shift toward multi-use tools has been observed as consumers seek storage-efficient kits.

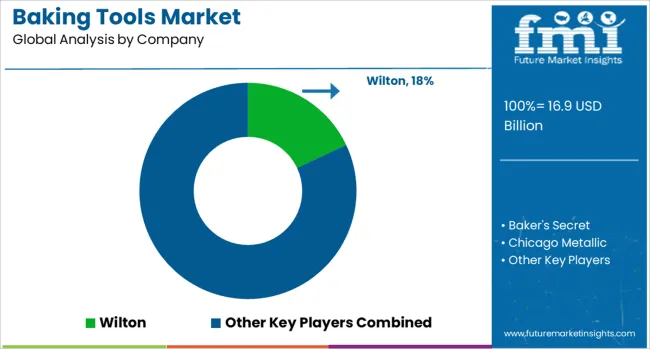

The baking tools market features globally recognized brands such as Wilton, Baker's Secret, Chicago Metallic, Cuisinart, Fat Daddio's, Joseph Joseph, KitchenAid, and Le Creuset, each competing through product range, material quality, and design innovation. Wilton holds a leading position with its extensive portfolio of bakeware, decorating tools, and accessories, catering to both home bakers and professionals with consistent quality and seasonal collections. Baker's Secret leverages its heritage in non-stick bakeware, focusing on durable, oven-safe products with easy-release coatings that appeal to frequent bakers. Chicago Metallic is recognized for its professional-grade pans and specialty bakeware designed for precision and uniform results in commercial and home kitchens.

Cuisinart combines bakeware with multifunctional kitchen tools, emphasizing ergonomic designs and premium materials that enhance versatility. Fat Daddio's differentiates with anodized aluminum products known for even heat distribution and long-lasting performance, favored in professional pastry kitchens. Joseph Joseph integrates space-saving and multifunctional designs into its baking tools, targeting modern, compact kitchen environments. KitchenAid capitalizes on its brand strength in small appliances, offering coordinated bakeware lines that complement its mixers and baking accessories. Le Creuset stands out for its premium enameled stoneware and cast iron bakeware, appealing to the high-end consumer segment. Competitive strategies focus on expanding e-commerce presence, introducing limited-edition collections, and leveraging influencer collaborations. With increasing interest in home baking, these players are positioned to capture growth by offering innovative, durable, and aesthetically appealing baking solutions.

In July 2025, Wilton launched a new tiered bakeware system, EVERYDAY, PREMIUM, ULTRA, and ALUMINUM, plus icing pouches, designed to help bakers choose pans by skill level and budget.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.9 Billion |

| Price | Medium, Low, and High |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Offline and Online |

| Type | Conventional tools and Smart tools |

| Product Type | Baking pans and molds, Cake decorating tools, Measuring implements, Mixing equipment, Pastry and rolling tools, Specialty baking gadgets, and Digital/smart baking tools |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wilton, Baker's Secret, Chicago Metallic, Cuisinart, Fat Daddio's, Joseph Joseph, KitchenAid, and Le Creuset |

| Additional Attributes | Dollar sales, share, category growth by product type, competitive positioning, regional demand trends, pricing benchmarks, emerging retail channels, and consumer preferences shaping product innovation. |

The global baking tools market is estimated to be valued at USD 16.9 billion in 2025.

The market size for the baking tools market is projected to reach USD 27.8 billion by 2035.

The baking tools market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in baking tools market are medium, low and high.

In terms of end use, residential segment to command 51.0% share in the baking tools market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baking and Cooking Paper Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Molds And Trays Market Size and Share Forecast Outlook 2025 to 2035

Baking Soda Substitute Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Market Share Breakdown of the Baking and Cooking Paper Market

Baking Paper Market

Brow Tools Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Carbide Tools Market Growth - Trends & Forecast 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Striking Tools Market Size and Share Forecast Outlook 2025 to 2035

Survival Tools Market Trends - Growth & Forecast 2025 to 2035

UK Power Tools Market Analysis – Size, Share & Forecast 2025-2035

KSA Power Tools Market Insights – Trends, Demand & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA