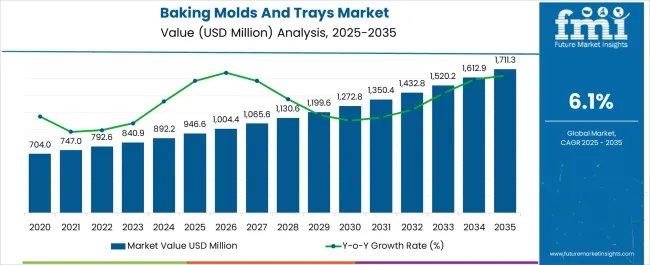

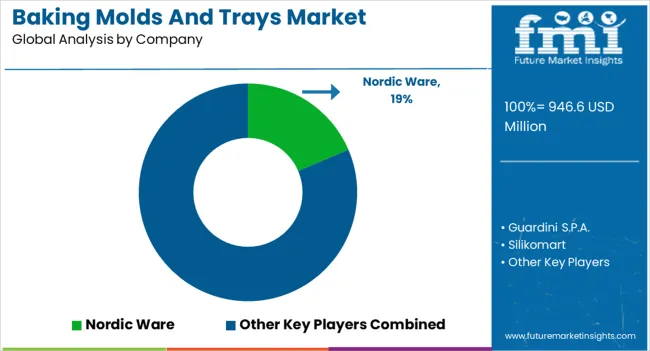

The Baking Molds And Trays Market is estimated to be valued at USD 946.6 million in 2025 and is projected to reach USD 1711.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Baking Molds And Trays Market Estimated Value in (2025 E) | USD 946.6 million |

| Baking Molds And Trays Market Forecast Value in (2035 F) | USD 1711.3 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The baking molds and trays market is expanding steadily, driven by the rising popularity of home baking, professional patisserie culture, and the growth of commercial food production units. Demand is being fueled by consumer preference for convenience, product consistency, and aesthetically appealing baked goods.

Advancements in manufacturing have enabled the introduction of non stick coatings, heat resistant materials, and innovative designs that enhance baking efficiency and product quality. Regulatory focus on food grade materials and safety compliance has further influenced adoption trends across both household and commercial settings.

The market outlook remains promising as rising urbanization, growing café culture, and expanding retail bakery chains continue to generate sustained demand for durable and versatile baking molds and trays.

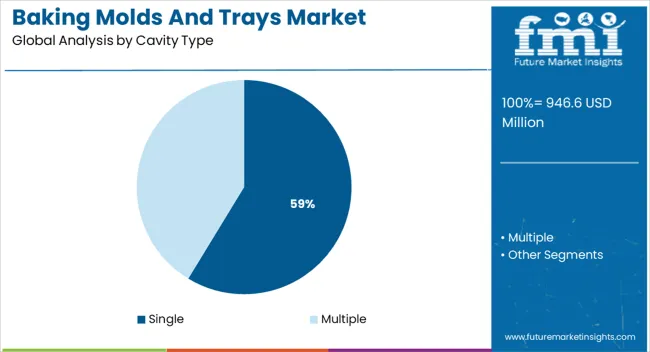

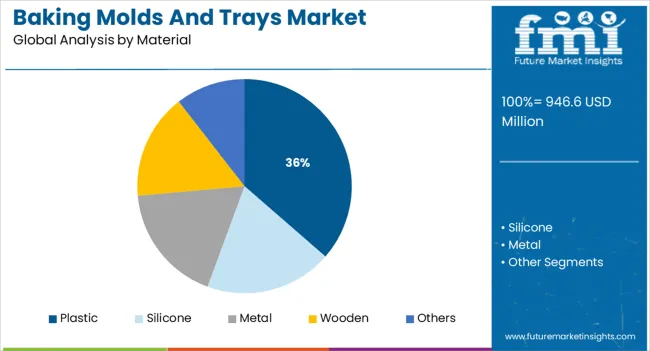

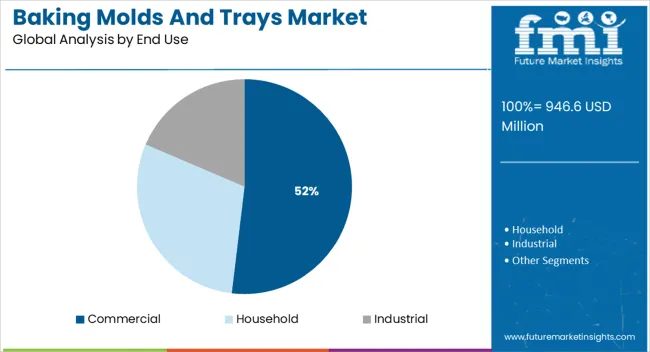

The market is segmented by Cavity Type, Material, and End Use and region. By Cavity Type, the market is divided into Single and Multiple. In terms of Material, the market is classified into Plastic, Silicone, Metal, Wooden, and Others. Based on End Use, the market is segmented into Commercial, Household, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single cavity segment is expected to account for 58.70% of total market revenue by 2025, positioning it as the leading cavity type. This dominance is supported by its widespread use in producing uniform baked goods and its suitability for both household and commercial applications.

The ease of portion control, consistent output, and compatibility with a variety of recipes have made single cavity molds the preferred choice. In addition, single cavity designs enable simplified cleaning and durability, which are essential for repeated use in commercial environments.

The combination of efficiency and reliability has strengthened the segment’s leadership within cavity type adoption.

The plastic segment is projected to represent 36.40% of market revenue by 2025 within the material category. Growth is attributed to the lightweight, cost effective, and versatile nature of plastic molds and trays, which allow for innovative designs and wide accessibility.

Plastic molds offer flexibility, affordability, and resistance to breakage, making them popular in both home kitchens and large scale bakeries. Advances in high quality food grade plastics have enhanced their performance in heat resistance and durability.

Their adaptability to modern consumer preferences and affordability compared to alternatives continue to support their strong presence in the material segment.

The commercial segment is estimated to contribute 51.90% of total market revenue by 2025, establishing it as the largest end use category. This is primarily due to the rising number of bakeries, restaurants, and food service outlets that require consistent, high volume production.

The ability of molds and trays to deliver efficiency, reduce preparation time, and maintain uniformity in baked goods has reinforced their importance in commercial kitchens. Investment in durable, professional grade baking equipment has further strengthened adoption in this segment.

The combination of operational efficiency and alignment with the needs of expanding commercial food production continues to position the commercial category as the dominant end use within the market.

Growth in the fast-moving consumer goods industry has caused accelerated growth in the baking molds & trays sector. It is predicted to rise at 6.1% CAGR from 2025 to 2035, in comparison to the 3.1% CAGR registered from 2020 to 2025. The market accounted for nearly 1.8% of the bakery & confectionery market in 2024.

| Particulars | Details |

|---|---|

| Jan-Jun (H1), 2024 (A) | 3.0% |

| Jan-Jun (H1), 2025 Projected (P) | 2.7% |

| Jan-Jun (H1), 2025 Outlook (O) | 3.4% |

| BPS: H1,2025 (O) - H1,2025 (A) | 40 |

| BPS: H1,2025 (O) - H1,2024 (A) | 70 |

Globally, an economic surge has resulted in the rise in consumption of bakery and confectionery products, which makes the market expand at a Y-o-Y of 3.2% in 2025.

On the back of these factors, the global baking molds & trays industry is anticipated to create an incremental opportunity of USD 704 million during the assessment period. The market showed an amazing jump from USD 665.3 million in 2020 to USD 946.6 million in 2025.

Restaurants and bakeries are shifting towards non-stick baking molds & trays to reduce the time and labor invested in cleaning utensils. Traditionally usage of plastic molds & trays was very common in the food services industry, but lately, it has been transitioning to lightweight, durable, safe, and hygienic silicone molds & trays.

The bakery and confectionery segment is anticipated to expand almost 2 times its current value, by the end of 2035.

Short-term growth (2025 to 2029): A growing inclination towards e-Commerce is observed, and the industry is expected to grow steadily during the forecast period. Big brands are already acknowledging the value of e-commerce and wholesale packaging, without compromising on consumer satisfaction.

Medium-term growth (2035 to 2035): An increase in disposable income has caused consumers in emerging economies to spend more on the food and food services sector, and this trend is expected to continue in the coming years.

Long-term growth (2035 to 2035): The increasing mass production of bakery and confectionery food items has spurred the demand for baking molds & trays in commercial and industrial sectors. This continues to create a conducive environment for baking molds & trays sector growth through 2035.

Increasing awareness about the use of hygienic packaging solutions for various food packaging applications in emerging economies offers immense growth opportunities to the baking molds & trays market.

Consumers prefer ready-to-eat meals available in the microwave and oven-safe packaging that suit their busy lifestyles and need for hassle-free cooking operations. While demand is picking up globally, low penetration in some emerging economies due to fewer suppliers and manufacturers offering packaging solutions might hinder the growth of the market.

To capitalize on untapped potential in emerging economies, market players are collaborating with regional and local players. Expansion strategies adopted by them are expected to bode well for the global market.

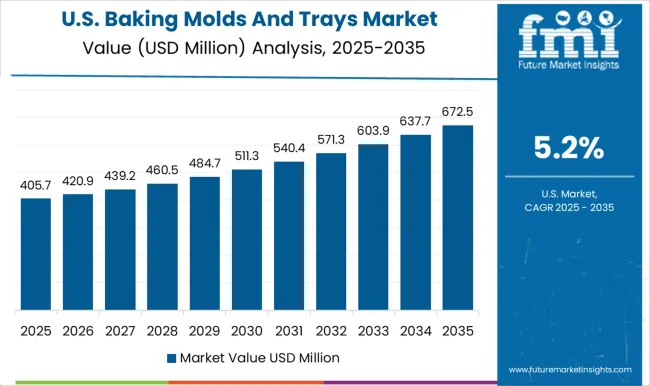

North America is forecast to be the most money-making market. The United States dominated the market with a share of 15.2% in 2025. According to the analysis, the United States is expected to hold almost 80% of the North America baking molds & trays market till 2035.

As per the American Bakers Association, the baking industry generates a profit of almost 2% of the GDP of the United States. The baked products manufactured and sold in the United States surpassed USD 946.6 million in 2025. Consumers have more preference for bread besides rolls and cakes, and this consumption is increasing at a fast pace.

In the United Kingdom, the market for baking trays and molds has been expanding significantly. In 2025, the market was worth USD 21.4 million. The popularity of baking as a hobby and the rising number of home bakers have played a significant role in this growth.

The market is anticipated to expand at a predicted CAGR of 4.86%, with a value of USD 32.8 million during the forecast period. The expanding trend of healthy eating, as well as the rising demand for convenience and specialty goods, are anticipated to fuel this expansion.

The most widely used baking trays and molds are those constructed of silicone, glass, and metal. Metal molds, which make up about 70% of the market, account for the majority of sales. However, as they are simple to use, simple to clean, and have excellent non-stick properties, silicone molds are becoming more and more well-liked.

| Country | China |

|---|---|

| Market CAGR (2025 to 2035) | 6.53% |

| Market Value 2025 | USD 65.5 million |

| Market Value 2035 | USD 115.7 million |

| Country | India |

|---|---|

| Market CAGR (2025 to 2035) | 8.36% |

| Market Value 2025 | USD 38.3 million |

| Market Value 2035 | USD 78.8 million |

China has always gained global popularity due to its stronghold in infrastructural & industrial growth. In 2024, the country is projected to account for over 36% of the baking molds & trays sector in East Asia.

Besides increasing uptake of the latest technologies, the low cost of manufacturing and availability of cheap labor has positioned China to exhibit strong growth in the East Asia baking molds & trays business.

According to the National Health & Nutrition Survey, China is Asia’s leading market for the food & food services industry, also making it highly lucrative for sales of baking molds & trays manufacturers.

India is the leading shareholder, accounting for almost 25% of sales in the South Asia baking molds & trays sector by 2035. The expansion and penetration of the baking & confectionery services present lucrative opportunities for baking molds & trays industry growth in India. As per FMI, the demand for reusable mold is considerably high in the country.

As per FMI, Japan had a market share of 6.3% and a worth of USD 51.5 million in 2025. Japan is one of the key producers of baking molds & trays in East Asia. Manufacturers from Japan are keenly focusing on developing safe products for consumers.

Also, major bakery & confectionary providers from Japan are transitioning from plastic molds & trays to silicone and wooden molds & trays, which are sustainable and do not cause a carbon footprint. Subsequently, the Japan baking molds & trays market created an incremental opportunity of USD 55.4 million during the forecast period.

Section 419 (Section 350h) of the Food and Drug Administration (FDA), states the standards for produce safety. These safety regulations are set to boost the market for safe and hygienic food preparing and packaging solutions like baking molds & trays in Japan. To fulfill this regulation, many of the key players in Japan are planning to shift towards clean room facilities and green baking containers.

Multiple cavities are widely preferred in the market due to the convenience it offers, due to which they commanded over 79.9% of the market share in 2025. Globally, the demand for convenience in day-to-day life has transformed packaging, as consumers who are vastly leading busy lifestyles are likely to have more influence on the packaging industry than any other existing factor.

Attributes such as convenience in storage and handling, and ease of usage, have largely affected the use of packaging. Due to this, people are more inclined towards purchasing bakery & confectionary products. As a result, the usage of multiple cavity baking molds & trays is likely to expand by 2.02 times by 2035.

Metal is widely used in the market due to its flexibility, durability, and lightweight properties. Metal accounted for about 32.6% of the market share in 2025. North America and Europe are largely emphasizing sustainable development and implementing strict rules to curb the carbon footprint.

The trend is moving away from plastic as a basic material and toward silicone.

Silicone has a large market share since it is a better environmentally friendly solution and can be recycled after being used for a while.

The industrial segment leads the global baking molds & trays holding market. It accounted for a share of about 57% in the year 2024. The industrial segment continues to lead the market due to the high demand for factory-produced bakery & confectionery products, chocolates, and bread among others.

Baking Molds & Trays Start-ups Meeting the Need for Commercial Bakers

The market is fiercely competitive, with many start-ups concentrating on offering cutting-edge solutions for the baking sector. Bake Boss, Bakershacks, and Bake Rite are a few of the top start-up businesses in the baking molds and trays sector.

These businesses are concentrating on offering an extensive selection of molds and trays of high caliber that are made to satisfy the requirements of industrial bakers. These startups also put a lot of effort into giving their clients personalized solutions.

Fresh Strategies Supports Baking Molds & Trays Industry Players to Focus on Sustainable Products

Companies operating in the baking molds & trays market are aiming at expansion and strategic partnerships with other manufacturers to expand their product manufacturing capabilities, product portfolio, and global presence.

The global baking molds and trays market is estimated to be valued at USD 946.6 million in 2025.

The market size for the baking molds and trays market is projected to reach USD 1,711.3 million by 2035.

The baking molds and trays market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in baking molds and trays market are single and multiple.

In terms of material, plastic segment to command 36.4% share in the baking molds and trays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Baking Soda Substitute Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baking Paper Market

Baking and Cooking Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of the Baking and Cooking Paper Market

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Food Trays Sector

CPET Trays Market

Sieve Trays Market Size and Share Forecast Outlook 2025 to 2035

Pharma Trays Market Size, Share & Forecast 2025 to 2035

Correx Trays Market

Insert Trays Market

Syringe Trays Market

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA